Crypto World

Tom Lee-Backed Bitmine Controls 3.6% of Ethereum Supply After Price Crash

In a risky but potentially rewarding play, Ethereum treasury company Bitmine Immersion Technologies (BMNR) has become the largest corporate holder of ETH, now controlling 3.6% of the total supply after aggressively buying the dip.

The firm, backed by Fundstrat’s Tom Lee, purchased an additional 40,613 Ether last week as prices collapsed toward $1,700, bringing Bitmine’s total treasury to over 4.3 million tokens despite sitting on massive unrealized losses from its ETH portfolio, which holds 4.3 million tokens at an average price of $3,826.

- Bitmine added 40,613 ETH during the crash, bringing total holdings to 4.3 million tokens.

- The firm now controls roughly 3.6% of the total circulating Ethereum supply.

- Unrealized losses exceed $7.8 billion with an average entry price of $3,826.

Bitmine Ethereum Accumulation Strategy Explained

Led by Chairman Tom Lee, Bitmine pivoted from mining for Bitcoin to an Ethereum-exclusive treasury strategy in mid-2025 with a goal to eventually acquire 5% of the total ETH supply.

The company sees temporary market downturns as acquisition opportunities rather than setbacks, mirroring high-conviction plays seen in broader crypto selloff contexts.

“Bitmine has been steadily buying Ethereum… given the strengthening fundamentals,” Lee stated in a press release, countering concerns about the firm’s $7.8 billion paper loss.

Lee argues that current prices do not reflect Ethereum’s utility as the “future of finance,” positioning the firm for long-term dominance despite the immediate pain on its balance sheet.

What 3.6% Supply Control Means for Ethereum Markets

Bitmine’s total stack now sits at approximately $8.7 billion based on current prices hovering just above $2,000.

On-chain data indicates the firm bought the latest tranche of 40,613 tokens as ETH plunged from $2,300 to lows of $1,700.

Unlike purely speculative holders, Bitmine leverages its position for yield; nearly 2.9 million of its tokens are currently staked, generating an estimated $202 million in annualized rewards at current prices.

While investors continue pouring capital into the sector despite the wipeout, Bitmine’s sheer scale allows it to absorb significant liquidity during panic events.

The company plans to launch MAVAN, a proprietary U.S.-based validator network, to potentially stake its entire holding and maximize yield generation.

How Bitcoin’s Concentration of Ethereum Could Affect ETH Price

The concentration of such a vast amount of Ether in a single corporate entity raises questions about market influence and liquidation risks.

While Lee predicts a V-shaped recovery, the firm remains deeply underwater with an average purchase price of $3,826. This resilience stands in stark contrast to other institutional players; for instance, Trend Research slashed Ether holdings to cover loans during the same market crash.

If Bitmine sustains its position without forced selling, it removes substantial supply from the market, potentially accelerating price appreciation if demand returns.

The post Tom Lee-Backed Bitmine Controls 3.6% of Ethereum Supply After Price Crash appeared first on Cryptonews.

Crypto World

Big Demand Zone Below $2K Signals ETH’s Next Move

Ether faced resistance to hold above $2,000 on Tuesday as market sentiment cooled, and a 31% drop in 2026 has drawn comparisons to price fractals seen in prior bull markets. The slide to roughly $1,736 underscored a broader consolidation, with traders weighing the risk of further draws versus the potential of a patient, bottoming process. On-chain watchers have repeatedly highlighted a defined demand zone spanning approximately $1,300 to $2,000, a band that could attract buyers if price action continues to meander lower. The narrative here centers on whether Ether can form a durable base or slip into a protracted period of range-bound trading that delays a meaningful breakout. For context, market participants continue to monitor liquidity flows, derivative risk, and evolving network fundamentals that often foreshadow macro moves.

Key takeaways

-

ETH’s drop to about $1,736 may mark the initial low in a broader consolidation phase rather than a final bottom.

-

On-chain cost-basis data clusters between $1,300 and $2,000, reinforcing this range as a potential demand zone.

-

A fractal comparison of the 2021–2022 cycle with 2024–2025 suggests a pattern where an early bottom is followed by retests to lower levels before a durable base forms.

-

UTXO Realized Price Distribution (URPD) points to meaningful overhead resistance near $2,822 and $3,119, concentrations that could cap rallies unless substantial demand emerges below current levels.

-

Derivatives data show concentrated long-liquidation risk around $1,455 from $1,700, while more than $12 billion in short liquidity sits up to $3,000, implying a potential shift in momentum once downside liquidity is absorbed.

Tickers mentioned: $ETH

Sentiment: Neutral

Price impact: Neutral. Near-term risk remains balanced by base-building signals and a defined demand zone.

Market context: The broader crypto backdrop continues to digest on-chain signals alongside macro risks. Ethereum withdrawals from exchanges have spiked to the highest levels since October 2025, with net outflows exceeding 220,000 ETH, and Binance alone recording roughly 158,000 ETH in daily net outflows—the largest since August 2025. These flows coincided with ETH trading in a $1,800–$2,000 range, suggesting a combination of accumulation and risk-off repositioning. Meanwhile, stablecoin activity on Ethereum has risen markedly, with stablecoin transaction volume up about 200% over the past 18 months even as the price has lagged. This divergence can foreshadow a re-rating if network fundamentals and liquidity conditions align with price action.

Why it matters

The unfolding pattern matters because it frames Ether’s potential trajectory in the context of a longer base-building phase rather than a quick recovery. If the fractal framework holds, the asset could spend more time coiling within a defined band, testing lower supports before a durable upside breakout emerges. This matters for traders and risk managers who must gauge how much exposure to maintain during a broad consolidation while tracking evolving on-chain activity and derivatives signals that historically precede major moves.

From a broader market perspective, the interaction between on-chain demand zones and subtle shifts in exchange flows could signal how liquidity is reallocated as institutions and retail participants reassess risk. The observed uptick in stablecoin settlements and the outflows from centralized venues imply a transfer of risk away from exchanges in favor of self-custody and potentially longer-duration holding patterns. If this trend persists, it could set the stage for a renewed bid when price action tests critical levels in the $1,500s or higher.

Additionally, the ongoing dialogue around whether Ether is capitulating or merely consolidating highlights the nuanced nature of market cycles. The fractal approach, which aligns current action with prior periods of broad basing, suggests that patience and disciplined risk management may be more prudent than chasing short-term rallies during uncertain liquidity regimes. Independent observers are watching for confirmations from on-chain metrics and derivatives markets that could either reinforce a gradual re-rating or expose the market to sharper, faster moves once liquidity conditions flip.

What to watch next

-

Price tests of the $1,500–$1,600 zone and whether buyers re-emerge at the lower end of the demand band.

-

Verification of key URPD levels around $1,237 and $1,881 as potential cycle floors and pockets of demand if price retraces further.

-

Monitoring long versus short liquidity dynamics, including long-liquidation risks around $1,455 from the $1,700 area and substantial short liquidity up to $3,000, which could shape the slope of any ensuing rally.

-

Trends in exchange withdrawals and stablecoin turnover on Ethereum, which may presage shifts in market participation and risk tolerance.

-

Derivative market signals, including any evolving bias after absorption of near-term liquidity pressures, to gauge whether the market transitions from distribution to accumulation.

Sources & verification

- Ether UTXO Realized Price Distribution (URPD) data and interpretations from Glassnode.

- Rising Ethereum withdrawals from exchanges and related net flows, with Binance’s outflows highlighted as a notable datapoint from CryptoQuant.

- Derivatives risk indicators, including the Cuingood-style liquidation heat map from Coinglass, detailing long-liquidation risk levels and short liquidity concentrations to $3,000.

- Weekly chart framing and fractal comparisons published with reference to ETHUSDT data on TradingView (Cointelegraph/TradingView).

- Ethereum Foundation SEAL collaboration articles on wallet security and related efforts to curb drainers.

Ether fractal signals an extended base-building phase

Ether (CRYPTO: ETH) has again drawn analysts to a familiar price-action pattern where a pronounced dip is followed by a prolonged period of range-bound activity rather than an immediate leg higher. On the weekly chart, a move toward the $1,730 area resembles a “first low” rather than a definitive market floor, echoing structures seen during the 2021–2022 period when ETH spent roughly a year consolidating near a first low of approximately $1,730 and a broader support band around $885. These historical touchpoints, when viewed through a fractal lens, suggest the current cycle may unfold similarly: a first phase of downside risk that yields to a more extended base-building phase before demand returns with greater resilience. The weekly framing in this narrative is anchored by the ETHUSDT pair on TradingView, which has provided the visual reference for these comparisons. The fractal interpretation is not a guarantee, but it offers a framework for interpreting the sequence of on-chain activity and price movements against the backdrop of a market still digesting liquidity and macro cues.

In the near term, the market’s focus shifts to whether Ether can sustain a bid above the immediate support around $1,500–$1,600 or if price testing compounds the pressure toward the $1,237 level, a region that previous analyses identify as a potential cycle floor. The on-chain support is reinforced by URPD observations, which show substantial realized price concentration at higher levels, underscoring a stubborn overhead that could keep rallies in check unless fresh demand emerges. At the same time, the index of supply concentration at $2,822 and $3,119 constitutes a ceiling that traders must clear to generate meaningful upside momentum. These resistance pillars remind investors that any attempt to re-rate Ether will require a combination of technical durability and sustained capital inflows.

Meanwhile, market participants should monitor the interplay between on-chain signals and derivatives dynamics. The heat map of long liquidations suggests a risk horizon near $1,455 when price drifts from $1,700, while a large pool of short liquidity up to $3,000 implies a potential upside framework once sellers exhaust liquidity pressure. The balance between these forces—realized price levels, withdrawal trends, and the evolving derivative landscape—will shape whether Ether can complete a longer, steadier base or remains vulnerable to periodic risk-off episodes that push the price toward the lower bound of the current range.

As observers parse these signals, one constant remains: the market’s attention to demand zones and supply barriers. The convergence of on-chain data with macro risk sentiment can either reinforce a patient, base-building narrative or catalyze a more decisive move if new catalysts emerge. The evolving ecosystem continues to attract attention from developers and investors who watch for signs of renewed network activity, institutional participation, and regulatory clarity that could shift the risk calculus in Ether’s favor.

Crypto World

Crypto PAC Fairshake leaps into first midterm Senate race with $5 million in Alabama

Crypto’s $193 million campaign-finance force, the Fairshake political action committee, is launching into congressional midterm season with a massive $5 million injection into the Republican primary campaign of Barry Moore, a U.S. congressman now running for Senate.

One of Fairshake’s affiliates, Defend American Jobs, is committing that spending to support Moore, even though the general election remains almost nine months away. That marks one of the group’s first major forays into what promises to be a high-stakes, high-spending election season.”We are proud to stand with Barry Moore, a leader who will fight for economic growth and make America the crypto capital,” Fairshake said in a Tuesday statement.

Fairshake had also recently devoted funds to Representative French Hill, the chairman of the House Financial Services Committee who has led the charge on crypto legislation in the U.S., according to a representative of the PAC. Hill and his allies already managed to get a crypto market structure bill through the House of Representatives last year and are now awaiting a matching effort in the U.S. Senate.

Such crypto legislation is the central purpose of Fairshake’s giving — promoting pro-crypto candidates ready to pass friendly bills and opposing those who stand against such legislation.

As with all the super PAC’s giving, the money for Moore will be through “independent expenditures” under federal election law, meaning the cash can buy ads for the candidate, but they can’t deal directly with the campaign. Fairshake-backed ads in the 2024 election didn’t mention crypto at all, and this broadcast ad for Moore intends to feature the candidate’s endorsement from President Donald Trump.

Moore has served five years in the House, and he’s now campaigning to replace Senator Tommy Tuberville, a Republican who is aiming for the governor’s mansion this year. The Alabama congressman has so far served in the House’s Agriculture Committee, where crypto legislation was on the agenda last year.

“Crypto is not a fad,” Moore wrote in a December post on social media site X. “It is part of our future. It is part of Alabama’s future.”

Moore is one of five Republican candidates who announced their participation in that primary. Early polling has so far seen Moore generally in second place behind state Attorney General Steve Marshall. Both have “A” crypto ratings from Stand With Crypto, a group that reviews the digital assets views of political figures.

Read More: Industry’s PAC Keeps Seeking to Add Allies as Congress Hashes Out Crypto Legislation

Crypto World

Interactive Brokers Taps Coinbase for ‘Perpetual-Style’ Crypto Futures

Global brokerage IBKR now offers traditional and perpetual-style BTC and ETH futures trading to its clients.

Interactive Brokers (IBKR), a leading global brokerage with more than 4.5 million clients, rolled out small-sized nano BTC and ETH futures contracts today.

The contracts leverage Coinbase Derivatives’ traditional futures offerings, which have monthly expirations, and its “perpetual-style futures,” making IBKR the latest traditional brokerage to offer perpetuals.

The move is IBKR’s latest into crypto, after enabling stablecoin deposits in December.

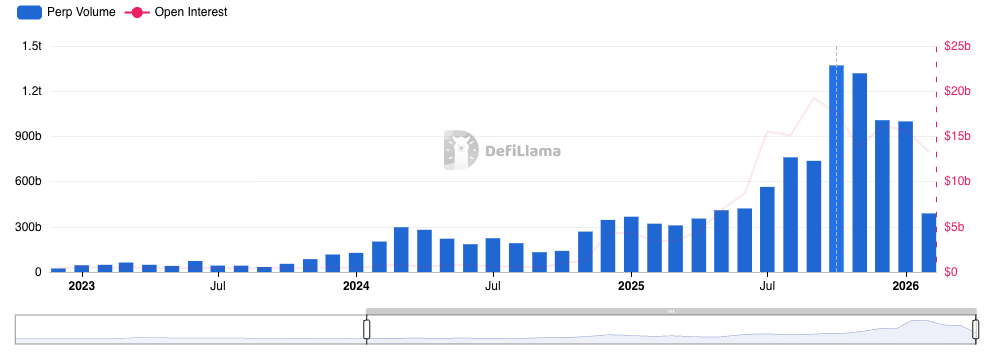

Perpetual derivatives exploded in 2025, driven by the success of platforms such as Hyperliquid, Lighter and Aster. Nearly $8 trillion in decentralized perpetuals trading occurred in 2025, according to DeFiLlama, compared with $2.55 trillion in 2024 and just $690 billion in 2023.

Traditional financial institutions continue to expand their crypto trading offerings, as evidenced by the CME Group adding new altcoin futures yesterday and even teasing its own native tokenized cash during its latest earnings call.

Unlike in previous crypto cycles, when traditional players slowly stepped away as prices dropped, leading institutions such as CME and IBKR continue to dive headfirst into the space, despite Bitcoin falling more than 50% from its October peak. However, it remains unclear whether TradFi’s focus on broadening trading access will meaningfully affect crypto prices.

Crypto World

Alphabet set to raise over $30 billion in global debt sale: sources

Sundar Pichai, chief executive officer of Alphabet Inc., during the Bloomberg Tech conference in San Francisco, California, US, on Wednesday, June 4, 2025.

David Paul Morris | Bloomberg | Getty Images

Alphabet’s debt sale keeps getting bigger.

The company is close to finalizing a global bond issuance in excess of $30 billion, according to two people familiar with the deal, an increase from the $20 billion it raised on Monday.

On Tuesday morning, Alphabet went to the European market to raise roughly $11 billion in sterling and Swiss francs, said the people, who asked not to be named because the details are private. Bloomberg reported earlier that Alphabet raised almost $32 billion.

Investors are showing heightened demand for high-quality paper from tech heavyweights that are leading the charge in artificial intelligence, one source said.

In its earnings report last week, Alphabet said it expects to shell out up to $185 billion in capital expenditures this year, more than double its 2025 capex. The group of hyperscalers, which also includes Amazon, Meta and Microsoft, are projected to collectively spend close to $700 billion in 2026. With tech companies pouring money into high-priced chips, large facilities and networking technology, analysts expect free cash flow to plummet this year.

Oracle was the first large tech company to test the debt market in 2026, with its $25 billion dollar offering last week. Meta is preparing a large debt offering in first part of this year, as it looks to accelerate its data center push across the U.S., the sources said.

Alphabet held a $25 billion bond sale in November. Its long-term debt quadrupled in 2025 to $46.5 billion. CFO Anat Ashkenazi said on last week’s earnings call that as the company considers its total investment, “we want to make sure we do it in a fiscally responsible way, and that we invest appropriately, but we do it in a way that maintains a very healthy financial position for the organization.”

Alphabet didn’t respond to a request for comment.

— CNBC’s Jennifer Elias contributed to this report.

WATCH: Alphabet’s bond sale

Crypto World

Vatican Bank makes first foray into equity indexes, setting stage for potential ETF launches

Gabriel Bouys | AFP | Getty Images

The Vatican Bank Tuesday launched two equity indexes tracking stocks that align with Catholic values. Its first foray into thematic investment products sets the bank up to potentially roll out other financial products, including ETFs in the future.

The bank, which reports to the Committee of Cardinals and the Pope, said Tuesday in a statement that the Morningstar IOR Eurozone Catholic Principles Index and the Morningstar IOR U.S. Catholic Principles Index include 50 medium and large-cap firms deemed to be consistent with Catholic ethical criteria, including prioritizing human bonds and social justice.

“Having benchmarks built in accordance with recognized Catholic ethical criteria allows us to make our performance assessment and reporting processes even more rigorous and transparent,” Giovanni Boscia, Vatican Bank deputy director general and CFO, said in the statement. “This initiative reaffirms our commitment as a financial institution serving the Church, further strengthening the role of the [Vatican Bank] as a reference point for the Catholic world.”

The Eurozone fund counts semiconductor supplier ASML Holding and telecommunications company Deutsche Telekom among its top holdings, while the US-based index’s largest holdings include Meta Platforms and Amazon.

Their rollouts also open up the possiblity the indexes could be licensed for use in an exchange traded fund.

The debut comes as investors’ appetite for ETFs and other thematic investment products grows. The global ETF market increased nearly 30% to top $14 trillion in 2024, per PricewaterhouseCoopers. And, the combined value of those funds could hit as much as $30 trillion by 2029, according to a PwC report dated March 2025.

Meanwhile, investment products rooted in social responsibility and other themes are appealing to certain slice of investors. The Ave Maria Mutual Funds, a fund family that allocates capital in accordance with Catholic teachings, said it had $3.8 billion in assets under management as of last year, per its website.

The Vatican Bank has been working to reform its image after a series of scandals. The Holy See-linked financial institution has faced several allegations of money laundering and ties with organized crime, particularly after the collapse of Milan-based Banco Ambrosiano in 1982. In 2021, former Vatican Bank president Angelo Caloia was found guilty of money laundering and embezzling millions of euros in connection with his role at the institution.

Crypto World

Miner Offloads $305M Bitcoin as Network Difficulty Sees Sharp Decline

Bitcoin mining stress deepened as difficulty fell 14% and Puell dipped below 0.8, even as Cango sold $305M in BTC.

Bitcoin mining conditions tightened sharply in late January and early February after network difficulty fell 14% over three weeks and publicly traded miner Cango disclosed a $305 million BTC sale over the weekend.

The combination of falling profitability metrics and selective balance sheet sales shows pressure spreading across the mining sector, even as broader on-chain data shows no signs of disorderly selling.

Difficulty Drops as Miners Cut Capacity

According to a February 10 brief published by on-chain analyst Axel Adler Jr., Bitcoin’s network difficulty dropped by a combined 14.1% between January 22 and February 6, following two consecutive downward adjustments of 3.3% and 11.2%. Such back-to-back cuts usually occur when less efficient mining equipment is taken offline, often during periods of weak price action.

During the same window, the price of BTC fell about 25%, briefly touching $60,000 before rebounding toward $70,000. At the time of writing, the flagship cryptocurrency was trading at around $69,000, down nearly 1% in the last 24 hours and more than 12% over the past week, based on CoinGecko data.

The asset has also lost 24% of its value over the past month and about 29% year over year, underperforming earlier-cycle expectations and keeping mining margins tight.

Against this backdrop, Cango confirmed it sold 4,451 BTC for approximately $305 million, citing balance sheet strengthening. The sale, approved by the company’s board, drew an immediate reaction from equity investors, with Cango shares closing 8% lower on the first trading day after the disclosure.

Adler described the transaction as a point event rather than evidence of widespread forced liquidation, noting that aggregate miner flows to exchanges are still holding steady.

You may also like:

Data from miner exchange inflows supports that view, with the 30-day moving average of daily miner transfers hovering near 82 BTC, only slightly lower than mid-January levels and well within recent norms, according to the market watcher. Furthermore, he reported that there have been no sustained spikes that would suggest broad reserve dumping.

Profitability Pressure and What Comes Next

Profitability metrics still point to strain. For instance, Adler pointed out in his brief that the Puell Multiple, which compares daily miner revenue to its annual average, slipped to a 30-day average of 0.77 in early February, down from 0.86 in mid-January. He added that spot readings briefly fell to around 0.61, levels historically associated with miner stress and capacity exits.

The analyst noted that miners earning below their annual average tend to prioritize liquidity, increasing the chance of selective reserve sales rather than aggressive expansion. According to him, completion of this stress phase typically requires a reversal in difficulty adjustments and a recovery in the Puell Multiple toward the 0.85 to 0.90 range.

For now, the data suggests the adjustment is playing out mainly through hashrate reductions instead of heavy selling. The risk, in Adler’s opinion, is a renewed price drop below $60,000, which could push profitability metrics lower and prompt similar sales from other public miners.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

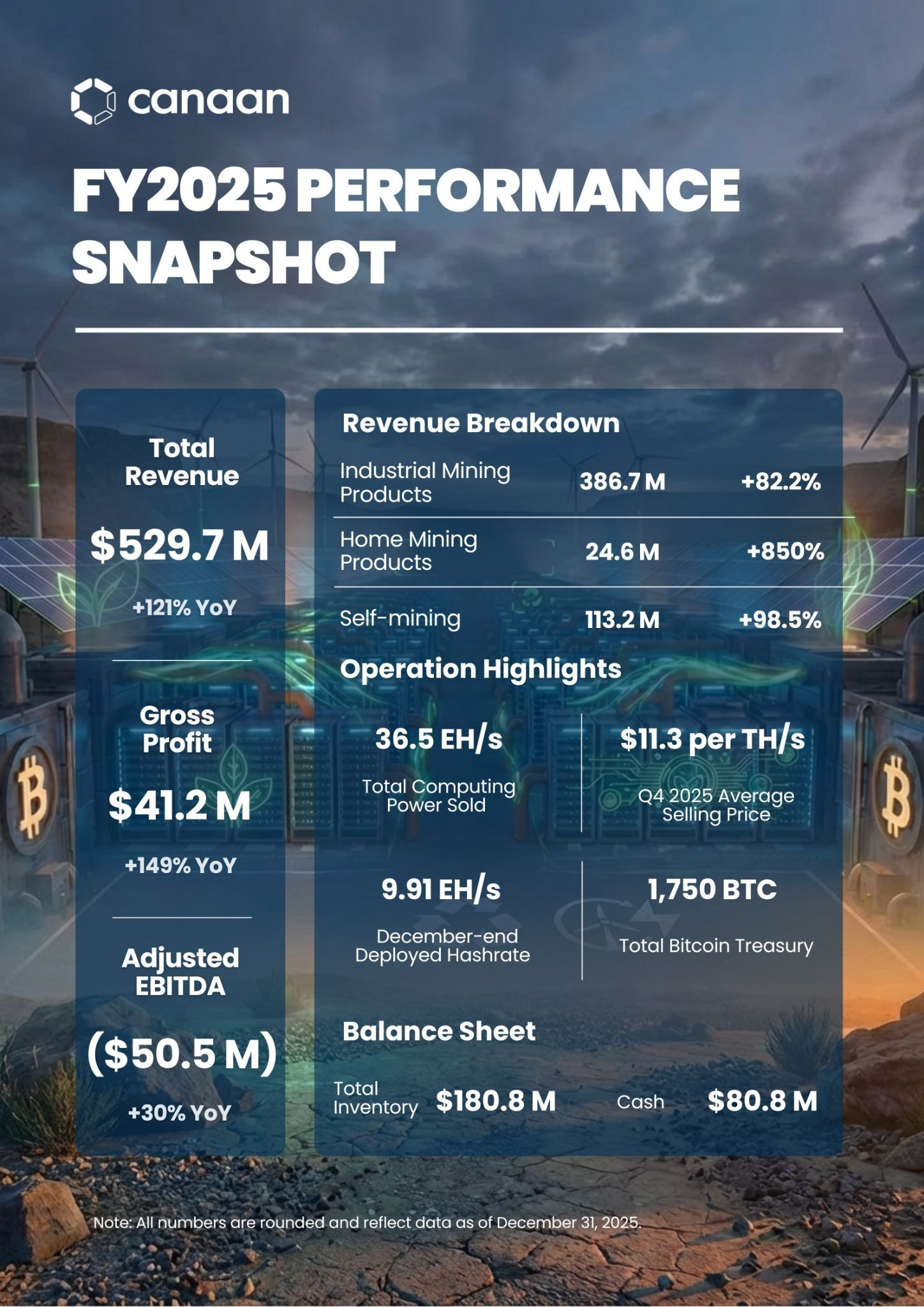

Crypto Miner Canaan Shares Sink 7% Despite Strong Q4

Crypto miner and manufacturer Canaan fell 6.9% on the Nasdaq on Tuesday despite reporting a 121.1% year-on-year increase in revenue to $196.3 million in the fourth quarter, driven by an increase in hardware sales and stronger mining performance.

Canaan reported that its Bitcoin (BTC) mining revenue rose 98.5% year-on-year to $30.4 million, helping boost its Bitcoin treasury to a record 1,750 BTC, valued at nearly $120 million, while the company also increased its Ether (ETH) holdings to 3,950 ETH, worth $7.9 million.

The revenue figure is Canaan’s highest quarterly posting in three years, and was also driven by Bitcoin mining machine sales, with the company shipping a record 14.6 exahashes per second (EH/s) of computing power during the quarter.

Canaan said computing power sales were supported by a “milestone order” from a US-based institutional miner, helping it set a new quarterly record for computing power sales and achieve a 60% year-on-year increase.

On the mining front, the Singapore-based company said it expanded its installed hashrate to 9.91 EH/s, with 7.65 EH/s operational during the quarter.

Bitcoin network hashrate has fallen from a record 1,150 EH/s in mid-October to 980 EH/s as miners continue to unplug unprofitable machines and pivot to AI and high-performance computing.

Despite the strong Q4 performance, Canaan (CAN) shares tanked another 6.87% to $0.56, Google Finance data shows, making it one of the lowest performers among the 15 largest Bitcoin miners by market cap.

Canaan’s risk of Nasdaq delisting worsens

At its current price of $0.56, the company is now down 18.1% year-to-date and 70.2% over the last 12 months.

On Jan. 16, Canaan said it received a letter from the Nasdaq warning that it must increase its share price to above $1 to meet the stock exchange’s minimum bid rule or risk being delisted.

Related: Bitcoin ETFs extend rebound as $145M in fresh inflows hit market

The Nasdaq gave the Singapore company 180 days, until July 13, to regain compliance with the rule, which requires its closing bid price to hit at least $1 for a minimum of 10 consecutive trading days. Canaan last closed above $1 on Nov. 28, 2025.

Magazine: 6 weirdest devices people have used to mine Bitcoin and crypto

Crypto World

Descending Channel Dominates as ETH Tests Demand Zone

Ethereum remains in a cyclical downswing after the recent capitulation leg that drove the price from the mid-$2,000s into the $1,800 demand region. The structure across higher timeframes is still dominated by a well-defined descending channel, with lower highs since late 2025 and momentum readings in oversold territory now attempting to stabilize.

Current conditions, therefore, reflect a market in the process of digesting a sharp repricing, where the next impulse will likely be defined by how the price reacts to the nearest resistance band around $2,700 and the reclaimed support zone near $1,800–$2,000.

Ethereum Price Analysis: The Daily Chart

The daily chart shows Ethereum trending within a broad downward channel, with the latest sell-off driving the asset into the lower boundary and the horizontal demand region between roughly $1,800 and $1,700. This zone has produced an initial reaction, but the sequence of lower highs and lower lows remains intact, and the bearish fair value gap around $2,300–$2,400 now acts as the first short-term resistance cluster.

Daily RSI has also bounced from deeply oversold readings but still resides in a bearish regime, indicating that any recovery for now is best classified as a corrective rebound within a dominant downtrend. Yet, a sustained move back above $2,400–$2,500 and the channel midline would be required to argue for a more durable trend change.

ETH/USDT 4-Hour Chart

On the 4-hour timeframe, the market displays a short-term basing attempt after the steep decline. The price carved out a descending leg that terminated near the $1,800 demand zone while the 4-hour RSI formed a clear bullish divergence, signalling seller exhaustion and prompting the current consolidation above the support zone at $1,800 and below the resistance level at $2,100.

This range now defines the tactical battlefield: holding above $1,800 would keep the developing recovery structure valid and open the door for a retest of the $2,200 short-term resistance level, whereas a decisive breakdown below $1,800 would indicate that the relief phase has failed and expose the lower daily supports closer to $1,600.

On-Chain Analysis

The Exchange Supply Ratio for Ethereum has continued to trend lower and currently sits near the lowest levels of the displayed series, around 0.135, implying that an increasingly smaller fraction of the total ETH supply is held on centralized exchanges. This persistent decline, even as prices have sold off toward the $2,000 area, suggests that a significant portion of the supply has migrated to self-custody or staking and is less immediately available for sale, reducing structural spot sell-side liquidity.

In the short term, this configuration can amplify volatility, with sharp downtrends driven by derivatives and forced selling facing relatively thin spot order books. But from a medium-term perspective, a depressed exchange supply ratio combined with already realized downside often characterizes late-stage phases of a corrective cycle, where additional marginal supply becomes progressively harder to source if demand begins to recover.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

Crypto World

Crypto’s ‘age of speculation’ is over, says Galaxy CEO Mike Novogratz

Justin Tallis | Afp | Getty Images

Throughout its history, bitcoin and other cryptocurrencies have been subject to significant price fluctuations, whether that’s due to larger macro factors impacting all asset classes or during “crypto winters” tied to industry concerns.

But with a crypto-friendly Trump administration and expectations for passage of a cryptocurrency market structure bill, many onlookers expected another bull run in digital assets to start 2026. However, it’s been the exact opposite. Bitcoin is down more than 21% so far this year, and it fell to $60,062.00 last week — its lowest level in roughly 16 months. That marked a drop of nearly 50% from its record back in October 2025.

What is driving this latest decline? Rather than a single event, Galaxy founder and CEO Mike Novogratz said at the CNBC Digital Finance Forum on Tuesday in New York City that it’s a reflection of a larger industry shift. When bitcoin fell 22% in less than a day back in November 2022 following the collapse of FTX, there was a “breakdown in trust,” Novogratz told CNBC’s MacKenzie Sigalos at the event. “This time, there’s no smoking gun,” he said. “You look around like, what happened?”

Bitcoin price since the start of 2026

Novogratz did note the wipeout that occurred in October 2025 as a significant event, when more than 1.6 million traders suffered a combined $19.37 billion erasure of leveraged positions over a 24-hour period, a situation that he said, “wiped out a lot of retail and market makers” and put plenty of pressure on prices.

“Crypto is all about narratives, it’s about stories,” he said. “Those stories take a while to build and you’re pulling people in … so when you wipe out a lot of those people, Humpty Dumpty doesn’t get put back together right away,” he said.

But Novogratz also sees something more lasting he expects to come out of the current downturn, saying the recent era of crypto investing, “the age of speculation,” will be phased out going forward as the crypto industry has brought in “institutions where people have a different risk tolerance.”

“Retail people don’t get into crypto because they want to make 11% annualized,” he said. “They get in because they want to make 30 to one, eight to one, 10 to one.”

Some traders will always speculate, Novogratz says, but overall, “it’s going to be transposed or replaced by us using these same rails, these crypto rails, to bring banking [and] financial services to the whole world. And so, it’s going to be real world assets with much lower returns.”

He also pointed to tokenized stocks as assets that will have “a different return profile.”

Sigalos asked Novogratz if the eventual passage of the CLARITY Act could be a catalyst for the industry, with the stall in the crypto market structure bill’s momentum on Capitol Hill at least a short-term headwind. He is confident a crypto market structure bill will eventually become law.

“I talked to [Senate Minority Leader] Chuck Schumer two nights ago and he said ‘We’re going to pass the goddamn CLARITY Act,’” Novogratz said. “The Democrats want to pass the act, and the Republicans want to.”

Novogratz said the crypto industry needs the bill for “a lot of reasons,” but notably, “We need it for spirit back in the crypto market.”

Crypto World

Davos WEF 2026: Crypto Enters Its Execution Phase

At the World Economic Forum 2026 in Davos, crypto was no longer framed as a parallel financial system. Instead, it appeared as emerging institutional infrastructure—regulated, operational, and increasingly shaped by legislation, market structure, and real deployment timelines.

Across CNBC House and Bloomberg House, the conversation shifted decisively away from hype. The focus was execution: what can realistically ship in 2026, under which rules, and with what return on capital.

Sponsored

Why Davos Matters for Crypto in 2026

Davos is less about announcements and more about institutional alignment. This year’s theme, “A Spirit of Dialogue,” reflected crypto’s transition from ideology to negotiation—between regulators, market operators, and incumbents.

Crypto repeatedly surfaced in discussions around financial infrastructure modernization, settlement efficiency, tokenization of regulated assets, and market resilience. The signal was clear: crypto is now being judged on compliance, governance, and measurable outcomes, not narratives.

CNBC House: Stablecoins and Tokenization, Narrowed

CNBC House debuted in 2026 as a curated venue for C-suite and policy-level discussions. Its tone was pragmatic. Conversations with Binance Co-CEO Richard Teng and Ripple CEO Brad Garlinghouse positioned 2026 as an execution year, not a speculative cycle.

Sponsored

Stablecoins emerged as the most deployable use case—where institutional demand, technical readiness, and regulatory attention already overlap. Tokenization, meanwhile, was framed less as a sweeping transformation and more as a targeted efficiency upgrade: faster settlement, improved collateral mobility, lower operational risk, and better auditability.

Crypto’s challenge at Davos was attention. It now competes directly with AI, cybersecurity, and operational resilience for executive capital. The bar in 2026 is ROI.

Sponsored

Bloomberg House: Legislation as the Bottleneck

If CNBC House captured intent, Bloomberg House captured constraints.

Coinbase CEO Brian Armstrong focused on US legislation, particularly the stalled Clarity Act. In early 2026, Coinbase withdrew support for the Senate market structure bill, arguing its latest draft could restrict tokenized equities, DeFi, and stablecoin rewards—putting crypto firms at a disadvantage to banks.

His opposition delayed the bill’s markup and highlighted a key reality: policy details, not technology, are pacing adoption. Stablecoins sit at the center of that debate, with yield, consumer protection, and financial stability now active fault lines.

Sponsored

Tokenization at Bloomberg House was framed as market structure competition. Moves toward 24/7 trading and blockchain-based rails suggest the battle is no longer about feasibility, but about who controls standards, fees, and distribution.

What Davos Made Clear

Crypto’s next phase is defined by integration, not disruption. Stablecoins are the leading institutional wedge. US legislation sets the tempo. Tokenization is becoming incremental, regulated, and competitive.

Davos sent a clear message: crypto’s future will be decided less by narratives—and more by who can deliver institution-grade infrastructure under real-world rules.

This article was contributed by Ionut Gaucan, an independent industry expert reporting from Davos. The views expressed are the author’s own and do not necessarily reflect those of BeInCrypto.

-

Tech7 days ago

Tech7 days agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

Politics2 days ago

Politics2 days agoWhy Israel is blocking foreign journalists from entering

-

NewsBeat1 day ago

NewsBeat1 day agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

Sports4 days ago

Sports4 days agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

Tech4 days ago

Tech4 days agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

Business2 days ago

Business2 days agoLLP registrations cross 10,000 mark for first time in Jan

-

NewsBeat2 days ago

NewsBeat2 days agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

Sports2 days ago

Sports2 days agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Sports3 days ago

Former Viking Enters Hall of Fame

-

Politics2 days ago

Politics2 days agoThe Health Dangers Of Browning Your Food

-

Sports5 days ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

Business3 days ago

Business3 days agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

NewsBeat4 days ago

NewsBeat4 days agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Business5 days ago

Business5 days agoQuiz enters administration for third time

-

Crypto World8 hours ago

Crypto World8 hours agoBlockchain.com wins UK registration nearly four years after abandoning FCA process

-

Crypto World17 hours ago

Crypto World17 hours agoU.S. BTC ETFs register back-to-back inflows for first time in a month

-

NewsBeat2 days ago

NewsBeat2 days agoResidents say city high street with ‘boarded up’ shops ‘could be better’

-

Sports1 day ago

Kirk Cousins Officially Enters the Vikings’ Offseason Puzzle

-

Crypto World16 hours ago

Crypto World16 hours agoEthereum Enters Capitulation Zone as MVRV Turns Negative: Bottom Near?

-

NewsBeat6 days ago

NewsBeat6 days agoStill time to enter Bolton News’ Best Hairdresser 2026 competition