Crypto World

SBF Seeks New FTX Fraud Trial After Fresh Witness Testimony

Former FTX chief executive Sam Bankman-Fried has asked a federal court for a new trial, arguing that testimony from witnesses not available at the original 2023 trial could undermine the government’s portrayal of FTX’s finances before its collapse. The Feb. 5 filing, submitted to the Manhattan federal court by Bankman-Fried’s mother, Barbara Fried, a retired Stanford law professor, is being reviewed separately from the formal appeal process. Legal observers described the move as a long shot, noting that motions for a new trial face steep legal hurdles. The filing keeps the case active as the crypto industry continues to reckon with the fallout from FTX’s collapse. Bankman-Fried was convicted on seven counts tied to the misuse of customer funds at FTX and Alameda Research and was subsequently sentenced to 25 years in prison.

Key takeaways

- Bankman-Fried filed for a new-trial request in Manhattan federal court on February 5, arguing that testimony from witnesses not previously available could alter the government’s narrative about FTX’s financial condition before November 2022.

- The filing is distinct from his ongoing appeal and is considered a high-risk, rarely-granted remedy, according to coverage of the development.

- The witnesses cited include former FTX executives Daniel Chapsky and Ryan Salame; Salame has already pleaded guilty to related charges and is serving a seven-and-a-half-year sentence.

- Bankman-Fried is asking for a different judge to review the motion, contending that the trial judge, Lewis Kaplan, showed “manifest prejudice” during the proceedings.

- Separately, the FTX bankruptcy estate continues to unwind assets and make payments to creditors, with billions disbursed in 2025 and further payouts anticipated as asset recoveries and claims reviews proceed.

Sentiment: Neutral

Market context: The case sits at the intersection of a reopened legal battle over crypto exchange governance and the ongoing process of asset recovery in the FTX bankruptcy, a backdrop shaping investor sentiment in the broader crypto ecosystem as markets adjust to renewed regulatory scrutiny and liquidity considerations.

Why it matters

The motion filed by Bankman-Fried signals an enduring strategy to contest every possible avenue of review, even after a high-profile conviction that has already reverberated through the industry. By arguing that testimony from former executives who did not appear at trial could alter the narrative surrounding FTX’s finances, the defense aims to inject fresh context into a case that has already established a precedent for the treatment of customer funds and corporate governance within crypto-linked entities. While the odds of a successful new trial remain remote, the procedural maneuver underscores how defendants in landmark crypto cases may pursue multiple tracks to challenge outcomes, particularly when complex financial arrangements are involved.

The allegations hinge on questions about how FTX and Alameda Research presented their financial position in the crucial period leading up to the collapse in November 2022. The defense contends that additional perspective from former executives could complicate the government’s portrayal of solvency and liquidity, potentially altering jurors’ understanding of the company’s underlying finances. The decision to seek a different judge for review adds another layer to the strategy, suggesting the defense believes the presiding judge’s conduct during trial could have influenced the jury’s interpretation. This line of argument echoes earlier appeals discussions that suggested the defense perceived improper constraints on explaining investor fund availability during the proceedings.

On the other side, prosecutors and the bankruptcy team remain focused on recovering value for creditors through a phased payout schedule. The FTX estate’s process has already distributed billions of dollars to creditors in 2025, and officials indicate that additional disbursements will follow as asset recoveries continue and claims are reviewed. The contrast between ongoing asset recovery efforts and a post-conviction legal bid highlights how the FTX saga continues to unfold across multiple fronts—criminal accountability, civil actions, and creditor recovery—well after the initial collapse and sentencing.

What to watch next

- Whether the court will accept the new-trial motion for review, and if so, whether the request is reassigned to a different judge for consideration.

- Any formal responses from prosecutors and the defense, including potential replies outlining why the witnesses’ testimony could be deemed significant or inconsequential to the verdict.

- Timing and scope of further rulings in the criminal case, including any procedural milestones tied to the appellate process or ancillary motions.

- Progress of the FTX bankruptcy estate’s payout plan, including any announced disbursements or adjustments to the repayment calendar as asset recoveries evolve.

Sources & verification

- Motion filed on February 5 in Manhattan federal court by Sam Bankman-Fried’s team, with commentary noting its position as a long-shot challenge.

- Bloomberg’s coverage of the new-trial bid and related scheduling considerations.

- Details of Bankman-Fried’s seven-count conviction tied to the alleged misuse of customer funds at FTX and Alameda Research.

- Salame’s guilty plea and seven-and-a-half-year prison sentence as a related development in the case.

- FTX bankruptcy estate updates describing the phased payout approach and cumulative distributions to creditors in 2025, along with ongoing reviews of remaining claims.

New-trial bid keeps FTX fallout in play as prosecutors press ahead

The central argument in Bankman-Fried’s latest filing rests on the potential impact of testimony from witnesses who were not called at trial, specifically former FTX executives Daniel Chapsky and Ryan Salame. By positing that such testimony could challenge the government’s narrative about FTX’s financial health before the collapse, the defense is attempting to reopen questions about solvency and liquidity that were central to the jury’s assessment in 2023. While the court process for a new trial remains arduous, the submission indicates that the defense believes new material could alter the perception of the company’s finances, a linchpin of the government’s case against Bankman-Fried on seven criminal counts tied to customer funds misuse.

The move to seek a different judge to review the motion adds a procedural layer to the strategy. Bankman-Fried’s team argues that Judge Lewis Kaplan’s conduct during the trial may have introduced what the defense characterizes as “manifest prejudice.” This argument mirrors prior appellate contentions that Kaplan did not allow certain defenses relating to the availability of funds to repay investors to be presented to jurors. The defense’s aim appears to be twofold: to introduce new witnesses who could reframe the financial narrative and to secure an impartial reassessment of the trial dynamics, should the court grant a fresh review.

At the same time, the broader legal and regulatory environment surrounding FTX remains unsettled. The bankruptcy estate’s ongoing efforts to return capital to creditors underscore the complexity of unwinding a multibillion-dollar platform that collapsed under rapid liquidity strains and stakeholder risk. In 2025, the estate distributed billions and indicated that further disbursements would follow as asset recoveries progress and claims are thoroughly reviewed. This ongoing process continues to shape the broader market’s expectations for recovery timelines and the level of restitution investors and customers might eventually receive.

Observers emphasize that even if the new-trial bid does not succeed, it keeps the legal narrative alive, ensuring continued scrutiny of evidence and procedures that could influence future crypto-related prosecutions and settlements. The case thus remains a focal point for discussions about governance, financial disclosures, and customer protections within the crypto space, reinforcing the idea that accountability mechanisms beyond initial verdicts may play a meaningful role in shaping industry standards and investor confidence.

Crypto World

Saylor shoots down any idea of forced BTC sale

Concerns that Strategy (MSTR) will be forced to sell bitcoin amid falling prices are “an unfounded concern,” chairman Michael Saylor said during a CNBC interview, affirming the company’s commitment to ongoing purchases.

“Our net leverage ratio is half the typical investment grade company,” Saylor said. “We’ve got 50 years worth of dividends and bitcoin, we’ve got two and a half years worth of dividends just in cash on our balance sheet … we’re not going to be selling, we’re going to be buying bitcoin. I expect we’ll be buying bitcoin every quarter forever.”

Last week, the company added 1,142 BTC to its holdings for roughly $90 million, at an average price of $78,815 per coin. The company’s total stack now stands at 714,644 coins, purchased for about $54.35 billion, bringing the average cost per bitcoin to $76,056 — well above the current price of around $69,000.

Saylor’s comments come as bitcoin has seen significant volatility (almost exclusively downward) over the past months, though he emphasized that swings are part of the asset’s design. “The key to keep in mind is that bitcoin is digital capital,” he continued. “It’s going to be two to four times as volatile as traditional capital like gold or equity or real estate. It’s got two to four times the performance this decade of traditional capital. It’s the most useful global capital asset in the world, you can put more leverage on it. You can trade it in more ways than any other kind of capital assets. So the volatility is the bug, but the volatility is the feature.”

Strategy reported an operating loss of $17.4 billion and a net loss of $12.6 billion for the fourth quarter, reflecting largely non-cash mark-to-market accounting tied to bitcoin’s price decline. The results highlight how swings in the cryptocurrency’s value continue to influence the company’s financial statements despite its long-term investment strategy.

Saylor also addressed the notion that bitcoin’s current price levels could represent a new form of market maturity, which he characterized as a good thing.

Strategy’s balance sheet and its digital credit business are central to its strategy, Saylor said. The firm’s digital credit structure has emerged as one of the most actively traded credit instruments of the decade, generating substantially higher cash flow than traditional fixed-income products and far exceeding the trading volume of preferred stocks.

“There isn’t any credit risk in the balance sheet of the company,” he said.

Saylor declined to offer a short-term bitcoin price prediction but reiterated confidence in long-term performance. “I don’t really make predictions over 12 months. I think that bitcoin is going to double or triple the performance of the S&P over the next four to eight years. And I think that’s the only thing we need to know.”

Shares of the company are down 3% on Tuesday, bringing the year-to-date decline to 15% and the year-over-year fall to 60%.

Crypto World

Crypto’s banker adversaries didn’t want to deal in latest White House meeting on bill

Crypto industry negotiators arrived at the White House on Tuesday ready to talk about a legislative deal on stablecoin yields, but their banking counterparts brought further demands for a ban on such rewards in the Senate’s crypto market structure bill, according to people familiar with the talks.

The fight over whether stablecoins should be able to offer rewards — a lobbying battle between Wall Street bankers and crypto insiders — is one of the chief headwinds keeping the Senate Banking Committee from advancing the Digital Asset Market Clarity Act. It’s now been a sticking point for months, and the banking side held their ground on prohibiting the rewards activity and more, according to a principles document circulated by the bank negotiators, despite the White House’s insistence last week that both sides come with ideas for compromising.

The document called for a general prohibition on stablecoin yield, according to a copy obtained by CoinDesk, suggesting a ban on “any form of financial or non-financial consideration to a payment stablecoin holder in connection with the payment stablecoin holder’s purchase, use, ownership, possession, custody, holding or retention of a payment stablecoin.”

The crypto team at the table was said to include executives from Coinbase, Ripple, a16z, the Crypto Council for Innovation and the Blockchain Association, according to people familiar with the plans. The White House sought to pare down the numbers of participants in the most recent gathering there last week, which hadn’t produced significant progress on the question of stablecoin rewards programs that are a key component of crypto platforms’ business models.

Despite the lack of significant progress, crypto representatives struck a hopeful note in statements about the meeting.

“We’re encouraged by the progress being made as stakeholders remains constructively engaged on resolving outstanding issues,” said Blockchain Association CEO Summer Mersinger, who was said to participate in the meeting.

“The important work continues,” said Ji Kim, the CEO of CCI, in a statement after the meeting, saying his group “appreciates the banking industry for their continued engagement.”

Banking groups involved in the meeting, including the Bank Policy Institute and American Bankers Association, issued a statement after the meeting, though it included no details about next steps on the legislation.

“As we noted during the meeting, that framework can and must embrace financial innovation without undermining safety and soundness, and without putting the bank deposits that fuel local lending and drive economic activity at risk,” the group said in the combined statement.

The document they were said to have shared insisted that stablecoin activity “must not drive deposit flight that would undercut Main Street lending.” It asked that the requested ban come with an enforcement stick for regulators, and the document suggested a study by regulators that examines the effect of stablecoin activity on deposits.

After two White House meetings on the topic and no significant movement of the line on yields, the matter may return to the discretion of lawmakers working on the bill.

Before the Senate can approve a bill, the banking panel needs to clear it through a majority vote. The legislation already has its necessary backing from the Senate Agriculture Committee, and a similar bill with the same name won a vote in the House of Representatives last year. But bankers have raised their concerns about the threat to deposits at the core of their industry.

However, stablecoin yield isn’t the only major sticking point. Senate Democratic negotiators have demanded that the effort include a ban on deep crypto involvement from senior government officials, driven primarily by President Donald Trump’s personal crypto interests. The Democratic lawmakers have also insisted on greater protections against crypto’s use in illicit finance and also that the Commodity Futures Trading Commission get fully staffed by commissioners — including Democratic appointees — before it can get to work on crypto regulations.

While Trump’s crypto adviser, Patrick Witt, has predicted the negotiators will find common ground soon, he also told CoinDesk that the White House won’t support an effort that targets the president. Witt was said to lead the meeting on Tuesday, as he did the one last week.

The Clarity Act faces a number of practical challenges beyond the policy disputes, including the Senate’s ongoing friction over a last remaining budget issue: the funding of the Department of Homeland Security, which runs Immigration and Customs Enforcement (ICE). The Senate is always a tough place to secure necessary floor time to move legislation, and the closer the chamber gets to the lengthy breaks before the midterm elections this year, the more difficult it is to find enough time to handle a major crypto bill.

Read More: Crypto industry, banks not yet close to stablecoin yield deal at White House meeting

UPDATE (February 10, 2025, 23:16 UTC): Adds comment from the bank lobbying groups.

UPDATE (February 10, 2025, 00:12 UTC): Adds details about the bankers’ document stating their principles on yield.

Crypto World

Onchain Options Volumes Hit All-Time Highs as Lending Yields Dry Up

Options premium volumes and trading activity are ramping up as users explore new areas in DeFi.

As decentralized finance (DeFi) matures, users are turning to alternative platforms, such as onchain options, to generate higher yields.

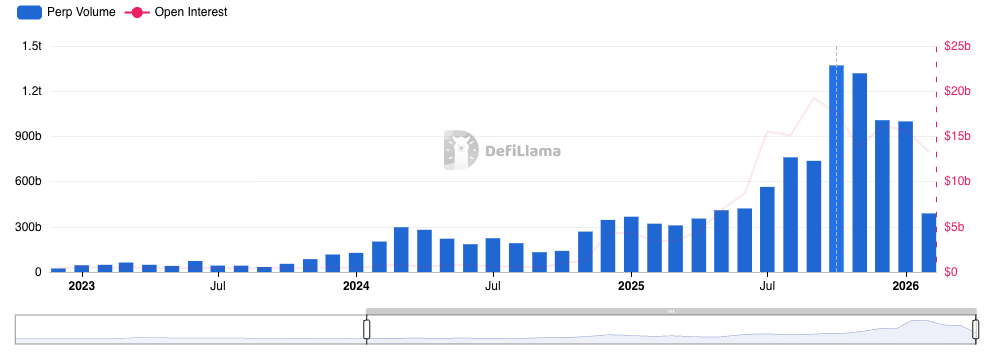

Onchain options activity reached all-time highs over the last two weeks, with $44 million of volume in the first week of February and $28 million during the last week of January.

More than 80% of the total onchain options volumes are concentrated in leading protocols, Ithaca and Derive. Over the last week, Ithaca processed $26 million in volume and Derive recorded $11 million, while the third-busiest protocol, Overtime, recorded just $2 million.

While the exact catalyst for the growth isn’t clear, it could be a combination of traditional lending platforms like Aave offering lower yields than in prior years, and also potentially some anticipation of Hyperliquid’s upcoming HIP-4 markets, which will allow users to trade binary outcomes that function similarly to options.

Just yesterday, a popular DeFi trader known as Route 2 Fi posted on X, “Where are people getting yield these days? 2% APR on USDT at Aave isn’t exactly sexy.” The post gained significant traction online, indicating that many DeFi participants are also seeking new, lucrative yield sources.

Crypto World

Sub-$2K ETH Price Levels Emerge As Key Long-Term Demand Zones

Ether (ETH) struggled to hold prices above $2,000 on Tuesday, and against this backdrop, analysts noted that Ether’s 31% decline in 2026 fits a familiar price fractal from previous bull markets.

Key takeaways:

-

ETH’s recent dip to $1,736 may mark only the first of many lows in a larger consolidation phase.

-

Onchain cost-basis data clusters from $1,300 to $2,000, reinforcing this range as a potential demand zone.

ETH fractal hints at a longer base-building phase

A long-term fractal comparison between the 2021-2022 and 2024-2025 cycles suggests that Ether’s sharp sell-off mirrors a pattern in which an initial bottom is formed before the price revisits lower levels due to further market weakness.

On the weekly chart, ETH’s drop toward the $1,730 region resembles its “first low,” rather than a definitive market floor.

In 2021, ETH spent 12 months consolidating around the first low ($1,730) and a lower support band ($885), allowing leverage to reset and spot demand to rebuild.

Applying this framework, ETH may continue ranging from about $1,300 to $2,000, with downside tests toward the $1,500–$1,600 zone possible before a sustained base is formed.

Onchain cost basis data cites $1,300–$2,000 as a demand zone

Ether’s UTXO realized price distribution (URPD) data underlines the chances of an extended consolidation. Large supply clusters remain above current prices, with $2,822 accounting for 5.86% of the ETH supply and $3,119 holding 6.15%, forming heavy overhead resistance.

Below current spot prices, notable clusters appear at $1,881 (1.58 million ETH) and $1,237, suggesting potential demand zones if the price continues to retrace.

Structurally, $1,237 stands out as a potential cycle floor, followed by intermediate support near $1,584 and stronger acceptance around $1,881, where the realized supply concentration increases.

Derivatives data aligns with this view. The liquidation heat map shows cumulative long liquidations at risk of $4 billion to $6 billion, ranging to $1,455 from $1,700, and these are levels that may still be targeted by sellers.

However, more than $12 billion in short liquidity is stacked up to $3,000, implying that once downside liquidity is absorbed, the directional bias may shift higher in the coming months.

Related: Analysts debate whether Ether has capitulated or has further to fall

What is giving Ether structural support?

Data from CryptoQuant shows Ether withdrawals from exchanges have surged to their highest level since October 2025, with net outflows exceeding 220,000 ETH. Binance recorded daily net outflows of about 158,000 ETH on Thursday, the largest since August 2025.

These flows coincided with ETH trading from $1,800 to $2,000, suggesting accumulation or risk-off repositioning at these levels.

MNCapital founder Michaël van de Poppe highlighted a similar dynamic, noting that price often lags network and narrative growth.

Stablecoin transaction volume on Ethereum has risen about 200% over the past 18 months, even as the ETH price remains about 30% lower, a divergence that may lead to a parabolic repricing for the altcoin.

Related: Ethereum Foundation teams up with SEAL to combat wallet drainers

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

Crypto World

Big Demand Zone Below $2K Signals ETH’s Next Move

Ether faced resistance to hold above $2,000 on Tuesday as market sentiment cooled, and a 31% drop in 2026 has drawn comparisons to price fractals seen in prior bull markets. The slide to roughly $1,736 underscored a broader consolidation, with traders weighing the risk of further draws versus the potential of a patient, bottoming process. On-chain watchers have repeatedly highlighted a defined demand zone spanning approximately $1,300 to $2,000, a band that could attract buyers if price action continues to meander lower. The narrative here centers on whether Ether can form a durable base or slip into a protracted period of range-bound trading that delays a meaningful breakout. For context, market participants continue to monitor liquidity flows, derivative risk, and evolving network fundamentals that often foreshadow macro moves.

Key takeaways

-

ETH’s drop to about $1,736 may mark the initial low in a broader consolidation phase rather than a final bottom.

-

On-chain cost-basis data clusters between $1,300 and $2,000, reinforcing this range as a potential demand zone.

-

A fractal comparison of the 2021–2022 cycle with 2024–2025 suggests a pattern where an early bottom is followed by retests to lower levels before a durable base forms.

-

UTXO Realized Price Distribution (URPD) points to meaningful overhead resistance near $2,822 and $3,119, concentrations that could cap rallies unless substantial demand emerges below current levels.

-

Derivatives data show concentrated long-liquidation risk around $1,455 from $1,700, while more than $12 billion in short liquidity sits up to $3,000, implying a potential shift in momentum once downside liquidity is absorbed.

Tickers mentioned: $ETH

Sentiment: Neutral

Price impact: Neutral. Near-term risk remains balanced by base-building signals and a defined demand zone.

Market context: The broader crypto backdrop continues to digest on-chain signals alongside macro risks. Ethereum withdrawals from exchanges have spiked to the highest levels since October 2025, with net outflows exceeding 220,000 ETH, and Binance alone recording roughly 158,000 ETH in daily net outflows—the largest since August 2025. These flows coincided with ETH trading in a $1,800–$2,000 range, suggesting a combination of accumulation and risk-off repositioning. Meanwhile, stablecoin activity on Ethereum has risen markedly, with stablecoin transaction volume up about 200% over the past 18 months even as the price has lagged. This divergence can foreshadow a re-rating if network fundamentals and liquidity conditions align with price action.

Why it matters

The unfolding pattern matters because it frames Ether’s potential trajectory in the context of a longer base-building phase rather than a quick recovery. If the fractal framework holds, the asset could spend more time coiling within a defined band, testing lower supports before a durable upside breakout emerges. This matters for traders and risk managers who must gauge how much exposure to maintain during a broad consolidation while tracking evolving on-chain activity and derivatives signals that historically precede major moves.

From a broader market perspective, the interaction between on-chain demand zones and subtle shifts in exchange flows could signal how liquidity is reallocated as institutions and retail participants reassess risk. The observed uptick in stablecoin settlements and the outflows from centralized venues imply a transfer of risk away from exchanges in favor of self-custody and potentially longer-duration holding patterns. If this trend persists, it could set the stage for a renewed bid when price action tests critical levels in the $1,500s or higher.

Additionally, the ongoing dialogue around whether Ether is capitulating or merely consolidating highlights the nuanced nature of market cycles. The fractal approach, which aligns current action with prior periods of broad basing, suggests that patience and disciplined risk management may be more prudent than chasing short-term rallies during uncertain liquidity regimes. Independent observers are watching for confirmations from on-chain metrics and derivatives markets that could either reinforce a gradual re-rating or expose the market to sharper, faster moves once liquidity conditions flip.

What to watch next

-

Price tests of the $1,500–$1,600 zone and whether buyers re-emerge at the lower end of the demand band.

-

Verification of key URPD levels around $1,237 and $1,881 as potential cycle floors and pockets of demand if price retraces further.

-

Monitoring long versus short liquidity dynamics, including long-liquidation risks around $1,455 from the $1,700 area and substantial short liquidity up to $3,000, which could shape the slope of any ensuing rally.

-

Trends in exchange withdrawals and stablecoin turnover on Ethereum, which may presage shifts in market participation and risk tolerance.

-

Derivative market signals, including any evolving bias after absorption of near-term liquidity pressures, to gauge whether the market transitions from distribution to accumulation.

Sources & verification

- Ether UTXO Realized Price Distribution (URPD) data and interpretations from Glassnode.

- Rising Ethereum withdrawals from exchanges and related net flows, with Binance’s outflows highlighted as a notable datapoint from CryptoQuant.

- Derivatives risk indicators, including the Cuingood-style liquidation heat map from Coinglass, detailing long-liquidation risk levels and short liquidity concentrations to $3,000.

- Weekly chart framing and fractal comparisons published with reference to ETHUSDT data on TradingView (Cointelegraph/TradingView).

- Ethereum Foundation SEAL collaboration articles on wallet security and related efforts to curb drainers.

Ether fractal signals an extended base-building phase

Ether (CRYPTO: ETH) has again drawn analysts to a familiar price-action pattern where a pronounced dip is followed by a prolonged period of range-bound activity rather than an immediate leg higher. On the weekly chart, a move toward the $1,730 area resembles a “first low” rather than a definitive market floor, echoing structures seen during the 2021–2022 period when ETH spent roughly a year consolidating near a first low of approximately $1,730 and a broader support band around $885. These historical touchpoints, when viewed through a fractal lens, suggest the current cycle may unfold similarly: a first phase of downside risk that yields to a more extended base-building phase before demand returns with greater resilience. The weekly framing in this narrative is anchored by the ETHUSDT pair on TradingView, which has provided the visual reference for these comparisons. The fractal interpretation is not a guarantee, but it offers a framework for interpreting the sequence of on-chain activity and price movements against the backdrop of a market still digesting liquidity and macro cues.

In the near term, the market’s focus shifts to whether Ether can sustain a bid above the immediate support around $1,500–$1,600 or if price testing compounds the pressure toward the $1,237 level, a region that previous analyses identify as a potential cycle floor. The on-chain support is reinforced by URPD observations, which show substantial realized price concentration at higher levels, underscoring a stubborn overhead that could keep rallies in check unless fresh demand emerges. At the same time, the index of supply concentration at $2,822 and $3,119 constitutes a ceiling that traders must clear to generate meaningful upside momentum. These resistance pillars remind investors that any attempt to re-rate Ether will require a combination of technical durability and sustained capital inflows.

Meanwhile, market participants should monitor the interplay between on-chain signals and derivatives dynamics. The heat map of long liquidations suggests a risk horizon near $1,455 when price drifts from $1,700, while a large pool of short liquidity up to $3,000 implies a potential upside framework once sellers exhaust liquidity pressure. The balance between these forces—realized price levels, withdrawal trends, and the evolving derivative landscape—will shape whether Ether can complete a longer, steadier base or remains vulnerable to periodic risk-off episodes that push the price toward the lower bound of the current range.

As observers parse these signals, one constant remains: the market’s attention to demand zones and supply barriers. The convergence of on-chain data with macro risk sentiment can either reinforce a patient, base-building narrative or catalyze a more decisive move if new catalysts emerge. The evolving ecosystem continues to attract attention from developers and investors who watch for signs of renewed network activity, institutional participation, and regulatory clarity that could shift the risk calculus in Ether’s favor.

Crypto World

Crypto PAC Fairshake leaps into first midterm Senate race with $5 million in Alabama

Crypto’s $193 million campaign-finance force, the Fairshake political action committee, is launching into congressional midterm season with a massive $5 million injection into the Republican primary campaign of Barry Moore, a U.S. congressman now running for Senate.

One of Fairshake’s affiliates, Defend American Jobs, is committing that spending to support Moore, even though the general election remains almost nine months away. That marks one of the group’s first major forays into what promises to be a high-stakes, high-spending election season.”We are proud to stand with Barry Moore, a leader who will fight for economic growth and make America the crypto capital,” Fairshake said in a Tuesday statement.

Fairshake had also recently devoted funds to Representative French Hill, the chairman of the House Financial Services Committee who has led the charge on crypto legislation in the U.S., according to a representative of the PAC. Hill and his allies already managed to get a crypto market structure bill through the House of Representatives last year and are now awaiting a matching effort in the U.S. Senate.

Such crypto legislation is the central purpose of Fairshake’s giving — promoting pro-crypto candidates ready to pass friendly bills and opposing those who stand against such legislation.

As with all the super PAC’s giving, the money for Moore will be through “independent expenditures” under federal election law, meaning the cash can buy ads for the candidate, but they can’t deal directly with the campaign. Fairshake-backed ads in the 2024 election didn’t mention crypto at all, and this broadcast ad for Moore intends to feature the candidate’s endorsement from President Donald Trump.

Moore has served five years in the House, and he’s now campaigning to replace Senator Tommy Tuberville, a Republican who is aiming for the governor’s mansion this year. The Alabama congressman has so far served in the House’s Agriculture Committee, where crypto legislation was on the agenda last year.

“Crypto is not a fad,” Moore wrote in a December post on social media site X. “It is part of our future. It is part of Alabama’s future.”

Moore is one of five Republican candidates who announced their participation in that primary. Early polling has so far seen Moore generally in second place behind state Attorney General Steve Marshall. Both have “A” crypto ratings from Stand With Crypto, a group that reviews the digital assets views of political figures.

Read More: Industry’s PAC Keeps Seeking to Add Allies as Congress Hashes Out Crypto Legislation

Crypto World

Interactive Brokers Taps Coinbase for ‘Perpetual-Style’ Crypto Futures

Global brokerage IBKR now offers traditional and perpetual-style BTC and ETH futures trading to its clients.

Interactive Brokers (IBKR), a leading global brokerage with more than 4.5 million clients, rolled out small-sized nano BTC and ETH futures contracts today.

The contracts leverage Coinbase Derivatives’ traditional futures offerings, which have monthly expirations, and its “perpetual-style futures,” making IBKR the latest traditional brokerage to offer perpetuals.

The move is IBKR’s latest into crypto, after enabling stablecoin deposits in December.

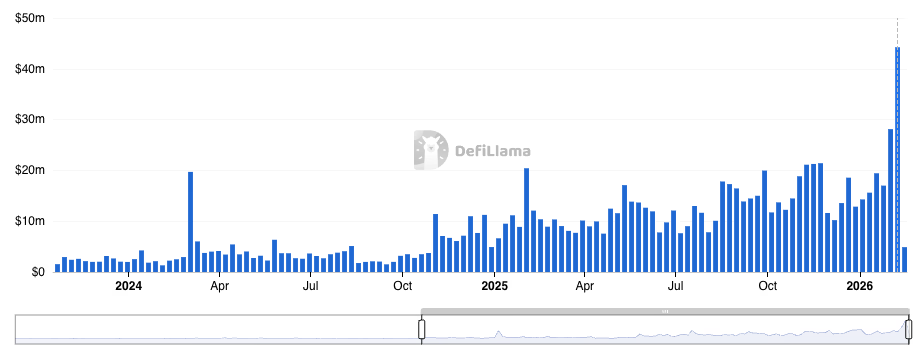

Perpetual derivatives exploded in 2025, driven by the success of platforms such as Hyperliquid, Lighter and Aster. Nearly $8 trillion in decentralized perpetuals trading occurred in 2025, according to DeFiLlama, compared with $2.55 trillion in 2024 and just $690 billion in 2023.

Traditional financial institutions continue to expand their crypto trading offerings, as evidenced by the CME Group adding new altcoin futures yesterday and even teasing its own native tokenized cash during its latest earnings call.

Unlike in previous crypto cycles, when traditional players slowly stepped away as prices dropped, leading institutions such as CME and IBKR continue to dive headfirst into the space, despite Bitcoin falling more than 50% from its October peak. However, it remains unclear whether TradFi’s focus on broadening trading access will meaningfully affect crypto prices.

Crypto World

Alphabet set to raise over $30 billion in global debt sale: sources

Sundar Pichai, chief executive officer of Alphabet Inc., during the Bloomberg Tech conference in San Francisco, California, US, on Wednesday, June 4, 2025.

David Paul Morris | Bloomberg | Getty Images

Alphabet’s debt sale keeps getting bigger.

The company is close to finalizing a global bond issuance in excess of $30 billion, according to two people familiar with the deal, an increase from the $20 billion it raised on Monday.

On Tuesday morning, Alphabet went to the European market to raise roughly $11 billion in sterling and Swiss francs, said the people, who asked not to be named because the details are private. Bloomberg reported earlier that Alphabet raised almost $32 billion.

Investors are showing heightened demand for high-quality paper from tech heavyweights that are leading the charge in artificial intelligence, one source said.

In its earnings report last week, Alphabet said it expects to shell out up to $185 billion in capital expenditures this year, more than double its 2025 capex. The group of hyperscalers, which also includes Amazon, Meta and Microsoft, are projected to collectively spend close to $700 billion in 2026. With tech companies pouring money into high-priced chips, large facilities and networking technology, analysts expect free cash flow to plummet this year.

Oracle was the first large tech company to test the debt market in 2026, with its $25 billion dollar offering last week. Meta is preparing a large debt offering in first part of this year, as it looks to accelerate its data center push across the U.S., the sources said.

Alphabet held a $25 billion bond sale in November. Its long-term debt quadrupled in 2025 to $46.5 billion. CFO Anat Ashkenazi said on last week’s earnings call that as the company considers its total investment, “we want to make sure we do it in a fiscally responsible way, and that we invest appropriately, but we do it in a way that maintains a very healthy financial position for the organization.”

Alphabet didn’t respond to a request for comment.

— CNBC’s Jennifer Elias contributed to this report.

WATCH: Alphabet’s bond sale

Crypto World

Vatican Bank makes first foray into equity indexes, setting stage for potential ETF launches

Gabriel Bouys | AFP | Getty Images

The Vatican Bank Tuesday launched two equity indexes tracking stocks that align with Catholic values. Its first foray into thematic investment products sets the bank up to potentially roll out other financial products, including ETFs in the future.

The bank, which reports to the Committee of Cardinals and the Pope, said Tuesday in a statement that the Morningstar IOR Eurozone Catholic Principles Index and the Morningstar IOR U.S. Catholic Principles Index include 50 medium and large-cap firms deemed to be consistent with Catholic ethical criteria, including prioritizing human bonds and social justice.

“Having benchmarks built in accordance with recognized Catholic ethical criteria allows us to make our performance assessment and reporting processes even more rigorous and transparent,” Giovanni Boscia, Vatican Bank deputy director general and CFO, said in the statement. “This initiative reaffirms our commitment as a financial institution serving the Church, further strengthening the role of the [Vatican Bank] as a reference point for the Catholic world.”

The Eurozone fund counts semiconductor supplier ASML Holding and telecommunications company Deutsche Telekom among its top holdings, while the US-based index’s largest holdings include Meta Platforms and Amazon.

Their rollouts also open up the possiblity the indexes could be licensed for use in an exchange traded fund.

The debut comes as investors’ appetite for ETFs and other thematic investment products grows. The global ETF market increased nearly 30% to top $14 trillion in 2024, per PricewaterhouseCoopers. And, the combined value of those funds could hit as much as $30 trillion by 2029, according to a PwC report dated March 2025.

Meanwhile, investment products rooted in social responsibility and other themes are appealing to certain slice of investors. The Ave Maria Mutual Funds, a fund family that allocates capital in accordance with Catholic teachings, said it had $3.8 billion in assets under management as of last year, per its website.

The Vatican Bank has been working to reform its image after a series of scandals. The Holy See-linked financial institution has faced several allegations of money laundering and ties with organized crime, particularly after the collapse of Milan-based Banco Ambrosiano in 1982. In 2021, former Vatican Bank president Angelo Caloia was found guilty of money laundering and embezzling millions of euros in connection with his role at the institution.

Crypto World

Miner Offloads $305M Bitcoin as Network Difficulty Sees Sharp Decline

Bitcoin mining stress deepened as difficulty fell 14% and Puell dipped below 0.8, even as Cango sold $305M in BTC.

Bitcoin mining conditions tightened sharply in late January and early February after network difficulty fell 14% over three weeks and publicly traded miner Cango disclosed a $305 million BTC sale over the weekend.

The combination of falling profitability metrics and selective balance sheet sales shows pressure spreading across the mining sector, even as broader on-chain data shows no signs of disorderly selling.

Difficulty Drops as Miners Cut Capacity

According to a February 10 brief published by on-chain analyst Axel Adler Jr., Bitcoin’s network difficulty dropped by a combined 14.1% between January 22 and February 6, following two consecutive downward adjustments of 3.3% and 11.2%. Such back-to-back cuts usually occur when less efficient mining equipment is taken offline, often during periods of weak price action.

During the same window, the price of BTC fell about 25%, briefly touching $60,000 before rebounding toward $70,000. At the time of writing, the flagship cryptocurrency was trading at around $69,000, down nearly 1% in the last 24 hours and more than 12% over the past week, based on CoinGecko data.

The asset has also lost 24% of its value over the past month and about 29% year over year, underperforming earlier-cycle expectations and keeping mining margins tight.

Against this backdrop, Cango confirmed it sold 4,451 BTC for approximately $305 million, citing balance sheet strengthening. The sale, approved by the company’s board, drew an immediate reaction from equity investors, with Cango shares closing 8% lower on the first trading day after the disclosure.

Adler described the transaction as a point event rather than evidence of widespread forced liquidation, noting that aggregate miner flows to exchanges are still holding steady.

You may also like:

Data from miner exchange inflows supports that view, with the 30-day moving average of daily miner transfers hovering near 82 BTC, only slightly lower than mid-January levels and well within recent norms, according to the market watcher. Furthermore, he reported that there have been no sustained spikes that would suggest broad reserve dumping.

Profitability Pressure and What Comes Next

Profitability metrics still point to strain. For instance, Adler pointed out in his brief that the Puell Multiple, which compares daily miner revenue to its annual average, slipped to a 30-day average of 0.77 in early February, down from 0.86 in mid-January. He added that spot readings briefly fell to around 0.61, levels historically associated with miner stress and capacity exits.

The analyst noted that miners earning below their annual average tend to prioritize liquidity, increasing the chance of selective reserve sales rather than aggressive expansion. According to him, completion of this stress phase typically requires a reversal in difficulty adjustments and a recovery in the Puell Multiple toward the 0.85 to 0.90 range.

For now, the data suggests the adjustment is playing out mainly through hashrate reductions instead of heavy selling. The risk, in Adler’s opinion, is a renewed price drop below $60,000, which could push profitability metrics lower and prompt similar sales from other public miners.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

-

Tech7 days ago

Tech7 days agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

Politics2 days ago

Politics2 days agoWhy Israel is blocking foreign journalists from entering

-

NewsBeat1 day ago

NewsBeat1 day agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

Sports4 days ago

Sports4 days agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

Tech4 days ago

Tech4 days agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

Business2 days ago

Business2 days agoLLP registrations cross 10,000 mark for first time in Jan

-

NewsBeat2 days ago

NewsBeat2 days agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

Sports2 days ago

Sports2 days agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Sports3 days ago

Former Viking Enters Hall of Fame

-

Politics2 days ago

Politics2 days agoThe Health Dangers Of Browning Your Food

-

Sports5 days ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

Business3 days ago

Business3 days agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

NewsBeat4 days ago

NewsBeat4 days agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Business5 days ago

Business5 days agoQuiz enters administration for third time

-

Crypto World8 hours ago

Crypto World8 hours agoBlockchain.com wins UK registration nearly four years after abandoning FCA process

-

Crypto World17 hours ago

Crypto World17 hours agoU.S. BTC ETFs register back-to-back inflows for first time in a month

-

NewsBeat2 days ago

NewsBeat2 days agoResidents say city high street with ‘boarded up’ shops ‘could be better’

-

Sports1 day ago

Kirk Cousins Officially Enters the Vikings’ Offseason Puzzle

-

Crypto World17 hours ago

Crypto World17 hours agoEthereum Enters Capitulation Zone as MVRV Turns Negative: Bottom Near?

-

NewsBeat6 days ago

NewsBeat6 days agoStill time to enter Bolton News’ Best Hairdresser 2026 competition