Video

Economists are blind to the next financial crisis: Top Economist Explains

Learn 50+ Years of Economics in Only 7 Weeks, by applying here: https://www.stevekeen.com

(Plus get Ravel — the economic visualization software used in this video — as a bonus if you’re accepted and join.)

This Economic Bubble is About to Burst & Most Economists Are BLIND to It!

While the world is fixated on the artificial intelligence boom, a silent and far more dangerous crisis is brewing in the global bond markets. In this critical video, Professor Steve Keen, a top economist, issues a dire warning: the bursting of the ai bubble could directly trigger a devastating sovereign debt crisis.

Discover why the neoliberal economic model, built on unsustainable debt, deregulation, and pure financial illusion, is on the brink of collapse. As millions face the reality of working past and the U.S. struggles to sell its debt in 2026, the tech sector’s promise of infinite productivity is colliding head-on with a harsh credit crunch.

Professor Keen masterfully dismantles the myth that markets, or even advanced AI, can simply “self-correct.” He reveals how decades of ignored credit cycles and reckless Wall Street dominance have pushed our economic system to its absolute limit. With global buyers now pulling back from U.S. Treasury bonds, the consequences are rapidly hitting the real economy – and no algorithm will be able to print the productivity needed to pay the bill.

In this video, we cover:

✅ The ai illusion: Why technology cannot fix a broken credit system

✅ The 2026 crisis: Why the U.S. is struggling to sell its debt right now

✅ retirement reality: Why working past 65 is the new normal

✅ System Failure: How mainstream economics ignored the warning signs

✅ The Verdict: Will the ai crash finally break the US debt market?

Don’t miss this essential analysis that reveals why economists are blind to the next financial crisis and how it will impact you.

Who is Dr. Steve Keen?

Dr. Steve Keen is an influential economist who has dedicated over 50 years to challenging mainstream economic theories. Since his days as a university student, he has been engaged in a David vs. Goliath battle against conventional economic models. Holding a Ph.D. in economics, Dr. Keen is well-known for his critical analysis and advocacy for more realistic economic approaches. His work emphasizes the importance of accounting for financial instability and incorporates elements of complex systems theory.

Curious Minds, Engineers, and Finance Professionals will appreciate his methodical breakdown of economic phenomena and his development of the Minsky software, which models financial crises. Dr. Keen’s contributions are crucial for anyone seeking a deeper understanding of how economic systems can impact technological and financial environments. His teachings offer valuable insights into the economic forces shaping our world. By following his analysis, professionals can gain a better grasp of economic dynamics that influence their fields.

Learn 50+ Years of Economics in Only 7 Weeks, by applying here: https://www.stevekeen.com

(Plus get Ravel — the software used in this video — as a bonus if you’re accepted and join.)

#AIBubble #SovereignDebt #FinancialCrisis #SteveKeen #EconomicCollapse #BondMarket #USDebt #CreditCrunch #Neoliberalism #GlobalEconomy

source

Video

EMERGENCY Crypto Bloodbath Wipes $1 TRILLION – JPMorgan “Bitcoin Beats Gold Long-Term”! Buy Now?

EMERGENCY Crypto Bloodbath Wipes $1 TRILLION – JPMorgan “Bitcoin Beats Gold Long-Term”! Buy Now?

OG (partner)

Sign up to OG.com here: https://bit.ly/OGMARKETSWENDYO

The Big Game Bonus: Learn more: Earn Up to $500 More in The Big Game Bonus

#ogpartner #sponsored

iTrustCapital (partner)

https://www.itrustcapital.com/go/crypto-wendy

https://x.com/iTrustCapital

Crypto markets have wiped out over $1T in market cap since mid-January, with BTC falling below its previous cycle high and all post-election gains erased amid heavy liquidations.

It get crazier, because at the same time, JPMorgan says Bitcoin’s long-term outlook is now more attractive than gold, even as short-term volatility shakes out the market!

Are you buying gold and silver? Let me know in the comments! (We also have big XRP news so make sure you watch until the end xo)

00:00 HI

04:48 Bitcoin and altcoin market overview

09:31 Crypto market structure updates

30:00 OG (partner)

31:45 XRP, BNB, and ETH news

34:54 The state of the crypto markets & bitcoin

Support The O Show with Ref Links:

✨Stake VET support TSCL ➡️ https://tinyurl.com/VeChain-WendyO

✨Get $100 with ITRUST ➡️ https://www.itrustcapital.com/go/crypto-wendy

✨Join OG today to trade EVERYTHING ➡️ https://bit.ly/OGMARKETSWENDYO

✨Get 20% off ARCULUS with code Wendy20 ➡️ https://www.getarculus.com/

✨Get 20% off SUMM code WENDY20 ➡️ https://tinyurl.com/Summ-Wendy20

✨GET 10% OFF BITCOIN 2026 USE WENDYO ➡️ https://bit.ly/BITCOIN2026WENDYO

✨Privacy Browser➡️ https://brave.com/wendy

✨Crypto IRAs Advice Mgmt ➡️ https://daimio.typeform.com/WendyO

✨Crypto Services I Use ➡️ https://cryptowendyo.com/partners

✨TOP CRYPTOS I LIKE ON KRAKEN ➡️ https://app.kraken.com/JDNW/WendyO

✨$500 PHEMEX Bonus ➡️https://phemex.com/en/promo/activity/558?referralCode=B6RWJ

Interested in being featured on The O Show?

Contact CryptoWendyO@protonmail.com

Official Wendy O Social Media Links can be found here: https://cryptowendyo.com/partners

CURRENT PARTNERS: MARKET CIPHER – BRAVE

This media is NOT an offer to buy or sell securities, simply for entertainment purposes

Disclaimer: Please be advised that I own a diverse portfolio of cryptocurrency assets, and anything written or discussed in connection to cryptocurrencies– regardless of the subject matter’s content– may represent a potential conflict of interest. I wish to always remain transparent and impartial to the cryptocurrency community, and therefore, the content of my media is intended FOR GENERAL INFORMATION PURPOSES ONLY. Nothing that I write or discuss should be construed, or relied upon, such as investment, financial, legal, regulatory, accounting, tax or similar advice. Nothing should be interpreted as a solicitation to invest in any cryptocurrency, and nothing herein should be construed as a recommendation to engage in any investment strategy or transaction. Please be advised that it is in your own best interests to consult with investment, legal, tax or similar professionals regarding any specific situations and any prospective transaction decisions. This channel is not responsible for the performance of actions of any sponsors, partners or affiliates. All information is found publicly on the internet and could change or be doctored now or any time in the future. This channel is for entertainment purposes ONLY and does not intend to slander or harm anyone.

PLEASE NOTE: In consideration for producing content the company, made a generous contribution to support the “CryptoWendyO” socials channel. This disclosure is in compliance with Section 17(b) of the United States Securities Act of 1933.

#bitcoin #btc #cryptomarket #cryptotrading #trading #cryptolegislation #cryptoregulation #bitcoinreserve #cbdc #xrp #ripple #cryptostocks #stocks #stockmarket #ethereum #eth #ether #ai #artificialintelligence #aiagents #aiagent #bnbchain #bnb #binance #jpmorgan #gold #preciousmetals #spotbitcoinetf #bitcoinetf #etf #etfs #cryptoetf #cryptoetfs #cryptomining #bitcoinmining #cme #worldlibertyfinancial #donaldtrump #trump #wlfi #brianarmstrong #coinbase #cryptonews #crypto #cryptocurrency #xrpripple #cryptowendyo #solana #sol #dogecoin #doge #cardano #ada #hbar #vechain #finance

bitcoin,btc,crypto,cryptocurrency,cryptowendyo,ethereum,eth,crypto news,bitcoin news,ripple xrp,bitcoin price,bitcoin price prediction,xrp news,cryptocurrency news,crypto news today,btc news,ripple xrp news,bitcoin trading,bull market,cryptonews,crypto trading,crypto liquidation,crypto liquidation today,crypto market,bitcoin price analysis,jpmorgan,gold,precious metals,crypto market structure,crypto market structure bill,crypto legislation,xrp,ripple

source

Video

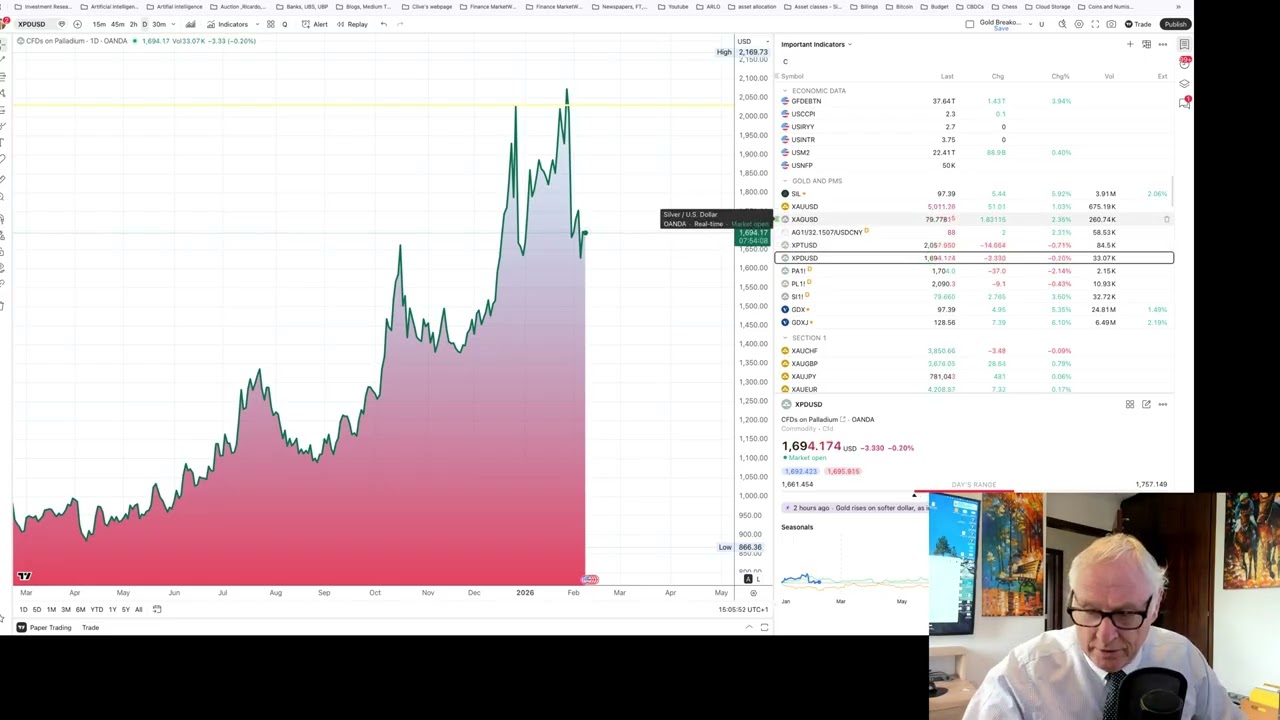

Financial Markets update Monday 9th February 2026. Update on COMEX silver and Shanghai premium.

Financial News today.

Update on COMEX Silver March Open interest. Delivery problem looming.

Dow hits record 50’000.

Tech stocks up and down, it’s a mixed bag and looking wobbly.

Dollar showing weakness against a basket of currencies, especially the Swiss franc.

No change in BoE rates (3.75%) or in ECB rates (2%). CME Fed watch tool indicates that the 18th March Fed meeting will keep rates on hold at 3.75%.

Gold and Silver are up today with gold above $5000 again but not showing much momentum at $5014 (+1.1%) and silver at $80.14 is up 2.86%.

Open interest for March Silver is currently 380 million ounces, but only 103 million ounces are currently available. February deliveries in the first few days amounted to 100% of the open interest of a month before.

🤝 Support the Channel & Useful Resources

If you’d like to support the channel, please consider using the affiliate links below. It doesn’t cost you anything extra and helps me continue producing independent, high-quality investment content.

📊 SimplyWall.st

You can unlock the free version of SimplyWall.st using my link below:

👉 https://goto.simplywall.st/AP4L3a

• No credit card required

• One portfolio and up to 10 stocks

You can also receive 30% off the Unlimited version by upgrading through the affiliate link below this video.

The Unlimited plan costs less than a cup of coffee per week — and if you can’t afford a cup of coffee, you probably shouldn’t be trading stocks.

🪙 Interested in Gold or Silver?

If you’re considering whether gold or silver could play a role in your portfolio or pension savings — or you’d like guidance on what type of precious metals to own — my trusted affiliates in the UK, Europe, and the USA would be happy to speak with you.

🇬🇧 UK & Europe — Gold Bullion Partners

Gold Bullion Partners handle large orders efficiently, offer highly competitive pricing, and provide excellent investor support.

📞 Call Nick: +44 207 031 8077

📩 Request a call back:

Please mention “Clive Thompson” in the “How did you hear about us?” box and include your country code.

UK investors: Gold can now be held inside a SIPP, and Gold Bullion Partners can arrange this for you.

🇺🇸 USA — ITM Trading

ITM Trading helps U.S. investors protect their wealth with physical gold and silver.

📞 Call: 866-449-9330

📩 Request a call back:

https://calendly.com/itmtrading/clive

More information:

https://learn.itmtrading.com/clive

Thank you very much for supporting the channel.

👤 About Me

I’ve been investing for over 50 years. I’ve made plenty of mistakes — and I’ve learned from them.

My aim is to help you grow and protect your wealth by sharing real-world experience: when to own stocks, bonds, cash, gold, silver, property, and other assets — and just as importantly, when not to.

You can learn more about my work, portfolios, and resources at:

👉 https://clivethompson.com/

Learn from my mistakes — so you don’t have to make them yourself.

Ask

source

Video

The Real XRP Flip Of The Switch

Welcome to Zach Rector’s channel!

iTrust Capital- https://www.itrustcapital.com/go/zach-rector

Legal & Estate Planning- https://calendly.com/new-client-specialists/15-minute-interview-affiliate?a1=Rector&month=2025-12

Are you ready to take advantage of the greatest transfer of wealth in world history?

Join our community at http://www.ZachRector.com and discover how you can not only survive, but thrive in this exciting time.

XRP Family MERCH- https://zachrector.com/shop/

Patreon/Discord Private Community- https://www.patreon.com/zachrector

Buy XRP & Trade Crypto-

Caleb & Brown- https://www.calebandbrown.com/affiliates/zach-rector/

Uphold- https://wallet.uphold.com/signup?referral=7ae0597d45

Coinbase- https://coinbase.com/join/PJCHZE2?src=ios-link

Coinbase Advanced Trading- https://advanced.coinbase.com/join/XXTYJ2Z

First Ledger- https://firstledger.net/?ref=DO9SdgMahaeK

Send XRP Tips & NFTs- r41a9RBNQYVx1XowGUUNEbJxKdKnMpHQEo

Precious Metals- https://zachrector.com/gold-and-silver/

Book 1 on 1 Call with Zach- https://calendly.com/zachrector/30min?month=2024-09

Crypto Wallets-

Ellipal- https://www.ellipal.com/?rfsn=6318619.6c7e7c

DCent Wallet- https://store.dcentwallet.com/products/biometric-wallet-affiliates?bg_ref=qBGObYeQ71

Trezor- https://trezor.io/trezor-model-t?transaction_id=102790791fb667a080e84dbbf37fc1&offer_id=134&affiliate_id=10442

Follow us on social media for the latest updates on:

Twitter (https://www.twitter.com/ZachRector7),

Rumble (https://www.rumble.com/user/zachrector7),

YouTube (https://www.youtube.com/user/Rector94),

TikTok (https://www.tiktok.com/@ZachRector7).

Thank you for joining us on this journey to financial freedom!

#xrp #ripple #xlm #stellar #xdc #buyback

#CryptocurrencyExchange #CryptocurrencyWallet #CryptocurrencyMarketNews #AltcoinInvesting #BlockchainTechnology #CryptocurrencyRegulations #HODL

#trading #investing #altcoins #crypto #blockchain #cryptocurrency #bitcoin

source

Video

Fractal Analytics and Aye Finance IPO Final Decision #shorts

#fractalanalyticsipo

#fractalanalytics

#fractalanalyticsipoguide

#fractal

#fractalanalyticsipotips

#fractalipo

#ayefinanceipo

#ayefinance

#ayefinanceipoguide

#ayefinanceipogmp

#ayefinanceiponews

#ayefinanceipotips

#newipo

fractal analytics ipo

fractal ipo

fractal analytics ipo review

fractal analytics

fractal analytics limited

fractal analytics limited ipo

fractal analytics ltd ipo

fractal analytics ltd

fractal analytics ipo analysis

fractal analytics ipo latest update

fractal analytics ipo update

fractal analytics ipo news

fractal analytics ipo apply or not

fractal analytics ipo apply or avoid

fractal analytics ipo subscribe or not

fractal analytics ipo announcement

fractal analytics ipo investment

fractal analytics ipo guide

fractal analytics ipo investment strategy

fractal analytics ipo insights

fractal analytics ipo tips

fractal analytics ipo gmp

fractal analytics ipo subscription

fractal analytics ipo final decision

aye finance ipo

aye ipo

aye finance ipo review

aye finance

aye finance limited

aye finance limited ipo

aye finance ltd ipo

aye finance ltd

aye finance ipo analysis

aye finance ipo latest update

aye finance ipo update

aye finance ipo news

aye finance ipo apply or not

aye finance ipo apply or avoid

aye finance ipo subscribe or not

aye finance ipo announcement

aye finance ipo investment

aye finance ipo guide

aye finance ipo investment strategy

aye finance ipo insights

aye finance ipo tips

aye finance ipo gmp

aye finance ipo subscription

aye finance ipo final decision

latest ipo

ipo final decision

source

Video

Is It Time To Give Up On Crypto And Move On?? How Low Will Bitcoin And Altcoins Go???

Welcome back for another daily market update as always this will be a jam packed one!

💎Join the Patreon and get exclusive access to our private Discord community which includes:

💎2 Weekly Meetings With Me

💎My Portfolio

💎Altcoin Watch List

💎Early Access To Interviews And Videos

💎Courses

👇Patreon Link 👇

https://www.patreon.com/AllinCrypto

👇Podcasts – Allincrypto Podcast

My Twitter – https://twitter.com/RealAllinCrypto

PLEASE LIKE COMMENT AND SUBSCRIBE FOR MORE CONTENT

THANKS FOR WATCHING

DISCLAIMER: I am not a financial adviser and this video is not financial advise this video is here for entertainment and educational use only

#bitcoin #btc #crypto #altcoins #ai #bullrun #solana #cardano #ada #Hbar #hedera #ethereum #eth #ripple #xrp #icp

source

Video

2026 U.S Economy Explain with The Financial Coin Historian

The year 2026 marks a pivotal departure from everything we thought we knew about the post-pandemic economy. We are witnessing a “Regime Change” in the United States financial architecture that historians will likely study for decades to come. While the media focuses on daily stock tickers, a much deeper structural recalibration is underway—one that signals the terminal phase of a long-term debt cycle.

In this exclusive investigative documentary, The Financial Coin Historian deconstructs the macroeconomic landscape of 2026. We move beyond the headlines to expose the “High-Wire Act” the US economy is performing: balancing a massive Artificial Intelligence infrastructure boom against a crumbling sovereign debt wall and the most aggressive protectionist trade policies since 1946.

Key Investigations Include:

The Legislative Earthquake: We break down the “One Big Beautiful Bill Act” (OBBBA). Signed into law in mid-2025, this legislation has radically restructured the American fiscal social contract. We analyze how unprecedented tax deregulation is colliding with the largest cuts to basic needs programs in history, creating a “K-shaped” expansion where asset owners thrive while the working class faces a silent depression.

The Warsh Doctrine: The nomination of Kevin Warsh as Federal Reserve Chairman signals the end of the “Data-Dependent” era. We explain Warsh’s “Anti-Phillips Curve” philosophy and his plan to aggressively shrink the Fed’s $6.6 Trillion balance sheet. Why does this “Hard Money” pivot threaten to crash the bond market, and is it a necessary purge or a policy error reminiscent of 1928?

The AI Capex Boom: While the consumer struggles, trillions are flowing into AI data centers and hardware. We analyze how this $600 Billion annual spend is artificially propping up GDP while simultaneously driving a “Jobless Recovery” through agentic automation.

The Tariff Trap: With effective tariff rates hitting 9.9%—levels not seen since the post-WWII era—we explore the new “Reciprocal Tariff Regime.” How is the trade war with the Global South driving domestic inflation, and why is the “historic trade deal” with India a geopolitical weapon disguised as commerce?

The Gold Super-Cycle: Why are institutions like J.P. Morgan and Deutsche Bank targeting $6,300 gold? We expose the “Central Bank Revolt,” where nations are quietly dumping Treasuries to buy 800 tons of physical gold annually, preparing for a post-dollar settlement system.

The 2026 landscape is defined by “Dispersion and Selectivity.” The tide is going out, and we are about to see who is swimming naked. This is not just an economic update. It is a historical roadmap for the end of an era.

#USEconomy2026 #KevinWarsh #FederalReserve #GoldPrice #OBBBA #FinancialReset #TheFinancialCoinHistorian #DebtCrisis #AIStockMarket #Inflation

⚠️ Disclaimer: This video is for educational and historical purposes only. The content presented here is a forensic analysis of economic history, market data, and financial cycles. It does not constitute financial, investment, legal, or tax advice. The views expressed are based on the analysis of historical patterns and current data points as of early 2026. Past performance is not indicative of future results. Please consult with a certified financial professional before making any investment decisions.

🔔 Subscribe to The Financial Coin Historian for more deep-dive history and financial truth.

source

Video

Money Man “Let’s Talk About It” Official Video

Listen to the album “Predator”. Out Now!

Stream: https://music.empi.re/predator

#MoneyMan #Predator #EMPIRE

Official Video by Money Man – “Let’s Talk About It” © 2026 Black Circle / EMPIRE

source

Video

Bitcoin Flash Crash to $60,000 Was the Best Buy Signal in Years

Today, let’s examine Bitcoin’s charts and metrics, as well as the latest Macro and Crypto news. Additionally, a look at the latest crypto news.

💸Make Free Predictions on *ClashPicks* ► https://www.clashpicks.com/

🐤Follow ClashPicks’ X ► https://x.com/ClashPicks

**Exchange Partners**

🟩Bitunix Exchange ► *$100,000 Deposit Bonus* ► https://bit.ly/3Tmp1Hq

🟦BTCC Exchange ► *10% Deposit Bonus* ► https://bit.ly/4kk20Qa

**Crypto Pulse**

🟧CryptoPulse Trading Discord ► https://discord.com/invite/georgeplaysclash

🐤Follow CryptoPulse’s X For Trade Setups ► https://x.com/CryptoPulse_CRU

**Clash**

🖥️Check Out *Clash’s Website* ► https://georgeplaysclashroyale.com/

💜Join *Clash Discord* ► https://discord.com/invite/georgeplaysclash

🕹️Join *Clash’s Weekly Tournaments* ► https://georgeplaysclashroyale.com/tournament

📱GeorgePlaysClashRoyale YouTube ► https://www.youtube.com/@Georgeplaysclashroyale

📱GeorgePlaysClashRoyale TikTok ► http://tiktok.com/@georgeplaysclashroyale

🐤GeorgePlaysClashRoyale (For Clash) ► https://x.com/GeorgePlayClash

✅Buy $Clash Here ► https://georgeplaysclashroyale.com/buy

✅Clash’s CA: 6nR8wBnfsmXfcdDr1hovJKjvFQxNSidN6XFyfAFZpump

0:00 Intro

0:35 Market Overview

1:55 BTC Flash Crash

6:50 Tech Sell Off

7:00 India US Deal

7:10 US Iran

8:45 ETF Flow

9:30 Bitcoin RSI

11:45 Strategy

13:05 Metaplanet

13:55 Charles Schwab

14:30 Binance

15:25 Other Bitcoin Buyers

17:00 Profit Vs Loss

18:05 Mayer Multiple

20:20 Q&A

🔴Full Disclaimer: This video and its contents are for informational purposes only and do not constitute an offer to sell or trade, a solicitation to buy, or recommendation for any security, cryptocurrency, or related product, nor does it constitute an offer to provide investment advice or other related services by CryptosRUs. CryptosRus may have a financial investment with the cryptocurrencies discussed in this video. In preparing this video, no individual financial or investment needs of the viewer have been taken into account nor is any financial or investment advice being offered. Any views expressed in this video were prepared based upon the information available at the time such views were written. Changed or additional information could cause such views to change.

source

Video

Ridiculous, amirite?? If you choose to have a financial advisor, that’s totally fine

Ridiculous, amirite??

If you choose to have a financial advisor, that’s totally fine. But I urge you, especially at this time of year, to look back at your December statement and see what that annual fee is that they are charging you to “manage” your money.

Brace yourself.

And no ladies, you don’t need someone to do this for you. You just need an education to understand the foundations of a solid financial plan and you can keep those thousands in your own pocket.

Have you checked your fees lately?

Tell me in the comments..

Rooting you on, always! ❤️

Molly

#womenandmoney #womeninfinance #financialclarity #certifiedfinancialplanner

source

Video

Bitcoin Is Massively Oversold (Last Chance?)

Bitcoin capitulation, alts rekt, stocks danger, here’s what you need to know!

👉 Summ turns crypto chaos into confidence. Get 20% off your first year with code LARK20. https://summ.com/us?via=lark&promo=LARK20

Join the Inner Circle for exclusive content and updates 🚀

👉 https://cryptolark.co/THEINNERCIRCLE

Follow me on X for real-time thoughts & market insights 🧠

👉 https://x.com/larkdavis

Follow on Instagram for market highlights, mindset, and financial insights 📈

👉 https://www.instagram.com/larkdavisofficial

Want to get your project in front of one of the biggest audiences in crypto? Sign up to sponsor my newsletter here

👉 https://larkdavis.org/sponsorships/

🌟🌟🌟 TOP CRYPTO SERVICES & PRODUCTS 🌟🌟🌟

💸 BYBIT $30,030 BONUS & FEE DISCOUNT 👉 https://cryptolark.co/BYBIT

🚀 PHEMEX (available everywhere) $1,000 DEPOSIT BONUS 👉 https://cryptolark.co/PHEMEX

🔒 BEST CRYPTO WALLET TO KEEP YOUR ASSETS SAFE

👉 BUY LEDGER WALLET HERE ►► https://shop.ledger.com/r/lark-davis?r=6877

NOTE: The above are affiliate links and I receive a commission when you use these links to start your accounts. Using any cryptocurrency platform involves risk which may result in a complete loss of funds. Futures trading is a high-risk activity and should only be undertaken by those who understand the risks and are prepared to sustain a complete loss of funds. Thank you for your support.

00:00 Crypto Massively Oversold

00:39 Jim Cramer Warning

02:58 Worst Week in Recent Memory

03:22 Stocks vs Crypto Disconnect

05:29 If Stocks Roll Over…

07:20 Bitcoin ETF Reality

08:12 Bear Case Bitcoin Targets

09:05 Mining Cost Bottom Signal

09:47 Liquidation Map Setup

12:28 Altcoins Breaking Down

14:44 Bitcoin Trades Like Tech

16:02 Bitcoin Upside Reality

🧨🧨 FULL PORTFOLIO AND DISCLOSURE OF VENTURE INVESTMENTS 🧨🧨

https://cryptolark.co/personalportfolio

#bitcoin #crypto #investing #cryptocurrency #cryptocurrencies #altcoins #cryptobullrun #ethereum

Disclaimer

This content is intended purely for general knowledge and educational discussion. It is not financial advice, a recommendation, or a financial promotion under the laws of any jurisdiction. Nothing shared here should be interpreted as an offer to buy or sell any virtual asset, financial product, or security. The material is not tailored to any specific investor profile and is not intended to guide investment decisions.

All views expressed are personal opinions or general commentary for informational purposes only. Unless explicitly stated, no part of this content has been sponsored, commissioned, or endorsed by any issuer, platform, or third party. Virtual Assets involve significant risk and can be extremely volatile. You could lose some or all of

your investment, and there are no legal or financial protections in place. Some assets may be illiquid, difficult to transfer, or subject to irreversible transactions.

Past results do not predict future performance. This content does not imply that investing is easy, safe, or guaranteed to yield returns. Where partnerships or paid collaborations are involved, those will be clearly marked in accordance with applicable disclosure requirements. Please do your own research and speak with a qualified advisor before making any investment. Only invest what you’re fully prepared to lose.

source

-

Tech7 days ago

Tech7 days agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

Politics2 days ago

Politics2 days agoWhy Israel is blocking foreign journalists from entering

-

NewsBeat1 day ago

NewsBeat1 day agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

Sports4 days ago

Sports4 days agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

Tech4 days ago

Tech4 days agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

Business2 days ago

Business2 days agoLLP registrations cross 10,000 mark for first time in Jan

-

NewsBeat2 days ago

NewsBeat2 days agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

Sports2 days ago

Sports2 days agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Sports4 days ago

Former Viking Enters Hall of Fame

-

Politics3 days ago

Politics3 days agoThe Health Dangers Of Browning Your Food

-

Sports5 days ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

Business3 days ago

Business3 days agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

NewsBeat5 days ago

NewsBeat5 days agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Business5 days ago

Business5 days agoQuiz enters administration for third time

-

Crypto World12 hours ago

Crypto World12 hours agoBlockchain.com wins UK registration nearly four years after abandoning FCA process

-

Crypto World20 hours ago

Crypto World20 hours agoU.S. BTC ETFs register back-to-back inflows for first time in a month

-

NewsBeat2 days ago

NewsBeat2 days agoResidents say city high street with ‘boarded up’ shops ‘could be better’

-

Sports1 day ago

Kirk Cousins Officially Enters the Vikings’ Offseason Puzzle

-

Crypto World20 hours ago

Crypto World20 hours agoEthereum Enters Capitulation Zone as MVRV Turns Negative: Bottom Near?

-

NewsBeat6 days ago

NewsBeat6 days agoStill time to enter Bolton News’ Best Hairdresser 2026 competition