Crypto World

Robinhood Q4 2025 Earnings Miss Revenue Targets as Crypto Trading Revenue Drops 38% Year-Over-Year

TLDR:

- Robinhood reported Q4 revenue of $1.28 billion, missing Wall Street’s $1.35 billion estimate by 5.2%

- Crypto revenue declined 38% year-over-year to $221 million while options revenue surged 41% to $314 million

- Gold subscribers reached 4.2 million users, up 58% year-over-year, driving premium service adoption

- Company deployed $653 million in share buybacks during 2025, repurchasing 12 million shares at $54.30 average

Robinhood Q4 2025 earnings revealed mixed results as the trading platform reported revenue of $1.28 billion, falling short of Wall Street’s $1.35 billion estimate.

The company posted adjusted EBITDA of $761 million, missing analyst expectations of $833 million, while net income reached $605 million.

Transaction-based revenue totaled $776 million, marking a 15% year-over-year increase but trailing the estimated $791.6 million. Earnings per share of $0.66 beat the $0.63 estimate.

Revenue Streams Show Divergent Performance Trends

The platform’s crypto trading segment experienced a notable decline during the quarter. Crypto revenue dropped 38% year-over-year to $221 million, missing the $242 million estimate.

This contraction came as digital asset trading volumes moderated from previous periods. Meanwhile, options revenue surged 41% to $314 million, demonstrating continued retail investor appetite for derivatives trading.

Equities revenue climbed 54% to $94 million, reflecting increased stock trading activity among users. Net interest revenue grew 39% to $411 million, benefiting from higher interest rates and expanded lending operations.

Other revenue streams jumped 109% to $96 million, driven by diversified product offerings beyond core trading services.

Total revenue grew 27% year-over-year despite the crypto segment’s weakness. Transaction-based revenue represented the largest component at $776 million.

Wall St Engine shared detailed metrics through their platform, noting the variance between actual and estimated results across multiple categories.

Operating expenses rose 38% year-over-year to $633 million, outpacing revenue growth. Adjusted operating expenses including stock-based compensation reached $597 million, up 18% from the prior year.

The expense increase reflected continued investment in platform infrastructure and regulatory compliance costs.

User Metrics and Capital Allocation Strategy

Funded customers reached 27.0 million, representing 7% year-over-year growth. Investment accounts totaled 28.4 million, an 8% increase from the previous year.

Gold subscribers, the platform’s premium tier, hit 4.2 million, surging 58% year-over-year as users sought enhanced features and benefits.

Total platform assets under management reached $324 billion, jumping 68% year-over-year. Average revenue per user stood at $191, climbing 16% compared to the prior year.

Net deposits totaled $15.9 billion for the quarter, with trailing twelve-month deposits reaching $68.1 billion.

The company maintained its cash position at $4.3 billion in cash and cash equivalents. Share buybacks continued during the quarter, with $100 million deployed to repurchase 0.8 million shares at an average price of $119.86. Full-year 2025 buybacks totaled $653 million, retiring 12 million shares at an average price of $54.30.

Management addressed the quarter’s results and long-term strategy in their earnings commentary. According to company executives, “Our vision hasn’t changed: we are building the Financial SuperApp.”

The leadership team reflected on the annual performance, stating that “2025 was a record year where we set new highs for net deposits, Gold Subscribers, trading volumes, revenues, and profits, and we closed the year with a strong Q4.”

Crypto World

Robinhood Chain Testnet Launches on Arbitrum for Tokenized Real-World Assets

TLDR:

- Robinhood Chain testnet enables developers to build financial-grade apps on Arbitrum technology

- Infrastructure partners Alchemy, Chainlink, LayerZero, and TRM already integrating with platform

- Testnet will feature Stock Tokens for integration testing ahead of mainnet launch later in 2025

- Platform supports tokenized assets, lending protocols, and perpetual futures exchanges on Layer 2

Robinhood Chain has officially launched its public testnet, marking a major step in the company’s blockchain ambitions.

The Layer 2 network, built on Arbitrum technology, targets financial services and tokenized real-world assets. Developers can now access the testnet to build and validate applications on the Ethereum-compatible platform.

Infrastructure partners including Alchemy, Allium, Chainlink, LayerZero, and TRM have already begun integration work.

Infrastructure and Technical Foundation

Robinhood announced the testnet launch through its official social media channels, inviting developers to explore the platform’s capabilities.

The company tweeted that developers can now build on a financial-grade Ethereum Layer 2 designed to support tokenized assets.

The network provides compatibility with standard Ethereum development tools while leveraging Arbitrum’s proven Layer 2 technology.

This approach enables developers to work within a familiar environment while accessing enhanced scalability features.

The company has published comprehensive developer documentation at https://docs.robinhood.com/chain to support early builders.

Network entry points are now accessible, allowing participants to connect and begin testing their applications. The testnet phase serves multiple purposes, from identifying technical issues to establishing network stability before mainnet deployment.

Johann Kerbrat, SVP and GM of Crypto and International at Robinhood, outlined the platform’s vision in a statement. “The testnet for Robinhood Chain lays the groundwork for an ecosystem that will define the future of tokenized real-world assets,” he said.

The executive added that the platform will “enable builders to tap into DeFi liquidity within the Ethereum ecosystem.” Kerbrat expressed enthusiasm about collaborating with infrastructure partners to bring financial services onchain.

Early infrastructure partners play a crucial role in the testnet phase. Their involvement ensures that essential services and tools are available from the start.

This collaborative approach aims to create a robust foundation for future applications and services on the network.

Developer Features and Future Roadmap

The testnet environment supports seamless bridging and self-custody functionality for digital assets. Developers can build financial-grade decentralized products, including tokenized asset platforms and lending protocols.

The architecture also accommodates perpetual futures exchanges and similar complex financial applications.

Robinhood plans to introduce testnet-only assets in coming months to facilitate integration testing. Stock Tokens will be available exclusively for development purposes, allowing builders to test trading mechanisms and settlement processes. Direct testing with Robinhood Wallet will provide additional integration opportunities for developers.

The platform emphasizes reliability, security, and compliance as core design principles. These priorities reflect Robinhood’s experience in regulated financial services and its infrastructure capabilities. The mainnet launch is scheduled for later this year, though specific timing remains to be announced.

Steven Goldfeder, Co-Founder and CEO of Offchain Labs, emphasized the partnership’s potential in his remarks. “With Arbitrum’s developer-friendly technology, Robinhood Chain is well-positioned to help the industry deliver the next chapter of tokenization,” he stated.

Goldfeder noted the collaboration aims to advance permissionless financial services across the ecosystem. “Working alongside the Robinhood team, we are excited to help build the next stage of finance,” he added.

Crypto World

Ethereum price prediction as 220K ETH leaves exchanges

Ethereum price is testing a key demand zone as more than 220,000 ETH leaves exchanges, tightening liquid supply during a sharp market pullback.

Summary

- Ethereum price prediction hinges heavily on ETH holding the $1,850 demand zone.

- Exchange reserves have dropped by 220,000 ETH, while accumulating addresses now hold 27 million ETH, about 23% of supply.

- Holding $1,850 could open a rebound toward $2,000–$2,100, while a breakdown risks a move toward $1,750.

Ethereum was trading at $1,975 at press time, down 4% in the past 24 hours. The broader trend remains under pressure. ETH has fallen 12% over the last seven days, 37% in the past month, and is now down 61% from its August 2025 high of $4,946.

Spot trading volume came in at $22 billion, down 11.30% over the past day. On the derivatives side, Coinglass data shows futures volume declining 14% to $47 billion, while open interest dropped 5% to $23 billion.

That combination suggests traders are closing positions rather than aggressively adding new leverage.

220K ETH leaves exchanges as long-term wallets grow

While price has struggled, on-chain behavior tells a different story.

According to a Feb. 10 analysis by CryptoQuant contributor Arab Chain, more than 220,000 Ethereum (ETH) has been withdrawn from exchanges in recent days, the largest net outflow since October. On Feb. 5, Binance alone recorded approximately 158,000 ETH in daily net outflows, the highest since last August.

Large exchange withdrawals typically reduce immediate sell-side pressure. When ETH moves into private wallets or long-term storage, it becomes less accessible for quick liquidation.

This doesn’t guarantee upside, but it changes the supply dynamic. If demand stabilizes, a tighter float can amplify price reactions.

Additional data from analyst _OnChain shows that “accumulating addresses” — defined as wallets that have never recorded an outflow, hold at least 100 ETH, and are not linked to exchanges or miners — now control 27 million ETH, or roughly 23% of the circulating supply.

Historically, Ethereum has traded below the realized price of these accumulating addresses only twice in nine years: during the 2025 all-time low and again since January 2026. That context suggests long-term holders are less likely to sell near current levels.

Ethereum price prediction: Can $1,850 hold?

With lower highs and lower lows, Ethereum is still clearly in a downward trend. Selling pressure increased after the recent drop below the $3,200–$3,300 range, and the price moved closer to the $1,850 support zone.

During the sell-off, the 20-period Bollinger Bands widened considerably, suggesting increased volatility.

The price briefly touched the lower band around $1,690, as is often the case with large declines. The middle band, which is now at $2,490, is acting as resistance, while the upper band is situated near $3,290.

The relative strength index fell below 30, entering oversold territory, and currently hovers around 30–32. Momentum is weak, though the pace of the decline has slowed, and there’s no clear bullish divergence yet.

If the $1,850 support holds, Ethereum could stabilize and attempt a rebound toward $2,000–$2,100. A more sustained recovery would require a move above $2,490 to reclaim the middle band and signal a potential trend shift. For that to happen, RSI would need to climb above 40–45, and volume would need to expand on green candles.

If $1,850 fails, downside risk increases quickly. A break below that level could expose $1,750, followed by the lower Bollinger Band around $1,690. Continued declines in open interest and weak spot volume would reinforce a bearish continuation scenario.

Crypto World

Banks, Crypto fail to reach agreement in White House stablecoin meeting

A White House meeting on stablecoin yield and rewards ended without a deal, but participants described the discussions as more productive than previous talks, according to details shared by journalist Eleanor Terrett.

Summary

- White House stablecoin yield talks ended without a deal, but both banks and crypto firms described the meeting as more productive than earlier discussions.

- Banks introduced written “prohibition principles” and signaled limited flexibility by acknowledging potential exemptions for transaction-based stablecoin rewards.

- The White House urged both sides to reach an agreement on stablecoin rewards regulation by March 1, with further talks expected soon.

The gathering brought together senior banking executives, crypto industry leaders, and policy staff to debate whether and how stablecoin issuers should be allowed to offer yield or rewards.

While no compromise was reached, negotiations moved into more detailed territory.

White House stablecoin talks show progress but no final deal

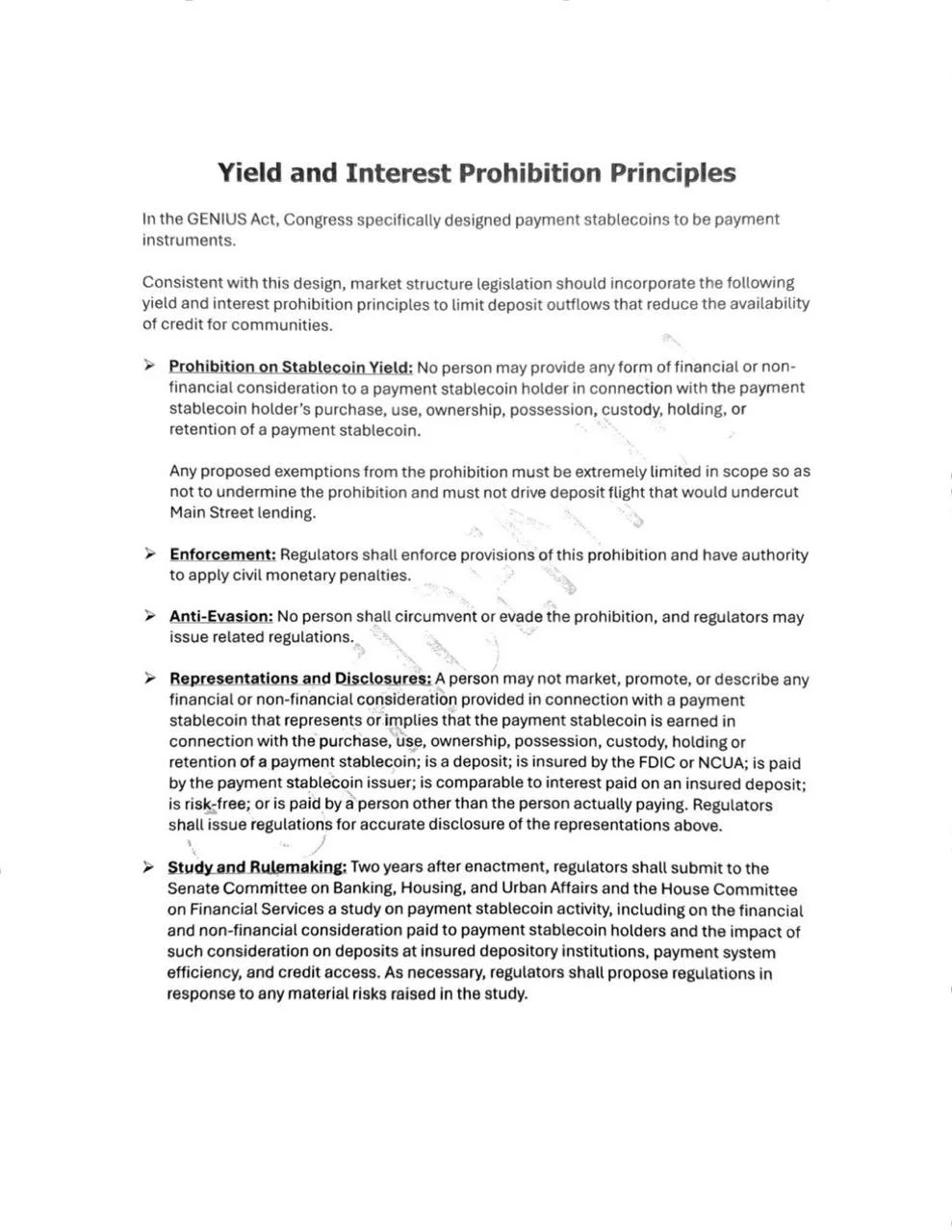

Banking representatives arrived with a written set of “prohibition principles” outlining firm red lines around stablecoin rewards. These principles detailed what banks are willing to accept and where they refuse to budge.

One notable shift emerged. Banks included language allowing for “any proposed exemption” related to transaction-based rewards.

Sources described this as a meaningful concession, as banks had previously declined to discuss exemptions altogether.

Much of the debate centered on “permissible activities.” This refers to what types of account behavior would allow crypto firms to offer rewards. Crypto companies pushed for broad definitions. Banks argued for narrower limits to reduce risk and regulatory exposure.

Ripple’s Chief Legal Officer Stuart Alderoty said that “compromise is in the air,” signaling cautious optimism despite unresolved issues.

March 1 deadline looms as talks continue

The meeting was smaller than the first White House session on stablecoins. It was led by Patrick Witt, Executive Director of the President’s Crypto Council. Staff from the Senate Banking Committee were also present.

Crypto attendees included representatives from Coinbase, a16z, Ripple, Paxos, and the Blockchain Association. Major banks in attendance included Goldman Sachs, JPMorgan, Bank of America, Wells Fargo, Citi, PNC, and U.S. Bank, alongside leading banking trade groups.

The White House has urged both sides to reach an agreement by March 1. Further discussions are expected in the coming days. However, it remains unclear whether another full-scale meeting will be held before the deadline.

Crypto World

xMoney Expands Domino’s Partnership to Greece, Powering Faster Checkout Experiences

[PRESS RELEASE – Vaduz, Liechtenstein, February 9th, 2026]

xMoney ($XMN) is expanding its partnership with Domino’s, bringing its payment infrastructure to Domino’s Greece following a successful rollout in Cyprus.

The collaboration focuses on acquiring services, enabling Domino’s Greece to accept card payments and digital wallets, including Apple Pay and Google Pay, across both web and mobile ordering platforms.

At the core of the integration is xMoney’s embeddable checkout solution, designed to deliver a seamless payment experience without redirection. Customers complete their orders faster, while all sensitive payment data is securely handled by xMoney’s compliant infrastructure.

The expansion was announced in person at a community event hosted at SuiHub Athens – a community space established to support builders and Sui ecosystem partners – bringing together the xMoney and Sui teams, Domino’s representatives, and building on xMoney’s previously announced work with Sui to expand real-world payment access across Europe.

“Domino’s operates in a high-volume, real-time environment where speed and reliability are critical,” said Manos Tsouloufris, CTO of Daufood. “xMoney’s checkout solution supports multiple payment methods in a single, seamless flow, helping us serve customers faster at scale.”

While the current implementation focuses on fiat payments, the two teams are also exploring future possibilities around digital asset payments, where network speed, user experience, and confirmation times make sense for real-world commerce.

The launch in Greece represents the next step in a broader European expansion, reinforcing xMoney’s role as a trusted payments partner for brands that operate at scale and its presence within the Sui ecosystem reflects a growing focus on practical, consumer-facing payment experiences built for everyday use.

“When people order food, they don’t think about payments, and that’s exactly the point,” said Gregorious Siourounis, Co-Founder and CEO of xMoney. “Our role is to make checkout fast, reliable, and invisible, so brands like Domino’s can focus on their customers. Bringing this experience to Greece is a natural next step.”

As xMoney expands across markets and merchant use cases, XMN supports the broader ecosystem by aligning long-term participation and infrastructure growth across the network. Designed to sit alongside xMoney’s licensed payment rails, XMN helps structure how value, incentives, and future on-chain capabilities evolve, without impacting the simplicity of everyday checkout experiences.

Faster checkout. Less friction.

Payments that deliver.

About Domino’s

Founded in 1960, Domino’s Pizza is the largest pizza company in the world, with a significant business in both delivery and carryout pizza. It operates a network of company-owned and independent franchise stores in the United States and more than 90 international markets.

About xMoney

xMoney is revolutionizing the payments landscape with strategic European licenses, delivering a seamless, secure, and forward-thinking ecosystem powered by innovative product design, cutting-edge technology, and unwavering compliance. XMN, xMoney’s newly launched token, is natively integrated into the licensed and regulated payment infrastructure – empowering merchants and consumers with lightning-fast, trustworthy transactions underpinned by full regulatory transparency. Now trading on Kraken, KuCoin, MEXC, Bitvavo, Bluefin and other exchanges, XMN is primed for broader adoption with a robust pipeline of integrations ahead.

Contact details:

Website: www.xmoney.com

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Crypto Speculation Era Ending As Institutions Enter Market

The days of outsized gains in crypto may be coming to an end as more risk-averse institutional players are entering the space, replacing retail investors who chase rapid gains, according to Galaxy CEO Mike Novogratz.

Novogratz reportedly said at the CNBC Digital Finance Forum on Tuesday in New York that it reflects the maturing industry.

“Retail people don’t get into crypto because they want to make 11% annualized,” he said. “They get in because they want to make 30 to one, eight to one, 10 to one,” he said.

Novogratz referenced FTX’s collapse in 2022, which resulted in a bear market that saw Bitcoin (BTC) prices fall 78% from $69,000 to $15,700 in November that year, stating that there was a “breakdown in trust” then.

Novogratz also acknowledged that the Oct. 10 leverage flush, which he called a significant event that “wiped out a lot of retail and market makers,” and increased selling pressure — though there wasn’t any major catalyst.

“This time, there’s no smoking gun,” he said. “You look around like, what happened?”

“Crypto is all about narratives, it’s about stories,” he said. “Those stories take a while to build, and you’re pulling people in … so when you wipe out a lot of those people, Humpty Dumpty doesn’t get put back together right away.”

Tokenized real-world assets will drive markets

Novogratz said he expects the industry to shift from high-return speculation to more practical applications, such as tokenized real-world assets that offer steadier returns.

However, some traders will always speculate, said Novogratz, but it’s going to be “transposed or replaced by us using these same rails, these crypto rails, to bring banking [and] financial services to the whole world. And so, it’s going to be real-world assets with much lower returns.”

Related: Chainlink co-founder’s 2 reasons this bear market feels different

Chainlink co-founder Sergey Nazarov made a similar argument on Tuesday, stating that tokenized RWAs will “surpass cryptocurrency in the total value in our industry, and what our industry is about will fundamentally change.”

Long-term Bitcoin believers will be fine

David Marcus, the co-founder and CEO of Lightspark and a former PayPal executive, told Bloomberg on Tuesday that there has also been a shift in who is holding Bitcoin.

“It’s just a change of who’s holding Bitcoin, and you’re moving from people that had long-term belief and were holding Bitcoin directly to just access to Bitcoin being wired off to our financial system and markets.”

He added that the change in holders and the Oct. 10 leverage flush have changed the dynamic, but those who have long believed that Bitcoin is a “hedge to everything else that’s happening in the markets” will be fine.

Magazine: Bitcoin difficulty plunges, Buterin sells off Ethereum: Hodler’s Digest

Crypto World

Per-Tx Encryption vs Malicious MEV

As MEV threats intensify on Ethereum, researchers are pursuing cryptographic shields designed to cloak mempool data until blocks finalize. Fresh measurements show almost 2,000 sandwich attacks every day, draining more than $2 million from the network each month. Traders executing large WETH and WBTC swaps, as well as other liquid assets, remain exposed to front-running and back-running. The field has grown beyond early threshold-encryption experiments toward per-transaction designs that aim to encrypt a transaction’s payload rather than entire epochs. Early prototypes like Shutter and Batched threshold encryption (BTE) laid groundwork by encrypting data at epoch boundaries; now, per-transaction designs are being explored for finer-grained protection and potentially lower latency. The debate centers on whether real-world deployment on Ethereum is feasible or remains primarily in research channels.

Key takeaways

- Flash Freezing Flash Boys (F3B) proposes per-transaction threshold encryption to keep transaction data confidential until finality, using a designated Secret Management Committee (SMC) to manage decryption shares.

- Two cryptographic paths exist within F3B: TDH2 (Threshold Diffie-Hellman 2) and PVSS (Publicly Verifiable Secret Sharing), each with distinct trade-offs in setup, latency, and storage.

- Latency overhead from finality is modest in simulations: about 0.026% for TDH2 (197 ms) and 0.027% for PVSS (205 ms) with a committee of 128 trustees on Ethereum-like conditions.

- Storage overhead is a consideration: roughly 80 bytes per transaction under TDH2, with PVSS inflating as the number of trustees rises due to per-trustee shares and proofs.

- Deployment remains challenging: integrating encrypted transactions requires changes to the execution layer and may demand a major hard fork beyond The Merge; nonetheless, F3B’s trust-minimized approach could later find use beyond Ethereum, including sealed-bid auction contracts.

Tickers mentioned: $ETH, $WETH, $WBTC

Market context: The broader crypto environment continues to weigh on MEV mitigation efforts as developers seek privacy-preserving mechanisms that do not erode finality or throughput. The ongoing discussion touches on protocol upgrades, research benchmarks, and cross-chain applicability, with activity spanning academic papers, industry tooling, and governance proposals.

Why it matters

The MEV arms race has harsh consequences for liquidity and trader outcomes, especially in high-volume decentralized exchanges where sandwich-type strategies exploit visible mempool activity. By moving toward per-transaction encryption, proponents argue that the incentive to front-run could diminish, since collateralized decryption happens only after a transaction has reached finality. This could improve fair access to liquidity for both retail and institutional traders, while potentially reducing the aggressive search for edge cases that currently drive MEV. Yet, the effectiveness hinges on the cryptographic primitives’ resilience and the ecosystem’s ability to absorb the added complexity without eroding security guarantees.

From a builder’s perspective, the F3B framework presents a clear tension between privacy and performance. The TDH2 path emphasizes a fixed committee and a streamlined data footprint, while PVSS offers more flexibility by letting users select trustees but incurs larger ciphertexts and greater computational overhead. The simulations suggest that, when configured appropriately, privacy-preserving measures can coexist with Ethereum’s throughput and finality targets. However, achieving real-world deployment would demand careful coordination among clients, miners or validators, and ecosystem tooling to ensure compatibility with existing smart contracts and wallets.

Investors and researchers should watch how the incentive structures evolve. F3B’s staking and slashing regime aims to deter premature decryption and collusion, but no system is immune to off-chain coordination risks. If the mechanism proves robust, it could influence future designs for privacy in permissionless networks and inspire alternative approaches to secure computation in open ledgers. The potential applications extend beyond straightforward trades; encrypted mempools could also underpin privacy-centric auctions and other latency-sensitive, trust-minimized interactions where upfront data leakage would otherwise enable manipulation.

What to watch next

- Further experimental results and real-world testnet pilots evaluating F3B’s latency, throughput, and storage under varied network loads.

- Rigorously documented security analyses of TDH2 and PVSS in active blockchain environments, including proofs of correct decryption and resilience against malicious actors.

- Public discussion of integration strategies with the Ethereum execution layer, and whether any client, protocol, or governance changes could enable phased deployment.

- Exploration of F3B-style privacy techniques in non-ETH networks or sub-second blockchains to gauge broader applicability and performance trade-offs.

- Sealed-bid auction use cases and other cryptographic applications where encrypted bids remain hidden until a defined deadline, aligning with F3B’s post-finality execution flow.

Sources & verification

- Flash Freezing Flash Boys (F3B) — arXiv:2205.08529

- How batched threshold encryption could end extractive MEV and make DeFi fair again — Cointelegraph

- Applied MEV protection via Shutter’s threshold encryption — Cointelegraph

- The Merge — Ethereum upgrades: A beginner’s guide to Eth2.0 — Cointelegraph

- TDH2 (Threshold Diffie-Hellman 2) — Shoup et al. (paper)

Per-transaction encryption reshapes the MEV battle on Ethereum

Flash Freezing Flash Boys introduces a pivot from epoch-wide secrecy to transaction-level privacy. The core idea is to encrypt the transaction with a fresh symmetric key and then shield that key with a threshold-encryption scheme reachable only by a predefined committee. In practice, a user signs a transaction and distributes an encrypted payload along with an encrypted symmetric key to the consensus layer. The designated Secret Management Committee (SMC) holds decryption shares, but will not release them until the chain has achieved the required finality, at which point the protocol jointly reconstructs and decrypts the payload for execution. This workflow is designed to avert the exposure of transaction details during the propagation window, thereby reducing the opportunities for MEV-based manipulation.

Two theoretical treatments underpin the approach. TDH2, which relies on a distributed key generation (DKG) process to produce a public key and shares, pairs a fresh symmetric key with a ciphertext that the committee can unlock in a threshold fashion. PVSS, by contrast, uses long-term keys for trustees and Shamir’s secret sharing, allowing a user to distribute shares encrypted with each trustee’s public key. Each model is accompanied by a set of zero-knowledge proofs to deter malformed decryption data, addressing concerns about chosen-ciphertext attacks and decryption validity. The two paths present different performance profiles: a fixed committee streamlines setup and reduces per-transaction data size (TDH2), while PVSS offers flexibility at the cost of larger ciphertexts and higher computation. In practical terms, simulations on a PoS-like Ethereum environment suggest sub-second delays after finality—well within acceptable bounds for many DeFi operations—and minimal storage pressure per transaction under TDH2. The numbers, of course, depend on committee size and network conditions.

Yet, deployment remains a topic of debate. Even if encryption constructs behave well in simulation, integrating encrypted transactions into the execution layer would likely require substantial changes—potentially a hard fork beyond The Merge—to ensure compatibility with current contracts and wallet software. Nevertheless, the research marks a meaningful step toward privacy-enhanced DeFi, showing that it is possible to conceal sensitive data without sacrificing finality. The broader implication is that encrypted mempools could find application beyond Ethereum, in networks pursuing privacy-preserving, trust-minimized protocols where delayed or withheld execution is acceptable or desirable. For now, the path to real-world usage remains cautious and incremental, with F3B serving as a benchmark for what privacy-preserving MEV mitigation could look like in practice.

Crypto World

RAIN Explodes by 20% Daily, Bitcoin Stalls Below $70K: Market Watch

Aside from RAIN, the other notable gainers today are M and NEXO, while HYPE has lost over 5% of value.

Bitcoin’s price recovery attempts were once again halted at just over $70,000, and the asset now sits over a grand lower.

Most larger-cap altcoins have remained sluggish on a daily scale, aside from ZEC, which has jumped by 5.5%, and HYPE, which has dropped by over 5%.

BTC Stopped at $70K

The primary cryptocurrency’s recent price movements raised a lot of questions about the state of the market. The asset stood at $90,000 on January 28 but plunged hard in the following week or so. In fact, the culmination, at least for now, took place last Friday morning when it dropped to $60,000 for the first time in well over a year.

This meant that BTC had lost $30,000 in the span of under 200 hours. After such a calamity, it was expected that there would be some sort of rebound, which took place immediately on Friday. In a matter of less than one trading day, the cryptocurrency surged by $12,000 and tapped $72,000 by Saturday morning.

However, it couldn’t proceed further and slipped below $70,000, where it spent most of the weekend. It tried to initiate another leg up on Monday but was stopped on a couple of occasions at $71,000 and $72,000. It has declined slightly since that local peak and now sits at $69,000.

Its market cap has declined to $1.380 trillion on CG, while its dominance over the alts stands firm at 57%.

RAIN Keeps Going

Ethereum continues to fight to stay above $2,000 after a minor daily decline. TRX has slipped by a similar percentage as well. In contrast, XRP has jumped above $1.40 after a 3% increase. BNB, SOL, BCH, and ADA are also in the green, led by ZEC’s impressive 6% surge to $242.

HYPE, on the other hand, has dropped by 5.5% daily and now struggles below $30. RAIN has taken the main stage in terms of daily gains, having soared by almost 20% to well over $0.01. The other notable gainers now are NEXO, ASTER, and M.

The total crypto market cap has remained relatively still since yesterday at just over $2.420 trillion on CG.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

Crypto World

Fairshake Supporting Barry Moore’s Senate Bid With $5M

Defend American Jobs, an affiliate of crypto super political action committee (PAC) Fairshake, will reportedly spend $5 million to support crypto-friendly politician Barry Moore in his bid for the US Senate, according to Bloomberg.

A five-week campaign will start this week with ads on broadcast TV and the Fox News Channel featuring US President Donald Trump endorsing Moore, Bloomberg reported on Tuesday, citing a statement from Fairshake.

Super PACs raise money from corporations and associations; however, the committees can’t directly donate to or coordinate with political campaigns. Instead, they fund ads and other media to urge voters to support a specific candidate.

“We are proud to stand with Barry Moore, a leader who will fight for economic growth and make America the crypto capital,” Fairshake reportedly said in a statement.

Fairshake is one of the most prominent crypto-related PACs, backed by crypto companies including Coinbase and Ripple Labs.

It spent roughly $130 million during the 2024 US elections to support pro-crypto candidates. The election ended with a flood of elected officials with pro-crypto views.

Moore is labeled ‘strongly supportive’ of crypto

Moore was first elected to the US House in 2020 and was part of the US House Agriculture Committee, which included the Digital Asset Market Clarity Act on its agenda last year.

He has also expressed crypto-friendly sentiment in the past. In an X post on Dec. 5, he appeared to approve of Trump’s crypto stance and related executive orders.

“Crypto is not a fad. It is part of our future. It is part of Alabama’s future,” Moore said.

A survey of 500 Republican voters, reported by the Alabama Daily News, found that 26s would vote for Alabama Attorney General Steve Marshall if the election were held in February. About 17% said they would vote for Moore.

Related: Trump Bitcoin adviser David Bailey wants to create a $200M PAC

Both have a rating of “strongly supportive” of crypto by advocacy organization Stand With Crypto, which compiles previous statements and actions to rate US politicians on their crypto stances.

Crypto PACs spend big on the industry

The US midterm primary elections are held in May, when each party will choose its nominee, followed by the general election on Nov. 3, when voters decide who will be elected.

Fairshake disclosed in January that it had amassed $193 million in cash ahead of the midterm elections. The Gemini Trust Company and Foris Dax, the parent company of Crypto.com, sent $21 million to a Trump-aligned PAC last year, which could also come into play in the midterms.

Magazine: 2026 is the year of pragmatic privacy in crypto — Canton, Zcash and more

Crypto World

“Compromise Is in the Air”: New Details from White House Stablecoin Talks

TLDR:

- Banks accepted limited exemption language on stablecoin rewards after previously rejecting all transaction-based incentives.

- Crypto firms want broad definitions of permissible activities, while banks seek tighter limits to protect deposit structures.

- The White House urged both sides to reach a stablecoin deal before March 1 to sustain legislative momentum.

- A smaller meeting size allowed more detailed policy language discussions than earlier White House sessions.

A smaller White House meeting brought banks and crypto firms closer on stablecoin policy but stopped short of agreement.

Participants described the discussion as more detailed and more focused than earlier sessions. Officials pressed both sides to resolve disputes over rewards and account activity rules. A March 1 deadline now shapes the next phase of negotiations.

White House Stablecoin Talks Focus on Rewards and Exemptions

The meeting centered on whether crypto companies can offer rewards tied to stablecoin transactions. Banks arrived with written principles outlining limits they would accept.

One key shift emerged around conditional exemptions. Banking groups signaled openness to limited carve-outs after earlier resistance to any transaction-based rewards.

Crypto firms pushed for broad definitions of what counts as permissible account activity. Banks argued that narrower language would better protect traditional deposit models.

According to reporting by Eleanor Terrett, both sides called the session productive despite failing to reach a final compromise. Deal terms received deeper technical discussion than in prior meetings.

Ripple’s chief legal officer Stuart Alderoty said the atmosphere suggested growing willingness to bridge gaps. He also pointed to continued bipartisan momentum for crypto market structure legislation.

The White House urged participants to settle core disagreements before March 1. Officials framed the deadline as necessary to keep legislative progress on track.

Banks and Crypto Narrow Differences on Stablecoin Policy Scope

This gathering included fewer participants than the first White House session. It was led by the executive director of the President’s Crypto Council, Patrick Witt.

Crypto attendees included representatives from Coinbase, Ripple, Paxos, Andreessen Horowitz, the Blockchain Association, and the Crypto Council for Innovation.

Major banks present were Goldman Sachs, JPMorgan, Bank of America, Wells Fargo, Citi, PNC Bank, and U.S. Bank. Trade groups such as the ABA and ICBA also joined.

Senate Banking Committee staff attended, signaling legislative interest in the outcome of the talks. Their presence added pressure for measurable progress.

Discussion focused on defining “permissible activities” for accounts offering stablecoin rewards. Crypto firms sought flexibility to innovate, while banks stressed financial stability concerns.

Sources in the room said the tone was more constructive than earlier meetings. Participants exchanged draft language rather than general objections.

No final resolution emerged by the end of the session. However, further discussions are expected in the coming days among the same parties.

The White House continues to position itself as a mediator between financial institutions and crypto companies. Officials want an agreement that can inform broader stablecoin and market structure rules.

Crypto World

No Stablecoin Bill Deal at 2nd Crypto, Banks White House Meet

A White House-brokered meeting between crypto and bank representatives to reach an agreement on stablecoin provisions in the market structure bill has been described as “productive,” but remains unresolved.

“Productive session at the White House today — compromise is in the air,” Ripple legal chief Stuart Alderoty, one of the meeting’s attendees, posted to X on Tuesday.

“Clear, bipartisan momentum remains behind sensible crypto market structure legislation. We should move now — while the window is still open,” he added.

Congress is looking to pass a bill to define how US market regulators are to police crypto. The House passed a similar bill, the CLARITY Act, in July, but the effort has stalled as the Senate Banking Committee has yet to garner enough bipartisan support to advance it.

Momentum to advance the bill was lost when major crypto lobbyist Coinbase pulled its support for the bill last month over provisions that would prohibit all yield payments tied to stablecoins.

Banking lobbyists have argued that yield payments to stablecoin holders on third-party platforms such as exchanges pose a risk to bank deposits and could undermine the banking system.

Bankers, crypto flag need for more discussions

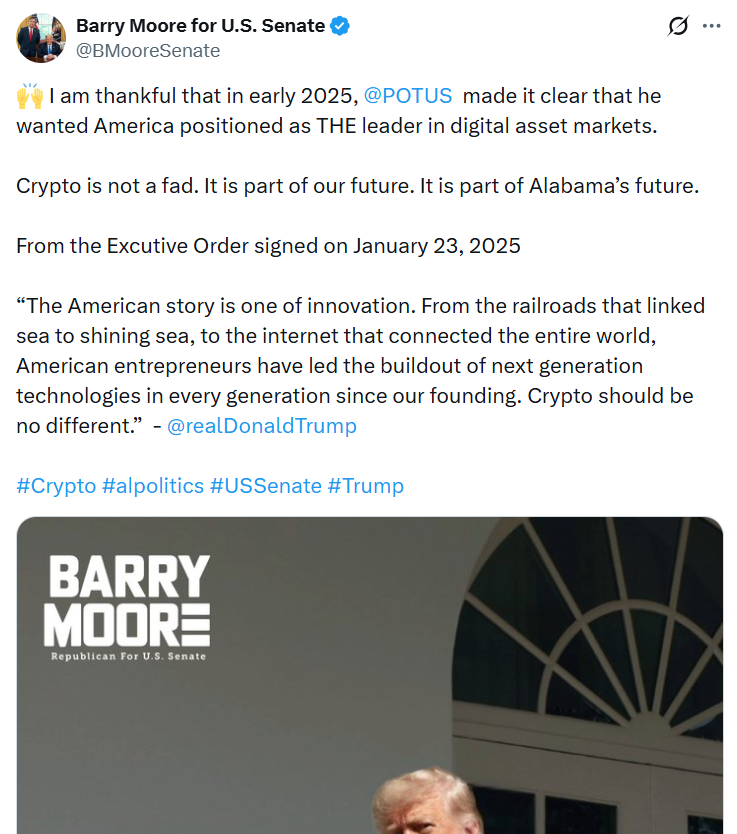

The meeting on Tuesday was the second in two weeks to bring banks and the crypto industry to the White House; the first on Feb. 2 was described by White House crypto adviser Patrick Witt as “constructive” and “fact-based.”

Dan Spuller, the industry affairs lead at crypto advocacy group the Blockchain Association, posted to X that the latest meeting “was a smaller, more focused session” with “serious problem-solving.”

“Stablecoin rewards were front and center,” he added. “Banks did not come to negotiate from the bill text, instead arriving with broad prohibitive principles, which remains a key disagreement.”

A handout given at the meeting by the banking groups reportedly listed “yield and interest prohibition principles” that should be included in the Senate’s crypto bill, reiterating the group’s push to ban all stablecoin yield payments.

Related: Crypto PACs secure massive war chests ahead of US midterms

Three major banking groups, the American Bankers Association, the Bank Policy Institute, and the Independent Community Bankers of America, said in a joint statement that “ongoing discussions” were needed to move the legislation forward.

They added that a “framework can and must embrace financial innovation without undermining safety and soundness, and without putting the bank deposits that fuel local lending and drive economic activity at risk.”

Meanwhile, BitGo CEO Mike Belshe said that both crypto and banks “should stop re-litigating” the GENIUS Act, which banned stablecoin issuers from paying yield directly, to get the market structure bill across the line.

“That battle was fought. If you don’t like GENIUS, amend it,” he added. “Market structure has nothing to do with yield on stablecoins and must not be delayed further.”

Magazine: How crypto laws changed in 2025 — and how they’ll change in 2026

-

Tech7 days ago

Tech7 days agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

Politics3 days ago

Politics3 days agoWhy Israel is blocking foreign journalists from entering

-

NewsBeat1 day ago

NewsBeat1 day agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

Sports4 days ago

Sports4 days agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

Tech4 days ago

Tech4 days agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

Business3 days ago

Business3 days agoLLP registrations cross 10,000 mark for first time in Jan

-

Tech4 hours ago

Tech4 hours agoSpaceX’s mighty Starship rocket enters final testing for 12th flight

-

NewsBeat2 days ago

NewsBeat2 days agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

Sports2 days ago

Sports2 days agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Politics3 days ago

Politics3 days agoThe Health Dangers Of Browning Your Food

-

Sports4 days ago

Former Viking Enters Hall of Fame

-

Sports5 days ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

Business3 days ago

Business3 days agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

NewsBeat5 days ago

NewsBeat5 days agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Business6 days ago

Business6 days agoQuiz enters administration for third time

-

Crypto World15 hours ago

Crypto World15 hours agoBlockchain.com wins UK registration nearly four years after abandoning FCA process

-

Crypto World23 hours ago

Crypto World23 hours agoU.S. BTC ETFs register back-to-back inflows for first time in a month

-

NewsBeat2 days ago

NewsBeat2 days agoResidents say city high street with ‘boarded up’ shops ‘could be better’

-

Sports1 day ago

Kirk Cousins Officially Enters the Vikings’ Offseason Puzzle

-

Crypto World23 hours ago

Crypto World23 hours agoEthereum Enters Capitulation Zone as MVRV Turns Negative: Bottom Near?