Business

A Conversation with Ihab Abou Letaif

Ihab Abou Letaif is a business professional with experience in retail operations and consumer goods. His work focuses on how businesses operate day-to-day, especially in complex, high-pressure markets. He is known for a practical and disciplined approach to management.

His career has been shaped by hands-on roles in operations, finance, and business development. He has worked closely with store performance, inventory control, and supply chain coordination. This has given him a clear view of how small decisions affect margins, cash flow, and long-term stability.

Operating in Venezuela has required adaptability and strong financial discipline. Ihab has spent years working in environments marked by inflation, supply volatility, and shifting consumer behaviour. His experience in these conditions has strengthened his focus on efficiency, risk control, and realistic planning.

A large part of his work has involved building and managing teams. He believes that clear processes and shared responsibility are essential for scale. He places importance on training, accountability, and steady execution rather than rapid expansion.

Ihab’s leadership style is calm and analytical. He prioritises data, systems, and repeatable results. Instead of chasing trends, he focuses on fundamentals that support sustainable growth.

His professional interests include retail economics, inventory management, and supply chain resilience in emerging markets. He continues to study how convenience and food retail are evolving across Latin America. Through this work, he is recognised as a knowledgeable operator with a grounded understanding of the retail industry.

Q: You grew up around business. How did that shape your early interest in retail and operations?

From a young age, I was exposed to how businesses actually run. Not just ideas, but responsibility. I saw how daily decisions affected staff, suppliers, and cash flow. That early exposure made me curious about operations. Retail stood out because results are immediate. You see what works and what does not very quickly.

Q: What did your education add to that early experience?

My education focused on business and management, but with a practical angle. It was less about theory and more about application. I learned how to read numbers, understand costs, and think in systems. That helped me later when I moved into operational roles, where decisions need to be fast and grounded in reality.

Q: How did your professional career begin?

I started working in retail and consumer goods in hands-on roles. Early on, I was involved in daily operations. Stock levels, supplier coordination, and staff scheduling. These roles are demanding, but they teach discipline. You learn quickly that small inefficiencies add up.

Q: What lessons stood out during those early years?

Inventory control was a major one. Having too much stock ties up cash. Having too little loses sales. I remember dealing with supply delays and learning how to plan around uncertainty. That experience shaped how I think about risk and preparation.

Q: You have worked in Venezuela, a challenging environment for retail. How did that influence your approach?

Operating in a high-inflation environment requires precision. Cash flow management becomes central to survival. You cannot rely on assumptions. You need updated data and clear controls. It also teaches humility. External conditions matter, and flexibility is essential.

Q: How did those conditions affect your leadership style?

They pushed me towards clarity and calm. In volatile markets, panic spreads fast. I try to keep processes simple and communication clear. Teams perform better when they understand priorities. My focus has always been on execution rather than ambition.

Q: What role did team management play as your responsibilities grew?

As operations scaled, team structure became critical. Training people to understand why processes matter made a real difference. I learned that leadership is not about control, but alignment. When people understand the system, they make better decisions on their own.

Q: Can you share an example of a practical challenge you faced?

One recurring issue was balancing supplier reliability with cost. Sometimes cheaper options caused delays or quality issues. Over time, I learned to value consistency. A stable supply chain reduces hidden costs and operational stress, especially in emerging markets.

Q: How do you view the convenience and food retail sector today?

It is becoming more disciplined. Margins are tight, so efficiency matters more than scale. Convenience stores in Latin America are growing, but success depends on understanding local demand and logistics. Copying models without adapting them rarely works.

Q: What topics continue to interest you professionally?

I focus on retail economics, inventory systems, and supply chain resilience. I also study how consumer behaviour changes under economic pressure. These factors shape long-term sustainability more than short-term trends.

Q: How do you define effective leadership in this industry?

Effective leadership is quiet and consistent. It is about building systems that work without constant intervention. Data, discipline, and trust matter more than visibility. Results should speak for themselves.

Q: Looking back, what has been most important in your career journey?

Staying grounded. Retail teaches you that fundamentals matter. Cash flow, stock control, and people are always at the centre. No matter the market, those principles remain the same.

Business

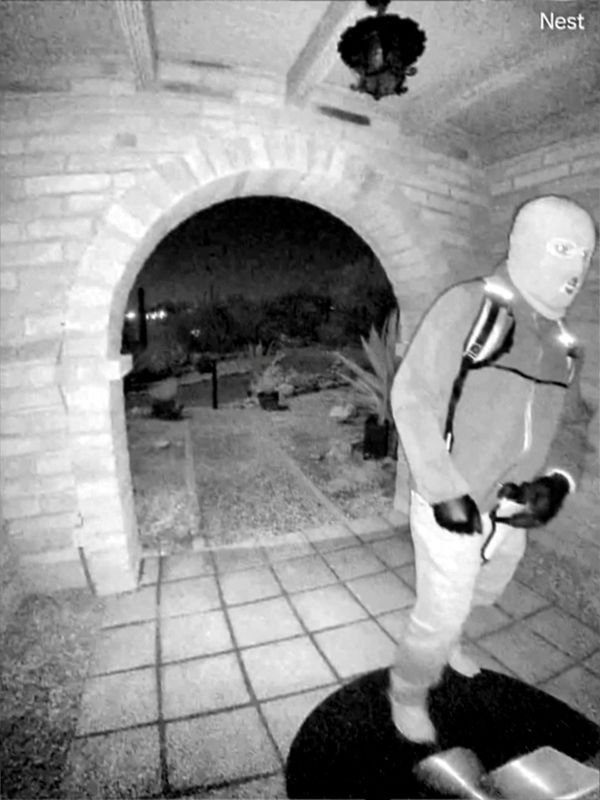

Shadowy video, first known arrest mark big breaks in Nancy Guthrie abduction

Shadowy video, first known arrest mark big breaks in Nancy Guthrie abduction

Business

Amazon Hints on Building AI Content Marketplace for Publishers

Amazon may be preparing a significant shift in how AI companies access training data, as mounting copyright lawsuits continue to reshape the industry.

According to recent reports, the tech giant is exploring a new content marketplace that would enable publishers to directly license their material to AI developers, potentially offering a cleaner and legally safer alternative to scraped data.

Amazon’s AI Content Marketplace Explained

The Information first reported that sources familiar with the discussions say Amazon has been meeting privately with publishing executives to outline a centralized marketplace for licensable content.

Ahead of a recent AWS conference aimed at publishers, Amazon reportedly circulated internal materials referencing a potential “content marketplace,” signaling that the idea has moved beyond early speculation.

While Amazon has not officially announced the project, the company confirmed it is actively collaborating with publishers across AWS, advertising, and AI-related initiatives. If launched, the marketplace would position Amazon as a key intermediary between content owners and AI companies seeking high-quality training data.

Why Licensed AI Training Data Is Now Critical

The push for licensed datasets comes as AI firms face increasing legal and regulatory pressure. Lawsuits from authors, publishers, and media organizations have challenged the widespread use of scraped copyrighted content in AI training. These disputes have exposed financial and reputational risks for companies relying on unlicensed material.

To mitigate that risk, tech giants are pivoting toward direct licensing agreements that provide a clearer legal footing while ensuring access to reliable, premium data. A marketplace model could scale this process dramatically.

Microsoft Has Already Set the Blueprint

According to TechCrunch, Amazon would be following a path already established by Microsoft, which recently launched its Publisher Content Marketplace. Microsoft’s platform provides publishers with a transparent way to license content, while offering AI developers consistent and scalable access to approved material.

Why Publishers Are Paying Attention

For publishers, an Amazon-backed marketplace could unlock a new, recurring revenue stream at a time when traditional traffic models are under pressure.

Many media companies have raised concerns that AI-generated summaries in search engines and assistants reduce click-throughs and ad revenue.

Licensing content directly to AI systems could help offset those losses, turning AI adoption from a threat into a monetization opportunity.

Speaking of AI, some Amazon employees criticized CEO Andy Jassy for saying that AI will take their jobs. Back in July, they feared that more layoffs were expected to come in 2026.

Fast forwardto 2026, the Seattle giant announced its plans to lay off thousands of corporate employees last month.

Originally published on Tech Times

Business

iPhone 18 Pro Price Leak From Jeff Pu Brings Surprising News Apple Fans Didn’t Expect

Apple appears prepared to maintain pricing for its next-generation iPhone 18 Pro and iPhone 18 Pro Max, offering flagship performance without a cost increase despite rising component expenses.

According to GF Securities analyst Jeff Pu, Apple’s strategic supplier negotiations and internal cost optimizations are key to avoiding price hikes in 2026.

iPhone 18 Pro Pricing Likely to Remain Stable

Based on MacRumors’ report, Pu’s research note highlights Apple’s aggressive approach to managing costs. Even as memory prices surge due to AI data center demand, the tech giant’s enormous purchasing power reportedly allows it to secure favorable RAM deals from suppliers like Samsung and SK Hynix.

Combined with targeted savings in displays, camera modules, and other components, the company is positioning itself to launch the 18 Pro series at the same price as last year’s models.

Pu is also the same source who said that Intel will make chips using the 14A process. This will be a big move for the iPhone maker who is looking to diversify chip suppliers outside the normal TSMC negotiation.

Strategic Supply Chain Moves

Apple’s careful supply chain management reflects a broader strategy to protect consumers from inflation-driven smartphone price spikes. The company aims to deliver next-gen performance while maintaining premium value through leveraging supplier negotiations and optimizing manufacturing efficiencies.

Stable Prices Matter

Maintaining steady pricing is especially important in 2026, as buyers face more competition from high-end Android devices offering comparable features at lower costs.

A price hold could encourage upgrades among existing users and sustain Apple’s market share in the premium segment.

What Buyers Can Expect

While official confirmation awaits Apple’s launch event, analysts suggest the iPhone 18 Pro and Pro Max will deliver upgraded hardware, enhanced performance, and new features without a higher price tag.

For consumers, this could be a rare opportunity to access cutting-edge technology at familiar costs, according to GSM Arena. This is an attractive proposition in an otherwise inflationary tech market.

Originally published on Tech Times

Business

Goldminer Evolution posts bumper profit, dividend payout

Mungari mine operator Evolution Mining has pledged to pay a record 20 cents dividend to shareholders as its board approves a raft of growth investment amid the gold price environment.

Business

PZ Cussons outlines strategy targeting double-digit shareholder returns

PZ Cussons outlines strategy targeting double-digit shareholder returns

Business

Earnings momentum and trade clarity to drive markets: Vikas Khemani

“Now, we have been saying in our previous discussion, in our previous interaction that we have been very positive on the earnings outlook and that is what has happened, in last two quarters sequentially earnings have been better. So, by and large earnings have been in line with the expectations and even especially in the mid and smallcap space earnings have been very good and nothing changes from our perspective. We think this momentum will continue,” Khemani said.

He added that recent resolutions in the US trade deal and tariff uncertainties have further bolstered corporate confidence, especially among exporters in the mid and smallcap space.

Reflecting on the broader market outlook for 2026, Khemani expressed optimism. “I have said in our previous discussion that 2026 would be a better year than 2025 for the simple reason. If you see, we started 2025 with a lot of negativity or noise or negative news… When all these things were happening, India was going through a significant monetary stimulus as well as the fiscal stimulus and that was obviously working very well at the economic level. There was uncertainty around a little bit of on the export due to tariffs which also has got lifted. Also, in this crisis what India has been able to do is FTAs, long pending FTAs with the other countries, likes of EU and the New Zealand and other parts of the world. So today, we are sitting on a situation where you have good monetary and economic stimulus and all the broader uncertainties are behind. There will always be uncertainty in the market something or other, there is no doubt on that, but broadly there is not much uncertainty on the growth and as more and more people get comfortable around this environment and meanwhile in this period the valuations have come down, a lot of froth which has got kind of cleared, so you will see markets doing well. Now, how much it does well it all depends a lot more on the liquidity which I think should get better this year especially from the foreign investor perspective. So, I am quite optimistic about the market in 2026.”

When asked about the lagging mid and smallcap sectors, Khemani explained that recovery typically starts with largecaps before extending to smaller companies. “It always happens that once the recovery happens it always led by the largecaps and the mid and smallcap follows through… A) they tend to accelerate. I mean, the volatility in the earning with the change in the macro environment generally tends to be far more pronounced than in any largecap or large company and that happens in the share prices as well. So, I am quite optimistic that this environment is going to be good for mid and smallcap. Now whether it really meaningfully picks up in two months, three months, six months, I do not know but directionally we are finding interesting ideas, risk-reward looks very good.”

On investment strategy, Khemani emphasized stock-specific valuations rather than broad index levels. “See, looking at the broad indices cannot be the right answer, you have to look at individual stock specific and you have to see in the context of the potential growth… So, always you have to see valuation in the context of the growth and the ROEs business model company generates and that is how we always evaluate, we do not get carried away by the broader noise and you have seen over the years how our stock picks have been… we have never believed only in the consensus calls, we have taken contra… I mean against the consensus calls but once we are convinced about the potential growth and the risk-reward of the story, then we do take the sizable bets.”

Khemani also discussed the consumption sector, highlighting selective exposure in consumer discretionary stocks, automobiles, and auto ancillaries. “Like I said that it is linked to the macro environment which we saw last 12 to 18 months and with that lag it happened… in last six-eight months we have meaningfully kind of played that out especially in a consumer discretionary space, even automobiles we take as part of the consumption and that we have fairly large exposure… you look at companies, what are the growth drivers, you do not necessarily play only the first order impact, you can play also second order impact where you understand the risk-reward given the valuations.”Looking ahead, Khemani confirmed a focus on mid and smallcaps within his portfolio. “We have product which is more mid and smallcap focused, we have flexicap product where we are definitely right now almost 60% mid and smallcap… Some of the spaces which could stand out in this year would be chemicals… Auto, auto components look pretty decent. The building materials product looks very decent. So, consumer discretionary space you can find lots of ideas. Within banking and financial services you are finding… we think that is more likely to play out. So again, you look at different-different segments… line towards AI related enabled companies, there we are kind of playing out more.”

With optimism around earnings, macro stability, and selective sector plays, experts like Khemani suggest that 2026 could offer better opportunities for investors, particularly in mid and smallcap spaces, while staying alert to market volatility.

Business

Tariffs and falling demand leave Scotch distillers under pressure

Growing numbers of Scottish spirits producers are showing signs of financial strain as weakening export demand, rising costs and trade barriers squeeze margins across the sector.

Research by restructuring specialist BTG Begbies Traynor found that 69 Scottish distillers were facing “significant” or “critical” financial distress at the end of the year, up from 49 in the previous quarter.

According to the Scotch Whisky Association, Scotland is home to more than 150 whisky distilleries, alongside more than 90 producing gin and a smaller number making vodka, rum and liqueurs.

Thomas McKay, managing partner of BTG in Scotland, said producers were facing a “perfect storm of lowering demand, rising production costs and increased tariffs in key markets”.

Exports to the United States and China, two of Scotch whisky’s most important markets, have been dented by tariffs and duties, while domestic trends have also shifted.

Several UK pub groups have reported that customers are increasingly trading down from spirits to cheaper alternatives such as beer or soft drinks. At the same time, broader societal changes, including declining alcohol consumption among younger consumers, have weighed on volumes.

McKay noted that demand for Scotch whisky and gin peaked during the pandemic in 2020, when lockdown consumption surged both in the UK and internationally.

“When that demand fell away, the resulting oversupply pushed prices down, just as additional export costs to the US began to rise sharply,” he said.

Distillers have also been hit by steep increases in energy and labour costs over the past two years, further eroding profitability.

The challenges have already prompted retrenchment. Last month, craft brewer BrewDog announced plans to close its distillery and spirits arm, underscoring the pressure across the wider drinks sector.

The strain is not confined to Scotland. Export volumes of French wine and spirits fell last year to their lowest level in 25 years.

Industry body FEVS said shipments dropped 3 per cent year-on-year to 168 million cases, the weakest performance since the turn of the century. The value of sales declined 8 per cent to €14.3 billion, the poorest showing on that measure for five years.

Tariffs imposed by the United States under President Trump, as well as duties in China, were cited as key headwinds.

Gabriel Picard, chairman of FEVS, said that new trade agreements between the European Union and India, as well as Mercosur countries in South America, could help support exports in the year ahead. However, he warned that sales of cognac and wine to the US and China could deteriorate further.

For Scotland’s distillers, the coming year is likely to test resilience. With costs elevated, export markets volatile and domestic consumers tightening belts, the industry that has long been one of Britain’s flagship exporters is confronting one of its most challenging trading environments in decades.

Business

Google Goes Long With 100-Year Bond Sale. We’ve Seen This Before.

Google Goes Long With 100-Year Bond Sale. We’ve Seen This Before.

Business

Heineken to cut up to 6,000 jobs as beer demand falters

Heineken to cut up to 6,000 jobs as beer demand falters

Business

Workday Stock Falls. Wall Street Isn’t Taking Kindly to Co-Founder’s Return as CEO.

Workday Stock Falls. Wall Street Isn’t Taking Kindly to Co-Founder’s Return as CEO.

-

Tech7 days ago

Tech7 days agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

Politics3 days ago

Politics3 days agoWhy Israel is blocking foreign journalists from entering

-

NewsBeat1 day ago

NewsBeat1 day agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

Sports4 days ago

Sports4 days agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

Tech4 days ago

Tech4 days agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

Business3 days ago

Business3 days agoLLP registrations cross 10,000 mark for first time in Jan

-

Tech4 hours ago

Tech4 hours agoSpaceX’s mighty Starship rocket enters final testing for 12th flight

-

NewsBeat2 days ago

NewsBeat2 days agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

Sports2 days ago

Sports2 days agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Politics3 days ago

Politics3 days agoThe Health Dangers Of Browning Your Food

-

Sports4 days ago

Former Viking Enters Hall of Fame

-

Sports5 days ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

Business3 days ago

Business3 days agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

NewsBeat5 days ago

NewsBeat5 days agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Business6 days ago

Business6 days agoQuiz enters administration for third time

-

Crypto World15 hours ago

Crypto World15 hours agoBlockchain.com wins UK registration nearly four years after abandoning FCA process

-

Crypto World24 hours ago

Crypto World24 hours agoU.S. BTC ETFs register back-to-back inflows for first time in a month

-

NewsBeat2 days ago

NewsBeat2 days agoResidents say city high street with ‘boarded up’ shops ‘could be better’

-

Sports1 day ago

Kirk Cousins Officially Enters the Vikings’ Offseason Puzzle

-

Crypto World24 hours ago

Crypto World24 hours agoEthereum Enters Capitulation Zone as MVRV Turns Negative: Bottom Near?