Crypto World

Per-Tx Encryption vs Malicious MEV

As MEV threats intensify on Ethereum, researchers are pursuing cryptographic shields designed to cloak mempool data until blocks finalize. Fresh measurements show almost 2,000 sandwich attacks every day, draining more than $2 million from the network each month. Traders executing large WETH and WBTC swaps, as well as other liquid assets, remain exposed to front-running and back-running. The field has grown beyond early threshold-encryption experiments toward per-transaction designs that aim to encrypt a transaction’s payload rather than entire epochs. Early prototypes like Shutter and Batched threshold encryption (BTE) laid groundwork by encrypting data at epoch boundaries; now, per-transaction designs are being explored for finer-grained protection and potentially lower latency. The debate centers on whether real-world deployment on Ethereum is feasible or remains primarily in research channels.

Key takeaways

- Flash Freezing Flash Boys (F3B) proposes per-transaction threshold encryption to keep transaction data confidential until finality, using a designated Secret Management Committee (SMC) to manage decryption shares.

- Two cryptographic paths exist within F3B: TDH2 (Threshold Diffie-Hellman 2) and PVSS (Publicly Verifiable Secret Sharing), each with distinct trade-offs in setup, latency, and storage.

- Latency overhead from finality is modest in simulations: about 0.026% for TDH2 (197 ms) and 0.027% for PVSS (205 ms) with a committee of 128 trustees on Ethereum-like conditions.

- Storage overhead is a consideration: roughly 80 bytes per transaction under TDH2, with PVSS inflating as the number of trustees rises due to per-trustee shares and proofs.

- Deployment remains challenging: integrating encrypted transactions requires changes to the execution layer and may demand a major hard fork beyond The Merge; nonetheless, F3B’s trust-minimized approach could later find use beyond Ethereum, including sealed-bid auction contracts.

Tickers mentioned: $ETH, $WETH, $WBTC

Market context: The broader crypto environment continues to weigh on MEV mitigation efforts as developers seek privacy-preserving mechanisms that do not erode finality or throughput. The ongoing discussion touches on protocol upgrades, research benchmarks, and cross-chain applicability, with activity spanning academic papers, industry tooling, and governance proposals.

Why it matters

The MEV arms race has harsh consequences for liquidity and trader outcomes, especially in high-volume decentralized exchanges where sandwich-type strategies exploit visible mempool activity. By moving toward per-transaction encryption, proponents argue that the incentive to front-run could diminish, since collateralized decryption happens only after a transaction has reached finality. This could improve fair access to liquidity for both retail and institutional traders, while potentially reducing the aggressive search for edge cases that currently drive MEV. Yet, the effectiveness hinges on the cryptographic primitives’ resilience and the ecosystem’s ability to absorb the added complexity without eroding security guarantees.

From a builder’s perspective, the F3B framework presents a clear tension between privacy and performance. The TDH2 path emphasizes a fixed committee and a streamlined data footprint, while PVSS offers more flexibility by letting users select trustees but incurs larger ciphertexts and greater computational overhead. The simulations suggest that, when configured appropriately, privacy-preserving measures can coexist with Ethereum’s throughput and finality targets. However, achieving real-world deployment would demand careful coordination among clients, miners or validators, and ecosystem tooling to ensure compatibility with existing smart contracts and wallets.

Investors and researchers should watch how the incentive structures evolve. F3B’s staking and slashing regime aims to deter premature decryption and collusion, but no system is immune to off-chain coordination risks. If the mechanism proves robust, it could influence future designs for privacy in permissionless networks and inspire alternative approaches to secure computation in open ledgers. The potential applications extend beyond straightforward trades; encrypted mempools could also underpin privacy-centric auctions and other latency-sensitive, trust-minimized interactions where upfront data leakage would otherwise enable manipulation.

What to watch next

- Further experimental results and real-world testnet pilots evaluating F3B’s latency, throughput, and storage under varied network loads.

- Rigorously documented security analyses of TDH2 and PVSS in active blockchain environments, including proofs of correct decryption and resilience against malicious actors.

- Public discussion of integration strategies with the Ethereum execution layer, and whether any client, protocol, or governance changes could enable phased deployment.

- Exploration of F3B-style privacy techniques in non-ETH networks or sub-second blockchains to gauge broader applicability and performance trade-offs.

- Sealed-bid auction use cases and other cryptographic applications where encrypted bids remain hidden until a defined deadline, aligning with F3B’s post-finality execution flow.

Sources & verification

- Flash Freezing Flash Boys (F3B) — arXiv:2205.08529

- How batched threshold encryption could end extractive MEV and make DeFi fair again — Cointelegraph

- Applied MEV protection via Shutter’s threshold encryption — Cointelegraph

- The Merge — Ethereum upgrades: A beginner’s guide to Eth2.0 — Cointelegraph

- TDH2 (Threshold Diffie-Hellman 2) — Shoup et al. (paper)

Per-transaction encryption reshapes the MEV battle on Ethereum

Flash Freezing Flash Boys introduces a pivot from epoch-wide secrecy to transaction-level privacy. The core idea is to encrypt the transaction with a fresh symmetric key and then shield that key with a threshold-encryption scheme reachable only by a predefined committee. In practice, a user signs a transaction and distributes an encrypted payload along with an encrypted symmetric key to the consensus layer. The designated Secret Management Committee (SMC) holds decryption shares, but will not release them until the chain has achieved the required finality, at which point the protocol jointly reconstructs and decrypts the payload for execution. This workflow is designed to avert the exposure of transaction details during the propagation window, thereby reducing the opportunities for MEV-based manipulation.

Two theoretical treatments underpin the approach. TDH2, which relies on a distributed key generation (DKG) process to produce a public key and shares, pairs a fresh symmetric key with a ciphertext that the committee can unlock in a threshold fashion. PVSS, by contrast, uses long-term keys for trustees and Shamir’s secret sharing, allowing a user to distribute shares encrypted with each trustee’s public key. Each model is accompanied by a set of zero-knowledge proofs to deter malformed decryption data, addressing concerns about chosen-ciphertext attacks and decryption validity. The two paths present different performance profiles: a fixed committee streamlines setup and reduces per-transaction data size (TDH2), while PVSS offers flexibility at the cost of larger ciphertexts and higher computation. In practical terms, simulations on a PoS-like Ethereum environment suggest sub-second delays after finality—well within acceptable bounds for many DeFi operations—and minimal storage pressure per transaction under TDH2. The numbers, of course, depend on committee size and network conditions.

Yet, deployment remains a topic of debate. Even if encryption constructs behave well in simulation, integrating encrypted transactions into the execution layer would likely require substantial changes—potentially a hard fork beyond The Merge—to ensure compatibility with current contracts and wallet software. Nevertheless, the research marks a meaningful step toward privacy-enhanced DeFi, showing that it is possible to conceal sensitive data without sacrificing finality. The broader implication is that encrypted mempools could find application beyond Ethereum, in networks pursuing privacy-preserving, trust-minimized protocols where delayed or withheld execution is acceptable or desirable. For now, the path to real-world usage remains cautious and incremental, with F3B serving as a benchmark for what privacy-preserving MEV mitigation could look like in practice.

Crypto World

BingX Rolls Out Copy Trading Plaza and Enhanced Lead Trader Homepage in Major Upgrade to Copy Trading Suite

PANAMA CITY, February 11, 2026 – BingX, a leading cryptocurrency exchange and Web3-AI company, announced the upcoming launch of an array of enhancements to its copy trading suite, including the all-new Copy Trading Plaza and an upgraded Lead Trader Homepage. This major overhaul redefines BingX’s copy trading experience with a refreshed experience, smarter discovery, and deeper data transparency, aimed at significantly increasing visibility and engagement across its copy trading ecosystem.

The new Copy Trading Plaza consolidates discovery, evaluation, and execution into a single, intuitive destination designed to help users identify top strategies faster and with greater confidence:

- Intelligent Discovery: Discover both real traders and AI-driven strategies tailored to your trading preference on the BingX mobile app

- Centralized Copy Trading Hub: One-stop access to curated trader lists and strategy insights to improve overall copy trading efficiency

- Professional-Grade Metrics: Select trading strategies with advanced ranking and filtering powered by professional risk and performance metrics

The revamped Lead Trader Homepage offers a variety of advancements:

- Multidimensional Data: A fully revamped personal page with multidimensional performance data, offering copiers greater transparency and Lead Traders more opportunities

- Enhanced Transparency: Deep dives into trading behavior, risk profile, and historical performance, allowing traders to implement new trading strategies with greater confidence

- New Set of Tools: Integrated tools to help Lead Traders build credibility, grow visibility, and manage copiers more effectively

As the first exchange to offer copy trading in Web3, BingX operates one of the industry’s largest and most active copy trading communities. To date, the platform has recorded over 1.3 billion cumulative copy trading orders and $580 billion in cumulative trading volume, underscoring its scale, liquidity, and long-standing user trust.

“This overhaul is a structural leap forward for copy trading on BingX,” said Vivien Lin, Chief Product Officer at BingX. “By unifying smarter discovery, professional-grade metrics, and enhanced trader profiles, we’re enabling users to make faster, better-informed decisions while empowering Lead Traders to build influence and long-term value.”

To celebrate the launch, BingX is rolling out a limited-time campaign, offering users who complete their first copy trade or apply to become a lead trader and place their first trade by February 28 via the new homepage will be entered into a lucky draw, with the top prize reaching up to 9,999 USDT.

About BingX

Founded in 2018, BingX is a leading crypto exchange and Web3-AI company, serving over 40 million users worldwide. Ranked among the top five global crypto derivatives exchanges and a pioneer of crypto copy trading, BingX addresses the evolving needs of users across all experience levels.

Powered by a comprehensive suite of AI-driven products and services, including futures, spot, copy trading, and TradFi offerings, BingX empowers users with innovative tools designed to enhance performance, confidence, and efficiency.

BingX has been the principal partner of Chelsea FC since 2024, and became the first official crypto exchange partner of Scuderia Ferrari HP in 2026.

For media inquiries, please contact: media@bingx.com

For more information, please visit: https://bingx.com/

Disclaimer: This is a Press Release provided by a third party who is responsible for the content. Please conduct your own research before taking any action based on the content.

Crypto World

Pi Network’s Price Sees Another All-Time Low, But Next 3 Days Could Be Even Worse: Details

Here’s why PI could continue to chart big losses in the next few days.

The overall market-wide correction that took place in the past 12 hours or so has not been kind to many altcoins, but there’s one that stands out as perhaps the biggest victim of the brutal state of the industry.

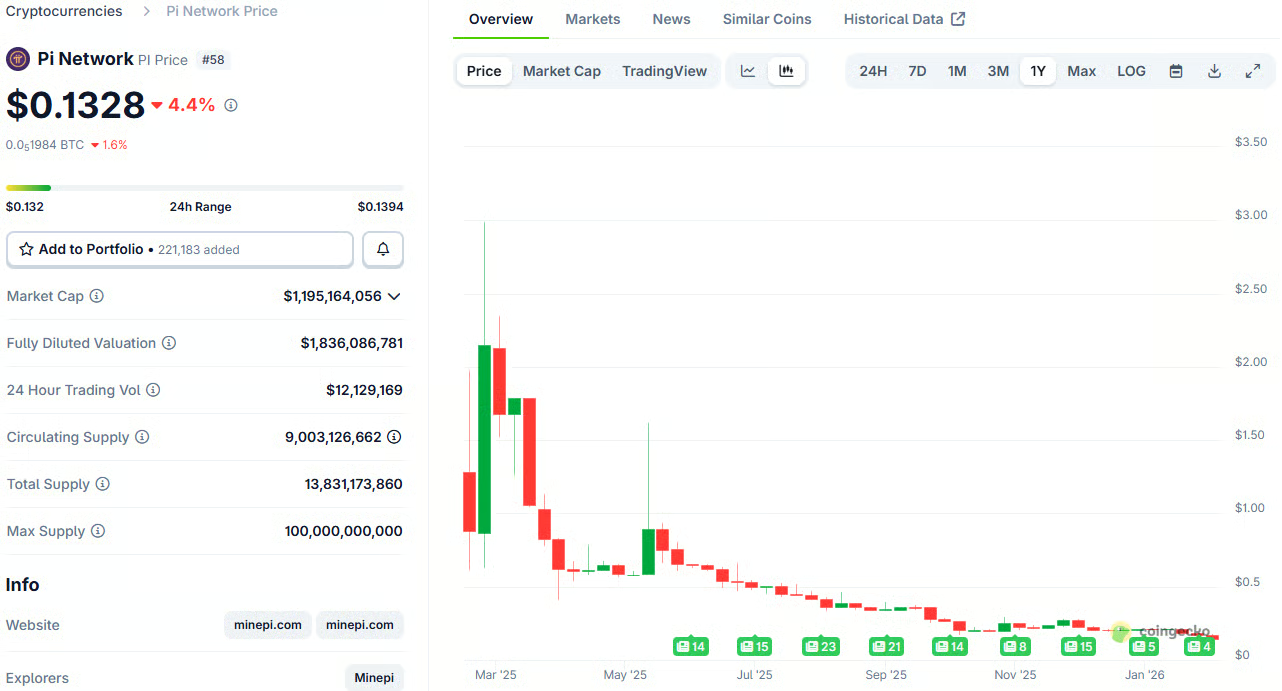

Pi Network’s native token, which traded close to $3 less than a year ago, has been on a massive free-fall ride since then. The latest price crash from minutes ago meant a fresh all-time low of $0.132, according to data from CoinGecko. In fact, the chart below demonstrates a clear and painful pattern, showing a 95.6% decline in less than a year.

While this calamity is already bad enough, on-chain data suggests that it might not be the end of PI’s struggles.

PiScan is a website dedicated to increasing the project’s transparency, especially when it comes to the daily (and monthly) schedules for token unlocks. After all, a significant portion of PI has been locked, and investors are gradually receiving access to their holdings.

However, the next few days could intensify the selling pressure because the schedule does not show a “gradual” token unlock. On average, the number of coins to be released in the next month stands at just over 8.5 million, which is already a lot higher than the 4-5 million seen just a couple of months ago.

However, these numbers are significantly higher for February 12, 13, and 14. More precisely, 16.9 million tokens will be released on February 14, while the number for tomorrow will be 18.9 million. February 13, which, coincidentally (or not), is Friday the 13th, will be the record day, with 23.6 million PI unlocked.

It’s worth noting that once these tokens are released, they will be free for trading. Although this doesn’t guarantee they will be sold off immediately, it certainly raises such concerns given the overall market state, rising FUD, and the latest criticism of Pi Network and its team.

You may also like:

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

Crypto World

STON.fi Brings Bitcoin and Ethereum to TON DeFi

STON.fi, one of the leading AMM protocols on The Open Network (TON), announced that TON-native representations of Bitcoin (BTC) and Ethereum (ETH) are now available within the ecosystem in a fully non-custodial DeFi format.

The integration gives TON users direct access to the two largest crypto assets, including the ability to swap them and provide liquidity, while maintaining full control over their funds.

BTC and ETH are represented on TON as wrapped assets issued in TON-native format, each fully backed 1:1 by the underlying tokens and managed through smart contracts. Ethereum is available as wrapped ETH (WETH), while Bitcoin is accessible via cbBTC, a Bitcoin-backed token issued by Coinbase and fully collateralized with BTC on a one-to-one basis. This structure allows both assets to be used across decentralized applications within TON ecosystem without interacting directly with their native blockchains.

Through STON.fi, users can deploy WETH and cbBTC across TON DeFi, including swapping and providing liquidity via WETH/USDt and cbBTC/USDt pools. At the same time, Omniston, STON.fi’s liquidity aggregation protocol, enables swaps to WETH and cbBTC from any TON-native token, routing liquidity across the ecosystem. Applications integrated with Omniston instantly gain access to WETH and cbBTC liquidity, enabling swaps across hundreds of TON-based dApps without additional integrations and expanding the range of available DeFi strategies within the ecosystem.

“Bringing BTC and ETH into TON DeFi is about expanding real utility, not just asset coverage,” said Slavik Baranov, CEO of STON.fi Dev. “This launch enables users to actively use Bitcoin and Ethereum inside TON ecosystem rather than holding them passively. By making these assets usable in TON-native DeFi, we’re strengthening the overall depth of the ecosystem.”

As TON continues to develop as a blockchain closely integrated with Telegram — a messenger used daily by hundreds of millions of people — access to major crypto assets directly within Telegram-native and TON-based applications has become a natural part of the ecosystem’s evolution. Bitcoin and Ethereum sit at the core of the global crypto economy, and their availability on TON allows users to access these assets directly within the apps they already use, without leaving the ecosystem, through decentralized and permissionless infrastructure.

To learn more about how WETH and cbBTC integration works on STON.fi, users can visit: https://ston.fi/eth-ton and https://ston.fi/btc-ton.

About STON.fi

STON.fi is one of the leading non-custodial swap dApps and a suite of swap-enabling protocols within The Open Network (TON) ecosystem, known for its deep liquidity, wide token coverage, and dominance in total value locked (TVL) and trading volume. With over $6.8 billion in total trading volume and more than 31 million operations, STON.fi dominates TON DeFi ecosystem in token coverage, liquidity depth, and active user participation. Backed by top investors such as CoinFund, Delphi Ventures, The Open Platform, Karatage, TON Ventures, and others, STON.fi continues to advance decentralized finance through open development and innovations such as Omniston — a decentralized liquidity aggregation protocol.

Crypto World

Arkham Intelligence said to be shutting trading platform as crypto bear market bites

Arkham Exchange, the cryptocurrency trading platform built by data analytics company Arkham Intelligence, is closing down, according to a person familiar with the matter.

Arkham, whose backers include OpenAI CEO Sam Altman, did not respond to requests for comment.

The company, which was founded in 2020 and now boasts over 3 million registered users, floated the idea of adding a crypto derivatives exchange back in October 2024. The plan was to compete with giants such as Binance for retail investors.

By early 2025, Arkham Exchange had added spot crypto trading in a number of U.S. states. But volumes appear to have been a challenge, despite the firm adding a mobile trading app in December.

Binance, the largest crypto exchange by volume, had almost $9 billion of daily trading, according to CoinGecko data. Coinbase (COIN), the No. 2, had $2 billion. Akrham recorded just under $620,000 in the past 24 hours.

In addition to Altman, Arkham’s backers include Draper Associates, Binance Labs and Bedrock.

Arkham hosts its own native crypto token, ARKM, which was trading at close to $0.12 at the time of writing.

Crypto World

Why Everyone’s Talking About Robinhood Q4 2025 Earnings

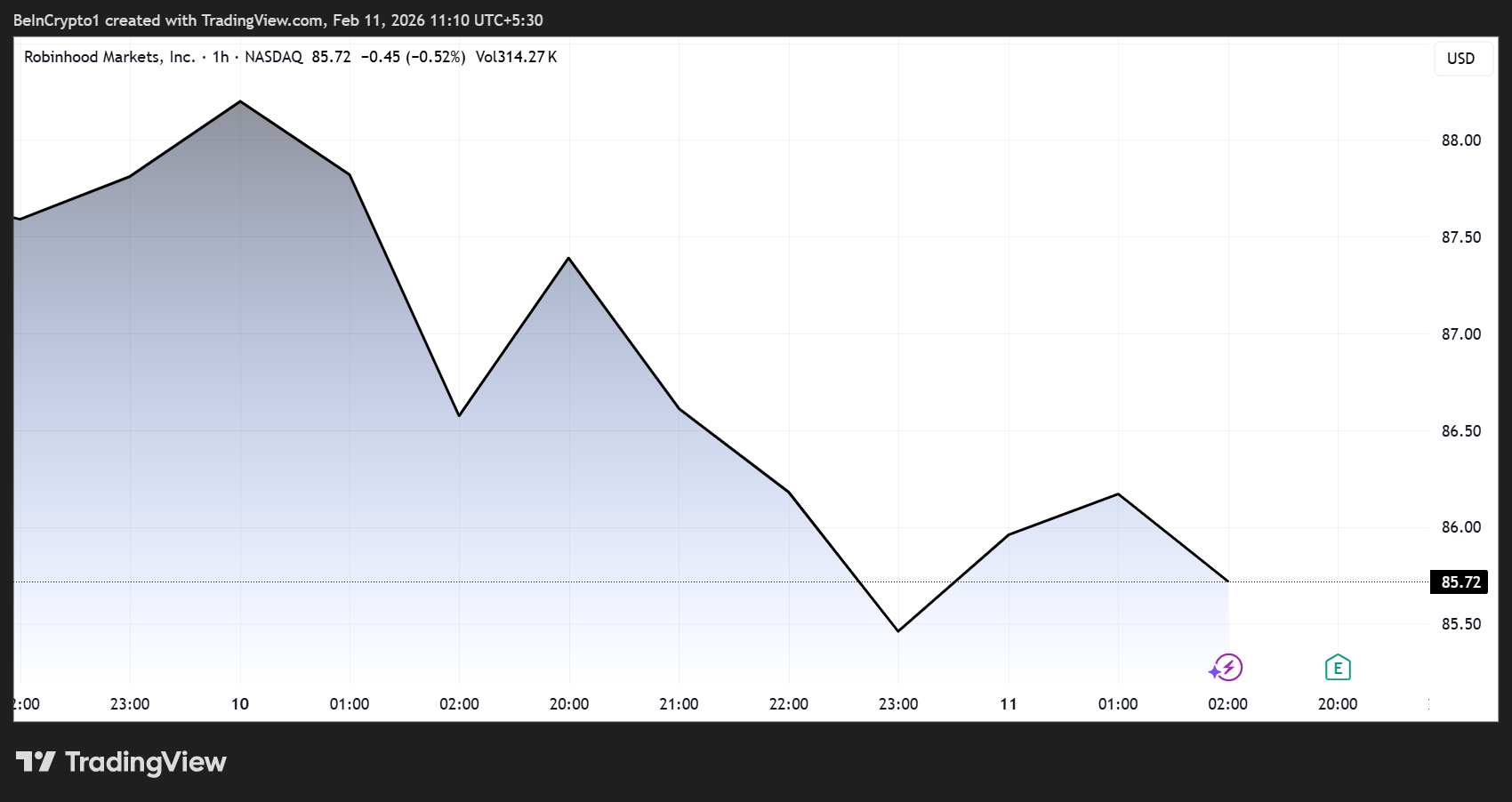

Robinhood’s Q4 2025 earnings report triggered a sharp market reaction, with the company’s stock falling roughly 8% after revenue came in below expectations.

Yet the most striking takeaway from the call was not the drop in crypto trading revenue, but the growing prominence of prediction markets and automation as pillars of the platform’s future strategy.

Robinhood Earnings Show Prediction Markets Overtaking Crypto as Key Growth Driver

Nearly one-third of analyst questions during the earnings call focused on prediction markets, reflecting how quickly the sector is moving from experimental feature to potential core business line.

Sponsored

Sponsored

“30% of $HOOD Q&A (6 of 20 questions) concerned prediction markets, by far the #1 topic,” stated Matthew Sigel, Head of Digital Assets Research at VanEck.

According to Sigel, the attention reflects fast-paced growth across the industry, with volumes now above $10 billion per month (approximately $300–400 million per day), roughly comparable to the average daily US sports betting handle.

Revenue Miss and Crypto Slowdown

Robinhood reported Q4 net revenue of $1.28 billion, below expectations of about $1.35 billion. Transaction-based revenue and crypto trading also missed forecasts, with crypto revenue coming in at approximately $221 million versus expectations closer to $248 million.

Analysts see the market reaction as largely tied to high expectations and slowing growth in key metrics rather than structural weakness in the business.

Christian Bolu, senior analyst at Autonomous Research, described the results as disappointing on the surface but constructive in outlook.

“I would say look at an expensive stock, and you know a topline miss is not helpful at all,” Bolu said, noting that some key metrics, including deposit growth, also slowed.

However, he emphasized that the longer-term outlook remains positive:

“The commentary from the management team is pretty constructive in terms of the pipeline for 2026 in terms of new business growth, and actually, transaction volumes have been very strong in January as well. So, the outlook here is actually pretty decent.”

Sponsored

Sponsored

Prediction Markets Move to Center Stage

While crypto remains an important segment, analysts increasingly see prediction markets and event contracts becoming a larger share of the business over time.

“Over time, we think things like event contracts and prediction markets will be a bigger part of the business than crypto,” Bolu added in the interview with Yahoo Finance.

The opportunity is substantial. Despite rising competition from platforms like Kalshi and Polymarket, Robinhood’s distribution advantage could prove decisive.

“The good thing about Robinhood is their value prop from a business perspective is the distribution,” Bolu said. “There aren’t many folks that can distribute or have the distribution that they do.”

Regulation Remains the Key Constraint

Even as interest grows, regulatory uncertainty remains the biggest barrier to expansion. Sigel highlighted that the issue was directly addressed during the earnings call.

“Binary yes/no contracts … can fit under CFTC event contract authority… But contracts with continuous or formula-based payouts tied to a single issuer’s financial performance could be treated as SEC ‘security-based swaps’ under Dodd-Frank.”

Sponsored

Sponsored

However, the Van Eck executive acknowledged that the lack of clarity is slowing progress:

“There’s no formal framework clarifying that boundary yet, which is why management referenced needing ‘regulatory relief.’”

AI Automation Quietly Reshaping the Business

Beyond new trading products, Robinhood is also transforming its internal operations through automation and artificial intelligence. Against this backdrop, Sigel shared one of the most striking disclosures from the call:

“AI support is really cranking. Now over 75% of our cases are solved by AI, including the complex cases that previously required licensed brokerage professionals,” he shared.

The company is also automating its engineering workflow, optimizing the entire engineering pipeline from code writing through code review to deployment and testing.

Reportedly, this is already turning into real savings and efficiency gains, estimated at over $100 million in 2025 alone.

These cost reductions could help offset cyclical revenue swings in areas like crypto and options trading.

Sponsored

Sponsored

A More Diversified Robinhood

Analysts say Robinhood today looks very different from the trading app that rose to prominence during earlier crypto and meme-stock cycles.

Bolu described the company as “a much more mature company a much more diversified company,” pointing to:

- Growing net interest income

- Retirement accounts

- Banking products, and

- Credit cards as additional revenue streams.

This diversification is one reason many analysts remain bullish despite short-term volatility. More than 80% of analysts still rate the stock a buy, according to market commentary following the results.

Robinhood’s latest earnings reinforced a key shift: crypto may no longer be the dominant narrative driving the platform.

Instead, the next phase of growth appears to be forming around prediction markets, options trading, subscriptions, and AI-driven efficiency. These segments could reduce reliance on highly cyclical crypto trading volumes.

If those trends continue, the earnings call may ultimately be remembered less for a revenue miss and more for revealing where the platform is heading next.

Crypto World

Tom Lee sees bitcoin rebound, ether bottoming below $1,800

HONG KONG — Thomas Lee, chief investment officer of Fundstrat and chairman of ether treasury firm BitMine Immersion (BMNR), said that investors should focus less on timing the exact low and start looking for entries in a keynote speech at Consensus Hong Kong 2026 on Wednesday.

“You should be thinking about opportunities here instead of selling,” Lee said.

BTC has suffered a 50% drawdown from its October record highs, its worst correction since 2022.

On Wednesday, bitcoin fell back below $67,000, giving up some of the bounce from last week’s crash lows. After managing a rapid reversal above $72,000 from $60,000 over the weekend, BTC was down 2.8% over the past 24 hours. Ethereum’s ether , meanwhile, slipped to $1,950, also around 3% lower.

‘Perfected bottom’

Lee attributed the recent weakness in crypto prices to the volatility in metals, which rippled across asset classes. Late January, gold’s market capitalization fluctuated by trillions of dollars in a single day, triggering margin calls and weighing on risk assets.

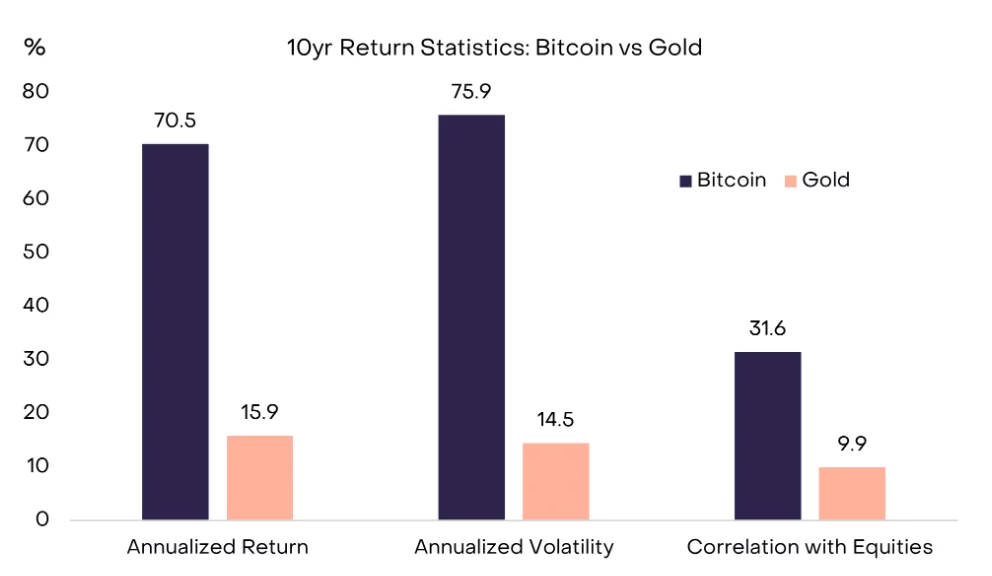

After bitcoin severely underperformed gold in 2025, he argued that the yellow metal likely has topped for this year and bitcoin is poised to outperform through 2026.

On ether , Lee said repeated 50% drawdowns since 2018 have often been followed by sharp rebounds.

Citing market technician Tom DeMark, he said ETH may need to briefly dip below $1,800 to form a “perfected bottom” before a more sustained recovery.

Read more: SkyBridge’s Scaramucci is buying the bitcoin dip, calls Trump a crypto President

Crypto World

Bitcoin trades like growth assets today, Gold tomorrow

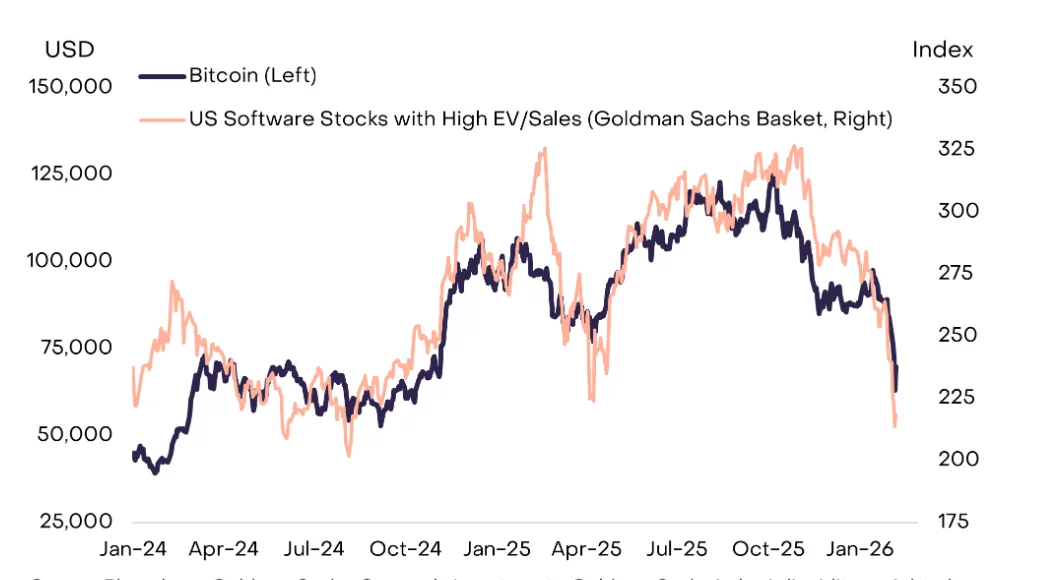

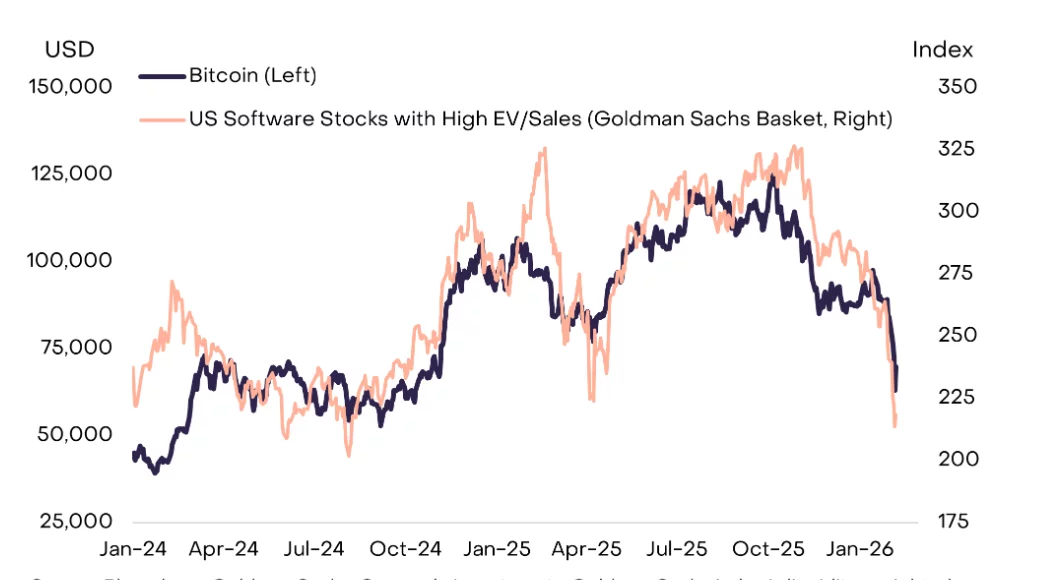

In its latest Market Byte research note, Grayscale Investments highlights a meaningful shift in Bitcoin’s price behavior. Recent BTC trading patterns resemble growth assets more closely than safe-haven commodities like gold, challenging the long-standing “digital gold” narrative.

Summary

- Bitcoin is trading more like a growth asset than gold, with recent price action closely tracking high-growth software stocks and broader risk assets, according to Grayscale.

- Near-term BTC moves are being driven by risk sentiment, not store-of-value demand, limiting its effectiveness as a hedge during equity market drawdowns.

- Grayscale maintains a long-term bullish thesis, arguing Bitcoin could eventually evolve into a gold-like monetary asset with lower volatility and weaker equity correlations if adoption continues.

According to the report’s key takeaways, Bitcoin’s (BTC) sharp move lower in early February — where the price dipped to around $60,000 on February 5 before a modest bounce — was driven by correlation with broader risk assets rather than traditional store-of-value flows.

Grayscale’s research shows Bitcoin’s price movements have tracked high-growth software stocks closely, especially since early 2024, with both falling in sync during recent sell-offs.

This behavior ushows Bitcoin’s sensitivity to market sentiment and cyclical risk appetite, similar to technology or growth equity performance during sell-offs.

What this means for Bitcoin traders

For traders, this means treating BTC more like a beta-driven risk asset in the near term. Rather than acting as a hedge during turbulent markets, Bitcoin has recently declined alongside broader speculative assets and failed to demonstrate the safe-haven characteristics typically associated with gold.

This shift has practical implications for portfolio construction and risk management. Traditional strategies that lean on Bitcoin as a hedge against macro uncertainty or inflation may be less effective when BTC behaves in sync with growth asset risk cycles.

Grayscale stresses that Bitcoin has not yet achieved gold-like status as a monetary asset, and that gap is central to the investment thesis.

However, in a future economy shaped by AI agents, humanoid robots, and tokenized capital markets, the firm argues a digital, blockchain-based commodity like Bitcoin is better suited to become the dominant store of value than physical assets such as gold or silver.

Grayscale adds that if Bitcoin succeeds in this role over the long term, its return profile could eventually shift. Price behavior may begin to resemble gold rather than growth stocks, marked by lower volatility, weaker equity correlations, and more stable — though lower — expected returns.

Crypto World

XRP price prediction as Goldman Sachs invests $153M in XRP ETFs

Goldman Sachs has renewed institutional focus on XRP after disclosing a $153 million investment in XRP ETFs, alongside major allocations to Bitcoin, Ethereum, and Solana.

Summary

- Goldman Sachs disclosed a $153 million investment in XRP ETFs, placing the token alongside its major holdings in Bitcoin and Ethereum and reinforcing XRP’s institutional relevance.

- XRP is trading near $1.37, with technical indicators showing fragile momentum as price remains capped below key moving averages and broader market sentiment stays cautious.

- Bitcoin’s ongoing consolidation is limiting altcoin upside, making BTC’s next directional move a critical factor for XRP’s near-term breakout or breakdown.

Goldman Sachs’ XRP exposure draws attention

The disclosure, highlighted by journalist Eleanor Terrett, places the Ripple token (XRP) among a select group of digital assets held at scale by one of Wall Street’s most influential banks.

The timing of the revelation is notable. Goldman has representation at a White House meeting centered on stablecoin yield policy, underscoring its role in shaping regulatory discussions.

CEO David Solomon is also scheduled to speak at the World Liberty Financial forum next week, reinforcing the firm’s growing public engagement with digital asset markets.

While ETF exposure does not directly translate into spot demand, the move adds credibility to XRP’s institutional narrative at a time when regulatory clarity remains a key market catalyst.

XRP price analysis and near-term outlook

XRP is currently trading near $1.37, reflecting continued consolidation after a sharp sell-off earlier this month.

TradingView data shows the token struggling to reclaim key short-term moving averages, indicating that bullish momentum remains fragile. The Relative Strength Index is still positioned below the neutral 50 level, signaling muted buying pressure and cautious trader sentiment.

Price action suggests that the $1.30–$1.32 region is acting as a critical support zone. A breakdown below this area could open the door to a deeper retracement toward $1.20, where buyers may attempt to re-enter.

On the upside, XRP would need a sustained move above $1.45–$1.50 to confirm a shift in market structure and pave the way for a recovery toward the $1.60–$1.65 range.

Until a clear breakout or breakdown occurs, XRP is likely to remain range-bound, with volatility driven by external catalysts.

Meanwhile, Bitcoin (BTC) seems to be consolidating following a volatile start to the year. The lack of a decisive move in Bitcoin has capped upside momentum across altcoins, keeping XRP’s recovery attempts limited.

Crypto World

The Next Phase of Crypto Hacks May Start With a Video Call

A North Korea–nexus threat actor is enhancing its social engineering playbook. The group is integrating AI-enabled lures into crypto-focused hacks, according to a new report from Google’s Mandiant team.

The operation reflects a continued evolution in state-linked cyber activity targeting the digital asset sector, which saw a notable increase in 2025.

Sponsored

Sponsored

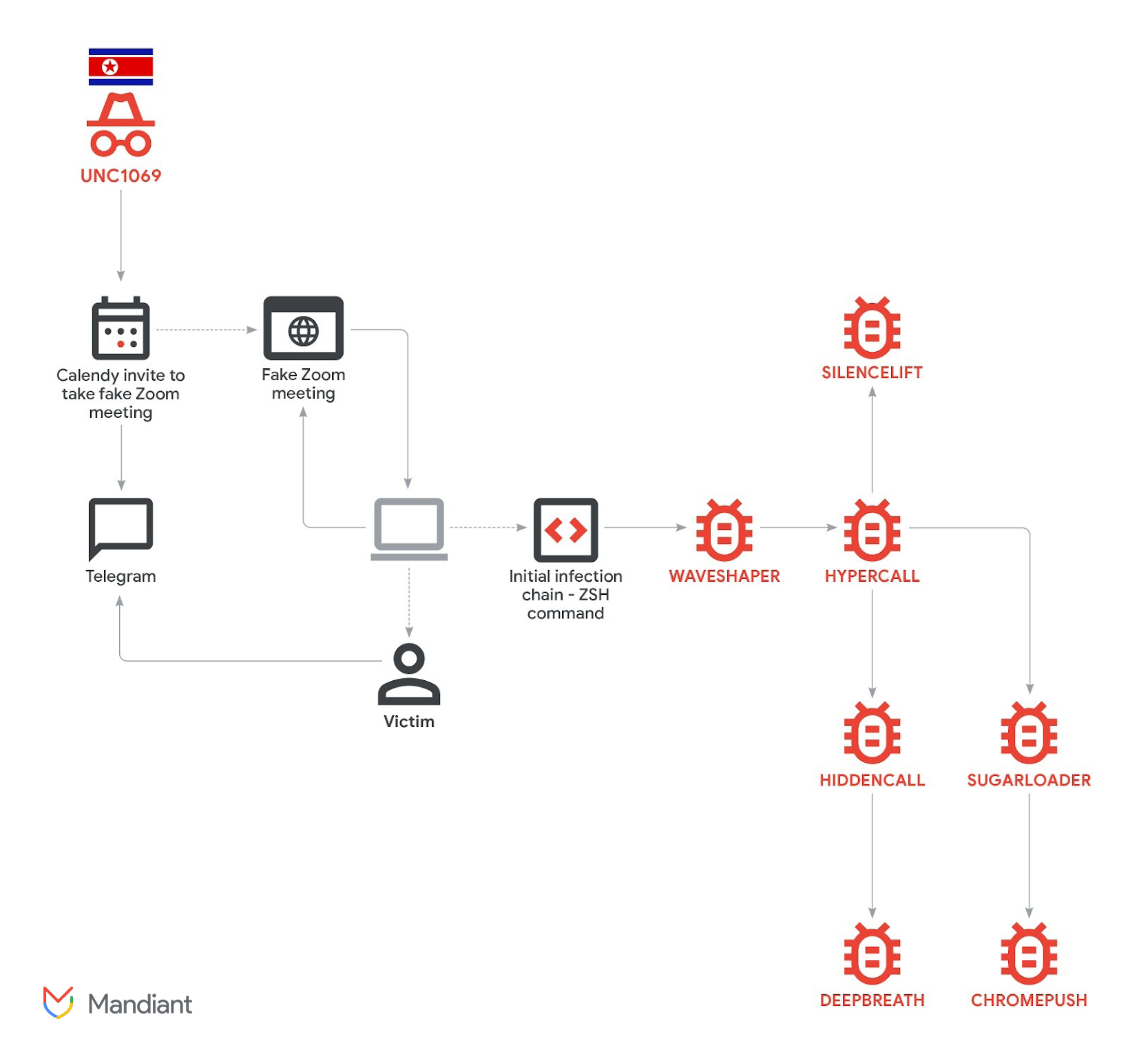

Fake Zoom Call Triggers Malware Attack on Crypto Firm

In its latest report, Mandiant detailed its investigation into an intrusion targeting a FinTech company in the cryptocurrency sector. The attack was attributed to UNC1069. It is a financially motivated threat group active since at least 2018, with links to North Korea.

“Mandiant has observed this threat actor evolve its tactics, techniques, and procedures (TTPs), tooling, and targeting. Since at least 2023, the group has shifted from spear-phishing techniques and traditional finance (TradFi) targeting towards the Web3 industry, such as centralized exchanges (CEX), software developers at financial institutions, high-technology companies, and individuals at venture capital funds,” the report read.

According to investigators, the intrusion began with a compromised Telegram account belonging to a crypto industry executive. The attackers used the hijacked profile to contact the victim. They gradually built trust before sending a Calendly invitation for a video meeting.

The meeting link directed the target to a fake Zoom domain hosted on infrastructure controlled by the threat actors. During the call, the victim reported seeing what appeared to be a deepfake video of a CEO from another cryptocurrency company.

“While Mandiant was unable to recover forensic evidence to independently verify the use of AI models in this specific instance, the reported ruse is similar to a previously publicly reported incident with similar characteristics, where deepfakes were also allegedly used,” the report added.

The attackers created the impression of audio problems in the meeting to justify the next step. They instructed the victim to run troubleshooting commands on their device.

Sponsored

Sponsored

Those commands, tailored for both macOS and Windows systems, secretly initiated the infection chain. This led to the deployment of multiple malware components.

Mandiant identified seven distinct malware families deployed during the intrusion. The tools were designed to steal Keychain credentials, extract browser cookies and login data, access Telegram session information, and collect other sensitive files.

Investigators assessed that the objective was twofold: to enable potential cryptocurrency theft and harvest data that could support future social engineering attacks.

The investigation revealed an unusually large volume of tooling dropped onto a single host. This suggested a highly targeted effort to harvest as much data as possible from the compromised individual.

The incident is part of a broader pattern rather than a standalone case. In December 2025, BeInCrypto reported that North Korean-linked actors siphoned more than $300 million by posing as trusted industry figures during fraudulent Zoom and Microsoft Teams meetings.

The scale of activity throughout the year was even more striking. In total, North Korean threat groups were responsible for $2.02 billion in stolen digital assets in 2025, a 51% increase from the previous year.

Chainalysis also revealed that scam clusters tied on-chain to AI service providers show significantly higher operational efficiency than those without such links. According to the firm, this trend suggests a future in which AI becomes a standard component of most scam operations.

With AI tools growing more accessible and advanced, creating convincing deepfakes is easier than ever. The coming time will test whether the crypto sector can adapt its security fast enough to confront these advanced threats.

Crypto World

These Altcoins Bleed Out Again as Bitcoin Dips Below $67K: Market Watch

ZRO has entered the top 100 alts after a massive surge, while most other altcoins have plunged hard yet again.

After several consecutive days of trading sideways between $68,000 and $72,000, bitcoin’s floor gave in hours ago and the asset dipped below $67,000 for the first time since Friday.

Most altcoins have joined the ride south, with ETH dumping beneath $2,000, XRP trading below $1.40, and BNB struggling to remain above $600.

BTC Slips Below $67K

It’s safe to say that the past couple of weeks have been highly unfavorable for the crypto bulls. On January 28, exactly two weeks ago, bitcoin stood tall at $90,000. However, it charted a notable price correction since then that lasted days and culminated, at least for now, last Friday.

At the time, the cryptocurrency plunged by approximately $17,000 in just over 24 hours and dumped to $60,000 on Friday morning. This became its lowest price point since before the US presidential elections in November 2024. The bulls were quick to intervene at this point and helped BTC rebound to $72,000 on that same day.

The weekend was calmer, with bitcoin trading sideways between $68,000 and $72,000. It tried to take down the upper boundary but failed on Monday and Tuesday and the subsequent rejection drove it south to under $67,000 where it currently struggles as well.

Its market capitalization has declined to $1.340 trillion on CG, while its dominance over the alts has dropped below 57%.

Alts Back in Red

Most alts have suffered even more over the past day. Ethereum has lost the $2,000 support after a 3.2% decline. A 4.1% drop from XRP has driven it to well below $1.40, while BNB is down to $600 after a 5% decrease.

SOL, ADA, HYPE, DOGE, LINK, LTC, and many other larger-cap alts are also in the red, while XMR has defied the trend today with a 3% increase to over $340.

Pi Network’s native token has charted another all-time low, while MYX is down by over 12%. BGB is next in terms of daily losses with a 9% drop. In contrast, ZRO has entered the top 100 alts after skyrocketing by 20%.

The total crypto market cap has shed over $50 billion daily and is down to $2.350 trillion on CG.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

-

Politics3 days ago

Politics3 days agoWhy Israel is blocking foreign journalists from entering

-

NewsBeat2 days ago

NewsBeat2 days agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

Sports4 days ago

Sports4 days agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

Tech5 days ago

Tech5 days agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

Business3 days ago

Business3 days agoLLP registrations cross 10,000 mark for first time in Jan

-

Tech6 hours ago

Tech6 hours agoSpaceX’s mighty Starship rocket enters final testing for 12th flight

-

NewsBeat2 days ago

NewsBeat2 days agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

Sports2 days ago

Sports2 days agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Politics3 days ago

Politics3 days agoThe Health Dangers Of Browning Your Food

-

Sports4 days ago

Former Viking Enters Hall of Fame

-

Sports5 days ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

Business3 days ago

Business3 days agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

NewsBeat5 days ago

NewsBeat5 days agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Business6 days ago

Business6 days agoQuiz enters administration for third time

-

Crypto World17 hours ago

Crypto World17 hours agoBlockchain.com wins UK registration nearly four years after abandoning FCA process

-

Crypto World1 day ago

Crypto World1 day agoU.S. BTC ETFs register back-to-back inflows for first time in a month

-

NewsBeat2 days ago

NewsBeat2 days agoResidents say city high street with ‘boarded up’ shops ‘could be better’

-

Sports2 days ago

Kirk Cousins Officially Enters the Vikings’ Offseason Puzzle

-

Crypto World1 day ago

Crypto World1 day agoEthereum Enters Capitulation Zone as MVRV Turns Negative: Bottom Near?

-

NewsBeat6 days ago

NewsBeat6 days agoStill time to enter Bolton News’ Best Hairdresser 2026 competition