Crypto World

BTC and XRP Crash Over? Analyst Pinpoints Exact Rebound Timeline

The timeframe might be shorter than you expect.

The cryptocurrency market is bleeding out once again, led by bitcoin’s decline to under $67,000 for the first time since last Friday’s calamity.

However, one analyst believes there’s finally good news for BTC and XRP, and he even provided a more precise timing for the potential rebound.

The primary cryptocurrency has been in a free-fall state for weeks. It stood over $90,000 on January 28, but dumped by $30,000 since then to bottom out, at least for now, at $60,000 last Friday.

It tried to recover some ground since then and tapped $72,000 on a couple of occasions, but was stopped yesterday again and driven to under $67,000 as of press time.

Approximately at the time when the latest correction took place, popular analyst Ali Martinez said on X that the early TD Sequential buy signal had flashed for BTC. Moreover, he was precise with the timing of the potential rebound, claiming that it could be in the next 3-9 days.

Early TD Sequential buy signal on Bitcoin $BTC, suggesting a potential rebound could take shape over the next 3–9 days. pic.twitter.com/E1poXoOcNI

— Ali Charts (@alicharts) February 10, 2026

The metric, developed by Tom DeMark, identifies potential market reversal points, usually after a strong move in either direction. Martinez has frequently posted about the TD Sequential for several cryptocurrencies, and the indicator’s success rate has been rather impressive, especially for Ripple’s XRP.

You may also like:

Before the latest drop, the cross-border token also flashed a buy signal. Although it has since retraced by 3-4%, Martinez reminded that the TD Sequential has “perfectly timed” the local top for XRP in the past, and could signal a rapid rebound now.

The TD Sequential perfectly timed the local top on $XRP, and now it’s flashing a buy signal. pic.twitter.com/5FI3Pepsnz

— Ali Charts (@alicharts) February 10, 2026

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Stablecoins Expansion into UAE Banking System

Key Insights

- Ripple and Zand link RLUSD and AEDZ to support regulated stablecoin payments and custody in the UAE.

- The partnership focuses on XRPL-based issuance, liquidity, and compliance-led banking integration.

- The move supports the UAE digital economy strategy and institutional blockchain adoption.

Ripple and Zand Bank Strengthen Blockchain Banking Ties

Ripple has also increased its collaboration with Zand Bank in the UAE to enable a regulated infrastructure of stablecoins. According to reports shared on X, the collaboration connects Ripple’s US dollar stablecoin, RLUSD, with Zand’s dirham-backed AEDZ token. Both assets will operate within a compliant banking framework.

🚨BREAKING: RIPPLE EXPANDS ENTERPRISE BLOCKCHAIN PUSH WITH ZAND DEAL@Ripple and @Official_Zand have announced a partnership focused on advancing the digital economy.

The collaboration will use Zand’s AEDZ stablecoin and Ripple’s $RLUSD stablecoin.

The goal is to bring… pic.twitter.com/9Ygz7tnMvW

— BSCN (@BSCNews) February 10, 2026

The partnership builds on a payment agreement signed in 2024 as it now shifts focus to custody, issuance, and liquidity. Ripple and Zand aim to bring blockchain-based settlement into institutional finance rather than trading activity.

How Will Stablecoins Integrate Into Regulated Banking

The companies plan to integrate RLUSD into Zand Bank’s regulated digital asset custody platform. This measure will enable institutions to hold and operate the stablecoins within the jurisdiction of the UAE. The partners will also evaluate the direct liquidity channels between RLUSD and AEDZ.

Zand Bank has confirmed plans to issue AEDZ on the XRP Ledger. XRPL offers fast settlement, low fees, and a consensus-based design. These features support payment efficiency while meeting regulatory expectations. Zand states that AEDZ remains fully backed by dirham reserves with regular attestations.

Why Does the XRP Ledger Matter for This Initiative

The project relies on the Ripple blockchain as its technical basis. XRPL allows settling in almost no time and issuing tokens without incurring excessive costs of operations. These facilities are applicable to bank level payment and depository services.

Ripple continues to position XRPL as a settlement layer for institutions and Zand partnership aligns with this strategy. It supports real-world use cases such as:

- Cross-border payments

- Treasury management

- Asset tokenization within a controlled environment

What Does This Mean for the UAE Digital Economy

Zand Bank is one of the UAE’s first fully digitized licensed banks. Ripple opened more branches in the region by forming custody and security dealings. Collectively, they endeavor to offer infrastructure that can help enable banks and corporations to adopt a compliant blockchain.

This growth marks the shift where regulated institutions are now leveraging stablecoins as financial instruments and not speculative assets. It is also an indication of even greater adoption of blockchain systems in conventional banking systems.

Crypto World

Spot Bitcoin ETFs Post $166M Inflows Despite Market Dip

Update (Feb. 11, 10:00 am UTC): This article has been updated to correct the reported number of shares.

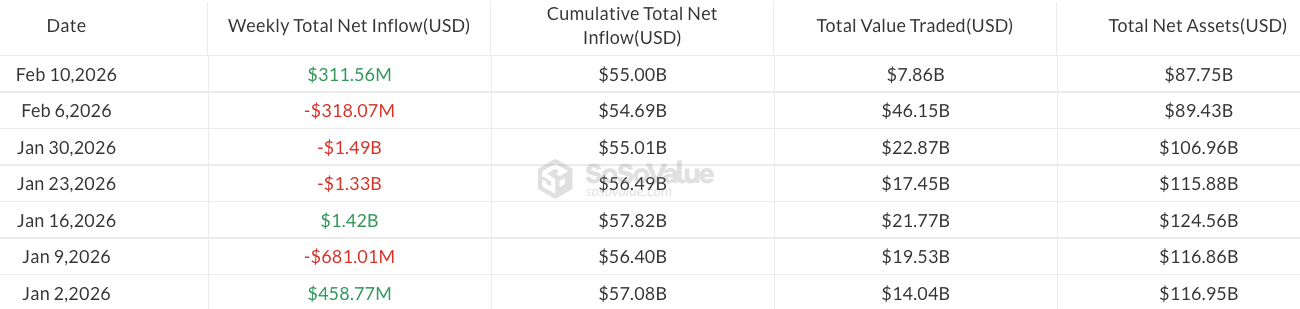

US spot Bitcoin exchange-traded funds (ETFs) extended their inflow streak to three sessions, with this week’s gains nearly offsetting last week’s outflows.

Spot Bitcoin (BTC) ETFs recorded $166.6 million in inflows on Tuesday, bringing total inflows this week to $311.6 million, according to data from SoSoValue.

Last week, the funds saw net outflows of $318 million, marking three consecutive weeks of losses totaling more than $3 billion.

Bitcoin ETF momentum has picked up in recent sessions, despite BTC price declining 13% over the past seven days and briefly slipping below $68,000 on Tuesday, according to CoinGecko.

Earlier this week, analysts observed signs of a potential trend shift across crypto exchange-traded products, noting a slowdown in the pace of selling.

Goldman trims Bitcoin ETF exposure, adds XRP and Solana ETFs

US investment bank Goldman Sachs reported yesterday that it trimmed its Bitcoin ETF exposure in the fourth quarter of 2025, according to a Form 13F filing with the Securities and Exchange Commission.

The bank specifically reduced holdings in BlackRock’s iShares Bitcoin Trust ETF (IBIT), cutting shares outstanding by 39%, from around 34 million in Q3 to 20.7 million in Q4, worth around $1 billion.

It also decreased stakes in other Bitcoin funds and companies, including Fidelity Wise Origin Bitcoin (FBTC) and Bitcoin Depot, and reduced its Ether (ETH) ETF positions.

At the same time, Goldman Sachs disclosed its first-ever positions in XRP (XRP) and Solana (SOL) ETFs, acquiring 6.95 million shares of XRP ETFs, worth $152 million, and 8.24 million shares of Solana ETFs, valued at $104 million.

Related: Bernstein calls Bitcoin sell-off ‘weakest bear case’ on record, keeps $150K 2026 target

According to SoSoValue data, spot altcoin ETFs saw modest inflows Tuesday, with Ether funds adding around $14 million, while XRP and Solana ETFs gained $3.3 million and $8.4 million, respectively.

On Thursday, Eric Balchunas, senior ETF analyst at Bloomberg, noted that the majority of Bitcoin ETF investors had held their positions despite the recent downturn, estimating that only about 6% of total assets exited the funds even as Bitcoin prices fell sharply.

He added that, although BlackRock’s IBIT saw its assets drop to $60 billion from a peak of $100 billion, the fund could remain at this level for years while still holding the record as the “all-time-fastest ETF to reach $60 billion.”

Magazine: Bitcoin difficulty plunges, Buterin sells off Ethereum: Hodler’s Digest, Feb. 1 – 7

Crypto World

Ethereum Whales Accumulate Aggressively as ETH Price Drops Below $2K

Ethereum accumulation addresses have witnessed a surge in daily inflows since Friday, suggesting growing confidence in Ether’s (ETH) long-term price trajectory despite its latest drop below $2,000.

Key takeaways:

-

Ether’s drop below $2,000 has left 58% of addresses with unrealized losses.

-

Accumulation addresses have absorbed about $2.6 billion in ETH over five days.

-

Key Ether levels to watch below $2,000 include $1,800, $1,500, $1,200, and potentially $750–$1,000 in extreme scenarios.

58% of Ether addresses are now in the red

Ether’s 38% drop over the last month has seen it fall below key support levels, including the average entry price of accumulation addresses, the cost basis of spot Ethereum ETF investors, and the psychological level at $2,000.

The ETH/USD pair now trades 60.5% below its all-time high of $4,950, leaving a significant portion of holders underwater. This includes BitMine, the world’s largest Ethereum treasury linked to investor Tom Lee, which saw its paper losses swell to over $8 billion.

Related: Large demand zone below $2K ETH price gives signal on where Ether may go

With ETH trading at $1,954 on Wednesday, only 41.5% Ethereum addresses are in profit, while over 58% are in the red.

Ether’s current market price is also below the average cost basis of accumulation addresses currently at $2,580, suggesting that long-term holders are increasingly under strain.

ETF investors are also feeling the pressure. James Seyffart, senior ETF Analyst at Bloomberg, highlighted that Ethereum ETF holders are currently in a worse position than their Bitcoin counterparts.

With ETH hovering below $2,000, the altcoin trades well below the estimated average ETF cost basis of about $3,500.

Ether accumulation absorbs 1.3 million ETH in five days

Despite the sharp downturn, investor confidence has not fully eroded. Data from CryptoQuant showed Ethereum accumulation addresses have received 1.3 million Ether worth approximately $2.6 billion at current rates.

The “full-scale accumulation” of ETH began in June 2025, and is “proceeding even more aggressively,” CryptoQuant analyst CW8900 said in Wednesday’s Quicktake analysis, adding:

“The current price will likely appear attractive to $ETH whales.”

As a result, the total ETH held by these long-term holders reached a record 27 million. That marks a 20.36% gain so far in 2026 despite the ETH price declining 34.5% over the same period.

Accumulation addresses are wallets that continuously receive ETH without making any outgoing transactions. They may belong to long-term holders, institutional investors, or entities strategically accumulating Ether rather than actively trading.

Large spikes in inflows to these addresses often signal strong confidence in Ether’s long-term potential, with past trends showing that such surges frequently precede price rallies.

For example, on June 22, 2025, Ethereum accumulation addresses recorded a then-all-time high daily inflow of over 380 million ETH. Nearly 30 days later, ETH’s price rose by almost 85%. A 25% price rally followed November 2025’s inflow spike into the accumulation addresses.

Key ETH price levels to watch below $2,000

The ETH/USD pair extended its losses below $2,000, a key support level, which the bulls must reclaim to prevent further downside.

“$ETH failed to hold above the $2,000 level and is now going down,” crypto analyst Ted Pillows said in an X post on Wednesday, adding:

“The next key level is around the $1,800-$1,850 level if Ethereum doesn’t reclaim the $2,000 level soon.”

Fellow analyst Crypto Thanos shares similar views, telling followers to “get ready” for a $1,500 ETH price if $2,000 is not reclaimed by the end of the week.

Zooming out, LadyTraderRa said Ether is “definitely going” to retest the $750-$1,000 zone, based on past price action on the monthly candle chart.

Glassnode’s UTXO realized price distribution (URPD), which shows the average prices at which ETH holders bought their coins, reveals that below $2,000, key support levels for ETH sit at $1,880, $1,580, and $1,230.

As Cointelegraph reported, the ETH/USD pair could drop to $1,750 and then $1,530, after failing to hold above $2,100.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

Crypto World

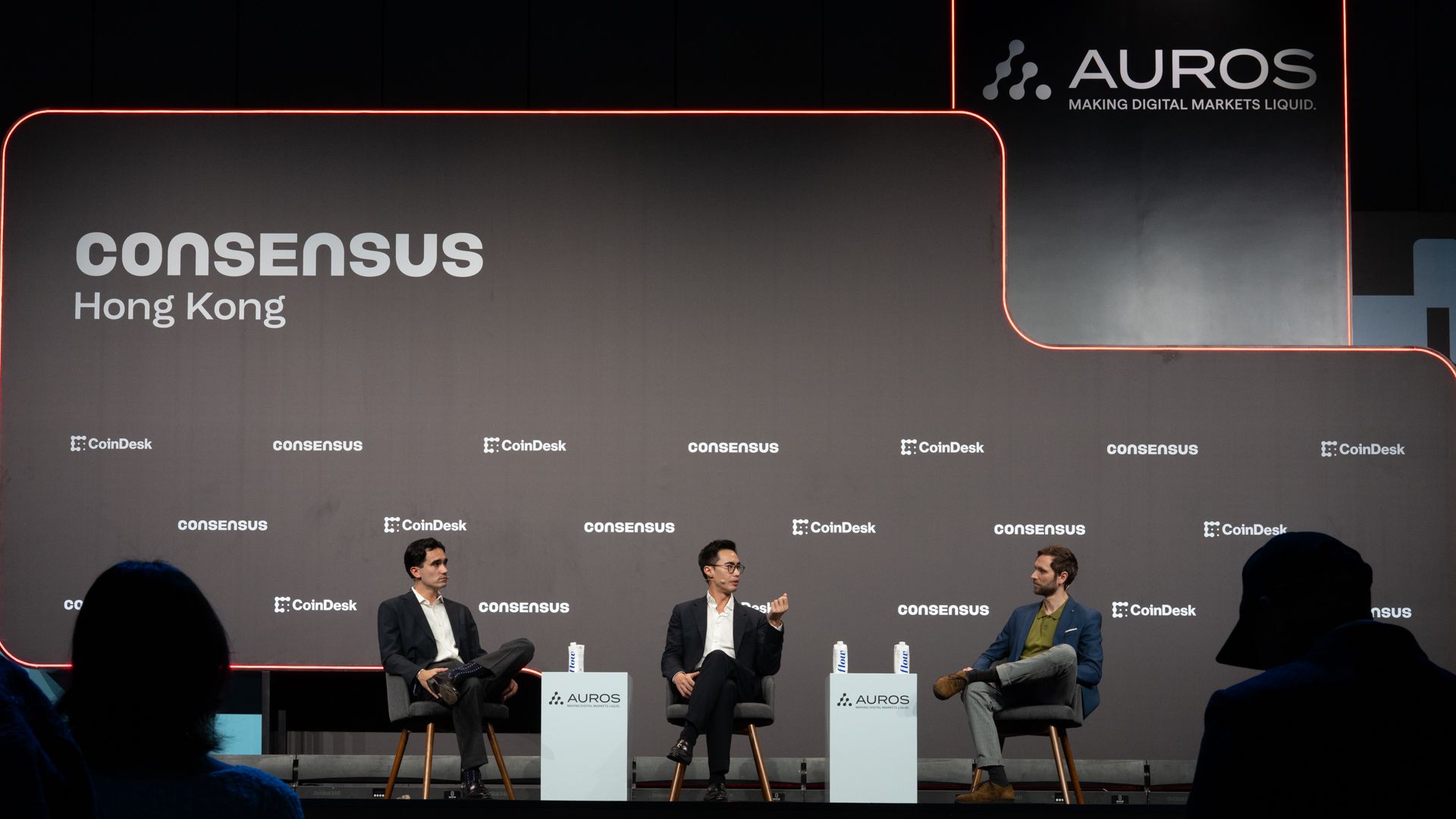

Regulation, derivatives helping drive TradFi institutions into crypto, panellists say

Clearer rules and improved technology are accelerating the convergence of traditional finance (TradFi) and decentralized markets, driving established institutions into areas such as crypto derivatives, according to panelists at Consensus Hong Kong.

“Regulation is really important. It gives you the rails that you need to operate in,” said Jason Urban, global co-head of digital assets at Galaxy Digital (GLXY), who took part in the “Ultimate Deriving Machine” panel.

Other speakers, including executives from exchange operator ICE Futures U.S., crypto prime brokerage FalconX and investment company ARK Invest highlighted how developments in the U.S., such as the 2024 approval of spot crypto exchange-traded funds (ETFs) and harmonization between the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) have flipped crypto from a speculative sideline to a portfolio staple.

The key takeaway is that derivatives are set to grease the path for trillions of dollars in institutional inflows to the market. The momentum goes well beyond bitcoin , the largest cryptocurrency by market value.

ICE Futures U.S. President Jennifer Ilkiw highlighted forthcoming overnight rate futures tied to Circle Internet’s (CRCL) USDC stablecoin, launching in April, and multitoken indexes as evidence of institutions looking beyond bitcoin for exposure to a range of tokens.

“It makes it very easy. It’s like, if you’re taking our MSCI Emerging Markets, there’s hundreds of equities in there. You don’t need to know every single one,” she said, citing demand from former crypto skeptics.

Josh Lim, the global co-head of markets at FalconX, stressed bridging traditional financial exchanges like the CME with liquidity pools in decentralized finance (DeFi) using prime brokerages for hedge-fund arbitrage and leverage.

“Hyperliquid, obviously has been a big theme for this year, and last year, we’ve enabled a lot of our hedge fund clients to access that marketplace through our prime brokerage offering,” Lim said, referring to the largest decentralized exchange (DEX) for derivatives.

“It’s actually essential for firms like us … to bridge this liquidity gap between TradFi and DeFi … That’s a big edge,” Lim said. Crypto innovations like 24/7 trading and perpetuals are influencing Wall Street.

ARK Invest President Tom Staudt called the debut of spot bitcoin ETFs in the U.S. a milestone that slotted crypto into mainstream wealth managers’ portfolios and systems.

But he urged adoption of a true industry-wide beta benchmark — a broader market standard for measuring an asset’s risk and performance relative to the overall crypto market. There’s a need for a diversified index, rather than relying solely on a single reference point like bitcoin, he said.

“Bitcoin is a specific asset, but it’s not an asset class … You can’t have alpha without beta,” he said, pointing to futures as the gateway for structured products and active strategies.

inaction now is akin to “career suicide,” as real-world assets come onchain and demand participation, Urban said.

Crypto World

Uniswap Grabs Early Win as US Judge Dismisses Bancor Patent Lawsuit

A New York federal court has dismissed a patent infringement suit brought by Bancor-affiliated entities against Uniswap, finding that the asserted claims describe abstract ideas that are not eligible for patent protection under US law. Judge John G. Koeltl of the Southern District of New York granted the defendants’ motion to dismiss the complaint filed by Bprotocol Foundation and LocalCoin Ltd. The ruling, issued on February 10, leaves room for the plaintiffs to amend within 21 days; absent a timely amendment, the dismissal would become with prejudice. While the decision represents a procedural win for Uniswap, it does not resolve the merits of the underlying dispute, which centers on whether the decentralized exchange’s technology infringes patented methods for pricing and liquidity.

Key takeaways

- The court applied the Supreme Court’s two-step framework for patent eligibility and determined the challenged claims relate to an abstract concept—the calculation of currency exchange rates for transactions—rather than a patentable invention.

- Even though the patents touch on blockchain-based automation, the judge found no inventive concept sufficient to transform the abstract idea into a patent-eligible application.

- The complaint was dismissed without prejudice, giving Bprotocol Foundation and LocalCoin Ltd. a 21-day window to file an amended complaint addressing the court’s concerns.

- Direct infringement, induced infringement, and willful infringement claims were all dismissed, with the court indicating the plaintiffs failed to plausibly plead that Uniswap’s code contains the patented reserve-ratio features.

- Despite the procedural success for Uniswap, the door remains open for reassertion if the plaintiffs can reframe the allegations to meet the patent-eligibility standard or otherwise articulate a viable infringement theory.

Market context: The ruling sits within ongoing debates over software and business-method patents in crypto, where courts have repeatedly scrutinized whether blockchain-enabled pricing and liquidity mechanisms constitute protectable inventions or abstract financial practices.

Sentiment: Neutral

Market context: The decision comes amid a broader climate in which courts assess blockchain-related claims under established tests for patent-eligibility, potentially influencing how crypto developers approach IP risk and claims enforcement.

Sources & verification: The memorandum opinion and order from Judge Koeltl (Feb. 10); the CourtListener docket for Bprotocol Foundation v. Universal Navigation Inc.; Hayden Adams’ X post reacting to the decision; the original Bancor-Uniswap patent dispute coverage and filings cited in the referenced materials.

Why it matters

The court’s analysis reinforces the notion that merely applying a conventional pricing algorithm within a blockchain framework may not suffice to render a claim patentable. By characterizing the disputed concepts as abstract ideas tied to currency exchange calculations, the ruling underscores the enduring legal distinction between mathematical formulas and patent-eligible tech implementations, even when those implementations run on decentralized networks. For Uniswap (CRYPTO: UNI), the decision protects the platform from an immediate patent-ownership challenge rooted in fundamental pricing logic that was already broadly implemented across digital asset exchanges.

From Bancor’s perspective, the dismissal—without prejudice—creates a strategic opening. The plaintiffs can attempt to adjust the pleading to address the court’s concerns, potentially reframing the claims to emphasize an “inventive concept” or to articulate a more concrete, non-abstract application tied to a particular technology environment. The outcome may influence later filings against other DeFi protocols if claim language can be refined to meet the legal standard, especially in cases where developers claim that specific programmable constraints or reserve mechanisms are patentable because they are uniquely tied to a given protocol.

Beyond the parties involved, the decision signals how the U.S. patent system balances the protection of crypto innovations against broad, abstract financial techniques. While it does not close the door on all IP actions in DeFi, it does remind developers and litigants that the mere use of blockchain infrastructure or smart contracts does not automatically render a broad abstract idea patent-eligible. The landscape remains nuanced, with the potential for future rulings to alter how similar claims are framed and prosecuted.

https://platform.twitter.com/widgets.js

The immediate post-decision commentary from Uniswap founder Hayden Adams, who publicly celebrated the outcome, reflects the high-stakes nature of these disputes for open-source, community-driven projects. Adams’ brief social post—“A lawyer just told me we won”—highlights how patent battles intersect with developer culture and the public perception of DeFi innovation.

What to watch next

- Whether Bprotocol Foundation and LocalCoin Ltd. file an amended complaint within 21 days, and how the revised claims address the court’s abstract-idea reasoning.

- Any subsequent court rulings that interpret or apply the “inventive concept” standard to parallel DeFi patent cases, potentially shaping future strategy for both plaintiffs and defendants.

- Whether additional documents—such as claim charts or technical specifications—emerge to support allegations of infringement tied to Uniswap’s protocol code.

- Possible settlements or alternative dispute-resolution steps if parties seek to narrow the dispute without protracted litigation.

Sources & verification

- Memorandum opinion and order by Judge Koeltl, February 10, Southern District of New York.

- CourtListener docket: Bprotocol Foundation v. Universal Navigation Inc. (docket page cited in filing history).

- Hayden Adams’ X post reacting to the ruling.

- Bancor’s patent infringement allegations against Uniswap as documented in prior coverage.

What the ruling changes for DeFi and IP strategy

Uniswap’s procedural win reinforces the importance of framing crypto innovations in terms of concrete technical improvements rather than broad economic practices. For developers, it underscores the need to articulate how a protocol’s specific architecture—beyond generic pricing formulas—contributes a novel, non-obvious technical solution. For plaintiffs, the decision emphasizes the necessity of tying claims to verifiable technical embodiments, such as particular code features or protocol configurations, that clearly differ from ordinary market operations.

What to watch next

Going forward, observers will closely track whether a revised complaint could survive the patent-eligibility hurdle and, if so, how the court will evaluate whether a claimed feature meaningfully transforms an abstract idea into patent-eligible subject matter. The interplay between public blockchain code and patented concepts is likely to remain a focal point as more DeFi projects navigate IP risk in a rapidly evolving regulatory and judicial environment.

Rewritten Article Body

Judicial decision reframes patent-eligibility in a DeFi dispute between Bancor-affiliated plaintiffs and Uniswap

In a decision that foregrounds the ongoing jurisprudence around crypto patents, a New York federal court ruled that Bancor-affiliated plaintiffs’ claims against the Uniswap ecosystem are directed to abstract ideas rather than concrete, patentable inventions. The Southern District of New York, applying the Supreme Court’s two-step framework for patent eligibility, concluded that the core concept—calculating currency exchange rates to facilitate transactions—lacks the inventive concept required to qualify for patent protection. The ruling focuses on US patent law’s limits, not on the operational legitimacy of Uniswap’s decentralized exchange (Uniswap), which remains a foundational player in the DeFi space.

The plaintiffs—Bprotocol Foundation and LocalCoin Ltd.—had alleged that Uniswap’s protocol infringed patents tied to a “constant product automated market maker” mechanism that underpins many liquidity pools on decentralized exchanges. The court’s analysis rejected the argument that merely implementing a pricing formula on blockchain infrastructure could overcome the abstract-idea hurdle. In its view, the use of existing blockchain and smart contract technologies to address an economic problem does not constitute a patentable invention. The court emphasized that limiting an abstract idea to a particular technological environment does not convert it into patent-eligible subject matter, and it found no further inventive concept that would transform the abstract idea into patentable territory.

Crucially, the memorandum explained that the asserted claims cover the abstract idea of determining exchange rates for transactions rather than a specific, novel technical improvement. The court highlighted that “currency exchange is a fundamental economic practice,” and that the claimed method amounted to nothing more than a mathematical transformation performed in a blockchain-enabled setting. The decision expressly notes that merely asserting a mathematical formula within a decentralized framework does not, by itself, generate eligibility. The ruling also rejected arguments that a particular linkage to reserve ratios in Uniswap’s code or ecosystem would rescue the claims from the abstract-idea category.

Beyond the abstract-idea assessment, the court dismissed the infringement theories levelled by the plaintiffs. It found that the amended complaint failed to plausibly plead direct infringement—specifically, that Uniswap’s publicly available code embodies the claimed reserve ratio constants. Claims of induced and willful infringement were likewise dismissed, with the court stating that the plaintiffs did not credibly show that Uniswap’s team had knowledge of the patents before the lawsuit was filed. The dismissal was without prejudice, preserving the option for the plaintiffs to file an amended pleading that could address these shortcomings.

The decision came with a notable public response: Hayden Adams, the founder of Uniswap, took to X to acknowledge the outcome, signaling a morale boost for developers and teams operating in the open-source DeFi space. The public posting underscored the practical impact of court rulings on the culture and momentum of decentralized finance development.

The procedural posture of the case remains in flux. While Uniswap’s legal team secured a favorable procedural ruling, the case is not over. The plaintiffs have 21 days to amend their complaint; failure to do so would convert the dismissal into one with prejudice, effectively ending the action barring any new claims. If Bancor and LocalCoin elect to proceed with an amended filing, the court will scrutinize whether the revised claims meet the patent-eligibility standard and sufficiently articulate any alleged infringement in a way that satisfies the pleading requirements set forth by the court.

In the broader context, the decision contributes to a growing body of decisions that caution against overbroad or abstract patent claims in the crypto and DeFi space. It reinforces the premise that software-driven financial concepts—however novel in a blockchain setting—must advance a concrete technical improvement to clear the patent bar. The outcome also signals that, for now, DeFi projects focusing on open, interoperable codebases may enjoy a degree of protection from aggressive patent assertions based on abstract pricing ideas, at least until a more precise standard for crypto-specific technology claims emerges in the courts.

Crypto World

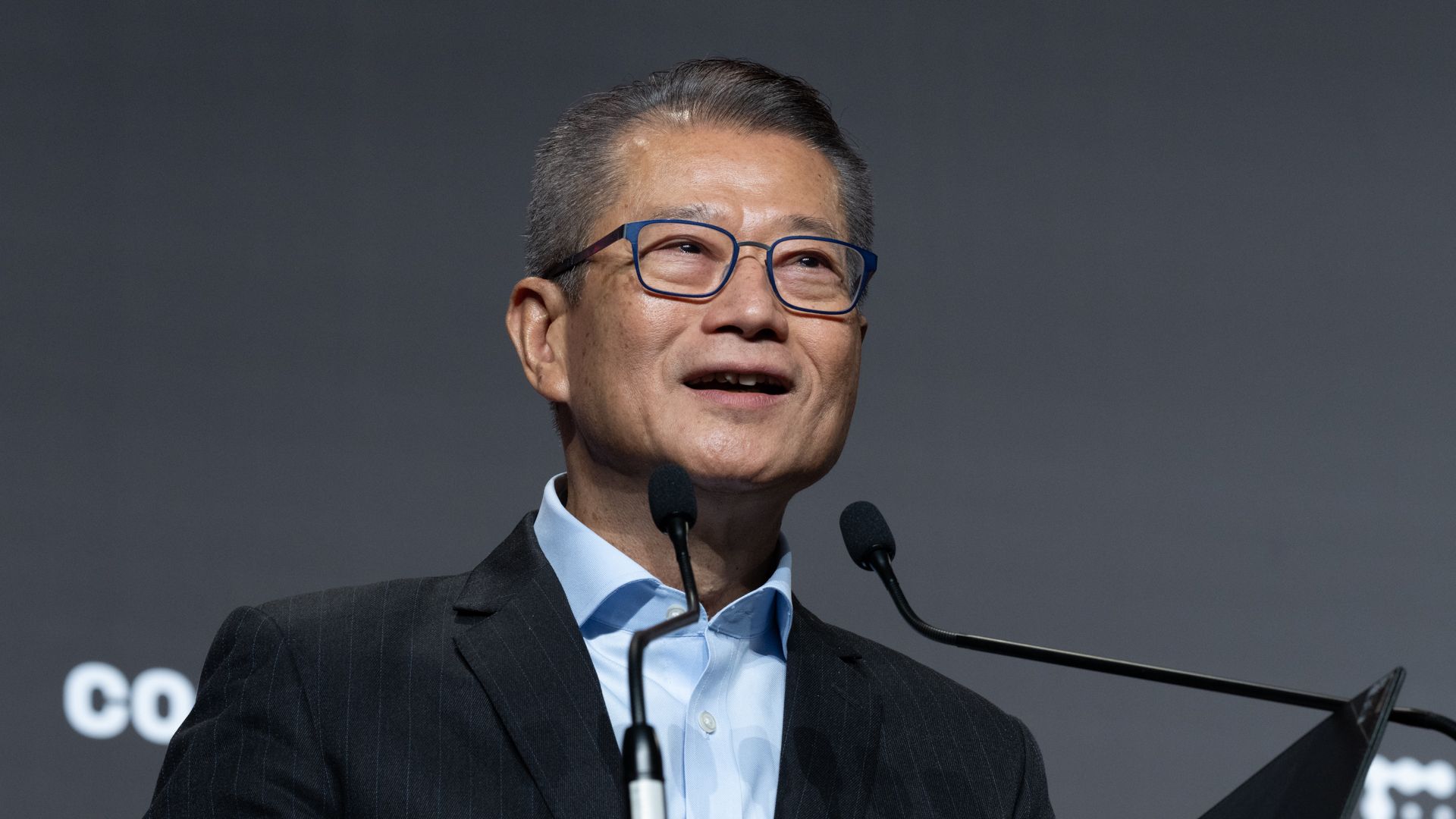

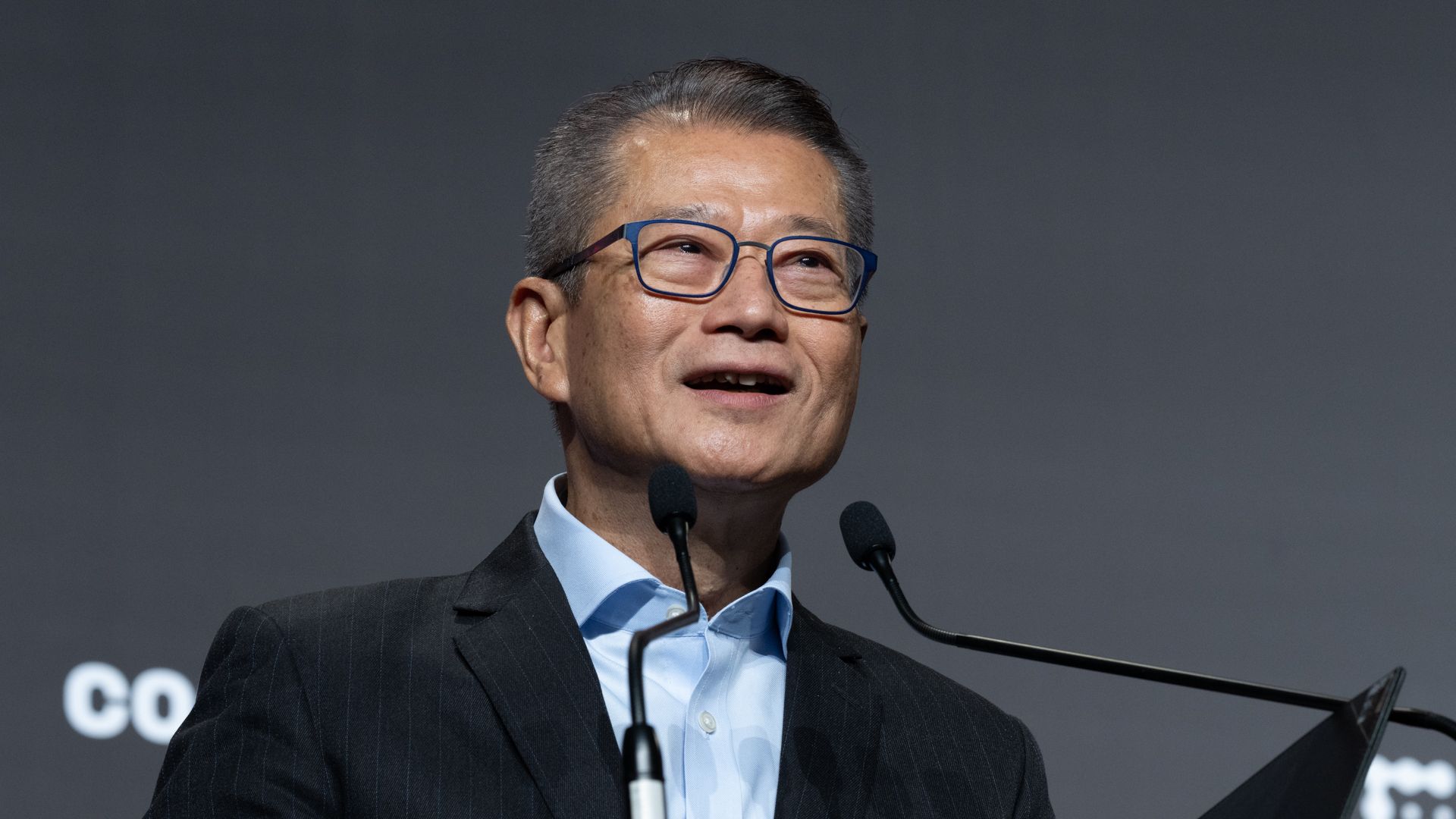

Hong Kong ready to issue first stablecoin licenses in March, Financial Secretary says

HONG KONG — Hong Kong is ready to begin issuing the first of its stablecoin licenses next month, the Special Administration Region’s Financial Secretary said Wednesday.

Hong Kong will only issue a small batch of licenses initially, Hong Kong’s Paul Chan Mo-Po said Wednesday at CoinDesk’s Consensus Hong Kong conference.

“In giving our licenses, we ensure that licensees have novel use cases, a credible and sustainable business model and strong regulatory compliance capabilities,” he said.

Hong Kong is also moving to finalize its licensing regime for custodian service providers, he said, and looking to introduce legislation this summer.

“Together with the framework already in place, this will ensure that our regulatory regime comprehensively covers the team of the digital asset ecosystem,” he said.

Speaking more broadly, Chan pointed to three trends in particular maturing at this moment: The growth of tokenized products in the real world, increasing interaction between decentralized finance (DeFi) and traditional finance and the growing ties between artificial intelligence (AI) and digital assets.

“Tokenization initiatives are moving from proof of concept to real world deployment supported by more institutional adoption government bonds, money market funds and other more traditional financial instruments are increasingly being issued onchain, using digital ledgers to enhance settlement efficiency enable fractional ownership and unlock liquidity in assets that have traditionally been less liquid.”

He also pointed to increasing growth in AI.

“As AI agents become capable of making and executing decisions independently, we may begin to see the early forms of what some call the machine economy, where AI agents can hold and transfer digital assets, pay for services and transact with one another onchain,” Chan said.

Crypto World

Here’s What You Need to Know

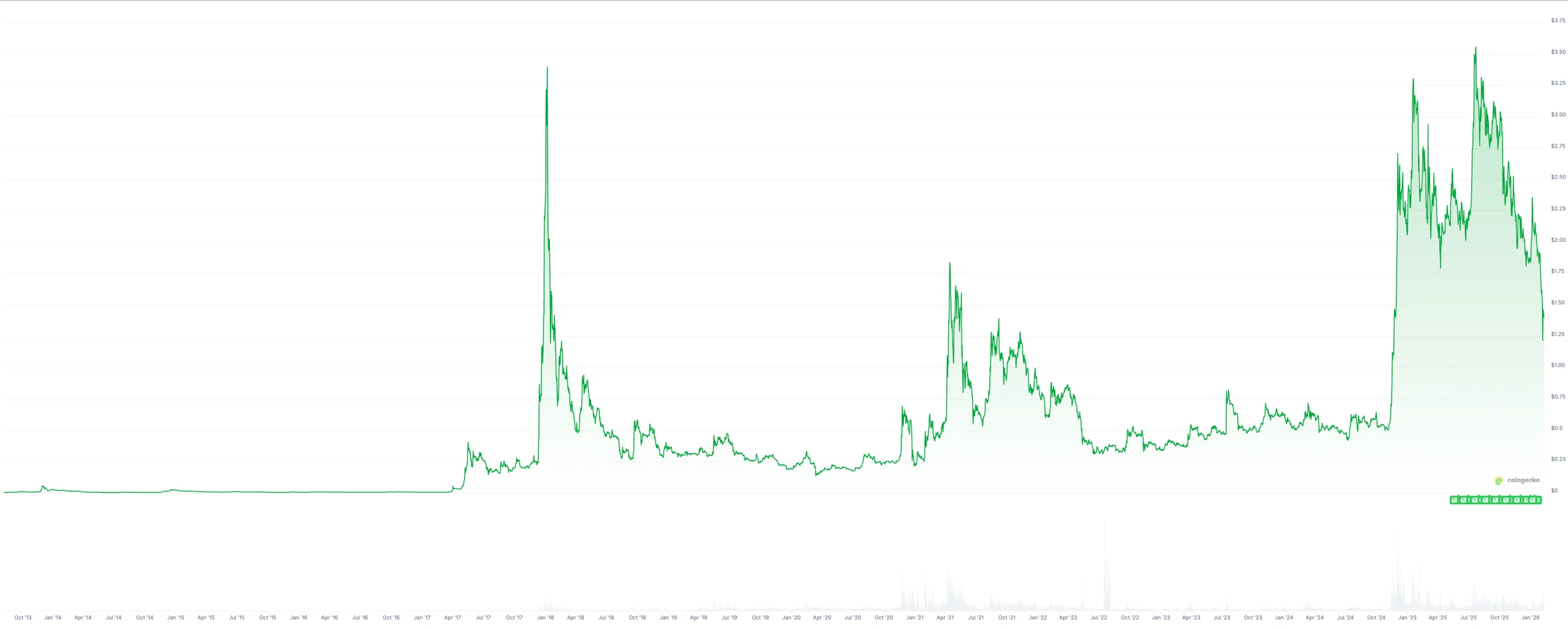

How is XRP performing during bear markets and is a parabolic recovery rally inbound? Let’s find out what history has to say.

Ripple’s XRP is down 15% in the past seven days, 26% in the past fortnight, and over 40% in the past year. Clearly, it’s in a downtrend in what’s currently considered to be a bear market in the crypto industry.In the following, we will examine XRP’s price, some of its fundamentals, and try to figure out how it holds up during crypto winters.

After all, the popular saying is that we should “buy when there’s blood on the street,” and it feels like there’s plenty of blood on the streets right now. Just yesterday, for example, the popular Crypto Fear & Greed Index was at 7 points (Extreme fear). That’s right, we have rarely seen sentiment so depressed.

XRP During Crypto Winters

The first thing to consider when it comes to investing in cryptocurrencies is the type of coin you’re eyeing. XRP is an altcoin, meaning that it is inherently much more volatile than Bitcoin and, by extension, almost all of traditional finance. Unlike many other altcoins, XRP is tied to a large US-based corporation that is spending millions of dollars on marketing and other activities to generate value for its shareholders and users.

Ripple is building an “ultra-fast” settlement layer for banks and all sorts of financial institutions ot use, arguing that this is what the future holds. You know, no intermediaries, 24/7 access, etc. But what has this done for XRP exactly?

Well, its first pronounced crypto winter was felt back in 2018. After peaking above $3 and with Wall Street calling it the next coin to buy, XRP lost most of its value and traded close to $0.3 for most of the bear market.

Then came the bull market of 2021. In April of that year, the price surged to a high of around $1.7 and tracked most of the crypto market, attempting a double-top in November and eventually, once again, losing most of its value and plunging back toward $0.35 in spring 2022. XRP remained in a range around that level all the way until November of 2024, when it skyrocketed in value above $2, later achieving a new all-time high in July 2025.

In other words, bottom buyers enjoyed a nice return of close to 10x if they got in during the bear market ranges and sold around the top. Now, the price is repeating a similar pattern and is once again cooling down following a parabolic rally.

You may also like:

At the time of this writing, XRP sits on a total market cap of around $85 billion, meaning that it’s hard to argue in favor of a face-melting, millionaire-making rally. However, if history is any indication, cycles exist, and Ripple’s native cryptocurrency has been somewhat tracking them, despite a year-long lawsuit that had supposedly suppressed its dollar value for a while.

What You Need to Know Next?

When it comes to the crypto markets, there are quite literally two types of assets – Bitcoin and everything else, where everything else tends to be a lot less sustainable in terms of price and staying power.

As I mentioned above, there’s a fully functioning, large-scale, US-based corporation behind XRP. Ripple is continually expanding its operations and product offerings. They have issued a stablecoin, RLUSD, and are actively obtaining additional licenses across major jurisdictions.

But XRP itself is not directly tied to the company’s success. The investment thesis, aside from its speculative nature, remains questionable, particularly as the industry matures and competition intensifies.

XRP holders do not receive anything – in fact, they’re buying a cryptocurrency that’s meant to transact. They also made this clear during the trial against the U.S. Securities and Exchange Commission, which argued that XRP is a security.

It does have a fixed supply, that’s true, but a lot of that supply is also concentrated in the hands of the company itself, which regularly sells it to fund operations.

So, is XRP a good investment right now? There has been a historic precedent in the altcoin producing face-melting rallies following periods of a prolonged downturn; there’s absolutely no denying that. However, history should never be used as an indication of what’s to happen next, and there might be another 90% of downside before any potential relief, so keep that in mind.

Naturally, none of the above is financial advice. It’s just an observation of XRP’s price performance in previous market cycles as well as its connection to Ripple.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Tokenization still at start of hype cycle, but needs more use cases, specialists say

If there is a classic technology hype cycle attached to tokenization — the representation of any asset on blockchains like Ethereum — we are barely getting started.

That was the view of Min Lin, managing director of global expansion at Ondo, who pointed out the U.S. Treasuries market alone is worth $29 trillion. Adding in the global equities market pushes that value closer to $127 trillion, of which $69 trillion is in the U.S. alone, Lin said at CoinDesk’s Consensus Hong Kong conference.

But while the numbers are dizzying, and there is no doubt demand from traditional finance to explore tokenized real world assets (RWAs), there has to be care and attention when it comes to matching the hype to real world utility, said Graham Ferguson, head of ecosystem at Securitize.

“It’s incumbent on us to figure out how we distribute these and I think, historically, we haven’t done a great job of ascribing utility to these assets,” Ferguson said. “We have all these assets that we could tokenize. We have tons of different choices. We have to, we have to figure out, how do we unite that hype, how do we bring that together.”

It’s important not to “jump the gun on the regulatory side of things,” Ferguson of Securitize pointed out. That said, the U.S. The Securities and Exchange Commission (SEC) is waking up to the idea that tokenization can form the plumbing of future markets, and does not mean just “isolated compliance islands.”

“We’ve been around for a while talking about the benefits of settlement when it comes to tokenization and programmatic compliance built into the token standard itself, transferability of these assets among KYC’d [know-your-customer] individuals,” Ferguson said. ”We’re really excited for the regulatory clarity. No pun intended.”

Ondo’s focus is on efficiency. The firm has been busy tokenizing stocks and EFTs and recently announced the introduction of Ondo Perps, whereby those tokenized equities can be used as collateral margin directly — rather than using stablecoins as collateral on exchanges or DEXs, Lin explained.

Essentially, these firms’ different approaches to tokenization involve two design choices: in the case of Ondo, it’s about quickly and easily wrapping assets in a token; with Securitize, it comes down to issuing securities natively on chain and smoothing out the jurisdictional compliance wrinkles associated with that process.

Securitze’s approach “has always been to do this in lockstep with regulators,” Ferguson said. “So in the US and the EU, or regulated as a transfer agent, as a broker dealer, and we’ve always kind of done things by the book,” he said.

This comes with challenges when working with DeFi protocols, Ferguson acknowledged, because of the need to track who the beneficial owner of an asset is at every point in time.

“In crypto and DeFi, we’re used to massive pools of assets, so we are fixated on figuring out ways of working with these protocols so that we’re able to implement the same tracking mechanisms that are required in order to trade and transfer securities. And so it’s not necessarily the most DeFi comfortable approach,” Ferguson said.

For Lin of Ondo, tokenization falls into either a permissionless camp and a permissioned camp.

For example, OUSG, the Ondo Short-Term US Treasuries Fund is available for a global audience, and is permissioned which means users are able to transfer this asset to whitelisted addresses only.

On the other hand, Ondo Global Markets tokenizes publicly traded U.S. stocks and ETFs, which is permissionless following a given compliance period, but is only available to investors outside the U.S.

“What we have done at Ondo is a wrapper model for our Ondo global markets products,” Lin said. “That permissionless approach allows for us to operate and transfer freely from peer to peer within DeFi. So you’re able to use DeFi protocols to be able to leverage those products in lending and collateral margin.”

When it comes to tokenizing anything and everything, there’s no doubt this wrapping approach will get results faster; Ondo was able to tokenize BitGo stock some 15 minutes after the firm started trading on public markets, for instance.

“This wrapper model is essentially allowing us to scale much quicker. Today, we have around 200 plus tokenized stocks and ETFs. We’re looking to be able to scale that to thousands,” Lin said. “The wrapper model has been widely adopted. Stablecoins are essentially wrapped U.S. dollars and we have adopted a very similar model.”

Crypto World

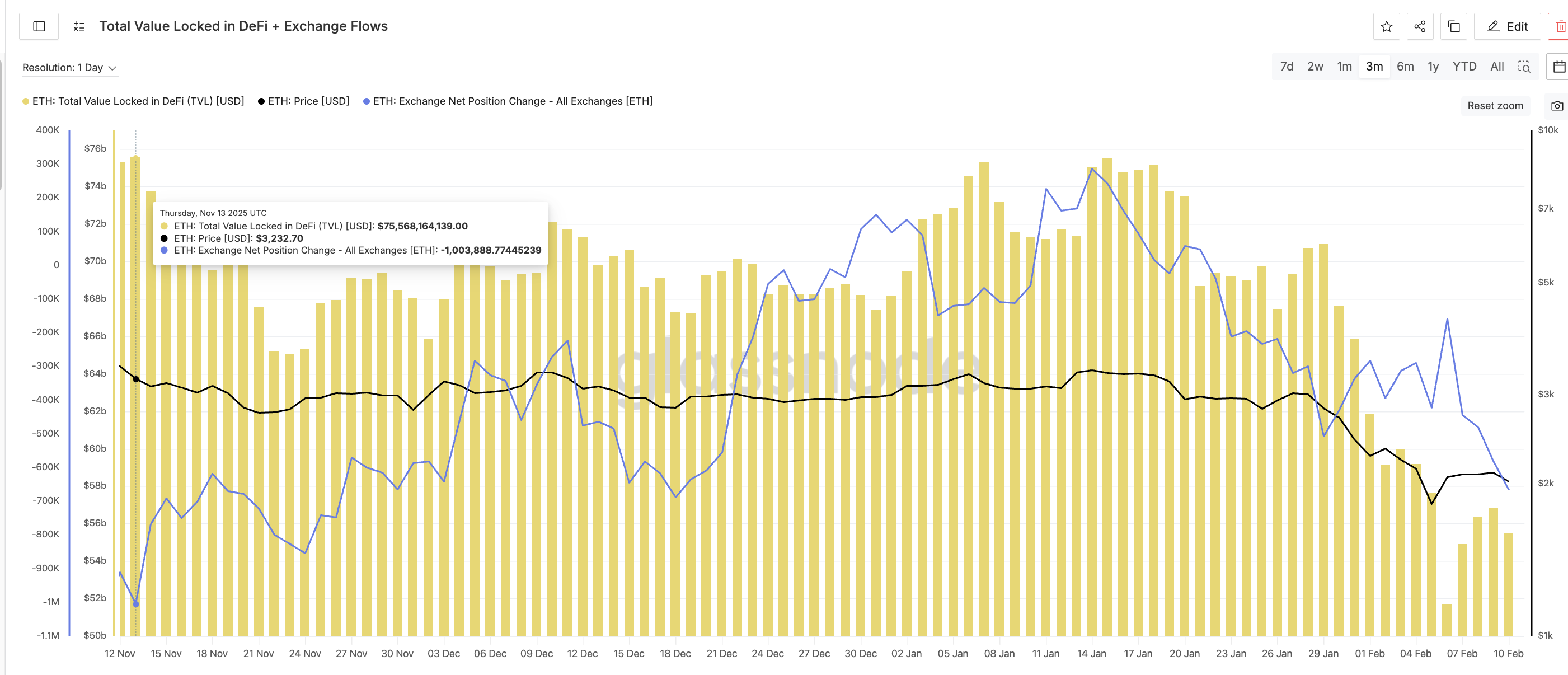

Ethereum Price Faces 50% Breakdown Risk as DeFi TVL Slides

The Ethereum price is down more than 5% over the past few days and has now slipped below a key short-term structure. On February 10, ETH fell under $1,980 after failing to hold a narrow rebound channel. This move followed a sharp decline in DeFi activity and weakening institutional flows. Yet, despite the pressure, large holders have started adding again.

The question is simple: is this early accumulation, or just a temporary pause before another leg lower?

Pattern Break Confirms Weak ‘Big Money’ Support

Ethereum’s recent rebound from early February formed inside a bear flag. This structure acted like a short-term recovery attempt, not a trend reversal. On February 10, the price slipped below the lower boundary of the flag, triggering a pattern break with over 50% crash potential, as predicted in a previous Ethereum analysis.

Sponsored

Sponsored

This move mattered because it happened alongside weak money flow.

The Chaikin Money Flow, or CMF, measures whether capital is entering or leaving an asset using price and volume. When CMF moves above zero, it often shows large-scale institutional-style buying. When it stays below, it signals weak participation.

Between February 6 and February 9, ETH bounced, but CMF never crossed above zero. It also failed to break its descending trendline. This meant the rebound lacked strong backing from large investors.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

In simple terms, the price moved up, but serious money did not follow strongly enough. When rebounds happen without strong CMF backing, they tend to fail. That is exactly what happened here. Once buying momentum stalled, sellers regained control and pushed ETH lower.

This confirms that the pattern break was not random. It was possibly supported by fading big money flows. But technical weakness alone does not explain the full picture.

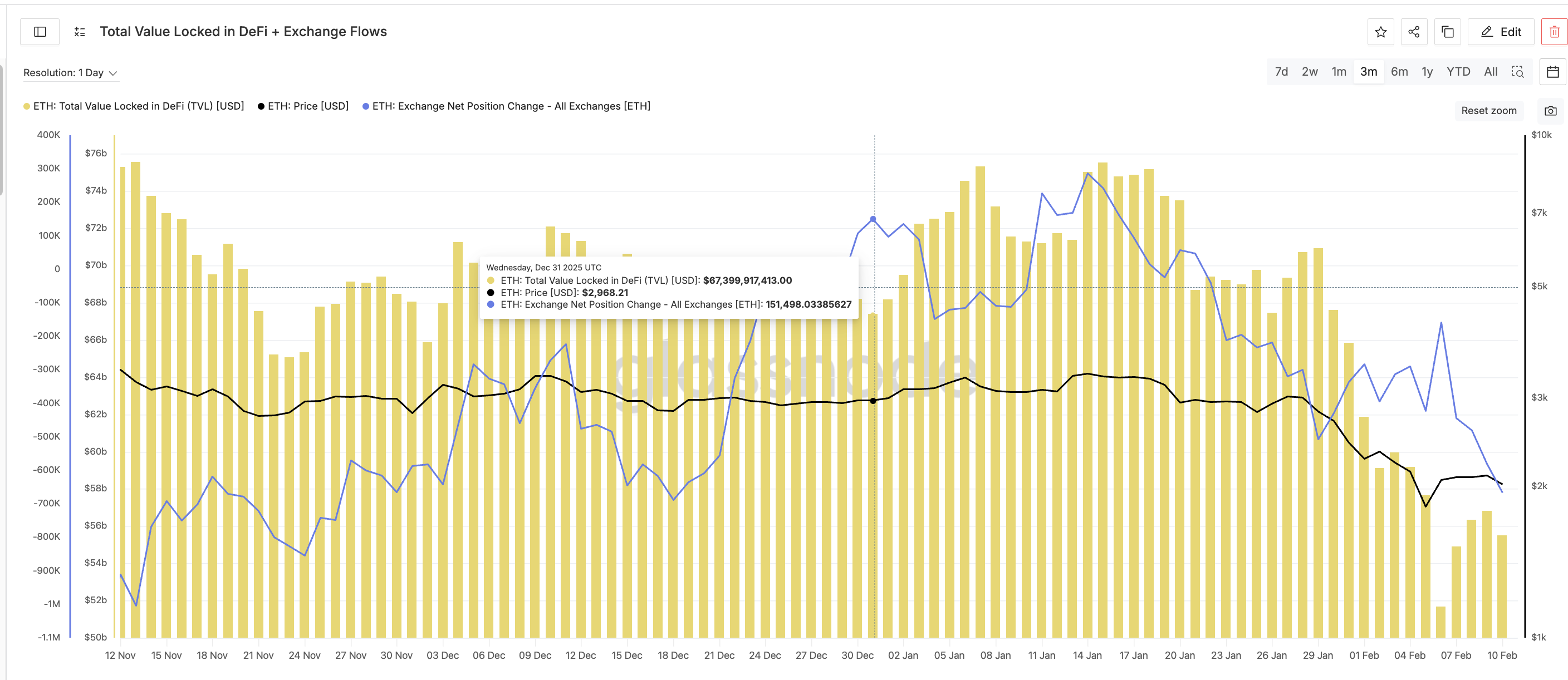

DeFi TVL and Exchange Flows Reveal a Structural Problem

A deeper issue sits inside Ethereum’s DeFi activity.

Total Value Locked, or TVL, measures how much money is stored inside decentralized finance platforms. It reflects real usage, capital commitment, and long-term confidence. When TVL rises, users are locking funds. When it falls, capital is leaving.

Sponsored

Sponsored

BeInCrypto analysts combined the TVL and exchange flow dashboards to show a clear pattern.

On November 13, DeFi TVL stood at $75.6 billion. At the same time, ETH traded around $3,232. The exchange net position change was strongly negative, indicating more coins were leaving exchanges than entering. Investors were possibly moving ETH into self-custody.

That was a healthy setup.

By December 31, TVL had dropped to about $67.4 billion. ETH fell to $2,968. Exchange flows flipped positive. Around 1.5 million ETH moved onto exchanges. Selling pressure increased. Now look at February.

On February 6, DeFi TVL touched a three-month low of $51.7 billion. ETH was near $2,060. Exchange outflows weakened sharply (the Net Position line reached a local peak). Even though net flows stayed slightly negative, buying pressure collapsed, as explained by the February 6 peak. This shows a repeating relationship.

When TVL falls, exchange inflows rise or outflows weaken. That means capital is shifting from long-term use toward potential selling.

Sponsored

Sponsored

As of February 10, TVL has only recovered to around $55.5 billion, down almost $20 billion from the mid-November levels. That is still close to the three-month low. Without a stronger recovery, exchange-side pressure is likely to return. So the pattern break is happening while Ethereum’s core usage remains weak.

That is a structural problem, not just a chart issue.

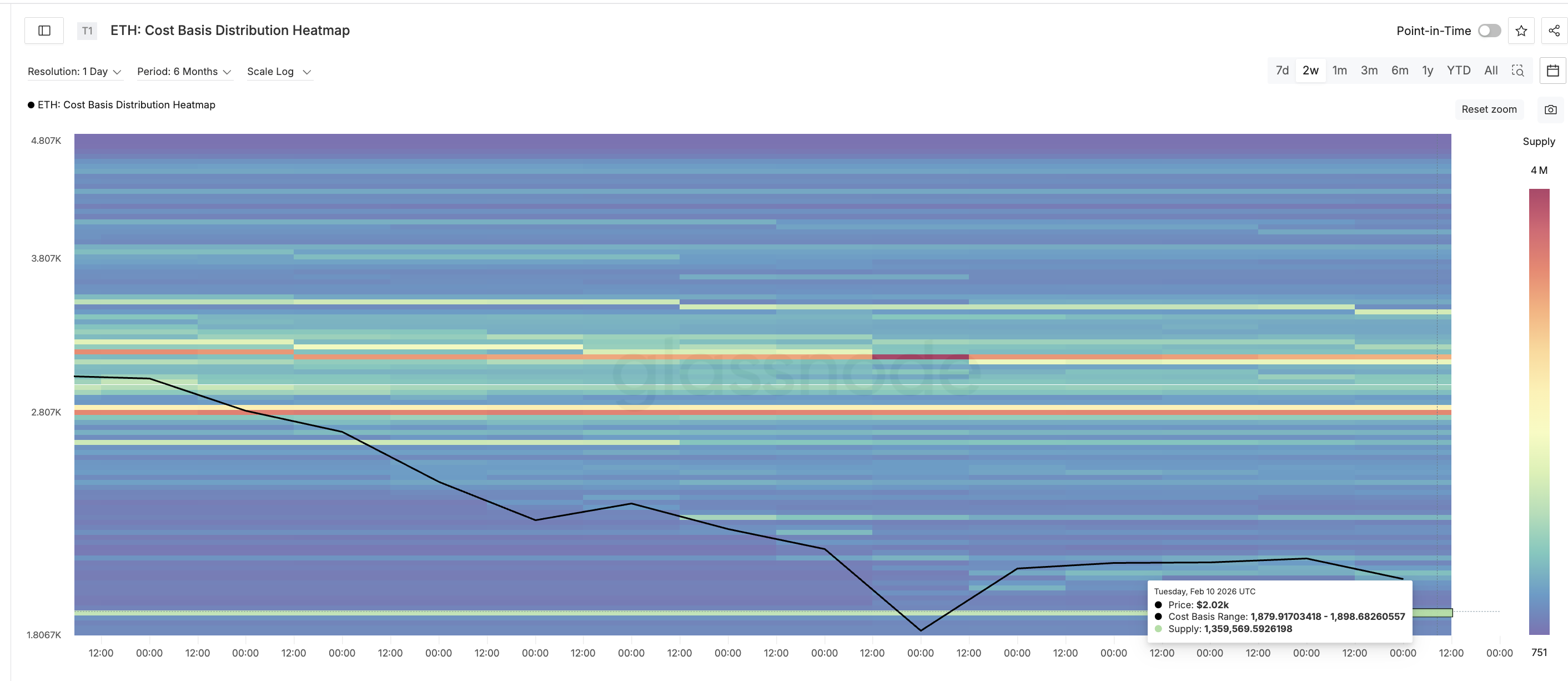

Whale Accumulation and Cost Basis Explain the Ethereum Price Support

Despite weak technicals and falling TVL, whales have not fully exited.

Whale supply tracks how much ETH is held by large wallets, excluding exchanges. Since February 6, whale holdings fell from about 113.91 million ETH to nearly 113.56 million. That confirmed the distribution during the breakdown. But over the past 24 hours, this trend paused.

Holdings edged back up slightly, from 113.56 million ETH to 113.62 million, showing small-scale accumulation. This suggests that whales are testing support rather than committing fully.

The reason becomes clear when looking at cost basis data.

Sponsored

Sponsored

Cost basis heat maps show where large groups of investors bought their coins. These zones often act as support because holders defend their entry prices. For Ethereum, a major cluster sits between $1,879 and $1,898. Around 1.36 million ETH were accumulated in this range. That makes it a strong demand zone.

The current price is hovering just above this area.

As long as ETH stays above this band, whales have an incentive to defend it. Falling below would push many holders into losses and likely trigger heavier selling. This explains the cautious buying.

Whales are not betting on a rally. They are possibly protecting a critical cost zone.

From here, the Ethereum price structure becomes clear.

Support sits near $1,960 and then $1,845. A daily close below $1,845 would break the main cost cluster and confirm deeper downside risk. If that happens, the next major downside zones sit near $1,650 and $1,500.

On the upside, ETH must reclaim $2,150 to stabilize. Only above $2,780 would the broader bearish structure weaken. Until then, rebounds remain weak.

Crypto World

Judge Dismisses Bancor-Affiliated Patent Case Against Uniswap

A New York federal judge dismissed a patent infringement lawsuit brought by Bancor-affiliated entities against Uniswap, ruling that the asserted patents claim abstract ideas and are not eligible for protection under US patent law.

In a memorandum opinion and order dated Tuesday, Feb. 10, Judge John G. Koeltl of the US District Court for the Southern District of New York granted the defendant’s motion to dismiss the complaint filed by Bprotocol Foundation and LocalCoin Ltd. against Universal Navigation Inc. and the Uniswap Foundation.

The court found that the patents are directed to the abstract idea of calculating crypto exchange rates and therefore fail the two-step test for patent eligibility established by the US Supreme Court.

The ruling marks a procedural win for Uniswap, but it is not final. The case was dismissed without prejudice, giving the plaintiffs 21 days to file an amended complaint. If no amended complaint is filed, the dismissal will convert to one with prejudice.

Shortly after the ruling, Uniswap founder Hayden Adams wrote on X, “A lawyer just told me we won.”

Cointelegraph reached out to representatives of Bprotocol Foundation and Uniswap for comment but had not received a response by publication.

Judge finds that patents claim abstract ideas

As previously reported, Bancor alleged that Uniswap infringed patents related to a “constant product automated market maker” system underpinning decentralized exchanges.

The dispute centered on whether Uniswap’s protocol unlawfully used patented technology for automated token pricing and liquidity pools.

Koeltl said that the patents were directed to “the abstract idea of calculating currency exchange rates to perform transactions.”

He wrote that currency exchange is a “fundamental economic practice” and that calculating pricing information is abstract under established Federal Circuit precedent.

The judge rejected arguments that implementing the pricing formula on blockchain infrastructure made the claims patentable, and said the patents merely use existing blockchain and smart contract technology “in predictable ways to address an economic problem.”

He said limiting an abstract idea to a particular technological environment does not make it patent-eligible. The court also found no “inventive concept” sufficient to transform the abstract idea into a patent-eligible application.

Related: Vitalik draws line between ‘real DeFi’ and centralized yield stablecoins

Complaint fails to plead infringement

Beyond patent eligibility, the court found that the amended complaint did not plausibly allege direct infringement.

According to the memorandum, the plaintiffs failed to identify how Uniswap’s publicly available code includes the required reserve ratio constant specified in the patents.

The judge also dismissed claims of induced and willful infringement, finding that the complaint did not plausibly allege that the defendants knew about the patents before the lawsuit was filed.

The dismissal without prejudice leaves open the possibility that Bprotocol Foundation and LocalCoin Ltd. could attempt to refile with revised claims.

Magazine: A ‘tsunami’ of wealth is headed for crypto: Nansen’s Alex Svanevik

-

Politics3 days ago

Politics3 days agoWhy Israel is blocking foreign journalists from entering

-

NewsBeat2 days ago

NewsBeat2 days agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

Sports4 days ago

Sports4 days agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

Business3 days ago

Business3 days agoLLP registrations cross 10,000 mark for first time in Jan

-

Tech5 days ago

Tech5 days agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

Tech8 hours ago

Tech8 hours agoSpaceX’s mighty Starship rocket enters final testing for 12th flight

-

NewsBeat2 days ago

NewsBeat2 days agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

Sports2 days ago

Sports2 days agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Politics3 days ago

Politics3 days agoThe Health Dangers Of Browning Your Food

-

Sports4 days ago

Former Viking Enters Hall of Fame

-

Sports5 days ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

Business3 days ago

Business3 days agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

NewsBeat5 days ago

NewsBeat5 days agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Business6 days ago

Business6 days agoQuiz enters administration for third time

-

Crypto World19 hours ago

Crypto World19 hours agoBlockchain.com wins UK registration nearly four years after abandoning FCA process

-

Crypto World1 day ago

Crypto World1 day agoU.S. BTC ETFs register back-to-back inflows for first time in a month

-

NewsBeat2 days ago

NewsBeat2 days agoResidents say city high street with ‘boarded up’ shops ‘could be better’

-

Sports2 days ago

Kirk Cousins Officially Enters the Vikings’ Offseason Puzzle

-

Crypto World1 day ago

Crypto World1 day agoEthereum Enters Capitulation Zone as MVRV Turns Negative: Bottom Near?

-

NewsBeat6 days ago

NewsBeat6 days agoStill time to enter Bolton News’ Best Hairdresser 2026 competition