Business

How to Choose Your Forex Broker? A 2026 Guide for UK Investors

In the vast and often turbulent ocean of the financial markets, your broker is your vessel. Choose a sturdy, well-equipped ship, and you can navigate through economic storms to reach your destination.

Choose a leaky raft, and you may find yourself sinking before you even leave the harbor. As we settle into 2026, the retail forex industry has become more competitive than ever. Hundreds of brokers are vying for your attention with flashy advertisements and promises of low spreads. However, for the serious investor, the decision must be based on rigorous due diligence rather than marketing hype. Whether you are a seasoned trader looking to switch providers or a novice taking your first steps, selecting the right partner is the single most critical decision you will make. This guide breaks down the essential criteria for choosing a broker that aligns with your financial goals and risk appetite.

1. Regulation and Safety of Funds

The first rule of trading is preservation of capital. Before you even look at spreads or trading platforms, you must verify the broker’s regulatory status. In 2026, the distinction between regulated and unregulated entities is stark.

The Importance of Tier-1 Licenses

A reputable broker will always be authorized by a top-tier regulatory body. In the UK, this is the Financial Conduct Authority (FCA). Other respected regulators include ASIC (Australia) and CySEC (Cyprus). These bodies enforce strict standards, such as segregating client funds from the company’s operating capital. According to Wikipedia, regulatory oversight is the primary defense against fraud in the retail forex market, ensuring that brokers adhere to fair practices and maintain sufficient capital reserves.

Negative Balance Protection

Ensure your broker offers negative balance protection. This feature guarantees that you cannot lose more than your initial deposit. In a market known for its volatility, where gaps can occur over the weekend, this safety net is indispensable for managing your long-term financial health.

2. Trading Costs and Transparency

Every pip counts. Over the course of a year, the difference between a 1-pip spread and a 2-pip spread can amount to thousands of pounds in transaction costs. However, low costs should not come at the expense of execution quality.

Spreads vs. Commissions

Brokers generally operate on two models:

- Commission-Free: You pay no separate fee, but the cost is built into a slightly wider spread.

- Raw Spread/ECN: You get spreads as low as 0.0 pips but pay a fixed commission per lot traded. For high-volume traders and scalpers, the raw spread model often proves cheaper. A leading forex broker will be transparent about these costs, displaying them clearly on their website rather than hiding them in the fine print.

Hidden Fees

Be wary of non-trading fees. Some brokers charge for withdrawals, inactivity, or even currency conversion. Always check the “banking” or “funding” section of the broker’s site to ensure you won’t be penalized for moving your own money.

3. Execution Speed and Infrastructure

In 2026, technology is the great equalizer. The speed at which your order travels from your terminal to the market can determine whether you make a profit or suffer “slippage” (getting filled at a worse price than expected).

Dealing Desk (DD) vs. No Dealing Desk (NDD)

- Market Makers (DD): These brokers take the other side of your trade. While they offer stable spreads, there is an inherent conflict of interest.

- NDD/STP Brokers: These brokers route your orders directly to liquidity providers (banks, hedge funds). This model is generally preferred by professional traders as it ensures transparency and faster execution without human intervention.

Platform Stability

Does the broker offer industry-standard platforms like MetaTrader 4 (MT4), MetaTrader 5 (MT5), or cTrader? Proprietary platforms can be good, but they often lack the advanced customizability of established software. Ensure the platform has a track record of stability during high-impact news events.

4. Range of Markets and Instruments

While your primary focus might be forex, a diversified portfolio is key to risk management. The best brokers in 2026 act as multi-asset gateways.

Beyond Currency Pairs

Look for a broker that offers access to:

- Commodities: Gold, Silver, Oil.

- Indices: S&P 500, FTSE 100, DAX.

- Shares: Access to global equities. Having all these assets under one roof allows you to hedge your positions. For example, if the USD weakens, you might want to long Gold. Being able to do this instantly on the same account is a massive logistical advantage.

5. Customer Support and Education

Even the best technology fails occasionally, and you will eventually have a question. When that happens, you need immediate answers.

24/7 Availability

The forex market runs 24/5, and crypto markets run 24/7. Your broker’s support should match these hours. Test their live chat before you sign up. Do they answer in seconds, or are you stuck in a queue?

Educational Resources

A broker invested in your success will provide educational tools. Look for webinars, daily market analysis, and tutorials. Furthermore, understanding risk and return is fundamental to your survival in the markets; a good broker will provide resources that help you grasp these concepts rather than just encouraging you to trade blindly.

Conclusion: Making the Final Call

Choosing a forex broker is not a decision to be rushed. It requires balancing cost, safety, and technological capability. By focusing on regulated entities that offer transparent pricing and NDD execution, you set a solid foundation for your trading career. Remember, the goal is not just to find a place to trade, but to find a partner that facilitates your growth as an investor. Take your time, test their demo accounts, and ensure they meet the high standards required for trading in 2026.

Business

McDonald’s focus on value is creating tensions with some franchisees

The restaurant sector has spent the past 18 months trying to figure out how to reach consumers in a hypercompetitive and uneven economy. McDonald’s, which is set to report earnings after the bell Wednesday, has doubled down on value messaging to customers via Extra Value Meals and Snack Wraps, which will likely help to boost sales this quarter.

But the focus on value has caused frustrations at times among parts of the chain’s operator base.

The company rolled out new franchise standards for McDonald’s operators on Jan. 1, including assessing locations on how their prices deliver value. McDonald’s said its owners are still able to set their own prices, but the standards nonetheless shape and define how franchisees — which operate 95% of McDonald’s restaurants — run their stores.

A cohort of operators is standing ground in their ability to independently set prices.

The National Owners Association, an independent franchisee advocate group, adopted a Franchisee Bill of Rights in August and circulated it in an email to members last month as the standards took effect, according to a copy of the message viewed by CNBC.

The last of the bill’s rights is the “right to set prices without fear of recourse,” which says, “Franchisees, as independent Owner/Operators, have the right to set menu prices for their restaurants based on their own business judgment and market conditions. This right exists irrespective of the pricing decisions of any national, regional, or local co-op or franchisor initiative. Franchisees must be free to manage their pricing strategy without fear of intimidation, or diminished support from McDonald’s or its affiliated entities.”

It also lists the “right to renewal and transfer,” giving owners the “absolute right to a fair and reasonable opportunity to renew franchise agreements … subject only to objective, clearly stated standards of approval.”

In December, McDonald’s told operators it would begin value assessments as part of its updates to franchising standards. Continued noncompliance could result in penalties or even termination.

At the time, the company said its new standards would provide “greater clarity … to ensure every restaurant delivers consistent, reliable value across the full customer experience,” according to a memo reviewed by CNBC.

In a statement, McDonald’s told CNBC that the business model creates the opportunity for entrepreneurs to be in business “for themselves, but never by themselves,” adding, “As franchisor, we have a responsibility to protect the strength and integrity of the brand and ensure every Owner/Operator upholds the standards that make McDonald’s so successful, for the benefit of all. This includes showing up for customers with great value – a core expectation the majority of our franchisees understand and proudly deliver.”

Some operators bristled at the changes in recent Wall Street research. In a two-part survey of 20 McDonald’s operators released last month, Kalinowski Equity Research wrote that it asked franchisee contacts if they were in favor of the changes to national franchising standards. For context, McDonald’s said it has some 2,000 owner/operators in the U.S. franchise system.

“As it turns out, every single one of the franchisees who responded to this question said ‘No.’ This is the first time in the 20+ year history of our McDonald’s Franchisee Survey that all respondents to a Yes-or-No question have all provided the exact same answer,” Kalinowski wrote.

Kalinowski also had operators quantify their relationship with McDonald’s corporate arm on a scale of 1 to 5, with 1 being poor and 5 being excellent. The average response received was 1.37, a “pretty noticeable step down from the October 2025 average response of 1.71,” the survey said.

It’s not the first time some operators and McDonald’s have butted heads. Tensions have surfaced in recent years over a restaurant grading system that took effect and changes made to how restaurant agreements are renewed.

Still, McDonald’s stock was one of the better performers in an abysmal year for the restaurant sector in 2025, rising 5%.

Kalinowski’s respondents also rated their business outlook for the next six months on a scale of 1 to 5, with 1 being poor and 5, excellent. The average response was 2.58, the best in the 11 quarters. Last quarter, CEO Chris Kempczinski said full-year cash flow was set to be solid for operators at the same time value investments were being made.

“Throughout the quarter, McDonald’s seems to be doing a better general job of promoting value to quick-service consumers, or at least it’s doing so notably better than some other large, quick-service burger concepts are,” Kalinowski wrote.

Likewise, fellow firm BTIG recently upgraded the stock.

“We expect the change in value strategy and perception to lead to the most meaningful earnings growth for the company since 2023,” BTIG wrote.

Business

Form 8K Frontier Group Holdings Inc For: 11 February

Form 8K Frontier Group Holdings Inc For: 11 February

Business

Ondas: The Industrial Bridge To Autonomous Dominance

Ondas: The Industrial Bridge To Autonomous Dominance

Business

Kraft Heinz to Pause Work on Separation, Boost Investments in Food Business

is pumping the breaks on its breakup plan.

The company said Wednesday that it is pausing work on a planned split between its condiment and grocery staples businesses.

Copyright ©2026 Dow Jones & Company, Inc. All Rights Reserved. 87990cbe856818d5eddac44c7b1cdeb8

Business

El Paso airport closed for 10 days over ‘special security reasons’

Former FAA safety team member Kyle Bailey joins ‘Fox & Friends’ to weigh in on a sudden shutdown of El Paso airspace due to security reasons.

The Federal Aviation Administration has grounded all flights to and from El Paso International Airport in Texas for the next 10 days, the agency announced Wednesday, warning that the U.S. government “may use deadly force” against an aircraft in violation, if it is deemed to pose “an imminent security threat.”

All flights to and from El Paso are grounded, including commercial, cargo and general aviation. The restriction is effective from February 10 at 11:30 p.m. MST to February 20 at 11:30 p.m. MST. The FAA cited “special security reasons” for the closure, but did not elaborate.

The no-fly restriction applies to airspace over El Paso as well as nearby Santa Teresa, New Mexico.

A sign at the El Paso International Airport (ELP) on December 25, 2025, in El Paso, Texas. (Photo by Kirby Lee/Getty Images / Getty Images)

El Paso airport issued a statement confirming the closure on Wednesday.

“Travelers should contact their airlines to get the most up-to-date flight status information,” it said in a statement.

TRUMP SAYS CUBA IS ‘READY TO FALL’ AFTER CAPTURE OF VENEZUELA’S MADURO

A person watches an Air Canada airplane being towed away from a gate at Terminal 1 at Pearson International Airport on February 6, 2024, in Toronto, Canada. (Gary Hershorn/Getty Images / Getty Images)

Former FAA safety team member Kyle Bailey told Fox News on Wednesday that a 10-day restriction like this is “unprecedented.” He also noted the airport’s proximity to the Fort Bliss Army post.

“It’s definitely something like a national security event, a high-level VIP,” Bailey speculated, “but the interesting thing is that on the Mexican side of the border there is no flight restriction.”

President Donald Trump speaks to journalists after signing an executive order in the Oval Office of the White House. (Anna Moneymaker/Getty Images / Getty Images)

GET FOX BUSINESS ON THE GO BY CLICKING HERE

“I think it’s safe to say that it’s something very big, either from a national security standpoint or perhaps testing something — equipment or something going into the air around the vicinity of those bases,” he added.

FOX Business’ Bonny Chu contributed to this report.

Business

Kraft Heinz pauses work to split the company as new CEO says ‘challenges are fixable’

Kraft Heinz in September 2025 announced plans to split into two separately traded companies, reversing its 2015 megamerger, which was orchestrated by billionaire investor Warren Buffett.

Justin Sullivan | Getty Images News | Getty Images

Kraft Heinz on Wednesday said that it is pausing work on its previously announced plans to split the company.

Shares of the company fell 6% in premarket trading.

CEO Steve Cahillane, who joined Kraft Heinz in January, said in a statement that many of the company’s issues are “fixable and within our control.”

“My number one priority is returning the business to profitable growth, which will require ensuring all resources are fully focused on the execution of our operating plan,” he said. “As a result, we believe it is prudent to pause work related to the separation and we will no longer incur related dis-synergies this year.”

Kraft Heinz also plans to invest $600 million to fuel a turnaround of its U.S. business. The company plans to spend the money on its marketing, sales, and research and development. The investment will also go towards “product superiority and select pricing,” according to Cahillane.

In September, the company announced plans to split, reversing much of the blockbuster $46 billion merger from a decade ago that created one of the biggest food companies in the world.

Warren Buffett, who helped mastermind the deal, said that he was disappointed in the decision. Berkshire Hathaway has since taken a formal step toward unwinding its 28% stake in Kraft Heinz.

In December, Kraft Heinz announced Cahillane’s hiring. He previously led Kellogg through its own breakup and then headed spinoff Kellanova until its sale to Mars.

This is breaking news. Please refresh for updates.

Business

A Timeline of Shinawatra Clan in Thai Politics

The Shinawatra family’s impact on Thai politics stands out as one of the most significant—and divisive—elements of the country’s 21st-century history, marked by a pattern of sweeping election victories repeatedly disrupted by judicial or military interventions.

However, the “Shin clan” political movement, which includes Thai Rak Thai, the People Power Party, and Pheu Thai, has faced a significant decline, now only third in the 2026 general election—its lowest standing since its formation. Once a dominant force with a track record of landslide victories, the movement is now struggling with diminished political influence and the emergence of formidable new competitors.

A timeline of the “Shinawatra Era” in Thai politics.

The Rise of Thaksin (1998–2006)

Thaksin Shinawatra, a telecommunications tycoon, disrupted the traditional political establishment with a platform of “pro-poor” policies known as Thaksinomics.

- 1998: Thaksin founds the Thai Rak Thai (TRT) party.

- 2001: TRT wins a landslide victory. Thaksin becomes Prime Minister, introducing universal healthcare and rural microcredit.

- 2005: Thaksin becomes the first PM in Thai history to serve a full term and win a consecutive absolute majority.

- 2006 (The Turning Point): Mass “Yellow Shirt” protests erupt over allegations of corruption and tax evasion regarding the sale of his company, Shin Corp.

- September 2006: While Thaksin is at the UN in New York, the military ousts him in a coup.

Proxy Battles and the Red Shirts (2007–2010)

Despite Thaksin being in exile, his political machine remained dominant under new names.

- 2007: The People’s Power Party (PPP), a TRT successor, wins the election. Samak Sundaravej becomes PM.

- 2008: Courts remove Samak for accepting payment for a TV cooking show. His successor (and Thaksin’s brother-in-law) Somchai Wongsawat is also removed by the court shortly after.

- 2010: Pro-Thaksin “Red Shirt” protesters occupy central Bangkok. A military crackdown leads to over 90 deaths.

The Yingluck Era (2011–2014)

The family returned to direct power with Thaksin’s youngest sister, Yingluck, leading the new Pheu Thai Party.

- 2011: Yingluck Shinawatra becomes Thailand’s first female Prime Minister after another landslide win.

- 2013: Her government attempts to pass an amnesty bill that would allow Thaksin to return without jail time. This sparks massive “Blue Sky” protests.

- May 2014: After months of deadlock, the Constitutional Court removes Yingluck for abuse of power. Days later, General Prayut Chan-o-cha leads a military coup.

The Paetongtarn Era (2023–2025)

After nearly a decade of military-aligned rule, the Shinawatras made a dramatic comeback in a shifted political landscape.

- May 2023: Pheu Thai loses to the Move Forward Party (MFP) in the general election but eventually forms a coalition with former rivals (pro-military parties) to secure the premiership.

- August 2023: Thaksin Shinawatra returns to Thailand after 15 years in exile. He is sentenced to prison but immediately moved to a hospital and later paroled.

- August 2024: Following the court-ordered removal of PM Srettha Thavisin, Paetongtarn “Ung Ing” Shinawatra (Thaksin’s daughter) is elected Prime Minister.

Summary of Shinawatra Prime Ministers

| Name | Relation | Term | Reason for Leaving |

| Thaksin Shinawatra | Patriarch | 2001–2006 | Military Coup |

| Somchai Wongsawat | Brother-in-law | 2008 | Court Order |

| Yingluck Shinawatra | Sister | 2011–2014 | Court Order / Military Coup |

| Paetongtarn Shinawatra | Daughter | 2024–2025 | Court Order |

The 2026 Election: A Historic Low

- Campaign and Outcome:

- Pheu Thai, seeking to restore its popularity, fielded “Dr Shane” Yodchanan Wongsawat (a Shinawatra family member) as its prime ministerial candidate, campaigning with the slogan “Overhaul Thailand—Pheu Thai can do it.”

- Unofficial results from the February 8, 2026, election indicate Pheu Thai has fallen to third place, signaling it is no longer the dominant party capable of forming a government.

- Key Factors Contributing to the Decline:

- Rise of New Parties: The emergence of new progressive parties, such as the People’s Party, with liberal branding and strong appeal to new voters, directly challenged Pheu Thai’s base.

- Strong Rivals: Bhumjaithai has established a solid voter base and local political power-brokers, positioning it to form a second-term government.

- Loss of Strongholds: A major upset occurred in Chiang Mai, a long-standing Shinawatra stronghold, where Pheu Thai failed to win a single seat. The People’s Party swept six constituencies, while Kla Tham secured four in remote areas, demonstrating a significant shift in voter allegiances across urban and rural/border regions.

- Political Instability: The repeated removal of prime ministers through legal and ethical challenges further damaged the party’s image and stability.

Pheu Thai must reflect on these successive electoral defeats, as the “Shinawatra clan” experiences a decline in political influence, while opposing parties strengthen and gain momentum. This shift in the political landscape signals a need for Pheu Thai to reassess its strategies, rebuild its grassroots support, and adapt to the changing demands of the electorate. Failure to address these challenges could further erode its standing, allowing rival parties to consolidate their power and reshape the nation’s political dynamics.

Other People are Reading

Business

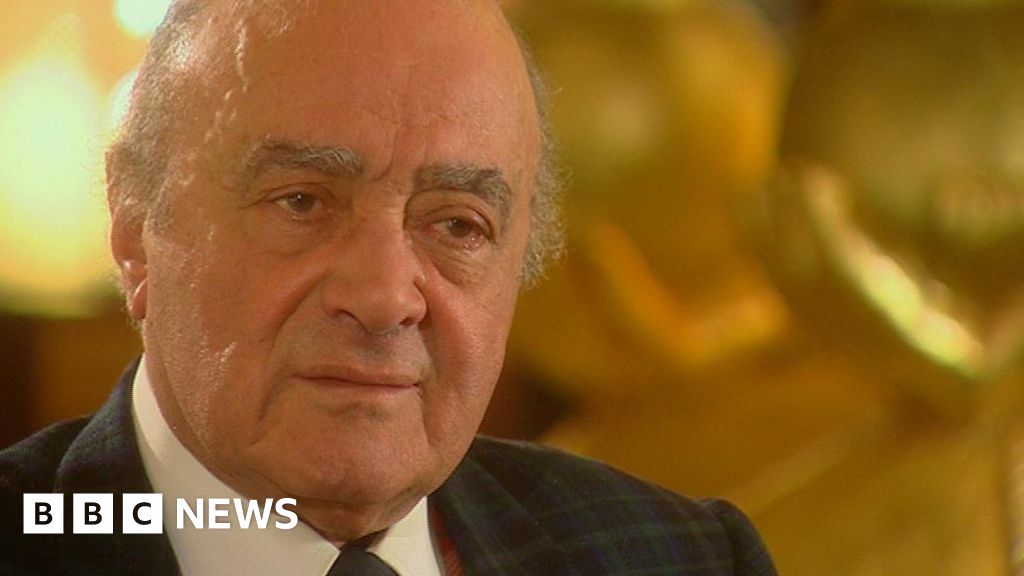

More than 180 survivors engaged in Harrods abuse redress scheme

The late Mohamed Al Fayed has been accused of sexual harassment during his time as owner.

Business

Paramount Tries to Outbid Netflix for Warner Bros With Extra Cash Incentives

Paramount Skydance has boosted its bid for Warner Bros Discovery by offering shareholders extra cash if the deal drags beyond 2026 and agreeing to cover Netflix’s breakup fee if Warner Bros walks away.

The move is the latest in Paramount’s ongoing battle with Netflix for the Hollywood studio’s prized film and TV assets.

The new incentives include a 25-cent-per-share “ticking fee,” worth about $650 million per quarter from early 2027 until the deal closes.

According to CNA, Paramount has not increased its $30-per-share offer, totaling $108.4 billion including debt, but pledged to fund the $2.8 billion termination fee Warner Bros would owe Netflix if their $82.7 billion merger collapses.

Both Netflix and Paramount covet Warner Bros for its blockbuster franchises, including “Game of Thrones,” “Harry Potter,” and DC Comics superheroes like Batman and Superman.

Paramount, which owns CBS, would also acquire Warner Bros’ television networks, including CNN and TNT, which are expected to spin off into a separately traded company, Discovery Global.

Paramount CEO David Ellison said, “We are making meaningful enhancements – backing this offer with billions of dollars, providing shareholders with certainty in value, a clear regulatory path, and protection against market volatility.”

The company has also raised Ellison’s personal guarantee to $43.3 billion and secured $54 billion in debt financing from Bank of America, Citigroup, and Apollo.

Paramount’s Desperate Warner Bros Bid $650M Quarterly “Bribes” to Kill the Deal?

Paramount is throwing everything to block Warner Bros from merging with them.

They now promise $650 million every quarter to WB shareholders if the deal doesn’t close by end of 2026.Plus they’ll… https://t.co/FhbIAK4Bgv pic.twitter.com/cjmB13pcfc

— PolymarketSuccubus (@polymarketsuc) February 10, 2026

Warner Bros Board Reviews Paramount Offer

Despite the sweetened offer, analysts say Paramount may struggle to win over Warner Bros shareholders.

Ross Benes, senior analyst at Emarketer, called the move “throwing spaghetti at the wall and hoping something sticks,” noting that Paramount’s best chance may come from regulatory hurdles blocking Netflix.

Activist investor Ancora Holdings, which owns roughly $200 million in Warner Bros shares, has expressed opposition to the Netflix deal and could push for Paramount if the board fails to secure a better offer, Reuters reported.

Warner Bros said its board will review the updated offer but maintains support for Netflix’s merger.

Paramount has also addressed other concerns by offering to backstop Warner Bros’ planned debt exchange and certifying compliance with US antitrust regulators.

It is in talks with regulators in the US, EU, and UK and has secured foreign investment approval in Germany.

Netflix’s $82.7 billion all-cash offer remains in place. Gaining Warner Bros’ assets could give Netflix cultural and streaming power, with nearly half a billion subscribers worldwide. A Warner Bros shareholder vote on the Netflix deal is expected by April.

Originally published on vcpost.com

Business

Banca Generali stock falls despite beating Q4 profit expectations

Banca Generali stock falls despite beating Q4 profit expectations

-

Politics3 days ago

Politics3 days agoWhy Israel is blocking foreign journalists from entering

-

NewsBeat2 days ago

NewsBeat2 days agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

Sports4 days ago

Sports4 days agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

Business3 days ago

Business3 days agoLLP registrations cross 10,000 mark for first time in Jan

-

Tech5 days ago

Tech5 days agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

Tech9 hours ago

Tech9 hours agoSpaceX’s mighty Starship rocket enters final testing for 12th flight

-

NewsBeat3 days ago

NewsBeat3 days agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

Sports2 days ago

Sports2 days agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Sports4 days ago

Former Viking Enters Hall of Fame

-

Politics3 days ago

Politics3 days agoThe Health Dangers Of Browning Your Food

-

Sports5 days ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

Business3 days ago

Business3 days agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

NewsBeat5 days ago

NewsBeat5 days agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Business6 days ago

Business6 days agoQuiz enters administration for third time

-

Crypto World21 hours ago

Crypto World21 hours agoBlockchain.com wins UK registration nearly four years after abandoning FCA process

-

Crypto World1 day ago

Crypto World1 day agoU.S. BTC ETFs register back-to-back inflows for first time in a month

-

NewsBeat2 days ago

NewsBeat2 days agoResidents say city high street with ‘boarded up’ shops ‘could be better’

-

Sports2 days ago

Kirk Cousins Officially Enters the Vikings’ Offseason Puzzle

-

Crypto World1 day ago

Crypto World1 day agoEthereum Enters Capitulation Zone as MVRV Turns Negative: Bottom Near?

-

NewsBeat6 days ago

NewsBeat6 days agoStill time to enter Bolton News’ Best Hairdresser 2026 competition