Crypto World

Here’s What You Need to Know

How is XRP performing during bear markets and is a parabolic recovery rally inbound? Let’s find out what history has to say.

Ripple’s XRP is down 15% in the past seven days, 26% in the past fortnight, and over 40% in the past year. Clearly, it’s in a downtrend in what’s currently considered to be a bear market in the crypto industry.In the following, we will examine XRP’s price, some of its fundamentals, and try to figure out how it holds up during crypto winters.

After all, the popular saying is that we should “buy when there’s blood on the street,” and it feels like there’s plenty of blood on the streets right now. Just yesterday, for example, the popular Crypto Fear & Greed Index was at 7 points (Extreme fear). That’s right, we have rarely seen sentiment so depressed.

XRP During Crypto Winters

The first thing to consider when it comes to investing in cryptocurrencies is the type of coin you’re eyeing. XRP is an altcoin, meaning that it is inherently much more volatile than Bitcoin and, by extension, almost all of traditional finance. Unlike many other altcoins, XRP is tied to a large US-based corporation that is spending millions of dollars on marketing and other activities to generate value for its shareholders and users.

Ripple is building an “ultra-fast” settlement layer for banks and all sorts of financial institutions ot use, arguing that this is what the future holds. You know, no intermediaries, 24/7 access, etc. But what has this done for XRP exactly?

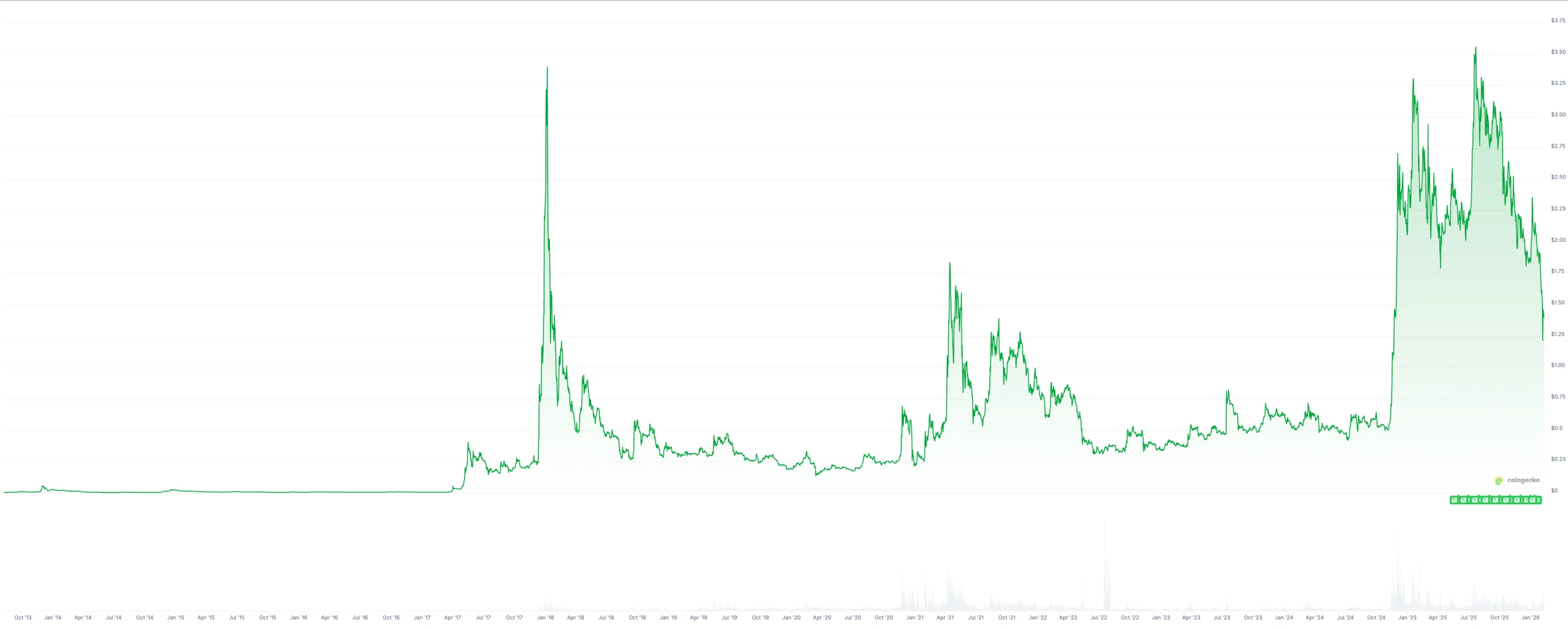

Well, its first pronounced crypto winter was felt back in 2018. After peaking above $3 and with Wall Street calling it the next coin to buy, XRP lost most of its value and traded close to $0.3 for most of the bear market.

Then came the bull market of 2021. In April of that year, the price surged to a high of around $1.7 and tracked most of the crypto market, attempting a double-top in November and eventually, once again, losing most of its value and plunging back toward $0.35 in spring 2022. XRP remained in a range around that level all the way until November of 2024, when it skyrocketed in value above $2, later achieving a new all-time high in July 2025.

In other words, bottom buyers enjoyed a nice return of close to 10x if they got in during the bear market ranges and sold around the top. Now, the price is repeating a similar pattern and is once again cooling down following a parabolic rally.

You may also like:

At the time of this writing, XRP sits on a total market cap of around $85 billion, meaning that it’s hard to argue in favor of a face-melting, millionaire-making rally. However, if history is any indication, cycles exist, and Ripple’s native cryptocurrency has been somewhat tracking them, despite a year-long lawsuit that had supposedly suppressed its dollar value for a while.

What You Need to Know Next?

When it comes to the crypto markets, there are quite literally two types of assets – Bitcoin and everything else, where everything else tends to be a lot less sustainable in terms of price and staying power.

As I mentioned above, there’s a fully functioning, large-scale, US-based corporation behind XRP. Ripple is continually expanding its operations and product offerings. They have issued a stablecoin, RLUSD, and are actively obtaining additional licenses across major jurisdictions.

But XRP itself is not directly tied to the company’s success. The investment thesis, aside from its speculative nature, remains questionable, particularly as the industry matures and competition intensifies.

XRP holders do not receive anything – in fact, they’re buying a cryptocurrency that’s meant to transact. They also made this clear during the trial against the U.S. Securities and Exchange Commission, which argued that XRP is a security.

It does have a fixed supply, that’s true, but a lot of that supply is also concentrated in the hands of the company itself, which regularly sells it to fund operations.

So, is XRP a good investment right now? There has been a historic precedent in the altcoin producing face-melting rallies following periods of a prolonged downturn; there’s absolutely no denying that. However, history should never be used as an indication of what’s to happen next, and there might be another 90% of downside before any potential relief, so keep that in mind.

Naturally, none of the above is financial advice. It’s just an observation of XRP’s price performance in previous market cycles as well as its connection to Ripple.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Why XRP Could Still Dip Below $1, Analysts Explain

XRP (CRYPTO: XRP) has retraced nearly 63% from its multi-year high of $3.66 to around $1.36 as of Wednesday, a move that market analysts say could carry bearish implications unless buyers reassert themselves. The slide comes amid a confluence of technical signals and growing on-chain activity that could either reinforce a near-term downshift or set the stage for a stubborn reversal. Traders are weighing a technical setup that points toward further pressure against a backdrop of sustained demand from spot XRP ETFs and persistent whale accumulation, painting a nuanced picture for the digital asset’s near-term trajectory. The Gaussian Channel, a charting method used to identify trends and potential support or resistance levels, places XRP at a crossroads where previous patterning has often dictated the tempo of subsequent moves.

Key takeaways

- The price action has broken below a critical zone near $1.40, aligning with a bearish setup that could extend losses toward the $0.70–$1 range if support fails.

- The Gaussian Channel shows the upper regression band near $1.16 and the middle band around $0.70, suggesting that a test of important structural levels could unfold over the coming weeks or months.

- A drop below the local low of $1.12 would validate the bearish scenario described by market technicians, potentially accelerating the downside case.

- Spot XRP ETF inflows have continued, with cumulative net inflows reaching about $1.01 billion and inflows of roughly $3.26 million on a single day, underscoring ongoing institutional interest.

- On-chain activity has picked up, with whale transactions exceeding $100,000 and active addresses surging to a six-month high, signaling that buyers remain engaged despite the price decline.

- Nevertheless, persistent ETF demand and on-chain signals could counterbalance the technical headwinds if liquidity conditions remain favorable and market sentiment improves.

Tickers mentioned: $XRP, $BTC, $ETH

Sentiment: Bearish

Price impact: Negative. A break below key supports could push XRP toward the mid-band around $0.70, extending the downside unless buyers step in.

Trading idea (Not Financial Advice): Hold. Near-term risk remains elevated if $1.12 fails, but renewals in ETF inflows and on-chain activity keep the scene cautiously balanced.

Market context: The XRP market remains closely tethered to liquidity flows from spot XRP ETFs and evolving on-chain activity. Spot XRP ETF inflows have continued, contributing to roughly $1.01 billion in cumulative net inflows and sustaining roughly $1.01 billion in assets under management, with daily inflows of millions that underscore ongoing institutional interest. At the same time, on-chain dynamics have shown resilience, with whale activity and active addresses rising even as price action remains under pressure. These factors collectively reflect a broader environment where ETF-driven demand can offset, at least temporarily, technical headwinds.

Why it matters

For investors watching XRP, the current setup matters because it juxtaposes a stubborn price decline with stubborn liquidity support. The Gaussian Channel’s readings imply that XRP could oscillate within a defined corridor before a decisive breakout or breakdown occurs. If the upper band near $1.16 acts as a temporary ceiling and the price fails to hold above the lower levels, the drawdown could extend toward the $0.70–$1 region, a zone that previously lacked robust testing for sustained support. Such a breach would be meaningful not just for XRP bulls and bears but for funds and institutions tracking the asset as part of broader crypto exposure. The dynamics of ETF flows, as observed in late-2025 through 2026, emphasize that institutional demand can create a buffer against rapid declines, but they are not a guarantee against further losses if macro conditions or sentiment deteriorate.

“The middle regression band currently ties up around $0.70, which is also a previous year-long resistance level seen back in 2023/2024, and hasn’t been backtested for support.”

On the liquidity side, the market has benefitted from a steady stream of ETF inflows. The Canary XRP ETF launch, which began late in 2025, has contributed to a trajectory of inflows that has pushed the cumulative total higher, with the latest daily inflows evidencing continued demand from institutional players. This flow is not a panacea for price declines, but it argues for a more nuanced outlook than a pure technical read would suggest. Meanwhile, on-chain metrics paint an equally important portrait. Analysts have highlighted a surge in XRP activity: whale transactions of over $100,000 and a spike in active addresses have suggested that sector participants remain engaged and are deploying capital despite adverse price movements. These signals can be precursors to a bottom or a renewed uptrend, depending on whether they align with broader market liquidity and risk appetite.

Analysts have also cited the importance of the price level around $1.12. A move below that local low could be a technical confirmation of the bearish scenario, triggering a cascade of downside protections and prompting a reevaluation of risk parity in XRP portfolios. Conversely, if ETF inflows persist and on-chain activity maintains its strength, XRP could find a foundation and attempt a staged recovery as liquidity conditions improve and risk sentiment stabilizes. The tension between price-driven momentum and liquidity-driven demand is a defining feature of XRP’s current phase, and market participants are closely watching both channels for signals of the next major move.

As the market weighs these factors, the broader crypto environment remains cautious. The behavior of BTC and ETH—often a barometer for risk sentiment—has a bearing on how XRP will respond to developing macro cues and regulatory dynamics. Although XRP has decoupled at times from the broader market, the path of least resistance in the near term could be influenced by the balance between selling pressure at technical resistance and fresh inflows that sustain institutions’ appetite for XRP exposure.

What to watch next

- Monitoring XRP’s level relative to the $1.12 local low to gauge whether the bearish scenario gains traction.

- Tracking the Gaussian Channel bands around $1.16 (upper) and $0.70 (middle) for potential testing or breakout signals.

- Observing ongoing spot XRP ETF inflows and AUM, which could widen the collision between technical resistance and liquidity-driven strength.

- Watching on-chain metrics, especially the trajectory of whale transactions and daily active addresses, for signs of renewed accumulation or distribution.

Sources & verification

- Chart Nerd’s analysis on Gaussian Channel fractals and XRP price projections referenced in a social post.

- Discussion on XRP price movement below the 1.60 level and potential downside scenarios.

- Canary XRP ETF launch and the resulting inflow data, including cumulative inflows and daily inflows feeding assets under management.

- Santiment’s reports on whale activity, large XRP transactions, and address activity as a measure of on-chain demand.

Market reaction and key details

The current XRP setup binds a bear-case price scenario to a backdrop of ongoing ETF inflows and active on-chain participation. While the price remains under pressure, the inflows into spot XRP ETFs and sustained whale engagement provide a counterbalancing force that could underpin a bottom if liquidity remains ample and risk appetite stabilizes. The path forward will likely hinge on whether XRP can stabilize above critical support levels and whether on-chain signals translate into durable buying interest.

What to watch next

- Whether XRP can hold above $1.12 on a closing basis, which would delay a deeper pullback.

- How ETF inflows trend over the next several sessions and whether AUM surpasses the $1.05–$1.10 billion range.

- Any new regulatory or product developments affecting XRP ETFs or custodial structures that could influence liquidity and investor confidence.

Crypto World

Stablecoin Conversion Costs Highest in Africa, Data Shows

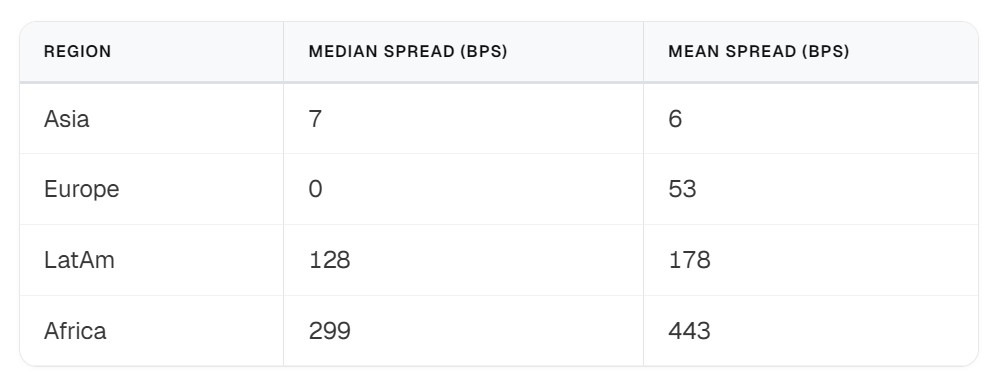

Africa recorded the highest median stablecoin-to-fiat conversion spreads among tracked regions in January, according to data observed by payments infrastructure company Borderless.xyz, covering 66 currency corridors and nearly 94,000 rate observations.

The regional median spread was 299 basis points, or about 3%, compared with roughly 1.3% in Latin America and 0.07% in Asia. In Africa, conversion costs ranged from about 1.5% in South Africa to nearly 19.5% in Botswana.

The data measures “spreads,” or the gap between a provider’s buy and sell rate for a stablecoin-to-fiat pair. Similar to a bid-ask spread in traditional markets, it reflects the execution cost paid when converting stablecoins into local fiat currency.

The findings suggest that while stablecoins are promoted as a cheaper alternative to traditional remittance rails, actual costs vary widely across African markets and appear closely tied to local provider competition and liquidity.

Competition drives pricing gaps

Borderless.xyz found that markets with several competing providers generally had conversion costs between about 1.5% and 4%. In markets with only one provider, costs often exceeded 13%.

Botswana recorded the highest median conversion cost in January at 19.4%, though pricing improved later in the month. Congo’s costs were also above 13%. By contrast, South Africa, which has a more competitive foreign exchange market, showed costs of about 1.5%.

The report suggested that these differences are driven primarily by local market conditions, such as liquidity and competition, rather than the underlying blockchain technology. In countries where multiple providers operate, conversion costs stayed closer to the regional average.

Related: Uganda opposition leader promotes Bitchat amid fears of internet blackout

Stablecoins versus traditional foreign exchange

The report also compares stablecoin mid-rates with traditional interbank foreign exchange rates, measuring what it calls the “TradFi premium.”

This metric reflects whether stablecoin exchange rates are cheaper or more expensive than traditional FX mid-market rates.

Across 33 currencies globally, the median difference between stablecoin exchange rates and traditional mid-market foreign exchange rates was about 5 basis points, or 0.05%, indicating the two were largely in line.

In Africa, the median gap was wider at roughly 119 basis points, or about 1.2%, though the difference varied significantly depending on the country.

On Jan. 24, economist Vera Songwe said at the World Economic Forum in Davos that stablecoins are helping reduce remittance costs across Africa, where traditional transfer services can charge about $6 per $100 sent.

The new data adds context, suggesting that while stablecoins offer faster settlement and potential savings compared with legacy services, conversion costs within specific corridors remain elevated.

Magazine: Hong Kong stablecoins in Q1, BitConnect kidnapping arrests: Asia Express

Crypto World

BTC trims losses following strong January employment report

U.S. jobs growth sizably strengthened in the first month of 2026.

There were 130,000 jobs added in January, according to a Wednesday report from the Bureau of Labor Statistics. Economist forecasts had been for 70,000 jobs added, up from jobs growth of 48,000 in December.

The unemployment rate fell to 4.3% versus forecasts for 4.4% and December’s 4.4%.

Trading in a tight range close to $69,000 for much of the week, bitcoin had dipped back to the $67,000 area in the hours prior to the report. In the immediate aftermath of the strong data, bitcoin rose to $67,500, though still down 2% over the past 24 hours.

U.S. stock index futures are continuing with modest gains, the Nasdaq 100 higher by 0.55% and S&P 500 by 0.5%. Lower earlier, the dollar is now higher on the session, and the 10-year U.S. Treasury yield has jumped five basis points to 4.20%.

After having cut rates multiple times in the second half of 2025, the Federal Reserve held policy steady at its January meeting, and members showed little inclination to resume rate cuts at the bank’s next meeting in March.

Ahead of this morning’s job numbers, interest rate traders were placing just 21% chances of a March easing, according to CME FedWatch. Just following the report, those chances had dipped to 19%.

Crypto World

Ethena-backed suiUSDe stablecoin goes live on Sui with $10 million yield vault launch

The Ethena-backed eSui Dollar (suiUSDe) has launched on Sui Mainnet, expanding the network’s stablecoin offerings and introducing the network’s first synthetic dollar to onchain trading and yield infrastructure, the Sui Foundation said in a blog post Wednesday.

The rollout also brings suiUSDe to DeepBook Margin, where it becomes the first synthetic dollar supported by the trading system.

Alongside the launch, SUI Group Holdings seeded a newly launched suiUSDe vault with $10 million, marking one of the largest initial stablecoin deployments on Sui to date.

The permissionless vault, operated by Ember Protocol and incubated by the Bluefin team, is designed to provide stablecoin-based yield to both institutional and retail participants. The vault has an initial capacity of $25 million, SUI Group said in a separate press release Thursday.

Despite broad market weakness and waves of forced liquidations across crypto, decentralized finance’s total value locked (TVL) has held up, suggesting traders continue to seek yield and passive income even as bearish sentiment weighs on the market.

Read more: Bitcoin and ether are tanking, but DeFi investors are refusing to cave to the panic

Synthetic dollars like suiUSDe are designed to function as onchain market infrastructure rather than tokenized claims on offchain cash. Unlike fiat-backed stablecoins, which typically move between venues as a neutral unit of account, synthetic dollars are built to operate natively inside trading and risk systems.

Because they are part of the market itself, synthetic dollars can integrate directly with margin engines, liquidation logic and reward mechanisms. That allows them to act as active collateral and liquidity drivers, rather than passive settlement assets.

Demand for that model has grown alongside the rise of yield and leverage-focused strategies, where users want capital efficiency and exposure in a single instrument. Ethena’s rapid growth has demonstrated that appetite, and bringing a similar structure to Sui extends it into a high-performance, programmable environment.

DeepBook Margin, unveiled last month, is a key piece of that shift. By embedding margin trading directly into the liquidity layer, it allows synthetic dollars like suiUSDe to be used natively for leveraged trading, risk management and rewards within a single execution venue.

“Launching the Ethena-backed suiUSDe was about establishing native, reliable dollar infrastructure on Sui,” said Marius Barnett, Chairman of SUI Group, in the release. “Seeding the suiUSDe Vault with $10 million is how we move that infrastructure into active use,” he added.

SuiUSDe was developed in collaboration with Ethena Labs and was first announced in the fourth quarter of 2025. With its mainnet debut, the asset is now available across multiple Sui-based protocols, including Aftermath, Bluefin, Cetus, Navi, Scallop, Suilend and others, broadening its use in trading, lending and yield strategies.

Sui is a layer-1 blockchain developed by Mysten Labs, designed to support high-throughput transactions and programmable onchain assets.

Read more: Sui Group charts new course for crypto treasuries with stablecoins and DeFi

Crypto World

130k jobs in January, but there were massive revisions

U.S. employers added 130,000 jobs in January, far exceeding expectations and signaling a rebound in hiring, though sweeping revisions sharply reduced prior payroll estimates.

Summary

- U.S. employers added 130,000 jobs in January, nearly double economist expectations of 70,000.

- Major benchmark revisions cut total 2025 job growth from 584,000 to 181,000 and signaling a weaker labor backdrop than previously reported.

- Crypto markets slid sharply, with the BTC down more than 11% for the week and falling another 2.5% over the past 24 hours amid broader market volatility.

The Labor Department reported Wednesday that nonfarm payrolls increased by 130,000 last month, well above economists’ forecasts of 70,000 and a sharp acceleration from December’s downwardly revised gain of 48,000.

The unemployment rate edged down to 4.3% from 4.4%, defying expectations for a steady reading.

However, the report also included significant benchmark revisions. The Bureau of Labor Statistics erased roughly 898,000 jobs from payroll estimates covering April 2024 through March 2025. As a result, total nonfarm employment growth for 2025 was revised down substantially, from 584,000 to 181,000.

The revisions suggest the labor market was considerably weaker over the past year than previously reported, even as January’s headline figures point to renewed hiring momentum at the start of 2026.

Crypto markets slid sharply, with Bitcoin (BTC) down more than 11% for the week and falling another 2.5% over the past 24 hours amid broader market volatility.

Crypto World

Why AI Integration is Now Mandatory for Crypto Exchange Development?

MEXC’s AI suite, launched in August 2025, marks the advent of a new standard in cryptocurrency exchange development. The leading crypto exchange software recognized that legacy crypto exchanges aren’t losing users because they’re slow, but because they’re not innovating.

It’s a 2019-era assumption that traders will stay if you offer enough trading pairs, decent liquidity, and a clean UI.

A crypto exchange software in 2026 that merely executes orders is no longer enough. Markets move in milliseconds, narratives shift in minutes, and information spreads faster than human reaction time.

Traders are left drowning in data, juggling between charts, indicators, on-chain dashboards, social feeds, whale trackers, and news alerts. Since trading decisions require them to integrate several tools across different platforms, exchanges just become a trading engine, which is easy to replace.

At a higher level, Institutional investors own an AI-powered trading infrastructure that detects patterns in seconds, analyzes indicators, and executes positions. Retail traders don’t have access to such tools, which is why they struggle to compete in markets. By integrating AI-tools inspired by MEXC, cryptocurrency exchange software can enable average users to access institutional-grade analysis, leveling the playing field for retail traders and institutional desks.

Why AI is no longer optional in Crypto Exchange Development?

For years, AI in crypto exchange was treated as a cosmetic upgrade. Crypto exchanges experimented with basic bots, basic alerts, surface-level analytics, and labelled them intelligent. The phase is now over. What changed isn’t the technology alone but the market and trader behavior as well.

Modern crypto markets are events and narrative-driven and reflexive. Prices react not just to order flow, but to tweets, governance proposals, whale movements, ETF speculations, regulatory headlines, and memecoin virality. When the retail reaction time cannot scale to this velocity, it is not the traders’ constraint but a trading infrastructure limitation.

AI embedded at the cryptocurrency exchange development infrastructure level can transform trading platforms from a passive execution venue to an active intelligence layer. And this shift addresses four structural weaknesses that traditional exchange systems cannot solve on their own.

1. Information Latency

Markets often react to new developments before most traders have had time to interpret them. By the time someone finishes reading the headline, the price adjustment may already be in progress or nearly complete.

AI-powered cryptocurrency exchange software can potentially reduce this lag by building agents that:

-

- Continuously scan multi-source inputs (news feeds, social streams, wallet flows, macro signals)

- Classify relevance in real time

- Rank signals based on the probability of market impact

By doing this, they can list top trading pairs, high-potential-tokens and best trading strategies in real time. This does not replace traders but compresses the delay between signal emergence and signal recognition.

2. Cognitive Overload

Data abundance has become counterproductive. As stated above, traders juggle charts, on-chain dashboards, sentiment trackers, and news feeds across multiple platforms. Scattered data slows decisions and increases error rates.

Smart AI integrations in crypto exchange development address this by:

-

- Filtering low-signal noise

- Correlating sentiment, capital flow, and price structure

- Presenting contextualized insight instead of raw feeds

This way, AI-powered news boards or chat assistants present real-time structured interpretations before the traders, who are just one click away from executing a trade.

3. Non-Linear Market Risk

Crypto volatility rarely unfolds in straight lines. Liquidation cascades, sentiment reversals, and liquidity shocks amplify themselves. Static thresholds and rule-based triggers often struggle in these environments.

Strategically crafted and integrated AI models in crypto exchange software, by contrast, adapt dynamically:

-

- Recognizing pattern shifts across regimes

- Updating probability distributions as conditions change

- Anticipating stress conditions rather than reacting after breakdown

Such models can be leveraged to create smart trading assistants for traders and intelligent risk management and security mechanisms for cryptocurrency exchange software.

4. Retention in a Low-Switching-Cost Environment

Crypto users face almost zero friction when switching platforms. Most platforms today have brief onboarding cycles and no custodial lock-ins. Funds move instantly. APIs connect everywhere. Liquidity is increasingly multi-platform.

In this environment, execution quality alone is insufficient for differentiation as a crypto exchange software. Traders increasingly prefer platforms that assist decision-making by surfacing opportunities, contextualizing risk, and shortening analysis time.

AI-powered trading integration in cryptocurrency exchange development addresses this retention problem by embedding decision-support into the trading experience itself. When an exchange:

-

- Surfaces relevant opportunities in real time

- Contextualizes price movements automatically

- Flags risk before exposure escalates

It reduces the trader’s dependency on external tools, slashing the chances of crypto exchange software abandonment.

What Role Does AI Play in Modern Crypto Exchange Infrastructure?

AI in cryptocurrency exchange development isn’t about adding more indicators or prettier dashboards, but giving your exchange a brain of its own. It compresses the chaos into clarity by detecting signals before they appear and linking events, sentiment, on-chain flows, and price action into a single decision context.

Its impact spans core infrastructure, compliance logic, capital protection systems, and trader cognition layers. Let’s locate exactly where it operates inside the stack when a cryptocurrency exchange software implements MEXC-inspired AI tools integration.

| Layer | AI Role | Deployment Location |

|---|---|---|

| Execution Layer | Slippage prediction | Off-chain engine |

| Surveillance | Behavioral modeling | Backend analytics layer |

| Risk Engine | Predictive liquidation scoring | Core risk module |

| Intelligence Layer | Signal aggregation & NLP | Data processing cluster |

1. AI at the Matching Engine & Trade Execution Layer

The order matching engine is traditionally deterministic. It matches orders based on a price-time priority and predefined logic, which fails under regime shifts, liquidity shocks, and high-volatility bursts.

- AI-Augmented Adaptive Order Matching Under Volatile Conditions

AI models analyze:

-

- Real-time order book depth changes

- Liquidity imbalances

- Spread expansion velocity

Instead of blindly matching based on static rules, an AI-based order matching system can:

-

- Adjust routing logic during volatility spikes

- Detect spoof-driven depth distortions

- Optimize execution sequencing under stress

Implementing this during crypto exchange development improves order fill quality without rewriting trading fundamentals.

- Slippage Prediction & Execution Path Optimization

Rather than calculating slippage after execution, AI models estimate:

-

- Expected impact cost

- Liquidity fragmentation

- Cross-market price deviations

AI-enhanced execution engines in crypto exchange software can then:

-

- Split large orders dynamically

- Delay or accelerate routing based on impact probability

- Optimize for reduced adverse selection

This results in measurable improvement in order execution efficiency.

- Load-Aware & Volatility-Sensitive Fee Logic

Static fee tiers appear flat and irrelevant. AI/ML-based load-aware and volatility-sensitive adjust fee based on:

-

- Network congestion

- Liquidity supply elasticity

- Market stress indicators

This enables cryptocurrency exchange software to:

-

- Protect liquidity during extreme volatility

- Incentivize depth when spreads widen

- Stabilize trading conditions programmatically

Power Up Your Crypto Exchange with AI — Start Building Today

2. AI in Market Surveillance & Trade Integrity Systems

Rule-based surveillance systems rely on predefined thresholds. Manipulators evolve faster than static rules, making them irrelevant in the face of rapidly shifting markets. AI introduces behavioral modeling and real-time market surveillance systems.

- Moving Beyond Static Rule-Based Surveillance

Instead of detecting fixed patterns, AI-based models integrated in crypto exchange software development learn:

-

- Normal order flow behavior per account

- Clustered wallet activity

- Correlated spoof cycles

Anomalies are detected relative to behavioral baselines, not arbitrary thresholds.

- Behavioral Modeling for Wash Trading & Spoofing Detection

AI systems integrated inside cryptocurrency exchange software analyze:

-

- Order placement and cancellation cadence

- Volume recycling patterns

- Cross-account coordination signals

This allows crypto exchanges to identify:

-

- Synthetic liquidity inflation

- Coordinated wash rings

- Layered spoof walls designed to mislead depth perception

This enables cryptocurrency exchanges to neutralize manipulation before it distorts price formation, safeguarding both liquidity providers and platform credibility.

- Real-Time Intervention vs Post-Trade Enforcement

Traditional enforcement occurs after trades settle. Cryptocurrency exchanges review the activities later and then react. This creates distrust among the exchange users.

AI-powered reaction time intervention systems integrated in crypto exchange software enable:

-

- Pre-trade risk scoring

- Order throttling

- Temporary restrictions before damage propagates

This protects both liquidity providers and platform reputation if implemented properly.

3. AI-Powered Risk Engines & Capital Protection

Most liquidation systems in traditional crypto exchange software rely on fixed formulas:

-

- If the margin ratio falls below X → liquidate

- If maintenance margin is breached → force close

This breaks during cascading leverage events, where price drops trigger liquidations, which trigger further price drops.

AI upgrades the liquidation engine from a static trigger system to a dynamic stress model.

- Predictive Liquidation Modeling

Instead of waiting for accounts to cross a fixed threshold, AI-powered liquidation models continuously evaluate how close an account is to becoming unstable under changing market conditions.

They analyze:

-

- Volatility clustering – Is volatility accelerating in a way that increases liquidation probability?

- Position concentration – Is the trader heavily exposed to a single high-risk asset?

- Correlated leverage exposure – Are multiple leveraged positions likely to fall together?

This allows the system to:

-

- Flag accounts likely to breach the margin before they actually do

- Adjust maintenance requirements gradually instead of triggering sudden liquidation

- Issue early warnings when risk probability spikes

The practical impact is fewer sudden liquidations and reduced cascade amplification during stress events.

- Volatility-Aware Leverage & Margin Controls

In traditional crypto exchange software margin systems, leverage limits are static. A trader can use 20× leverage regardless of whether volatility is low or exploding.

AI allows the leverage policy to adapt in real time based on:

-

- Current volatility regime

- Liquidity depth stability

- Funding rate stress signals

For example:

-

- During extreme volatility, allowable leverage can automatically compress

- During stable conditions, it can expand

This prevents systemic overexposure without halting trading activity. The cryptocurrency exchange software remains operational, but risk intensity is regulated dynamically.

- AI-Driven Account Health Scoring

A single margin ratio does not reflect real risk.

AI systems compute a composite risk profile that includes:

-

- Asset correlation across open positions

- Cross-market contagion risk

- Liquidity fragility of held assets

- Probability-weighted drawdown scenarios

Instead of treating accounts as either “safe” or “liquidate,” an AI-enhanced cryptocurrency exchange evaluates risk as a probability curve.

That matters because risk is rarely binary. It builds progressively. AI makes that progression measurable.

4. AI-Powered Market Intelligence & Trader Decision Systems

Execution intelligence optimizes how trades are processed. Market intelligence determines which trades get placed in the first place.

This layer sits above the core exchange engine and functions as a decision-compression system. Its role is not to automate trading, but to reduce signal discovery time, contextualize volatility, and quantify probability in environments where information arrives faster than humans can process it.

The problem it solves is not execution but decision latency and fragmented signal interpretation.

A. AI Signal Aggregation & Asset Opportunity Discovery

Traders today monitor dozens of inputs:

-

- On-chain token inflows/outflows

- Social velocity shifts

- Funding rate anomalies

- Derivatives open interest spikes

- Liquidity migration across pairs

Individually, none of these guarantees opportunity. The edge appears when they converge.

AI systems built inside crypto exchange development can:

- Continuously ingest multi-source market data

- Normalize heterogeneous signals (on-chain, sentiment, derivatives)

- Detect confluence clusters where multiple early indicators align

Instead of ranking tokens by volume or price change, the system ranks them by:

-

- Attention acceleration

- Capital rotation probability

- Early-stage momentum asymmetry

This changes asset discovery from reactive scanning to probabilistic opportunity surfacing.

The impact: traders identify rotation before it becomes obvious on the 4H chart.

B. Real-Time Event Intelligence & News Reaction Systems

Modern market catalysts originate outside the order book:

-

- Regulatory statements

- ETF developments

- Whale wallet activity

- Protocol upgrades

- Narrative shifts

Traditional cryptocurrency exchange software display price after impact where AI-integrated exchanges perform:

-

- NLP-based classification of incoming events

- Historical pattern comparison against similar past catalysts

- Real-time impact scoring based on liquidity conditions

When a signal crosses defined probability thresholds, the system:

-

- Flags the event

- Quantifies potential impact range

- Links context directly to trade interfaces

This reduces the informational advantage gap between institutions and retail participants.

C. Conversational AI for Market Reasoning & Trade Context

Markets are multi-variable systems. Traders often ask layered questions:

- “Why is this token outperforming the sector?”

- “How does this macro event affect L2 assets?”

- “Is this funding spike sustainable?”

Instead of manually correlating data across dashboards, conversational AI:

- Maps natural language queries to structured market datasets

- Performs cross-asset inference

- Produces explainable, data-backed summaries

This accelerates structured reasoning without replacing strategy. The analysis cycles are reduced from minutes to seconds.

D. AI-Augmented Charting & Contextual Market Visualization

Charts traditionally show price. Traders must overlay context manually.

AI-enhanced visualization integrates:

- Event annotations tied to precise time intervals

- Whale transaction overlays

- Sentiment inflection markers

- Pattern probability projections

More importantly, models can assign confidence intervals to detected formations rather than labeling patterns categorically.

Instead of:

“Head and shoulders detected.”

The system communicates:

“Pattern probability: 68% under current liquidity regime.”

That difference matters. It reframes technical analysis from visual intuition to statistical inference.

Takeaway

The next generation of crypto exchange development won’t compete on who has more features. They’ll compete on who helps traders think faster, react earlier, and manage risk before the market turns hostile. That shift from execution-first crypto exchange software platforms to intelligence-driven trading environments is already underway. And exchanges that ignore it aren’t being conservative. They’re falling behind.

Cryptocurrency exchanges that integrate AI natively, on the other hand, transition from being transaction venues to becoming decision engines.

At Antier, we design crypto exchange software infrastructure with this transition in mind. Our AI-ready exchange architectures are built to integrate predictive analytics, behavioral risk modeling, and multi-source signal intelligence directly into the core trading stack, not as surface-level add-ons.

Share your requirements today!

Frequently Asked Questions

01. What is the significance of MEXC’s AI suite launched in August 2025?

MEXC’s AI suite represents a new standard in cryptocurrency exchange development, addressing the need for innovation beyond just offering trading pairs and liquidity, enabling traders to access advanced tools for better decision-making.

02. Why is AI considered essential in modern crypto exchange development?

AI is essential because it transforms trading platforms into active intelligence layers, allowing for real-time analysis and execution, which is crucial in fast-paced markets driven by events and narratives.

03. How does AI integration benefit retail traders compared to institutional investors?

AI integration provides retail traders with access to institutional-grade analysis and tools, leveling the playing field and helping them compete more effectively in markets dominated by institutional investors.

Crypto World

Over 9 million XRP transferred to KT DeFi, whale activity comes into focus

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

The transfer of more than 9 million XRP to KT DeFi has sparked fresh discussion about whale activity and shifting capital flows within the crypto market.

Summary

- Blockchain data shows a whale moved over 9 million XRP to the KT DeFi platform, drawing attention to large-holder strategies and DeFi trends.

- Analysts suggest the transfer could be linked to liquidity management, yield optimization, or participation in cloud mining models.

- KT DeFi positions itself as a regulated UK-based digital asset mining platform with third-party audits, insurance coverage, and a multi-layered security framework.

Recent blockchain monitoring data shows that a whale address has transferred more than 9 million XRP to the KT DeFi platform. At current market prices, the transaction represents a substantial amount, quickly drawing market attention to large-holder capital movements and evolving trends within the DeFi ecosystem.

Industry analysts suggest the transfer may be related to liquidity allocation strategies, yield optimization adjustments, or participation in emerging models such as cloud mining.

KTDeFi: A regulated global digital asset mining service platform

KTDeFi is a UK-headquartered global digital asset mining service platform dedicated to providing compliant, transparent, and high-security digital asset participation solutions to users worldwide.

The company operates in accordance with applicable UK regulations and complies with relevant requirements under the European Union’s Markets in Financial Instruments Directive (MiFID II) framework. All operational processes, including platform management, asset custody, and profit distribution, are conducted within a clearly defined legal structure to ensure a secure and reliable investment environment.

Compliance and audit framework

To enhance operational transparency and system integrity, KT DeFi undergoes annual security and compliance audits conducted by the independent third-party firm PricewaterhouseCoopers (PwC).

In addition, client fund protection mechanisms are supported by insurance coverage through Lloyd’s of London, further strengthening risk mitigation and investor confidence.

Technology and security infrastructure

From a technical standpoint, KT DeFi employs a multi-layered security architecture to ensure stable platform operations and data protection:

- Cloudflare enterprise-grade protection, providing network acceleration and DDoS mitigation

- McAfee cloud security solutions, enabling real-time threat detection and data security

- High-performance ASIC and GPU hardware, optimizing computational efficiency and operational performance

The platform maintains 99.99% system uptime, supporting continuous and stable service delivery. To date, no major security incidents have been publicly disclosed.

User feedback from Europe

Amelie M. Kirk, IT Consultant from Munich, Germany, stated: “I have followed the digital asset market for years, but prefer stable and transparent yield models. KTDeFi’s cloud mining service offers clear information disclosure and fee structures that align with my long-term asset allocation strategy.”

Isabella, a business owner from Vienna, Austria, commented: “Compared to directly holding cryptocurrencies, this model feels less exposed to short-term price volatility. The platform’s emphasis on green energy is particularly important to me and enhances trust.”

Alexandra S. Wheeler, a finance professional from Zurich, Switzerland, added: “Compliance and risk management are essential to me. KTDeFi’s audit structure and European energy and operational infrastructure standards align closely with traditional financial frameworks.”

Management statement

Emma Louise Stevens, CEO of KT DeFi, stated: “KT DeFi is committed to helping global investors enhance the value of their digital assets within a lawful, transparent, and secure framework. We place particular emphasis on meeting European regulatory standards and continuously strengthening our risk management systems and sustainable development strategies.”

How to get started with KT DeFi

1. Register an account

Visit the official KT DeFi website and complete the registration process. New users may receive a $17 welcome bonus.

2. Deposit digital assets

Deposit XRP or other supported cryptocurrencies. Funds will be reflected in the users’ personal account dashboard.

3. Select a mining contract

Users can choose a cloud mining contract that suits their needs. Once activated, the system will automatically manage the mining or computational allocation process and distribute earnings according to the agreed terms.

For more information, please visit the official website.

Conclusion

As the digital asset market continues to evolve, whale capital movements and innovative yield models such as cloud mining are becoming key focal points for investors. The transfer of more than 9 million XRP to KT DeFi provides another significant data point for observing trends in the broader crypto ecosystem.

Disclosure: This content is provided by a third party. Neither crypto.news nor the author of this article endorses any product mentioned on this page. Users should conduct their own research before taking any action related to the company.

Crypto World

Hong Kong to issue stablecoin licences as Malaysia tests Ringgit digital assets

Major financial hubs in Asia are stepping up regulated digital asset efforts in 2026, with Hong Kong preparing to issue its first stablecoin licences as early as March, while Malaysia’s central bank begins testing ringgit-based stablecoins and tokenised deposits under its innovation hub.

Summary

- Hong Kong is preparing to issue its first stablecoin licences as early as March 2026, with regulators signaling a cautious rollout limited to a small number of fully compliant issuers.

- The framework emphasizes reserve backing, risk management, AML controls, and clear use cases, reinforcing Hong Kong’s push to position itself as a regulated digital finance hub.

- In parallel, Bank Negara Malaysia has launched pilots under its Digital Asset Innovation Hub to test ringgit-denominated stablecoins and tokenised deposits for wholesale and cross-border payments.

In Hong Kong, government officials confirmed that the territory is on track to grant its first batch of stablecoin issuer licences in March 2026 under a regulatory framework established by the Stablecoins Ordinance.

The ordinance requires prospective issuers to meet strict standards for use cases, risk controls, anti-money-laundering measures and reserve backing before they are authorized. Only a very limited number of licences is expected initially, as regulators focus on operational readiness and compliance.

Addressing the regulatory push, Hong Kong’s Financial Secretary and HKMA officials have reiterated their goal of fostering a safe and regulated stablecoin ecosystem, part of the city’s broader ambition to become a regional hub for digital finance, payments and tokenised assets.

Malaysia tests Ringgit stablecoins and tokenised deposits

In Kuala Lumpur, Bank Negara Malaysia’s Digital Asset Innovation Hub (DAIH) has onboarded three initiatives to test ringgit-denominated stablecoins and tokenised deposits for 2026.

These pilots, led by Standard Chartered Bank Malaysia, Capital A, Maybank and CIMB, will explore wholesale payment and settlement use cases, including domestic and cross-border flows. The tests are conducted in a controlled environment to assess implications for monetary and financial stability and to inform policy direction.

Under the DAIH, participants are evaluating how stablecoins and digital deposit tokens might streamline settlement, enhance liquidity and modernise institutional payment infrastructure while preserving regulatory safeguards.

Authorities in Malaysia plan to provide greater clarity on the use and policy framework for ringgit-linked digital assets by the end of 2026.

Together, these developments show a concerted regional trend toward formalising digital financial instruments.

Hong Kong’s move to grant licences for regulated stablecoin issuance dovetails with Malaysia’s ground-level experimentation with tokenised money, reflecting an increasing willingness among Asian regulators to integrate digital asset technologies into mainstream financial systems under strict oversight.

Crypto World

treasury firms face make-or-break test as $1.4b losses mount

Solana price prediction steep slide is hammering ETFs and corporate treasuries, with $1.4b in paper losses exposing how fragile institutional crypto risk-taking has become.

Summary

- Solana price prediction dropped about 38–40% in 30 days, from near $135 to the mid‑$80 range, even as January DEX volumes hit roughly $117b and daily activity neared 160m transactions.

- Spot Solana ETFs saw a $11.9m single‑day outflow and nearly $8.92m over the week, cutting AUM from above $1.1b to roughly $733m as professional money de‑risks.

- Corporate holders including Forward Industries, Sharps Technology, DeFi Development Corp, and Upexi now sit on an estimated $1.4b in unrealized SOL losses.

Solana (SOL) price prediction: latest selloff has turned into a stress test for both institutional vehicles and the handful of public companies that bet their treasuries on the network’s native token.

Solana price prediction seen as tailwinds for new hypothesis

Solana, the seventh‑largest cryptocurrency by market capitalization, plunged to a two‑year low near $67 early last week before clawing back to the $84–$87 band, leaving the asset down roughly 38% over the past 30 days and more than 70% below its January 2025 peak around $295. The move marks one of the steepest drawdowns among major layer‑1s in the current downturn, even as the network still processes around 160 million daily transactions and handled about $117 billion in DEX volume in January, briefly overtaking Ethereum on that metric.

Solana’s sharp reset has carved out the $84–$87 band as the first meaningful pivot zone, and if the network can sustain roughly 160 million daily transactions and DEX volumes anywhere near January’s $117 billion run‑rate, the current drawdown increasingly looks like late‑stage capitulation rather than the start of a structural collapse, opening room for a medium‑term recovery path back toward the $120–$150 area, while a clean break below $80 would invalidate this hypothesis and re‑open the door to a full retest of the two‑year low around $67 or even the $50–$60 range.

Institutional outflows and funds

Flows data underscore how quickly professional money is backing away. Solana‑focused exchange‑traded funds saw $11.9 million in net outflows on February 6, the second‑largest single‑day exit on record for the sector, cutting total assets under management from peaks above $1.1 billion to roughly $733 million. Grayscale’s SOL ETF shed $1.296 million on February 9, partly offset by $1.281 million of inflows into Bitwise’s BSOL product, leaving a marginal net outflow of $15,000 for the day but weekly redemptions still near $8.92 million.

These moves come against a wider backdrop of risk reduction across digital‑asset funds, with crypto investment products recently recording weekly outflows above $1.7 billion as macro uncertainty and tighter policy expectations weigh on sentiment.

Corporate treasuries in the red

The damage is most acute for listed firms that treated SOL as a balance‑sheet asset. The four largest disclosed corporate holders—Forward Industries, Sharps Technology, DeFi Development Corp, and Upexi—now sit on an estimated $1.4 billion in combined unrealized losses, according to recent treasury disclosures. Forward alone holds about 6.9 million SOL at an average entry near $232, leaving what amounts to “unrealized losses approaching $1 billion” with the token trading in the mid‑$80s, while its own equity has slid from almost $40 last year to roughly $5. Sharps Technology and DeFi Development Corp, holding roughly 1.9 million and 2.2 million SOL respectively, have watched their share prices fall between 59% and 80% over the past six months.

Technicals, self‑custody and broader market

Technicians warn that price structure is still fragile. Market analyst Alex Clay has flagged a completed head‑and‑shoulders breakdown targeting the $42 zone, with other chart watchers eyeing interim supports in the $50–$75 region and some calling for potential spikes down toward $30 if selling pressure accelerates. On‑chain, more than 1.07 million SOL have left centralized exchanges in just 72 hours, a shift analyst Ali Martinez interprets as fear‑driven self‑custody rather than aggressive dip‑buying, with the $100 mark now framed as the “critical psychological level” bulls must reclaim to repair sentiment.

Investors tracking the fallout across the Solana ecosystem and wider market can follow ongoing developments in institutional adoption, large‑cap balance‑sheet losses, and capitulation dynamics through recent coverage of Solana’s institutional deals, the mounting mark‑to‑market hit at major crypto‑exposed corporates, and the latest leg lower in altcoins.

Crypto World

Volatility ahead of US jobs report

Bitcoin price is back on shaky ground ahead of Wednesday’s nonfarm payrolls release. The 8:30 a.m. ET data drop has traders on edge, as macro catalysts often trigger sudden volatility.

More than $250 million in leveraged trades were flushed out in just one day, hammering long positions the hardest. The move below short-term support blindsided bulls and reinforced how quickly this market can unravel.

Summary

- Bitcoin is trading near $66,700, slipping below $67,000, and triggering over $250 million in leveraged liquidations, mostly affecting long positions.

- Short-term momentum is bearish, with the $69,000–$71,000 range acting as key resistance and $72,000 needing a decisive breakout to shift momentum.

- Failure to reclaim $69,000–$71,000 could push Bitcoin toward $64,000, with $60,000 as a critical psychological support where panic selling may intensify.

Current market scenario: Technical weakness builds

As of February 11, Bitcoin (BTC) is trading near $66,700 after breaking below $67,000 and triggering another flush of liquidations.

Traders see this as a break on the daily chart. The two-week support that had absorbed recent dips is gone, and momentum in the short term is clearly bearish.

Spikes in liquidations often reflect forced selling, not a steady trend. Still, the lack of a strong bounce is raising concerns about broader weakness.

All eyes are on Wednesday’s Nonfarm Payrolls report at 8:30 a.m. ET. Delayed by last month’s brief federal shutdown, the data is expected to move markets. Some Trump administration officials have suggested the numbers might come in weaker than expected, which could fuel rate-cut bets and support risk assets — though volatility is likely before any clear trend emerges.

Key levels to watch

From a technical view, the battle zone is clearly $69,000–$71,000. But even if Bitcoin rallies into that range, it’s resistance until proven otherwise.

A meaningful shift in momentum requires a decisive breakout above $72,000, confirmed by a strong daily close. Without it, any rally could quickly fizzle and remain part of the larger corrective move.

Failing to reclaim $69,000–$71,000 within 24 hours could open the door toward $64,000. Beneath that, the psychological $60,000 level comes into focus — an area where panic selling has historically intensified.

It’s a narrow window with high stakes. Bulls need to act fast. Bears are waiting patiently.

BTC price prediction: What comes next?

Macro catalysts are steering short-term moves. Should the jobs report fall short of expectations and risk appetite improve, Bitcoin price could climb toward resistance. But without decisively reclaiming $72,000, any rally risks fading quickly.

Should selling continue and a $64,000 break, the market could accelerate toward $60,000, where long-term buyers may step in. That zone may ultimately decide whether the broader uptrend holds.

The near-term Bitcoin price prediction leans toward continued volatility. The market is perched at a technical crossroads, and macro data may spark the next big move.

For now, the Bitcoin outlook is cautiously neutral-to-bearish, though a decisive breakout above $72,000 could swing sentiment sharply back toward the bulls.

Traders should prepare for rapid price action, as sharp moves could come in either direction.

-

Politics3 days ago

Politics3 days agoWhy Israel is blocking foreign journalists from entering

-

NewsBeat2 days ago

NewsBeat2 days agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

Sports4 days ago

Sports4 days agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

Business3 days ago

Business3 days agoLLP registrations cross 10,000 mark for first time in Jan

-

Tech5 days ago

Tech5 days agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

Tech10 hours ago

Tech10 hours agoSpaceX’s mighty Starship rocket enters final testing for 12th flight

-

NewsBeat3 days ago

NewsBeat3 days agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

Sports2 days ago

Sports2 days agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Sports4 days ago

Former Viking Enters Hall of Fame

-

Politics3 days ago

Politics3 days agoThe Health Dangers Of Browning Your Food

-

Sports5 days ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

Business3 days ago

Business3 days agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

NewsBeat5 days ago

NewsBeat5 days agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Business6 days ago

Business6 days agoQuiz enters administration for third time

-

Crypto World22 hours ago

Crypto World22 hours agoBlockchain.com wins UK registration nearly four years after abandoning FCA process

-

Crypto World1 day ago

Crypto World1 day agoU.S. BTC ETFs register back-to-back inflows for first time in a month

-

NewsBeat2 days ago

NewsBeat2 days agoResidents say city high street with ‘boarded up’ shops ‘could be better’

-

Sports2 days ago

Kirk Cousins Officially Enters the Vikings’ Offseason Puzzle

-

Crypto World1 day ago

Crypto World1 day agoEthereum Enters Capitulation Zone as MVRV Turns Negative: Bottom Near?

-

NewsBeat6 days ago

NewsBeat6 days agoStill time to enter Bolton News’ Best Hairdresser 2026 competition