Money

Parent gets paid £677 in compensation after fighting unfair ‘free hours’ nursery fees – could YOU claim money back too?

A PARENT has been awarded £677 in compensation from his local council after complaining that his daughter’s nursery charged him fees for free childcare hours, The Sun can reveal.

Earlier this year, we exposed how nurseries had begun charging parents new fees following the introduction of extra free childcare hours in April, which goes against government guidance.

We have seen evidence of “supplementary fees”, “registration fees” and new “consumables charges” being added, even where parents have offered to provide those consumables themselves.

Under government guidance, nurseries cannot charge so-called top-up fees, non-refundable registration fees or any other fees not clearly identified as for consumables, for free childcare hours.

Charging fees for consumables is allowed, but they should not be made a condition of accessing a free place and an alternative should be offered, such as providing your own items, the guidance says.

The extra free childcare hours in April was the first phase of a plan to offer 30 free hours to all eligible parents of children between nine months and three years old by September 2025.

But at the time, a number of parents reported seeing new fees being added to their invoices.

Nurseries have long argued that they don’t receive enough funding from the Government to offer free hours and need to find ways to make up the shortfall.

But the Government says the funding it provides is adequate.

Following our investigation earlier this year, the Department for Education said it was collecting evidence of nurseries charging extra fees for free hours and would intervene if it believed it was a widespread issue.

The Sun has now learned that one parent has won back £677 from his local council after complaining that his nursery was charging him a “supplementary fee” per hour of free childcare.

Alex Hays* from near Dover in Kent, was awarded £677 by Kent County Council following a five-month battle over the fees.

Alex and his wife only claimed 20 hours of childcare a week for their three-year-old daughter, so all of these hours were funded.

But he said their nursery, Kid Ease in Swingfield, near Dover, charged them £1.50 per hour, or £150 a month, in so-called supplementary fees for those funded hours.

Then in March this year, Kid Ease emailed Alex a letter that let him know these fees would be rising to £1.95 an hour.

The letter from the childcare provider, seen by The Sun, blamed the fee hike on a “turbulent economy” and “inflationary pressures” putting it under financial pressure.

“Together, these factors mean we will need to introduce a fee increase from 1st April 2024,” the letter said.

It went on to say parents would now be charged a supplementary fee of £1.95 per hour of funded childcare.

At this point, Alex began researching whether parents could be charged supplementary fees and discovered this was actually against government guidelines.

“I knew they probably shouldn’t have been charging the fees, but when they increased them I decided I’d had enough,” Alex said.

“I asked for an itemised breakdown of what the fees were paying for, but they just said it was for consumables like food and refused to give me an actual breakdown.”

Alex and his wife then decided to formally complain to Kent County Council, which appointed a third party, The Education People, to investigate.

After 12 weeks with no response, they escalated the case to the Local Government Ombudsman, which gave The Education People 28 working days to provide a final response.

Finally, in September, The Education People found in favour of Alex, and, in an email seen by The Sun, said it was working with Kid Ease to ensure it complies with the Kent Provider Agreement going forward.

Alex and his wife paid a total of £909 in extra fees for claiming free childcare hours to Kid Ease nursery and received back £677 in compensation – roughly 75%.

This was because they had £4 per day deducted for lunches for 58 days, totalling £232.

The family has since moved their daughter to another nursery.

Alex is now urging other parents to complain if they are being charged any extra fees for free hours.

“The guidelines are very clear, working parents absolutely cannot be forced to pay extra fees by providers and shouldn’t feel that they have to in order to receive or continue receiving free childcare,” he said.

“If you are a parent and want to pay fees for additional services, that’s completely up to you, but I’d encourage you to at least ask what it’s paying for.”

A Department for Education spokesperson told The Sun: “We have published statutory guidance for local authorities which makes clear that extra charges for consumables or additional hours should not be made a condition of accessing a free place – and continue to monitor this issue closely.”

The Sun contacted Kent Council for further comment. It is understood that Kid Ease is challenging the decision by The Education People.

Kid Ease states it may charge a “supplementary fee” for funded hours in its most recent terms and conditions available online.

Here’s what Kid Ease said

A spokesperson for Kid Ease said the following:

“Concerning the parent’s complaint, Kid Ease investigated this matter thoroughly and submitted considerable evidence to Kent County Council. Unfortunately, the Council made its initial decision in respect of the complaint without reference to Kid Ease. The decision has been formally challenged, and whilst the Council considers our challenge, we are unable to comment in detail.

“We can, however, confirm Kid Ease is fully aware of and at all times complies with statutory guidance on FEE and supplementary charges for free childcare places. We do not charge top up fees or registration fees. Additional fees are only charged for consumables as well as costs such as trips and specialist tuition, all of which are permissible.

“Permissible charges for consumables and services are communicated to all parents, both verbally and in writing, prior to parents making their choice. By email, this parent confirmed these permissible charges had been explained and requested sessions with supplementary fees.

“All FEE funded sessions are provided free and invoiced at £0 and parents always have a choice of free sessions or free sessions with supplementary fees.

“Kid Ease disagrees with and is challenging Kent County Council’s decision because we consider it to be unlawful and not in accordance with the Government’s and their own Guidance.

“Kid Ease has always followed Government Guidance & the Kent Provider Agreement and is mystified by the Council’s conclusion. The Council has not specified which part of the Guidance Kid Ease has allegedly breached.”

New fees for free childcare hours

Alex is one of a number of parents who has complained that they began being charged new fees when extra free childcare hours kicked in.

Earlier this year, one parent told The Sun they began being charged a compulsory £29 daily “consumables charge”, regardless of whether they were only claiming free hours or not.

They were also charged a £55 “non-refundable registration fee” just for registering for their free hours, which is explicitly against government guidance.

An email to the parent, whose child attended a nursery in West Byfleet, Surrey, said: “All children claiming funding of either 15 or 30 hours per week will be required to pay a daily fee for consumables.

“When claiming a funded-only place, parents are required to pay a non-refundable £50 registration fee.”

Another parent from Huddersfield reported seeing a compulsory consumables charge worth “1x daily rate” appear on her monthly invoice, worth an extra £61. She only claimed free childcare hours.

Unfortunately, many parents are afraid to stand up their nursery because they’re scared of their place being withdrawn – but it’s important to remember these charges actually aren’t allowed to be compulsory under government rules

Martyn James

Since our previous investigation, The Sun has learned the West Byfleet nursery has written to parents informing them it will be removing the compulsory charge for free childcare hours.

But many parents are still faced with these fees – and experts say that parents are too afraid to complain for fear of losing their childcare place.

Consumer expert Martyn James said: “Unfortunately, many parents are afraid to stand up their nursery because they’re scared of their place being withdrawn.

“But it’s important to remember these charges actually aren’t allowed to be compulsory under government rules.”

What fees can nurseries charge?

Nurseries are allowed to charge for consumables, even for free childcare hours. This can cover things like food, nappies or other items used during the day.

However, these fees cannot be compulsory. The nursery must offer a reasonable alternative, such as allowing you to provide your own consumables or forfeiting trips out.

Under government guidance, nurseries are not allowed to charge:

- A top-up fee (any difference between a provider’s normal charge to parents and the funding they receive from the LA to deliver the free place)

- A non-refundable registration fee. (A fee to register for a place that is not returned to you when you take up that place. This may also be called an “enrolment fee”, “admissions fee” or “booking fee”)

- Any additional fees on top of your funded hours that are not specifically identified as being for any consumables – although providing these yourself should be an alternative option

The government advises that parents should speak to their local authority or provider about any additional charges on top of the childcare hours they receive through the entitlement, including any alternative options they offer.

How to complain if you think you’re being charged unfairly for free hours

If you’re unhappy with the fees your nursery or childminder is charging you, your first port of call should be to speak to your provider.

Ask them for a breakdown of what any extra fees are paying for, and remind them of government guidance.

If they refuse to provide a breakdown or offer an alternative, raise a formal complaint.

They should have a formal complaints process they can share with you.

If you don’t agree with the outcome of the complaint, you can speak to Citizens Advice for further assistance or legal advice.

Or, like Alex, contact your local council to start a complaint that way.

It’s best to keep any evidence you can to back up your claim, such as emails detailing any charges, or correspondence refusing to provide a breakdown or alternative options.

Mr James advised: “If you’re worried about losing your place, consider speaking to your local council to let them know anonymously, or ask Citizens Advice if it can intervene without revealing who you are.”

*name changed to protect identity

Do you have a money problem that needs sorting? Get in touch by emailing squeezeteam@thesun.co.uk

CryptoCurrency

3 Dividend Stocks That Reward You Through Thick and Thin

This year, some notable companies have cut or eliminated their dividends. For example, former stalwarts Walgreens and 3M ended decades-long streaks of dividend growth with deep cuts to their payouts. It’s a situation that can make some investors want to give up altogether on income investing.

However, while some formerly reliable companies have disappointed investors on the dividend front in recent years, others have continued to make their payments no matter what. Enterprise Products Partners (NYSE: EPD), Oneok (NYSE: OKE), and NextEra Energy (NYSE: NEE) stand out to a few Fool.com contributors for their dividend stability. Here’s why you should consider adding them to your portfolio.

Enterprise Products Partners is built to pay you well

Reuben Gregg Brewer (Enterprise Products Partners): For 26 consecutive years, midstream energy giant Enterprise Products Partners has increased its distributions. That’s a huge commitment to its unitholders, but there’s more for income investors to like here than just the distribution history. It all starts with its master limited partnership structure, which is designed to pass income on to investors in a tax-advantaged manner. (A portion of the distribution is usually return of capital.) So down to its foundation, Enterprise is about paying its investors well.

Then, factor in its business model. Enterprise owns energy infrastructure like pipelines, storage, refining, and transportation assets that are vital to the energy sector’s operation. However, unlike other segments of the industry, the midstream segment is largely fee driven. Enterprise generates reliable cash flows based on the use of its assets, so the often-volatile prices of oil and natural gas don’t really have that big an impact on its financial results. Demand for energy, which is usually strong even when oil prices are weak, is the key determinant of Enterprise’s success.

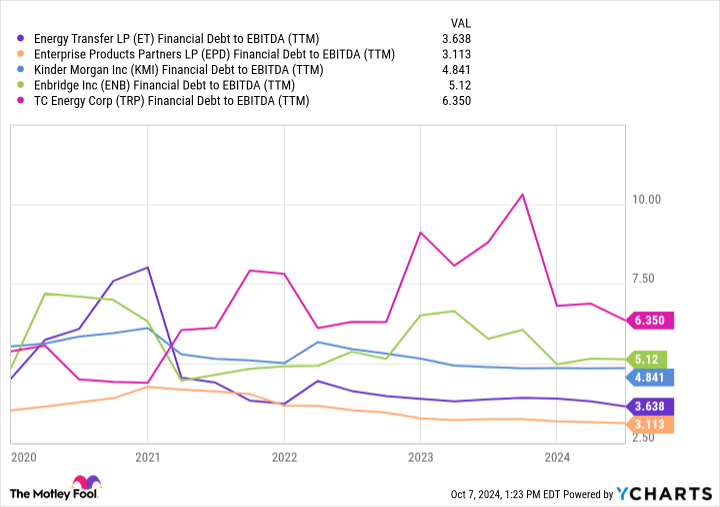

Then there’s the fact that Enterprise has an investment-grade rated balance sheet. Moreover, its leverage is normally toward the low end of its peer group, so it is conservative on both an absolute and relative basis. Lastly, the partnership’s distributable cash flow covers its distribution 1.7 times over.

All in all, a lot would have to go wrong before Enterprise Products Partners would need to cut its distribution. It is far more likely that it will continue to grow those disbursements, albeit slowly, as its capital investment plans pan out. But slow and steady distribution growth combined with a huge 7% yield will probably sound like music to most dividend investors’ ears.

Over a quarter century of growth and stability (and more growth coming down the pipeline)

Matt DiLallo (Oneok): Pipeline giant Oneok has proven its dividend durability over the decades. It has achieved more than a quarter century of dividend stability. While it hasn’t increased its payment every year during that period, it has a strong track record on payout hikes. Since 2013, Oneok has produced peer-leading total dividend growth of more than 150%. That’s impressive, considering that the world experienced two notable periods of oil price volatility during that period.

Oneoke has delivered sustainable earnings growth over the years. Its portfolio of pipelines and related midstream infrastructure generates predictable fees backed by long-term contracts and government-regulated rate structures. Its earnings grow as the volumes flowing through that infrastructure increase due to production growth, organic expansion projects, and acquisitions.

The company has been on an acquisition-fueled expansion binge in recent years. Last year, it bought Magellan Midstream Partners in a transformational $18.8 billion deal that increased its diversification and cash flow. The highly accretive deal will add an average of more than 20% to its free cash flow per share through 2027. That supports management’s view that Oneok will be able to grow its dividend by 3% to 4% annually during that period while also repurchasing shares and reducing its leverage ratio.

Oneok followed that up with a $5.9 billion deal to buy Medallion Midstream and a meaningful interest in EnLink Midstream this August. The transaction will be immediately accretive to its free cash flow and capital allocation strategy. After closing that deal, Oneok plans to buy the rest of EnLink, further boosting its cash flow per share. The company also expects to complete additional organic expansion projects, further enhancing its growth rate.

The midstream giant’s investments will help fuel its dividend growth for the next several years, even if there’s another market downturn. Those features make Oneok a great stock to buy for those seeking reliable dividends.

A steady dividend grower

Neha Chamaria (NextEra Energy): NextEra Energy, which has a yield of 2.6% at its current stock price, has rewarded its shareholders through thick and thin, and management is determined to continue doing so. The utility and clean energy giant has paid regular dividends for decades, but more importantly, increased them steadily over time. Between 2003 and 2023, the compound annual growth rate (CAGR) of NextEra Energy’s dividend was nearly 10%, backed by a 9% CAGR in its adjusted earnings per share (EPS) and an 8% CAGR in operating cash flow during the period.

NextEra Energy operates two businesses — Florida Power & Light Company (the largest electric utility in Florida) and clean energy company NextEra Energy Resources (the world’s largest generator of wind and solar energy). So while its regulated utility business generates stable cash flows, clean energy is where its growth largely comes from.

NextEra Energy expects its adjusted EPS to grow at an annualized rate of 6% to 8% through 2027, and expects annual dividend hikes of around 10% through 2026 as it pumps billions of dollars into both businesses.

More specifically, NextEra Energy plans to spend over $34 billion on Florida Power & Light between 2024 and 2027 and more than $65 billion on renewable energy over the next four years. That’s massive, and if done right, should steadily boost NextEra Energy’s earnings and cash flows to support bigger dividends for years, regardless of how the economy fares.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

-

Amazon: if you invested $1,000 when we doubled down in 2010, you’d have $21,022!*

-

Apple: if you invested $1,000 when we doubled down in 2008, you’d have $43,329!*

-

Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $393,839!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of October 7, 2024

Matt DiLallo has positions in 3M, Enterprise Products Partners, and NextEra Energy. Neha Chamaria has no position in any of the stocks mentioned. Reuben Gregg Brewer has positions in 3M. The Motley Fool has positions in and recommends NextEra Energy. The Motley Fool recommends 3M, Enterprise Products Partners, and Oneok. The Motley Fool has a disclosure policy.

Don’t Give Up on Dividends: 3 Dividend Stocks That Reward You Through Thick and Thin was originally published by The Motley Fool

CryptoCurrency

Could Buying SoundHound AI Now Be Like Buying Nvidia in 2023?

Nvidia‘s (NASDAQ: NVDA) stock has been an absolutely incredible performer recently. Since the start of 2023, it rose by more than 800%. Most investors would be thrilled to own a stock that delivered returns like that, but not every company has the potential. It requires a massive growth catalyst to justify such gains.

SoundHound AI (NASDAQ: SOUN) is one company that could have this potential. It’s a key player in one niche of the artificial intelligence (AI) sector, and has a massive backlog for its products.

SoundHound’s product is gaining momentum

SoundHound AI’s technology can parse human speech and perform various tasks based on what it hears. Among the ways it’s already being used most are in processing restaurant orders and improving digital assistants in vehicles, but its capabilities extend far beyond those two use cases.

In the automotive segment, SoundHound partnered with Stellantis; the giant automaker will integrate SoundHound’s tech into its vehicles across Europe and Japan. This will give people access to generative AI functions while they’re driving — an improvement from the voice assistants that are available on vehicles today. If SoundHound can win business with other automakers and break into other regions, this segment of its business alone could provide it with a huge amount of growth.

SoundHound also worked with several companies in the restaurant sector to automate telephone and drive-thru orders, which saves restaurants on wages. According to the company, these AI assistants actually outperform humans in terms of order speed and accuracy, so the customer doesn’t feel like the experience declined. Some of SoundHound’s restaurant customers, among them White Castle and Jersey Mike’s, are fairly big, but there’s serious room for it to grow if it can capture some of the largest fast-food businesses.

SoundHound AI could achieve even greater success if its solutions are utilized in new applications.

But is that potential enough to make its stock the next Nvidia?

Nvidia has one key advantage that SoundHound does not

In the second quarter, SoundHound generated $13.5 million in revenue, which was up 54% year over year. That’s quite small compared to other AI businesses.

However, the key figure investors should focus on is SoundHound’s backlog, which totals $723 million. This figure doubled from a year ago, showing that rising demand has outpaced SoundHound’s capability to integrate its product with its customers’ systems.

This is factoring into SoundHound’s current valuation, as Wall Street has high hopes for the company.

Trading at 23 times sales, SoundHound stock already carries a premium valuation. By contrast, Nvidia traded for around 15 times forward earnings at the start of 2023. That was a dirt-cheap price, and also a far cry from the forward earnings ratio of 47 it trades at today.

SoundHound already has a premium price tag, which detracts from its growth potential from here. But if it can mature into a business that generates $100 million in revenue per quarter, Nvidia-like performance for the stock is still possible.

If SoundHound achieved that and carried a valuation of 20 times sales, it would be worth $8 billion, up 370% from its market cap today. That would be a solid return, but still far less than what Nvidia produced.

SoundHound stock’s premium price tag may prevent it from delivering Nvidia-like returns from here, but that doesn’t mean it won’t be a great investment. However, it’s a bit of a long shot considering the niche use cases for its product and the company’s small size. It could make investors some serious money, but don’t expect Nvidia-like returns.

Should you invest $1,000 in SoundHound AI right now?

Before you buy stock in SoundHound AI, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and SoundHound AI wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $826,130!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of October 7, 2024

Keithen Drury has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia. The Motley Fool recommends Stellantis. The Motley Fool has a disclosure policy.

Could Buying SoundHound AI Now Be Like Buying Nvidia in 2023? was originally published by The Motley Fool

Money

Morrisons shoppers are just realising an axed chocolate bar is back on sale – but they’re all saying the same thing

MORRISONS shoppers are all saying the same thing about an axed chocolate bar that’s back on sale.

Mars rebranded the iconic bar in 1990 but it has returned to supermarket shelves for a limited time under the old name.

Marathon bars were renamed Snickers over 30 years ago to bring the branding in line with the US.

But Mars has launched a limited edition version of the bar with the old Marathon branding.

Shoppers have been able to pick up the bar, made up of nougat, caramel and nuts wrapped in milk chocolate, from Morrisons for the last few weeks.

A four-pack of the retro 41.7g bars costs £1.95.

But some, commenting on a recent Facebook post by the retailer, have only just realised – and they’re all saying one thing.

Morrisons’ post from yesterday reads: “Feeling nostalgic? The marathon bar is back and exclusive to Morrisons!

“Available in store and online. Limited stock, run don’t walk.”

Commenting on the post, plenty of shoppers have commented questioning the size of the limited edition bar.

One joked “are they the original size too?” while another commented “hope it’s gone back to the original size as well then”.

And a third quipped: “Are they the same original size or snack size.”

Snickers bars have massively shrunk in size since their launch in the UK in 1968.

Even between 2012 and 2017, data from the Office for National Statistics revealed the popular bar had gone from 58g to 45g in size – a 22% drop – while keeping the price the same.

The tactic, known as shrinkflation, has been used by other chocolate makers to keep their profits ticking over.

History of Snickers

Snicker’s history goes back almost 100 years to pre-World War Two times.

1930 – Snickers, named after a horse, launches for the first time in the USA for five cents.

1968 – Snickers launches in the UK under the name Marathon before being re-branded to Snickers in 1990.

2010 – The famous “You’re not you when you’re hungry” campaign and advert is created.

2019 – Snickers Crisps is launched combining puffed rice, chocolate, caramel and peanuts.

2021 – Snickers unveils its Creamy Peanut Butter flavour.

What is shrinkflation?

Shrinkflation is when manufacturers shrink the size or quantity of a product while keeping the price the same.

This means that consumers pay more per given amount.

Rising the price per gram is a strategy used by companies to stealthily boost profit margins or to cement them in times of rising production costs.

Companies will often engage in shrinkflation when their production costs begin to rise.

A heavy hit to profit margins may force the company to simply shrink its products rather than increase the price.

One of the best ways to notice shrinkflation is by spotting a redesign on the packaging or a new slogan.

This may mean the company has made a change and that change may just be the size of the product.

It is mainly seen in the food and beverage industries but can also happen in almost all markets.

It is a form of hidden inflation as shrinkflation often goes unnoticed by customers.

In recent weeks, pet owners have spotted that multipacks of Purina Felix Original cat food shrunk by 15%.

Popular milkshake makers Frijj has also been accused of milking customers by quietly shrinking the size of their milkshakes without slashing the price.

Do you have a money problem that needs sorting? Get in touch by emailing money-sm@news.co.uk.

Plus, you can join our Sun Money Chats and Tips Facebook group to share your tips and stories

CryptoCurrency

China warns EU against separate EV price negotiations

BEIJING (Reuters) -China urged the European Union on Saturday not to conduct separate negotiations over the price of China-made electric vehicles sold in the EU, warning that this would “shake the foundations” of bilateral tariff negotiations.

“If the European side, while negotiating with China, conducts separate price commitment negotiations with some companies, it will shake the foundation and mutual trust of the negotiations … and be detrimental to advancing the overall negotiation process,” China’s Ministry of Commerce said in comments published on its website.

It didn’t cite any evidence for the EU carrying out these separate talks beyond saying there had been “relevant reports”.

The comments come days after Brussels rejected a Chinese proposal for EVs made in China to be sold within the bloc at a minimum price of 30,000 euros ($32,000), a move Beijing hoped would avert EU tariffs being imposed next month.

Various manufacturers including European-owned companies in China have authorized the China Chamber of Commerce for Machinery and Electronics to propose a price commitment plan that represents the overall position of the industry, the commerce ministry said.

“This is the basis for the current China-EU consultations,” it added.

(Reporting by Eduardo Baptista; Editing by William Mallard and David Holmes)

CryptoCurrency

The bull market is 2 years old. Here’s where Wall Street thinks stocks go next.

The bull market in the S&P 500 (^GSPC) began two years ago and is showing few signs of slowing.

Backed by the rise of artificial intelligence euphoria and a surprisingly resilient US economy, the S&P 500 has gained more than 60% in the past two years and is hovering near an all-time high.

Wall Street strategists who spoke with Yahoo Finance believe the bull can keep running wild. Barring any unexpected shocks, the path higher appears to be clear, with earnings growth expected to keep accelerating and the economy on seemingly solid footing as the Federal Reserve cuts interest rates.

A bull market for the S&P 500 was officially declared in June 2023 when the index rose 20% from its recent bear market low. History says this bull market still has legs. At two years, the bull market is well shy of the average run of 5.5 years. And the total return thus far, about 60%, is a far cry from the average 180% gain, per research from Carson Group chief market strategist Ryan Detrick.

In the past few weeks, several Wall Street equity strategists have made the case for the benchmark index to rise further into both year-end and into 2025, supported by accelerating earnings for the S&P 500.

“We continue to be surprised by the strength of market gains and decided yet again that something more than an incremental adjustment was warranted,” BMO Capital Markets chief investment strategist Brian Belski wrote in a September note when raising his year-end price target for the S&P 500 to a Street high of 6,100 from a previous target of 5,600.

On Oct. 4, Goldman Sachs boosted its year-end target to 6,000 and initiated a 12-month target of 6,300. Goldman Sachs chief equity strategist David Kostin did note, though, that already high valuations could limit the upside for how far the index can reach in 2025.

Risks to the rally

Strategists who spoke with Yahoo Finance agreed with Kostin that already stretched valuations present a challenge to how much higher stocks can go. Charles Schwab senior investment strategist Kevin Gordon noted that dating back to the mid-1960s, the only time valuations have been this stretched on a trailing 12-month price-to-earnings ratio were 2021 and the dot-com bubble of the late 1990s.

“This would tell you that the bull is much older or somewhat near the end of this life,” Gordon said.

But strategists often warn that a high valuation itself isn’t a proper tool for calling the end of a bull market. Stocks can trade at what are considered to be expensive valuations for longer than expected. What that does tell investors is that much of the good news that could push stocks higher might’ve already been priced in.

“If you look at what the market’s discounting right now, we’d say front and center, a big chunk of what’s being priced in is a soft landing sentiment,” Citi equity strategist Scott Chronert told Yahoo Finance.

Piper Sandler chief investment strategist Michael Kantrowitz noted that high valuations themselves aren’t why bull markets end. There needs to be a catalyst. He explained there are two common reasons market drawdowns happen: a spike in interest rates or a rise in the unemployment rate.

With inflation well off the boil of 2022 and the recent increase in unemployment stalling out, neither of the two downside catalysts are clearly in view.

There could, of course, be a surprise no one sees coming. But “it’s a little bit harder to see where the shock comes from,” Chronert said. “If things continue to play out incrementally, investors can handle a little bit of a change [to the economic narrative] here, a little bit of a change there … It’s when you get a more immediate unraveling, and it’s hard to really say that immediate unraveling is going to come.”

This sets the market up for a narrative shift. To Kantrowitz, the currently expensive valuations show that the bull market is likely moving from a macro-driven environment, where factors like inflation falling and other signs of economic resilience have pushed stocks higher, to one that is more based on the fundamentals.

“For this market to continue moving higher, and particularly to determine what stocks lead, it’s going to be all about earnings,” Kantrowitz said.

The bar for earnings remains high. Consensus estimates project earnings to grow nearly 10% in 2024 and almost 15% in 2025. The key for investors remains finding which sectors are seeing earnings growth accelerate rather than just staying steady.

And , according to Chronert, part of that story could come down to the two letters that defined the first part of the bull market: AI.

Chronert, who said his team is still a holder of the “Magnificent Seven” tech cohort, doesn’t doubt that the AI narrative will continue to manifest itself in the market. But after significant gains seen in those tech stocks over the past two years amid large earnings growth, focus may continue to shift to the broadening impact of AI on companies that aren’t making the AI chips or the cloud servers operating the new technology.

For AI to continue to have broader impact on the market and keep pushing earnings growth for the index above expectations, “you’ve got to have more companies delivering on the AI promise via margins [and] profitability metrics,” Chronert said.

He added, “It would be that sort of thesis that has to play out, and that’s going to take two to five years.”

Josh Schafer is a reporter for Yahoo Finance. Follow him on X @_joshschafer.

Click here for in-depth analysis of the latest stock market news and events moving stock prices

Read the latest financial and business news from Yahoo Finance

CryptoCurrency

Scroll lists on Binance, sparking debate over centralization concerns

Scroll’s Binance listing has sparked community debate, with critics raising concerns about centralization, while Scroll’s co-founder has highlighted global growth strategies.

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoHyperelastic gel is one of the stretchiest materials known to science

-

Technology3 weeks ago

Technology3 weeks agoWould-be reality TV contestants ‘not looking real’

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoHow to unsnarl a tangle of threads, according to physics

-

Science & Environment3 weeks ago

Science & Environment3 weeks ago‘Running of the bulls’ festival crowds move like charged particles

-

Womens Workouts3 weeks ago

Womens Workouts3 weeks ago3 Day Full Body Women’s Dumbbell Only Workout

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoMaxwell’s demon charges quantum batteries inside of a quantum computer

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoLiquid crystals could improve quantum communication devices

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoQuantum ‘supersolid’ matter stirred using magnets

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoSunlight-trapping device can generate temperatures over 1000°C

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoITER: Is the world’s biggest fusion experiment dead after new delay to 2035?

-

News4 weeks ago

the pick of new debut fiction

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoHow to wrap your mind around the real multiverse

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoWhy this is a golden age for life to thrive across the universe

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoNerve fibres in the brain could generate quantum entanglement

-

News3 weeks ago

News3 weeks agoOur millionaire neighbour blocks us from using public footpath & screams at us in street.. it’s like living in a WARZONE – WordupNews

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoQuantum forces used to automatically assemble tiny device

-

Technology2 weeks ago

Technology2 weeks agoIs sharing your smartphone PIN part of a healthy relationship?

-

Science & Environment2 weeks ago

Science & Environment2 weeks agoX-rays reveal half-billion-year-old insect ancestor

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoA slight curve helps rocks make the biggest splash

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoTime travel sci-fi novel is a rip-roaringly good thought experiment

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoLaser helps turn an electron into a coil of mass and charge

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoPhysicists are grappling with their own reproducibility crisis

-

Business2 weeks ago

Eurosceptic Andrej Babiš eyes return to power in Czech Republic

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoNuclear fusion experiment overcomes two key operating hurdles

-

News4 weeks ago

News4 weeks ago▶️ Hamas in the West Bank: Rising Support and Deadly Attacks You Might Not Know About

-

News3 weeks ago

News3 weeks agoYou’re a Hypocrite, And So Am I

-

Sport3 weeks ago

Sport3 weeks agoJoshua vs Dubois: Chris Eubank Jr says ‘AJ’ could beat Tyson Fury and any other heavyweight in the world

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoCaroline Ellison aims to duck prison sentence for role in FTX collapse

-

News3 weeks ago

News3 weeks ago▶️ Media Bias: How They Spin Attack on Hezbollah and Ignore the Reality

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoA new kind of experiment at the Large Hadron Collider could unravel quantum reality

-

Business2 weeks ago

Should London’s tax exiles head for Spain, Italy . . . or Wales?

-

Technology2 weeks ago

Technology2 weeks ago‘From a toaster to a server’: UK startup promises 5x ‘speed up without changing a line of code’ as it plans to take on Nvidia, AMD in the generative AI battlefield

-

Football2 weeks ago

Football2 weeks agoFootball Focus: Martin Keown on Liverpool’s Alisson Becker

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoRethinking space and time could let us do away with dark matter

-

News4 weeks ago

News4 weeks agoNew investigation ordered into ‘doorstep murder’ of Alistair Wilson

-

News3 weeks ago

The Project Censored Newsletter – May 2024

-

Technology2 weeks ago

Technology2 weeks agoQuantum computers may work better when they ignore causality

-

MMA2 weeks ago

MMA2 weeks agoConor McGregor challenges ‘woeful’ Belal Muhammad, tells Ilia Topuria it’s ‘on sight’

-

Sport2 weeks ago

Sport2 weeks agoWatch UFC star deliver ‘one of the most brutal knockouts ever’ that left opponent laid spark out on the canvas

-

News3 weeks ago

News3 weeks agoIsrael strikes Lebanese targets as Hizbollah chief warns of ‘red lines’ crossed

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoA tale of two mysteries: ghostly neutrinos and the proton decay puzzle

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoFuture of fusion: How the UK’s JET reactor paved the way for ITER

-

Technology2 weeks ago

Technology2 weeks agoGet ready for Meta Connect

-

Business2 weeks ago

Ukraine faces its darkest hour

-

Health & fitness3 weeks ago

Health & fitness3 weeks agoThe secret to a six pack – and how to keep your washboard abs in 2022

-

Technology4 weeks ago

Technology4 weeks agoThe ‘superfood’ taking over fields in northern India

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoUK spurns European invitation to join ITER nuclear fusion project

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoWhy we need to invoke philosophy to judge bizarre concepts in science

-

News3 weeks ago

News3 weeks agoWhy Is Everyone Excited About These Smart Insoles?

-

Health & fitness2 weeks ago

Health & fitness2 weeks agoThe 7 lifestyle habits you can stop now for a slimmer face by next week

-

CryptoCurrency3 weeks ago

CryptoCurrency3 weeks agoCardano founder to meet Argentina president Javier Milei

-

Politics3 weeks ago

UK consumer confidence falls sharply amid fears of ‘painful’ budget | Economics

-

MMA3 weeks ago

MMA3 weeks agoRankings Show: Is Umar Nurmagomedov a lock to become UFC champion?

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoMeet the world's first female male model | 7.30

-

News3 weeks ago

News3 weeks agoFour dead & 18 injured in horror mass shooting with victims ‘caught in crossfire’ as cops hunt multiple gunmen

-

Womens Workouts3 weeks ago

Womens Workouts3 weeks ago3 Day Full Body Toning Workout for Women

-

Technology3 weeks ago

Technology3 weeks agoRobo-tuna reveals how foldable fins help the speedy fish manoeuvre

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoPhysicists have worked out how to melt any material

-

Health & fitness3 weeks ago

Health & fitness3 weeks agoThe maps that could hold the secret to curing cancer

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoBeing in two places at once could make a quantum battery charge faster

-

News4 weeks ago

News4 weeks agoHow FedEx CEO Raj Subramaniam Is Adapting to a Post-Pandemic Economy

-

CryptoCurrency3 weeks ago

CryptoCurrency3 weeks agoDecentraland X account hacked, phishing scam targets MANA airdrop

-

CryptoCurrency3 weeks ago

CryptoCurrency3 weeks agoLow users, sex predators kill Korean metaverses, 3AC sues Terra: Asia Express

-

Womens Workouts3 weeks ago

Womens Workouts3 weeks agoBest Exercises if You Want to Build a Great Physique

-

Womens Workouts3 weeks ago

Womens Workouts3 weeks agoEverything a Beginner Needs to Know About Squatting

-

TV3 weeks ago

TV3 weeks agoCNN TÜRK – 🔴 Canlı Yayın ᴴᴰ – Canlı TV izle

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoCNN TÜRK – 🔴 Canlı Yayın ᴴᴰ – Canlı TV izle

-

Servers computers2 weeks ago

Servers computers2 weeks agoWhat are the benefits of Blade servers compared to rack servers?

-

Technology2 weeks ago

Technology2 weeks agoThe best robot vacuum cleaners of 2024

-

News3 weeks ago

News3 weeks agoChurch same-sex split affecting bishop appointments

-

Politics3 weeks ago

Politics3 weeks agoTrump says he will meet with Indian Prime Minister Narendra Modi next week

-

Sport3 weeks ago

Sport3 weeks agoUFC Edmonton fight card revealed, including Brandon Moreno vs. Amir Albazi headliner

-

CryptoCurrency3 weeks ago

CryptoCurrency3 weeks agoEthereum is a 'contrarian bet' into 2025, says Bitwise exec

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoHow one theory ties together everything we know about the universe

-

Business4 weeks ago

JPMorgan in talks to take over Apple credit card from Goldman Sachs

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoQuantum time travel: The experiment to ‘send a particle into the past’

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoTiny magnet could help measure gravity on the quantum scale

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoMost accurate clock ever can tick for 40 billion years without error

-

CryptoCurrency3 weeks ago

CryptoCurrency3 weeks agoBitcoin miners steamrolled after electricity thefts, exchange ‘closure’ scam: Asia Express

-

CryptoCurrency3 weeks ago

CryptoCurrency3 weeks agoDorsey’s ‘marketplace of algorithms’ could fix social media… so why hasn’t it?

-

CryptoCurrency3 weeks ago

CryptoCurrency3 weeks agoDZ Bank partners with Boerse Stuttgart for crypto trading

-

CryptoCurrency3 weeks ago

CryptoCurrency3 weeks agoBitcoin bulls target $64K BTC price hurdle as US stocks eye new record

-

CryptoCurrency3 weeks ago

CryptoCurrency3 weeks agoBlockdaemon mulls 2026 IPO: Report

-

Business3 weeks ago

Thames Water seeks extension on debt terms to avoid renationalisation

-

Politics3 weeks ago

‘Appalling’ rows over Sue Gray must stop, senior ministers say | Sue Gray

-

CryptoCurrency3 weeks ago

CryptoCurrency3 weeks agoCoinbase’s cbBTC surges to third-largest wrapped BTC token in just one week

-

News2 weeks ago

News2 weeks agoUS Newspapers Diluting Democratic Discourse with Political Bias

-

Technology2 weeks ago

Technology2 weeks agoMicrophone made of atom-thick graphene could be used in smartphones

-

Technology3 weeks ago

Technology3 weeks agoiPhone 15 Pro Max Camera Review: Depth and Reach

-

News3 weeks ago

News3 weeks agoBrian Tyree Henry on voicing young Megatron, his love for villain roles

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoHow do you recycle a nuclear fusion reactor? We’re about to find out

-

CryptoCurrency3 weeks ago

CryptoCurrency3 weeks agoRedStone integrates first oracle price feeds on TON blockchain

-

CryptoCurrency3 weeks ago

CryptoCurrency3 weeks ago‘No matter how bad it gets, there’s a lot going on with NFTs’: 24 Hours of Art, NFT Creator

-

Business3 weeks ago

How Labour donor’s largesse tarnished government’s squeaky clean image

-

News3 weeks ago

News3 weeks agoBrian Tyree Henry on voicing young Megatron, his love for villain roles

-

Travel3 weeks ago

Travel3 weeks agoDelta signs codeshare agreement with SAS

-

Politics2 weeks ago

Politics2 weeks agoHope, finally? Keir Starmer’s first conference in power – podcast | News

-

Technology2 weeks ago

Technology2 weeks agoUniversity examiners fail to spot ChatGPT answers in real-world test

-

CryptoCurrency3 weeks ago

CryptoCurrency3 weeks agoLouisiana takes first crypto payment over Bitcoin Lightning

-

CryptoCurrency3 weeks ago

CryptoCurrency3 weeks agoCrypto scammers orchestrate massive hack on X but barely made $8K

You must be logged in to post a comment Login