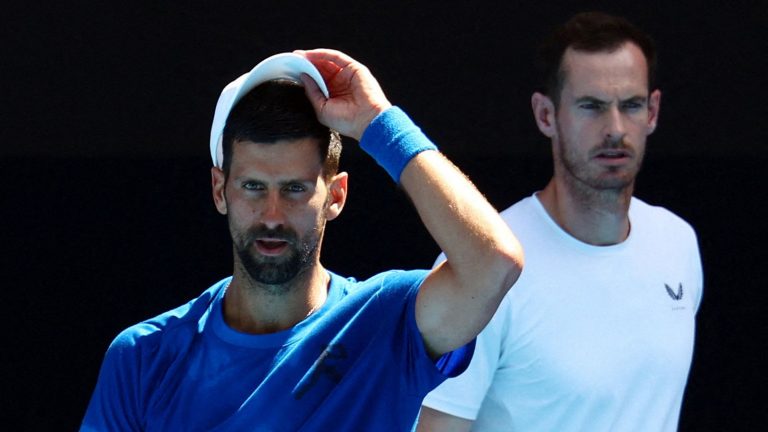

2025 Ram 2500 Heavy Duty

Ram

DETROIT — Stellantis has redesigned its large Ram heavy-duty trucks — and it’s betting those updates will help reverse three consecutive years of sales declines for the brand.

The new Ram 2500 and 3500 pickups and chassis cab trucks feature updated interior and exterior designs, as well as a new 6.7-liter Cummins turbo diesel engine that produces 430 horsepower and a best-in-class 1,075 foot-pounds of torque, according to the automaker.

The heavy-duty trucks are expected to arrive in U.S. dealers during the first quarter of this year and will sell for roughly $2,300 more than current models, starting at $47,560.

They follow the delayed rollout of their redesigned smaller sibling Ram 1500 pickup, which was released last year.

2025 Ram 3500 Heavy Duty

Ram

Ram CEO Tim Kuniskis, who returned to the automaker in December after retiring in May, said the rollout of the Ram 1500 is improving.

“It’s been super delayed, let’s be honest. We should have been fully launched up on that [1500] truck this summer. We should have had [the heavy-duty trucks] already,” Kuniskis said during a media event. “It’s getting better every day.”

Pickup trucks are crucial products for American brands such as Ram, which reported a 19% year-over-year decline in sales in 2024. That included a 16% drop in sales for its Ram pickup trucks. That compares with competitors such as Ford and GM‘s Chevrolet, which reported level sales in 2024 for their pickups.

2025 Ram 5500 Chassis Cab

Ram

“We’ve been getting our ass kicked,” Kuniskis said, noting the 1500 model rollout is largely to blame for the brand’s sales decline.

The diesel engine is an important option for heavy-duty truck customers, many of whom use the vehicles for hauling, towing and other work-related jobs. The other engine option is a 6.4-liter Hemi V-8 that delivers 405 horsepower and 429 foot-pounds of torque.

For 2025, the Ram Heavy Duty lineup includes Tradesman, Big Horn/Lone Star, Laramie, Rebel, Power Wagon, Limited Longhorn and Limited models. The trucks are built in Saltillo, Mexico.

2025 Ram 3500 Heavy Duty

Ram

+ There are no comments

Add yours