Uncategorised

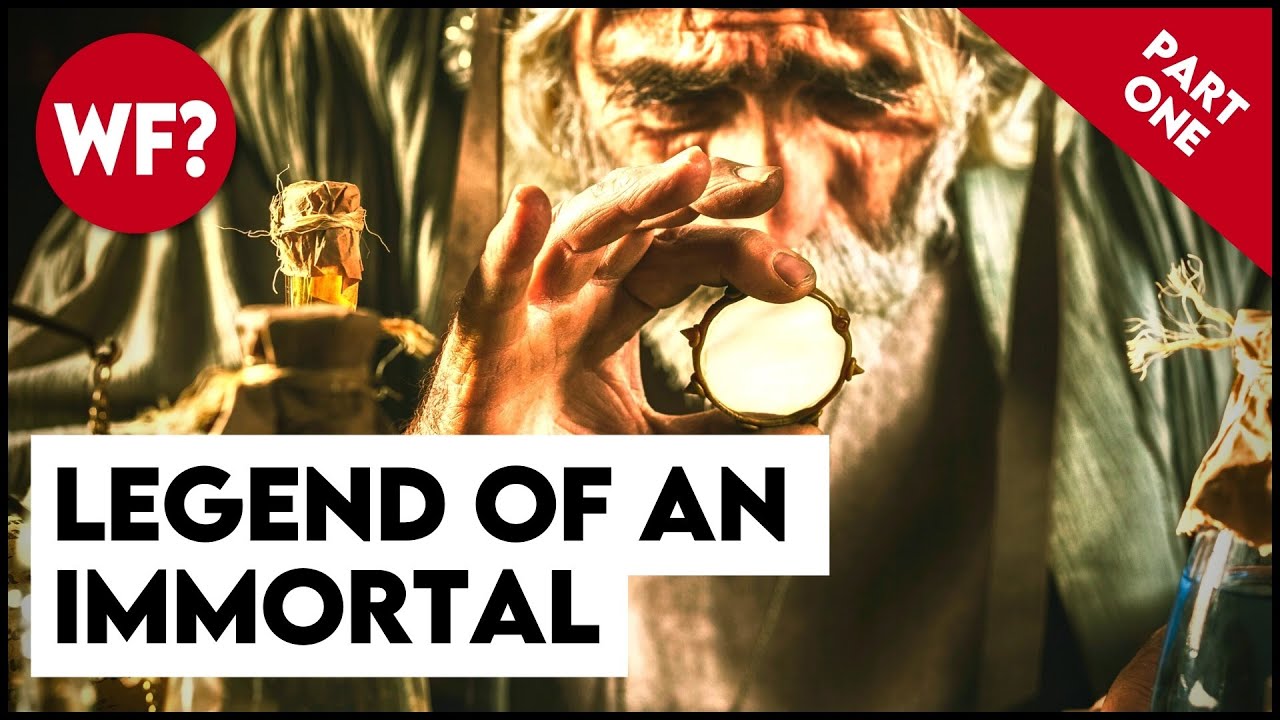

THE LEGEND of the Immortal: The Count of Saint Germain

CHASING THE IMMORTAL COUNT

The Count of Saint Germain has been called a prophet, a sorcerer, and an immortal.

He’s been spotted all over the world for a thousand years. And every time he’s seen, he looks exactly the same age.

The Count of Saint Germain advised Kings, Queens and Emperors. He was present at every significant event in European history. And even was an important contributor to America’s struggle for Independence.

He spoke a dozen languages fluently. He played piano and violin like a virtuoso.

He was an expert in art, science, politics, philosophy and history.

Some say he walked the earth during the time of Christ.

Some say he walks the earth still.

This is his story.

—-

👉 Part 1:https://www.youtube.com/watch?v=EZsihZg1EGs

👉 Part 2: https://www.youtube.com/watch?v=VJme28KSb6I

WHY IS THIS IN TWO PARTS?

👉https://www.youtube.com/watch?v=4hCdez_WlCc

Thank you Patreon members Jim H, Daniel M, Mauricio, EW, Bill H, Stella, Sal, Dalton, John G, Aaron C, Jacob S, Jason S, Christy and Erik A, Steven S, Hockey, Kalmar, Moon Raker, Patrick I, Mikey2ky, Laura G, All Canadian Reptile Girl, Uncle Michael, Brian N, Robin L (Black Belt!), Grace Cupcake, Lost Pilot

〰

🙏 SUPPORT THE WHY FILES

🙏 https://www.patreon.com/thewhyfiles (Fun, Free Perks!)

👽 BUY WHY FILES MERCH

👽 https://shop.thewhyfiles.com (Code: LIZZIDPEEPLE for 10% off first order)

💬 CHAT WITH US ON DISCORD

💬 https://thewhyfiles.com/discord

〰

🌐 OFFICIAL WEB SITE: https://thewhyfiles.com

🕵️ Submit a topic, suggestion or just say hi:

🕵️ https://thewhyfiles.com/tips

🎨 Have a product suggestion or want to design artwork for TWF?

🎨 https://thewhyfiles.com/merch

📸 BE A WHY FILES MODEL (and get free stuff!)

📸 Send a photo of you/family/friends watching TWF,

📸 wearing TWF gear, using TWF merchandise:

📸 https://thewhyfiles.com/wild

〰

🎧 THE PODCAST VERSION

🎧 https://thewhyfiles.com/podcast

〰

⁍ TWF on SOCIAL (in order of importance)

⁍ https://www.reddit.com/r/TheWhyFiles/

⁍ https://twitter.com/OMGTheWhyFiles

⁍ https://www.instagram.com/OMGTheWhyFiles

⁍ https://www.tiktok.com/@thewhyfiles

⁍ https://www.facebook.com/OMGTheWhyFiles

〰

🐠 BETTER CHANNELS TO WATCH:

🐠 https://www.youtube.com/c/HecklefishMoriarty

🤓 https://www.youtube.com/c/TheWhyFilesBackstage

—-

SOURCES & LINKS

https://www.wikiwand.com/en/Wandering_Jew

Letters of Horace Walpole:

https://www.gutenberg.org/files/12073/12073.txt

Casanova’s memoirs:

https://www.gutenberg.org/files/2981/2981-h/2981-h.htm#linkC2HCH0003

#unsolvedmysteries #immortality #urbanlegend

source