Crypto World

Franklin Templeton to Let Tokenized Money Funds Back Binance Trades

Global investment manager Franklin Templeton announced the launch of an institutional off‑exchange collateral program with Binance that lets clients use tokenized money market fund (MMF) shares to back trading activity while the underlying assets remain in regulated custody.

According to a Wednesday news release shared with Cointelegraph, the framework is intended to reduce counterparty risk by reflecting collateral balances inside Binance’s trading environment, rather than moving client assets onto the exchange.

Eligible institutions can pledge tokenized MMF shares issued via Franklin Templeton’s Benji Technology Platform as collateral for trading on Binance.

The tokenized fund shares are held off‑exchange by Ceffu Custody, a digital asset custodian licensed and supervised in Dubai, while their collateral value is mirrored on Binance to support trading positions.

Franklin Templeton said the model was designed to let institutions earn yield on regulated money market fund holdings while using the same assets to support digital asset trading, without giving up existing custody or regulatory protections.

Related: Franklin Templeton expands Benji tokenization platform to Canton Network

“Our off‑exchange collateral program is just that: letting clients easily put their assets to work in regulated custody while safely earning yield in new ways,” said Roger Bayston, head of digital assets at Franklin Templeton, in the release.

The initiative builds on a strategic collaboration between Binance and Franklin Templeton announced in 2025 to develop tokenization products that combine regulated fund structures with global trading infrastructure.

Off‑exchange collateral to cut counterparty risk

The design mirrors other tokenized real‑world asset collateral models in crypto markets. BlackRock’s BUIDL tokenized US Treasury fund, issued by Securitize, for example, is also accepted as trading collateral on Binance, as well as other platforms, including Crypto.com and Deribit.

That model allows institutional clients to post a low-volatility, yield‑bearing instrument instead of idle stablecoins or more volatile tokens.

Other issuers and venues, including WisdomTree’s WTGXX and Ondo’s OUSG, are exploring similar models, with tokenized bond and short‑term credit funds increasingly positioned as onchain collateral in both centralized and decentralized markets.

Related: WisdomTree’s USDW stablecoin to pay dividends on tokenized assets

Regulators flag cross‑border tokenization risks

Despite the trend of using tokenized MMFs as collateral, global regulators have warned that cross‑border tokenization structures can introduce new risks.

The International Organization of Securities Commissions (IOSCO) has cautioned that tokenized instruments used across multiple jurisdictions may exploit differences between national regimes and enable regulatory arbitrage if oversight and supervisory cooperation do not keep pace.

Cointelegraph asked Franklin Templeton how the tokenized MMF shares are regulated and protected and how the model was stress‑tested for extreme scenarios, but had not received a reply by publication.

Magazine: Getting scammed for 100 Bitcoin led Sunny Lu to create VeChain

Crypto World

Sam Bankman-Fried Seeks FTX Retrial Citing Fresh Testimony

FTX founder Sam Bankman-Fried is legally challenging his 25-year sentence, filing a motion for a new trial on February 10.

The thirty-three-year-old cites “fresh testimony” that allegedly proves the defunct exchange was solvent.

The filing potentially throws a spanner in the liquidation process, with the claim that the Department of Justice suppressed critical evidence during the original proceedings.

Why Is Bankman-Fried Seeking a New FTX Trial Now?

It has been years since FTX’s November 2022 collapse wiped out $8 billion in customer funds.

Since then, self-custody has become a buzzword for retail investors, who have had to live through multiple bear markets while US regulators prepare comprehensive legislation to ensure it doesn’t happen again.

However, SBF isn’t done fighting. Serving a 25-year sentence, the disgraced mogul filed a pro se motion citing Rule 33 of the Federal Rules of Criminal Procedure.

Bankman-Fried argues that his original conviction was a miscarriage of justice because key witnesses never took the stand.

While global enforcement efforts often successfully target financial malfeasance through standard audits, SBF contends the DOJ’s rapid prosecution missed the actual financial reality of FTX.US.

He maintains that the money was “always there,” a claim he intends to support with evidence that was allegedly unavailable during his initial defense.

What the New Motion Claims

The new filing specifically hinges on declarations from Daniel Chapsky, the former head of data science at FTX.US.

According to the motion, Chapsky’s data analysis contradicts the government’s narrative regarding the $8 billion shortfall.

Bankman-Fried also points to potentially favorable testimony from former co-CEO Ryan Salame, who is currently serving a seven-and-a-half-year sentence.

In the legal documents filed Feb. 10, Bankman-Fried alleges that prosecutors intimidated witnesses and that Judge Lewis Kaplan showed “manifest prejudice” by rushing the verdict. He is demanding a new judge for any retrial, framing the original proceedings as politically motivated “lawfare”.

While the industry has largely shifted toward a compliance-focused market structure to prevent another FTX-style meltdown, SBF argues the DoJ prevented him from showing the jury data that proved solvency.

Legal experts note that Rule 33 motions face an incredibly high bar, often viewed as a “Hail Mary” in federal appeals.

What This Means for Crypto Regulation

While a retrial is statistically unlikely, the motion keeps the FTX wounds fresh for active traders and victims awaiting restitution.

The persistence of the case highlights the long-term risks of offshore exchange failures.

Regulators are likely to use this continued legal drama to justify stricter oversight. We are already seeing similar crackdowns globally, such as when Venezuela’s anti-corruption investigation shut down exchanges in a massive sweep.

For the market, this serves as a stark reminder that the legal fallout from the 2022 crash is far from over, even as prices recover.

Discover:

The post Sam Bankman-Fried Seeks FTX Retrial Citing Fresh Testimony appeared first on Cryptonews.

Crypto World

White House Stablecoin Talks Stall as Banks Push for Yield Restrictions

High-stakes negotiations between U.S. banking giants and crypto executives at the White House hit a wall yesterday, ending in an impasse over stablecoin yields.

Banks demanded restrictive “prohibition principles” on holder rewards, while crypto leaders argued such bans would suffocate innovation in the digital dollar economy.

Key Takeaways

- Banks are pushing for a broad ban on all financial and non-financial benefits tied to holding payment stablecoins.

- Crypto firms, including Coinbase and Ripple, rejected the proposals, warning they would stifle competition.

- Treasury Secretary Scott Bessent faces a hard deadline of July 2026 to finalize GENIUS Act implementation rules.

Will Banking Interests Kill the Yield?

The core friction stems from the implementation of the GENIUS Act, signed in July 2025, which aims to regulate stablecoin issuance while insulating traditional banking deposits.

Banks argue that interest-bearing stablecoins threaten their liquidity models, essentially fearing a massive deposit drain if users can earn higher yields on-chain.

This regulatory tug-of-war highlights the industry’s shift toward a compliance-focused market where regulatory pressures now dictate project viability.

The White House Crypto Policy Council is scrambling to find common ground. Yesterday’s meeting was the second this month. With lawmakers and the industry hoping to finalize rules by the midterm elections this November, the clock is ticking.

Banks are effectively trying to firewall their deposit base from digital competitors, a move that could neuter the competitive advantage of non-bank stablecoin issuers.

Discover: The next crypto to explode in 2026

Inside the Closed-Door Battle at the White House

According to a document presented by the banking side during the session, which included Goldman Sachs and JPMorgan Chase, the banks laid out strict “prohibition principles.”

These principles call for a total ban on any benefits, financial or otherwise, tied to holding or using payment stablecoins. Attendees noted that banks took a hard line, demanding enforcement measures that go well beyond the current draft of the market structure bill.

While current legislative drafts generally bar passive yield, banks want to crush even limited activity-based rewards.

Crypto stakeholders, including the Blockchain Association and Ripple, reportedly “dug in” against these demands.

The banking sector insists that exemptions for stablecoin rewards must be extremely narrow in scope, leaving little room for the types of incentive programs that drive DeFi adoption.

Discover: New cryptocurrencies to invest in today

Implications for the Market

If these restrictions hold, the U.S. risks stifling the very innovation the GENIUS Act was meant to legitimize.

Investors should watch the July deadline closely; failure to compromise could force a capital to flee to jurisdictions with clearer, pro-yield frameworks.

Just as Venezuela’s anti-corruption investigation rocked its local crypto industry with aggressive shutdowns, a heavy-handed U.S. ban on stablecoin yields could severely impact domestic liquidity.

While banks aim to protect their deposit base from disruption, the crypto market views yield as a fundamental feature, not a bug.

If the banks win this round, the utility of U.S.-regulated stablecoins could be capped at simple transaction rails, stripping them of their investment potential.

Discover: February’s best crypto presales

The post White House Stablecoin Talks Stall as Banks Push for Yield Restrictions appeared first on Cryptonews.

Crypto World

JPMorgan among those cutting price targets following Q4 miss

Robinhood (HOOD) shares slumped 10% in early trading on Wednesday after fourth-quarter revenue missed estimates, with a decline in crypto trading impacting results.

The popular trading app reported fourth-quarter earnings per share of $0.66, beating expectations of $0.63. However, revenue came in at $1.28 billion, below the $1.33 billion analysts had forecast.

A downturn in crypto trading weighed heavily on results, with crypto revenue dropping 38% year over year to $221 million.

Wall Street bank JPMorgan cut its price target on Robinhood to $113 from $130 following the softer-than-expected fourth quarter, while maintaining a neutral rating and warning that tougher 2025 comps raise the bar for 2026.

That new price target still represents potential upside of more than 50% from the current price of $76.50.

Transaction revenue of $776 million fell short, driven by a drop in crypto revenue to $221 million amid a late-year slide in digital asset markets. Net interest revenue of $411 million also missed the bank’s estimates, pressured by weaker securities lending and lower yields.

While January volumes have improved year over year, the bank’s analysts, led by Kenneth Worthington, said growth is moderating across key metrics, prompting the bank to trim top-line forecasts and lower its price target.

Compass Point’s Ed Engel took a more constructive view, though also cutting his price target to $127 from $170 while reiterating a Buy rating. He noted that Robinhood’s January KPIs showed solid momentum across all segments — including better-than-feared crypto volumes — despite the weak fourth quarter. However, a 9% EBITDA miss, driven by lower securities lending and declining take rates in crypto and options trading, weighed on results.

The most surprising detail, Engel said, was Robinhood’s 2026 operating expense guidance of 18% growth. He expects spending to fund product expansion in areas such as crypto, DeFi, and prediction markets, which could pay off in the second half of 2026. Until then, however, investors may lower EBITDA expectations.

He pointed to internalization of prediction markets, a potential Trump-related user bump, and possible mega-IPOs from SpaceX, Anthropic or OpenAI as longer-term tailwinds.

He also flagged that Robinhood’s crypto take rate declined by 3 bps quarter-over-quarter in the fourth quarter and has fallen an additional 5 bps in so far in 2026 as higher-volume traders make up a larger share of the mix.

Engel: “In the near-term, we could see investors penalize HOOD for the higher spending, but sentiment could rebound by mid-2026 as investment ROIs begin to materialize.”

Read more: Robinhood misses Q4 revenue estimates as fourth-quarter results dinged by crypto slump

Crypto World

Fragile Optimism in Crypto as ETF Flows Return

Spot Bitcoin ETFs added $145 million, Ethereum saw $57 million inflows, signaling fragile optimism after a sharp crypto sell-off.

Even though they were trading at around $68,000 and $1,980, respectively, at the time of writing, Bitcoin and Ethereum bounced yesterday after sharp sell-offs, with BTC reaching $71,000 and ETH climbing to $2,150 following the resumption of spot ETF inflows.

The rebound renewed speculation that BTC may have established a local floor, but traders are also bracing for today’s Non-Farm Payroll (NFP) report and Friday’s Consumer Price Index (CPI) release, two data points that could reset Federal Reserve rate expectations and determine whether the rally holds.

ETF Flows Turn Positive, But On-Chain Data Signals Volatility Ahead

In its latest market update, digital asset trading firm QCP noted that spot Bitcoin ETFs recorded $145 million in net inflows yesterday, building on Friday’s $371 million. Spot ETH ETFs also reversed course with $57 million in net inflows after three days of red.

The shift follows a period of intense selling pressure that recently drove BTC to around $60,000, its lowest level since before the November 2024 U.S. elections.

Despite the inflows, on-chain data suggests market participants are preparing for continued turbulence. For example, CryptoQuant contributor CryptoOnchain reported that on February 6, over 7,000 BTC moved from Binance to other spot exchanges, making it the second-highest daily volume in the past year.

At the same time, the seven-day moving average of flows from Binance to derivative exchanges spiked to 3,200 BTC, the highest level since January 2024. The analyst interpreted the migration of funds to derivative platforms as a sign that large holders are either hedging downside risk or positioning for sharp price swings.

Meanwhile, QCP market watchers revealed that the Coinbase BTC discount has narrowed from approximately 20 basis points to 9 basis points, signaling a moderation in U.S.-led selling. But the Crypto Fear & Greed Index remains at 9, deep in “extreme fear” territory, with the trading firm describing conditions as “thin ice that happens to be holding.”

You may also like:

Historical Context and On-Chain Trends

Bitcoin’s correction has drawn the broader market lower, with the OG cryptocurrency dipping below $67,000 and altcoins such as ETH, XRP, and BNB losing significant ground. The total crypto market capitalization has fallen to $2.36 trillion, shedding over $50 billion in daily value. Still, not all assets have mirrored this decline, as the likes of XMR gained 3%, while ZRO entered the top 100 following a 20% surge.

Unlike previous cycles, this downturn has avoided major systemic failures. Chainlink co-founder Sergey Nazarov pointed out on February 10 that real-world assets (RWAs) on the blockchain are expanding despite price volatility, with institutional interest sustained by technological advantages and 24/7 markets.

While the market looks for big economic changes, the increase in ETF investments provides some hope, but QCP warns that past price changes and how derivatives are set up mean traders should be careful and manage risks wisely.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Why XRP Could Still Dip Below $1, Analysts Explain

XRP (CRYPTO: XRP) has retraced nearly 63% from its multi-year high of $3.66 to around $1.36 as of Wednesday, a move that market analysts say could carry bearish implications unless buyers reassert themselves. The slide comes amid a confluence of technical signals and growing on-chain activity that could either reinforce a near-term downshift or set the stage for a stubborn reversal. Traders are weighing a technical setup that points toward further pressure against a backdrop of sustained demand from spot XRP ETFs and persistent whale accumulation, painting a nuanced picture for the digital asset’s near-term trajectory. The Gaussian Channel, a charting method used to identify trends and potential support or resistance levels, places XRP at a crossroads where previous patterning has often dictated the tempo of subsequent moves.

Key takeaways

- The price action has broken below a critical zone near $1.40, aligning with a bearish setup that could extend losses toward the $0.70–$1 range if support fails.

- The Gaussian Channel shows the upper regression band near $1.16 and the middle band around $0.70, suggesting that a test of important structural levels could unfold over the coming weeks or months.

- A drop below the local low of $1.12 would validate the bearish scenario described by market technicians, potentially accelerating the downside case.

- Spot XRP ETF inflows have continued, with cumulative net inflows reaching about $1.01 billion and inflows of roughly $3.26 million on a single day, underscoring ongoing institutional interest.

- On-chain activity has picked up, with whale transactions exceeding $100,000 and active addresses surging to a six-month high, signaling that buyers remain engaged despite the price decline.

- Nevertheless, persistent ETF demand and on-chain signals could counterbalance the technical headwinds if liquidity conditions remain favorable and market sentiment improves.

Tickers mentioned: $XRP, $BTC, $ETH

Sentiment: Bearish

Price impact: Negative. A break below key supports could push XRP toward the mid-band around $0.70, extending the downside unless buyers step in.

Trading idea (Not Financial Advice): Hold. Near-term risk remains elevated if $1.12 fails, but renewals in ETF inflows and on-chain activity keep the scene cautiously balanced.

Market context: The XRP market remains closely tethered to liquidity flows from spot XRP ETFs and evolving on-chain activity. Spot XRP ETF inflows have continued, contributing to roughly $1.01 billion in cumulative net inflows and sustaining roughly $1.01 billion in assets under management, with daily inflows of millions that underscore ongoing institutional interest. At the same time, on-chain dynamics have shown resilience, with whale activity and active addresses rising even as price action remains under pressure. These factors collectively reflect a broader environment where ETF-driven demand can offset, at least temporarily, technical headwinds.

Why it matters

For investors watching XRP, the current setup matters because it juxtaposes a stubborn price decline with stubborn liquidity support. The Gaussian Channel’s readings imply that XRP could oscillate within a defined corridor before a decisive breakout or breakdown occurs. If the upper band near $1.16 acts as a temporary ceiling and the price fails to hold above the lower levels, the drawdown could extend toward the $0.70–$1 region, a zone that previously lacked robust testing for sustained support. Such a breach would be meaningful not just for XRP bulls and bears but for funds and institutions tracking the asset as part of broader crypto exposure. The dynamics of ETF flows, as observed in late-2025 through 2026, emphasize that institutional demand can create a buffer against rapid declines, but they are not a guarantee against further losses if macro conditions or sentiment deteriorate.

“The middle regression band currently ties up around $0.70, which is also a previous year-long resistance level seen back in 2023/2024, and hasn’t been backtested for support.”

On the liquidity side, the market has benefitted from a steady stream of ETF inflows. The Canary XRP ETF launch, which began late in 2025, has contributed to a trajectory of inflows that has pushed the cumulative total higher, with the latest daily inflows evidencing continued demand from institutional players. This flow is not a panacea for price declines, but it argues for a more nuanced outlook than a pure technical read would suggest. Meanwhile, on-chain metrics paint an equally important portrait. Analysts have highlighted a surge in XRP activity: whale transactions of over $100,000 and a spike in active addresses have suggested that sector participants remain engaged and are deploying capital despite adverse price movements. These signals can be precursors to a bottom or a renewed uptrend, depending on whether they align with broader market liquidity and risk appetite.

Analysts have also cited the importance of the price level around $1.12. A move below that local low could be a technical confirmation of the bearish scenario, triggering a cascade of downside protections and prompting a reevaluation of risk parity in XRP portfolios. Conversely, if ETF inflows persist and on-chain activity maintains its strength, XRP could find a foundation and attempt a staged recovery as liquidity conditions improve and risk sentiment stabilizes. The tension between price-driven momentum and liquidity-driven demand is a defining feature of XRP’s current phase, and market participants are closely watching both channels for signals of the next major move.

As the market weighs these factors, the broader crypto environment remains cautious. The behavior of BTC and ETH—often a barometer for risk sentiment—has a bearing on how XRP will respond to developing macro cues and regulatory dynamics. Although XRP has decoupled at times from the broader market, the path of least resistance in the near term could be influenced by the balance between selling pressure at technical resistance and fresh inflows that sustain institutions’ appetite for XRP exposure.

What to watch next

- Monitoring XRP’s level relative to the $1.12 local low to gauge whether the bearish scenario gains traction.

- Tracking the Gaussian Channel bands around $1.16 (upper) and $0.70 (middle) for potential testing or breakout signals.

- Observing ongoing spot XRP ETF inflows and AUM, which could widen the collision between technical resistance and liquidity-driven strength.

- Watching on-chain metrics, especially the trajectory of whale transactions and daily active addresses, for signs of renewed accumulation or distribution.

Sources & verification

- Chart Nerd’s analysis on Gaussian Channel fractals and XRP price projections referenced in a social post.

- Discussion on XRP price movement below the 1.60 level and potential downside scenarios.

- Canary XRP ETF launch and the resulting inflow data, including cumulative inflows and daily inflows feeding assets under management.

- Santiment’s reports on whale activity, large XRP transactions, and address activity as a measure of on-chain demand.

Market reaction and key details

The current XRP setup binds a bear-case price scenario to a backdrop of ongoing ETF inflows and active on-chain participation. While the price remains under pressure, the inflows into spot XRP ETFs and sustained whale engagement provide a counterbalancing force that could underpin a bottom if liquidity remains ample and risk appetite stabilizes. The path forward will likely hinge on whether XRP can stabilize above critical support levels and whether on-chain signals translate into durable buying interest.

What to watch next

- Whether XRP can hold above $1.12 on a closing basis, which would delay a deeper pullback.

- How ETF inflows trend over the next several sessions and whether AUM surpasses the $1.05–$1.10 billion range.

- Any new regulatory or product developments affecting XRP ETFs or custodial structures that could influence liquidity and investor confidence.

Crypto World

Stablecoin Conversion Costs Highest in Africa, Data Shows

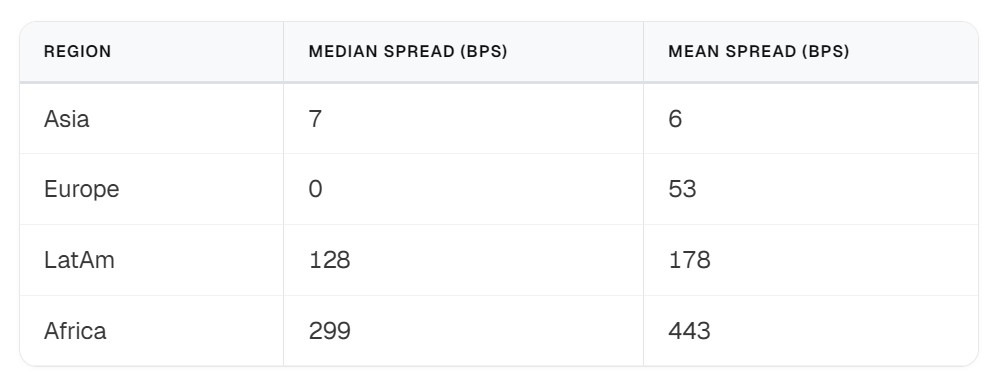

Africa recorded the highest median stablecoin-to-fiat conversion spreads among tracked regions in January, according to data observed by payments infrastructure company Borderless.xyz, covering 66 currency corridors and nearly 94,000 rate observations.

The regional median spread was 299 basis points, or about 3%, compared with roughly 1.3% in Latin America and 0.07% in Asia. In Africa, conversion costs ranged from about 1.5% in South Africa to nearly 19.5% in Botswana.

The data measures “spreads,” or the gap between a provider’s buy and sell rate for a stablecoin-to-fiat pair. Similar to a bid-ask spread in traditional markets, it reflects the execution cost paid when converting stablecoins into local fiat currency.

The findings suggest that while stablecoins are promoted as a cheaper alternative to traditional remittance rails, actual costs vary widely across African markets and appear closely tied to local provider competition and liquidity.

Competition drives pricing gaps

Borderless.xyz found that markets with several competing providers generally had conversion costs between about 1.5% and 4%. In markets with only one provider, costs often exceeded 13%.

Botswana recorded the highest median conversion cost in January at 19.4%, though pricing improved later in the month. Congo’s costs were also above 13%. By contrast, South Africa, which has a more competitive foreign exchange market, showed costs of about 1.5%.

The report suggested that these differences are driven primarily by local market conditions, such as liquidity and competition, rather than the underlying blockchain technology. In countries where multiple providers operate, conversion costs stayed closer to the regional average.

Related: Uganda opposition leader promotes Bitchat amid fears of internet blackout

Stablecoins versus traditional foreign exchange

The report also compares stablecoin mid-rates with traditional interbank foreign exchange rates, measuring what it calls the “TradFi premium.”

This metric reflects whether stablecoin exchange rates are cheaper or more expensive than traditional FX mid-market rates.

Across 33 currencies globally, the median difference between stablecoin exchange rates and traditional mid-market foreign exchange rates was about 5 basis points, or 0.05%, indicating the two were largely in line.

In Africa, the median gap was wider at roughly 119 basis points, or about 1.2%, though the difference varied significantly depending on the country.

On Jan. 24, economist Vera Songwe said at the World Economic Forum in Davos that stablecoins are helping reduce remittance costs across Africa, where traditional transfer services can charge about $6 per $100 sent.

The new data adds context, suggesting that while stablecoins offer faster settlement and potential savings compared with legacy services, conversion costs within specific corridors remain elevated.

Magazine: Hong Kong stablecoins in Q1, BitConnect kidnapping arrests: Asia Express

Crypto World

BTC trims losses following strong January employment report

U.S. jobs growth sizably strengthened in the first month of 2026.

There were 130,000 jobs added in January, according to a Wednesday report from the Bureau of Labor Statistics. Economist forecasts had been for 70,000 jobs added, up from jobs growth of 48,000 in December.

The unemployment rate fell to 4.3% versus forecasts for 4.4% and December’s 4.4%.

Trading in a tight range close to $69,000 for much of the week, bitcoin had dipped back to the $67,000 area in the hours prior to the report. In the immediate aftermath of the strong data, bitcoin rose to $67,500, though still down 2% over the past 24 hours.

U.S. stock index futures are continuing with modest gains, the Nasdaq 100 higher by 0.55% and S&P 500 by 0.5%. Lower earlier, the dollar is now higher on the session, and the 10-year U.S. Treasury yield has jumped five basis points to 4.20%.

After having cut rates multiple times in the second half of 2025, the Federal Reserve held policy steady at its January meeting, and members showed little inclination to resume rate cuts at the bank’s next meeting in March.

Ahead of this morning’s job numbers, interest rate traders were placing just 21% chances of a March easing, according to CME FedWatch. Just following the report, those chances had dipped to 19%.

Crypto World

Ethena-backed suiUSDe stablecoin goes live on Sui with $10 million yield vault launch

The Ethena-backed eSui Dollar (suiUSDe) has launched on Sui Mainnet, expanding the network’s stablecoin offerings and introducing the network’s first synthetic dollar to onchain trading and yield infrastructure, the Sui Foundation said in a blog post Wednesday.

The rollout also brings suiUSDe to DeepBook Margin, where it becomes the first synthetic dollar supported by the trading system.

Alongside the launch, SUI Group Holdings seeded a newly launched suiUSDe vault with $10 million, marking one of the largest initial stablecoin deployments on Sui to date.

The permissionless vault, operated by Ember Protocol and incubated by the Bluefin team, is designed to provide stablecoin-based yield to both institutional and retail participants. The vault has an initial capacity of $25 million, SUI Group said in a separate press release Thursday.

Despite broad market weakness and waves of forced liquidations across crypto, decentralized finance’s total value locked (TVL) has held up, suggesting traders continue to seek yield and passive income even as bearish sentiment weighs on the market.

Read more: Bitcoin and ether are tanking, but DeFi investors are refusing to cave to the panic

Synthetic dollars like suiUSDe are designed to function as onchain market infrastructure rather than tokenized claims on offchain cash. Unlike fiat-backed stablecoins, which typically move between venues as a neutral unit of account, synthetic dollars are built to operate natively inside trading and risk systems.

Because they are part of the market itself, synthetic dollars can integrate directly with margin engines, liquidation logic and reward mechanisms. That allows them to act as active collateral and liquidity drivers, rather than passive settlement assets.

Demand for that model has grown alongside the rise of yield and leverage-focused strategies, where users want capital efficiency and exposure in a single instrument. Ethena’s rapid growth has demonstrated that appetite, and bringing a similar structure to Sui extends it into a high-performance, programmable environment.

DeepBook Margin, unveiled last month, is a key piece of that shift. By embedding margin trading directly into the liquidity layer, it allows synthetic dollars like suiUSDe to be used natively for leveraged trading, risk management and rewards within a single execution venue.

“Launching the Ethena-backed suiUSDe was about establishing native, reliable dollar infrastructure on Sui,” said Marius Barnett, Chairman of SUI Group, in the release. “Seeding the suiUSDe Vault with $10 million is how we move that infrastructure into active use,” he added.

SuiUSDe was developed in collaboration with Ethena Labs and was first announced in the fourth quarter of 2025. With its mainnet debut, the asset is now available across multiple Sui-based protocols, including Aftermath, Bluefin, Cetus, Navi, Scallop, Suilend and others, broadening its use in trading, lending and yield strategies.

Sui is a layer-1 blockchain developed by Mysten Labs, designed to support high-throughput transactions and programmable onchain assets.

Read more: Sui Group charts new course for crypto treasuries with stablecoins and DeFi

Crypto World

130k jobs in January, but there were massive revisions

U.S. employers added 130,000 jobs in January, far exceeding expectations and signaling a rebound in hiring, though sweeping revisions sharply reduced prior payroll estimates.

Summary

- U.S. employers added 130,000 jobs in January, nearly double economist expectations of 70,000.

- Major benchmark revisions cut total 2025 job growth from 584,000 to 181,000 and signaling a weaker labor backdrop than previously reported.

- Crypto markets slid sharply, with the BTC down more than 11% for the week and falling another 2.5% over the past 24 hours amid broader market volatility.

The Labor Department reported Wednesday that nonfarm payrolls increased by 130,000 last month, well above economists’ forecasts of 70,000 and a sharp acceleration from December’s downwardly revised gain of 48,000.

The unemployment rate edged down to 4.3% from 4.4%, defying expectations for a steady reading.

However, the report also included significant benchmark revisions. The Bureau of Labor Statistics erased roughly 898,000 jobs from payroll estimates covering April 2024 through March 2025. As a result, total nonfarm employment growth for 2025 was revised down substantially, from 584,000 to 181,000.

The revisions suggest the labor market was considerably weaker over the past year than previously reported, even as January’s headline figures point to renewed hiring momentum at the start of 2026.

Crypto markets slid sharply, with Bitcoin (BTC) down more than 11% for the week and falling another 2.5% over the past 24 hours amid broader market volatility.

Crypto World

Why AI Integration is Now Mandatory for Crypto Exchange Development?

MEXC’s AI suite, launched in August 2025, marks the advent of a new standard in cryptocurrency exchange development. The leading crypto exchange software recognized that legacy crypto exchanges aren’t losing users because they’re slow, but because they’re not innovating.

It’s a 2019-era assumption that traders will stay if you offer enough trading pairs, decent liquidity, and a clean UI.

A crypto exchange software in 2026 that merely executes orders is no longer enough. Markets move in milliseconds, narratives shift in minutes, and information spreads faster than human reaction time.

Traders are left drowning in data, juggling between charts, indicators, on-chain dashboards, social feeds, whale trackers, and news alerts. Since trading decisions require them to integrate several tools across different platforms, exchanges just become a trading engine, which is easy to replace.

At a higher level, Institutional investors own an AI-powered trading infrastructure that detects patterns in seconds, analyzes indicators, and executes positions. Retail traders don’t have access to such tools, which is why they struggle to compete in markets. By integrating AI-tools inspired by MEXC, cryptocurrency exchange software can enable average users to access institutional-grade analysis, leveling the playing field for retail traders and institutional desks.

Why AI is no longer optional in Crypto Exchange Development?

For years, AI in crypto exchange was treated as a cosmetic upgrade. Crypto exchanges experimented with basic bots, basic alerts, surface-level analytics, and labelled them intelligent. The phase is now over. What changed isn’t the technology alone but the market and trader behavior as well.

Modern crypto markets are events and narrative-driven and reflexive. Prices react not just to order flow, but to tweets, governance proposals, whale movements, ETF speculations, regulatory headlines, and memecoin virality. When the retail reaction time cannot scale to this velocity, it is not the traders’ constraint but a trading infrastructure limitation.

AI embedded at the cryptocurrency exchange development infrastructure level can transform trading platforms from a passive execution venue to an active intelligence layer. And this shift addresses four structural weaknesses that traditional exchange systems cannot solve on their own.

1. Information Latency

Markets often react to new developments before most traders have had time to interpret them. By the time someone finishes reading the headline, the price adjustment may already be in progress or nearly complete.

AI-powered cryptocurrency exchange software can potentially reduce this lag by building agents that:

-

- Continuously scan multi-source inputs (news feeds, social streams, wallet flows, macro signals)

- Classify relevance in real time

- Rank signals based on the probability of market impact

By doing this, they can list top trading pairs, high-potential-tokens and best trading strategies in real time. This does not replace traders but compresses the delay between signal emergence and signal recognition.

2. Cognitive Overload

Data abundance has become counterproductive. As stated above, traders juggle charts, on-chain dashboards, sentiment trackers, and news feeds across multiple platforms. Scattered data slows decisions and increases error rates.

Smart AI integrations in crypto exchange development address this by:

-

- Filtering low-signal noise

- Correlating sentiment, capital flow, and price structure

- Presenting contextualized insight instead of raw feeds

This way, AI-powered news boards or chat assistants present real-time structured interpretations before the traders, who are just one click away from executing a trade.

3. Non-Linear Market Risk

Crypto volatility rarely unfolds in straight lines. Liquidation cascades, sentiment reversals, and liquidity shocks amplify themselves. Static thresholds and rule-based triggers often struggle in these environments.

Strategically crafted and integrated AI models in crypto exchange software, by contrast, adapt dynamically:

-

- Recognizing pattern shifts across regimes

- Updating probability distributions as conditions change

- Anticipating stress conditions rather than reacting after breakdown

Such models can be leveraged to create smart trading assistants for traders and intelligent risk management and security mechanisms for cryptocurrency exchange software.

4. Retention in a Low-Switching-Cost Environment

Crypto users face almost zero friction when switching platforms. Most platforms today have brief onboarding cycles and no custodial lock-ins. Funds move instantly. APIs connect everywhere. Liquidity is increasingly multi-platform.

In this environment, execution quality alone is insufficient for differentiation as a crypto exchange software. Traders increasingly prefer platforms that assist decision-making by surfacing opportunities, contextualizing risk, and shortening analysis time.

AI-powered trading integration in cryptocurrency exchange development addresses this retention problem by embedding decision-support into the trading experience itself. When an exchange:

-

- Surfaces relevant opportunities in real time

- Contextualizes price movements automatically

- Flags risk before exposure escalates

It reduces the trader’s dependency on external tools, slashing the chances of crypto exchange software abandonment.

What Role Does AI Play in Modern Crypto Exchange Infrastructure?

AI in cryptocurrency exchange development isn’t about adding more indicators or prettier dashboards, but giving your exchange a brain of its own. It compresses the chaos into clarity by detecting signals before they appear and linking events, sentiment, on-chain flows, and price action into a single decision context.

Its impact spans core infrastructure, compliance logic, capital protection systems, and trader cognition layers. Let’s locate exactly where it operates inside the stack when a cryptocurrency exchange software implements MEXC-inspired AI tools integration.

| Layer | AI Role | Deployment Location |

|---|---|---|

| Execution Layer | Slippage prediction | Off-chain engine |

| Surveillance | Behavioral modeling | Backend analytics layer |

| Risk Engine | Predictive liquidation scoring | Core risk module |

| Intelligence Layer | Signal aggregation & NLP | Data processing cluster |

1. AI at the Matching Engine & Trade Execution Layer

The order matching engine is traditionally deterministic. It matches orders based on a price-time priority and predefined logic, which fails under regime shifts, liquidity shocks, and high-volatility bursts.

- AI-Augmented Adaptive Order Matching Under Volatile Conditions

AI models analyze:

-

- Real-time order book depth changes

- Liquidity imbalances

- Spread expansion velocity

Instead of blindly matching based on static rules, an AI-based order matching system can:

-

- Adjust routing logic during volatility spikes

- Detect spoof-driven depth distortions

- Optimize execution sequencing under stress

Implementing this during crypto exchange development improves order fill quality without rewriting trading fundamentals.

- Slippage Prediction & Execution Path Optimization

Rather than calculating slippage after execution, AI models estimate:

-

- Expected impact cost

- Liquidity fragmentation

- Cross-market price deviations

AI-enhanced execution engines in crypto exchange software can then:

-

- Split large orders dynamically

- Delay or accelerate routing based on impact probability

- Optimize for reduced adverse selection

This results in measurable improvement in order execution efficiency.

- Load-Aware & Volatility-Sensitive Fee Logic

Static fee tiers appear flat and irrelevant. AI/ML-based load-aware and volatility-sensitive adjust fee based on:

-

- Network congestion

- Liquidity supply elasticity

- Market stress indicators

This enables cryptocurrency exchange software to:

-

- Protect liquidity during extreme volatility

- Incentivize depth when spreads widen

- Stabilize trading conditions programmatically

Power Up Your Crypto Exchange with AI — Start Building Today

2. AI in Market Surveillance & Trade Integrity Systems

Rule-based surveillance systems rely on predefined thresholds. Manipulators evolve faster than static rules, making them irrelevant in the face of rapidly shifting markets. AI introduces behavioral modeling and real-time market surveillance systems.

- Moving Beyond Static Rule-Based Surveillance

Instead of detecting fixed patterns, AI-based models integrated in crypto exchange software development learn:

-

- Normal order flow behavior per account

- Clustered wallet activity

- Correlated spoof cycles

Anomalies are detected relative to behavioral baselines, not arbitrary thresholds.

- Behavioral Modeling for Wash Trading & Spoofing Detection

AI systems integrated inside cryptocurrency exchange software analyze:

-

- Order placement and cancellation cadence

- Volume recycling patterns

- Cross-account coordination signals

This allows crypto exchanges to identify:

-

- Synthetic liquidity inflation

- Coordinated wash rings

- Layered spoof walls designed to mislead depth perception

This enables cryptocurrency exchanges to neutralize manipulation before it distorts price formation, safeguarding both liquidity providers and platform credibility.

- Real-Time Intervention vs Post-Trade Enforcement

Traditional enforcement occurs after trades settle. Cryptocurrency exchanges review the activities later and then react. This creates distrust among the exchange users.

AI-powered reaction time intervention systems integrated in crypto exchange software enable:

-

- Pre-trade risk scoring

- Order throttling

- Temporary restrictions before damage propagates

This protects both liquidity providers and platform reputation if implemented properly.

3. AI-Powered Risk Engines & Capital Protection

Most liquidation systems in traditional crypto exchange software rely on fixed formulas:

-

- If the margin ratio falls below X → liquidate

- If maintenance margin is breached → force close

This breaks during cascading leverage events, where price drops trigger liquidations, which trigger further price drops.

AI upgrades the liquidation engine from a static trigger system to a dynamic stress model.

- Predictive Liquidation Modeling

Instead of waiting for accounts to cross a fixed threshold, AI-powered liquidation models continuously evaluate how close an account is to becoming unstable under changing market conditions.

They analyze:

-

- Volatility clustering – Is volatility accelerating in a way that increases liquidation probability?

- Position concentration – Is the trader heavily exposed to a single high-risk asset?

- Correlated leverage exposure – Are multiple leveraged positions likely to fall together?

This allows the system to:

-

- Flag accounts likely to breach the margin before they actually do

- Adjust maintenance requirements gradually instead of triggering sudden liquidation

- Issue early warnings when risk probability spikes

The practical impact is fewer sudden liquidations and reduced cascade amplification during stress events.

- Volatility-Aware Leverage & Margin Controls

In traditional crypto exchange software margin systems, leverage limits are static. A trader can use 20× leverage regardless of whether volatility is low or exploding.

AI allows the leverage policy to adapt in real time based on:

-

- Current volatility regime

- Liquidity depth stability

- Funding rate stress signals

For example:

-

- During extreme volatility, allowable leverage can automatically compress

- During stable conditions, it can expand

This prevents systemic overexposure without halting trading activity. The cryptocurrency exchange software remains operational, but risk intensity is regulated dynamically.

- AI-Driven Account Health Scoring

A single margin ratio does not reflect real risk.

AI systems compute a composite risk profile that includes:

-

- Asset correlation across open positions

- Cross-market contagion risk

- Liquidity fragility of held assets

- Probability-weighted drawdown scenarios

Instead of treating accounts as either “safe” or “liquidate,” an AI-enhanced cryptocurrency exchange evaluates risk as a probability curve.

That matters because risk is rarely binary. It builds progressively. AI makes that progression measurable.

4. AI-Powered Market Intelligence & Trader Decision Systems

Execution intelligence optimizes how trades are processed. Market intelligence determines which trades get placed in the first place.

This layer sits above the core exchange engine and functions as a decision-compression system. Its role is not to automate trading, but to reduce signal discovery time, contextualize volatility, and quantify probability in environments where information arrives faster than humans can process it.

The problem it solves is not execution but decision latency and fragmented signal interpretation.

A. AI Signal Aggregation & Asset Opportunity Discovery

Traders today monitor dozens of inputs:

-

- On-chain token inflows/outflows

- Social velocity shifts

- Funding rate anomalies

- Derivatives open interest spikes

- Liquidity migration across pairs

Individually, none of these guarantees opportunity. The edge appears when they converge.

AI systems built inside crypto exchange development can:

- Continuously ingest multi-source market data

- Normalize heterogeneous signals (on-chain, sentiment, derivatives)

- Detect confluence clusters where multiple early indicators align

Instead of ranking tokens by volume or price change, the system ranks them by:

-

- Attention acceleration

- Capital rotation probability

- Early-stage momentum asymmetry

This changes asset discovery from reactive scanning to probabilistic opportunity surfacing.

The impact: traders identify rotation before it becomes obvious on the 4H chart.

B. Real-Time Event Intelligence & News Reaction Systems

Modern market catalysts originate outside the order book:

-

- Regulatory statements

- ETF developments

- Whale wallet activity

- Protocol upgrades

- Narrative shifts

Traditional cryptocurrency exchange software display price after impact where AI-integrated exchanges perform:

-

- NLP-based classification of incoming events

- Historical pattern comparison against similar past catalysts

- Real-time impact scoring based on liquidity conditions

When a signal crosses defined probability thresholds, the system:

-

- Flags the event

- Quantifies potential impact range

- Links context directly to trade interfaces

This reduces the informational advantage gap between institutions and retail participants.

C. Conversational AI for Market Reasoning & Trade Context

Markets are multi-variable systems. Traders often ask layered questions:

- “Why is this token outperforming the sector?”

- “How does this macro event affect L2 assets?”

- “Is this funding spike sustainable?”

Instead of manually correlating data across dashboards, conversational AI:

- Maps natural language queries to structured market datasets

- Performs cross-asset inference

- Produces explainable, data-backed summaries

This accelerates structured reasoning without replacing strategy. The analysis cycles are reduced from minutes to seconds.

D. AI-Augmented Charting & Contextual Market Visualization

Charts traditionally show price. Traders must overlay context manually.

AI-enhanced visualization integrates:

- Event annotations tied to precise time intervals

- Whale transaction overlays

- Sentiment inflection markers

- Pattern probability projections

More importantly, models can assign confidence intervals to detected formations rather than labeling patterns categorically.

Instead of:

“Head and shoulders detected.”

The system communicates:

“Pattern probability: 68% under current liquidity regime.”

That difference matters. It reframes technical analysis from visual intuition to statistical inference.

Takeaway

The next generation of crypto exchange development won’t compete on who has more features. They’ll compete on who helps traders think faster, react earlier, and manage risk before the market turns hostile. That shift from execution-first crypto exchange software platforms to intelligence-driven trading environments is already underway. And exchanges that ignore it aren’t being conservative. They’re falling behind.

Cryptocurrency exchanges that integrate AI natively, on the other hand, transition from being transaction venues to becoming decision engines.

At Antier, we design crypto exchange software infrastructure with this transition in mind. Our AI-ready exchange architectures are built to integrate predictive analytics, behavioral risk modeling, and multi-source signal intelligence directly into the core trading stack, not as surface-level add-ons.

Share your requirements today!

Frequently Asked Questions

01. What is the significance of MEXC’s AI suite launched in August 2025?

MEXC’s AI suite represents a new standard in cryptocurrency exchange development, addressing the need for innovation beyond just offering trading pairs and liquidity, enabling traders to access advanced tools for better decision-making.

02. Why is AI considered essential in modern crypto exchange development?

AI is essential because it transforms trading platforms into active intelligence layers, allowing for real-time analysis and execution, which is crucial in fast-paced markets driven by events and narratives.

03. How does AI integration benefit retail traders compared to institutional investors?

AI integration provides retail traders with access to institutional-grade analysis and tools, leveling the playing field and helping them compete more effectively in markets dominated by institutional investors.

-

Politics3 days ago

Politics3 days agoWhy Israel is blocking foreign journalists from entering

-

NewsBeat2 days ago

NewsBeat2 days agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

Sports4 days ago

Sports4 days agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

Business3 days ago

Business3 days agoLLP registrations cross 10,000 mark for first time in Jan

-

Tech5 days ago

Tech5 days agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

Tech11 hours ago

Tech11 hours agoSpaceX’s mighty Starship rocket enters final testing for 12th flight

-

NewsBeat3 days ago

NewsBeat3 days agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

Sports2 days ago

Sports2 days agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Sports4 days ago

Former Viking Enters Hall of Fame

-

Politics3 days ago

Politics3 days agoThe Health Dangers Of Browning Your Food

-

Sports5 days ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

Business3 days ago

Business3 days agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

NewsBeat5 days ago

NewsBeat5 days agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Business6 days ago

Business6 days agoQuiz enters administration for third time

-

Crypto World22 hours ago

Crypto World22 hours agoBlockchain.com wins UK registration nearly four years after abandoning FCA process

-

Crypto World1 day ago

Crypto World1 day agoU.S. BTC ETFs register back-to-back inflows for first time in a month

-

NewsBeat2 days ago

NewsBeat2 days agoResidents say city high street with ‘boarded up’ shops ‘could be better’

-

Sports2 days ago

Kirk Cousins Officially Enters the Vikings’ Offseason Puzzle

-

Crypto World1 day ago

Crypto World1 day agoEthereum Enters Capitulation Zone as MVRV Turns Negative: Bottom Near?

-

NewsBeat6 days ago

NewsBeat6 days agoStill time to enter Bolton News’ Best Hairdresser 2026 competition

EXCLUSIVE: SBF SEEKS NEW TRIAL, CLAIMS DOJ SILENCED DEFENSE WITNESSES AND MISLED JURY ON FTX SOLVENCY

EXCLUSIVE: SBF SEEKS NEW TRIAL, CLAIMS DOJ SILENCED DEFENSE WITNESSES AND MISLED JURY ON FTX SOLVENCY (@CarloD_Angelo)

(@CarloD_Angelo)