Crypto World

Coinbase stock at risk ahead of earnings as Robinhood’s crypto revenue dip

Coinbase stock price retreated by over 5% on Wednesday as traders and investors remained pessimistic about its business ahead of its fourth-quarter earnings report.

Summary

- Coinbase share price is stuck in a bear market after falling from $445 in 2025 to $153.

- The company will publish its fourth-quarter financial results on Wednesday.

- Robinhood’s crypto revenue slumped 38%, and Coinbase’s figure dropped as well.

Wall Street pros are turning bearish on Coinbase

Coinbase, the biggest crypto exchange in the U.S., dropped to $154, down sharply from its 2025 high of $445. This crash has erased billions of dollars in value, with the valuation dropping from close to $100 billion to $41 billion.

The stock retreated as Wall Street analysts scaled down their target amid the ongoing crypto market crash. JPMorgan reduced its target from $399 to $290, while maintaining the overweight rating. Cantor Fitzgerald also reduced the stock target to $221 from $277, while Citigroup cut from $500 to $400.

The most bearish analyst is Ed Engel of Compass Point, who lowered the target from $230 to $190, while maintaining a sell rating.

Coinbase stock also retreated after Robinhood’s stock price plunged by over 10% after releasing its results on Tuesday. A key reason for its weak financial results was that its closely-watched crypto revenue dropped by over 38% in the fourth quarter. It has grown by triple digits in the previous quarters.

Therefore, there is a likelihood that Coinbase will also publish weak financial results after the market closes on Wednesday. Third-party data shows that Coinbase’s retail transaction volume dropped by 15% as Bitcoin (BTC) and other altcoins dropped. This is notable as the transaction revenue is the biggest part of its business.

Wall Street analysts expect Coinbase’s revenue to come in at $1.84 billion, down 78% from the same period in 2024. This decline will occur despite revenue from Deribit, a company it acquired last year. If this estimate is accurate, then its annual revenue will drop by 19.1% to $7.24 billion.

Worse, Coinbase will likely experience another weak first quarter because of the ongoing crypto market crash, with Bitcoin moving to $67,000 today and crypto ETF outflows continue. These factors likely explain why Cathie Wood’s Ark Invest has dumped the stock.

Coinbase stock price technical

The weekly timeframe chart shows that the COIN stock price has crashed in the past few months, dropping from the all-time high of $445 in July 2025 to the current $153.

It has dropped below the 61.8% Fibonacci Retracement level at $190. Most importantly, the stock has dropped to key support, where it has failed to move below twice since 2024.

Coinbase share price has also dropped below the 50-week and 100-week Exponential Moving Averages and the weak, stop & reverse level of the Murrey Math Lines tool.

A drop below the key support level at $143 will confirm the bearish outlook and point to more downside, potentially to the 78.6% retracement level at $120.

Crypto World

But On-Chain Data Tells a Different Story

Just before the complete exit, Yi predicted ETH would reach $10,000, and BTC would surpass $200,000.

Trend Research, the trading firm led by Liquid Capital founder Jack Yi, has fully exited its Ethereum positions, closing out what was once Asia’s largest ETH long, according to on-chain monitoring platform Arkham.

At its peak, Trend Research held approximately $2.1 billion in leveraged Ethereum long positions, accumulated by borrowing stablecoins against ETH collateral.

Bullish Tweets, Brutal Exit

Arkham data revealed that the firm closed its final ETH position on Sunday. The exit resulted in a total realized loss of roughly $869 million. Interestingly, the complete exit followed several days of position reductions as Ether’s price declined toward the $1,750 level, which triggered stress across leveraged positions in the market.

Notably, Yi had publicly reiterated his bullish outlook just days before the firm fully exited its ETH exposure. In a post on X published four days prior to the final exit, Yi said Trend Research remained “bullish on the next major bull market,” and even predicted that ETH would go beyond $10,000 and Bitcoin above $200,000. He described the firm as having made “partial adjustments to manage risk.”

Yi also addressed broader market conditions in the post, and spoke about the lack of liquidity and alleged platform-driven manipulation. Despite these concerns, he maintained that the long-term trajectory of the crypto industry remained intact. He further asserted that current prices represented an attractive entry point for spot positions when viewed on a multi-year horizon, while acknowledging that extreme volatility has historically forced many bullish traders out of positions before subsequent rebounds.

Accumulation Trend During Market Stress

Amidst the market turmoil, Ethereum “accumulating addresses” – defined as wallets with no history of outflows, balances of at least 100 ETH, and no association with exchanges, miners, or smart contracts – currently hold 27 million ETH, according to CryptoQuant’s analysis. This figure represents approximately 23% of Ether’s circulating supply.

CryptoQuant also found that the altcoin has traded below the realized price of these accumulating addresses only twice in its history. The first time was when the market hit a low in 2025, while the second has been unfolding since January 2026. This means that accumulating addresses have continued to add to positions despite recent price declines and the forced unwinding of leveraged trades

You may also like:

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Arkham to turn forgotten CEX into future DEX

Data analytics firm Arkham Intelligence says it plans to pivot its crypto exchange spin-off to a fully decentralized model amid struggles to attract enough trading volume to compete with its multi-billion-dollar rivals.

That’s according to a report by CoinDesk.

Arkham’s founder, Miguel Morel, told CoinDesk, that Arkham “is becoming a fully decentralized exchange rather than a centralized exchange,” adding, “The future of crypto trading is decentralized, and that’s what we’re building towards.”

Arkham launched its exchange in late 2024 with the aim of competing with the likes of Binance and other established crypto exchanges for retail interest.

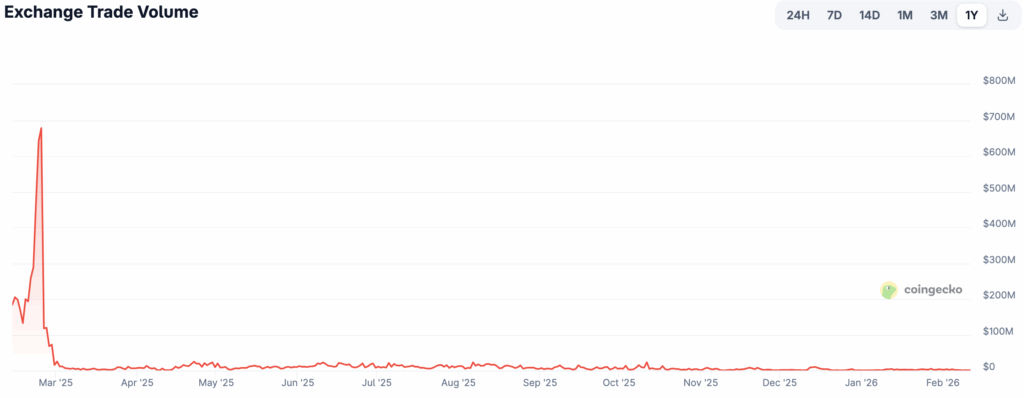

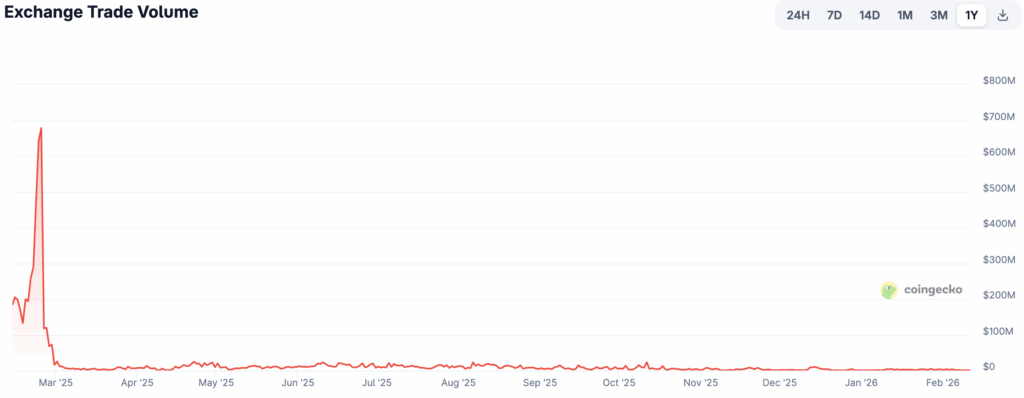

The exchange saw over $677 million in trading volume across February 2025, however, since then, it’s struggled to push daily trading volume beyond $22 million.

Read more: Arkham accused of misrepresenting Zcash data in viral post

Big-name exchanges such as Coinbase and Bybit, however, pull in billions of dollars worth of trading volume with Binance averaging tens of billions on most days.

The Arkham token (ARKM) has fallen by 2.6% in the last 24 hours and is down 82.4% since it was launched in 2023.

Arkham Exchange volume kept alive by airdrop

Users on X noted how many crypto traders were just using the exchange to farm one of its airdrops. One user said, “Season 1 paid out, fomo marketing did its job and now they are sunsetting the platform 😂.”

Arkham claims to have previously given away over $20 million for the Season 1 airdrop. It then tied its Season 2 airdrop to the newly launched exchange and rewarded trading activity with points that can be redeemed for ARKM.

It claimed that the Season 2 airdrop was still ongoing back in April 2025. It’s unclear what will happen to the points accrued by users.

Read more: Arkham ‘deanonymizes blockchains,’ obscures its own ARKM token sales

Late last year, Arkham announced that its exchange was getting its own app and that it was partnering with MoonPay to expand on its fiat on and off-ramps.

Arkham offers users dashboards that are able to track the crypto holdings of various entities, from the likes of Donald Trump’s “Trump Media” to Ethereum treasury firms like Bitmine.

It was founded by Morel in 2020 and is backed by the likes of OpenAI’s Sam Altman, Binance Labs, Bedrock, and Draper Associates.

Protos has reached out to Arkham for comment and will update this piece should we hear back.

Got a tip? Send us an email securely via Protos Leaks. For more informed news and investigations, follow us on X, Bluesky, and Google News, or subscribe to our YouTube channel.

Crypto World

Gen Z trusts code over bank promises

Welcome to our institutional newsletter, Crypto Long & Short. This week:

- Haider Rafique of OKX shares a firm study on the generational perspectives of crypto investing

- Top headlines institutions should pay attention to by Francisco Rodrigues

- Sky defies 2026 downturn in Chart of the Week

Expert Insights

Gen Z Trusts Code Over Bank Promises

By Haider Rafique, global managing partner, OKX

It’s no secret that the banking industry is worried about crypto disruption.

After months of intense lobbying, the Senate Banking Committee postponed its markup of market structure legislation, due in part to banks’ stance on stablecoin yield.

But it might not matter, because banks have a much bigger crisis on their hands: they’re completely missing out on younger consumers based on the basic principle of trust.

Given the behaviors we’ve observed on the OKX app around the world, we decided to conduct a study to understand generational perspectives in our evolving industry.

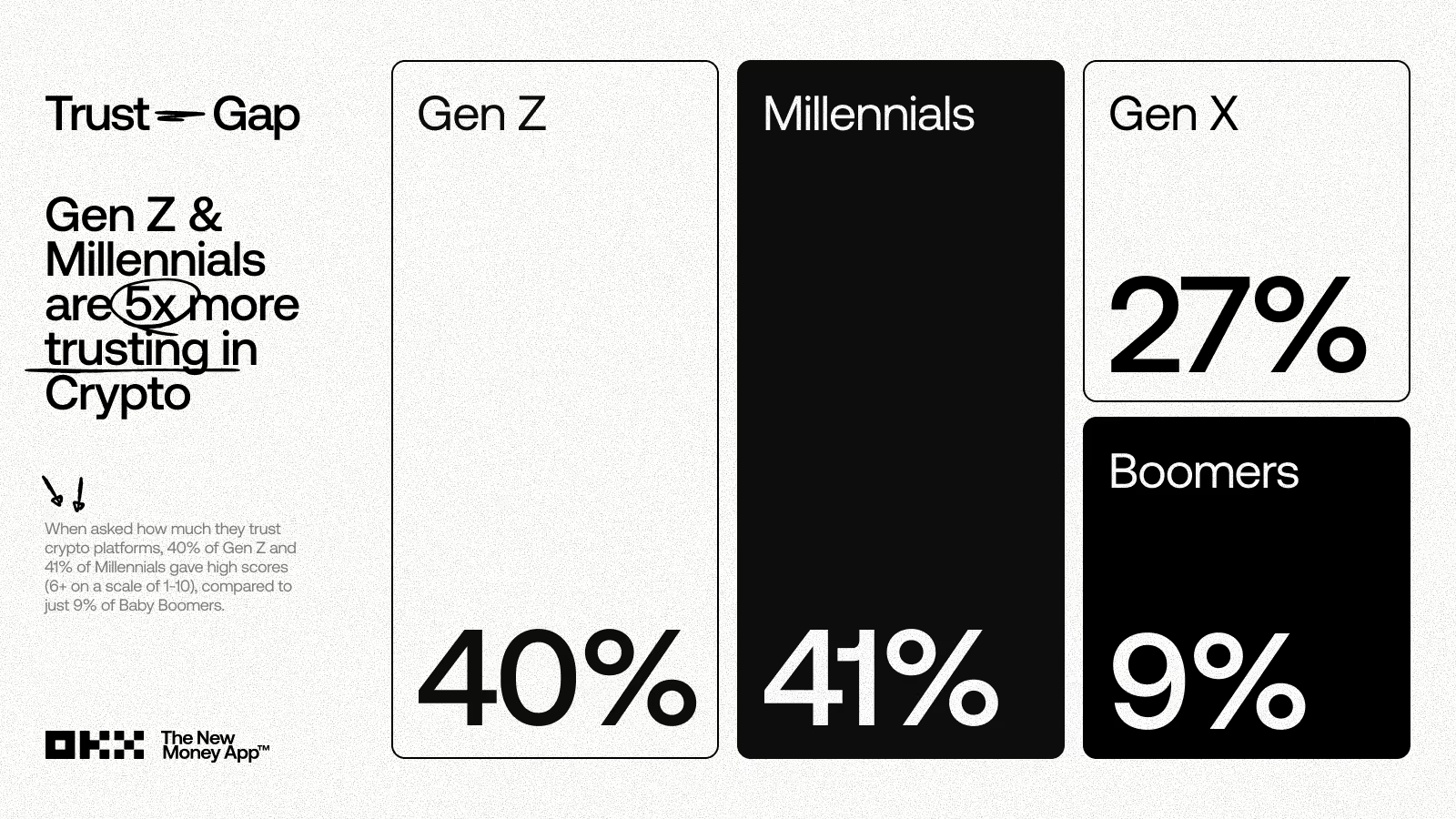

The key insights paint a clear picture: Gen Z and millennial consumers are nearly 5x more trusting of crypto compared to their boomer counterparts. Additionally, one in five Gen Z and millennial consumers say they have low trust in traditional financial institutions, while nearly three quarters (74%) of baby boomers maintain high levels of trust in the old system.

The “why” behind all of this is much deeper than viral trends and memecoins. This is a generation raised on open‑source code and real‑time dashboards who now expect the same transparency from TradFi.

And now, as the world moves on-chain and everything gets tokenized, it’s clear that young people see the digital economy as their stock market.

TradFi isn’t theirs. It belongs to their parents and grandparents.

A generation shaped by institutional failure

A recent FINRA and CFA Institute report suggests a sizable share of Gen Z investors now lean heavily into crypto relative to other assets — a behavioral signal that younger Americans are willing to look outside traditional channels when they don’t believe they’re getting transparency or competitive returns. According to the study, nearly 20% of Gen Z investors only hold crypto.

For banks, this should be a wake‑up call that trust is no longer something institutions can declare but something they must demonstrate.

Boomers built their financial lives in an era when institutions were the safest option available. Regulation meant protection, and trust was something you extended first and questioned later.

Gen Z has lived through the opposite. They came of age during the aftermath of the 2008 financial crisis, entered adulthood with high student debt and now face a housing market millions of units short alongside ongoing inflation.

They’ve also lived through years of policy whiplash on student loans, shifting repayment rules and weakened borrower protections. These reversals reinforced a simple lesson that institutional promises can change overnight. When trust is repeatedly tested, skepticism becomes rational.

Banks aren’t losing Gen Z to crypto; they’re losing them to trust.

Control over promises

That skepticism is reshaping what influences trust for younger generations. For boomers, security means regulatory oversight and the perceived stability of legacy institutions.

Contrarily, Gen Z consistently ranks platform security above regulation as the top driver of trust. For Gen Z, security is more personal and technical with direct ownership of assets, the ability to verify how systems work and the freedom to move value without intermediaries.

It’s why both Gen Z and millennials are 4x more bullish on crypto in 2026 compared to boomers. They can see transactions on-chain, self‑custody, audit protocols and understand the rules without waiting for a quarterly statement or a regulator’s update.

Transparency is central to this shift. Boomers tend to equate trust with regulatory approval, but Gen Z equates trust with visibility. They want to understand how decisions are made, how risks are managed and how incentives are aligned. They want clarity on fees, yields and conflicts of interest, and systems that are open by default.

Traditional banks have historically struggled here. Their value proposition was built in an era when limited transparency was often treated as a feature. And now, when a generation is accustomed to real‑time dashboards and proof of reserves, the idea of waiting for a monthly statement feels absurd. Transparency has become a baseline requirement for credibility.

The future of finance

Banks should be asking themselves: why do younger customers trust transparency more than tradition? Younger Americans want the stability of regulated finance paired with the transparency and control of digital assets, and they want products that reflect how they already interact with technology and money. The institutions that understand this shift and build for it will define the future of finance. The ones that don’t will continue to watch as younger Americans look elsewhere.

Headlines of the Week

Francisco Rodrigues

Markets stumbled this past week and miner capitulation intensified. That led to the steepest decline for Bitcoin’s mining difficulty since 2021, while corporate accumulation of cryptocurrencies and other assets continued and Russia moved closer to formalize crypto-backed lending.

Chart of the Week

Sky defies 2026 downturn

Sky has decoupled from the 2026 market downturn, outperforming BTC, CD5, and the CD20 index by 45%, 50% and 57% respectively YTD. This resilience is anchored by a consistent business model: January revenue surged 1.5x YoY to $19 million, fueling $10.4 million in YTD buybacks ($8.5 million in Jan; $1.9 million last week) and driving a flight to quality that pushed the USDS (Sky’s stablecoin) market cap from $5.8 billion to $6.5 billion.

Listen. Read. Watch. Engage.

Note: The views expressed in this column are those of the author and do not necessarily reflect those of CoinDesk, Inc., CoinDesk Indices or its owners and affiliates.

Crypto World

MYX Finance crashes 30% in a day as sell-off deepens

- MYX Finance price dropped more than 30% to under $4 amid mounting selling pressure.

- The Relative Strength Index (RSI) suggests oversold conditions, potentially sparking a relief bounce.

- Downside is, however, the path of least resistance amid a technical breakdown.

MYX Finance (MYX) price has declined by more than 30% in the past 24 hours, hitting fresh lows under $4.

The Sequoia and Consensus-backed decentralized liquidity protocol ranked as the biggest loser among the top 100 coins on Wednesday, with its dramatic downturn extending the rot since prices sharply dropped from highs of $6.9.

As of writing on February 11, 2026, the token’s price hovered at levels last seen in early January.

MYX Finance price falls 30% as sell-off intensifies

There were sharp declines across the broader cryptocurrency market on Wednesday as Bitcoin fell to under $66k again.

But while Arbitrum, Bittensor, World Liberty Financial, and Jupiter all slipped, MYX Finance’s 30% drop over the period was the sharpest.

The bleeding pushed the token below the critical $4 threshold, with a return to $3.88 marking the biggest drop since the 48% mauling on October 10, 2025.

Why is MYX Finance price down?

MYX is crashing amid massive selling pressure. According to CoinMarketCap data, the altcoin saw a nearly 120% spike in daily trading volume as prices plummeted.

As noted, the sell-off comes as the broader crypto market jitters push sentiment into extreme fear territory.

Bitcoin’s struggle to hold above $70k, with sharp declines to $65k in the past 24 hours, has exacerbated the downside action.

Spooked holders are now dumping the MYX accumulated during the token’s rally to above $6.9 last month.

The price capitulation now has MYX Finance’s total value locked (TVL) down to $27 million. DeFiLlama also shows protocol fees, a key revenue driver, are also sharply down as institutional interest wanes.

Open interest in MYX perpetual futures contracts has slipped to $26 million, compared to over $182 million in October 2025 and $59 million in early January.

Technical analysis: What next for MYX?

From a technical perspective, MYX Finance’s trajectory is largely bearish.

The token has decisively broken below a multi-week ascending channel pattern on the daily chart, with the technical formation having supported its uptrend to year-to-date highs.

This breakdown, which could be confirmed by a close under the channel’s lower boundary, signals strong downside continuation.

Other indicators allude to the potential for further erosion of bullish momentum.

RSI on the daily chart is decisively sloping into oversold territory, but it’s not there yet to suggest room for bears to manoeuvre.

MYX price is also below a key ascending trendline from Nov. 2025, with psychological support at $3.60. If sellers drive MYX under $3.00, the next major demand reload zone will be $1.85.

On the upside, any short-term rebound faces formidable resistance at the $6.90 zone. Before that, bulls have to negotiate the mild overhead supply clusters around $4.80.

Crypto World

CryptoProcessing by CoinsPaid adds Polygon as part of its EVM payments infrastructure

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

CryptoProcessing by CoinsPaid adds Polygon support to enable merchants to accept POL and USDC payments on the EVM network.

Summary

- CoinsPaid adds Polygon support, enabling merchants to accept fast, low-cost POL and USDC payments on a widely adopted EVM network.

- Polygon integration expands CoinsPaid’s payment options, offering predictable fees, strong liquidity, and seamless EVM compatibility for merchants.

- Europe’s CoinsPaid now supports Polygon, giving businesses flexible crypto payment routing with speed, scalability, and stablecoin efficiency.

CryptoProcessing by CoinsPaid, Europe’s leading crypto payment gateway, has expanded its network coverage with support for Polygon, allowing merchants to process payments in POL and USDC on the EVM-compatible blockchain.

Commenting on the update, Alexey Tulia, Chief Technology Officer at CoinsPaid, said: “Polygon offers fast confirmations, low and predictable transaction costs, and well-established stablecoin liquidity for payment use cases. From a technical standpoint, it’s a mature option for merchants processing high transaction volumes and integrates cleanly with existing EVM-based payment flows.”

Polygon is among the most used EVM networks and ranks in the top tier globally by overall adoption. Its addition gives businesses more flexibility when selecting a network for crypto payments, particularly in cases where speed, cost predictability, and liquidity are important.

An additional EVM network for payments

Polygon operates as an account-based EVM blockchain, which makes it compatible with existing Ethereum-based infrastructure. For merchants already accepting payments across EVM networks, Polygon can be added without significant changes to underlying business logic or operational processes.

This allows businesses to route transactions through a network that fits their transaction profile while keeping the same processing setup.

Stablecoin payments on Polygon

With USDC on Polygon, CryptoProcessing supports a widely used stablecoin on a network optimised for high transaction throughput. This is relevant for merchants processing frequent payments, recurring billing, or cross-border transactions, where predictable costs and settlement times are important.

Support for POL provides additional flexibility for businesses that operate within the Polygon ecosystem or receive payments from counterparties using the network’s native asset.

Expanding network coverage

By adding Polygon, CryptoProcessing continues to expand its EVM network coverage and provide merchants with more choice in how they accept and process crypto payments. The integration supports higher transaction volumes while maintaining a consistent processing setup for businesses using the platform.

About CryptoProcessing by CoinsPaid

CryptoProcessing by CoinsPaid is Europe’s leading crypto payment gateway, enabling businesses worldwide to accept and process cryptocurrency payments seamlessly. The service provides a secure, compliant, and high-speed payment infrastructure that helps merchants expand globally, minimise transaction costs, and access new customer segments.

With more than 30 million transactions processed annually, robust security standards, and a reputation as one of the most reliable crypto payment solutions on the market, CryptoProcessing by CoinsPaid empowers companies to integrate crypto payments into everyday operations with confidence and ease.

Disclosure: This content is provided by a third party. Neither crypto.news nor the author of this article endorses any product mentioned on this page. Users should conduct their own research before taking any action related to the company.

Crypto World

SEC’s Paul Atkins grilled on crypto enforcement pull-back, including with Justin Sun, Tron

The top Democrat on the U.S. House Financial Services Committee demanded the chairman of the Securities and Exchange Commission explain during a Wednesday hearing what happened with the agency’s enforcement interest in Tron Foundation founder Justin Sun and whether his ties to President Donald Trump have had an influence.

Representative Maxine Waters highlighted the U.S. securities regulators’ abandonment of almost all of its previous crypto enforcement cases when Trump took over the White House and replaced the agency’s leadership last year. She underlined the case against Sun in which the agency investigated Sun and his company on wide-ranging allegations, including that they’d improperly jacked up the price of their token (TRX).

SEC Chairman Paul Atkins told the committee that he couldn’t discuss individual cases, but he expressed his willingness to have further conversations in a confidential briefing “to the extent the rules allow me to do that.”

Sun was formally accused by the SEC in 2023 of trying to artificially inflate TRX’s trading volume through a so-called “wash trading” scheme, allegedly having his own employees “engage in more than 600,000 wash trades of TRX between two crypto asset trading platform accounts he controlled.” But the agency moved to pause that case in court a year ago “while they consider a potential resolution.” No resolution has yet been announced.

“Well, while you were exploring a potential resolution, Mr. Sun has been busy ingratiating himself within Trump’s orbit,” Waters said to Atkins, referencing Sun’s ties to the Trump family’s World Liberty Financial Inc.

Waters also flagged a more recent development in which an alleged former girlfriend of Sun suggested publicly that she had evidence of TRX manipulation.

Spokespeople for Tron and Sun didn’t immediately respond to a request for comment on the exchange during Wednesday’s hearing.

“Chairman Atkins, you have said that under your leadership, the SEC will focus on real fraud,” she said. “Does your statement extend to fraud in the crypto market?”

“Whatever involves securities,” Atkins responded.

His agency last year dropped high-profile enforcement matters against Binance, Ripple, Coinbase, Kraken, Robinhood and several other companies, with its new management criticizing the “regulation-by-enforcement” approach to crypto under the agency’s previous leadership.

Asked by another Democratic lawmaker whether his agency ever protects investors at a cost to Trump’s businesses, Atkins responded, “As far as what the Trump family does or not, I can’t speak to that.”

While Democrats have focused on the SEC’s reversal of its previous crypto enforcement work, Republicans on the committee concentrated on Atkins’ promises that he’ll provide the crypto industry regulations to clarify — alongside the Commodity Futures Trading Commission — how the companies can operate in the U.S.

Atkins said the agencies are working on rules “consistent with what’s in the Clarity Act that you all passed here in the House, and hopefully what will come out of the joint work that you’re doing with the Senate. So, you know, we will carry that forward, and basically it’ll help give certainty as to where the jurisdiction of the two agencies are.”

As the SEC and CFTC work on that joint effort under their Project Crypto label, the CFTC also recently moved to embrace the new U.S. stablecoin approach by revising an earlier so-called “no action” letter that now clarifies that national trust banks can issue payment stablecoins, expanding the list of eligible tokenized collateral to include the tokens issued by such banks.

Also on Wednesday, the U.S. regulator of credit unions, the National Credit Union Administration, proposed a rule governing how firms can apply to become stablecoin issuers. It’s an opening step toward implementing last year’s Guiding and Establishing National Innovation for U.S. Stablecoins (GENIUS) Act — the crypto industry’s first major legislative win.

In the meantime, the crypto sector is now watching a policy race between Atkins’ SEC and Senate lawmakers working on the Clarity Act to regulate U.S. crypto markets. With recent setbacks dragging on the Senate’s progress, Atkins’ agency may take a lead in establishing digital assets rules.

Read More: House Democrats slam SEC for dropping crypto cases with Trump ties

Crypto World

Is Pepe Ready to Explode? Whales Load Up 23 Trillion Tokens

Pepe has lost nearly three quarters of its value, but top wallets have steadily accumulated since the market-wide October sell-off.

Popular meme coins, including Pepe, have been trading in the red for almost a month after shedding 40% as the broader market remains under pressure. Despite multiple attempts, the token has not been able to stabilize since the October crash last year.

Since then, PEPE whales have accumulated 23 trillion tokens.

Heavy Whale Accumulation

In the latest update, Santiment revealed that the frog-themed token has lost approximately 73% of its market capitalization since reaching its peak nearly nine months ago. Despite the steep decline, the on-chain analytics platform noted a major change in behavior among large holders.

During the broader market crash in October, which began around four months ago, the top 100 Pepe wallets switched direction and accumulated a combined 23.02 trillion PEPE tokens. Santiment highlighted that “smart money” wallets often play a significant role when altcoins eventually reverse trend and post major rallies.

While retail sentiment toward Pepe and the broader meme coins is currently very bearish, it stated that assets seeing heavy accumulation have historically broken out again once Bitcoin regains steady bullish momentum.

However, a market commentator said Pepe’s price trend looks strongly bearish. According to the analysis, PEPE is trading below all major moving averages, while the Supertrend indicator remains on a sell signal. The ADX shows strong trend strength, and the negative directional indicator appears to be dominating, which points to continued downside pressure.

The analyst identified $0.0000031 as an important support level to watch. If that level breaks, the next downside targets are $0.00000197 and then $0.000000529. The commentator added that only a move back above $0.00000726 would shift focus back to a potential reversal.

You may also like:

Meme Coins’ Struggle Continues

Pepe, which is trading at $0.0000035 after declining by 4% over the past day, is not the only meme coin to have suffered under the current market conditions. Dogecoin, the oldest and largest meme coin by market cap, has witnessed a similar downturn as it trades near $0.090. Shiba Inu was also down by almost 3% during the same period, hovering at $0.0000058.

Bonk and Floki shared a similar fate as well.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Ondo and Securitize discuss at Consensus Hong Kong

Hong Kong — Tokenization is gaining traction, but its success depends less on market hype and more on real-world utility, say executives from Ondo Finance and Securitize.

“There’s no shortage of firms, of issuers, of companies that are interested in tokenizing,” said Graham Ferguson, head of ecosystem at Securitize, during a panel discussion at Consensus Hong Kong. “But it’s on us to figure out how to distribute these assets on-chain via exchanges in a way that is compliant, regulatory-friendly globally.”

Ferguson emphasized that despite high interest on the institutional side, distribution and compliance remain the bottlenecks. “The biggest issue that we run into is communicating with exchanges and DeFi protocols about the requirements that are necessary to adhere to our obligations as a regulated entity,” he said.

Securitize has partnered with firms such as BlackRock to tokenize real-world assets, including U.S. Treasury funds. BlackRock’s BUIDL fund, launched in 2024, now holds over $2.2 billion in assets, making it the largest tokenized Treasury fund on the market.

Ondo Finance, which also focuses on tokenized Treasuries and exchange-traded funds (ETFs), has about $2 billion in total value locked (TVL) according to data from rwa.xzy. Min Lin, Ondo’s managing director of global expansion, said tokenized Treasuries today are a fraction of the potential market.

Both speakers stressed that the next phase of tokenization will be driven by what users can actually do with tokenized assets. Ondo recently enabled tokenized stocks and ETFs to be used as margin collateral in DeFi perpetuals — a first, Lin said.

“That brings a lot more capital efficiency in terms of the utility of those tokenized assets,” he added.

Ferguson agreed, arguing that technological advantages like programmable compliance and fast settlement aren’t enough on their own. “Utility is absolutely far and away number one,” he said. “That’s what will drive the next phase.”

Crypto World

Did the WBTC DAO approve Justin Sun’s HTX as a merchant?

Wrapped Bitcoin (WBTC) spent years marketing itself as being governed by decentralized autonomous organizations (DAOs) that would have oversight over many parts of the product, including “the addition and removal of merchants and custodians.”

Its whitepaper claimed that “signatures are required from DAO members in order to add/remove members.”

Even as recently as a few months ago, WBTC has continued to emphasize that it “operates through a DAO.”

However, this supposed role of the WBTC DAO hasn’t always been respected.

HTX, formerly Huobi, was added as a merchant, the product’s term for an entity who can initiate mints and burns of WBTC, however, it was not approved by the DAO members listed on the Github, but a different set of signers from a different multisignature wallet.

A review of the smart contract reveals that 0xbE6d2444a717767544a8b0Ba77833AA6519D81cD is one of the merchants returned by the “getMerchants” function.

Read more: Is HTX redeeming 80% of TrueUSD?

This address was listed as HTX on the WBTC dashboard in late 2024 when Protos reported on it being used to redeem approximately half a billion dollars worth of WBTC.

However, this address isn’t listed as one of the merchants on the WBTC DAO GitHub page.

HTX is listed as one of the merchants on the WBTC website.

The entities that are still listed on GitHub include defunct and fraudulent entities such as Alameda Research and Three Arrows Capital, both of which are also still listed on the smart contract.

By further reviewing blockchain transactions on Ethereum, we can identify that this address was added as a merchant in November 2024, approximately two months after BiT Global and Justin Sun got involved in WBTC.

Read more: WBTC relaunches on TRON, but abandoned version is bigger

At the time, this transaction came from 0x4dbbbFb0e68bE9D8F5a377A4654604a62E851e80.

Strangely, this address isn’t listed as one of the multisignature wallets for WBTC on GitHub.

The listed multisignature wallet doesn’t include any transactions for the day when HTX was added as a merchant.

The inclusion of HTX as a merchant becomes increasingly important in light of some of the problematic behaviors that the exchange is engaged in.

Read more: Justin Sun defends HTX while it lends 92% of its USDT on Aave

It appears the publicly disclosed multisignature wallet, 0xB33f8879d4608711cEBb623F293F8Da13B8A37c5, appears to have been quietly replaced with a brand new multisignature wallet.

The wallet that was used lists several owners, many of whom differ from the WBTC DAO Github:

- 0xFDF28Bf25779ED4cA74e958d54653260af604C20 — Listed as Kyber on the Merchants list on the GitHub, isn’t listed as a DAO member.

- 0xb0F42D187145911C2aD1755831aDeD125619bd27 — Listed as BitGo on the custodian part of the GitHub, isn’t listed as a DAO member on the current GitHub commit, is listed as a small DAO member on a pull request.

- 0xd5d4aB76e8F22a0FdCeF8F483cC794a74A1a928e — Not listed on the current GitHub commit, is mentioned in a pull request as Maker.

- 0xB9062896ec3A615a4e4444DF183F0531a77218AE — Listed as Aave on the Merchants list on the GitHub, is not listed as a DAO member on the current commit, and is mentioned as a small DAO member on a pull request.

- 0xddD5105b94A647eEa6776B5A63e37D81eAE3566F — Not listed on the current GitHub commit, is listed on a pull request as Tom Bean and is listed as a small DAO member there, multisignature wallet that includes:

- 0x97788A242B6A9B1C4Cb103e8947df03801829BE4 — Not listed on the GitHub at all.

- 0x59150a3d034B435327C1A95A116C80F3bE2e4B5E — Not listed on the GitHub at all.

- 0x926314B7c2d36871eaf60Afa3D7E8ffc0f4F9A80 — Not listed on the current GitHub commit, appears to be a multisignature wallet created using BitGo’s technology, and is listed as BitGo 2 on a pull request describing it as a member of the small DAO.

- 0x51c44979eA04256f678552BE65FAf67f808b3EC0 — Not listed on the current GitHub commit, appears to be another multisignature wallet created using BitGo’s technology, is listed as BitGo 3 on a pull request describing it as a member of the small DAO.

- 0x0940c5bcAAe6e9Fbd22e869c2a3cD7A21604ED8D — Not listed on the GitHub at all.

- 0x5DCb2Cc68F4b975E1E2b77E723126a9f560F08E8 — Not listed on the GitHub at all.

It is not clear why these changes aren’t reflected on the current version of the GitHub repository. Protos reached out to WBTC for some clarification, but it didn’t respond before publication.

By further reviewing the smart contract at 0x4dbbbFb0e68bE9D8F5a377A4654604a62E851e80, we can identify the five addresses that approved the listing of HTX:

- 0xFDF28Bf25779ED4cA74e958d54653260af604C20 — Kyber

- 0xb0F42D187145911C2aD1755831aDeD125619bd27 — BitGo

- 0xddD5105b94A647eEa6776B5A63e37D81eAE3566F — Tom Bean

- 0x926314B7c2d36871eaf60Afa3D7E8ffc0f4F9A80 — BitGo

- 0x51c44979eA04256f678552BE65FAf67f808b3EC0 — BitGo

This means that although this multisignature wallet requires five signatures, three of them came from the same entity.

Only two non-custodian entities approved the addition of HTX as a merchant and those aren’t currently listed as DAO members on GitHub.

Adding to the intrigue, Tom Bean’s project, bZx, was built on Kyber.

It’s also worth highlighting the fact that this multisignature wallet requires five signatures, BitGo controls three, and there are two addresses that aren’t listed at all on GitHub.

If those are controlled by BitGo or BiT Global, then it would be possible for the custodians to make changes without approval from a single additional WBTC DAO member.

Protos reached out to WBTC to determine the identity of those two addresses, but again, didn’t get a response before publication.

BiT Global was added without WBTC DAO approval

This isn’t the first time that WBTC has appeared to ignore the advertised role of its DAO.

The whitepaper for WBTC claimed that “addition/removal of custodians” would be controlled by this DAO.

This used to be echoed on the website, which claimed, “The addition and removal of merchants and custodians will be an open process controlled by a multi-signature contract.”

Read more: Coinbase to delist WBTC months after Justin Sun controversy

Mike Belshe, the chief executive of BitGo, also claimed when BiT Global was being installed that there was a large DAO that “owns the smart contract” and “picks, you know, how we do custody of this thing.”

Strangely, despite that claim, the WBTC DAO didn’t seem to be consulted on the addition of Sun-affiliated BiT Global as a custodian for WBTC.

The Github for the WBTC DAO still doesn’t list BiT Global as a custodian.

The website for WBTC does list BiT Global as one of the custodians, alongside BitGo and BitGo Singapore.

The “members” smart contract still only lists a single custodian, 0xb0F42D187145911C2aD1755831aDeD125619bd27, a BitGo address.

This address is a multi-signature, so it’s possible that BiT Global was added as a signer to this wallet, meaning that the smart contract did not need to be updated with a new custodian address.

Broadly, despite the fact that WBTC manages over $8 billion in value, it seems to have neglected and ignored the DAO that has frequently been an important part of its marketing.

It’s replaced the multisignature wallet that governs it, without updates, with members whose identity we do not know.

This replacement made it possible, or convenient, for HTX to be added as a merchant, but other problems have been ignored, such as the fact that both Alameda Research and Three Arrows Capital are included as merchants.

The large DAO was apparently bypassed regarding the addition of BiT Global.

However it is that WBTC operates, it’s not principally through its DAO.

Its claims of transparency and decentralization have been dashed against the difficulty of coordinating a variety of actors around the world.

Got a tip? Send us an email securely via Protos Leaks. For more informed news and investigations, follow us on X, Bluesky, and Google News, or subscribe to our YouTube channel.

Crypto World

UNI price pops as BlackRock taps Uniswap to tap liquidity

The Uniswap price spiked after securing a major deal with Securitize, BlackRock’s partner.

Summary

- UNI price jumped after a major partnership between Uniswap and Securitize.

- The partnership will see BlackRock’s BUIDL added to UniswapX.

- Technical analysis points to a UNI price reversal.

Uniswap (UNI) token jumped to a high of $4.57, its highest point since January 29, and 62% above its lowest level this year. It then pulled back to $3.7 at press time. It remains 68% below its 2025 peak.

UNI price jumped after a major deal between Uniswap and Securitize, a company that offers real-world asset tokenization. The partnership will see the BlackRock USD Institutional Digital Liquidity Fund (BUIDL) available on UniswapX.

As a result, on-chain trading for BUIDL will now be possible, unlocking liquidity options for BUIDL holders. It aims to bridge traditional finance and decentralized finance. In a statement, Hayden Adams, Uniswap Labs founder and CEO said:

“Enabling BUIDL on UniswapX with BlackRock and Securitize supercharges our mission by creating efficient markets, better liquidity, and faster settlement. I’m excited to see what we build together.”

The partnership came at a time when Uniswap is facing major headwinds, including the soaring competition from other DEX networks like PancakeSwap and Raydiu. Most of the competition is coming from perpetual DEX networks like Hyperliquid, edgeX, Lighter, and Aster.

For example, data compiled by DeFi Llama shows that Uniswap handled over $60 billion in volume in January, much lower than the October high of $123 billion. Its fees dropped to $58 million from the October high of $132 million.

On the other hand, Hyperliquid’s volume in January stood at over $208 billion, while its fees was $78 million. Aster and Lighter are handling more volume than Uniswap as demand for decentralized perpetual futures rise.

UNI price prediction: Technical analysis

The daily timeframe chart shows that the UNI crypto price has been in a strong downward trend in the past few months. It dropped from a high of $12.30 in August to a low of $2.80 this month.

The coin rebounded and retested the important resistance level at $4.55 after the BlackRock announcement. This price was important as it coincides with the neckline of the head-and-shoulders chart pattern that formed between April and January this year.

Therefore, there are signs that the coin has formed a break-and-retest pattern, a common continuation sign in technical analysis. This pattern often leads to a continuation, meaning the downward trend will resume as the crypto market crash continues.

-

Politics3 days ago

Politics3 days agoWhy Israel is blocking foreign journalists from entering

-

Sports5 days ago

Sports5 days agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

NewsBeat2 days ago

NewsBeat2 days agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

Business3 days ago

Business3 days agoLLP registrations cross 10,000 mark for first time in Jan

-

Tech5 days ago

Tech5 days agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

Tech18 hours ago

Tech18 hours agoSpaceX’s mighty Starship rocket enters final testing for 12th flight

-

Business3 days ago

Business3 days agoCostco introduces fresh batch of new bakery and frozen foods: report

-

NewsBeat3 days ago

NewsBeat3 days agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

Sports3 days ago

Sports3 days agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Politics3 days ago

Politics3 days agoThe Health Dangers Of Browning Your Food

-

Sports4 days ago

Former Viking Enters Hall of Fame

-

Sports5 days ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

Business3 days ago

Business3 days agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

NewsBeat5 days ago

NewsBeat5 days agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Business6 days ago

Business6 days agoQuiz enters administration for third time

-

Crypto World1 day ago

Crypto World1 day agoBlockchain.com wins UK registration nearly four years after abandoning FCA process

-

Crypto World2 days ago

Crypto World2 days agoU.S. BTC ETFs register back-to-back inflows for first time in a month

-

NewsBeat3 days ago

NewsBeat3 days agoResidents say city high street with ‘boarded up’ shops ‘could be better’

-

Sports2 days ago

Kirk Cousins Officially Enters the Vikings’ Offseason Puzzle

-

NewsBeat6 days ago

NewsBeat6 days agoStill time to enter Bolton News’ Best Hairdresser 2026 competition