Video

L’ignoranza finanziaria si eredita.,, ameno che tu non la spezzi !

🔸 Per la TUA sicurezza ONLINE scegli NordVPN.

Offerte NordVPN al seguente LINK: https://nordvpn.com/acfinance

🔸METHOOD Iscriviti su https://methood.disobey.club/

Il mio Obiettivo? Formazione Finanziaria in un mondo dove dire che è carente è essere molto gentili…..

🔗 https://x.com/disobeysrl?s=21

🔗 https://www.linkedin.com/company/disobey-srl/

Le informazioni presenti in questo video hanno esclusivamente scopo informativo e riflettono un parere personale. Non rappresentano in alcun modo consigli finanziari o di investimento.

🔸SOCIAL ATTENZIONE:

Qualsiasi PRODOTTOGRUPPO venduto a mio nome ,al di fuori di una mia sponsorizzazione attiva su YouTube nella Puntata , è TRUFFA !!!!

🔸 Per la TUA sicurezza ONLINE scegli NordVPN.

Offerte NordVPN utilizzano il seguente LINK: https://nordvpn.com/acfinance

► 🤘 X-Twitter : https://twitter.com/AcCriptoYT

► ✅TikTok: https://www.tiktok.com/@albertocastellar

► 📸 Instagram: https://www.instagram.com/accastellar/

Chi è Ac e perché può aiutarti❓

🔸 Economista attivo da 2 decenni nel mercato Tradizionale e dal 2016 nelle Criptovalute.

🔸 Autore del Canale AcCriptovalute. AC Finance

🔸 FOCUS in gestione strategica del mercato e sue caratteristiche.

🔸 Seguito e ritenuto da migliaia di persone il punto di riferimento delle Criptovalute, Finanza personale per ottenere una visione economica e concreta del mercato .

🔸DISCLAIMER !

#Ac non è un consulente finanziario ma un grande appassionato di criptovalute e blockchain, che desidera condividere opinioni ed esperienza.

Se decidete di investire in qualsiasi asset fate SEMPRE le vostre ricerche !

#ac è disponibile per consulenza o collaborazioni.

Email alberto@acfinance.tech

#guadagnare #formazione #mindset #ac #accastellar #asia #viaggi #cina #finanza #indipendenza #ad #acfinance

source

Video

4X profit on Lighters reselling #money

Video

The Death of Crypto Explained

Bitcoin is trading at the same price it was 5 years ago.” Let that sink in. The “Supercycle” was a lie, and the speculative casino is officially closed. If you are still waiting for a magical retail wave to save your bags, you are the exit liquidity.

In this brutally honest breakdown, I explain the structural death of “Old Crypto.” The moon boys are gone, volume has dried up, and 99% of altcoins are drifting to zero. We analyze the stagnation, the lack of innovation, and the uncomfortable reality of what comes next for this industry.

_________________________________________

𝗧𝗥𝗔𝗗𝗘 𝗪𝗛𝗘𝗥𝗘 𝗛𝗨𝗦𝗧𝗟𝗘 𝗧𝗥𝗔𝗗𝗘𝗦!

⬇⬇⬇⬇⬇⬇

⬜️ 𝗞𝗔𝗟𝗦𝗛𝗜 – 𝗬𝗼𝘂𝗿 𝗘𝗱𝗴𝗲 𝗶𝗻 𝗘𝘃𝗲𝗻𝘁 𝗠𝗮𝗿𝗸𝗲𝘁𝘀!

👉 Join here: https://bit.ly/kalshi-hustle

⬛️ 𝗚𝗥𝗩𝗧 – 𝗧𝗿𝗮𝗱𝗲 𝘄𝗶𝘁𝗵 𝗦𝗽𝗲𝗲𝗱 𝗮𝗻𝗱 𝗣𝗿𝗶𝘃𝗮𝗰𝘆!

☑️ Earn 10% interest on your total trading account balance!

👉 𝗝𝗼𝗶𝗻 𝗻𝗼𝘄: http://bit.ly/grvt-hustle

🟧 𝗕𝗟𝗢𝗙𝗜𝗡 – 𝗚𝗲𝘁 𝗩𝗜𝗣𝟭 + 𝗨𝗽 𝘁𝗼 𝗮 $𝟭,𝟬𝟬𝟬 𝗕𝗼𝗻𝘂𝘀 + 𝗮 𝗖𝗵𝗮𝗻𝗰𝗲 𝘁𝗼 𝗪𝗜𝗡 𝟵,𝟰𝟬𝟬 𝗨𝗦𝗗𝗧!

👉 𝗡𝗼 𝗞𝗬𝗖. 𝗦𝗶𝗴𝗻 𝘂𝗽: https://partner.blofin.com/d/Hustle

🟥 𝗔𝗦𝗧𝗘𝗥 – 𝗧𝗵𝗲 𝗡𝗲𝘅𝘁-𝗚𝗲𝗻 𝗣𝗲𝗿𝗽 𝗗𝗘𝗫 𝗳𝗼𝗿 𝗔𝗹𝗹 𝗧𝗿𝗮𝗱𝗲𝗿𝘀!!

👉 https://bit.ly/aster-hustle

🟦 𝗣𝗜𝗢𝗡𝗘𝗫 – 𝗟𝗲𝘁 𝗧𝗵𝗲 𝗕𝗼𝘁𝘀 𝗧𝗿𝗮𝗱𝗲 𝗳𝗼𝗿 𝗬𝗼𝘂!

👉 𝗦𝗶𝗴𝗻 𝘂𝗽: https://partner.pionex.com/p/Hustle

🟨 𝗡𝗘𝗫𝗨𝗦 – #𝟭 𝗗𝗲𝗰𝗲𝗻𝘁𝗿𝗮𝗹𝗶𝘇𝗲𝗱 𝗧𝗿𝗮𝗱𝗶𝗻𝗴 𝗔𝗽𝗽!!

👉 https://www.nexuslabs.gg/app?ref=Hustle

🟪 𝗘𝗗𝗚𝗘 𝗫 – 𝗨𝗻𝗹𝗼𝗰𝗸 𝗬𝗼𝘂𝗿 𝗧𝗿𝗮𝗱𝗶𝗻𝗴 𝗘𝗱𝗴𝗲! 𝗧𝗿𝗮𝗱𝗲 𝗮𝗻𝗱 𝗘𝗮𝗿𝗻 𝗣𝗼𝗶𝗻𝘁𝘀!

👉 https://bit.ly/edgex-hustle

🟩 𝗕𝗜𝗧𝗙𝗨𝗡𝗗𝗘𝗗 – 𝗛𝗮𝘃𝗲𝗻’𝘁 𝗴𝗼𝘁 𝗮 𝗹𝗼𝘁 𝗼𝗳 $$ 𝘁𝗼 𝗧𝗿𝗮𝗱𝗲 𝘄𝗶𝘁𝗵?

☑️ Purchase any BitFunded challenge to unlock access to bigger trading funds!

👉 𝗦𝗶𝗴𝗻 𝘂𝗽: https://bit.ly/bitfunded-hustle

___________________________________________

🟠 𝗔𝗞𝗘𝗗𝗢 – 𝗔𝘂𝘁𝗼𝗻𝗼𝗺𝗼𝘂𝘀 𝗔𝗜 𝗚𝗮𝗺𝗲 𝗣𝗹𝗮𝘁𝗳𝗼𝗿𝗺!

🔥 The first Multi-Agent AI framework built for autonomous content creation!

👉 𝗪𝗲𝗯𝘀𝗶𝘁𝗲: https://learn.akedo.fun

👉 𝗫: https://x.com/akedofun

___________________________________________

𝗙𝗢𝗟𝗟𝗢𝗪 𝗛𝗨𝗦𝗧𝗟𝗘

⬇⬇⬇⬇⬇⬇

🔥 𝗛𝘂𝘀𝘁𝗹𝗲 𝗼𝗻 𝗫 – https://x.com/0xHustlepedia

🔥 𝗛𝘂𝘀𝘁𝗹𝗲 𝗼𝗻 𝗜𝗻𝘀𝘁𝗮𝗴𝗿𝗮𝗺 – https://www.instagram.com/0xhustlepedia/

___________________________________________

👁️🗨️ 𝗖𝗿𝘆𝗽𝘁𝗼 𝗕𝗮𝗻𝘁𝗲𝗿 𝗮𝗯𝗶𝗱𝗲 𝗯𝘆 𝘁𝗵𝗲 𝗳𝗼𝗹𝗹𝗼𝘄𝗶𝗻𝗴 𝗰𝗼𝗱𝗲 𝗼𝗳 𝗰𝗼𝗻𝗱𝘂𝗰𝘁:

https://www.cryptobanter.com/our-ethics/

We take our code of ethics very seriously and have engaged @zachxbt ( / zachxbt ) to monitor our progress. If you feel we’re not living up to it and have hard evidence, please email ZachXBT directly at reportcb@protonmail.com

⚠️ 𝗕𝗘𝗪𝗔𝗥𝗘 𝗢𝗙 𝗦𝗖𝗔𝗠𝗠𝗘𝗥𝗦 𝗜𝗡 𝗢𝗨𝗥 𝗖𝗢𝗠𝗠𝗘𝗡𝗧𝗦 𝗔𝗡𝗗 𝗖𝗢𝗠𝗠𝗨𝗡𝗜𝗧𝗬 𝗖𝗛𝗔𝗡𝗡𝗘𝗟𝗦

___________________________________________

𝗦𝗽𝗲𝗰𝗶𝗮𝗹 𝘁𝗵𝗮𝗻𝗸𝘀 𝘁𝗼:

🎵 DJ Send!t

𝗧𝗵𝗲 𝗛𝘂𝘀𝘁𝗹𝗲 𝘀𝗼𝗻𝗴

https://bit.ly/3zMjXRo

These songs are licensed through Epidemic Sound. The email address linked to the account is accounts@cryptobanter.com Electro Animal – Oh the City

___________________________________________

In the Game is a live-streaming channel that brings you the hottest crypto news, market updates, and fundamentals of digital assets. Join the fastest-growing crypto trading community to get notified on the most profitable trades and the latest crypto market updates & news!!

📝 𝗗𝗶𝘀𝗰𝗹𝗮𝗶𝗺𝗲𝗿:

In the Game is a social podcast for entertainment purposes only!

All opinions expressed by the hosts, guests, and callers should not be construed as financial advice! Views expressed by guests and hosts do not reflect the views of the station. Listeners are encouraged to do their own research.

#CryptoGaming #Bitcoin #Altcoins #Hustle #BearMarket

⏱ 𝗧𝗶𝗺𝗲𝘀𝘁𝗮𝗺𝗽𝘀:

00:00 Worst Crypto Market Sentiment Ever Seen

01:41 Should You Sell All Your Crypto Now?

03:10 Why This Crash Is Worse Than FTX

06:06 Could MicroStrategy Blow Up? The Big Risk

06:47 My Top Crypto Picks: What I’m Holding

07:54 Why $64K Bitcoin Is A Generational Gift

11:01 2026 Prediction: When Is The Cycle Bottom?

13:53 Bitcoin Price Dropping Live: Warning To Traders

🎬 𝗠𝗼𝗿𝗲 𝗩𝗶𝗱𝗲𝗼𝘀:

WATCH MORE CRYPTO GAMING VIDEOS https://www.youtube.com/watch?v=bCa7_PWYwFY&list=PLmOv2_vzOoGdb8Z-MCwdhfFudYfbSipTx&index=1

source

Video

Paisa ka chakar #rakshabandhan #sisterlove #money #indimation

Video

Bitcoin Crashes Further To $65K! Where’s The Bottom??

#Bitcoin #Crypto #Finance

Welcome to Market Mavericks , where fast paced market analysis meets high probability trade setups brought to you by three of the world’s top chart technicians. This is your front row seat to the action in crypto, stocks, commodities, and more.

This isn’t just another finance show it’s your launchpad to becoming a market maverick. Learn from the best, trade smarter, and level up your portfolio.

🎙 Meet the Hosts

Scott Melker – Crypto investor, former DJ/producer, host of The Wolf Of All Streets podcast & #cryptotownhall , author of The Wolf Den newsletter.

YT: @ScottMelker · Twitter: @ScottMelker

Mike McGlone – Senior Macro & Commodity Strategist, Bloomberg Intelligence — creator of the Bloomberg Commodity Dashboard (BI COMD).

Twitter: @mikemcglone11

Gareth Soloway – 24-year technical trader & macro analyst, President of VerifiedInvesting.com (Crypto Swing Trading & trader education), Chief Market Strategist at InTheMoneyStocks.com since 2007.

YT: @GarethSolowayProTrader · Twitter: @GarethSoloway

🚀 Connect & Learn

Join The Wolf Pack Community Channel (Free Telegram) – Daily crypto market updates + direct chat with Scott: https://t.me/+34ihhgJnZYRlOWU8

Join The Wolf Pack News Channel (Free Telegram) – Daily crypto news & technical analysis with Scott: https://t.me/+Jzsrl5Xp9NJmMDk0

Free Wolf Den Newsletter – Crypto news & market analysis every weekday: https://thewolfden.substack.com/

📊 Featured Trading Tools

Arch Public – Hedge-fund-level algorithmic trading tools: https://archpublic.com/

Trading Alpha – Pro-grade crypto indicators (Code: 10OFF): https://tradingalpha.io/?via=scottmelker

📲 Follow Scott Melker

Twitter/X: https://x.com/scottmelker

Website: https://www.thewolfofallstreets.io/

Spotify: https://spoti.fi/30N5FDe

Apple Podcasts: https://apple.co/3FASB2c

📩Promote your brand with The Wolf of All Streets. For sponsorship & partnership opportunities, contact info@thewolfofallstreets.io

⚠️ Disclaimer

The views and opinions expressed here are solely my own and should in no way be interpreted as financial advice. This video was created for entertainment. Every investment and trading move involves risk. You should conduct your own research when making a decision. I am not a financial advisor. Nothing contained in this video constitutes or shall be construed as an offering of financial instruments or as investment advice or recommendations of an investment strategy or whether or not to “Buy,” “Sell,” or “Hold” an investment.

source

Video

If I Started Investing in 2026, This Is What I’d Do

📊 Join my Free ‘How & Where to Invest’ Live Workshop https://nischa.me/investyt

UK ISA and savings accounts: https://nischa.me/plum

Free fractional shares worth up to £100 (enter code ‘NISCHA’): https://nischa.me/trading212

In this video, I break down the exact 7-step plan I’d follow if I were starting investing from scratch in 2026, so you can avoid beginner mistakes and invest with confidence.

My products:

📶 Intentional Spending Tracker (free): https://nischa.me/ist

📊 How & Where to Invest LIVE Workshop (free): https://nischa.me/investyt

📙 Financial Wellbeing Toolkit: https://nischa.me/plan

Other tools:

UK ISA and savings accounts: https://nischa.me/plum

Free fractional shares worth up to £100 (enter code ‘NISCHA’): https://nischa.me/trading212

Timestamps:

00:00 Intro

01:01 Step 1

02:22 3 things to do before investing

04:16 Step 2

07:30 Step 3

09:53 Step 4

11:38 Step 5

13:37 Step 6

15:39 Step 7

DISCLAIMERS & DISCLOSURES

This content is for educational and entertainment purposes only. Nischa does not provide tax or investment advice. The information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors. Past performance is not indicative of future results. All investing involves risk, including the possible loss of principal.

This description contains affiliate links that allow you to find the items mentioned in this video and support the channel at no cost to you. Thank you for your support!

*T&C’s apply

source

Video

Crypto Crash EXPLAINED

Massive crypto crash explained! We break down why bitcoin and top altcoins are tumbling and what this means for the market. Stay updated with the latest crypto news, trends, and insights to navigate the current bitcoin and altcoin volatility.

💥 Join Our Trading Group

Discord – https://discord.gg/pJYe4Z9FWa

Toobit – https://www.toobit.com/t/DiscoverCrypto

Blofin – https://partner.blofin.com/d/DiscoverCrypto

●▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬●

➡️ Protect your BTC From Taxes – https://bitcoinira.com/

➡️ Crypto Tax Services – https://www.decrypted.tax/

➡️ Use ‘DC20’ for 20% off Arculus – https://www.getarculus.com/products/arculus-cold-storage-wallet

Bitcoin Ticker Box – https://tickerbox.eu?sca_ref=8841235.jarE9W1myNW

●▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬●

➡️ Follow on X – https://x.com/DiscoverCrypto_

●▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬●

All of our videos are strictly personal opinions. Please make sure to do your own research. Never take one person’s opinion for financial guidance. There are multiple strategies and not all strategies fit all people. Our videos ARE NOT financial advice. Our videos are sponsored & include affiliate content. Digital Assets are highly volatile and carry a considerable amount of risk. Only use exchanges for trading digital assets. We never keep our entire portfolio on an exchange.

#bitcoin #crypto

source

Video

#money #millionaire #cash #affirmations #motivation #dollar

Video

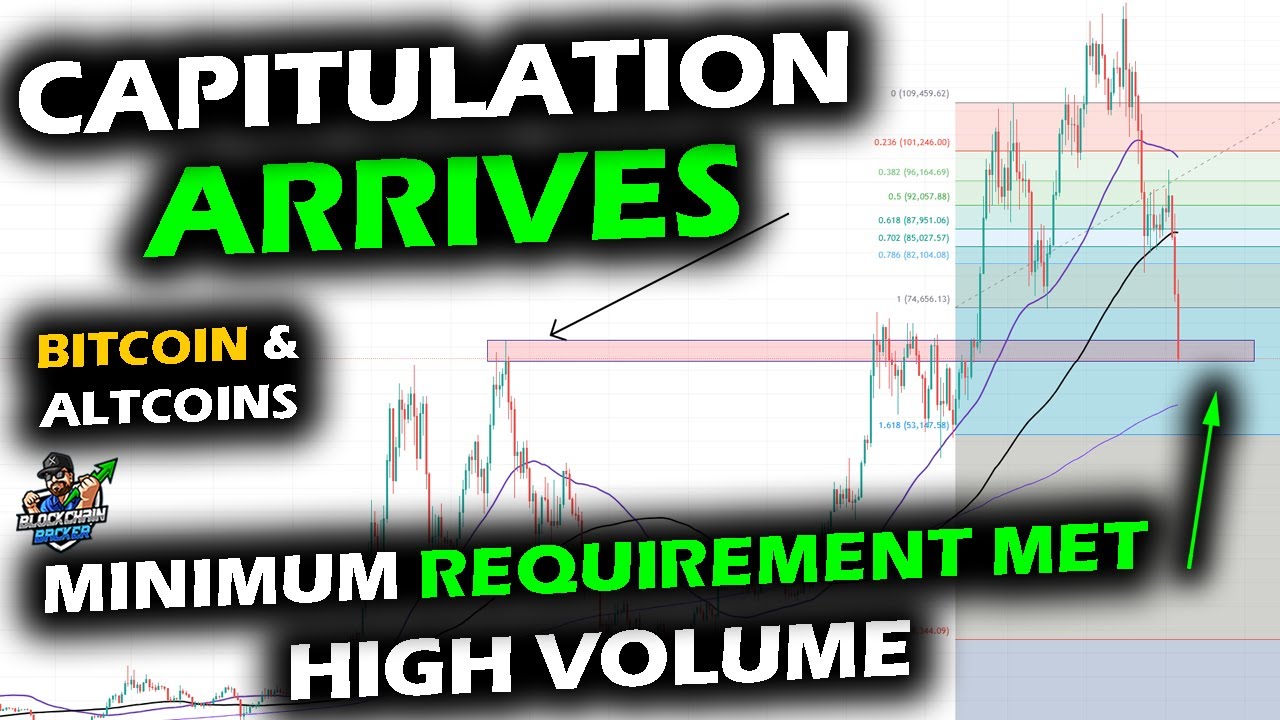

Capitulation Arrives as Bitcoin, XRP Price Chart and Altcoin Market Crash, Minimum Met, Bottom Hunt

Blockchain Backer Newsletter – https://blockchainbacker.substack.com

Blockchain Backer’s Technical Analysis Toolkit for Crypto – http://www.BCBacker.com

Blockchain Backer 702 Digital Art NFT Collection on XRP – https://nft.onxrp.com/collection/blockchain-backer/

Hi, I am the Blockchain Backer, bringing you the latest cryptocurrency news and analysis. The content of my channel primarily focuses on crypto news, motivation, and chart analysis on the XRP chart, Bitcoin chart, various Altcoin charts, and market cap charts.

DISCLAIMER: I am not a financial adviser. Investing and trading is risky, and you can lose your money. The information in this video should not be used to make any investment decisions. You should contact a licensed financial adviser prior to making any investment decisions. Any affiliate links in the description of these videos may provide a commission if you decide to purchase their products. I appreciate any and all support of my channel, and without you, I wouldn’t be here. Thank you.

source

Video

Sick Luke – MONEY MACHINE (feat. Lazza & Tony Effe) [Official Visual]

![Sick Luke - MONEY MACHINE (feat. Lazza & Tony Effe) [Official Visual]](https://wordupnews.com/wp-content/uploads/2026/02/1770843044_maxresdefault.jpg)

Ascolta #DOPAMINA il mio nuovo album:

https://linktr.ee/sicklukex2

Follow #SickLuke:

https://www.instagram.com/sicklukex2/

@sicklukex2000

Regia: Andrea Catini

D.O.P: Nicolò Ballante

Direttore di produzione: Daniele Masini

Assistente di produzione: Gianmarco Cannone per Duit S.r.l

Operatore: Jacopo Cerroni

1ac: Susanna Fortunato

Gaffer: Manuel Pistonsi

Elettricista: Marco Mineyichev

Scenografa: Ludovica Tata

Fotografo cover: Giacomo Gianfelici

Assistente fotografo: Giorgia Giannini

Runner: Andrea Fornalè

M.u.a: Chiara Lombardi

Stylist: Alessandro Preziosi

Edit: Andrea Catini

Color: Leonardo Marziali

Video backstage: Mirko Bordone

Foto backstage: Claudia Cosi

Location: Nero Studio

Una produzione Fulcro Lucem S.r.l. W/ StillAwake

Un progetto Carosello Records

℗ © 2025 Carosello Records

source

Video

EPSTEIN EMAILS JUST EXPOSED XRP – THIS CHANGES EVERYTHING

EPSTEIN EMAILS JUST EXPOSED XRP – THIS CHANGES EVERYTHING

XRP News Today, Crypto News, Bitcoin News, Altcoin News, Ripple XRP Price, Ripple XRP Chart, Ripple SEC News

👉 Join FREE Discord (12,000+ members)

https://whop.com/cryptocrusaders/?pass=prod_kMpHoF9HbzFfO

💰 ITrustCapital ($100 Bonus)

https://www.itrustcapital.com/go/ncash

👉 Crypto Apparel

https://www.tokenizedthreads.com

●▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬●

NordVPN: https://go.nordvpn.net/aff_c?offer_id=15&aff_id=98794&url_id=902

DCENT Wallets:

Single Package: https://tinyurl.com/3nkyr8y9

2X Package: https://tinyurl.com/yk9kb5jx

Exchanges:

ByBit: https://partner.bybit.com/b/ncash

MEXC: https://bit.ly/3I4NsSG

Coinbase: https://bit.ly/3QXgU11

Uphold: https://bit.ly/3ONsmdu

MY SOCIALS:

Instagram: https://www.instagram.com/ncashofficial/

Twitter (X): https://x.com/NCashOfficial

TikTok: https://www.tiktok.com/@ncashofficial

●▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬●

Keywords: crypto, cryptocurrency, bitcoin, ethereum, blockchain, crypto trading, altcoins, btc, eth, cryptocurrency news, cryptocurrency trading, crypto news, bitcoin news, ethereum news, blockchain technology, crypto investing, bitcoin price, ethereum price, crypto analysis, crypto market, bitcoin trading, crypto tips, bitcoin investing, ethereum investing, crypto wallet, decentralized finance, defi, nft, non-fungible tokens, crypto mining, blockchain explained, crypto tutorial, bitcoin explained, ethereum explained, how to buy crypto, crypto exchange, coinbase, binance, crypto for beginners, crypto 2024, bitcoin prediction, crypto future, digital currency, crypto trends, blockchain future, smart contracts, crypto regulation, crypto updates, hodl, bitcoin halving, crypto bull run, crypto bear market, ico, initial coin offering, blockchain startups, crypto security, crypto scams, crypto hacks, crypto taxes, bitcoin wallet, ethereum wallet, crypto portfolio, crypto trading strategies, crypto market analysis, crypto investment strategy, blockchain applications, crypto finance, web3, metaverse, decentralized apps, dapps

●▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬●

LEGAL & REGULATORY DISCLAIMER

1. Channel Ownership & Purpose

This channel is operated by a legally registered business. All content shared is for informational and entertainment purposes only and reflects the views of the channel as an organization.

2. No Financial, Legal, or Tax Advice Provided

I am not a licensed financial advisor, attorney, or tax professional. Nothing presented here should be interpreted as financial, investment, legal, or tax advice. Always seek advice from qualified professionals before making any financial decisions.

3. Sponsorships & Affiliate Links

Some content may include sponsored material or affiliate links. I may receive a commission if you make a purchase or sign up through these links, at no extra cost to you. I only feature products or services I personally use or believe in. However, you are solely responsible for conducting your own research before engaging with any promoted product or service.

4. Geographic Limitations

This content is not directed at, nor intended for use by, individuals located in the United Arab Emirates, United Kingdom, United States, Canada, or any other jurisdiction where the marketing, promotion, or discussion of virtual assets is restricted or prohibited.

If you reside in such areas, please refrain from acting on or engaging with this content.

5. Cryptocurrency Risk Disclosure

Investing in cryptocurrencies involves significant risk, including but not limited to:

Complete loss of invested funds

High market volatility

Low liquidity

Irreversible transactions

Exposure to fraud, scams, or market manipulation

There is no guarantee of investor protection or legal recourse. Participation is entirely at your own risk.

6. No Guarantees or Assurances

I do not guarantee the accuracy, completeness, timeliness, or effectiveness of any strategies, opinions, or information shared. No profits, outcomes, or results are assured. All decisions and actions you take are your sole responsibility.

7. Content Subject to Change

The information provided may become outdated over time. I reserve the right to modify, update, or remove any content without prior notice.

8. EU MiCA & Canada Compliance Notice

In compliance with the EU Markets in Crypto-Assets Regulation (MiCA) and applicable Canadian regulations:

This content is not intended as financial promotion or investment advice under MiCA or Canadian law.

Crypto-assets discussed may not be appropriate for all investors and are not covered by deposit protection or investor compensation schemes in the EU or Canada.

Efforts are made to ensure that all statements are fair, balanced, and not misleading.

If you are located in the EU or Canada, please ensure your interaction with this content aligns with local legal and regulatory requirements.

●▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬●

Description Tags (Ignore)

#ripple #xrp #bitcoin

source

-

Politics3 days ago

Politics3 days agoWhy Israel is blocking foreign journalists from entering

-

Sports5 days ago

Sports5 days agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

NewsBeat2 days ago

NewsBeat2 days agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

Business3 days ago

Business3 days agoLLP registrations cross 10,000 mark for first time in Jan

-

Tech5 days ago

Tech5 days agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

Business3 days ago

Business3 days agoCostco introduces fresh batch of new bakery and frozen foods: report

-

Tech18 hours ago

Tech18 hours agoSpaceX’s mighty Starship rocket enters final testing for 12th flight

-

NewsBeat3 days ago

NewsBeat3 days agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

Sports3 days ago

Sports3 days agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Politics3 days ago

Politics3 days agoThe Health Dangers Of Browning Your Food

-

Sports4 days ago

Former Viking Enters Hall of Fame

-

Sports5 days ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

Business3 days ago

Business3 days agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

NewsBeat5 days ago

NewsBeat5 days agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Business6 days ago

Business6 days agoQuiz enters administration for third time

-

Crypto World1 day ago

Crypto World1 day agoBlockchain.com wins UK registration nearly four years after abandoning FCA process

-

Crypto World2 days ago

Crypto World2 days agoU.S. BTC ETFs register back-to-back inflows for first time in a month

-

NewsBeat3 days ago

NewsBeat3 days agoResidents say city high street with ‘boarded up’ shops ‘could be better’

-

Sports2 days ago

Kirk Cousins Officially Enters the Vikings’ Offseason Puzzle

-

NewsBeat6 days ago

NewsBeat6 days agoStill time to enter Bolton News’ Best Hairdresser 2026 competition