Entertainment

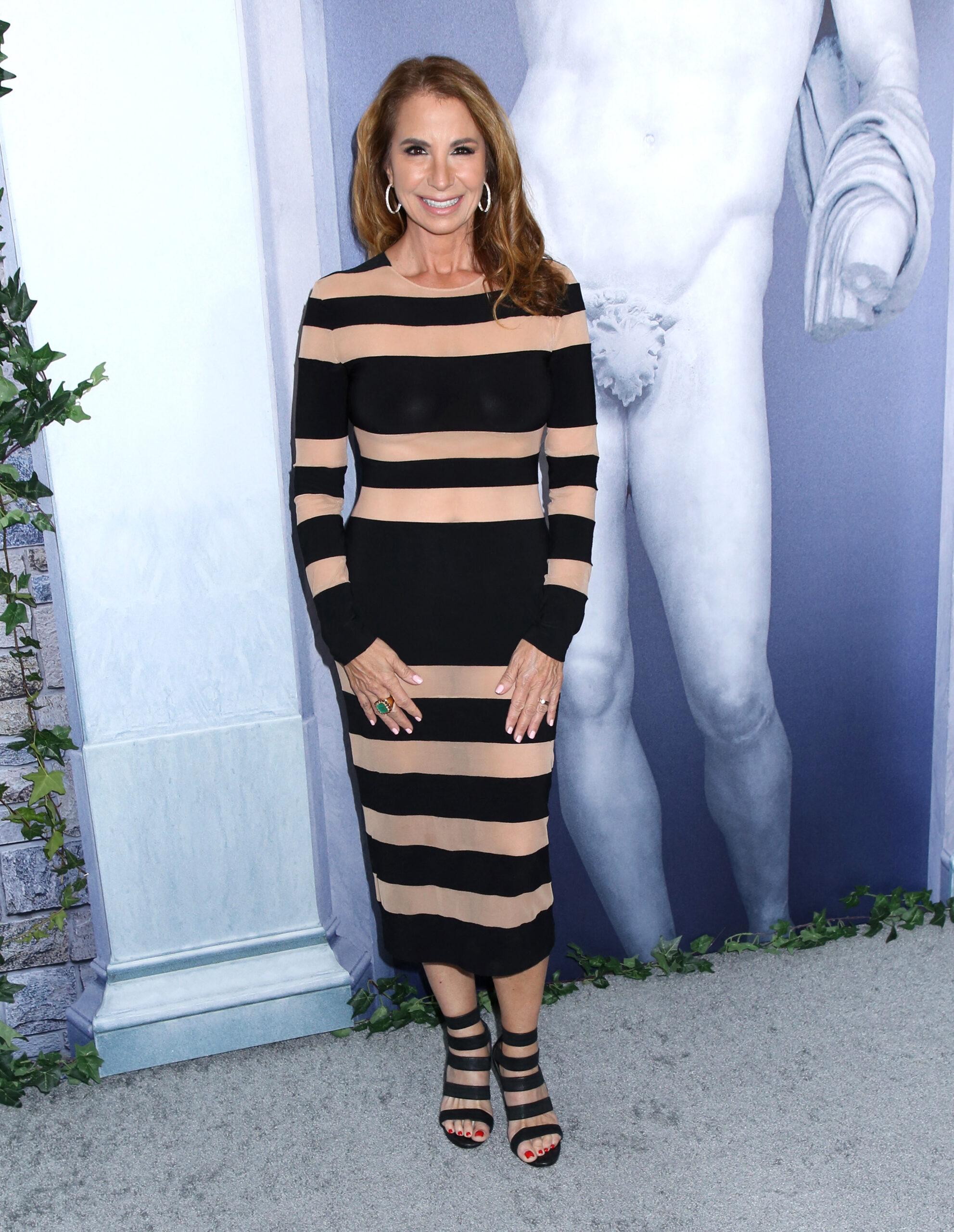

Jill Zarin Breaks Silence After Being Fired Over Critical Bad Bunny Comments

Former “Real Housewives of New York” star Jill Zarin is speaking out after being axed from a new reality show before production officially commenced. Zarin, one of the OGs on the original “Real Housewives” series, was fired ahead of season 5 in 2012 and recently faced intense backlash for her critical comments about Bad Bunny‘s Super Bowl Halftime performance.

Article continues below advertisement

Jill Zarin Responds Following ‘RHONY’ Spin-Off Firing, Says ‘I’m Human’

Zarin appears to be taking her firing personally, telling In Touch that the E! Network “didn’t even give me a chance” to rectify the situation. “I took it down right away. People make mistakes. I’m human.”

Zarin’s statement follows the announcement by the producers of the new “RHONY” spin-off, “The Golden Life,” that they have decided to part ways with the outspoken reality star.

“In light of recent public comments made by Jill Zarin, Blink49 Studios has decided not to move forward with her involvement in The Golden Life,” the statement read, according to The Blast. “We remain committed to delivering the series in line with our company standards and values.”

Article continues below advertisement

What Did Jill Zarin Say About Bad Bunny’s Super Bowl Halftime Show?

Zarin’s dramatic firing came after the Bravo OG slammed Bad Bunny’s Super Bowl Halftime performance, which became the most-watched in the program’s history, with over 130 million viewers.

In a since-deleted video, Zarin criticized Bad Bunny, saying it wasn’t “appropriate” to perform at the Big Game in Spanish, Bad Bunny’s native language.

Zarin also found an issue with some of Bad Bunny’s choreography, calling it “inappropriate” for the “Tití Me Preguntó” singer to be grabbing his crotch during the show.

Article continues below advertisement

Zarin Called Bad Bunny’s Performance A ‘Political Statement’

Zarin didn’t stop there. Later in the video, the “Real Housewives” reality star said she would’ve preferred to enjoy the show with an artist who sang in a language she knew before adding even more fuel to the fire.

“To me, it looked like a political statement because there were literally no white people in the entire thing. I’m not taking a side, one way or the other … I think it was an ICE thing. I think that the NFL sold out, and it’s very sad,” she said.

Zarin wasn’t the only public figure to voice frustration with Bad Bunny’s performance.

Donald Trump, Jake Paul, and conservative names like Kid Rock and Megyn Kelly also found issue with the Puerto Rican-inspired performance.

Article continues below advertisement

Someone Is On Zarin’s Side

A source spoke to Page Six after Zarin’s firing and condemned the E! Network for making such drastic changes so soon. “A lot of people were not happy about the Bad Bunny show,” the source shared, implying Zarin’s comments were shared by several others:

“Megyn Kelly had a viral video slamming it. Whether you like him or not, the President of the United States slammed it.”

The insider added that E! “completely overreacted.” They added that had network waited a week for things to die down, everything would’ve been OK. “The show doesn’t air for nine months,” they said.

They finished: “Jill said what half the country was saying, but she got fired for it.”

Article continues below advertisement

‘RHONY’ Spin-Off Coming To A TV Screen Later This Year

The new “RHONY” spin-off will now feature Ramona Singer, Sonja Morgan, Kelly Bensimon, and Luann de Lesseps. It’s unclear whether there will be casting changes since Zarin’s departure.

The show’s synopsis teases “fallouts and friendship” in the Sunshine State, adding that in “this new ‘golden’ era of life, the longtime friends are thriving in and around Palm Beach with fabulous homes and a bustling social scene.”

The spin-off garnered positive reactions after its announcement in early 2026, primarily because many viewers demanded the original “RHONY” women return to TV after Bravo fired them in 2021.

Zarin’s participation in the series was especially noteworthy, given that she has publicly called for her return to the series since her initial firing in 2012. In 2023, the crew was supposed to return for a legacy version of the series; however, that was canned after Zarin reportedly failed to reach an agreement with the show’s producers.

It’s unclear what Zarin’s next move will be. With Bravo officially moving on from most of the women and E! cutting her out of the deal, fans may only have the original “RHONY” archives to look back on.

Continue Reading

Entertainment

“The Daily Show” reviews Pam Bondi's greatest hits from congressional hearing: 'I don't know why you're laughing'

:max_bytes(150000):strip_icc():format(jpeg)/Pam-Bondi-021126-3dd42a3da7e644dd83f897ff7881c3b0.jpg)

Lawmakers asked the attorney general about the Jeffrey Epstein files, and Jordan Klepper noticed that it did not go well.

Entertainment

Every Star Trek Fan’s Worst Fears Confirmed By Tarantino Partner’s Meeting With Alex Kurtzman

By Joshua Tyler

| Updated

Roger Avary is a well-known Hollywood producer and director who got his start co-writing Pulp Fiction with Quentin Tarantino. He now co-hosts Tarantino’s film podcast, The Video Archives, but in addition to all of that, he’s also a major Star Trek fan.

How big a fan is he? Avary claims his family watches two or three Star Trek episodes nearly every day. He loves Star Trek so much that he offered to work on it, basically for free, when current Trek overlord Alex Kurtzman began launching new Star Trek television shows in the 2010s. What Avary learned after meeting with Kurtzman is the nightmare scenario every Trekkie has always suspected.

Avary told his story this week on The Joe Rogan Experience, saying of Alex Kurtzman, “I went in and met with the guy, I was like, I will write for scale. I will write on your new show. I just want to be part of it.”

If the writer of Reservoir Dogs, True Romance, Pulp Fiction, and Beowulf wants to work on your project for nothing, that would seem like a win. There was one problem, though: Roger Avary isn’t just an acclaimed writer; he’s also a huge Star Trek fan.

Kurtzman’s response was a hard no, and as Avary explains it, “He didn’t want anybody who had any kind of fondness for the original show. He wanted to do something new and create something new.”

Roger Avary has worked in Hollywood and helped write and direct some of the biggest, most successful movies of all time. Like his friend Tarantino, he has an encyclopedic knowledge of film and television. Because of that keen awareness of what’s good and what isn’t, he’s destroyed by what’s come of Star Trek in the wake of Kurtzman’s decisions.

Or as Avary put it: “This dweeb Alex Kurtzman just comes along and s**ts all over everything… Starfleet Academy is an abomination. I could not get through three episodes of Discovery. It’s just awful, awful storytelling… Picard was terrible.”

Roger Avary says he believes all film and television is, in some form, propaganda. Or as we sometimes phrase it on this site, screenwashing. The best movies, he suggests, are those that are personal propaganda in which a filmmaker has something personal or interesting he wants to say and delivers that message to the audience.

However, according to Avary, Alex Kurtzman’s Star Trek is corporate propaganda. Corporate propaganda is a form of screenwashing designed to deliver a pre-programmed message assigned by your overlords. Avary says of modern Star Trek, “They’re more interested in the corporate propaganda than they are any kind of personal propaganda.“

Entertainment

Nicole Curtis Apologizes For Using N-Word, Reacts to HGTV Cancelation

HGTV Star Nicole Curtis

I’m Sorry I Blurted The N-Word

… Comeback Canned

Published

|

Updated

Nicole Curtis is addressing the controversy surrounding HGTV pulling her show “Rehab Addict” from its platforms following the release of leaked footage showing her using a racial slur during filming.

Curtis tells TMZ … “I want to be clear: the word in question is wrong and not part of my vocabulary and never has been, and I apologize to everyone.” She tells us she was unaware of HGTV’s decision to pull the plug on her show on the same day it was set to return to air after a hiatus.

Waiting for your permission to load the Instagram Media.

Despite the surprising split, she tells us, “I’m grateful for the 15-year journey we’ve shared. It’s been a meaningful chapter, but my focus isn’t on my career. My focus, at this moment is rightfully on my relationships, and my community — the people who truly know my character and where my heart is.”

The controversy began when RadarOnline published production footage from the set of the home renovation series. In the clip, Curtis appears frustrated while working on a project and blurts out the n-word. Almost immediately, she reacts in shock to what she said.

HGTV tells us it was “recently made aware of an offensive racial comment made during the filming of Rehab Addict. Not only is language like this hurtful and disappointing to our viewers, partners, and employees — it does not align with the values of HGTV.”

Entertainment

Experts Stress Proof of Life Importance in Nancy Guthrie Search (Excl)

As the hunt for Nancy Guthrie continues, several experts are weighing in on the importance of proof of life in her case.

“Ransom is often not paid without proof of life because paying without verification risks funding a crime with no chance of recovery,” Dan Donovan, the Founder and Managing Partner of Stratoscope Holdings, a security and risk management firm, exclusively tells Us Weekly. “Proof of life is critical: it confirms the victim is alive, validates that the communicators control the victim, and helps assess credibility and intent.”

Retired FBI agent Scott Curtis agrees and shares a warning about the alleged ransom threat Nancy’s loved ones — including her daughters, Today cohost Savannah Guthrie and Annie Guthrie, and son Camron Guthrie — received. (The 84-year-old’s alleged abductor or abductors demanded a reported $6 million by 5 p.m. MST by February 9).

“I believe they haven’t received proof of life. You’re not going to make a ransom payment unless you have proof of life because once that payment goes [through], you will never hear from those kidnappers again, right?” Curtis tells Us. “So you want proof. You want some kind of guarantee.”

Nancy Guthrie Instagram/Savannah Guthrie

He also warns that there is no technical guarantee with advanced technology.

“There still could be some doubt in that proof of life, especially in this AI generated world we’re living in now,” Curtis cautions. “It couldn’t be a still photograph. It would have to be a video with audio with some definitive date stamp on there.”

Former CIA officer and FBI special agent Tracey Walder stresses that it’s the Guthrie family’s decision to pay a ransom or not. (Multiple notes have been sent to media outlets, claiming to be Nancy’s kidnapper and asking for money, including Bitcoin. The FBI has not yet confirmed to the public if any of the ransom notes are real).

“I don’t think they ever received a picture or anything like that, but maybe in the second note it had (details of) something that may have happened to her or not happened to her,” Walder says. “Whether or not to pay that decision lies solely with the family, not the FBI.”

She also sympathizes with the struggle Savannah, 54, and her siblings face.

“We don’t know what we would do in that situation. We may say, ‘Oh I am not paying $6 million without proof of life,’ but if it was your 84-year-old mother, and you had that money, then maybe you would.”

On February 10, the FBI released images and video from Nancy’s doorbell camera, showing a masked man armed with what appeared to be a gun outside her front door in Tucson, Arizona, on the night she disappeared.

The individual wore a backpack and gloves as they attempted to cover the camera with their hand and plants from the front yard.

Later that same day, a man from the neighboring town of Rio Rico was detained and questioned in connection with the disappearance of Nancy. He was subsequently released and has maintained his innocence.

Savannah has shared several emotional messages since her mother’s disappearance on February 1.

“We believe she is still alive. Bring her home,” she wrote via Instagram on Tuesday after the images of the masked man were released. “Anyone with information, please contact 1-800-CALL-FBI (1-800-225-5324) or the Pima County Sheriff’s Department 520-351-4900.”

Entertainment

‘Selling Sunset’ Production Exploring Christine Quinn Return

Christine Quinn

Eyed for Possible ‘Selling Sunset’ Season 10 Return

Published

Christine Quinn‘s “Selling Sunset” chapter could be reopening … TMZ has learned.

Multiple sources familiar with the situation tell TMZ … production for the Netflix hit series is gauging Christine’s interest in a possible return for Season 10, asking whether she’d consider coming back.

We’re told premature conversations have taken place and are ongoing … but nothing is official, and no contracts have been signed.

Christine starred on the show from Seasons 1 through 5 and quickly became one of its most polarizing personalities, known for her over-the-top fashion, sharp tongue, and explosive feuds with Chrishell Stause, Mary Fitzgerald, Heather Rae El Moussa, and Emma Hernan.

Her 2022 exit followed a turbulent fifth season marked by accusations of dishonesty, fractured friendships, and mounting behind-the-scenes tension. Christine denied wrongdoing and pushed back on how she was portrayed, claiming certain storylines were exaggerated or manufactured.

Her relationship with executive producer Adam DiVello became increasingly strained, with Christine accusing production of unfair treatment and narrative manipulation. She ultimately left both the series and The Oppenheim Group, skipping the Season 5 reunion.

Since then, Christine has written a memoir, launched new ventures, and gone through a highly publicized divorce.

Now, as Season 10 gears up, producers appear at least open to seeing if the former villain would walk back through the Oppenheim doors.

We’ve reached out to reps for Christine and Netflix … so far, no word back.

Entertainment

HGTV pulls “Rehab Addict” from its platforms after video emerges of star Nicole Curtis using racial slur

:max_bytes(150000):strip_icc():format(jpeg)/Nicole-Curtis-021126-e7e45243cb294bb391abdb1f533f88e6.jpg)

“Rehab Addict” was scheduled to air its first new episodes since July on Wednesday.

Entertainment

Reese Witherspoon 'devastated' over death of James Van Der Beek, whose final role is in “Legally Blonde” TV prequel

:max_bytes(150000):strip_icc():format(jpeg)/Reese-Witherspoon-James-Van-Der-Beek-021126-e15cbdab3055474b92e55b55c190ec67.jpg)

Van Der Beek will appear as a school superintendent in “Elle.”

Entertainment

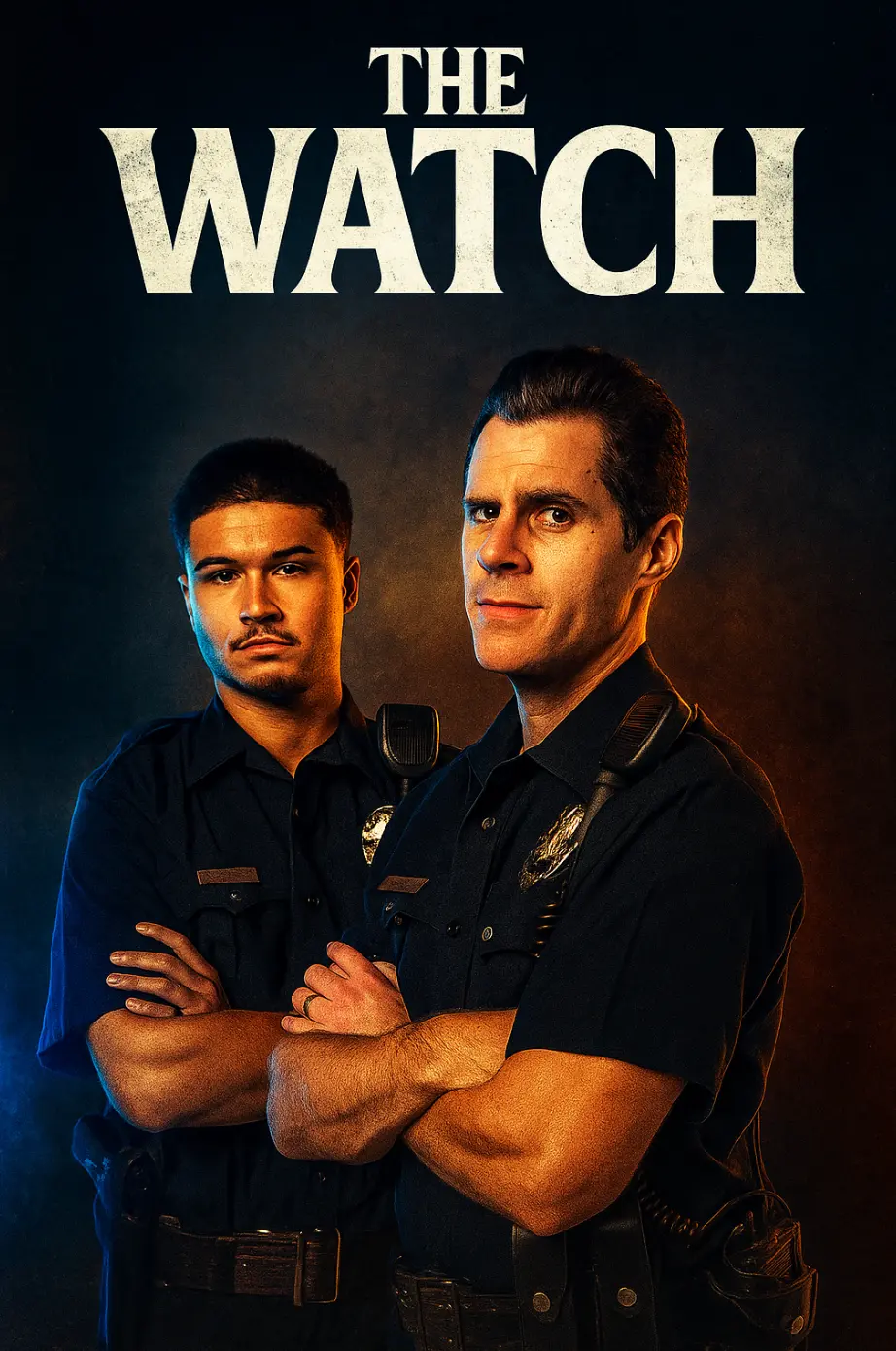

‘The Watch’ Blurs The Line Between Video Games And Television

Every major entertainment medium starts life in the spaces between others. Film grew out of photography and theater. Television evolved from radio and cinema. Video games borrowed from all of them before becoming something distinct. The Watch lives in one of those in-between spaces, with the project being led by Michael Mumbauer as an exploration of how game development principles can be applied to television-scale storytelling.

Rather than functioning as a tech demo or proof of concept, The Watch is presented as a finished pilot. It sits somewhere between television, video games, and short-form drama, built to test whether cinematic storytelling can operate inside a fully generative, vertical-first production pipeline while still feeling authored and intentional.

Article continues below advertisement

It is best understood less as a traditional show and more as a test world.

Article continues below advertisement

A Pilot Designed for Focus

Television pilots typically exist to communicate scale. Cast size, locations, and production value all signal ambition. The Watch takes a different approach.

Here, “micro” refers to precision rather than limitation. The project was built as a tightly controlled dramatic fragment, with written scenes, directed performances, deliberate camera language, and editorial oversight throughout. Creative decisions are made up front and carried through the pipeline rather than being left to automation.

That structure gives the pilot clarity. The system executes creative intent, but it does not generate the story on its own. As a result, The Watch feels purposeful in the way a pilot should, even though it operates at a smaller scale than traditional television.

Article continues below advertisement

World-Building Through Iteration

In conventional production, world-building tends to lock in early. Sets are built, locations are secured, and changes become costly. The Watch approaches its world more like a game environment.

The setting exists entirely inside a generative workflow, but it feels cohesive because its tone, visual continuity, performance style, and internal logic were defined early and refined through iteration. This allows the creative team to explore the world before finalizing it, adjusting details without the usual logistical penalties.

The result is a world that feels intentional rather than improvised, even though it was shaped through rapid experimentation.

Article continues below advertisement

Designed for Vertical Viewing

Vertical video is often seen as a platform-imposed constraint. The Watch treats it as a native storytelling format.

The framing prioritizes proximity over spectacle. Faces and small gestures carry more narrative weight, and camera movement is restrained and purposeful. Because the pilot was designed specifically for vertical viewing, it avoids the awkward compromises that often come with adapting horizontal content for phones.

The experience feels intimate and immediate, closer to a cinematic moment than disposable short-form content.

Article continues below advertisement

A Production Model Without Physical Production

One of the most notable aspects of The Watch is what its production process eliminates. There are no physical sets, no location shoots, and no traditional cameras. The usual reshoot and post-production cycles are replaced by an iterative workflow more commonly associated with game development.

Despite that, the finished pilot retains the familiar qualities of premium storytelling. Performances feel controlled, staging feels deliberate, and pacing is measured.

Generative tools streamline execution without replacing creative decision-making. Authorship remains central while much of the logistical friction is removed.

Where Three Mediums Converge

The Watch draws from three traditions. AI-driven video enables visual production without physical infrastructure. Game development informs how the world is built, explored, and refined. Micro-drama shapes pacing, intimacy, and format.

The result is not a novelty hybrid, but a coherent production approach that allows television concepts to be developed with the flexibility of software while maintaining narrative discipline.

Article continues below advertisement

Why the Micro-Pilot Matters

A micro-pilot allows creators to test tone, performance, and pacing through finished work rather than theoretical pitches. It offers a way to validate creative decisions early, before committing to full production infrastructure.

This does not replace traditional methods. It reshapes the front end of development.

The Watch demonstrates that a television world can be authored, explored, and proven creatively before physical production begins. As a starting point, it offers a clear glimpse at where game logic and television storytelling may continue to overlap.

Entertainment

HBO’s Cutthroat 4-Part Thriller Has Become a Must-Watch for ‘Succession’ Fans

Succession has not been on the air for close to three years, but the show’s impact is still felt all these years later. It introduced HBO‘s viewership to the cutthroat world of family empires and how money can affect relationships and loyalties. No other show has captured that feeling of unpredictability brought on by an ungodly amount of money better than Industry, the under-the-radar finance drama that has been stacking wins since it premiered in 2020. The British drama is the definition of a sleeper hit, having risen from a licensed streaming acquisition to headlining the 9 p.m. Sunday slot on HBO.

Data from FlixPatrol shows that the series is among the top ten most-watched shows on HBO Max, ranking fourth globally at the time of writing. The list is led by the latest Game of Thrones spinoff, A Knight of the Seven Kingdoms, The Pitt, and the spicy hockey phenomenon, Heated Rivalry. Industry takes viewers into the lives of the people who make money by making informed guesses and predictions. Sometimes they might do shady stuff to influence the outcome, but they don’t view it as immoral if they don’t get caught. Like Succession, the character ensemble includes many people you should hate but can’t help but love and perhaps admire. On Industry, relationships are fickle and transactional.

‘Industry’ Continues to Impress After Four Seasons

While other shows see a dip in popularity, Industry‘s star continues to rise as it captures attention across multiple platforms. The series has shown consistent growth in viewership and social media interest. Season 4 continues to receive the acclaim that has carried the Mickey Down and Konrad Kay drama since 2020. It has an impressive 96% score on the review aggregator Rotten Tomatoes, with critics praising its ability to reinvent itself while keeping its spirit. Collider’s Liam Gaughan highlighted this shift in his review of Industry Season 4, saying,

Season 4 of Industry directly teases the show’s future and presents some exciting open questions about how the ramifications of its finale will play out. Although there’s never the sense that Industry is holding itself back, the wider canvas that Season 4 operates on suggests that the series could continue to evolve to keep up with reality’s increasingly unbelievable events. Industry may share similarities with previous HBO dramas, but it’s evolved into a definitive show of the moment.

Catch new episodes live on HBO on Sundays at 9 p.m. or stream on HBO Max in the US. Stay tuned to Collider for more updates.

- Release Date

-

November 9, 2020

- Network

-

HBO

- Directors

-

Isabella Eklöf, Tinge Krishnan, Ed Lilly, Birgitte Stærmose, Zoé Wittock, Caleb Femi, Mary Nighy, Konrad Kay, Lena Dunham, Mickey Down

-

-

Marisa Abela

Yasmin Kara-Hanani

-

Harry Lawtey

Robert Spearing

-

Entertainment

Man Accused of Sexually Abusing a Child From Jail Gets Life Sentence

A Texas man was sentenced to life in prison after authorities said he continued to sexually abuse a child — who he is alleged to have abused previously — while he was in jail awaiting a murder trial.

Anthony Dewayne Taylor, 46, of Frisco, was sentenced on a charge of sexual performance of a child, the Collin County District Attorney’s Office announced in a news release issued on Wednesday, February 11.

Taylor is accused of abusing a minor victim beginning when she was 14 until she was 16, according to prosecutors.

“After being paroled on a drug trafficking charge from Oklahoma in 2020, Taylor reconnected with the victim’s family and gained access to the child,” the district attorney’s office said.

He allegedly abused her in multiple states and multiple Texas cities, according to prosecutors.

In October 2022, Taylor, described as “a career criminal and confirmed gang member,” was arrested on a murder charge in connection with a killing in Oklahoma City, the district attorney’s office said.

Ahead of his murder trial, Taylor repeatedly called the girl he previously abused from behind bars, according to prosecutors.

These phone calls were being recorded, the district attorney’s office said.

Over the phone, Taylor told the girl to “engage in lewd acts while the child was living in Collin County, leading to the sexual performance charges,” according to the district attorney’s office.

In December 2022 — two years before Taylor ultimately pleaded guilty to murder in December 2024 and was handed a 10-year prison sentence — the girl spoke out about the abuse, the district attorney’s office said.

She “bravely” opened up about the abuse, resulting in her family alerting the Frisco Police Department.

Taylor’s defense attorney, John B. Setterberg, declined Us Weekly’s request for comment on Wednesday, February 11. It was not immediately clear who represented Taylor in his murder case.

According to the district attorney’s office, the child detailed the alleged abuse she experienced from Taylor, including over the phone, in an interview at the Children’s Advocacy Center of Collin County.

Then a Frisco police detective, Kim Pruitt, discovered evidence corroborating what the girl shared when she visited Taylor’s home, the district attorney’s office said. Pruitt also got ahold of the recorded jail calls with the help of the Oklahoma City Police Department.

A Collin County jury ultimately convicted Taylor of sexual performance of a child at trial, which began on January 20, according to prosecutors and court records viewed by Us.

Taylor had been facing a sentence of five to 99 years in prison, or life in prison, the district attorney’s office said.

The jury decided a life sentence was appropriate, according to prosecutors.

“This convicted murderer continued to prey on a child even from behind bars,” District Attorney Greg Willis said in a statement. “A Collin County jury saw the full picture and delivered the only sentence that protects the public and our children – life in prison.”

Taylor has since filed an appeal in his case, court records show.

If you or someone you know is experiencing child abuse, call or text Child Help Hotline at 1-800-422-4453.

-

Politics4 days ago

Politics4 days agoWhy Israel is blocking foreign journalists from entering

-

Sports5 days ago

Sports5 days agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

NewsBeat2 days ago

NewsBeat2 days agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

Business4 days ago

Business4 days agoLLP registrations cross 10,000 mark for first time in Jan

-

Tech5 days ago

Tech5 days agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

Sports7 hours ago

Sports7 hours agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

Business3 days ago

Business3 days agoCostco introduces fresh batch of new bakery and frozen foods: report

-

Tech1 day ago

Tech1 day agoSpaceX’s mighty Starship rocket enters final testing for 12th flight

-

NewsBeat3 days ago

NewsBeat3 days agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

Sports3 days ago

Sports3 days agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Sports5 days ago

Former Viking Enters Hall of Fame

-

Politics4 days ago

Politics4 days agoThe Health Dangers Of Browning Your Food

-

Sports6 days ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

Business4 days ago

Business4 days agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

NewsBeat6 days ago

NewsBeat6 days agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Business7 days ago

Business7 days agoQuiz enters administration for third time

-

Crypto World8 hours ago

Crypto World8 hours agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

Crypto World2 days ago

Crypto World2 days agoBlockchain.com wins UK registration nearly four years after abandoning FCA process

-

Video3 hours ago

Video3 hours agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

Crypto World2 days ago

Crypto World2 days agoU.S. BTC ETFs register back-to-back inflows for first time in a month