Christopher John Eadie, known as Chris, was found dead in the garden of his home on the Sandringham estate near King’s Lynn by his partner Joanne.

![]() A new photograph of King Charles at Sandringham has been issued by Buckingham Palace to mark his (Image: Millie Pilkington/Sandringham Estate/PA Wire)

A new photograph of King Charles at Sandringham has been issued by Buckingham Palace to mark his (Image: Millie Pilkington/Sandringham Estate/PA Wire)

Norfolk Coroner’s Court heard the 63- year- old self-employed decorator had worked at the estate for more than 30 years and took enormous pride in carrying out projects for the late Queen and later King Charles.

His brother Mark Eadie told this newspaper that highly skilled Mr Eadie’s “perfectionism” meant he was frequently appointed for “the top jobs” within the Royal household, including painting the bedroom of the Prince and Princess of Wales.

But in recent years, work from the estate became less frequent following management changes and the introduction of new contractors, something that deeply affected him.

Mr Eadie, told the hearing Chris was a “talented perfectionist” who lived for his work.

“My brother was absolutely brilliant at his job,” he said. “He had incredible attention to detail and wouldn’t let anything go unless it was perfect.”

He added his brother was immensely proud of working for the Royal Family, carrying out jobs discreetly inside royal residences.

“He was loyal and wouldn’t talk about what he did, but I know he painted William and Kate’s bedroom and even met their children once in the garden. He said they were lovely,” he said.

![]() The Royal Family (Image: Prince and Princess of Wales/Josh Shinner)

The Royal Family (Image: Prince and Princess of Wales/Josh Shinner)

But one job in particular left him devastated.

Mr Eadie had been tasked with painting a pagoda over a Buddha at Sandringham in colours requested by the King. Although Chris felt the colours were “a bit garish”, he painted it exactly as instructed.

However, the King was not happy with how it looked and ordered it be repainted.

Mr Eadie said Chris dutifully stripped the structure and prepared it ready for new colours chosen by the King, only for the final painting work to be handed to another contractor.

“After all that detailed preparation, someone else was given the job,” his brother said. “He was devastated.”

The court heard that around the same time Chris had begun losing weight and suffering from a lack of appetite, becoming convinced he might have cancer.

Phone conversations with his brother revealed his mental health was deteriorating as worries over both his health and work at Sandringham mounted.

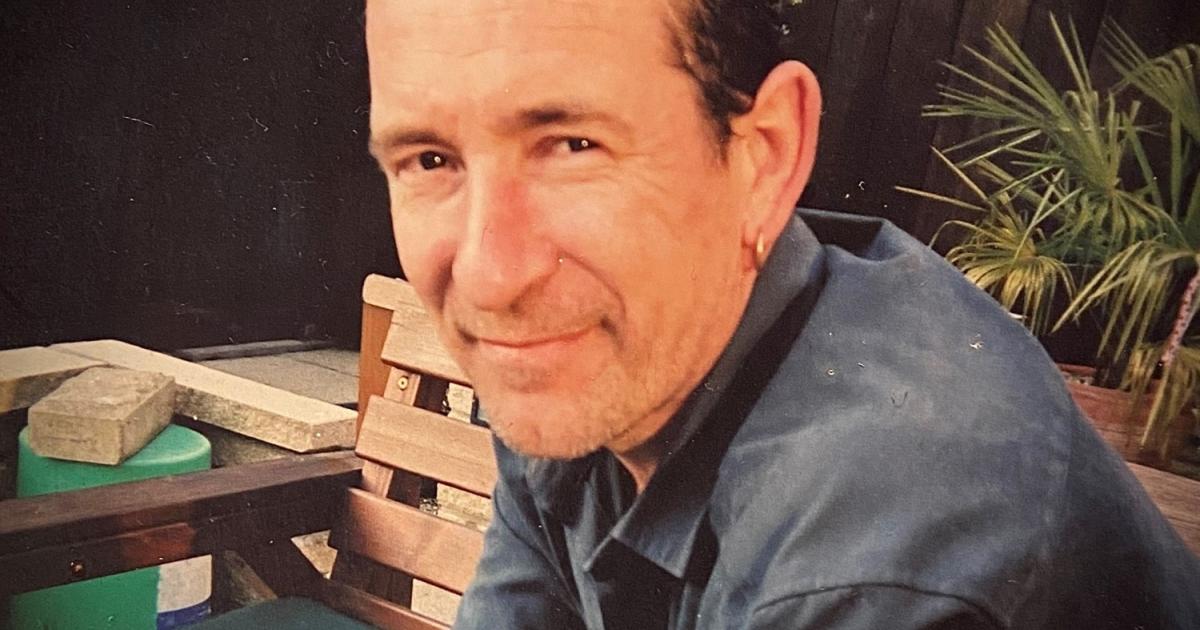

![]() Christopher John Eadie with one of his sons (Image: Memorial)

Christopher John Eadie with one of his sons (Image: Memorial)

His former partner, Joanna described him as a loving father to his two sons who took huge pride in his career and his long service to the royals.

But she said the reduction in work from Sandringham after decades of loyalty deeply upset him with the pagoda incident becoming a particular source of angst.

Six weeks before his death she found him sitting in the dark at home and later feared he had been considering harming himself.

In the days before he died she told the court he became unusually affectionate, something she now believes was part of saying goodbye.

Police officer David Norris told the inquest officers were called to the address after his partner discovered a note inside the house and found Mr Eadie hanging in a small garden space between sheds.

Paramedics attempted to resuscitate him after cutting him down but were unable to save him.

Inside the house officers found the handwritten letter and a bottle of open spirits.

Toxicology tests later showed only a small amount of alcohol in his system, along with raised levels of paracetamol, though not enough to have caused death.

A post-mortem examination concluded he died by hanging.

Medical evidence showed Mr Eadie had visited his GP earlier in the year complaining of weight loss and abdominal discomfort and later began taking antidepressants after reporting anxiety and work-related stress.

His medication for anxiety ran out shortly before his death on October 10, 2025, and a repeat prescription had not been requested.

Edward Parsons, land agent for the Sandringham Estate, said Mr Eadie had never been directly employed by the estate but was one of many contractors used for work, with jobs allocated based on requirements.

He said though Mr Eadie had been awarded a number of jobs in 2025, a decision had then been made not go ahead with work.

In his final note, Mr Eadie apologised to loved ones, writing: “Tell everyone I love them so much. I am sorry.”

Summing up, the coroner Yvonne Blake said worries about his health combined with work concerns had led to a decline in Mr Eadie’s mental health.

However, she concluded there was insufficient evidence to say he intended to end his life and recorded a conclusion reflecting mental health deterioration rather than suicide, saying: “I am not satisfied that he intended to die. He had a decline in mental health and was upset about work. These things prevented sufficient clarity of mind.

“He took his own life but the deterioration in mental health means I am not concluding suicide.”

She expressed condolences to his family, describing him as a man who clearly took immense pride in his work and was deeply loved by those close to him.

“I know he was a man who took great pride in his work. He was self employed but did a lot of work at Sandringham. He felt discarded not having as much work there as he used to and he put this down to different contractors being used.”