Crypto World

Miss foreign stock run in 2025? Still market money to be made overseas

After spending most of the past decade being trounced by the U.S. stock market, international equities are back and investing experts say the opportunity should last.

A brutal stretch of underperformance that lasted a decade ended in late 2024 and has sustained its momentum at the outset of 2026. After years of global allocations staying low for most U.S.-based investors because of the weak returns, the recent gains amid shifting macro conditions and growing concerns about U.S. market concentration are leading investors to take another look at the lack of international exposure in their portfolios.

It is not merely chasing hot recent performance, according to Tim Seymour, Seymour Asset Management chief investment officer. “This is not people saying … this is a time to trade global markets,” he said on this week’s CNBC’s “ETF Edge.”

Over the last ten years, global equities outside of the U.S. underperformed domestic markets by a wide margin, with Seymour noting that a major world equities benchmark ETF, the iShares MSCI ACWI ETF (ACWI), underperformed by about 60%. That gap shaped investor behavior and capital flowed into U.S. equities, particularly mega-cap technology stocks. Seymour described it as a generational dynamic among investors in which market capitalization growth in the U.S. “choked off a lot of international investing.”

But he says now the structural underweight that many U.S. investors have to global markets is a tailwind. While international equities represent roughly 30-40% of global market capitalization, Seymour estimates that at the high-end of the range, U.S. investor exposure to overseas markets is 12-15%, and in many cases much lower.

International equities began to outperform the U.S. in November 2024, and since that turn have beaten U.S. equities by roughly 15%, Seymour said. While that does not erase the decade of lagging returns, it marks a meaningful inflection point. “In a 14-month span, you’ve seen international outperform the U.S.” Seymour said. While the ten-year chart versus the U.S. stock market still looks poor, “it really is a story of where global growth has picked back up,” he added.

A popular exchange-traded fund choice among many U.S. investors to gain international exposure is the iShares MSCI Emerging Markets ETF (EEM), which has $26.55 billion in assets and has returned 42% over the past year. The iShares MSCI ACWI ETF is up 20% over the past year, besting the S&P 500’s return by about 5%. Seymour said while the potential returns from emerging markets are higher, investors who are looking to diversify overseas should tilt more heavily to developed market allocations, citing a 70%-30% split as a reasonable example.

Part of the renewed interest in overseas markets is tied to currency. A weakening U.S. dollar has improved returns for dollar-based investors holding foreign assets. Meanwhile, metals have surged as investors look for stores of value, an investing development that Seymour described it as a global trade rather than a U.S. only phenomenon.

“These are all providing tailwinds and a weakening dollar, of course, where this is leading investors to diversify their overall portfolios that had been previously U.S.-centric portfolios,” Jon Maier, J.P Morgan Asset Management chief ETF strategist, said on “ETF Edge.”

Seymour said the most important point for investors to understand when considering the additional of international stocks to a portfolio is that the fundamentals are improving. Earnings growth is appearing in places where stagnation once defined the outlook. Japan is a key example, he said, where years of corporate governance reform and shareholder focus is starting to boost returns.

Europe is also benefitting from lower interest rates, fiscal spending, and regulatory change. Seymour argued that deregulation in Europe may be a more powerful catalyst than similar efforts in the U.S. because it represents a sharper shift from the past. Banking, utilities, and industrials have all seen renewed momentum. He added that in additional to a decade of underperformance making these stocks cheap on a relative basis, many European banking stocks will benefit as much from central bank policy as U.S. banks and are better dividend plays, such as Barclays, Santander and SocGen.

Maier echoed this general view, saying that “developed international markets are certainly areas of interest to our clients.”

International markets also offer exposure to recent winning trades, including precious metals. Latin America has been one of the strongest performing regions this year, driven by gold and copper. Seymour said Chile and Peru are examples of international markets benefitting from rising commodity demand. Meanwhile, Brazil has gained on both commodity strength and shifting political expectations.

“Brazil’s the largest economy in Latin America,” Seymour said. “Some of this are the dynamics around commodities, but some of these are the dynamics around the geopolitics.”

The iShares MSCI Brazil ETF (EWZ), which has $8.91 billion in assets, is up almost 49% over the past year, while the iShares MSCI Peru and Global Exposure ETF (EPU) is up almost 118% during the same time period.

The dollar and metals trades came under pressure on Friday after President Trump announced Kevin Warsh as his pick to succeed Jerome Powell as Fed Chair, with market belief in Warsh as figure who will maintain Fed independence rather than force rates down at the president’s bidding. Gold, silver and platinum all crashed. However, these metals have seen enormous returns over the past year, with gold up over 90%, silver up roughly 200%, and platinum up 120%.

Market strategists say Trump administration global policies will continue to serve as longer-term tailwinds for international-themed trades. “Whether it is India and the EU cutting a trade deal or Canada cutting oil deals with China, the rest of the world is repositioning,” Seymour said.

Technology leadership is another trade where investors are reassessing the balance between U.S. and overseas holdings. Seymour highlighted South Korea as example, noting the country’s market is heavily weighted toward memory chip leaders like Samsung and SK Hynix, which make up around 46% of the South Korean stock market benchmark tracked by the iShares MSCI South Korea ETF (EWY), which is up 125% over the past year. “Memory has been on fire,” he said, making country level ETFs a practical way to gain exposure. Apple said on its earnings call on Thursday it can’t secure enough chips for iPhone demand, another sign supporting the strength of the memory trade.

Seymour noted other companies that are among the biggest chip players in the world, ASML and Taiwan Semi, also reside outside U.S., and there are many data center plays overseas as well.

The renewed interest in international equities reflects broader reallocation after years of neglect. Investors are responding to valuation gaps, earnings growth, and a world where capital and trade are increasingly multi directional. “These are global trades, not just U.S. trades,” Seymour said.

Crypto World

Ethereum L2 Builders Debate Scaling Role After Vitalik’s Rollup Rethink

Several layer-2 builders responded after Ethereum co-founder Vitalik Buterin said the original vision of L2s as the primary scaling engine “no longer makes sense,” calling for a shift toward specialization.

In a Wednesday post, Buterin argued that many L2s have failed to fully inherit Ethereum’s security due to continued reliance on multisig bridges, while the base layer is increasingly capable of handling more throughput via gas-limit increases and future native rollups.

The comments prompted responses from Ethereum layer 2s, who broadly agreed that rollups must evolve beyond being cheaper versions of Ethereum but diverged on whether scaling should remain central to their role.

The Ethereum ecosystem is grappling with a shifting roadmap that aims to make the base layer more capable, while L2s reposition themselves as specialized environments serving distinct technical needs.

Ethereum L2 builders accept shift, differ on scaling’s role

Karl Floersch, a co-founder of the Optimism Foundation, said in an X post that he welcomed the challenge of building a modular L2 stack that supports “the full spectrum of decentralization.”

He also acknowledged that major hurdles exist. These include long withdrawal windows, the lack of production-ready Stage 2 proofs and insufficient tooling for cross-chain apps.

“Stage 2 isn’t production-ready,” Floersch wrote, adding that existing proofs are not yet secure enough to support major bridges. He also supported native Ethereum precompile for rollups, a concept that Buterin recently emphasized as a way to make trustless verification more accessible.

Steven Goldfeder, the co-founder of Arbitrum developer Offchain Labs, took a more forceful stance in a lengthy X thread. He argued that while the rollup model has evolved, scaling remains a core value of L2s.

Goldfeder said Arbitrum was not built as a “service to Ethereum,” but because Ethereum provides a high-security, low-cost settlement layer that makes large-scale rollups viable.

He also pushed back on the idea that a scaled Ethereum mainnet could replace the throughput currently handled by L2 networks. Goldfeder cited periods of high activity when Arbitrum and Base processed over 1,000 transactions per second, while Ethereum handled fewer.

He warned that if Ethereum was perceived to be hostile to rollups, institutions might launch independent layer-1 chains rather than deploy on Ethereum.

Related: Stablecoin ‘dust’ txs on Ethereum triple post-Fusaka: Coin Metrics

Base frames differentiation, Starknet hints alignment

Jesse Pollak, head of Base, said in an X post that Ethereum’s L1 scaling was “a win for the entire ecosystem.” He agreed that L2s cannot just be “Ethereum but cheaper.”

Pollak said Base has focused on onboarding users and developers while working toward Stage 2 decentralization, adding that differentiation through applications, account abstraction and privacy features align with the direction Buterin outlined.

StarkWare CEO Eli Ben-Sasson, whose company develops the non-EVM Starknet rollup, offered a brief but pointed reaction on X, writing: “Say Starknet without saying Starknet.”

Ben-Sasson’s comment hinted that some ZK-native L2s see themselves as already fitting the specialized role Buterin described.

Magazine: Ethereum’s Fusaka fork explained for dummies: What the hell is PeerDAS?

Crypto World

DeFi Governance Capture – Smart Liquidity Research

How “decentralized governance” quietly became a game of influence.

The Promise of DeFi Governance

DeFi governance was supposed to be the antidote to centralized finance. Instead of executives and boards, protocols would be steered by token holders voting on proposals—fees, upgrades, emissions, treasury use.

In theory:

In reality, participation is low, power is concentrated, and influence often flows to whoever understands the system best—or pays the most.

Enter Delegates: Power by Proxy

Most token holders don’t vote. They’re busy, uninterested, or overwhelmed by technical proposals. So they delegate their voting power to someone else.

Delegates are meant to:

But delegation also creates a new class of political actors—full-time governors with enormous influence over protocol direction.

When a handful of delegates control 20–40% of voting power, governance stops being “community-led” and starts looking… familiar.

Bribes: The Open Secret

Governance bribes are not always hidden. In fact, many are openly marketed.

Bribing in DeFi usually looks like:

-

“Vote for this proposal and earn extra tokens.”

-

Incentives routed through bribe markets or side agreements

-

Protocols paying to influence emissions, listings, or parameter changes

From a game-theory perspective, it’s rational. From a governance perspective, it’s corrosive.

When votes are bought:

And the most capitalized actors dominate.

Governance Capture: When Decentralization Fails Quietly

Governance capture doesn’t require malicious intent. It often happens gradually.

Common paths to capture:

-

Large token holders or funds delegating to aligned voters

-

Professional delegates optimizing for bribe income

-

Voter apathy allows small coalitions to control outcomes

The result?

Decisions favor:

-

Emission-maximizing strategies

-

Partner protocols over users

-

Financial insiders over contributors

All while maintaining the appearance of decentralization.

Why This Is Hard to Fix

The uncomfortable truth: governance capture is not a bug—it’s an incentive problem.

Challenges include:

-

Token-weighted voting amplifies wealth concentration

-

Low participation makes capture easier

-

Bribes are difficult to ban without becoming subjective or authoritarian

-

Fully on-chain governance is slow to adapt to social realities

Every attempt to “fix” governance risks introduces new trade-offs.

Emerging Experiments and Partial Solutions

Some protocols are at least trying.

Approaches being tested:

-

Delegate transparency dashboards

-

Vote escrow systems that reward long-term alignment

-

Quorum adjustments and participation incentives

-

Bicameral governance (tokens + contributors)

-

Social slashing and reputation-based delegation

None is perfect—but pretending the problem doesn’t exist is worse.

The Grown-Up Take on DeFi Governance

DeFi governance isn’t broken. It’s just political.

Delegates are inevitable. Bribes are rational. Capture is predictable.

The real question isn’t “How do we eliminate these dynamics?”

It’s “How do we design systems that survive them?”

Protocols that acknowledge power, incentives, and human behavior will outlast those chasing a fantasy of pure decentralization.

Because in DeFi, code is law—but incentives write the constitution.

REQUEST AN ARTICLE

Crypto World

Bitcoin Dips As Strategy Total Holdings Reach 709k

Join Our Telegram channel to stay up to date on breaking news coverage

The Bitcoin price has dropped 4% in the last 24 hours to $89,427 as Michael Saylor’s company, Strategy, continues its aggressive accumulation of the cryptocurrency.

Last week, the company purchased 22,305 BTC for $2.13 billion, at an average price of $95,284 per coin, according to a U.S. Securities and Exchange Commission filing. This latest purchase brought Strategy’s total Bitcoin holdings to 709,715 BTC, bought for roughly $53.92 billion at an average cost of $75,979 per coin.

JUST IN: 🇺🇸 Michael Saylor’s STRATEGY now holds 709,715 bitcoin worth $64.5 BILLION

3.3% of the total supply 🔥 pic.twitter.com/00lCgEXZgn

— Bitcoin Archive (@BitcoinArchive) January 20, 2026

The company now holds about 3.37% of the total 21 million BTC supply and 3.55% of the 19.98 million currently in circulation, according to Blockchain.com. Strategy’s recent buying spree marks its largest Bitcoin acquisition since February 2025, when it purchased over 20,000 BTC for around $2 billion. Earlier this month, the company also bought 13,627 BTC ($1.3 billion), signaling a sharp acceleration in buying compared with most of last year.

Strategy Maintains Bitcoin Accumulation

The surge in purchases came amid Bitcoin briefly surpassing $97,000 and Strategy’s shares (MSTR) rising past $185, boosted further by Morgan Stanley Capital International’s (MSCI) decision not to exclude digital asset treasury companies from its market index.

Despite the recent price pullback, Strategy remains committed to its Bitcoin accumulation strategy. Analysts suggest that the market is now focusing on which digital asset treasury companies can survive through disciplined management and realistic expectations.

James Butterfill of CoinShares emphasized that long-term success depends on credible business models, disciplined treasury practices, and prudent handling of digital assets on corporate balance sheets. Strategy’s continued buying underscores Michael Saylor’s conviction that Bitcoin should remain a core part of corporate treasury strategy, even as volatility in cryptocurrency markets persists.

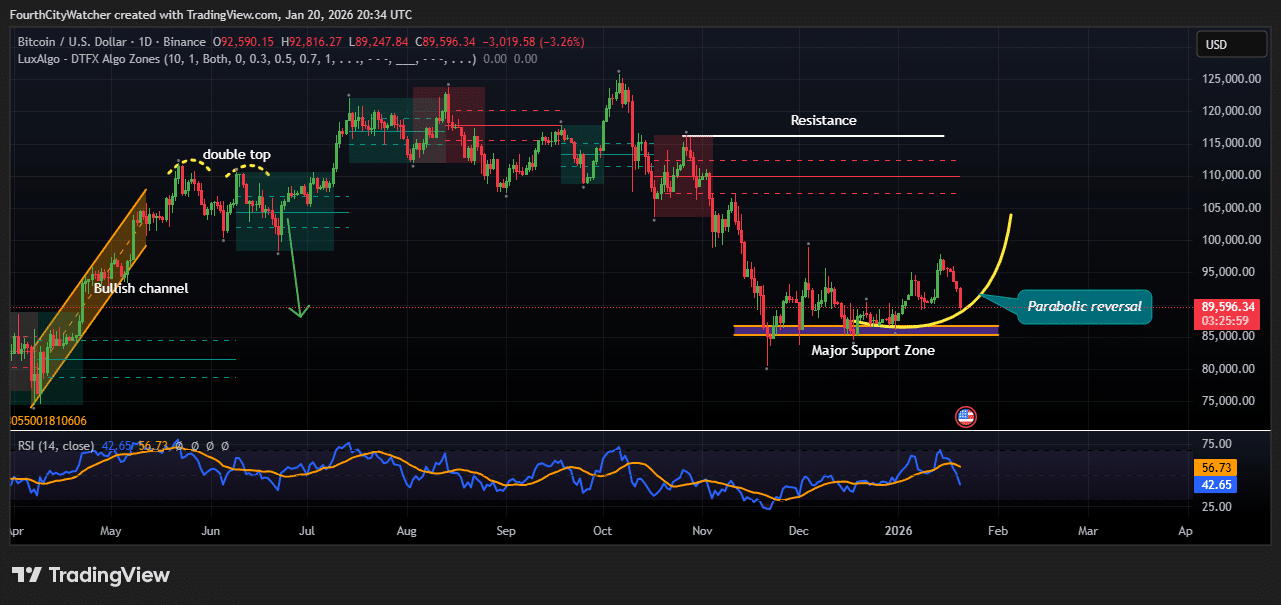

Bitcoin Tests Major Support Zone Near $85K

Bitcoin has pulled back to $89,596, marking a 3.26% drop in the past 24 hours, but technical indicators indicate a potential rebound may be forming. The daily chart shows Bitcoin currently hovering near a major support zone around $85,000–$87,000, which has historically acted as a strong floor for price declines.

Analysts are watching this level closely, as a bounce from here could trigger a parabolic reversal, pushing prices back toward $100,000. Earlier price action shows Bitcoin forming a bullish channel in April–May 2025, followed by a double top pattern in June, which led to a significant correction in the months that followed.

The market then entered a prolonged downtrend, facing repeated resistance levels near $115,000 and $110,000, which it failed to break multiple times. The repeated rejection at these highs reinforced selling pressure, while the support zone now serves as a key area for potential accumulation by investors.

BTCUSD Chart Analysis Source: Tradingview

The Relative Strength Index (RSI) is currently at 42.65, indicating that Bitcoin is neither oversold nor overbought but is approaching a level that often precedes upward momentum. Traders are likely monitoring RSI in combination with price action at the support zone to identify entry points for a potential bullish move.

If Bitcoin manages to hold above the support area and gains upward momentum, the chart suggests a parabolic recovery path toward previous resistance levels. However, failure to defend this zone could lead to further downside, potentially testing lower levels near $80,000. Overall, market sentiment remains cautious, with investors balancing optimism over a potential rebound with concerns over near-term volatility.

This technical setup highlights the ongoing tug-of-war between buyers and sellers, emphasizing that Bitcoin’s next major move will depend on how it reacts to the current support zone and whether it can reclaim momentum toward $100,000 and beyond.

Related Articles:

Best Wallet – Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage

Crypto World

XRP ETFs Beat BTC, ETH, and SOL Funds

Despite the positive inflows, XRP’s price fell below $1.55 once again before more volatility ensued.

In times of heightened uncertainty, rapidly evolving geopolitical situations, and volatility in the US government, investors have shown markedly different behavior toward the spot crypto ETFs.

While those with exposure to the world’s largest cryptocurrency have been consistently pulling funds out of them, the XRP alternatives actually outperformed their counterparts with a strong daily net inflow yesterday.

XRP Outmatches Competition

Data from SoSoValue shows that the spot Bitcoin ETFs have been predominantly in the red for the past several weeks. February 2 was a proper exception, with more than $560 million entering the funds. However, the previous business week saw more than $1.4 billion in net outflows. February 3 was another painful trading day, with $272 million being pulled out.

Given the cryptocurrency’s recent price decline, ETF investors’ holdings have dipped below their average cost basis for accumulated BTC for the first time in 18 months.

For the first time in over 18 months, Bitcoin $BTC has dipped below the ETF cost basis at $82,600.

This is the average price at which spot ETFs accumulated BTC. https://t.co/uH0xhcDTUz pic.twitter.com/f9VGeVtAxS

— Ali Charts (@alicharts) February 4, 2026

The other crypto ETFs tracking larger-cap altcoins, though, were in the green. The spot Ethereum ETFs attracted $14.06 million; the SOL funds saw a minor net inflow of $1.24 million; and the XRP products outperformed the rest with a net gain of $19.46 million. In total, the Ripple ETFs saw more daily inflows than all other crypto funds combined yesterday.

In fact, this was the XRP ETFs’ best day since January 5, when net inflows reached $46.10 million. The cumulative net inflows into the Ripple funds is up to $1.20 billion, which is still slightly below the $1.26 peak recorded before the January 29 crash.

You may also like:

XRP’s Volatility

Yesterday was another highly eventful and volatile trading day in the cryptocurrency markets. Perhaps due to the growing tension in the Middle East and the partial reopening of the US government, or to ETF inflows and outflows, BTC fell to a yearly low of $73,000 before rebounding to over $76,000 as of press time.

The altcoins went through similar fluctuations. Interestingly, XRP dropped to $1.53, then rose to $1.63 before settling at $1.60 as of now. This means that the token is down by almost 17% weekly and 25% monthly. It was brutally rejected at the $2.40 high reached on January 6, and has failed to stage any sort of sustainable recovery since then.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Base Fixes Transaction Delays After Config Error, Preserves L2 Lead

Base, Coinbase’s Ethereum layer-2 network, faced a weekend slowdown caused by a configuration error in a recent transaction-propagation change. While users reported elevated drops and longer waits for on-chain inclusion, blocks continued to be produced and the network did not experience a full outage. In a Wednesday post on X, Base explained that the modification to how transactions were propagated caused the block builder to repeatedly fetch transactions that could not be executed as base fees rose rapidly. The team rolled back the change and said stability has been restored, while outlining plans for longer-term fixes to harden the system against similar hiccups.

Key takeaways

- The incident stemmed from a propagation-change that triggered repeated fetches of non-executable transactions as base fees climbed, prompting a rollback to restore stability.

- Despite the hiccup, the network remained operational and continued producing blocks, indicating resilience even as throughput slowed.

- Longer-term fixes are targeted at the transaction pipeline, overhead reduction, mempool handling, and enhanced rollout monitoring, with an estimated one-month timeline.

- Base is the leading Ethereum layer-2 by TVL, holding about $4.2 billion and roughly 47.6% of the Ethereum L2 market, according to DefiLlama data on a recent Wednesday.

- Arbitrum (CRYPTO: ARB) sits in second place with about 27% of the L2 market, while other networks remain in single-digit shares.

- The episode underscores Base’s central role in Coinbase’s broader “super-app” strategy, integrating stablecoins and on-chain utilities into an expanding suite of products beyond traditional trading.

Tickers mentioned: $ETH, $ARB

Sentiment: Neutral

Market context: The episode highlights ongoing scaling tensions in the Ethereum ecosystem as users migrate activity to layer-2 solutions. Base’s ascent to a majority share of Ethereum L2 TVL underscores the significance of reliability as decentralized finance, payments, and other on-chain use cases increasingly rely on L2 infrastructure. The incident comes amid a landscape where TVL concentration among leading L2s remains pronounced, making resilience and governance in rollout processes particularly important for market participants.

Why it matters

The event is a reminder that even the most sophisticated scaling stacks face operational risk as they push higher throughput and lower fees for users. For Base, the stakes are heightened by Coinbase’s strategy to turn the network into the backbone of an “everything exchange”—a platform that blends crypto trading with stocks, prediction markets and other financial services. By positioning Base as the on-chain distribution layer for Coinbase’s broader product suite, the company aims to accelerate adoption and embed on-chain rails across multiple product lines.

From a technical perspective, the rollback demonstrates a fast-response mechanism in practice: a rollback to a safe configuration, followed by a commitment to strengthen the pipeline and monitoring. The plan to streamline the transaction pipeline, trim unnecessary overhead, optimize the mempool’s handling of pending transactions, and bolster monitoring during infrastructure rollouts indicates a shift from quick patch fixes toward more foundational resilience. The time horizon—a little over a month—reflects the emphasis on both rapid stabilization and longer-term reliability enhancements.

Market researchers and on-chain developers will be watching how these improvements translate into real-world throughput and user experience. Base’s leadership in TVL among Ethereum L2s—reported at about $4.2 billion and a 47.6% share on one recent update—highlights the impact of operational reliability on capital allocation across competing networks. Arbitrum trails at roughly 27% of the L2 market, illustrating a competitive dynamic where even small improvements in efficiency or uptime can influence flow and engagement on L2 ecosystems. The broader implication is that reliability, governance, and measurable performance gains become critical differentiators as users evaluate where to deploy capital and where to build new applications.

Crucially, the incident sits within Coinbase’s broader strategic framework. By strengthening Base and expanding its use cases—from stablecoins to real-world financial utilities—the company signals a long-term commitment to on-chain infrastructure as a foundation for diverse products. This approach is consistent with the trend of crypto platforms seeking to commoditize on-chain rails, enabling a wider array of services that extend beyond custody and trading. As the ecosystem evolves, the emphasis on robust, observable performance will be a key factor shaping developer and user confidence in Layer-2 networks as scalable, secure conduits for everyday financial activity.

What to watch next

- Progress of the one-month improvement window: updates on the rollout, new monitoring dashboards, and any interim performance metrics.

- Any subsequent status notices from Base on X or through official channels detailing stability metrics or new incidents.

- Changes to the transaction pipeline and mempool handling, including benchmarks on throughput and latency during peak periods.

- Definitive commentary from Coinbase and Base leadership about how the improvements may influence adoption of the “everything exchange” concept.

Sources & verification

- Official Base status update on X describing the rollback and restored stability: https://x.com/buildonbase/status/2018845942884237816

- DefiLlama data on Ethereum layer-2 TVL shares and Base’s market position: https://defillama.com/chains/ethereum

- Arbitrum market share reference: https://cointelegraph.com/arbitrum-price-index

Base’s scaling hiccup and the road ahead

Base sits atop Ethereum (CRYPTO: ETH), and its rapid ascent as the leading Ethereum layer-2 has reframed how developers and users think about scaling, gas efficiency, and on-chain usability. In the latest episode, a propagation-change misstep briefly disrupted everyday activity, renewing focus on the fragility that can accompany swift deployments. The network’s ability to continue producing blocks, even as a backlog of transactions faced difficulty entering the mempool, underscored resilience—yet also exposed the delicate balance between speed and reliability that underpins Layer-2 ecosystems.

In a Wednesday update on X, Base explained that the root cause lay in how transaction propagation was implemented during a previous change. As base fees climbed, the block builder repeatedly fetched transactions that could not be executed, creating artificial pressure and delays. The corrective move—rolling back the change—appeared to restore stable operation, and engineers signaled that the episode had highlighted gaps to address in the near term. The planned fixes emphasize a broader redesign: a more streamlined transaction pipeline, reduced overhead, refined mempool logic, and heightened vigilance during infrastructure rollouts. The goal is not only to restore performance but to prevent recurrence as activity continues to migrate toward Layer-2 solutions.

Techniques for measuring and maintaining throughput will be central as Base competes for dominance with other major Layer-2 networks. Arbitrum, for example, remains a formidable contender with a substantial share of the market, illustrating that users and developers weigh reliability, cost, and developer experience as they allocate liquidity across L2s. The competitive dynamic among networks—Base’s dominant position versus Arbitrum’s strong footing—suggests that even incremental improvements to uptime or transaction latency can yield meaningful shifts in on-chain activity and liquidity flows.

Beyond the technical fixes, Base’s role within Coinbase’s strategic framework is increasingly clear. The company has signaled a push toward an “everything exchange” model, a platform that blends crypto trading with traditional financial products and services. Stablecoins and on-chain payments are part of this vision, but the network’s future hinges on how seamlessly it can scale, support diverse product features, and maintain a high level of reliability for users and developers alike. As Base expands, it becomes a pillar in Coinbase’s broader ambition to normalize on-chain interactions across everyday financial use cases, reinforcing the importance of robust Layer-2 infrastructure in a rapidly evolving crypto landscape.

Crypto World

Here’s How US Funding Certainty Calmed Markets and Lifted Bitcoin

Bitcoin dipped to $72.8K during U.S. shutdown fears, then rebounded sharply after lawmakers passed a funding bill.

Bitcoin (BTC) slid to around $72,800 yesterday as U.S. lawmakers debated a stopgap funding package before rebounding once the House passed the bill on February 4, 2026, easing fears of a government shutdown.

The quick turnaround showed how closely crypto prices still track U.S. political risk, even when no blockchain-specific news is involved.

Shutdown Fears Ripple Through Crypto

According to a February 4 post by on-chain analytics firm Santiment, the sell-off unfolded during U.S. trading hours while headlines pointed to a tight vote in the House. As uncertainty built, BTC quickly fell, triggering about $30 million in DeFi liquidations and mirroring a synchronized drop in the S&P 500 and even gold, an asset typically viewed as a safe haven.

This correlation indicates traders were reducing exposure to volatile assets broadly due to the political standoff, not crypto-specific news.

The concern centered on whether Congress would approve a roughly $1.2 trillion funding package to keep most federal agencies running through September 30. Failure would have led to a partial shutdown, delaying economic data and adding stress to an already cautious market.

The tense vote saw Republican divisions, with one representative voting against the bill due to foreign aid provisions.

However, the bill ultimately passed, averting a shutdown and causing markets to respond with immediate relief. Bitcoin bounced from its lows, climbing over 5% within hours, and the S&P 500 also recovered. According to Santiment, the speedy recovery showed that fears of political dysfunction, rather than a fundamental reevaluation of Bitcoin’s value, were behind the earlier sell-off.

You may also like:

Broader Pressures on Bitcoin’s Price

While the funding bill news provided a clear short-term catalyst, Bitcoin is still facing broader headwinds. Per data from CoinGecko, the asset is down nearly 14% in the last seven days and 17% for the month.

A recently published analysis from Galaxy Digital pointed to deteriorating on-chain metrics, with research head Alex Thorn noting that 46% of Bitcoin’s circulating supply is now “underwater,” meaning it was last moved at higher prices, which can increase selling pressure. He also pointed out that there was a lack of significant accumulation by large holders.

Furthermore, on February 3, reports that Iran was seeking to shift the format of nuclear talks with the U.S. contributed to another leg down in Bitcoin’s price, pushing it below $75,000 and burning at least $20 million worth of derivative positions.

Additionally, some analysts like Doctor Profit have revised their downside targets, saying the cycle bottom could hit a range between $44,000 and $54,000. However, the key question is whether the resolution of the immediate U.S. political risk will be enough to reverse these negative technical and on-chain trends, or if BTC is still vulnerable to a deeper test of support.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

GAS Tanks 90% After AI Dev ‘Steps Back’

The Gas Town token has plunged to a $1.1 million valuation just four days after peaking above $60 million.

Crypto World

Most Crypto Holders Want to Pay with Bitcoin but Rarely Do, Survey Show

But most say limited merchant acceptance and high fees stop them from spending crypto.

Crypto World

Classic Chart Pattern Signals ETH Could Slip Below $2K

The price of Ethereum’s native token, Ether (ETH), risks sliding below $2,000 in February as a classic bearish setup plays out.

Key takeaways:

-

ETH breakdown keeps $1,665 downside target in focus.

-

MVRV bands also point to price sliding toward $1,725 or lower before a potential bottom.

ETH risks declining 25% in February

As of Wednesday, ETH had entered the breakdown stage of its prevailing inverse-cup-and-handle (IC&H) pattern. This could extend a downtrend that has already erased about 60% from its August 2025 peak.

An IC&H pattern forms when price forms a rounded top and then drifts higher in a small recovery channel. It typically resolves when the price breaks below the neckline support, often falling by as much as the cup’s maximum height.

Ether broke below the inverse cup-and-handle neckline near $2,960 in January. It later rebounded to retest that level as resistance, a common post-breakdown move, only to resume its decline.

ETH’s rebound also stalled below the 20-day (green) and 50-day (red) EMAs, which acted as overhead resistance.

These confluence indicators raised ETH’s odds of declining toward the IC&H breakdown target at around $1,665, down 25%, in February or by early March.

Historically, the inverse cup-and-handle hits its projected downside target with an 82% success rate, according to a study by Chartswatcher.

From a macro perspective, Ethereum’s downside risk is increasing as traders cut back on crypto bets, worried the market could slip into a broader 2026 downturn similar to past “four-year cycle” pullbacks.

Fears of an “AI bubble” popping are also forcing traders to avoid riskier bets such as crypto.

Ethereum’s MVRV bands hint at $1,725 target

Ethereum’s technical downside target sat just below the lowest boundary of its MVRV extreme deviation pricing bands, currently at $1,725.

These bands are onchain price zones that show when ETH is trading below or above the average price at which traders last moved their coins.

Historically, ETH price plunged near or even below the lowest MVRV band before bottoming out.

That includes the April 2025 bounce, when the ETH price rose 90% a month after testing the lowest MVRV deviation band around $1,390. A similar rebound occurred in June 2018.

Related: ETH funding rate turns negative, but US macro conditions mute buy signal

Therefore, Ether may decline toward $1,725 or below in February, which lines up with the IC&H downside target.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

Crypto World

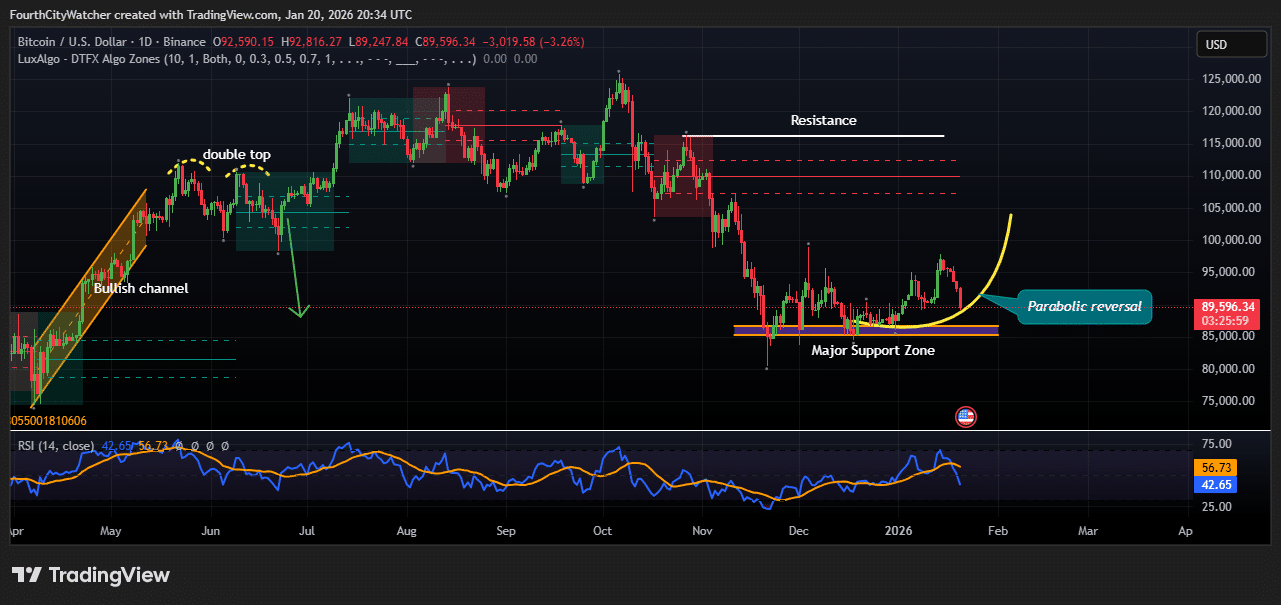

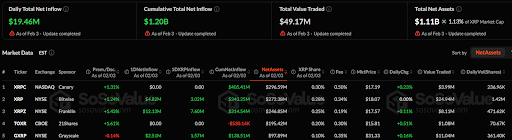

XRP ETFs Report $19.46M Daily Inflow as Total Assets Hit $1.11B

TLDR

- Total daily net inflow across XRP ETFs reached $19.46 million, with cumulative net inflow at $1.20 billion.

- XRPC ETF on NASDAQ saw no daily inflow, with assets totaling $296.59 million, representing 0.30% of XRP’s share.

- The XRP ETF, sponsored by Bitwise on NYSE, had a daily net inflow of $4.82 million, with assets of $272.38 million.

- The XRPZ ETF reported a daily inflow of $12.13 million, with assets at $246.85 million and a +0.11% daily change.

- The GXRP ETF had a negative daily change of -0.14%, with a net inflow of $2.51 million and assets of $195.42 million.

According to a SoSoValue update as of February 3, the total daily net inflow across XRP ETFs stood at $19.46 million. This brings the cumulative total net inflow to $1.20 billion. The total value traded on the day amounted to $49.17 million, with the total net assets reaching $1.11 billion, representing 1.13% of XRP’s market cap.

XRPC and TOXR ETFs Record No Change in Daily Flows

The XRP ETFs on the market showed various levels of performance. A look at individual XRP ETFs reveals that XRPC ETF, listed on NASDAQ and sponsored by Canary, saw no change in daily inflow with a cumulative net inflow of $405.41 million.

The fund’s assets amounted to $296.59 million, and it represented 0.30% of XRP’s market share. Its market price stood at $17.19, with a daily change of +0.23%. The value traded reached $3.99 million, with daily volume hitting 236.96K shares.

The TOXR ETF, listed on CBOE and sponsored by 21Shares, saw a positive change of +1.61%. Despite no inflow or outflow, the ETF has had a cumulative net inflow of $314.54 million and assets of $195.42 million, representing 0.25% of XRP’s share. The market price was $15.81, showing a +0.51% daily change. The value traded was $1.08 million, with 70.67K shares traded on the day.

XRPZ, GXRP, and XRP ETFs Reports Inflows

XRP on the NYSE, sponsored by Bitwise, experienced a daily net inflow of $4.82 million. Its total assets amounted to $272.38 million, representing 0.28% of XRP’s share. The fund’s market price was $18.07. The value traded reached $24.94 million, with a daily volume of 1.42 million shares.

The XRPZ ETF, listed on the NYSE and sponsored by Franklin, reported a daily inflow of $12.13 million. The ETF’s assets amounted to $246.85 million, or 0.25% of XRP’s share. Its market price was $17.57, reflecting a +0.11% daily change. This ETF saw $8.11 million in value traded, with a daily volume of 471.62K shares.

Finally, the GXRP ETF, listed on the NYSE and sponsored by Grayscale, had a negative daily change of -0.14%. It recorded a net inflow of $2.51 million, bringing total assets to $195.42 million. The ETF’s market price was $31.33, up 0.16% on the day. The total value traded was $11.04 million, and daily volume was 361.40K shares.

-

Crypto World5 days ago

Crypto World5 days agoSmart energy pays enters the US market, targeting scalable financial infrastructure

-

Crypto World6 days ago

Software stocks enter bear market on AI disruption fear with ServiceNow plunging 10%

-

Politics5 days ago

Politics5 days agoWhy is the NHS registering babies as ‘theybies’?

-

Crypto World5 days ago

Crypto World5 days agoAdam Back says Liquid BTC is collateralized after dashboard problem

-

Video1 day ago

Video1 day agoWhen Money Enters #motivation #mindset #selfimprovement

-

Tech3 hours ago

Tech3 hours agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

NewsBeat5 days ago

NewsBeat5 days agoDonald Trump Criticises Keir Starmer Over China Discussions

-

Politics2 days ago

Politics2 days agoSky News Presenter Criticises Lord Mandelson As Greedy And Duplicitous

-

Crypto World4 days ago

Crypto World4 days agoU.S. government enters partial shutdown, here’s how it impacts bitcoin and ether

-

Sports4 days ago

Sports4 days agoSinner battles Australian Open heat to enter last 16, injured Osaka pulls out

-

Fashion5 days ago

Fashion5 days agoWeekend Open Thread – Corporette.com

-

Crypto World4 days ago

Crypto World4 days agoBitcoin Drops Below $80K, But New Buyers are Entering the Market

-

Crypto World2 days ago

Crypto World2 days agoMarket Analysis: GBP/USD Retreats From Highs As EUR/GBP Enters Holding Pattern

-

Crypto World5 days ago

Crypto World5 days agoKuCoin CEO on MiCA, Europe entering new era of compliance

-

Business5 days ago

Entergy declares quarterly dividend of $0.64 per share

-

Sports2 days ago

Sports2 days agoShannon Birchard enters Canadian curling history with sixth Scotties title

-

NewsBeat1 day ago

NewsBeat1 day agoUS-brokered Russia-Ukraine talks are resuming this week

-

NewsBeat2 days ago

NewsBeat2 days agoGAME to close all standalone stores in the UK after it enters administration

-

Crypto World12 hours ago

Crypto World12 hours agoRussia’s Largest Bitcoin Miner BitRiver Enters Bankruptcy Proceedings: Report

-

Crypto World5 days ago

Crypto World5 days agoWhy AI Agents Will Replace DeFi Dashboards