Video

Day 3 | Command The Earth to Swallow Financial Debts | I Speak to the Earth 30 Days of Power

SOW# YOUR SPEAK TO THE EARTH BREAKTHROUGH SEED @Francismyles.com/donate | Zelle: info@francismyles.com | Paypal: info@francismyles.com | Mpesa +254728654304/ 0791267586 | Africa Donors: Francismyles.co.za |

Description#

Nothing controls people and nations like financial debt. Financial debt is Satan’s favorite strategy for enslaving the saints of the Most High. In the above passage of Scripture, a woman who was married to one of the sons of the prophets runs to the prophet Elisha in total desperation because financial creditors were on their way to enslave her children. Why? Her dead husband had left her with unresolved financial debts, and in ancient Israel, it was legal for creditors to take living relatives into forced labor until the family’s financial obligation was satisfied. Had it not been for the divine intervention of God, this poor widow would have lost her two sons to creditors she didn’t know.

This same story of enslavement to debt, however, has been self-repeating for generations as borrowers become slaves to lenders because of financial debt. Below is a prayer you can use to command the earth to swallow your financial debts by either wiping out the debts supernaturally, or by bringing forth a deluge of finances into your life so you can quickly pay off your debts. If God chooses to use the earth to vomit a deluge of finances in your life, you must have the integrity to pay off your debts as soon as the money comes in. That’s how God delivered me from being more than $300,000 in debt in 15 months.

source

Video

[S03:E59] Emas vs ASB vs KWSP: Mana satu pelaburan terbaik? – Dr Hanafee, CEO, MHZ Ingenious

![[S03:E59] Emas vs ASB vs KWSP: Mana satu pelaburan terbaik? - Dr Hanafee, CEO, MHZ Ingenious](https://wordupnews.com/wp-content/uploads/2026/02/1770914324_maxresdefault.jpg)

“Dah habis belajar, tapi risau tak dapat kerja ikut bidang? Atau pening tengok kawan-kawan dah mula buat ASB Financing tapi kita tak tahu apa-apa?”

Dalam episod podcast kali ini, kami bawakan barisan panelis hebat termasuk Financial Faiz dan pakar dari CIMB Bank untuk kupas tuntas tentang hala tuju kerjaya dan kenapa ‘sejarah hutang’ itu penting untuk masa depan anda. Jangan sampai dah nak beli rumah nanti, baru tahu rekod CCRIS kosong!

*Website*

🌐 Web ➜ https://financialfaiz.com

*Podcast player*

🍎 Apple ➜ https://financialfaiz.com/apple

🥑 Spotify ➜ https://financialfaiz.com/spotify

*Social media*

🐼 Tiktok ➜ https://financialfaiz.com/tiktok

🍇 Instagram ➜ https://financialfaiz.com/instagram

*Online channels*

🧊 Telegram ➜ https://financialfaiz.com/telegram

💬 Whatsapp ➜ https://financialfaiz.com/whatsapp

Penafian: Segala kandungan yang dikongsi adalah untuk tujuan maklumat sahaja dan tidak boleh dianggap sebagai nasihat kewangan. Sebarang keputusan pelaburan adalah tanggungjawab anda sendiri dan perlu dibuat berdasarkan situasi kewangan peribadi anda. Saya tidak bertanggungjawab atas sebarang kesilapan, peninggalan atau akibat daripada penggunaan kandungan ini, termasuk komen atau tindakan pihak ketiga di platform ini. Segala pandangan yang dikemukakan adalah pandangan peribadi saya semata-mata.

00:00 Intro

03:36 Latar belakang speaker

14:27 Pengalaman sebagai salesman

16:24 Cara tukar kerjaya selepas graduasi

22:39 Pesanan kepada pelajar tentang rekod CCRIS pertama

25:55 Perbezaan ASB dan ASB Financing

29:12 Perbezaan ASB, KWSP, Tabung Haji dan emas

35:19 Simpanan berisiko rendah di bank

37:00 Pengalaman keluar daripada krisis kewangan

41:59 Peranan bank dalam membantu menyelesaikan hutang kad kredit

43:14 Guna term financing untuk selesaikan hutang kad kredit

47:50 Sesi soal jawab

#financialfaiz #podcast #career

[S03:E59] Ijazah vs Kerjaya: Perlu Ke Kerja Ikut Bidang Belajar? – Dr Hanafee, CEO, MHZ Ingenious

source

Video

LIFESTYLE EP 2::CHIEF GODLOVE VS GIGY MONEY/KAMA PESA ZAKO NI ZA KISHIRIKINA MIMI HAINIHUSU/NATUMIKA

LIFESTYLE EP 2::CHIEF GODLOVE VS GIGY MONEY/KAMA PESA ZAKO NI ZA KISHIRIKINA MIMI HAINIHUSU/NATUMIKA SANA NA WATU KUWAFIKISHA SEHEMU HALAFU WANANISAHAU

#lifestyle #chiefgmedia #gigymoney @Chief_godlove @GigyMoneyMusic

🔥 Don’t miss the latest on #ViralNews #StoryTrends #Freemason Story

📅 New videos every week – Subscribe for more!

👇 Stay connected:

Instagram: @chiefgodlovebillionaire

TikTok: @chiefgodlovebillionaire

Website: https://chiefgodlove.vip/

source

Video

AI Trading Bot Made Me $1000 in ONE DAY TRADING (Passive Income)

📄 Text Guide & 🤖 Bot Source Code

https://telegra.ph/Step-by-Step-Guide-12-14

LAKEY INSPIRED – Overjoyed

Disclaimer:

PLEASE READ THIS DISCLAIMER CAREFULLY. BY ACCESSING OR USING THIS WEBSITE, PARTICIPATING IN ANY CRYPTO-RELATED PROJECT, OR ENGAGING WITH ANY ASSOCIATED PRODUCTS, SERVICES, OR TOKENS, YOU AGREE TO BE BOUND BY THE TERMS AND CONDITIONS SET FORTH BELOW.

General Risks

Investing in cryptocurrencies and blockchain-related projects carries inherent risks due to the speculative nature of the market, technological uncertainties, and regulatory complexities. There is no guarantee of returns or profits, and the value of your investment may fluctuate significantly, potentially resulting in partial or total loss.

No Investment Advice

The information provided on this website, in any associated materials, or by the project team does not constitute financial, investment, legal, or tax advice. You should consult with your own professional advisors before making any decisions related to your participation in this project or any related transactions.

By participating in this project or engaging with any associated products, services, or tokens, you acknowledge and agree that you have read, understood, and accepted the risks and conditions outlined in this disclaimer.

#ai #chatgpt #eth #crypto

tags

ethereum, trading bot, ai trading bot, ethereum trading bot, trading strategy, crypto trading, crypto bot, make money online, crypto news, ethereum price, bitcoin price, bitcoin, day trading, passive income, cryptocurrency, crypto, chatgpt trading bot, arbitrage bot, how to make money online, 1000 per day, passive income, crypto news

source

Video

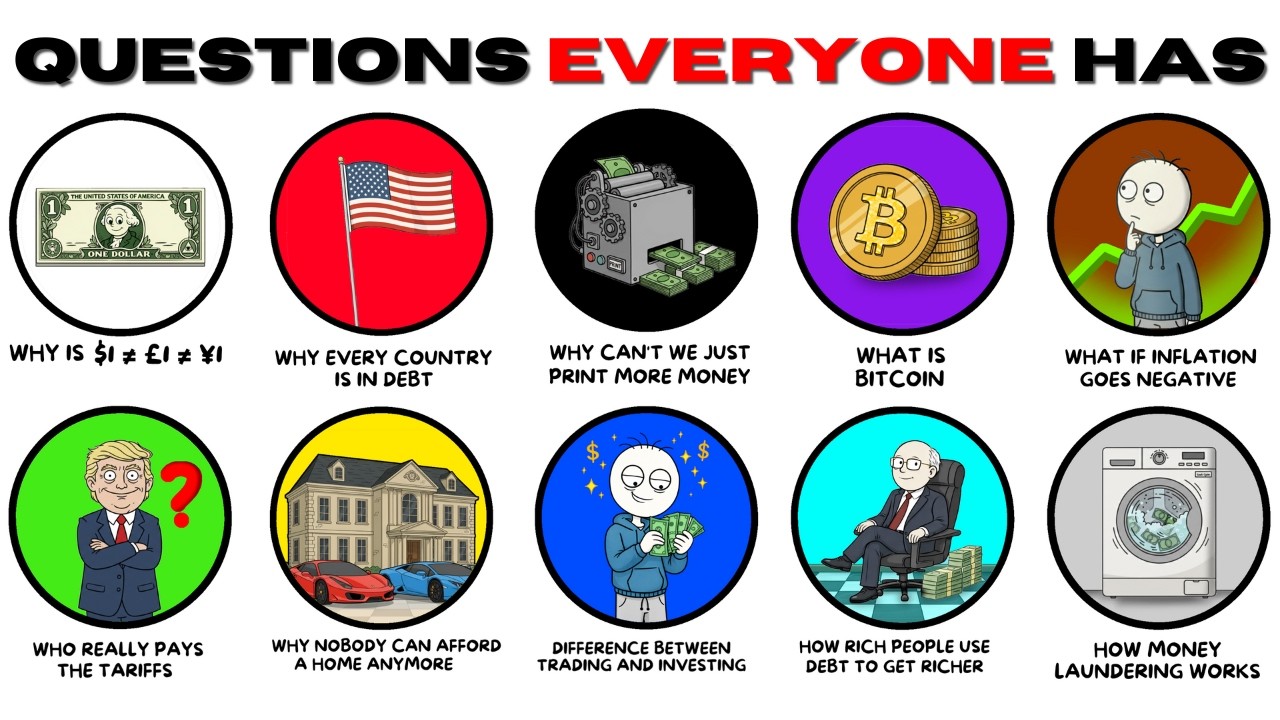

Simply Explaining Financial Questions EVERYONE Has

These are some of the most common financial questions I see people have, and I try to explain them as simply as possible. I hope you learn something and I hope you enjoy!

My complete 60+ page manipulation guide on how to spot and defend manipulation in everyday life:

👉 https://everythingprofessor.shop/products/invisible-strings-full-manipulation-defence-ebook

👜 Business Mail: everythingprofessor@gmail.com

Watch on Spotify: https://open.spotify.com/show/07ZgD0ECjWPrjFgTZ4uwW6

—————————————————————————————

Timestamps:

0:00 Why is $1 ≠ £1 ≠ ¥1

1:40 Why Every Country Is in Debt & Who They Owe

3:14 Why Can’t We Just Print More Money

4:39 What Is Bitcoin?

6:11 What If Inflation Goes Negative

7:40 Who Really Pays the Tariffs

9:00 Why Nobody Can Afford a Home Anymore

10:34 Difference Between Trading and Investing

12:11 How Rich People Use Debt to Get Richer

13:34 How Money Laundering Works

source

Video

LISA – ‘MONEY’ DANCE CHALLENGE

LISA – ‘MONEY’ DANCE PRACTICE VIDEO

#LISA #리사 #BLACKPINK #블랙핑크 #MONEY #MONEYChallenge #YG

source

Video

Live Intraday Trading | Crypto Bitcoin Live | VP Financials

Join VPF Crypto Community by opening an account from below links ⤵️

Delta Exchange – https://india.delta.exchange/?code=WLRHVC

After opening the account fill this form – https://forms.gle/W9Usdk5UUjgzk8FGA

How to open an account an trade in Delta Exchange India ⤵️

https://yt.openinapp.co/60tzi

Join VP Financials Trader’s Community by opening a demat account from below links ⤵️

Dhan : https://invite.dhan.co/?join=RORA44

Fyers : https://signup.fyers.in/?utm_source=AP-Leads&utm_medium=AP1550

Upstox : https://upstox.com/open-account/?f=23CYYK

📞 Contact our team on below details to get added ⤵️

+91 99987 63268 – https://bit.ly/3x1RneS

+91 99987 63446 – https://bit.ly/3RKNLp9

Join VP Financials Official Telegram Channel :

https://telegram.openinapp.co/j7ii2

https://t.me/vpfinancials (94K Subscribers)

Disclaimer :

All views and charts shared in this video are purely for knowledge and information purpose only. Our video is intended only to provide general and preliminary information to investors/traders and shall not be construed as the basis for any investment decision or strategy, our content is intended to be used and must be used for informational purpose only. It is very important to do your own analysis before making any investment based on your own personal circumstances.

#vpfinancials #stockmarket #banknifty #nifty #trading

source

Video

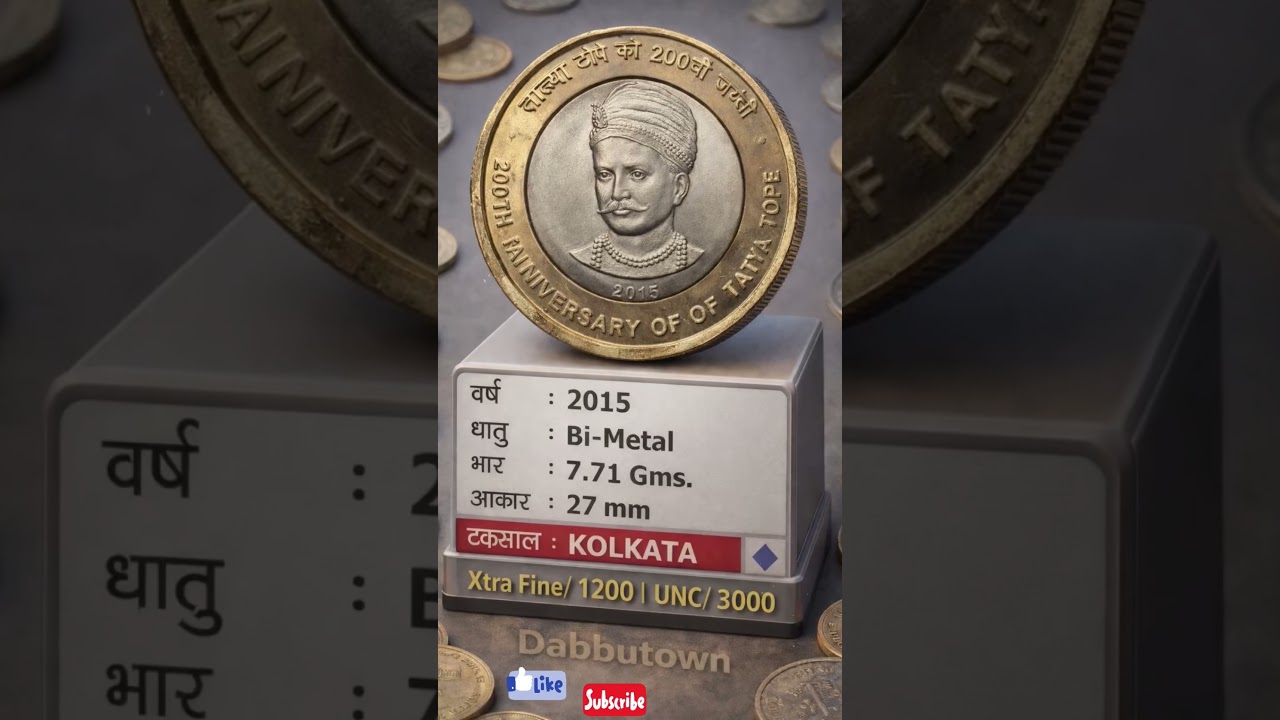

10 Rupees Tatya Tope 200th anniversary| Dabbutown | #oldcoins #money #trending #shortsfeed #ytshorts

भारत के महान स्वतंत्रता सेनानी तात्या टोपे की 200वीं जयंती पर जारी यह खास स्मारक सिक्का 🇮🇳✨

🪙 वर्ष: 2015

⚙️ धातु: Bi-Metal

⚖️ वजन: 7.71 ग्राम

📏 आकार: 27 mm

🏛️ टकसाल: Kolkata Mint

यह coin भारतीय इतिहास और 1857 की क्रांति से जुड़ी एक अनमोल धरोहर है 🔥

Collectors के लिए highly demanded coin 💎

💰 Price (Condition Wise): Value depends on demands and condition:

Xtra Fine – 1200

UNC – 3000

📌 Presented By: Dabbutown

Keywords:

Tatya Tope coin, Tatya Tope 200th birth anniversary coin, 2015 commemorative coin India, bi metal coin India, rare Indian coins, freedom fighter coin India, 1857 revolt coin, Kolkata mint coin, Indian commemorative coins, old Indian coin collection, UNC coin India, XF coin India, Dabbutown coins

Hashtags:

#TatyaTope #TatyaTopeCoin

#FreedomFighter #1857Revolt

#IndianHistory #RareCoin

#IndianCoins #CommemorativeCoin

#BiMetalCoin #KolkataMint

#CoinCollection #Numismatics

#UNCcoin #XFcoin

#RareIndianCoins

#Dabbutown #ViralCoins #TrendingCoins

source

Video

XRP JUST IN! If You Own XRP, You Need to Know This Now! XRP MASSIVE COMEBACK?!

IMPORTANT WARNING TO ALL XRP INVESTORS

The new Telegram group, join here, it is open and FREE to all – https://t.me/+LoW1GDD5rOI1YjM0

#xrp #xrpnews #xrpripple #cryptonews #crypto

My Website with all my affiliate links (Bydfi, BTCC) where you can get access to the Whale group – https://moneymakeravilev.kit.com/f54fe06808

Follow me on X – https://x.com/MakerLev

DISCLAIMER: Avi Lev, including but not limited to any guests appearing in his videos, are not financial/investment advisors, brokers, or dealers. They are solely sharing their personal experience and opinions; therefore, all strategies, tips, suggestions, and recommendations shared are solely for entertainment and educational purposes. There are financial risks associated with investing, and Avi Lev’s results are not typical; therefore, do not act or refrain from acting based on any information conveyed in this video, webpage, and/or external hyperlinks. For investment advice please seek the counsel of a financial/investment advisor(s), and conduct your own due diligence

Some of the links are affiliate links

COMMENT DISCLAIMER: I WILL NEVER CONTACT YOU IN ANYWAY (ON ANY PLATFORM). IF YOU GET CONTACTED BY ANYONE CLAIMING TO BE ME, IT IS NOT ME. FOR EXAMPLE, COMMENTS SHOWING WHATSAPP NUMBERS ARE NOT ME. ADDITIONALLY, PEOPLE HAVE THE ABILITY TO CALL YOU USING AI TECHNOLOGY SO IT SOUNDS LIKE ME. THIS AGAIN IS NOT ME. NEVER WILL I CONTACT YOU IN ANY WAY. PLEASE DO NOT CLICK ON ANY LINKS IN THE COMMENT SECTION BELOW. DO NOT RESPOND OR INTERACT WITH ANYONE ON ANY PLATFORM CLAIMING TO BE ME OR WORKING ON MY BEHALF – THEY ARE SCAMMERS.

This video is for informational and entertainment purposes only. It does not constitute financial, investment, or trading advice.

I am not a financial advisor. All opinions expressed in this video are my own or those of the individuals referenced.

You should always do your own research and consult with a licensed professional before making any financial decisions.

Cryptocurrency investments carry risk, and past performance is not indicative of future results.

The mention of any price targets, predictions, or market commentary should be understood as opinion — not fact or guarantees

The company’s services and content are not directed to, and are not intended for,residents of Israel

This channel provides global crypto market analysis and educational content in English. Our content is created for a global audience and is NOT intended for, marketed to, or directed at residents of Israel. All content is for informational purposes only and does not constitute financial advice.

tags –

xrp price,xrp price prediction,crypto news,xrp news,xrp ripple,ripple xrp,xrp news today,ripple xrp news,xrp crypto,xrp news today now,xrp today,xrp lawsuit,ripple news,xrp ripple news,xrp analysis,xrp coin,crypto news today,ripple price,xrp 2021,xrp sec,xrp technical analysis,xrp prediction,ripple sec news,cryptocurrency news

xrp price,xrp price prediction,crypto news,xrp news,xrp ripple,ripple xrp,xrp news today,ripple xrp news,xrp crypto,xrp news today now,xrp today,xrp lawsuit,ripple news,xrp ripple news,xrp analysis,xrp coin,crypto news today,ripple price,xrp 2021,xrp sec,xrp technical analysis,xrp prediction,ripple sec news,cryptocurrency news

xrp price,xrp price prediction,crypto news,xrp news,xrp ripple,ripple xrp,xrp news today,ripple xrp news,xrp crypto,xrp news today now,xrp today,xrp lawsuit,ripple news,xrp ripple news,xrp analysis,xrp coin,crypto news today,ripple price,xrp 2021,xrp sec,xrp technical analysis,xrp prediction,ripple sec news,cryptocurrency news

xrp price,xrp price prediction,crypto news,xrp news,xrp ripple,ripple xrp,xrp news today,ripple xrp news,xrp crypto,xrp news today now,xrp today,xrp lawsuit,ripple

source

Video

Financial Situation #mememandir

Video

Nabung #nabung #money #budgeting #savingchallenge #savingmoney #tabungan #uang

-

Politics4 days ago

Politics4 days agoWhy Israel is blocking foreign journalists from entering

-

Sports6 days ago

Sports6 days agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

Business4 days ago

Business4 days agoLLP registrations cross 10,000 mark for first time in Jan

-

NewsBeat3 days ago

NewsBeat3 days agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

Tech6 days ago

Tech6 days agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

Sports16 hours ago

Sports16 hours agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

Business4 days ago

Business4 days agoCostco introduces fresh batch of new bakery and frozen foods: report

-

Tech2 days ago

Tech2 days agoSpaceX’s mighty Starship rocket enters final testing for 12th flight

-

NewsBeat4 days ago

NewsBeat4 days agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

Sports4 days ago

Sports4 days agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Sports5 days ago

Former Viking Enters Hall of Fame

-

Politics4 days ago

Politics4 days agoThe Health Dangers Of Browning Your Food

-

Sports6 days ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

Business4 days ago

Business4 days agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

NewsBeat6 days ago

NewsBeat6 days agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Business7 days ago

Business7 days agoQuiz enters administration for third time

-

Crypto World17 hours ago

Crypto World17 hours agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

Video13 hours ago

Video13 hours agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

Crypto World2 days ago

Crypto World2 days agoU.S. BTC ETFs register back-to-back inflows for first time in a month

-

Crypto World2 days ago

Crypto World2 days agoBlockchain.com wins UK registration nearly four years after abandoning FCA process

![[S03:E59] Emas vs ASB vs KWSP: Mana satu pelaburan terbaik? - Dr Hanafee, CEO, MHZ Ingenious](https://wordupnews.com/wp-content/uploads/2026/02/1770914324_maxresdefault-80x80.jpg)