Crypto World

Cathie Wood Loads Up on Robinhood (HOOD) Stock During 9% Crash

TLDR

- Cathie Wood’s ARK Invest bought $33.8 million in Robinhood shares after the stock dropped 9% on Q4 earnings miss

- Robinhood now represents ARK’s largest crypto holding at $248 million, a 4.1% portfolio weighting

- CEO Vlad Tenev predicts prediction markets will enter a “supercycle” with trillions in annual volume potential

- The company launched Robinhood Chain testnet, a Layer 2 blockchain for tokenized assets

- Bitcoin ETFs saw $276 million in outflows Wednesday as crypto trading volumes declined

Cathie Wood made a bold move Wednesday, buying the dip on Robinhood shares while most investors headed for the exits. ARK Invest purchased $33.8 million worth of stock as shares plunged nearly 9% following a disappointing Q4 earnings report.

The buying spree wasn’t limited to Robinhood. ARK also added $16 million in other crypto-related stocks including Bullish and Circle as the broader digital asset market sold off.

Robinhood missed revenue estimates in Q4 as cryptocurrency trading volumes collapsed during Bitcoin’s recent weakness. The digital currency briefly dropped below $66,000, triggering a wave of selling across crypto-linked equities.

But Wood saw opportunity where others saw risk. The purchases pushed Robinhood to become ARK’s largest crypto-related position, with total holdings now worth approximately $248 million.

Blockchain Infrastructure Play

The timing coincided with Robinhood’s testnet launch of Robinhood Chain. This Layer 2 blockchain targets tokenized real-world assets and institutional financial services.

ARK appears to be betting on Robinhood’s transformation from a retail trading platform into a blockchain infrastructure provider. The quarterly earnings miss seems less important than the long-term strategic positioning.

Bitcoin ETFs recorded $276.3 million in net outflows Wednesday, nearly erasing weekly gains. Total assets under management dropped to $85.7 billion, the lowest level since late 2024.

While Bitcoin has stabilized around $67,200, institutional appetite remains muted. Many large investors are waiting for clearer market direction before deploying capital.

Prediction Markets Opportunity

CEO Vlad Tenev offered a different perspective during the earnings call. He described prediction markets as entering a “supercycle” that could eventually generate trillions in annual trading volume.

The data supports his optimism. Prediction markets volume more than doubled in Q4, reaching $12 billion in total contracts for 2025. The company has already processed $4 billion in 2026.

Robinhood is building its own prediction market platform through a joint venture with Susquehanna International Group. The move would give the company greater control over product offerings and potentially stronger margins.

Launch is expected later this year. The platform will compete with Kalshi and Polymarket in a rapidly expanding market.

Tenev told CNBC he remains bullish on crypto despite recent volatility. The company plans to continue expanding both digital asset offerings and prediction markets.

More details are expected at Robinhood’s “Take Flight” event on March 4. Tenev is scheduled to unveil new products and strategic initiatives.

Wall Street maintains a Strong Buy rating on the stock. Analysts have issued 14 Buy ratings, three Holds, and zero Sells over the past three months. The average price target of $135.79 suggests 56.9% upside potential.

Shares have declined nearly one-third year-to-date following Wednesday’s selloff.

Crypto World

Hyperliquid price confirms support at $28.40

Hyperliquid price is showing early signs of a bullish market structure shift after confirming strong demand at $28.40, setting the stage for a potential expansion toward higher levels.

Summary

- $28.40 reclaimed and defended, confirming demand after the breakout

- Bullish engulfing candles show strong momentum, supporting structure shift

- Holding support opens upside, with $48.02 as the next major resistance

Hyperliquid (HYPE) price action has entered a critical phase after reclaiming and successfully retesting a key high-timeframe support zone. Following a period of corrective consolidation, the market has responded with strong bullish impulses, suggesting that buyers are beginning to regain control. The $28.40 level, previously a major structural pivot, has now been confirmed as support, signaling a potential shift in the broader trend.

This development is significant, as market structure shifts often begin with decisive break-and-retest behavior at high-timeframe levels. With bullish momentum building and price holding above former resistance, Hyperliquid may be transitioning from a corrective phase into a new expansionary cycle.

Hyperliquid price key technical points

- $28.40 high-timeframe level has been reclaimed and retested, confirming strong demand

- Bullish engulfing candles signal impulsive buying pressure, supporting trend reversal

- Holding above support opens upside toward $48.02, the next major resistance

Hyperliquid’s recent price behavior has been characterized by impulsive bullish expansions, marked by strong bullish engulfing candles. These moves indicate aggressive buyer participation rather than slow accumulation, a key distinction when evaluating trend shifts.

After breaking above the $28.40 level, the price pulled back and reacted strongly from the value area high, confirming this region as newly established support. The first successful retest is often the most important, as it confirms whether former resistance has truly become demand. In this case, buyers stepped in decisively, reinforcing confidence in the bullish scenario.

This reaction suggests that market participants are willing to defend value above $28.40, shifting the balance of control away from sellers.

Liquidity sweep potential strengthens structure

One additional level to monitor closely is the 0.618 Fibonacci retracement positioned just below the current support zone. In many bullish structures, price briefly revisits this region to clear remaining sell-side liquidity before resuming its trend. A controlled retest of the 0.618 Fibonacci, followed by a strong bullish reaction, would further strengthen the case for a higher low.

Such behavior would confirm that the market has successfully absorbed supply and transitioned into accumulation above support. Importantly, this would solidify the shift in market structure from bearish or neutral to bullish.

Until that occurs, short-term volatility remains possible. However, as long as the price maintains acceptance above $28.40 on a closing basis, the broader bullish thesis remains intact.

Market structure shift opens upside expansion

From a market structure perspective, Hyperliquid appears to be transitioning into a higher-high and higher-low sequence. The impulsive nature of the recent move higher, combined with the successful support retest, suggests that the corrective phase may have concluded.

If price continues to hold above support and builds a higher low, the probability of a bullish expansion increases. In this scenario, the next major upside target sits near the high-timeframe resistance around $48.02. This level represents a prior rejection zone and is likely to act as the next area of supply.

A move toward this region would align with classic trend continuation behavior following a structural flip.

What to expect in the coming price action

From a technical, price-action, and market-structure perspective, Hyperliquid is positioned favorably as long as the $28.40 support level continues to hold. Short-term pullbacks remain healthy within bullish trends, particularly if they result in higher lows above key support.

For now, the evidence suggests that Hyperliquid has successfully completed a bullish retest and is beginning to shift the market structure. If buyers remain active, the path toward higher resistance levels remains open, with $48.02 emerging as the primary upside objective in the coming phase.

Crypto World

$1K Collapse or $3K Rally? 4 AIs Speculate What is More Likely for ETH in Q1

“The balance tilts toward gradual recovery or stabilization in Q1 rather than a dramatic collapse,” Grok stated.

The major red wave that swept through the entire crypto market at the start of February has severely impacted Ethereum (ETH), whose price fell below $1,800 at one point. Over the past few days, the bulls have reclaimed some lost ground, but the asset currently trades just below the psychological $2,000 level.

The big question now is which scenario is more plausible during the first quarter of the year: a crash to $1,000 or a pump to $3,000. Here are the viewpoints of four of the most popular AI-powered chatbots.

What Comes Next?

ChatGPT estimated that a 50% jump to $3K sometime in Q1 is more likely, reminding that ETH has initiated such moves many times in the past. It claimed that a rebound to that level will not require an extreme catalyst but only “bullish momentum and market stability.”

The chatbot did not rule out a collapse to $1,000 but argued that such a drop could occur only in the event of a macro panic, a regulatory crackdown, or the meltdown of a leading crypto exchange.

Grok – the chatbot integrated within X – shared a similar opinion. It stated that a jump toward the upper target carries a higher probability, but added that neither extreme option is guaranteed.

“The balance tilts toward gradual recovery or stabilization in Q1 rather than a dramatic collapse – making a push toward $3K (or at least meaningful upside) more plausible than a plunge to $1K, especially if macro conditions improve or adoption catalysts hit,” it forecasted.

Google’s Gemini joined the theory, saying that a rally is statistically “more aligned with historical patterns and analyst consensus.” It argued that a drop to $1,000 is a low probability scenario unless a major black swan event occurs.

Perplexity is the only chatbot (from those we consulted) that leans toward the bearish option. It stated that the crypto market has not been in its best shape lately, projecting a downside move for ETH to $1,000 and even lower in the coming weeks.

You may also like:

The Crash Could be a Blessing?

Just a few days ago, the popular X user Ted asked his almost 300,000 followers whether they expect ETH to plummet to $1,000 in 2026. In his view, a plunge of that dimension would be “a great buying opportunity.”

Some commentators claimed that such a scenario is possible only in a macro crisis that could undermine the reputation of the entire cryptocurrency sector. Others welcomed the idea of a collapse to $1K, agreeing with Ted that this would provide a solid reason to increase their exposure.

Hosky.Watcher, for instance, suggested that big dips can be “chances and traps.” They advised investors to enter the ecosystem with spare cash but not to touch “emergency funds or mortgage money.”

“Keep your sense of humor and a risk plan,” the alert reads.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Best Crypto to Buy for 2026: XRP, ETH, or Pepeto?

What do you do when the market feels shaky and everyone second-guesses their next move? Most people split into two camps, stick with proven large caps for stability, or find an earlier-stage setup where the upside math is bigger. Right now three names keep showing up in serious discussions: XRP, Ethereum, and Pepeto (PEPETO). Which one gives the best mix of safety and upside for 2026?

Best Crypto to Buy for 2026: XRP Recovery Play

XRP becomes a focus when markets cool because it’s widely treated as a recovery-driven large cap. When conditions stabilize, capital tends to rotate back here first.

XRP stays on 2026 watchlists for large-cap durability, confidence signals, and measured upside. It can still move meaningfully, but at its size, realistic outcomes look like solid multiples, not the explosive early-stage moves presales can deliver.

Ethereum is the core layer most crypto ecosystems rely on. When investors want infrastructure exposure rather than a single narrative, ETH is usually first.

Deep ecosystem activity, staking incentives keeping long-term holders engaged, and its role as the altcoin cycle benchmark make ETH a portfolio anchor. It’s not an early coin, it’s what people hold when they want long-term crypto exposure without speculation.

Best Crypto to Buy for 2026: Pepeto’s Early Window Still Open

Pepeto ($PEPETO): The High-Upside Setup for Best Crypto to Buy 2026

This is where the best crypto to buy conversation gets interesting. People didn’t miss SHIB because it lacked potential. They missed it because they waited for comfort. By the time it felt safe, the 45,000% was already gone. Pepeto (PEPETO) is sitting in that exact same phase right now, and the window is measurably closing.

Over $7M raised toward a $10M hard cap. That’s 70% gone. Each stage that closes raises entry permanently. Tokens still at $0.000000183, but that changes with every phase that fills. This isn’t early language for marketing purposes. The cap has a hard limit and once it’s hit, presale pricing disappears forever.

Here’s what that capital is buying into. PepetoSwap zero-fee demo already live, execution proof rare at this stage. Pepeto Bridge handling cross-chain routing. Planned Pepeto Exchange with 850+ projects already lined up before a single public trade happens. Smart contracts audited by SolidProof and Coinsult, verifiable, not promises. Built by a PEPE co-founder who already proved he understands what makes memes explode.

Then staking compounds everything. 214% APY means $100K generates $214K in tokens annually while waiting for listings. Position builds before a single exchange trade happens. High yields encourage holding, reduce circulating supply while ecosystem demand grows. Fewer tokens circulating plus growing demand equals upward price pressure, that’s how supply shocks form.

SHIB delivered life-changing outcomes with minimal infrastructure at launch. Pepeto starts with the missing pieces already in place. If earlier meme coins did that with nothing underneath, the math for a utility-backed setup is straightforward.

Why These Three Cover Different Roles in a Best Crypto to Buy 2026 Strategy

Smart 2026 positioning covers different roles:

- XRP = large-cap recovery narrative for renewed confidence

- Ethereum = infrastructure anchor for long-term adoption exposure

- Pepeto = high-upside early-stage setup where positioning timing matters most

Big coins protect capital during uncertain periods. Early-stage projects are where portfolios change, if the team delivers. Pepeto keeps showing up in best crypto to buy discussions because it’s the only option here still in a phase where early positioning can define the outcome.

Final Verdict: Best Crypto to Buy Before Pepeto’s Window Closes

XRP and Ethereum are strong 2026 holds, established, widely tracked, reliable. But Pepeto is being watched as the best crypto to buy for a completely different reason: still early, still in presale, still at $0.000000183 with a working ecosystem already rolling out.

Once the $10M cap hits, early pricing ends permanently.

Click To Visit The Official Website To Buy Pepeto

FAQ: Best Crypto to Buy for 2026

Why does Pepeto keep appearing in best crypto to buy lists for 2026? Still in presale with working infrastructure, 214% APY staking, audited contracts, and a hard $10M cap closing fast, the early window that created SHIB winners is still open here.

Can XRP or Ethereum still deliver strong gains in 2026? Yes, but as large caps they deliver measured moves. Pepeto offers asymmetric upside from micro-cap entry while the early window still exists.

Disclaimer: This is a Press Release provided by a third party who is responsible for the content. Please conduct your own research before taking any action based on the content.

Crypto World

Is This Crypto Winter Different? Experts Reevaluate Bitcoin

Bitcoin’s latest price action underscores a paradox at the heart of institutional crypto interest: capital is increasingly present, yet money managers remain wary of labeling BTC as a risk-off hedge. After topping near $120,000 in October, the asset has retraced more than 25% in the past month, prompting observers to parse whether the pullback signals a maturation of the market or a cooling in risk appetite among investors. The debate touches on four-year cycle dynamics, regulatory clarity, and how Wall Street–level players are recalibrating their exposure as policy conversations unfold.

Key takeaways

- Bitcoin has shed more than 25% in the month, testing critical levels as institutional risk appetite shifts and cycle dynamics influence pricing.

- The CLARITY Act, a centerpiece of US crypto regulation, remains stalled in the Senate, with banks and exchanges contending over stablecoin provisions that could reshape exchange economics.

- Grayscale argues that near-term BTC moves resemble growth equities with high enterprise value rather than traditional gold, signaling a non-traditional risk profile for the asset.

- High-level talks on crypto market structure legislation continue, including a White House engagement between crypto executives and bankers, signaling bipartisan momentum toward clarity.

- Kaiko Research flags a potential $60,000 level as a halfway point in the bear market, stressing that on-chain metrics will determine whether the four-year cycle framework holds.

- Regulatory clarity and the GENIUS Act are viewed as structural catalysts that could unlock new use cases for stablecoins and tokenized assets, potentially guiding long-term value for networks.

Tickers mentioned: $BTC, $COIN

Sentiment: Neutral

Price impact: Negative. Bitcoin fell more than 25% this month as institutions reevaluated risk positions and macro conditions remained uncertain.

Market context: The price pullback comes as the broader crypto environment weighs liquidity, risk appetite, and a regulatory landscape in flux, with policymakers debating how to modernize oversight of digital assets and market infrastructure.

Market context

The recent price action sits at the intersection between growing institutional involvement and ongoing regulatory ambiguity. While well-capitalized firms have shown continued interest in crypto products, their willingness to treat BTC as a risk-on asset remains contested. The conversation around regulatory clarity—particularly for market structure and stablecoins—has increasingly become the central driver of flows and product strategy, influencing whether institutions deepen exposure or recalibrate to avoid regulatory risk.

Why it matters

From a market efficiency perspective, the episode tests whether institutions can comfortably price BTC within a regulated framework that reduces tail risk while preserving participation. Grayscale has argued that BTC’s short-term moves align more with growth-oriented software equities than with precious metals, which could broaden the interpretation of what drives crypto prices beyond the traditional store-of-value narrative. The insistence on regulatory clarity suggests a path toward broader use cases—such as tokenized assets and stablecoins—that could, over time, add depth to liquidity and utility in the sector.

On the policy front, the CLARITY Act represents a sweeping redesign of crypto oversight, including DeFi, exchanges, and capital markets rules. The bill’s stalled status in the Senate has frustrated industry participants who argue that delay erodes confidence and slows strategic planning. Coinbase (EXCHANGE: COIN) and other major players have been key voices in the debate, reflecting how regulatory outcomes will shape product structuring, risk management, and partnerships going forward. The GENIUS Act, which passed in July 2025, is cited as part of a broader push toward a clearer regulatory framework, suggesting that lawmakers recognize the structural benefits of clearer rules for innovation and investor protection.

Analysts continue to weigh whether Bitcoin’s bear market can extend toward new price anchors or whether a structural shift in sentiment—driven by policy progress and institutional onboarding—will eventually rekindle momentum. Some observers point to a potential bottom in the high tens of thousands before a longer-term recovery, while others emphasize that the outcome will hinge on regulatory breakthroughs and the resilience of on-chain networks amid macro headwinds.

“I think there was a lot of sell-off just because firms that got into it from mainstream finance had to adjust their risk positions.”

“Retail people don’t get into crypto because they want to make 11% annualized … They get in because they want to make 30 to one, eight to one, 10 to one.”

Beyond the price action, the market is watching how geopolitical and regulatory signals converge. White House discussions between crypto executives and bankers—part of ongoing talks to resolve roadblocks to market structure reform—could influence the speed and direction of institutional flows. In the meantime, industry researchers note that on-chain metrics and cross-asset correlations will continue to shape the narrative around whether the four-year cycle remains intact or yields a different pattern for BTC and related assets.

In short, the bear market debate is less about a single catalyst and more about a convergence of cycles, policy, and evolving institutional incentives. As participants await clearer rules, the market will likely experience continued volatility, punctuated by moments when policy events or macro shifts trigger sharp repricings. The coming months could be decisive for whether BTC cement its role as a core allocation for institutions or whether it remains a higher-risk, higher-reward bet that requires more robust regulatory scaffolding before a broader class of investors can comfortably participate.

What to watch next

- Regulatory progress on the CLARITY Act and GENIUS Act, including any scheduled committee votes or floor actions.

- Outcomes of the White House meetings with crypto and banking representatives, and any policy signals that emerge from those discussions.

- Key price levels for BTC, with attention to whether the $60,000 region acts as a support or acts as a magnet for further downside.

- New on-chain metrics and cross-asset analyses that could confirm or challenge the four-year cycle framework.

- Regulatory clarity that could unlock additional use cases for stablecoins and tokenized assets, influencing the structure and liquidity of crypto markets.

Sources & verification

- Grayscale, Market Commentary: Bitcoin trading more like growth than gold.

- Federal Reserve Governor Chris Waller’s remarks at a monetary policy conference on crypto hype and risk positions.

- Mike Novogratz’s CNBC interview on institutional risk tolerance in crypto markets.

- Kaiko Research notes on critical support levels and cycle analysis.

- White House discussions involving crypto executives and bankers on market structure reform.

Bitcoin’s price slump tests institutional adoption and regulatory clarity

Bitcoin (CRYPTO: BTC) has moved under a cloud of regulatory uncertainty and shifting institutional appetite. After rallying to above $120,000 in October, the flagship crypto has retraced more than 25% in the past month, prompting observers to parse whether the pullback signals a maturation of the market or a cooling in risk appetite among investors. The pullback sits at the center of a broader debate about whether BTC is a risk-on asset or if a regulatory environment that supports product innovation and investor protection can coexist with a robust institutional footprint.

Price dynamics through this period suggest a mix of cyclical drivers and risk management by large players who entered crypto markets during a period of high enthusiasm. Some market participants attribute the sell-off to the four-year cycle framework commonly cited in crypto analysis, while others see a more general tightening of risk appetite among institutions that had pursued crypto exposure as part of a broader portfolio diversification strategy. The trajectory has been punctuated by sharp moves, with BTC slipping from its October highs and trading in lower ranges that have drawn comparisons to growth equities rather than to the classic safe-haven narrative associated with gold.

Within policy circles, the debate over appropriate regulation remains intense. The CLARITY Act would overhaul US crypto regulation, touching on areas from DeFi oversight to market infrastructure. The bill has stalled in the Senate as Coinbase (EXCHANGE: COIN) and the banking lobby clash over stablecoin provisions that could affect exchange economics and systemic risk. The absence of timely clarity has been cited by policymakers and industry participants as a key factor delaying broader institutional participation and product development. In parallel, the GENIUS Act, which had cleared its path in 2025, is viewed as part of a broader push toward a framework that could enable more predictable and scalable crypto markets.

Prominent voices in the industry have offered mixed perspectives. Fed governor Waller framed the current crypto environment as reflecting a fading wave of euphoria rather than a lasting structural shift toward digital gold. His comments at a recent monetary policy conference underscored the idea that institutions are still recalibrating risk positions as the macro backdrop evolves. In a separate interview, Galaxy Digital’s Mike Novogratz highlighted how institutions approach crypto with a different risk tolerance than retail investors, a distinction that can influence price action and liquidity dynamics. “Retail people don’t get into crypto because they want to make 11% annualized … They get in because they want to make 30 to one, eight to one, 10 to one,” he observed, pointing to the motivational differences that help explain long-term price trajectories beyond traditional hedges.

Meanwhile, market structure researchers at Grayscale have emphasized a broader context for BTC’s recent moves. They noted that short-term price action has shown correlations with software equities and tech-driven growth narratives rather than with gold or other conventional safe-haven assets. This view aligns with a broader market trend where digital assets are increasingly treated as high-growth tech exposures with unique risk characteristics rather than as proxies for traditional stores of value.

Looking ahead, the market will hinge on regulatory clarity and the pace at which policymakers can deliver predictable rules. The current discussions—including high-level talks that culminated in a White House meeting involving crypto and banking leaders—signal bipartisan momentum for market-structure reforms. If lawmakers can translate sentiment into concrete legislation, the door could open for a broader institutional onboarding, greater product innovation, and more defined risk management practices that could, over time, shape BTC’s role in diversified portfolios.

Crypto World

MYX Finance (MYX) Plunges 40% Daily, Bitcoin (BTC) Stalls at $67K: Market Watch

MYX is the most volatile token today, while PIPPIN has surged by 13%.

Bitcoin’s underwhelming price movements continue as the asset has failed to stage a notable recovery from its dip below $66,000 yesterday and now sits just a grand higher.

Some altcoins have posted more impressive gains over the past day, including HYPE and HBAR, both of which have gained around 5%.

BTC Stalls at $67K

The primary cryptocurrency has been in a knockdown state for weeks. Ever since it was rejected at $90,000 on January 28, the predominant force in the market has been the bears. The culmination of a week-long correction took place last Friday when they drove the asset to its lowest position in well over a year at $60,000.

After such a calamity in which bitcoin lost $30,000 in less than ten days, the bulls finally intervened and staged a quick and impressive rebound to $72,000. BTC tried to take down that level on a couple of occasions by Monday, but it was ultimately stopped.

The latest correction occurred yesterday when bitcoin slipped below $66,000 again. Although it bounced to $68,000 almost immediately, it couldn’t continue higher and now trades around $67,000 once more after a 5% weekly decline.

Its market cap struggles at $1.340 trillion on CG, while its dominance over the alts has dropped further to 56.6%.

MYX Plunges

Most larger-cap alts are slightly in the green on a daily scale. However, ETH continues to trade well below $2,000, and XRP is beneath $1.40. Only BNB has defended its territory and sits above $600 from the top 5 alts. HYPE and HBAR are today’s top gainers from this cohort of altcoins, posting 5% gains to $30 and $0.093, respectively.

PIPPIN continues to chart notable gains, surging 11% daily and a whopping 190% weekly to almost $0.50. ASTER and VET follow suit. In contrast, MYX has dumped by nearly 40% daily to under $3.3.

The total crypto market cap has remained below $2.4 trillion on CG, even though it has increased slightly ($2o billion or so) since yesterday.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

Crypto World

Smart investors are positioning in SolStaking

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

A sharp $90 billion crypto market selloff is prompting renewed attention on structured staking models designed to maintain capital efficiency during volatility.

Summary

- Bitcoin fell below $66,000, Ethereum approached $1,900, and altcoins dropped up to 7%, pushing sentiment into “Extreme Fear” territory.

- Rather than relying solely on price recovery, some investors are exploring staking and cloud-based models aimed at generating yield during downturns.

- SolStaking combines blockchain-based settlement with diversified real-world asset exposure and a defined compliance framework to support more stable participation in turbulent cycles.

In just a few hours, nearly $90 billion evaporated from the crypto market.

Bitcoin dropped sharply below $66,000. Ethereum slid toward $1,900. Altcoins fell 4%–7%. The Fear & Greed Index plunged into “Extreme Fear.”

This wasn’t just volatility. It was a reminder.

In high-risk cycles, assets without structure bleed the fastest.

And that’s exactly why capital is shifting toward structured participation models like SolStaking.

Volatility isn’t the problem. Passive exposure is.

When markets crash:

- Leverage accelerates liquidations

- Fear drives irrational exits

- Capital becomes reactive instead of strategic

Simply holding assets without a yield structure means users’ portfolios depend entirely on price recovery. That’s speculation.

Structured staking participation is strategy.

What is SolStaking?

SolStaking is a structured digital asset platform designed to help crypto holders maintain capital efficiency during volatile cycles.

Instead of relying purely on price appreciation, SolStaking allows users to participate in automated staking and cloud mining models supported by both blockchain infrastructure and diversified real-world asset operations (RWA).

The goal is simple: Keep assets working — even when markets aren’t.

Security and compliance infrastructure

In times of instability, security matters more than yield.

SolStaking operates with a clearly defined compliance and risk framework:

- U.S.-registered operating entity: Sol Investments, LLC

- Asset segregation: User staking assets are kept strictly separate from platform operating funds

- Independent audits: Periodic audits conducted by PwC

- Custody insurance: Coverage provided by Lloyd’s of London

- Enterprise-grade security: Multi-layer encryption, system isolation, and 24×7 risk monitoring

This structure is designed for long-term operational stability, not short-term hype.

Real-world asset support structure

Unlike purely speculative staking models, SolStaking integrates diversified real-world operational assets, including:

- AI data center infrastructure

- Sovereign and investment-grade bonds

- Physical gold and commodity exposure

- Industrial metal inventory

- Logistics and cold-chain infrastructure

- Agriculture and clean energy projects

These assets operate off-chain, generating structured revenue streams that are reflected through automated on-chain contract execution.

The result? Even during heavy market corrections, the operational structure continues functioning.

Contract participation

SolStaking offers various staking and cloud mining contract models tailored to different asset types and time horizons.

Users can participate using assets such as BTC, ETH, SOL, USDT, and others. Contracts are executed automatically by the system, with daily settlement mechanisms and transparent tracking.

For full details regarding available contract plans, participation terms, and performance structures, users are encouraged to visit the official website for the most up-to-date information.

Why this matters in a bear market

Bear markets don’t destroy capital overnight. They drain it slowly, through inactivity, poor structure, and emotional decision-making.

The difference isn’t who predicts the bottom. It’s who builds a structure that continues operating through volatility. When others are waiting for price recovery, structured participants are maintaining capital efficiency.

Final thought

Crypto will always be volatile. But how people position their assets during volatility is a choice.

People can wait for the next rally. Or they can structure their assets to operate through the storm.

SolStaking is built for high-volatility markets. To learn more, visit the official website.

Disclosure: This content is provided by a third party. Neither crypto.news nor the author of this article endorses any product mentioned on this page. Users should conduct their own research before taking any action related to the company.

Crypto World

Digital assets exchange-traded product landscape: past, present and future

In today’s newsletter, Joshua De Vos, head of research at CoinDesk, summarizes their latest crypto ETF report covering U.S. adoption, the speed at which it’s happening and asset concentration.

In Keep Reading, we link to the U.S. and Global ETF reports for those who want to do a deeper dive.

Digital assets exchange-traded product landscape: past, present and future

Crypto for Advisors – February – Digital Asset ETPs

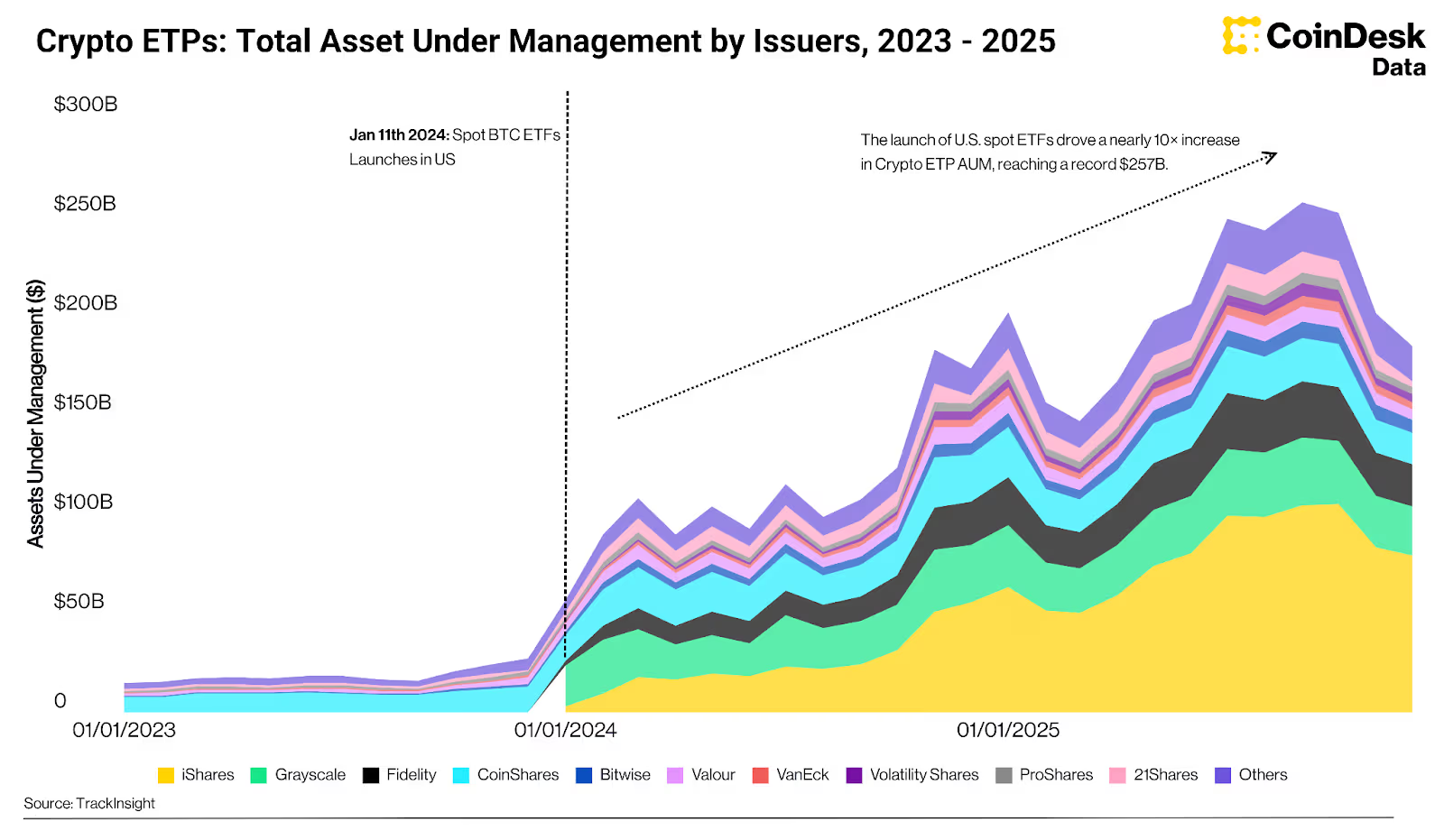

Digital asset Exchange-Traded Products (ETPs) are now one of the clearest signals of how quickly crypto is being integrated into traditional portfolio infrastructure. As presented in CoinDesk’s latest research report, the market has moved beyond the early phase of fragmented access and into a period where regulated wrappers and exchange-traded fund (ETF) distribution are materially shaping how capital enters the asset class.

The state of crypto ETP adoption

As of the end of 2025, crypto ETP assets under management (AUM) reached $184 billion. The United States remains the center of gravity, accounting for approximately $145 billion, or close to 80% of global assets AUM. ETFs dominate the product landscape, representing 84.6% of crypto structured products by assets. The market is also heavily skewed toward simple exposure. Around 94.1% of crypto ETPs employ a delta-one strategy, and 96.1% are passively managed.

The growth in AUM has been driven primarily by the launch of U.S. spot bitcoin ETFs in January 2024. The step-change was immediate. The launch cycle pushed crypto ETP assets sharply higher and created a product category that now sits inside the same ETF allocation frameworks used across equities, fixed income and commodities.

The pace of adoption has also been unusually fast when compared to earlier ETF cycles. U.S. bitcoin ETFs reached $100 billion in assets in just 11 months, while U.S. gold ETFs took nearly 16 years to surpass the same milestone. By early 2025, bitcoin ETFs had matched 91% of the top 10 U.S. gold ETFs by AUM, before gold’s subsequent rally widened the gap. This is less a statement about relative value and more a statement about how quickly bitcoin has been absorbed into institutional distribution channels once the wrapper became available.

Scale and concentration

Within the crypto ETP market, exposure remains heavily concentrated. Bitcoin-based products account for $144 billion in AUM, representing 78.2% of total AUM. Ether-based products have reached $26.5 billion, indicating that institutional demand is gradually broadening beyond bitcoin. Outside of those two assets, exposure remains limited. Solana- and XRP-linked products manage $3.8 billion and $3.0 billion respectively, while multi-cryptocurrency ETPs represent 0.62% of total AUM, or $2.16 billion.

The pipeline broadens

This hierarchy is consistent with how ETF markets typically develop. Institutions tend to begin with the most liquid assets, in the most established structures, before expanding into broader exposure as markets deepen and benchmarks standardise. That dynamic is now beginning to appear in the crypto ETP pipeline. As of end-2025, more than 125 digital asset ETP filings were pending, with bitcoin continuing to lead the filing landscape, followed by XRP and Solana as the most active single-asset categories.

The other notable development is the growing momentum behind basket products. Multi-cryptocurrency ETPs remain a small segment by AUM, but they represent the second most active category by number of pending filings. This matters because basket products tend to become more relevant as markets mature, correlations evolve and concentration risk becomes more apparent. Indices such as the CoinDesk 5 and CoinDesk 20 are increasingly being used as reference points for ETPs, structured notes and derivatives, reflecting the market’s gradual shift toward diversified exposure.

Advisor access

The expansion of crypto ETPs has also occurred before broad adoption across major advisory platforms. Many large advisors remain in evaluation or early allocation phases, suggesting current AUM reflects initial positioning rather than full participation. That is beginning to change, with firms such as Vanguard only recently expanding client access to crypto ETFs.

Looking ahead, the scale of the global ETF market provides context for how large the category could become. Global ETF and ETP assets are projected to grow to roughly $30 trillion by 2030. Within that framework, even modest allocation decisions have the potential to translate into a materially larger crypto ETP market over time.

This summary was created based on CoinDesk Research’s latest report; Digital Assets ETP Landscape: Past, Present and Future.

– Joshua De Vos, research team lead, CoinDesk

Keep Reading

Read the full global and U.S. ETF reports here:

Crypto World

Flipster FZE Secures In-Principle Approval from VARA, Reinforcing Commitment to Regulated Crypto Access

[PRESS RELEASE – Dubai, UAE, February 12th, 2026]

Flipster, a global cryptocurrency trading platform, has received in-principle approval from Dubai’s Virtual Assets Regulatory Authority (VARA) under Flipster FZE. The approval is a key milestone in Flipster’s expansion into the Middle East and reinforces its focus on building safe, compliant access to digital assets in regulated markets.

The in-principle approval allows Flipster FZE to progress toward offering regulated virtual asset services under VARA’s framework, with spot trading as the initial offering. It reflects Flipster’s long-term strategy to operate within established regulatory frameworks in key global markets.

“This milestone is a meaningful vote of confidence in our long-term commitment to the region,” said Benjamin Grolimund, General Manager at Flipster FZE. “The Middle East has become a blueprint for how digital assets should be regulated and adopted. VARA’s clear framework enables innovation while prioritizing trust and security — and we’re committed to building trading solutions that meet the highest standards globally.”

Flipster’s regulatory progress is matched by its continued enhancement of its compliance infrastructure. The platform’s partnership with Chainalysis enhances its capabilities in transaction monitoring and risk management — supporting Flipster’s readiness to meet VARA’s regulatory standards and operate with greater accountability and oversight.

Flipster first announced its entry into the Middle East in May 2025, with the appointment of Benjamin Grolimund, a seasoned fintech executive with prior leadership roles at Rain and Bloomberg. The UAE’s regulatory clarity and maturing digital asset ecosystem continue to position it as a strategic base for Flipster’s global growth plans.

About Flipster FZE

Flipster FZE is a regulated digital asset exchange planning to offer spot trading across leading cryptocurrencies. The platform is engineered for dependable execution, transparent pricing, and a streamlined user experience.

With a strong emphasis on compliance and security, Flipster provides users with a trusted venue to access digital asset markets with confidence.

Users can learn more at flipster.io or follow X.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Ethereum price nears oversold zone as ETH staking metric hits key milestone

Ethereum price remained in a bear market as the crypto market continued to weaken ahead of the U.S. consumer inflation report.

Summary

- Ethereum price has moved into a bear market after falling by 60% from its all-time high.

- The Relative Strength Index is approaching the oversold level.

- Ethereum’s staking ratio has jumped to a record high of 30%.

Ethereum (ETH) dropped to $1,985, down by 60% from its highest level in August last year. This is the token’s fourth consecutive week in the red, a move that has shed billions of dollars in value.

Ethereum’s price retreated as demand for its ETFs and futures open interest declined. Data compiled by SoSoValue shows that spot ETH ETFs shed over $129 million in assets on Wednesday, bringing the monthly outflow to over $224 million. It is the fourth consecutive month of outflows, with the cumulative net inflows being $11.75 billion.

More data show that Ethereum’s futures open interest has continued to fall over the past few months. Its open interest dropped to $23 billion, down sharply from last year’s high of over $70 billion. Falling open interest is a sign that investor demand has waned.

However, there are signs that more Ethereum is being moved today to staking pools. Data show that Ethereum staking recently crossed 30% of the total supply for the first time.

More data show that the staking queue has continued soaring in the past few months. There are now over 4 million ETH tokens in the queue waiting to be staked, with less than 25,000 waiting to exit.

Ethereum price prediction: Technical analysis

The weekly timeframe chart shows that the ETH price has been in a strong downward trend in the past few months, moving from $4,950 in August to the current $1,988.

It has crashed below the crucial support level at $2,112, its lowest level in August 2024.

On the positive side, the coin has formed an inverted head-and-shoulders pattern, a common bullish reversal sign in technical analysis.

Also, the Average Directional Index has dropped from 33 in July last year to 21 now, a sign that the downtrend is losing momentum.

Most notably, the Relative Strength Index is nearing the oversold level of 30, its lowest level since April last year. Ethereum has often rebounded whenever the RSI has moved into the oversold zone.

Therefore, as Tom Lee noted, there are signs that Ethereum is about to bottom. If this happens, the next level to watch will be the psychological $2,500 level.

Crypto World

BlackRock’s BUIDL Fund Hits Uniswap as UNI Jumped 40%

UNI surged 40% in minutes after Uniswap enabled trading for BlackRock’s tokenized BUIDL fund via UniswapX integration.

Uniswap’s UNI token jumped about 40% within half an hour, after Uniswap Labs announced that BlackRock’s tokenized money market fund BUIDL can now trade through its protocol.

The move links one of the world’s largest asset managers with a decentralized exchange, drawing attention from traders and institutional watchers alike.

BlackRock Fund Trading Goes Live on Uniswap Rails

In a February 11 press release, Uniswap Labs said it partnered with Securitize to make BlackRock’s USD Institutional Digital Liquidity Fund available for trading via UniswapX, its request-for-quote trading system.

The company stated that investors can swap BUIDL with approved counterparties at any time using smart contracts for settlement.

Hayden Adams, CEO of Uniswap Labs, said the integration aims to make markets cheaper and faster, while Securitize CEO Carlos Domingo said it brings traditional financial standards to blockchain-based trading.

BlackRock’s global head of digital assets, Robert Mitchnick, called the launch “a notable step” for tokenized funds interacting with decentralized finance systems. The asset manager also confirmed it has made an investment within the Uniswap ecosystem, though it did not disclose the amount or whether it bought UNI tokens.

Market reaction followed quickly, with UNI rising by more than 40% in about 30 minutes to touch $4.57 after the announcement and news of BlackRock’s involvement spread across trading desks.

You may also like:

As of the latest CoinGecko data, the excitement around the token seems to have petered down somewhat, with UNI now trading near $3.40, which is still up about 5% over 24 hours.

Despite the short-term jump, the token is still down about 9% over seven days and more than 35% in the past month, showing that the spike came after a longer decline.

Tokenized Assets Keep Drawing Major Finance Firms

The integration builds on a wider trend of institutions putting financial products on public blockchains. Earlier in the year, the official Ethereum account on X noted that 35 major firms, including BlackRock, JPMorgan, and Fidelity, have launched services tied to the network. Those projects range from tokenized stocks and funds to stablecoins and deposit tokens.

Securitize, which manages more than $4 billion in assets, has worked with asset managers such as Apollo, KKR, and BNY to tokenize funds. By linking its compliance-focused platform with Uniswap’s trading system, the companies are testing a structure where regulated investors can access blockchain liquidity while remaining within whitelisted environments.

UNI’s recent price swings show how closely traders track institutional activity tied to decentralized finance.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

-

Politics4 days ago

Politics4 days agoWhy Israel is blocking foreign journalists from entering

-

Sports6 days ago

Sports6 days agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

Business4 days ago

Business4 days agoLLP registrations cross 10,000 mark for first time in Jan

-

NewsBeat3 days ago

NewsBeat3 days agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

Tech6 days ago

Tech6 days agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

Sports16 hours ago

Sports16 hours agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

Business4 days ago

Business4 days agoCostco introduces fresh batch of new bakery and frozen foods: report

-

Tech2 days ago

Tech2 days agoSpaceX’s mighty Starship rocket enters final testing for 12th flight

-

NewsBeat4 days ago

NewsBeat4 days agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

Sports4 days ago

Sports4 days agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Sports5 days ago

Former Viking Enters Hall of Fame

-

Politics4 days ago

Politics4 days agoThe Health Dangers Of Browning Your Food

-

Sports6 days ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

Business4 days ago

Business4 days agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

NewsBeat6 days ago

NewsBeat6 days agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Business7 days ago

Business7 days agoQuiz enters administration for third time

-

Crypto World17 hours ago

Crypto World17 hours agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

Video13 hours ago

Video13 hours agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

Crypto World2 days ago

Crypto World2 days agoU.S. BTC ETFs register back-to-back inflows for first time in a month

-

Crypto World2 days ago

Crypto World2 days agoBlockchain.com wins UK registration nearly four years after abandoning FCA process

![[S03:E59] Emas vs ASB vs KWSP: Mana satu pelaburan terbaik? - Dr Hanafee, CEO, MHZ Ingenious](https://wordupnews.com/wp-content/uploads/2026/02/1770914324_maxresdefault-80x80.jpg)