Crypto World

Juspay Strengthens Middle East Presence with DIFC Headquarters

Editor’s note: In today’s fintech landscape, global payment infrastructures are increasingly decisive in unlocking cross-border commerce. Juspay’s Dubai DIFC HQ marks a milestone in its expansion, signaling a focus on enterprise-grade payments in the Middle East. The move aligns with GCC digitization goals and regional fintech collaboration, and demonstrates how scalable payments platforms can drive growth across international markets. This release outlines Juspay’s strategy and what it means for merchants, banks, and developers navigating multi‑currency challenges.

Key points

- Juspay opens a regional headquarters in DIFC Dubai to expand its Middle East presence.

- The expansion aims to serve enterprise merchants, banks, and networks across GCC and MEASA.

- The DIFC hub enables closer engagement with partners to scale enterprise payments.

- Juspay powers 500+ enterprise merchants and banks globally with full‑stack payment orchestration and related services.

Why this matters

This expansion signals a long‑term commitment to open, interoperable payments across the MEA region, offering an institutional‑grade platform to handle multi‑currency and regulatory challenges. It also reinforces Dubai’s role as a fintech hub and positions Juspay to partner with regional banks, networks and merchants to scale payments across markets.

What to watch next

- Regional team growth and partnerships with banks and networks in DIFC and GCC.

- Adoption of Juspay’s payments orchestration platform by MEA enterprises.

- Regulatory and compliance readiness to support multi‑currency, cross‑border payments across GCC and MEASA.

- Expansion of services to additional markets in MEASA as demand scales.

Disclosure: The content below is a press release provided by the company/PR representative. It is published for informational purposes.

Juspay Strengthens Middle East Presence with DIFC Headquarters

Dubai, February 10th, 2026 – Juspay, a global leader in payment infrastructure solutions for enterprises and banks, today announced its expansion into the Middle East with the opening of its regional headquarters in Dubai International Financial Centre (DIFC). This move marks an important step in Juspay’s international expansion, deepening its focus on serving enterprise merchants, banks, and financial institutions in the Middle East. The DIFC headquarters will support closer engagement with existing partners as enterprise payment demand continues to scale.

With digital commerce accelerating in the GCC region, rapidly scaling enterprises in sectors such as airlines, hospitality, e‑commerce, and financial services face increasing complexity driven by multiple regional currencies, evolving regulations, and diverse local payment methods.

To address this complexity, Juspay’s payments orchestration platform provides a unified & reliable payments stack, helping organizations optimize authorisation rates and costs, simplify compliance and scale seamlessly across GCC and global markets with institutional‑grade reliability.

Establishing operations in DIFC highlights Juspay’s long‑term commitment to the Middle East, with a focus on building , regulated, and enterprise‑grade payments infrastructure in the region. As a leading global financial hub, DIFC provides a strong regulatory environment, robust infrastructure, and access to high quality talent. Juspay plans to leverage this and work closely with regional banks, acquirers, networks, and ecosystem partners to deliver scalable and reliable payment solutions tailored for enterprises operating across global markets.

Commenting on the expansion, Sheetal Lalwani, Co‑founder & COO of Juspay, said: “Juspay has been building foundational payments infrastructure for large‑scale, mission‑critical commerce globally for over a decade. We are excited to bring these learnings to the Middle East and partner with merchants, banks, networks, and the broader ecosystem to build secure, scalable payments infrastructure that supports the region’s rapidly evolving digital economy.”

Salmaan Jaffery, Chief Business Development Officer at DIFC Authority said: “We are pleased to welcome Juspay to the Middle East, Africa and South Asia’s most significant fintech and financial services ecosystem. As a global leader in payment infrastructure, Juspay’s presence strengthens our growing digital economy, reinforces DIFC’s role as a catalyst for financial innovation and cements Dubai’s position as a top four global FinTech hub.”

With more than a decade of experience in scaling payment infrastructure, Juspay powers 500+ enterprise merchants and banks globally including Agoda, Amazon, Flipkart, Google, HSBC, IndiGo, Swiggy, Urban Company, Zepto & more. It offers a comprehensive suite of payment solutions that spans full‑stack payment orchestration, authentication, tokenisation, reconciliation, fraud solutions and more. The company also provides end‑to‑end, white‑label payment gateway and real‑time payments infrastructure tailored for banks. Together these capabilities enable merchants and banks to deliver seamless, reliable and scalable payment experiences to the end‑consumers.

Speaking about Juspay’s regional focus, Nakul Kothari, head of Middle East & APAC said, “By establishing our presence in the Middle East with DIFC, we continue our mission of building innovative payment solutions rooted in deep local market understanding. The region holds tremendous potential, and we are investing in long‑term partnerships with merchants and banks to help them build future‑ready payment stacks that can scale across markets.”

This expansion reflects Juspay’s long‑term vision of enabling open, interoperable, and accessible payments worldwide. With a team of over 1,500 payment experts solving payment complexities across Asia‑Pacific, Latin America, Europe, UK, and North America, Juspay is strategically positioned to reshape the Middle Eastern payments landscape. The company plans to grow its regional team, specifically targeting growth in business development, solution engineering, and partnerships.

About Juspay

Juspay is a leading multinational payments technology company, redefining payments for 500+ top global enterprises and banks. Founded in 2012, the company processes over 300 million daily transactions, exceeding an annualized total payment volume (TPV) of $1 trillion with 99.999% reliability. Headquartered in Bangalore, India, Juspay is powered by a global network of 1500+ payment experts operating across San Francisco, Dublin, São Paulo, Dubai, and Singapore.

Juspay offers a comprehensive product suite for merchants that includes open‑source payment orchestration, global payouts, seamless authentication, payment tokenization, fraud & risk management, end‑to‑end reconciliation, unified payment analytics & more. The company’s offerings also include end‑to‑end white label payment gateway solutions & real‑time payments infrastructure for banks. These products help businesses achieve superior conversion rates, reduce fraud, optimize costs, and deliver seamless customer experiences at scale.

To learn more about Juspay, visit: http://www.juspay.io

About Dubai International Financial Centre

Dubai International Financial Centre (DIFC) is one of the world’s most advanced financial centres, and the leading financial hub for the Middle East, Africa and South Asia (MEASA), which comprises 77 countries with an approximate population of 3.7bn and an estimated GDP of USD 10.5trn. With a 20‑year track record of facilitating trade and investment flows across the MEASA region, the Centre connects these fast‑growing markets with the economies of Asia, Europe, and the Americas through Dubai. DIFC is home to an internationally recognised, independent regulator and a proven judicial system with an English common law framework, as well as the region’s largest financial ecosystem of 46,000 professionals working across over 6,900 active registered companies – making up the largest and most diverse pool of industry talent in the region. Comprising a variety of world‑renowned retail and dining venues, a dynamic art and culture scene, residential apartments, hotels, and public spaces, DIFC continues to be one of Dubai’s most sought‑after business and lifestyle destinations. For further information, please visit our website: http://difc.ae, or follow us on LinkedIn and X @DIFC.

Crypto World

SBET executives urge to look beyond recent price action

As institutional adoption of digital assets matures, a new corporate playbook is emerging: treat ether not just as an investment, but as productive financial infrastructure.

The shift comes amid sharp downward market volatility. SharpLink Gaming (SBET) — which saw its stock soar last May after adopting an ether treasury strategy — has since plunged (along with every other of 2025’s hastily-formed digital asset treasury companies). It’s a reminder of the turbulence that continues to define the asset class.

At a panel discussion at Consensus Hong Kong 2026 featuring Sharplink Chairman Joe Lubin and CEO Joseph Chalom, the two executives outlined how DATs are evolving into a distinct institutional strategy.

“I’ve never seen more of a moment of differentiation where the actual macro tailwinds for Ethereum have never been better in its 10-and-a-half-year history,” said Chalom, pointing to the growth of stablecoins and tokenization. “Listen to Larry Fink at Davos, when he’s telling you $14 trillion of BlackRock assets will be tokenized, and over 65% of that to date is happening on Ethereum.”

While recent ether price action and ETF flows have raised concerns, Chalom framed them as part of broader macro de-risking. “Bitcoin and ether were very easy to de-risk,” he said, adding that rotations out of liquid assets are typical during volatility. “The largest players in institutional finance are telling us out loud — they’re coming to ether.”

SharpLink’s strategy differs, he argued, because it deploys permanent capital. “An ETF is a great passive exposure vehicle, but it needs to provide daily liquidity…We own permanent capital,” he said. “The third stage — which is actually most important — is making your ETH productive.”

Lubin emphasized ether’s distinguishing feature: yield.

“Ether would be a much better asset… because it is a productive asset. It yields. It has a risk-free rate,” he said, referring to staking returns of roughly 3%. SharpLink has staked nearly all its holdings and plans to continue accumulating. “We’ll keep buying ether. We’ll keep staking ether and adding new yield to ether.”

Beyond staking, Chalom described what he called “good institutional DeFi,” using long-term locked capital to earn risk-adjusted returns rather than chasing venture-style upside. “We’re not looking for convex VC 10x outcomes — we’re looking for the best risk-adjusted yield for our investors. And we’re actually confident that by doing it, we’ll improve the DeFi ecosystem by raising its standards.”

For Lubin, the shift resembles the early internet era. “A long time ago…there were internet companies. Now every company is an internet company. Soon, every company is going to be a blockchain company,” he said, predicting firms will increasingly hold tokens on balance sheets and require sophisticated onchain treasury tools.

Read more: Ethereum treasury firm SharpLink stakes $170M ETH on Linea network

Crypto World

Zcash faces potential 66% decline, holders reduce stakes

Zcash recorded a 7% price decline over the past 24 hours, while broader cryptocurrency markets also slipped. However, large holders reduced their positions by approximately 38% over the past seven days, raising concerns about the cryptocurrency’s near-term prospects.

Summary

- Large holders reduced their stakes by 38% over the past week, and technical analysis suggests a bearish flag pattern.

- Zcash has seen a 40% drop month-over-month.

- The concentration of 70% of the supply in the top 100 addresses suggests Zcash’s current price foundation may be unstable.

The privacy-focused cryptocurrency has increased 5.8% over the past week, but decreased over 40% month-over-month, according to CoinGecko.

Bitcoin and Ethereum experienced larger declines during the same period as the broader cryptocurrency market continued its selloff.

Exchange flow data showed net outflows on Feb. 12, indicating some purchasing activity. However, on-chain data revealed that large holders decreased their Zcash holdings by roughly 38% over seven days, with additional selling occurring in the past 24 hours. Exchange inflows increased simultaneously, suggesting coins moved from private wallets to exchanges.

Technical analysts identified a bearish flag and pole pattern forming on Zcash price charts. This formation typically appears after a sharp decline, followed by a consolidation period. When prices break down from this pattern, the resulting decline often matches the distance of the initial drop, according to technical analysis methodology. For Zcash, this measured move indicates a potential 66% decline from current levels if the pattern completes.

A four-month bearish divergence signal has also formed between October and February. During this period, Zcash prices reached a higher high while the Relative Strength Index (RSI), a momentum indicator, recorded a lower high. This divergence typically indicates weakening buying pressure despite rising prices.

The RSI continues to trend downward while prices remain near recent highs, creating a widening gap between price action and momentum indicators.

On-chain data shows the top 100 addresses control approximately 70% of the total supply. Smart money indicators remained flat with no significant accumulation detected, according to blockchain analytics.

The cryptocurrency rebounded from lows reached in early February. Technical analysts stated that a breakout above resistance levels would be required to invalidate the bearish setup, while a breakdown below key support would likely accelerate declines.

Market observers noted that the relative outperformance compared to other cryptocurrencies occurred while large holders distributed their positions, creating what analysts described as a potentially unstable foundation for current price levels.

Crypto World

Crypto PAC Fairshake seeks to force resistant Texas Democrat Al Green from U.S. House

The crypto industry’s campaign-finance arm, Fairshake, has begun rolling out its campaign strategies in its well-funded effort to pack Congress with lawmakers ready to pass friendly digital assets policy, and Democratic Representative Al Green is the first lawmaker on its hit list.

An affiliate of the Fairshake political action committee, which has begun deploying its $193 million war chest on this year’s congressional midterm elections, said it will spend $1.5 million on advertisements opposing Green’s primary campaign.

The critical Texas lawmaker has often noted potential hazards posed by cryptocurrencies to the U.S. financial system and to investors, co-sponsored a bill seeking to ban President Donald Trump from his personal crypto business interests and has voted against crypto policy legislation. That opposition earned him an “F” grade from Stand With Crypto, a group that assesses crypto support from politicians.

Green, who is among the most senior Democrats on the House Financial Services Committee that has a direct hand in crypto legislation, faces rivals in the Democratic primary for the recently redrawn Texas district he represents. Texas’ primaries come quickly next month, and longtime congressman Green would have to beat a younger Democrat, Christian Menefee, who just won a special election and took the redrawn district’s seat days ago.

“Texas voters can no longer sit by and have representation in Congress that is actively hostile towards a growing Texas crypto community,” Fairshake’s super PAC affiliate, Protect Progress, said in a statement. “We are committed to electing new members who embrace innovation, growth and wealth creation for all Americans.”

Menefee is supportive of blockchain technology, according to his campaign stance, and Stand With Crypto gives him an “A” grade.

In Green’s most recent election in 2024, his campaign spent less than $450,000 to retain his seat, which went unchallenged in the primary, and he needed even less in 2022. But he’s so far brought in more than $700,000 in this more difficult contest. Still, that’s less than half of Fairshake’s spending against him.

Fairshake also this week announced that it’ll spend $5 million to boost a pro-crypto Alabama Republican, U.S. Representative Barry Moore, in that state’s Senate primary. And the group is also backing House Financial Services Committee Chairman French Hill, according to a spokesman. The super PAC generally spends money on advertisements that are general political messages, not related to crypto issues, and because they’re “independent expenditures” under election law, Fairshake isn’t allowed to coordinate with campaigns.

Crypto World

Bitcoin Institutional Adoption Accelerates as ETFs and Corporate Treasuries Reshape Market

TLDR:

- Spot bitcoin ETFs and treasuries absorbed 1.2 times new supply in 2025, reshaping demand dynamics

- Peak-to-trough bitcoin declines now limited to 50% versus historical 70-80% drawdowns in cycles

- Digital asset treasuries hold 1.1 million BTC valued at $89.9 billion as corporate adoption grows

- U.S. Strategic Bitcoin Reserve holds 325,437 BTC representing 1.6% of total bitcoin supply today

Bitcoin continues its transformation from speculative asset to institutional holding. The digital currency has attracted major financial players through regulated exchange-traded funds and corporate strategies.

Data shows spot bitcoin ETFs and digital asset treasuries absorbed 1.2 times new supply in 2025. This shift reflects broader acceptance among investors.

ETF Growth and Corporate Treasury Adoption Reshape Market Dynamics

Spot bitcoin ETFs reached a milestone during 2025, altering the asset’s supply-demand profile. Morgan Stanley and Vanguard expanded platforms to include bitcoin products in the fourth quarter.

Vanguard’s decision proved noteworthy given its historical exclusion of commodities. These vehicles attracted capital from advisors, institutions, and retail investors.

Corporate adoption has moved beyond early adopters into mainstream finance. According to ARK Investment Management and 21Shares analysts, “the unifying theme for the current cycle is bitcoin’s transition from an optional new monetary technology to a strategic allocation.”

Strategy, formerly MicroStrategy, has accumulated holdings representing 3.5% of total supply. Digital asset treasury companies hold more than 1.1 million BTC, valued at $89.9 billion. The S&P 500 and Nasdaq 100 now include bitcoin-exposed companies like Coinbase and Block.

Sovereign interest materialized through the U.S. Strategic Bitcoin Reserve. The Trump Administration launched this reserve using seized bitcoin totaling 325,437 BTC.

This represents 1.6% of total supply valued at $25.6 billion. Texas led state-level adoption by adding bitcoin to reserves.

Regulatory developments have created clearer pathways for institutional participation. The proposed CLARITY Act would establish dual-oversight between CFTC and SEC.

This legislation provides a compliance roadmap with standardized maturity tests. The clarity reduces uncertainty that drove firms offshore.

Price Performance and Market Maturation Show Evolving Investor Behavior

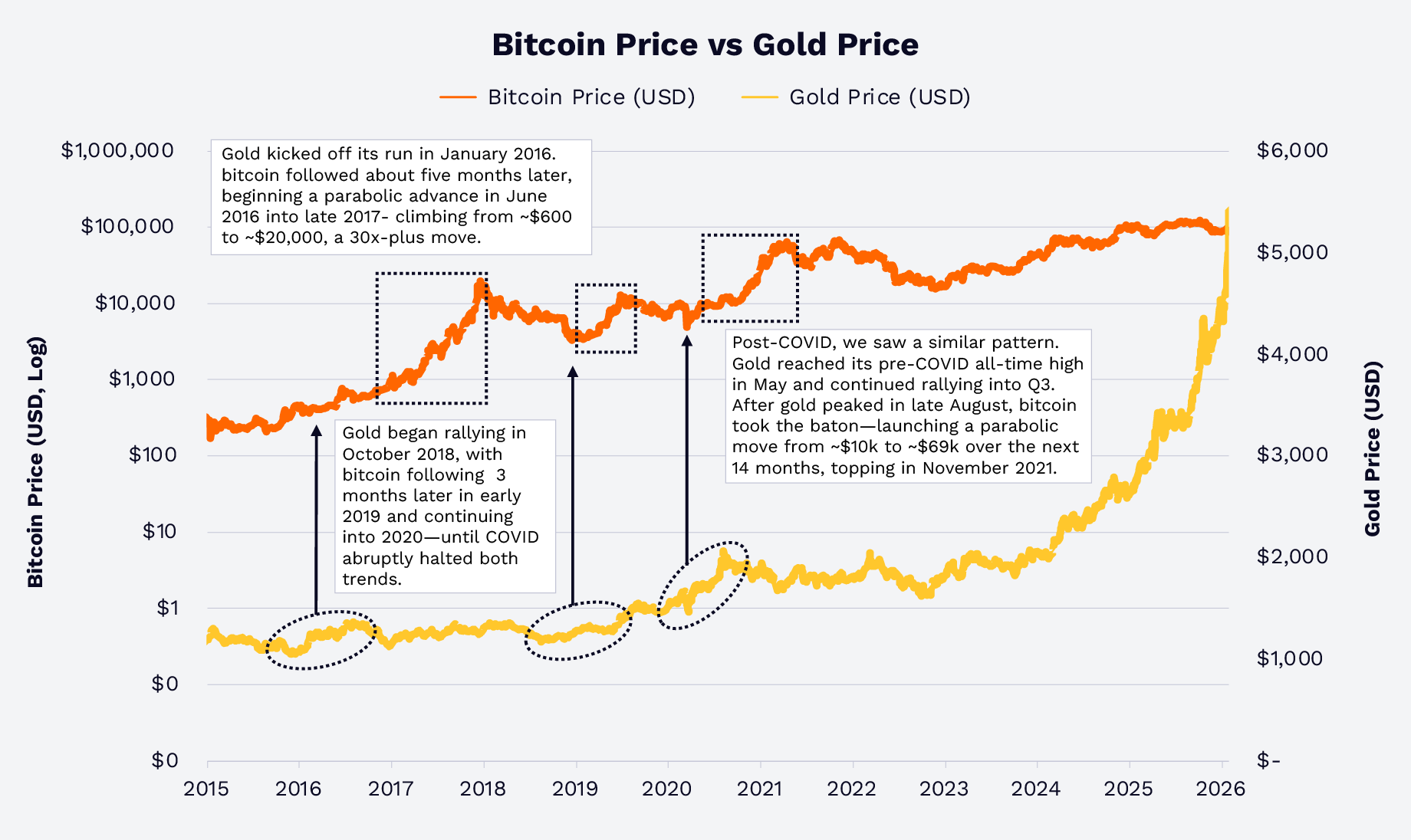

Bitcoin’s relationship with gold has demonstrated patterns throughout market cycles. Gold prices surged 64.7% during 2025 while bitcoin declined 6.2%.

Historical data from 2016, 2019, and 2020 shows gold movements preceded bitcoin rallies. Spot bitcoin ETFs achieved in under two years what gold ETFs required over 15 years.

.png)

Market volatility metrics reveal a maturing asset with improved risk characteristics. Peak-to-trough declines in the current cycle have not exceeded 50%.

This compares favorably to prior cycles where drawdowns reached 70-80%. The February 2026 correction maintained this trend.

Long-term holding strategies have outperformed market timing. A hypothetical investor purchasing $1,000 at yearly peaks from 2020 through 2025 generated positive returns.

The report notes that “in 2026, bitcoin’s story is less about whether it will survive and more about its role in diversified portfolios.”

Even accounting for February corrections, this strategy produced a 29% return. Position sizing and holding periods matter more than entry timing.

Correlation analysis shows bitcoin maintains low relationships with traditional assets. Weekly returns from 2020 through 2026 show a 0.14 correlation with gold.

This low correlation enhances portfolio diversification benefits. Combined with reduced volatility, bitcoin presents a different risk-reward proposition.

Crypto World

SEC Head Defends Enforcement Changes Amid Justin Sun Case Questions

SEC Chair Paul Atkins has defended the agency’s enforcement shift as lawmakers question why Justin Sun’s case was paused.

U.S. Securities and Exchange Commission (SEC) Chair Paul Atkins is facing scrutiny from lawmakers as the agency moves to reshape its cryptocurrency regulatory framework.

Democrats are questioning potential links between industry actors and President Donald Trump amid a broader decline in enforcement actions.

SEC Scrutinized Over Tron Case

During a House Financial Services Committee hearing, Democratic members zeroed in on the SEC’s decision to pause its case against Tron founder Justin Sun. Representative Maxine Waters pointed to what she described as a sweeping rollback of prior crypto enforcement actions after Trump entered the White House and new SEC leadership took over last year.

Waters referenced the regulator’s 2023 lawsuit against Sun, in which he was accused of organizing the unregistered sale of crypto securities tied to the TRX and BTT tokens and manipulating trading volumes.

Later in February 2025, the SEC asked the federal court overseeing the case to issue a stay, which paused the proceedings. Since that decision, Sun has become a major financial supporter of Trump-linked crypto ventures, purchasing billions of WLFI tokens, making him the largest backer of World Liberty Financial.

Waters also highlighted a more recent claim by his alleged former girlfriend, who publicly suggested she possesses evidence of TRX manipulation.

Atkins declined to address specifics of the case, telling lawmakers he could not comment on individual enforcement matters. He added that he would be open to further discussion in a confidential setting “to the extent the rules allow me to do that.”

You may also like:

When asked whether the agency ever acts to protect investors in ways that could negatively affect Trump-affiliated businesses, he responded, “As far as what the Trump family does or not, I can’t speak to that.”

Trump’s Ties to Binance

Lawmakers also raised concerns about other high-profile litigation the SEC dropped last year, including cases against Binance, Ripple, Coinbase, Kraken, and Robinhood.

In May 2025, the financial watchdog ended its lawsuit against Binance, which it had sued in 2023 for offering unlicensed services and misrepresenting trading controls. Trump later also pardoned Zhao, while a stablecoin issued by WLF was used by an Abu Dhabi investment firm for a $2 billion investment in Binance.

“Explain to me how this happens without any enforcement action,” Representative Stephen Lynch said. “The reputational damage that the SEC is suffering right now is unbelievable. And you’re in the seat, sir. It’s your responsibility. I’m just asking for an explanation.”

The SEC Chair defended the regulator, saying it has a “robust enforcement effort” and continues to bring cases. However, data from Cornerstone Research shows that its overall legal actions fell 30% in 2025, while crypto-related cases dropped 60%.

Atkins, who became the organization’s chair in April 2025 after Gary Gensler’s departure, is known for criticizing the previous aggressive approach and framing his leadership as a move away from litigation-heavy tactics.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Israeli soldier allegedly used military secrets to gamble on Polymarket

Israel is attempting to prosecute a reserve soldier who allegedly used military secrets to place bets on security operations via Polymarket.

Polymarket offers a multitude of markets on various military operations, from bets on the outcome of the Ukraine/Russia war, to more specific targeted missile strikes against various countries.

Israel’s Shin Bet security agency announced today that the soldier — who is facing court along with an alleged civilian accomplice — used “classified reports” accessed via their military role to help make bets that could threaten Israel’s national security.

The pair is charged with numerous security offences, as well as bribery and obstruction of justice. Several people were arrested, but only two have been charged so far.

A lawyer representing the soldier told Bloomberg that the indictment is “flawed,” adding that the charge of harm to national security has been dropped.

They added, however, that he’s still believed to have used confidential information without permission.

Pair might be connected to $150K Polymarket winnings on Israel-Iran strikes

It’s unknown which prediction markets the two bet on, or if they made any profits. There are suspicions, however, that they could be linked to the Polymarket account “ricosuave666.”

This account made over $150,000 betting on Israel’s strikes against Iran in 2025, and reportedly got each prediction correct across a war that lasted 12 days.

Israeli authorities then opened up an investigation into these bets.

Previous cases involving the leaking of military secrets led to an Israeli soldier reportedly being sentenced to 27 months in jail in 2023.

The individual passed on confidential information to users on social media so that they could gain credibility and popularity online.

Read more: Logan Paul fakes $1M Super Bowl bet on Polymarket

Every month, there seems to be another debate surrounding Polymarket and the use of insider information to make bets, but it’s unclear how capable the platform is of preventing these sorts of trades.

There were concerns over one account that made $437,000 betting on the exit of Venezuela’s former president Nicolás Maduro hours before the US captured him.

There were also concerns that someone was able to use insider information to bet on the Nobel Peace Prize before it was announced.

After the home of Polymarket’s CEO, Shayne Coplan, was raided by the FBI, a company spokesperson said, “We charge no fees, take no trading positions, and allow observers from around the world to analyze all market data as a public good.”

Protos has reached out to Polymarket for comment and will update this piece should we hear anything back.

Got a tip? Send us an email securely via Protos Leaks. For more informed news and investigations, follow us on X, Bluesky, and Google News, or subscribe to our YouTube channel.

Crypto World

CertiK awarded the “Best Security and Compliance Solution 2026” at SiGMA AIBC

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Web3 security firm CertiK honored for its contribution in web3 security and compliance at the 2026 SiGMA AIBC Eurasia Awards.

Summary

- CertiK named “Best Security & Compliance Solution 2026” at SiGMA AIBC Eurasia Awards for advancing crypto safety.

- CertiK has expanded into the Middle East, offering institutional-grade crypto security from its Abu Dhabi branch.

- CertiK has partnered with ADGM regulators to provide enterprise security solutions via Skynet.

CertiK, the web3 security services provider, received an award for “Best Security & Compliance Solution 2026” at the SiGMA AIBC Eurasia Awards ceremony on February 10, 2026.

The award is a recognition of the firm’s efforts in driving the crypto industry towards compliance and institutionalization. The SiGMA AIBC Eurasia Awards, jointly created by SiGMA and AIBC, is an award for the digital technology and innovation industries in the Eurasia region. It focuses on areas such as AI, blockchain, web3, and compliance security, and is well-known across the region.

Other award winners included web3 companies, including Crypto.com, OKX Wallet, Avalanche, and Cointelegraph.

The award comes at a time when CertiK has been expanding its presence in the Middle East since the launch of its branch in Abu Dhabi in 2025. According to the firm, it has launched a localized team recruitment drive to address the demand for security services in the Middle Eastern markets.

The company’s focus in the region has shifted to providing “institutional-level” security services. The goal of this service model is to provide banks, sovereign wealth funds, and large multinational corporations with security measures that meet traditional financial security requirements through advanced engineering capabilities and a tight defense matrix.

Since launching the branch in Abu Dhabi, CertiK has partnered with Abu Dhabi regulators, participated in roundtable discussions on the framework for virtual asset regulatory activities in the Abu Dhabi Global Market (ADGM), and offers services to local regulators via its security platform Skynet Enterprise.

According to CertiK, its services assist regulators in assessing the potential impact of abnormal events on corporate entities and the broader financial ecosystem, and promote the development of security compliance and innovation in the digital economy.

Disclosure: This content is provided by a third party. Neither crypto.news nor the author of this article endorses any product mentioned on this page. Users should conduct their own research before taking any action related to the company.

Crypto World

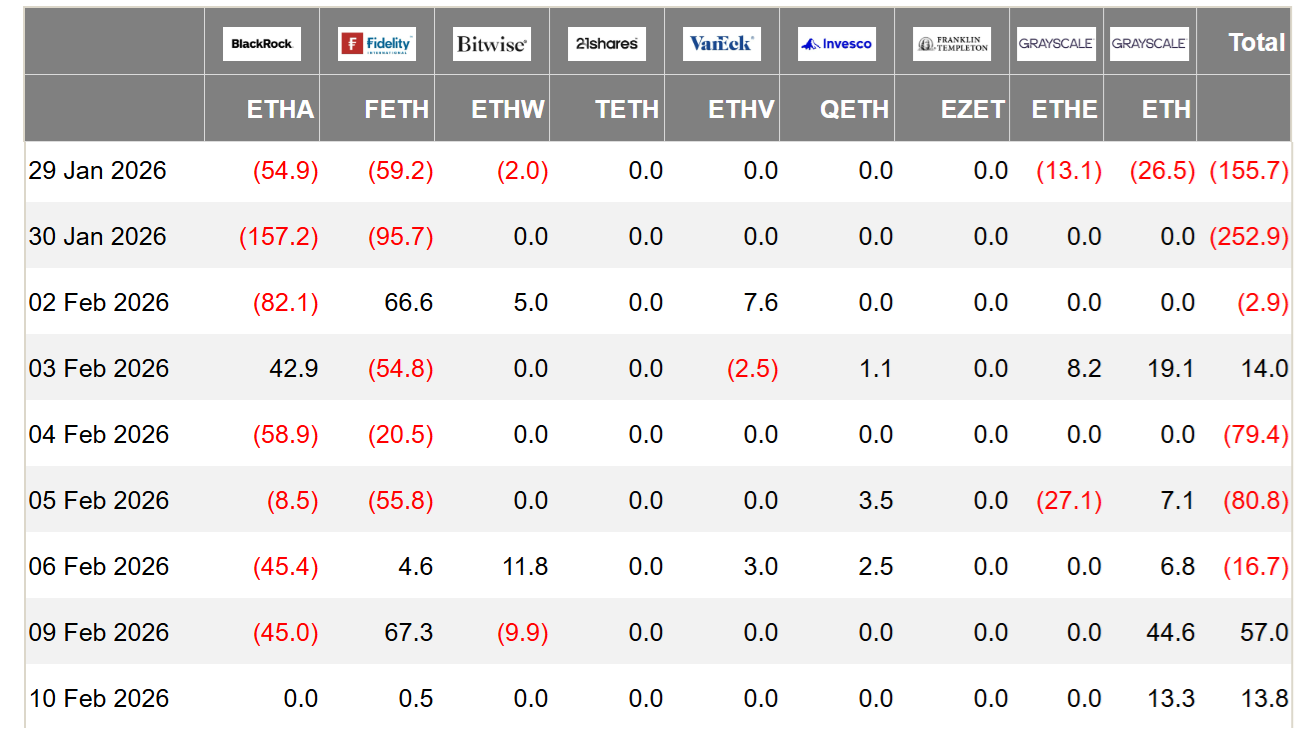

ETH ETF Flows, Onchain Volume Signal Recovery To $2.4K

Key takeaways:

-

Ether exchange-traded funds saw $71 million in inflows, signaling strong institutional appetite.

-

Weekly decentralized exchange volume doubled to $20 billion, narrowing the revenue gap with Solana.

Ether (ETH) price failed to sustain levels above $2,000 on Thursday, leaving traders to weigh the potential catalysts for a market turnaround. While optimism has waned since the crash to $1,745 on Friday, both exchange-traded fund (ETF) flows and ETH derivatives metrics are showing early signs of a reversal.

Traders now question if there is enough momentum for a bounce back toward $2,400.

US-listed Ether ETFs recently broke a three-day streak of outflows, attracting $71 million in fresh capital between Monday and Tuesday. Crucially, assets under management have stabilized at $13 billion, which is sufficient to maintain institutional interest. Ether ETFs currently average over $1.65 billion in daily trading volume, a level of liquidity that enables participation by the world’s largest hedge funds.

To put Ether ETFs in perspective, the State Street Energy Select Sector SPDR ETF (XLE US)— the largest in the US energy sector — trades an average of $1.5 billion per day. That instrument tracks a combined $2 trillion market capitalization across companies such as Exxon (XOM US), Chevron (CVX US), ConocoPhillips (COP US), The Williams Companies (WMB), and Kinder Morgan (KMI US).

ETH metrics and ETF inflows signal potential market recovery

While institutional appetite for Ether ETF trading is a positive indicator, it does not guarantee that demand for ETH derivatives is inherently bullish.

On Wednesday, the annualized premium (basis rate) of ETH futures remained below the 5% neutral threshold. This lack of demand for bullish leverage has been a constant theme for the past three months. However, the indicator has stabilized at 3%, even as the ETH price hit its lowest level in nine months. These derivatives markets are displaying moderate resilience, which remains an encouraging sign for Ether investors.

Related: Denmark’s Danske Bank allows clients to buy Bitcoin and Ether ETPs

Ether’s price weakness has driven Ethereum’s Total Value Locked (TVL) to $54.2 billion, down from $71.2 billion one month prior, according to DefiLlama data. Reduced deposits in the network’s smart contracts represent a major risk, as lower chain fees diminish the native staking yield. Moreover, Ethereum’s supply burn mechanism remains dependent on excessive demand for blockchain processing.

Despite these worsening conditions, demand for Ethereum decentralized applications (DApps) has been gradually improving throughout 2026.

Weekly decentralized exchange (DEX) volumes on the Ethereum network surged to $20 billion, up from $9.8 billion one month prior. This increased activity caused DApps revenue to reach $26.6 million in the seven days ending Feb. 8, providing a healthy indicator of ETH demand. While Solana remained the clear leader with $31.1 million in weekly DApps revenue, the gap between the two networks is narrowing.

Those monitoring Ether price performance exclusively fail to see that ETH onchain metrics and derivatives have displayed resilience, especially as inflows into Ether ETFs resumed. While it might take a couple of weeks for investors to fully regain confidence, there are strong indicators that a near-term rally toward $2,400 is possible.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

Crypto World

Aave Labs Proposes New DAO Value Accrual and Growth Framework

The new proposal aims to resolve the ongoing debate and align the interests of equity holders and token holders.

Two months after the Aave DAO and Aave Labs clashed on the DeFi platform’s governance forum, Aave Labs has formally submitted a new strategic framework proposal to the DAO called “Aave Will Win.”

The proposal intends to align the DAO and Labs over the future growth of Aave v4, and to direct 100% of product-layer value directly to the DAO.

Specifically, the proposal requests that the DAO ratifies Aave v4 as the protocol’s core foundation for future development, establishes a funding and growth framework to compete at a global financial scale, and formalizes a model where 100% of revenue generated by Aave-branded products, including those built by Labs, flows to the DAO treasury.

If passed, the deal would clarify structure and align incentives between the DAO and Labs, potentially serving as a landmark decision on tokenholder rights, which were called into question in December by Ernesto Boado, the former chief technical officer (CTO) at Aave Labs.

“The framework formalizes Aave Labs’ role as a long-term contributor to the Aave DAO under a token-centric model, with 100% of product revenue directed to the DAO,” said Stani Kulechov, the founder of Aave Labs.

“As onchain finance enters a decisive new phase, with fintechs and institutions entering DeFi, this framework positions Aave to capture major growth markets and win over the next decade,” Kulechov concluded.

While rumors have been circulating that major changes were coming to Aave, some prominent delegates, such as Marc Zeller of the Aave-Chan Initiative (ACI), were quick to dismiss them, saying, “there’s nothing positive on the short term, but i guess good try.”

It is unclear whether Zeller was privy to this proposal and whether his statements pertain directly to it.

Aave remains DeFi’s leading lending protocol, accounting for more than 50% of the total lending market with more than $52 billion in cumulative net deposits. Despite the protocol’s long-standing success, its native token has struggled alongside the rest of the altcoin market and is down 56% over the last year.

While the proposal is far from finalized, tokenholder alignment and DAO value accrual could potentially be a tailwind for the AAVE token.

Crypto World

Is Cardano on the Verge of a Further Dump?

A new drop or a major rally: what comes next for ADA?

Cardano’s ADA has been struggling lately, with its price nosediving to a five-year low at the start of February.

While bulls might be eager to see a decisive revival in the short term, the recent actions of the large investors suggest another move south could be on the way.

The Whales Know Something We Don’t?

The renowned analyst Ali Martinez revealed that Cardano whales have dumped approximately 190 million ADA in the past week. The USD equivalent of that stash is roughly $50 million (calculated at ongoing rates of $0.26 per coin).

Seven days ago, the total possessions of this cohort of investors were 13.57 billion ADA, whereas they currently hold around 13.38 billion tokens. The figure represents approximately 36.3% of the asset’s circulating supply.

There is a general assumption in the crypto space that whales are experienced investors who may have inside information about important upcoming events that could influence their buying or selling decisions. That said, their recent actions could spread panic across the community and prompt smaller players to cash out as well.

The purely economic impact is also worth noting. Large sell-offs increase the amount of ADA on the open market, which, combined with non-increasing demand, should lead to a price pullback.

ADA’s Relative Strength Index (RSI) is another bearish factor investors should be wary of. The indicator shows whether the asset is overbought or oversold based on recent price momentum. It ranges from 0 to 100 and helps traders identify when a trend may be about to end.

You may also like:

Readings above 70 signal that ADA has entered overbought territory and could be on the verge of a correction, while ratios below 30 favor a bullish scenario. As of this writing, the RSI stands at around 74.

History to Repeat Itself?

ADA is among the cryptocurrencies with vast communities, which consist of proponents and bullish analysts. Just a few days ago, X user Aman noted that the asset’s price has dropped to the demand zone of around $0.26, reminding that in the past this area has sparked major reversals.

Mentor shared a similar viewpoint, arguing that the last time ADA reached current levels, it later rose to nearly $1.40 in less than a month. “History is going to repeat itself soon,” they projected.

Over the last few months, ADA’s exchange netflows have been predominantly negative, which reinforces the optimistic predictions. The trend reflects investors moving coins from centralized platforms to self-custody, reducing the likelihood of short-term selling.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

-

Politics4 days ago

Politics4 days agoWhy Israel is blocking foreign journalists from entering

-

Sports6 days ago

Sports6 days agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

Business4 days ago

Business4 days agoLLP registrations cross 10,000 mark for first time in Jan

-

NewsBeat3 days ago

NewsBeat3 days agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

Tech6 days ago

Tech6 days agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

Sports20 hours ago

Sports20 hours agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

Business4 days ago

Business4 days agoCostco introduces fresh batch of new bakery and frozen foods: report

-

Tech2 days ago

Tech2 days agoSpaceX’s mighty Starship rocket enters final testing for 12th flight

-

NewsBeat4 days ago

NewsBeat4 days agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

Sports4 days ago

Sports4 days agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Sports5 days ago

Former Viking Enters Hall of Fame

-

Politics4 days ago

Politics4 days agoThe Health Dangers Of Browning Your Food

-

Sports6 days ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

Business4 days ago

Business4 days agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

NewsBeat6 days ago

NewsBeat6 days agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Crypto World21 hours ago

Crypto World21 hours agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

Video16 hours ago

Video16 hours agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

Crypto World2 days ago

Crypto World2 days agoBlockchain.com wins UK registration nearly four years after abandoning FCA process

-

Crypto World3 days ago

Crypto World3 days agoU.S. BTC ETFs register back-to-back inflows for first time in a month

-

NewsBeat3 days ago

NewsBeat3 days agoResidents say city high street with ‘boarded up’ shops ‘could be better’