Happy Friday, Gang! If it’s Friday, then it’s time for Fridays with Oscar, where we are all about casual stylish outfits and delicious recipes to kick off your weekend. Today, we’re continuing our dry January with a delicious mocktail and a great roasted broccoli salad — healthy recipes and casual fashion perfect for a relaxing start to your weekend. Whether you’re lounging at home or heading out for a casual Friday evening, we’ve got you covered with easy healthy recipes and comfortable yet chic outfits that are perfect for your weekend vibes.

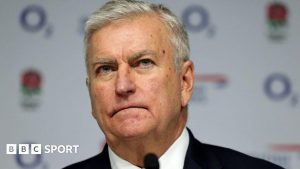

Beth’s Weekend Vibes Outfit

Half-zip tops are everywhere this year and I have snapped up quite a few from my favorite brands. This Luxe Cashmere Blend Colorblock Top from Chico’s really speaks to my style with its bold color-blocked stripes. Comfortable straight-leg jeans from Madewell are the perfect weekend go-to bottoms.

Luxe Cashmere Blend Colorblock Top | Madewell Black Stovepipe Jeans | Velvet Tassel Loafer

And keeping the blue from my top down to my toes, I have my new favorite loafers, the Velvet Tassel Loafer from J.McLaughlin. And, actually, J.McLaughlin is having a great sale! Their extra 40% Off Winter Sale makes today the perfect time to shop its fantastic winter collections. In fact, my favorite Velvet Jeans are on sale!

Shop the Outfit

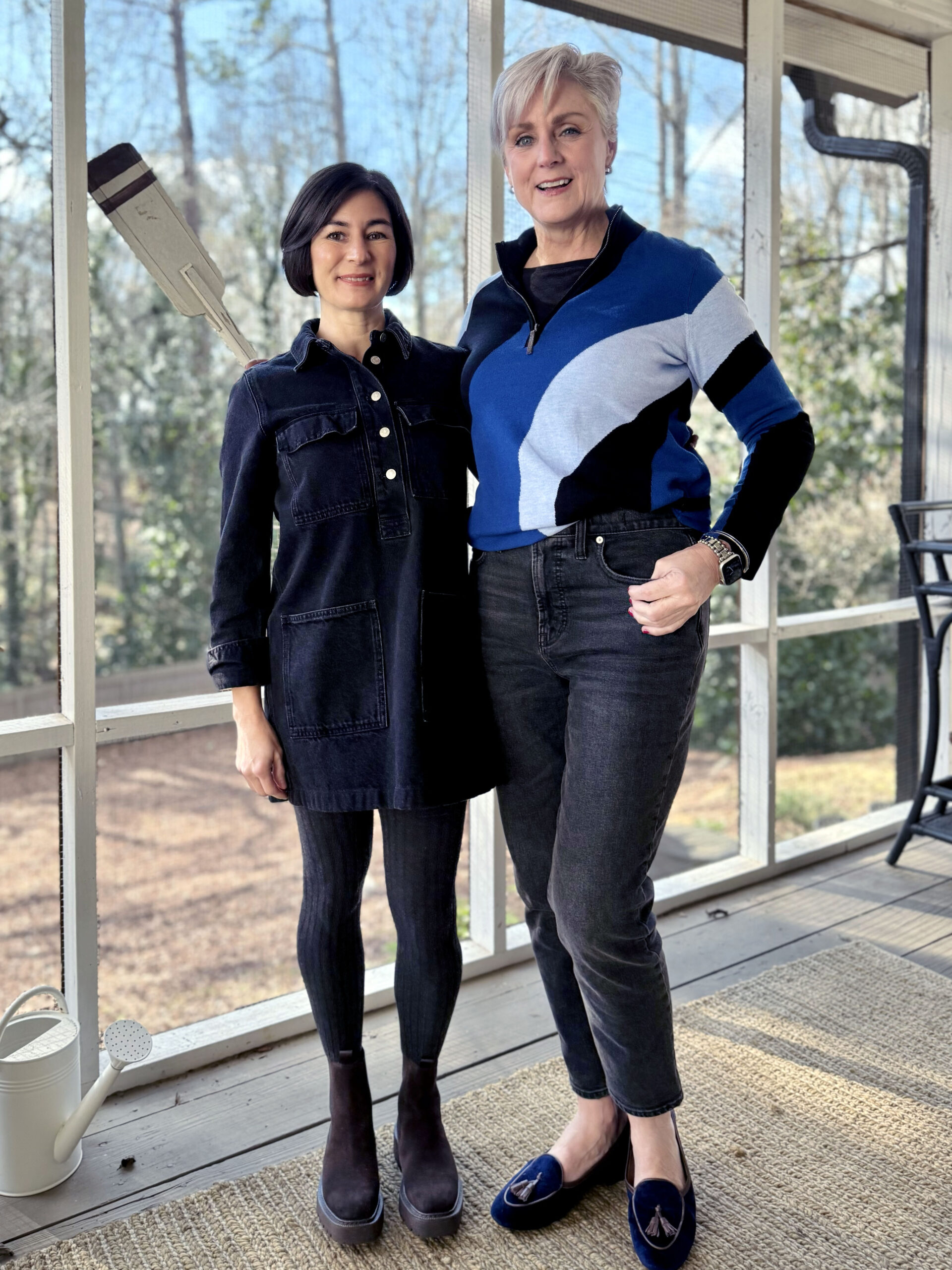

Kelly’s Weekend Vibes Outfit

Long-sleeve denim dresses are great for cooler temps; the thick denim fabric is warm and if you pair it with thick tights, like these Ribbed Tights from J.Crew, you will be quite comfortable – especially if you add tall boots instead of my Laguna Chelsea Boots. Size up on the dress so you can add another layer under the dress like a knit turtleneck for extra warmth. A perfect outfit for your casual weekend vibes!

Similar Black Denim Dress | Ribbed Tights | Laguna Chelsea Boots

Weekend Vibes: Blood Orange Mocktail

This blood orange mocktail doesn’t try to hide – it uses alcohol-free rosé which gives the true flavor of sipping on a wine cocktail. Top with sparkling water to make it a winter spritz, a perfect dry January alternative to the real thing.

- 2 tbsp. blood orange juice freshly squeezed

- 1 tbsp. lime juice freshly squeezed

- 1 cup alcohol-free Rosé

- Rosemary (or other herb) Sprigs for Garnish

-

Fill a large wine glass with ice. Take a slice of blood orange and press it against the inside of the glass.

-

Add the blood orange juice, lime juice, and alcohol-free rosé (or alternative). Stir gently.

-

Garnish with a sprig of rosemary, thyme, or mint.

Lemon Garlic Roasted Broccoli Salad

This recipe from Half-Baked Harvest is truly marvelous! So flavorful, with plenty of texture. Don’t skip the pomegranate, it adds a bright pop that really brings the whole salad to life. While the feta and avocado bring richness, the overall salad is light and herby, healthy and filling.

- 3 heads broccoli florets and stems roughly chopped

- 1/3 cup pine nuts

- 4 tablespoons olive oil

- 4 cloves garlic minced or grated

- kosher salt and pepper

- 1/4 cup chopped fresh parsley

- juice from 1 lemon

- 1 tablespoon balsamic vinegar

- pinch of crushed red pepper flakes

- 1-2 cups baby kale

- arils from 1 pomegranate

- 1 avocado sliced

- 6 ounces feta cheese crumbled

-

Preheat the oven to 425 degrees F.

-

On a large baking sheet, toss together the broccoli, pine nuts, 2 tablespoons olive oil, garlic, and a large pinch of both salt and pepper. Transfer to the oven and roast for 20-25 minutes or until the broccoli is just beginning to char. Remove from the oven and stir in the parsley.

-

Meanwhile, make the dressing. In a small bowl, whisk together the remaining 2 tablespoons olive oil, lemon juice, balsamic, and crushed red pepper flakes. Taste and season lightly with salt and pepper.

-

Pour the dressing over the roasted broccoli. Add the baby kale and pomegranate arils. Gently toss to combine. Transfer the salad to a bowl and top with feta and sliced avocado.

Here’s to Weekend Vibes, Cheers!

Oscar, Ollie, Kelly, and I wish you all a wonderful weekend.

Shop the Post

+ There are no comments

Add yours