Entertainment

“Stranger Things” star Caleb McLaughlin calls finale fan theory 'dumb' and weighs in on Eleven's fate

:max_bytes(150000):strip_icc():format(jpeg)/stranger-things-s5-caleb-mclaughlin-2-021226-a08e3073cd6e4698b92b2ec198d960b4.jpg)

“Guys, it’s over. It’s been 10 years. We were full-on kids and now we’re full-on adults, and we don’t need any more of us.”

Continue Reading

Entertainment

PINK VS. RED: Ladies in Lacy-Hot Lingerie Who'd You Rather?!

Pink or red — either way, these ladies are turning up the heat and making it extremely hard to choose … Check out these BAD ‘N BOLD bods in eye-catching fits, and vote: Who’d You Rather?!

Entertainment

10 Must-Watch TV Spin-Offs, Ranked

There’s a misconception that a spin-off is a retread of old material, because the best spin-offs were the result of creative and original thinking. It takes vision to imagine that an unlikely character can spawn an 11-season run, or to find the material for a hard-hitting drama within an iconic comedy.

The following shows are some of the very best TV spin-offs, each standing as an example of a must-watch program with mass appeal for all audiences. Whether it’s a sequel, a prequel, or an animated breakout hit, these are the spin-offs that are mandatory viewing, ranked by overall excellence and their ability to eat up days of your life while you binge.

10

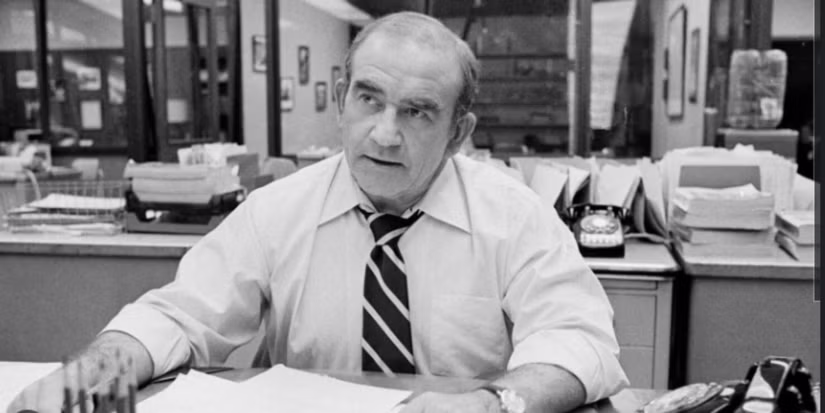

‘Lou Grant’ (1977–1982)

Everyone is familiar with the groundbreaking sitcom The Mary Tyler Moore Show, but far less attention is paid to the dramatic spinoff, Lou Grant. The series saw Mary Richards’ (Mary Tyler Moore) former boss, Lou Grant (Ed Asner), move to Los Angeles to work as editor for the fictional newspaper, the Los Angeles Tribune. The series used current social issues to explore the fast-paced and high-pressure world of print journalism.

Lou Grant is typically rare to find as a streaming option, but all five seasons of the series can be purchased on DVD. While it’s uncommon to see a spin-off change formats from half-hour comedy to hour-long drama, the character of Lou made the transition well, with the series earning 13 Primetime Emmys and a Peabody award. In fact, Asner was the first performer to win comedic and dramatic Emmys for playing the same character.

9

‘Boston Legal’ (2004–2008)

Boston Legal took viewers into the unpredictable world of the lawyers who worked at the legal firm of Crane, Poole & Schmidt. New hire Alan Shore (James Spader) is a brilliant attorney unafraid to work outside ethical boundaries, but his winning record in the courtroom and his close friendship with senior partner Denny Crane (William Shatner) keep him from packing up his office. Each episode combined legal drama and wry comedy to create a unique legal series that broke genre conventions.

The character of Alan Shore was originally introduced on the acclaimed legal drama The Practice in its final season, serving as a problematic anti-hero to stir up drama. However, Boston Legal took a much more lighthearted approach to a legal procedural that featured an irreverent comic tone that would frequently step into the absurd. Boston Legal is an addictively fun watch, with the chemistry between Spader and Shatner a compelling reason to binge.

8

‘Young Sheldon’ (2017–2024)

Fans of The Big Bang Theory could see the origins of the eccentric genius Sheldon Cooper (Jim Parsons) in the sitcom Young Sheldon. Predominantly set in the early ’90s, the series follows Iain Armitage in the role of the adolescent version of Sheldon Cooper as he grows up in Medford, Texas. Although fans saw brief glimpses of them in the original series, Young Sheldon fleshed out the boy genius’ relationship with his immediate family.

Some of the best spin-offs work because they can stand on their own without needing to be familiar with the original, which is the case with Young Sheldon. The series is a heartfelt and genuinely funny family comedy where the humor is based on the relationships developed through an excellent cast. Switching to a single-camera approach to Young Sheldon contributed to the series feeling like an authentic representation of growing up in the 90s, and the quality holds strong all the way up until its seventh-season finale.

7

‘Law & Order: Special Victims Unit’ (1999–Present)

Nearing thirty years on the air, one of television’s longest-running spin-offs is Law & Order: Special Victims Unit. Spinning off from the popular Law & Order, the series takes viewers along as the detectives of New York City’s Special Victims Unit take on cases that involve sex based crimes. The series has featured various detectives over the years, but most viewers think of partners Elliott Stabler (Christopher Meloni) and Olivia Benson (Mariska Hargitay) as the marquee faces of the show.

When Law & Order: Special Victims Unit first premiered, it stood out in a crowded lineup of criminal procedurals with shocking stories about sexual assault and domestic violence, but the show also added a human element that was missing from some of its more cut-and-dry peers. The series explored more than the crime and who was responsible; rather, Law & Order: Special Victims Unit regularly dove into the impact the crime had on the victim, and the psychological roadmap that caused the perpetrator to commit their horrible act.

6

‘Daria’ (1997–2002)

No animated character had mastered the art of a sarcastic response like Daria Morgendorffer (Tracy Grandstaff). In her MTV show Daria, audiences saw the character move with her family from the Texas city of Highland to the new town of Lawndale. Attending High School with her popular younger sister, Quinn (Wendy Hoopes), Daria navigates the frustrating world of public education with her best friend Jane (Hoopes).

A spin-off from Beavis and Butt-head, Daria allowed MTV to connect with an underserved portion of its audience who saw little representation of their experiences on TV. Daria didn’t stake her emotional well-being on how popular she was, but that didn’t mean she wasn’t in need of friendship or desired a romantic partner. The series holds up remarkably well, and even though things like the current fashion have changed, the core message of Daria hasn’t lost any of its relevance.

5

‘Star Trek: The Next Generation’ (1987–1994)

Whether it’s thought of as a spinoff or a sequel series, Star Trek: The Next Generation is one of the best pieces of science fiction on television. The series follows the exploratory mission of the USS Enterprise-D under the leadership of Captain Jean-Luc Picard (Patrick Stewart) in the 24th century. In the crew’s goal to discover new life in undiscovered reaches of space, they would encounter adventure and danger that required quick thinking to overcome.

The original Star Trek is an iconic science fiction series, but Star Trek: The Next Generation builds on the premise with fan-favorite new characters such as android Data (Brent Spiner) and Geordi La Forge (LeVar Burton). By shifting the focus away from the more action-oriented original series into a more thoughtful, character-driven narrative, Star Trek: The Next Generation set the tone for future installments of the franchise and created die-hard fans who followed along for all seven seasons.

4

‘Better Call Saul’ (2015–2022)

One of the best television dramas to never win an Emmy, Better Call Saul is a spinoff of top-tier quality. The series focused on the charismatic and morally flexible lawyer Saul Goodman (Bob Odenkirk), going back to when he was still known by his real name, Jimmy McGill. Over six seasons, audiences were treated to the rise of Jimmy from a down-on-his-luck con man to a key figure in the criminal underworld of Albuquerque, New Mexico.

Fans of Breaking Bad were excited to see a series based around Saul Goodman, but few were probably expecting to see a masterclass character study. Jimmy’s story never took the easy way out of making someone the villain or hero, but rather frequently allowed its characters to make decisions they thought were right in that moment. Odenkirk continued to outdo himself with his performance, and Jimmy’s relationship with Kim Wexler (Rhea Seehorn) will be remembered as one of the television greats.

3

‘The Jeffersons’ (1975–1985)

The Jeffersons holds such a noteworthy position as one of the best sitcoms of the ’70s that it’s easy to forget it’s a spinoff. The comedy follows George (Sherman Hemsley) and Louise Jefferson (Isabel Sanford) as they move to the Upper East Side of Manhattan after George’s dry cleaning business takes off. Episodes saw the married couple adjust to their new luxurious surroundings after a life of hard work and struggle.

George and Louise were recognizable characters on the game-changing sitcom All in the Family, but a spin-off that established the Jeffersons as successful business owners was an important and needed addition on television. Topics like racism and classism were explored through George and Louise’s experiences without losing the biting sense of humor the show was known for. The Jeffersons‘ combination of funny and fearlessness was a hit with viewers and carried the sitcom to an incredible 11-season run.

2

‘Frasier’ (1993–2004)

In Frasier, the smartest barfly in Boston, Frasier Crane (Kelsey Grammer), moves back to his hometown of Seattle. Although he’s still committed to mental health, Frasier takes a different approach to helping when he takes a job as a radio talk show host, counseling the many listeners who call into the show. When not in the studio, Frasier spends time reconnecting with his younger brother Niles (David Hyde Pierce) and his ex-cop father Martin (John Mahoney).

After eight seasons of being on Cheers, Frasier had gone through major life changes in front of the audience’s eyes, but the biggest were yet to come when the character moved home. By creating a complex family dynamic, Frasier could create noticeable long-term character arcs that were only enriched by some of the best casting ever done on a sitcom. Frasier was an awards favorite during the course of its time on NBC, and remains an example of how to build a sitcom around an already well-known character.

1

‘The Simpsons’ (1989–Present)

To call The Simpsons a successful spin-off is an understatement. With almost 40 seasons of the animated series produced, The Simpsons has forever established itself as one of the most important comedy series ever made. The day-to-day happenings of Homer Simpson (Dan Castellaneta) and his family in their hometown of Springfield are known the world over, where the word “D’oh” is translated into multiple languages.

Anyone who tuned in to The Tracey Ullman Show on Fox would have probably never guessed the strange animated shorts would become a juggernaut of a comedy series. However, once the Simpsons clan received their first full-length episode with the Christmas special “Simpsons Roasting on an Open Fire,” there was no looking back. The Simpsons have now starred in more than 800 episodes, one theatrically released movie, and a Simpsons Movie sequel on the way.

The Simpsons

- Release Date

-

December 17, 1989

- Network

-

FOX

- Directors

-

Steven Dean Moore, Mark Kirkland, Rob Oliver, Michael Polcino, Mike B. Anderson, Chris Clements, Wes Archer, Timothy Bailey, Lance Kramer, Nancy Kruse, Matthew Faughnan, Chuck Sheetz, Rich Moore, Jeffrey Lynch, Pete Michels, Susie Dietter, Raymond S. Persi, Carlos Baeza, Dominic Polcino, Lauren MacMullan, Michael Marcantel, Neil Affleck, Swinton O. Scott III, Jennifer Moeller

-

Homer Simpson / Abe Simpson / Barney Gumble / Krusty (voice)

-

Julie Kavner

Marge Simpson / Patty Bouvier / Selma Bouvier (voice)

Entertainment

Speed Skater Claims She Clashed With Snoop Dogg’s Security at Olympics

Former speed skater Marianne Timmer claimed that she had a negative run-in with Snoop Dogg’s security team at the 2026 Olympics.

Timmer, 51, was in attendance at the men’s 1,000-meter speed skating race on Wednesday, February 12. Snoop Dogg, 54, was also at the event, cheering on Team USA. The gold medalist claimed to Dutch outlet Sportnieuws on Thursday, February 12, that she encountered the rapper’s security team, who mistook her for a fan.

“I was standing against a wall, and one of the security guards pushed me even closer. I said, ‘Just act normal.’ It’s a really wide hall, about four meters,” she told the outlet, which was translated by Us Weekly. “Then the guy came back, and I said, ‘What?! Do I have to go through that wall or something?’”

Timmer alleged that the security guard did not like her comment and “started acting all up against” her. Timmer claimed she told the security guard that she was “waiting” to speak to Dutch athletes Jennings de Boo, Joep Wennemars and Kjeld Nuis, as she is a media commentator for the games. (De Boo, 22, ended up taking home the silver medal while the gold went to American speed skater Jordan Stolz.)

Timmer also claimed that security at the event was strict.

“We saw a Dutchman being roughly escorted away from the stands by some very large security guards. I could just picture myself being grabbed by the neck and thrown out,” she alleged to the outlet.

Us Weekly has reached out to Snoop Dogg for comment.

Snoop Dogg has attended multiple Olympic events since the games kicked off on February 6. The rapper is serving as Team USA’s first-ever honorary coach, a position that was announced ahead of the games.

“Team USA athletes are the real stars — I’m just here to cheer, uplift and maybe drop a little wisdom from the sidelines,” he said in a December 2025 statement after his role with Team USA was revealed. “This team represents the best of what sport can be: talent, heart and hustle. If I can bring a little more love and motivation to that, that’s a win for me.”

In addition to the speed skating event, Snoop Dogg was spotted cheering on the athletes for snowboarding, skiing and curling.

Earlier on Thursday, Snoop Dogg sat down with Carson Daly, Craig Melvin and Hoda Kotb to talk about his Olympics experience so far.

“The coaching has been phenomenal because I’ve been able to tell them about life and not just about the sports but about the things we dealing with in life in general and how to deal with it,” he said during the Today show. “Based off of me having so many journeys with these different scenarios that they go through.”

Snoop Dogg continued, “Being a mentor, being a coach, being a life coach and just an ear, somebody to listen to, somebody to be there for them. And that’s what I love about this position of Coach Snoop.”

Entertainment

7 Most Criminally Forgotten Hulu Shows, Ranked

Hulu has had a number of wildly successful original shows over the years, from The Handmaid’s Tale, to Only Murders in the Building, to Paradise. The streaming service has delivered both strong and suspenseful drama series, as well as silly and comforting comedy series. These shows have brought unique original characters, shocking plot twists, and moving character dynamics.

While there are so many hit Hulu shows that nearly everyone has watched, the streamer also has a number of excellent series that have gone under the radar, and that have even been pretty much forgotten aside from their most loyal fanbases. Whether these be series that were sadly deleted from the streamer after an early cancellation, or shows that never quite gained the attention they deserved, these are the most criminally forgotten Hulu shows.

7

‘Reboot’ (2022)

Reboot is a hilarious sitcom that follows a team of people who are all working on the reboot of a wildly popular family sitcom called Step Right Up. While the show was a hit back when it aired, all the cast members’ lives have since fallen apart, and everyone needs this to go well. The writing team behind the reboot is not going to make it easy for them, though, because it is led by the ever-clashing duo of the show’s original creator, Gordon Gelman (Paul Reiser), and his estranged daughter, Hannah (Rachel Bloom).

With clever meta humor and compelling dynamics between its main characters, Reboot was an entertaining and sharply funny sitcom that had a lot of potential. Reboot was sadly cancelled after just one season, just as the Step Right Up reboot was starting to find its sea legs, and as things were starting to get especially messy again between the cast and crew of the once-beloved sitcom.

6

‘Dollface’ (2019–2022)

Dollface follows Jules Wiley (Kat Dennings), a woman who’s reeling after being dumped by her long-term boyfriend, Jeremy (Connor Hines). More upsetting than the breakup itself is the fact that Jeremy had become Jules’ entire social life after she abandoned all her friends to focus on him, and now that the relationship is over, she realizes that she doesn’t actually have anyone else.

Now, Jules works to rekindle her old friendships and make some new ones, slowing building an unlikely friend group made up of her best friends from college, Madison (Brenda Song) and Stella (Shay Mitchell), as well as Jules’ coworker, Izzy (Esther Povitsky). Dollface is a fun and silly hangout comedy with a strong friend group at its center, but the show was sadly cancelled after just two seasons, and even removed from Hulu.

5

‘How to Die Alone’ (2024)

How to Die Alone follows Mel (Natasha Rothwell), a lonely and dissatisfied woman who works at JFK airport. After briefly dying when choking on takeout alone on her 35th birthday, Mel becomes determined to make the most of her second chance at life. She joins a management program in pursuit of a promotion, starts branching out in her friendships, and reconsiders her feelings for her engaged ex and close friend, Alex (Jocko Sims).

Although it was sadly cancelled after just one season, How to Die Alone still makes for an excellent watch. Over the course of the show’s single season, Mel rocks the boat, taking risks that mess up her mundane but comfortable life. In the process, her life starts to become bigger and bolder, and she winds up on the path towards becoming the person she wants to be – while also getting caught in the middle of a compelling love triangle.

4

‘Casual’ (2015–2018)

Casual is a sharply funny and chaotic sitcom that follows two codependent adult siblings named Valerie Meyers (Michaela Watkins) and Alex Cole (Tommy Dewey), and Valerie’s teenage daughter, Laura (Tara Lynne Barr). After being left by her husband of multiple decades for a much younger woman, Valerie takes Laura with her and moves in with Alex, who’s a wealthy bachelor after co-founding a successful dating website.

Alex encourages Valerie to shake things up and experiment with casual dating, while having Valerie and Laura living with him makes Alex realize how lonely he’s been. Casual is a hilarious and unpredictable show with storylines that sees Valerie and Alex trying to forge connections with the people around them, while often doing so in the wrong ways, and regularly sabotaging themselves and each other. For example, Alex secretly becomes best friends with Valerie’s one-night stand, Leon (Nyasha Hatendi), while Valerie goes to bizarre extremes (including crashing a party she’s not invited to) to make friends of her own.

3

‘How I Met Your Father’ (2022–2023)

How I Met Your Mother‘s delightful spin-off series, How I Met Your Father, picks up almost a decade after Robin (Cobie Smulders) and Barney’s (Neil Patrick Harris) wedding. An unrelated woman in her early 30s named Sophie Tompkins (Hilary Duff) is hopeful in her search for love, and on the way to a first date with the man she believes is her soulmate (Daniel Augustin), she meets and befriends the two current residents of Marshall (Jason Sudeikis) and Lily’s (Alyson Hannigan) old apartment: Sid (Suraj Sharma) and Jesse (Christopher Lowell).

Meanwhile, thirty years in the future, an older Sophie (Kim Cattrall) tells her college-age son the story of how she met his father – starting with the night she met four very important men, one of whom she reveals in the first episode is her son’s father. How I Met Your Father is a fun and cozy hangout comedy with swoonworthy romances and a compelling main story, but it was sadly cancelled after just two seasons.

2

‘Love, Victor’ (2020–2022)

Love, Victor is a teen dramedy series that takes place in the same world as Love, Simon. A few years after the events of the film, a closeted gay teenage boy named Victor Salazar (Michael Cimino) moves to Atlanta with his family. Overwhelmed with making new friends, joining Creekwood’s basketball team, and keeping his new crush a secret, Victor starts messaging Creekwood alum Simon Spier (Nick Robinson) for advice.

Love, Victor is one of the best teen shows of recent years, with three seasons that show Victor slowly coming into his own and becoming comfortable living authentically. It has unique and complex characters, some wonderful romances, and a number of Easter eggs that fans of Love, Simon will love. The show never got as much attention as similar series, but it still has a strong fanbase.

1

‘Looking for Alaska’ (2019)

Based on the John Green novel of the same name, Looking for Alaska follows a teenage boy named Miles Halter (Charlie Plummer) who goes away to a boarding school called Culver Creek Academy for his junior year of high school in search of “the Great Perhaps.” While there, Miles joins a close-knit friend group made up of his roommate, Chip “The Colonel” Martin (Denny Love), and his two best friends, Alaska Young (Kristine Froseth) and Takumi Hikohito (Jay Lee).

Miles’ life gets bigger and more interesting at Culver Creek, but it also gets more complicated. He gets wrapped up in a messy war against a group of wealthy students who go home every weekend, and he starts to fall in seemingly unrequited love with Alaska. This coming-of-age miniseries is sharply funny, emotionally devastating, and just a phenomenal book adaptation, but it’s sadly been removed from Hulu.

Entertainment

Beyoncé Debuts Bold New Bob

Beyoncé

HEY BEYHIVE, CHECK OUT MY BOB!

Published

Beyoncé returned to Instagram this week after a months-long hiatus … and last night, she debuted a bold new bob hairstyle!

Check out her new IG pics from Thursday — she’s clearly feeling her short honey-blonde style, posing with a confident smirk for her Beyhive.

The “TEXAS HOLD ‘EM” hitmaker is also showing off her famous curves in a skin-tight ensemble consisting of high-waisted forest green trousers and a wrapped off-the-shoulder top. She accentuated her waist further with a black belt.

This isn’t just a look — it’s a whole “Renaissance!”

Remember — before she skipped out on Instagram, she was rocking long, curly, golden locks … ranging from subtle waves to voluminous corkscrews.

She turned heads, for instance, at the November 2025 Las Vegas F1 Grand Prix in a custom, plunging Louis Vuitton racing jumpsuit that put her cleavage front and center … and her hair was just as dramatic — styled in tight, wind-swept caramel-colored curls.

Now that she’s back on the ‘gram … we look forward to more styles she’ll put into “Formation!”

Entertainment

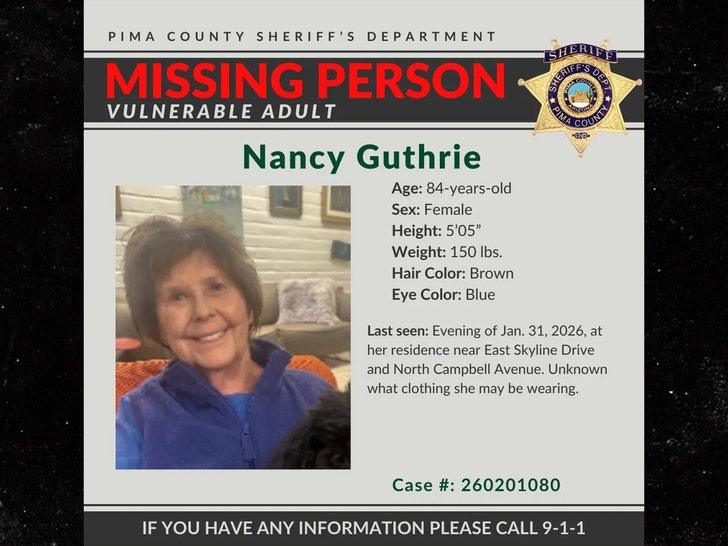

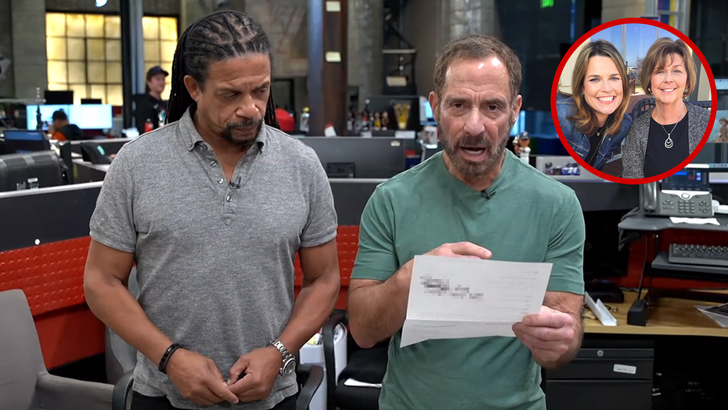

FBI Reportedly Butting Heads With Pima County Sheriff Over Guthrie Case

Nancy Guthrie Case

FBI, Sheriff Clash Over Evidence?!

Published

|

Updated

The FBI and Pima County Sheriff’s Department may be butting heads over the Nancy Guthrie kidnapping case, according to a new report.

The two agencies investigating the Guthrie case apparently didn’t see eye-to-eye over where recent evidence that was collected should be analyzed.

New York Post

Citing a law enforcement source, FOX News reported Thursday … FBI brass wanted DNA from Nancy’s home and other physical evidence to be sent to their crime laboratory in Quantico, Virginia, but Pima County Sheriff Chris Nanos denied the request, sending the items to a private lab in Florida for examination.

In response to the FOX article, Sheriff Nanos told NBC affiliate KVOA … the report was “not even close to the truth,” adding that his agency is cooperating with the FBI.

Among the items sent to the Florida lab were 2 gloves found on a roadside about 1.5 miles from Nancy’s Tucson home where she was abducted. The gloves looked similar to the ones worn by the alleged kidnapper who was caught on a doorbell camera lurking around the front door of the house.

The FBI says the masked suspect is a man who’s 5′ 9″ to 5′ 10″ with an average build who was carrying a black, 25-liter Ozark Trail Hiker Pack backpack.

TMZ.com

Purported ransom notes have been sent to several news outlets, including TMZ, demanding money in exchange for Nancy’s safe return.

Nancy has been missing since February 1 and was last seen by family on the evening of January 31.

Entertainment

Dua Lipa And Fiancé’s Altercation With Paparazzi Caught on Clip

What was meant to be a beautiful night for Dua Lipa and her fiancé, Callum Turner, quickly turned into a tense confrontation with paparazzi.

The “Levitating” hitmaker and the British actor sparked relationship rumors in January 2024, when they were seen getting cozy.

Though they have kept their relationship private, Lipa confirmed last year that they were a couple and were planning a wedding.

While the couple has been seen out together on occasion, their most recent outing in Paris took an unexpected turn, transforming into a chaotic ordeal.

Article continues below advertisement

Dua Lipa and Fiancé Callum Turner Hounded By Paparazzi After A Date Night

The “New Rules” singer Turner’s romantic evening at Le Voltaire restaurant was cut short when photographers crowded the restaurant’s exit, turning their departure into a frenzy.

A video of the encounter, later shared on X, showed the pair visibly distressed. The clip opened up with Turner visibly frustrated as he spoke to someone off-camera, repeatedly insisting, “It’s not okay.”

Moments later, Lipa steps out of the restaurant and begins walking away, holding Turner’s hand with one hand and shielding her face with the other.

Dressed casually in a fur coat layered over a green cropped top and black trousers, the singer made it clear she has no interest in engaging with the photographers.

Article continues below advertisement

“No, no, we’re not doing this,” she says firmly while covering her face. However, her pleas were ignored. “Dua, just give us one minute and we’ll leave you alone,” one voice called out, while another demanded, “Show us your face.”

The singer and her beau, frustrated over the hounding, then walked in the opposite direction, but that didn’t stop the paparazzi from chasing after them.

The couple kept on walking, and Lipa almost bumped into a pole. She then begs, “Can you please go away?” but another voice demands, “Give us some pictures.”

Article continues below advertisement

Fans Defend Dua Lipa And Callum Turner Against Paparazzi Confrontation

As expected, the clip went mainstream, and many of the singer’s fans rushed to her defense, labelling the photographers’ actions as harassment.

One X user wrote, “Never seen her this mad… they must’ve been following them around all freaking day.” Another suggested that the singer’s anger was valid, as they would be annoyed with flashlights going off in their face.

A third individual remarked, “This is actually exhausting to watch. They said no, multiple times, and still got swarmed and physically pushed.”

This fan wrote that celebrity pushback like this “needs to become the norm,” while another agreed the couple was right to defend their privacy, calling the paparazzi’s behavior over the line.

Article continues below advertisement

Dua Lipa Confirms Engagement To Callum Turner

Lipa and Turner have largely been lowkey about their romance, sharing only small glimpses. In June last year, Lipa confirmed they were engaged and soon to walk down the aisle.

At that time, the 29-year-old gushed about the feeling, calling it “exciting,” and noting she did not exactly grasp its significance until she experienced it.

“This decision to grow old together, to see a life and just, I don’t know, be best friends forever – it’s a really special feeling,” the singer shared, per The Blast.

Article continues below advertisement

Dua Lipa And Callum Turner Enjoy A Steamy Beach Date

Shortly after Lipa confirmed her plans to tie the knot with Turner, the couple was spotted on a vacation at Italy’s Amalfi Coast.

As The Blast reported, the pair were captured all loved up while lounging on a floating raft, sharing kisses and holding each other close between swims in the Mediterranean.

Lipa rocked a tiny polka-dot bikini, exposing so much of her skin, while Turner opted for bright orange swim trunks. Fans couldn’t get enough of the sizzling vacation moment, gushing about how the couple was serving vacation goals.

Dua Lipa Gets Candid About Motherhood And Her Viral Jacquemus Wedding Outfit

While revealing bits about herself, Lipa has opened up about having kids with Turner. The singer admitted it’s very much on her radar, but was uncertain about the timing.

“I’d love to have kids one day,” Dua Lipa admitted, per The Blast, adding that figuring out the right moment is what weighs on her mind, considering her career.

Dua Lipa has also addressed the backlash against her outfit for Simon Porte Jacquemus and Marco Maestri’s 2022 wedding.

According to The Blast, she explained that the groom, who also designed the dress, personally asked her to wear it. Lipa added that the dress matched the theme, and even though it was sheer, she felt confident in it.

Entertainment

Dorit Claims PK Is ‘Drinking Again’ During RHOBH Sit-Down With Mauricio

The highly anticipated sit-down between Dorit Kemsley and Mauricio Umansky on The Real Housewives of Beverly Hills is finally here — and it was actually quite awkward.

The Thursday, February 12, episode showed the duo having dinner to discuss Dorit’s ongoing issues with her estranged husband, PK Kemsley, and how Mauricio could help. Most of their discussion surrounded a possible “schedule” with the kids. Dorit claimed she was not “restricting” PK from seeing the kids, but Mauricio seemed to have heard otherwise.

“I want him to be involved. I need him to be involved,” she said. “But he has to show up clearheaded.”

Dorit claimed during Thursday’s episode that PK has “started drinking again” as well.

“He’s not drinking every day. He’s not overdrinking,” Mauricio said, defending his friend. “I go to dinner with him. He’s ordering a glass of wine, maybe two. We’re not sitting there pounding it. That’s not what he’s doing.”

Dorit responded, “He didn’t stop drinking for a year because [it was] just for a casual thing. He stopped drinking because he needed to stop drinking.”

Dorit shared alleged details about PK’s drinking habits during RHOBH season 14. She claimed PK was a “full-blown alcoholic” during the November 2024 premiere, which he has since denied.

“I’ve spent months trying to get PK to talk to me. I don’t know what his intentions are,” Dorit, 49, claimed during her confessional. “I don’t know where his head is, and right now I feel like I’m in limbo and I don’t have control over what happens next. I know I need to do something about it.”

Dorit further explained to viewers that the “biggest issue” with PK is his alleged failure to communicate with her.

“I’m really hoping that Mau can help,” she continued in her confessional. “Maybe as one of PK’s closest friends, Mau will nudge him in the right direction so we can get on the same page, because that’s what’s best for the kids.”

Dorit and PK announced their separation in May 2024 after nine years of marriage. She filed for divorce in April 2025. The former couple share son Jagger and daughter Phoenix.

During the sit-down that aired on Thursday, Mauricio made it clear that he wasn’t there “to take a side” and only wanted to offer guidance.

“He’s never once texted me to see the kids,” Dorit claimed. Mauricio responded, “He’s given me his phone and I’ve scrolled up and down the entire thing and seen your replies, his replies, the conversations about the kids.”

Dorit claimed it was an “isolated” conversation, claiming that PK was making things “one-sided,” but Mauricio disagreed. In her confessional, Dorit alleged that PK was most likely omitting the context of the conversations.

“If you want to help, Mau, then go to your friend and say to him, ‘PK, what’s the matter with you? She’s tried to sit down and speak to you,’” she said. “Tell him, ‘You’ve got to think about your kids.’ I am on his side. I am not his enemy.”

The Real Housewives of Beverly Hills airs on Bravo Thursdays at 8 p.m. ET and streams the next day on Peacock.

Entertainment

Friday the 13th Has a Lot of Final Girls, but Only One Is the Absolute Worst

Slashers are known for having a predictable formula so well known that the Scream franchise has spent three decades mocking them. One of the most used tropes is that of the final girl. She’s often book smart and shy, the type of young woman who notices everything around her while her friends are too busy partying and having sex. Laurie Strode (Jamie Lee Curtis) in Halloween is the epitome of this. The Friday the 13th series, with 12 movies and counting, has a plethora of final girls too, with none saving the day in multiple movies. Some have been great, like Ginny (Amy Steele) in Friday the 13th Part 2. Others, not so much. The worst, by far, shows up in the movie Jason Voorhees isn’t even part of. Sorry, Pam Roberts (Melanie Kinnaman) from Friday the 13th: A New Beginning, but your final girl character is just awful.

A Copycat Killer Is the Villain of ‘Friday the 13th: A New Beginning’

In 1984’s Friday the 13th: The Final Chapter, Jason Voorhees dies. No, really. In the film’s conclusion, young Tommy Jarvis (Corey Feldman) decimates him with a machete, finally ending his reign of terror. Still, the franchise was too profitable to be put to rest, so the next year it returned with Friday the 13th: A New Beginning. Jason might be dead and buried, but a new killer emerges, wearing a familiar hockey mask, to hack up teens around the Pinehurst Halfway House.

This is the home of troubled teens, including a teenage Tommy, now played by John Shepherd, who is so disturbed that we’re led to wonder if he could be the killer. A New Beginning is a flawed sequel and is seen by many as the worst of them all, yet it tries to do something different by examining the trauma of a male survivor after he takes out a mass killer. At the same time, it’s a murder mystery. Could it be Tommy? Is it someone at the halfway house? Or is Jason, somehow, back from the dead?

Pam Roberts Starts Off Being an Interesting Character

Running the home is Dr. Matt Letter (Richard Young) and the woman assisting him, Pam Roberts. She’s another in a long line of pretty young blondes, but Pam is different from the usual slasher fodder. She’s a kind soul who is genuinely interested in people and wants to help those who need it the most. That is shown several times, with Pam consoling a struggling patient or volunteering her time to take another, Reggie (Shavar Ross), to visit his family.

The 10 Most Iconic Horror Movie Characters Everyone Knows (Even Without Watching the Film)

A murderer’s row of murderers.

Pam also takes an interest in helping Tommy, who often sits quietly by himself, only to fly off the handle in a fit of rage in other moments. She feels like she could be the continuation of Ginny from Friday the 13th Part 2, the camp counselor studying to be a child psychologist. Rather than hating Jason, Ginny feels sorry for the boy he used to be. Is Pam who Ginny would aim to be like?

Pam Fails as a Final Girl in the Last Act of ‘Friday the 13th: A New Beginning’

Ginny is regarded by many as the best final girl because of her compassion, combined with her strength. When Jason Voorhees shows up in Friday the 13th Part 2, even though she’s scared, she takes the fight to him. This is where Pam Roberts falters badly. She’s not a coward who flees the scene per se, but she adds so little. Pam will investigate, and she makes it her mission to protect young Reggie, which is of course commendable. Yet scene after scene has Pam on the defense with her screaming, falling in the mud, or having to be saved by Reggie. She’s reactionary when the final girl role requires a forward thinker. It’s quite obvious that the filmmakers didn’t know what to do with her, because the best they could come up with was to put Pam in a thin, tight, white shirt, then turn on the rain sprinklers and send her running (and bouncing) through the third act.

Pam Roberts does get a few moments, like when she grabs a chainsaw and goes after “Jason”, or in the last scene in the barn loft, when she fights back again. After the nightmare ends, we see her in shock at a hospital cradling a sleeping Reggie in her lap. She is by no means a bad person. The fault is that Pam’s inclusion in the film feels like a narrative device. Someone needs to find the victims, so make it Pam. Someone has to run away from the killer, so make it Pam. Someone has to fight him and fail, so make it Pam.

Pam Roberts exists in Friday the 13th: A New Beginning to move the story along, a story that’s not about her. Tommy Jarvis is the final boy. This is his movie. He’ll get the kill and save everyone in the end. Pam is there because the formula requires that a female character must live. With everyone else dead, it had to be her. She makes it to the end by sheer luck of a thin script and nothing else.

Friday the 13th: A New Beginning is available to rent or buy on VOD services.

- Release Date

-

March 22, 1985

- Runtime

-

92 minutes

- Director

-

Danny Steinmann

-

-

John Shepherd

Tommy Jarvis

-

-

Melanie Kinnaman

Pam Roberts

Entertainment

Kylie Kelce Breaks Silence On Post-Breastfeeding Plans

Kylie Kelce is going to have a mom-bod soon; at least, that’s what she has on the books.

Jason Kelce‘s wife revealed her plans for her body, which she has mapped out for when she is done having kids. Just like other celebrities, she is looking to feel her best and more confident in her skin despite the changes that accompanied four pregnancies and breastfeeding journeys.

Kylie Kelce has been very open with her motherhood journey, addressing several matters surrounding parenting, pregnancy, and particularly public breastfeeding. Her candid lifestyle does not go unrecognized by the media, as she recently faced backlash for her children’s names.

Article continues below advertisement

Kylie Kelce Wants New Boobs

Kylie, the wife of the popular retired NFL star Jason Kelce, has laid her cards out on the table, revealing her post-baby plans. She shared that getting a boob job is on her list, but only after she has washed her hands of childbearing.

The word came during a conversation with her college friends, Amber and Gab, on the Galentine’s Day episode of her “Not Gonna Lie” podcast.

The trio reacted to a video of a woman showing her friends the results of her surgery, then Kylie dropped that sha had plans for them to go under the knife as well. The podcaster went further, saying:

“To be clear, there is a rough plan that eventually I will put my boobs back where they belong because, four kids. That’s all I have to say about that!”

Article continues below advertisement

The friend clique continued discussing their future boob job reveal, and TMZ notes that Kylie said she’s going to wait until her new breasts “settle,” while the reveal would be via Tiktok.

There is no definite timeline for when the mom of four would have the cosmetic procedure, because while she wants five kids, her husband thinks they might be four and done.

Article continues below advertisement

The Podcaster Previously Addressed Public Breastfeeding

Kylie previously spoke out on her podcast about her experience with nursing in public and how people make the natural act seem awkward. Citing an interaction with her father and father-in-law, both named Ed, she noted that they often tend to act differently when she is breastfeeding the baby.

She stated that once she starts feeding her fourth daughter, Finnley, they both tend to leave the room. “Finn a little fussy? Does she need to eat? All of a sudden, they disappear. It’s like a flash,” she said.

Kylie added that many people do not know how to act when a woman is breastfeeding around them and advised that they should just act normally.

Article continues below advertisement

The Blast reported that she explained there is no need to leave the vicinity, stare at the nursing mum’s boobs, or make awkward comments. Such moves, even when made in the bid to lighten the atmosphere, make things weird instead.

Article continues below advertisement

The Mother-Of-Four Says Covering Up While Nursing Is A Choice

Still addressing the subject, the retired NFL star’s wife shared that she had mastered the act of nursing discreetly. She patted herself on the back for not ever having a “nip slip” while breastfeeding in the presence of others, but this has not stopped people from getting uneasy.

“On more than one occasion, someone will come in, and I will be breastfeeding, completely covered, and someone will be like, ‘Oh, I’m sorry,’” she said.

“And I’m like, ‘I don’t know what we’re apologizing about. You actually haven’t seen my boobs,’” the podcaster added that another thing that has helped keep her nursy discreet in public is the size of her boobs.

Kylie described herself as a proud member of the “Itty Bitty Titty Committee,” adding that people can’t really see her breasts over the baby’s head. Furthermore, she stressed that covering up while breastfeeding is her choice and not an unspoken rule for every woman or nursing mother.

Article continues below advertisement

Kylie Kelce Faced Online Heat For Her Kids’ Names

The Blast covered that critics raised their voices over the media personality’s decision to give her daughters gender neutral names. The names of her four daughters are Wyatt, Elliotte, Bennett, and Finnley. The couple received backlash from the beginning with Wyatt, but Kylie strongly claims they do not take it to heart.

“When we were having our first daughter, people told me don’t tell people what you’re going to name your kid because then you get reactions,” she recalled. “And I’m like, ‘I don’t think you understand, I really don’t care at that point.’ If I’ve chosen, we’re going with it.”

She added that they faced the biggest reactions from the public with her name, joking that gender neutral names might actually benefit the girls in the professional world.

The podcaster also shared that deciding on a name for their youngest daughter was influenced by the choices for the other three, as they had to keep the trend.

Article continues below advertisement

Kylie Kelce Tried To Prank Her Husband With Viral Trend

Kylie made an attempt to pull a prank on Jason using a Tiktok trend where wives ragebait their husbands with questions. She disclosed how the prank did not work on Jason, as instead of getting angry at the question, he answered sweetly and sincerely.

Kylie called Jason and asked, “Do you ever wish you were more athletic?” to which he replied, “Oh, gosh, not really,” he said. “I feel like I’m pretty athletic.”

She continued telling her husband that she had been thinking about the question for a while. Later on during her podcast, she disclosed that she appreciated that the retired NFL star did not immediately get defensive responding to her question, as she had seen other couples do online.

The mom of four joked that Jason is very confident and that sometimes gets her mad because she has to think of other ways to get to him. “And I mean that in a loving way,” Kylie added as a subtle disclaimer.

-

Politics5 days ago

Politics5 days agoWhy Israel is blocking foreign journalists from entering

-

Sports6 days ago

Sports6 days agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

Business5 days ago

Business5 days agoLLP registrations cross 10,000 mark for first time in Jan

-

NewsBeat4 days ago

NewsBeat4 days agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

Tech7 days ago

Tech7 days agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

Sports2 days ago

Sports2 days agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

Business5 days ago

Business5 days agoCostco introduces fresh batch of new bakery and frozen foods: report

-

Tech2 days ago

Tech2 days agoSpaceX’s mighty Starship rocket enters final testing for 12th flight

-

NewsBeat5 days ago

NewsBeat5 days agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

Video3 hours ago

Video3 hours agoThe Final Warning: XRP Is Entering The Chaos Zone

-

Sports4 days ago

Sports4 days agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Sports6 days ago

Former Viking Enters Hall of Fame

-

Politics5 days ago

Politics5 days agoThe Health Dangers Of Browning Your Food

-

Business5 days ago

Business5 days agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

NewsBeat7 days ago

NewsBeat7 days agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Crypto World2 days ago

Crypto World2 days agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

Crypto World3 days ago

Crypto World3 days agoU.S. BTC ETFs register back-to-back inflows for first time in a month

-

Crypto World3 days ago

Crypto World3 days agoBlockchain.com wins UK registration nearly four years after abandoning FCA process

-

Video1 day ago

Video1 day agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

NewsBeat4 days ago

NewsBeat4 days agoResidents say city high street with ‘boarded up’ shops ‘could be better’