Entertainment

Ashley Darby States Why She Admitted to Kissing Charrisse’s Son

“Real Housewives of Potomac” star Ashley Darby shocked fans of the show when she admitted to having a romantic encounter with the son of co-star Charrisse Jackson-Jordan. Since then, both Jordan and her son, Jordan Jackson, have spoken out about the “RHOP” star, and she has also shed light on the situation, including admitting that it occurred more than once. Now, Darby is sharing her reasoning for admitting to the encounter on the show.

Article continues below advertisement

Ashley Darby Says She Wanted Charrisse Jackson-Jordan Back On ‘RHOP’

Darby appeared on the “What’s the Reality” podcast in February 2026, and the host asked why she chose to discuss the hookup with Jordan’s son. She stated in the clip, “It’s been just kind of sitting on me for a while. It’s been sitting on me for two years now.”

From there, she revealed that she brought it up because she wanted Jordan to return to the show as a main cast member, stating that she believed there would have been a more explosive reaction. According to Darby, “You know, I wanted Charrisse back on the show. I have. I almost told her umteen times, and I was gonna take it to my grave.”

Article continues below advertisement

She continued, “I was like, ‘Hey girl, this could be your chance. Get you back on the show. In the scene, I thought she was gonna like throw champagne in my face, flip the table, do a whole thing, nothing of the sort.”

Regarding Jordan’s time on the show, she appeared as a full-time cast member for its first two seasons. She then appeared as a friend of the show for seasons three, seven, and eight. She has since made appearances in various seasons, including the most recent.

Article continues below advertisement

The ‘RHOP’ Star Gave An Update On Where She Stands With The 27-Year-Old

Elsewhere in the interview, Darby was asked if she still speaks to Jordan’s son. She said, “No, we don’t speak.” However, she stated that after one of the events hosted during season 10 of “The Real Housewives of Potomac,” he attempted to “hang out.” Darby said, “Yeah, I put a stop to that. I’ve learned my lesson.”

From there, she went on to express regret, saying, “I mean, I do feel bad about it because if Charrisse genuinely feels the way she does, I am remorseful. I don’t like the way she’s going about it, and that’s where I’m losing respect for her, but if she’s genuinely upset and I can acknowledge that I crossed a line, then we can deal with it.”

Article continues below advertisement

Later, she stated, “But if you’re going to keep defaming me and saying all this stuff and talking bad about my character, then we have another problem.” Darby also stated that Jordan has received a ton of attention thanks to the scandal and that she’s “happy she’s back in the fold.”

Article continues below advertisement

Fans Are Reacting To The Revelation

Following Darby’s interview, “RHOP” fans shared their thoughts on her claim that she admitted to the affair to raise interest in Jordan’s return to the show. One person said on X, “The way she’s trying to spin this now. Ashley is a nasty -ss liar. Charrisse ain’t sh-t either, but Ashley is so trashy. She better not be on my screen season 11.”

Someone else wrote, “So Ashley is saying that because she wanted Charisse back on the show, she used the situation to get her back on? So, when people accuse her of making up storylines, why does Ashley deny it? Get her off. Now!”

A different fan of the show stated, “You know, Ashley really is the lowest of the low. She needs to go, there’s nothing else left for her on the show. These trash antics and then ‘Karen’ behavior after the fact are just too much.”

Finally, another fan said, “So, ‘hooking up’ with your friend’s child doesn’t speak to your character? It’s definitely giving cringe and predatory. (Not in an underage way, but in a ‘I’m waiting in the background to snatch you up the moment you turn legal’ way. Major Ick!”

Article continues below advertisement

Ashley Darby Insinuated That The Hookup Was More Than A Kiss

Darby appeared on Bravo’s “Watch What Happens Live” in December 2025. Host Andy Cohen asked her about the romantic encounter, beginning with her reasoning for hiding it. She stated that the then 27-year-old asked her to keep it a secret.

Cohen also asked if there was more than a kiss. She responded by smiling, gazing up into the air, and then playing with her ear before saying, “Well.” When asked if she saw him “only the one time,” Darby said, “No, it was more than one time. Yes, it was.” She also claimed that she believed Jordan had learned about the affair from seeing footage from the security camera at her home; however, this wasn’t the case.

Cohen then clarified that the affair took place while he was living at her co-star’s home in 2023.

Charrisse Jackson-Jordan Has Given Her Thoughts

Jordan has offered her thoughts on Darby’s romantic encounter on multiple occasions. One of the most recent was in January 2026, when she appeared on “Sherri.” When asked how her life has been since the episode aired, she stated, “It’s been a whirlwind. A whirlwind.”

When asked about her reaction to the news, she said, “You know, Ashley does a lot on TV, so I really didn’t believe her. So, I’m waiting for the joke, and when she said my son initiated it, I know my child, he didn’t initiate nothing. Now, if something happened, she initiated it.” She also stated that she believed Darby hooked up with her son for a storyline, saying, “I mean, what woman would do this just for general purposes. We don’t do that, Sherri.”

Entertainment

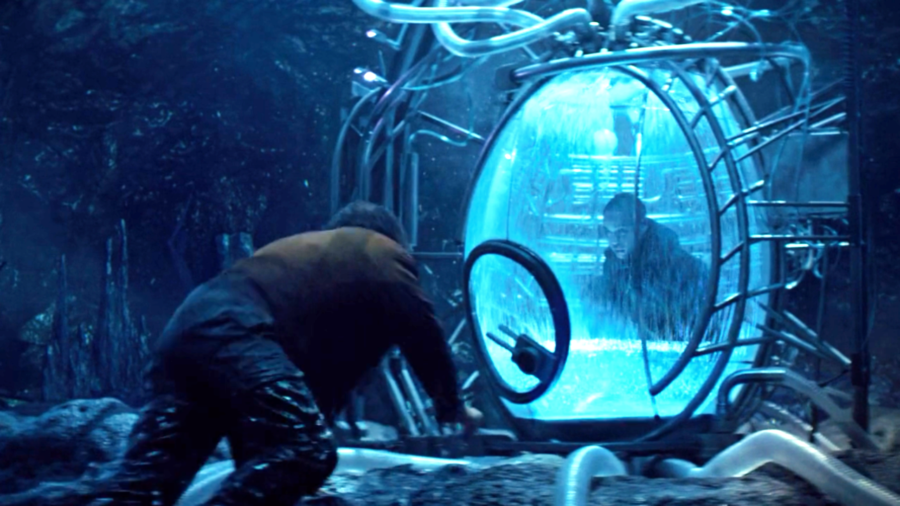

Netflix’s Unrated Sci-Fi Thriller Goes Absolutely Mental

By Robert Scucci

| Published

Looking for a neo-noir sci-fi thriller hinging on a time-traveling serial killer who only appears once every nine years, causing victims to bleed out of their eyes for no real rhyme or reason? I know you are, which brings me to the good news. 2019’s In the Shadow of the Moon will take you on this exact journey, and it’s an absolute trip. Think True Detective Season 1, but instead of an elite cabal of corrupt Louisiana officials operating a human trafficking ring behind closed doors, the primary antagonist is a mysterious figure who only surfaces during specific lunar cycles to go on a killing spree.

Is it an alien? A human from the future? Or is it simply a figment of our unraveling protagonist’s imagination as he becomes so obsessed with the case that he alienates everybody he once cared about, turning into a shell of a man over the course of a decades-long investigation that nobody else seems interested in solving?

It’s Happening Again …

In the Shadow of the Moon tells a time-hopping story in a progressive linear fashion, beginning in 1988 Philadelphia and concluding in 2024. We’re introduced to rookie cop Thomas Lockhart (Boyd Holbrook), heading out for his graveyard shift with his partner Maddox (Bokeem Woodbine) while leaving his very pregnant wife Jean (Rachel Keller) at home. What starts as a routine night quickly spirals when multiple victims die under the same bizarre circumstances.

Each victim bears puncture wounds, and their brains hemorrhage catastrophically, leaking from every facial orifice exactly how you’d expect. With the help of Thomas’ brother-in-law, Detective Holt (Michael C. Hall), they track down the woman they believe is responsible (Cleopatra Coleman). Before they can get answers, she jumps in front of a train, but not before telling Thomas intimate details about his life, including the fact that Jean will die during childbirth that very night.

By 1997, Thomas is a widowed detective struggling to raise his 9-year-old daughter, Amy (Quincy Kirkwood). He’s convinced the 1988 massacre was a one-off freak occurrence until the same pattern resurfaces on the nine-year anniversary. This time, the investigation expands to include a physicist named Naveen, who insists the killings are connected through time travel. Thomas, Maddox, and a now-promoted Lieutenant Holt dismiss the theory, but the nine-year cycle continues, tightening its grip on Thomas’ life.

We next see him in 2006, worse for wear after leaving the force to work as a private investigator focused solely on this case. By 2015, he’s a husk, still chasing answers while everyone else has moved on. The pattern persists, the obsession festers, and Thomas remains the only one who refuses to let it go.

If True Detective Were A Netflix Sci-Fi Original

As much as I want to root for In the Shadow of the Moon, a couple of things pulled me out of it. While this may sound nitpicky, the 1988 and 1997 sequences lack the kind of texture that really sells those eras. I’m not saying it needs to function as a full-blown period piece, but you’d be hard-pressed to distinguish the ’80s from the present day outside of the absence of smartphones, which bothered me more than it probably should have.

Minor criticism aside, In the Shadow of the Moon earns serious points for its ambitious premise and hard-boiled neo-noir vibe. The mystery is compelling enough to keep you locked in, and Boyd Holbrook’s physical portrayal of a man slowly losing everything in pursuit of answers is the selling point. Whoever handled his makeup in the later sequences deserves serious credit, because you can practically chart his decline through the lines of age etched across his face.

In the Shadow of the Moon takes familiar mystery-thriller beats, injects them with a bold sci-fi twist, and delivers a time-spanning character study that’s messy in places but undeniably intriguing. It’s currently streaming on Netflix, ready for anybody who wants their crime dramas with a side of lunar-induced chaos.

Entertainment

Juliette Lewis explains how early stardom prepared her to play a chair in new body-swap movie, “By Design”

:max_bytes(150000):strip_icc():format(jpeg)/By-Design-Samantha-Mathis-Juliette-Lewis-Robin-Tunney-021226-ac528025e37c49acb2176210a2c2201e.jpg)

“When I was younger, and just newly being looked at, it was very difficult for me.”

Entertainment

Stepbrother Arrested, Her Mom Speaks Out

The tragic death of 18-year-old Anna Kepner aboard a Carnival Cruise ship has taken a shocking turn. Her stepbrother was recently arrested in connection with the case, according to Anna’s father, Chris Kepner. And, the story is leaving the internet reeling. As more details remain under wraps, the teen’s death—initially ruled a homicide—has ignited widespread speculation and concern.

RELATED: Teen Suspect In Stepsister’s Carnival Cruise Ship Death Claims He Doesn’t Remember What Happened, Texts Claim

Stepbrother Arrested After Teen’s Carnival Cruise Death

Authorities arrested and charged the stepbrother of 18-year-old Anna Kepner, who tragically died aboard a Carnival cruise ship in November, the teen’s father, Chris Kepner, confirmed. Sources say authorities released the teen into a guardian’s custody, but they have not clarified the exact charges, leaving the investigation—and family drama—shrouded in secrecy.

Stepbrother Spotted In Court Amid Ongoing Investigation

Additionally, the stepbrother of Florida teen Anna Kepner appeared in federal court in Miami on Friday, as investigators continue digging into the shocking circumstances of her death aboard a Carnival cruise ship. Three months after 18-year-old Anna Kepner died aboard the Carnival Horizon during a family vacation, authorities saw her 16-year-old stepbrother leaving juvenile court and entering adult federal court, dressed in a camouflage hoodie with his face hidden beneath a low-pulled baseball cap and hood.

Anna Kepner’s Mom Speaks Out

Heather Wright, the biological mother of Anna Kepner, has walked back her earlier claim that her daughter’s stepbrother had been charged in connection with Anna’s death, admitting she was “misinformed.” She added that prosecutors and her ex-husband haven’t updated her on the case or provided any new details, leaving her frustrated and in the dark. Meanwhile, the stepbrother’s mother slammed his release from custody. She called it “deeply painful and disturbing” that someone she claims is responsible for Anna’s death is apparently walking free. Authorities have not yet formally accused the teen of any wrongdoing.

More Details From Anna Kepner’s Case

As previously reported, just weeks after Anna’s death during a Caribbean vacation in November, authorities named her stepbrother a “suspect” in court filings from an unrelated custody case. Sources briefed on the investigation say authorities found the Florida teen under a bed. Investigators found her body wrapped in a blanket and covered with life vests.

Furthermore, the family released a statement expressing gratitude to the FBI and Department of Justice for their handling of the case. Meanwhile, court records remain sealed due to the suspect’s juvenile status. Questions remain about the exact charges, and authorities, including the U.S. Attorney’s Office and local prosecutor, have declined to comment.

RELATED: Cause Of Death Reportedly Revealed For Slain Carnival Cruise Teenager As More Claims Surface About Her Stepbrother

What Do You Think Roomies?

Entertainment

10 Most Ambitious Movie Franchises of All Time, Ranked

Movie franchises are the bread and butter for every movie studio. These movies are mass entertainers and can bring a boatload of money that can power the studio for years to come. Take Star Wars, which started in 1977 and remains a recognizable title almost 50 years later. The right franchise can spark a new trend in cinema. Just a decade ago, Hollywood was in the fantasy-adventure era with movies like Harry Potter and Pirates of the Caribbean, then it went to the young adult era with Twilight and The Hunger Games, and now it is still firmly in the superhero trend.

Here, we take a look at some of the most ambitious film franchises of all time. Some reshaped filmmaking through technological breakthroughs, and a few aimed high before ultimately collapsing under their own weight. Whether they succeeded, stumbled, or did a bit of both, each reflects a moment where ambition, and maybe the promise of box office gold, is the driving power.

10

‘Sony’s Spider-Man Universe’ (2018–2024)

Sony’s Spider-Man Universe set out to build an MCU-inspired franchise centered on the hero’s rogue gallery of villains, beginning with Venom. The idea was to establish a parallel universe that could eventually intersect with Spider-Man himself. The franchise released six movies, including Morbius, Madame Web, and Kraven the Hunter, without Spider-Man ever appearing.

Sony must be appreciated for its (blind) ambition to build a cinematic universe to rival the MCU. While Venom went on to conclude its trilogy, the other movies mostly became memes and laughingstocks, with Morbius and Madame Web struggling with tone and narrative coherence. The franchise aimed to replicate the interconnected success of the MCU, but without clarity. For example, the end of Venom: Let There Be Carnage promised that Tom Hardy’s Eddie Brock would seek out Tom Holland‘s Spider-Man, but that was quickly dismissed. Madame Web also teased the appearance of Peter Parker, but the timeline wasn’t clear. After diminishing returns, Sony finally came to its senses and seemingly cancelled the universe.

9

‘DC Extended Universe’ (2013–2023)

Playing catch-up to the success of the Marvel Cinematic Universe, DC aimed to create a darker, more mythic version with the DC Extended Universe. Turning the standalone Man of Steel into the franchise starter, it expanded quickly with Batman v Superman: Dawn of Justice, which not only featured Batman and Wonder Woman but also teased other heroes and future storylines. A total of 11 films were planned afterwards, but only five were released. Ten other films in the franchise were not part of the original slate.

With Zack Snyder as its main architect, it’s clear that the DCEU would never be similar to its Marvel counterpart. However, Warner Bros. caved in after the unexpected reception of Batman v Superman: Dawn of Justice, and they started to tinker with Suicide Squad and Justice League, trying to make them lighter and fun, resulting in an uneven mess that couldn’t be repaired. There are great, successful movies in the franchise, like Wonder Woman or James Gunn‘s The Suicide Squad, but ultimately, studio interference and creative clashes killed the DCEU.

8

‘Dune’ (2021–2026)

After David Lynch‘s attempt in 1986, Denis Villeneuve adapted Frank Herbert’s dense, politically charged Dune with a measured, atmospheric approach. Rather than condensing the rich story into a single film, Villeneuve opted to split the story into two to give its world and ideas room to breathe. With a star-studded ensemble led by Timothée Chalamet, the film quickly became a critics’ and audiences’ favorite.

Villeneuve made a huge gamble with Dune. The first film literally ends at the midpoint of the story, and the sequel was not filmed back-to-back. If critics rejected the film or if it didn’t turn enough profit, the follow-up would not see the light of day. To make things worse, it was released post-COVID, released simultaneously in theaters and on HBO Max. However, Dune was a commercial success and was nominated for a whopping ten Oscars, winning six. The sequel, which offers the payoff, was equally beloved by audiences and critics. After making two films that can be considered among the best sci-fi films in recent memory, Villeneuve and the cast are now prepping the third film, which is due to be released in December 2026.

7

‘Pirates of the Caribbean’ (2003–2017)

Based on a Disneyland theme park ride, Pirates of the Caribbean: The Curse of the Black Pearl defied the odds and became a runaway hit. Two sequels, Dead Man’s Chest and At World’s End, were greenlit soon after with Johnny Depp, Orlando Bloom, and Keira Knightley returning alongside director Gore Verbinski. The sequels followed the trio as Davy Jones (Bill Nighy) demands that Jack Sparrow pay his debt, and the East India Trading Company attempts to eradicate piracy.

The Pirates of the Caribbean trilogy is blockbuster filmmaking at its finest. The films are not interested in simple storylines, but they have a complex, ambitious plot that sees each character team up and betray one another. Some may say it’s unnecessarily convoluted, yet it’s riveting and unexpected until the end. The production of the second and third films was notoriously intricate as they were filmed back-to-back. With lots of on-location shoots, enormous practical sets, and amazing CGI effects, the budget was high, with At World’s End becoming the most expensive film at its time. All of that paid off with a spectacular box office gross. The next two sequels, however, opted for the safe route and were far less exciting.

6

‘Star Wars’ (1977–present)

From the very first film in 1977, Star Wars has always been ambitious. From pioneering revolutionary effects and sound design to intricate world-building. The main story is about the Skywalker Saga, following Luke Skywalker (Mark Hamill) and later Anakin Skywalker (Hayden Christensen). The franchise is expanding even more with spin-offs like Rogue One and acclaimed series like Andor and The Clone Wars.

Each new Star Wars project carries the burden of decades of lore and fan expectations. The team behind each Star Wars entry tries to keep it fresh while also respecting what came before. The projects usually have top-tier talent and spare no budget (currently, The Force Awakens holds the title of being the most expensive film of all time). Some have argued that currently the franchise is in a limbo, but considering how beloved and relevant it is, it’s unlikely that Star Wars is retiring any time soon.

5

‘The Matrix’ (1999–2021)

The Matrix introduced a cyberpunk world where reality itself is a simulation by following Neo’s (Keanu Reeves) journey to fulfill his destiny as The One. The first film is a generational achievement, blending philosophy and sci-fi action in a seamless manner, and its success led to sequels that expanded the mythology and criticized popular culture.

The franchise’s complex storyline is already ambitious for its time, but then The Wachowskis also pushed the envelope by pioneering visual techniques like the famous bullet time. The sequels, The Matrix Reloaded and The Matrix Revolutions, were filmed back-to-back with bigger ideas and even bigger action sequences. The highway chase in Reloaded is still regarded as one of the best action sequences of all time. Recently, instead of crafting an easy legacy sequel, Lana Wachowski created a subversive film in The Matrix Resurrections that defies audiences’ expectations, showing that ambition is still in the franchise’s DNA.

4

‘Harry Potter’ (2001–2011)

The Harry Potter series chronicles the journey of the titular young wizard as he studies at Hogwarts and confronts the darkness in the magical world. Over eight films, the franchise matured alongside its audience, transitioning from whimsical, family-friendly fantasy to a coming-of-age drama with a darker plot. The main trio is played by Daniel Radcliffe, Rupert Grint and Emma Watson, but the series also boasts the best of British actors in the supporting roles.

Releasing eight films within the span of ten years is almost unheard of today. The franchise’s ambition is evident in how it committed to long-term planning and commitment. The pre-production of the next film usually started when the previous film had not even finished filming, and the production process could take up to a year for each movie. It was also able to retain the same core actors across the decade, reflecting the actual growth of the characters. As a result, the Potter movies are beloved all over the world. The franchise has been a merchandising gold mine and immortalized in theme parks and massive studio tours.

3

‘Avatar’ (2009–present)

James Cameron’s Avatar franchise is set on the lush alien world of Pandora and follows Jake Sully (Sam Worthington), who integrates with the native community through the avatar technology. The films may have familiar plots, but the technological aspects of the franchise are simply mindblowing. The films utilized revolutionary performance capture for the actors playing the Na’Vi and created the whole planet from scratch through CGI.

Avatar is deeply ambitious for its innovation and also linguistic aspects, with the franchise creating a whole new language system for the Na’Vi people. The sequels, Avatar: The Way of Water and Avatar: Fire and Ash, featured even more complicated effects where the actors had to act underwater and have their performances translated into their CG characters. Entire workflows were created specifically for this franchise, from virtual production to 3D exhibition standards. Considering the intricate production process, it’s no wonder that the final film is slated to be released in 2031.

2

‘Marvel Cinematic Universe’ (2008–present)

The Marvel Cinematic Universe began modestly with Iron Man, but with a sneaky post-credit scene that teased future team-up films, it evolved into an interconnected web of films and characters. Over time, it introduced dozens of heroes and villains while building toward large-scale crossover events like The Avengers and Avengers: Endgame. The franchise expanded even bigger with TV series like Agents of SHIELD and various Disney+ shows.

Across five game-changing phases, Kevin Feige’s approach to the MCU turned blockbuster filmmaking into something similar to long-form television, but with massive budgets and A-list talent showcased in cinemas. No franchise had ever attempted serialized storytelling across so many films with such narrative continuity. The scheduling of the actors in Avengers: Endgame alone seems like a nightmare, and they’re attempting a bigger one with Avengers: Doomsday. This kind of cinematic universe sparked a lot of imitators, but so far, none have come close to replicating Marvel’s overwhelming success.

1

‘The Lord of the Rings’ Trilogy (2001–2003)

Peter Jackson’s Lord of the Rings trilogy adapts J.R.R. Tolkien’s monumental fantasy book, following the journey of Frodo Baggins (Elijah Wood) and the Fellowship as they attempt to destroy the One Ring. Jackson was not a household name when the movie started production, nor were the actors in the ensemble, making it a risky yet ambitious production.

All three films in the trilogy were shot back-to-back, showing the studio’s confidence in the property. The shooting schedule, which is not in chronological order, was also an ambitious feat. The most famous example is when Ian McKellen shot his farewell with the Hobbits in his first week of filming. Jackson and his team benefited greatly from his ongoing partnership with Weta Workshop and Weta Digital, which are now among the best at making practical effects and CGI. The trilogy is considered among the best fantasy films and is considered a masterpiece in cinema.

Entertainment

Woah Vicky Faces Backlash After Calling Her Dad Racial Slur

Woah Vicky sparked major reactions online after posting a series of emotional tweets and offensive messages about her father on social media.

RELATED: Whew! Woah Vicky Turns Heads After Sharing A Message About What She’s Looking For In A “Successful” Black Athlete

Woah Vicky Shares Controversial Message About Her Dad

On Wednesday, Feb. 11, Vicky took to X to share tweets about feeling lonely and unsupported by her family. In one post, she directly addressed her father using explicit language and a racial slur, writing that she hated him and calling him out by name.

In additional tweets, Vicky suggested she felt abandoned, asking followers, “Can someone adopt me?” The posts quickly circulated across platforms, with many critics calling Vicky out for using a racial slur.

Vicky Issues Apology After “Crashing Out” Online

Following the backlash, Vicky returned to social media to address her comments and take responsibility for her outburst.

In a message on X, she apologized for her behavior, admitting she had acted out of emotion. She wrote,

“Hey, sorry for crashing out like that that was really bad and disrespectful for me to talk about my dad like that but I gotta stop doing that. I gotta control my emotions and I gotta forgive my dad and I forgive him his name because he’s a lost man and he needs God and I need God too. Everybody needs God everybody needs Jesus And.”

Social Media Weighs In on Viral Posts

Vicky’s tweets and apology quickly became a trending topic, with users across Instagram and X sharing mixed reactions.

Instagram user @jadiaaaaaaaaaa wrote, “During black history month is bold”

Another Instagram user @vibewithaaaa wrote, “Not the first time she used that word not surprised she’s been saying it”

While Instagram user @daniellexoo wrote, “She went viral for literally saying it all of the time years ago… not surprised”

Instagram user @gemini_queen_18 wrote, “I don’t think she typed that”

Another Instagram user @k.vmbrly wrote, “Yall have been letting her get away with this for YEARS. Mind you this is why she even got famous and yall been letting it slide over and over 🥴😩”

While Instagram user @cherryyy.___ wrote, “Everyone says this word. Why is it always such a problem when this girl says it”

Instagram user @sinisterbeautti93 wrote, “Now Vicky this is not what Jesus would do 😩”

Another Instagram user @kuh.dee.huh wrote, “People are only sorry when they get caught!!

While Instagram user @cici_cheri4 wrote, “She knows the only way she gets talked about is if she trolls us. 🙄”

RELATED: Whew! Woah Vicky Compliments Her Rumored Boo Antonio Brown In THIS Controversial Way (PHOTOS)

What Do You Think Roomies?

Entertainment

Kai Cenat Breaks Silence On Gabrielle “Gigi” Alayah & “Rumors”

Kai Cenat has broken his silence and mentioned Gabrielle “Gigi” Alayah while speaking on “rumors” and “speculations” that have been shared since their split.

RELATED: It’s Over?! Kai Cenat Shocks Fans After Announcing Split From Gabrielle “Gigi” Alayah, She Reacts

Kai Cenat Breaks Silence & Mentions Gabrielle “Gigi” Alayah While Speaking On “Rumors” & “Speculations” Since Their Split

On Friday, February 13, Cenat took to his Instagram Story to share a lengthy message with his more than 17 million followers. Furthermore, he began with, “I just want to say this from my heart. It can be confusing to see news about me and the people around me that isn’t true. I’ve been sharing my life online for a long time now and know that once you share aspects of your life with the world, it can be hard to keep things private.”

“There have been rumors, speculations, and comments made about my previous relationship and my friends. I want to apologize for not addressing things sooner, but I needed to take a step back from social media and process everything,” he continued. “People react to things in different ways, it is an emotional time and should have been handled PRIVATELY.”

Cenat added that if there’s ever something “important” or “real” that his fans need to hear, they will hear it directly from him. And this will apply to everything in his life, from his relationships to his businesses to his streams and beyond.

“I wish the best to Gabrielle and ask to please respect both sides,” he concluded.

Social Media Reacts

Social media users reacted to Kai Cenat’s statement in TSR’s comment section.

Instagram user @differeentt_ wrote, “Boy what”

While Instagram user @smokingonmyexpack_._ added, “It giving he just didn’t wanna be with Gigi anymore and used this as an excuse to leave her”

Instagram user @pinknflowers wrote, “Somebody sum this up for me in one sentence.”

While Instagram user @slaywithdre added, “.. So basically, they getting back together !?”

Instagram user @latyraa wrote, “He allowed all his ‘friends’ to bash her publicly and he’s speaking out WEEKS later? Yeah, NO.”

While Instagram user @slaywithdre added, “.. Kai, you said all that to say what?”

Instagram user @styleandpoise wrote, “This isn’t it Kai. You allowed your friends to disrespect her publicly for weeks, she finally responded and this is your statement?! Nah, you could’ve kept this. I hope GiGi is well, healing, and growing.”

While Instagram user @trinn2sexcc added, “mind you he came to the internet first”

Instagram user @black.art.universe wrote, “He said a whole lot of nothing, respectfully”

More On Kai Cenat & Gabrielle “Gigi” Alayah’s Split

As The Shade Room previously reported, in December 2025, Kai Cenat shocked fans when he announced he and Gigi had split up.

In turn, Gigi took to the internet, confirming their split but also implying that Cenat believed a false rumor about her cheating on him with NBA YoungBoy.

By January, Gabrielle Alayah had broken her silence on their split, per The Shade Room.

Then, later that month, Alayah was clearing her name from additional claims shared by Cenat’s assistant, per The Shade Room.

This, while also airing out Cenat’s friends for trying to pursue her and speaking negatively about her.

Amid all of this, however, Kai Cenat remained mum and even popped out in Paris to promote his apparent clothing line. This, while some of his friends shot back at Gigi.

RELATED: Deshae Frost & Rakai Respond After Kai Cenat’s Ex Gabrielle “Gigi” Alayah Airs Them Out Over Post-Breakup Shade (VIDEOS)

What Do You Think Roomies?

Entertainment

“The View” guest tells cohosts she loves 'all the fights,' points out 'a lot of downs' in show's tumultuous history

:max_bytes(150000):strip_icc():format(jpeg)/Zarna-Garg-Sunny-Hostin-the-view-021326-0c371deff58b4fc48a9e32c7a64a97a5.jpg)

Comedian Zarna Garg pointed to “all the ups and downs” over the years. “Yeah, we remember,” Sunny Hostin replied.

Entertainment

Emerald Fennell defends her changes to “Wuthering Heights”: 'You've got to make those hard decisions'

:max_bytes(150000):strip_icc():format(jpeg)/emerald-fennell-wuthering-heights-021026-1e705b5a1ac44e8ab6cbd1bfb9d9c967.jpg)

The writer-director says it would’ve been “very, very difficult” to tell the full story of “Wuthering Heights.”

Entertainment

Passengers Banned For Life After Insane Brawl on Jet2 Flight, Watch Video

‘Plane’ Crazy

Fists Fly on Flight, Passengers Banned for Life

Published

British budget airline Jet2 has banned two passengers for life after a brutal brawl broke out on a flight from Turkey to the United Kingdom … and, another passenger recorded all of it.

The flight took off from Antalya Thursday headed for Manchester … but had to make an emergency landing in Belgium after a shouting match began between several passengers.

Waiting for your permission to load the Instagram Media.

The flight crew tries to step in to calm the situation … but, that doesn’t tamp down tensions at all — the confrontation quickly turns physical, leading to a massive brawl.

Punches are thrown, one man ends up in a chokehold, and the airplane cabin descends into chaos.

According to a statement from Jet2, two men were off-loaded in Brussels and handed over to law enforcement. The flight then continued on to Manchester.

Jet2 said … “We can confirm that the two disruptive passengers will be banned from flying with us for life. We will also vigorously pursue them to recover the costs that we incurred as a result of this diversion.”

The airline adds they have zero tolerance for disruptive passenger behavior. The airline apologized to the other passengers and their crew for the scary situation.

Entertainment

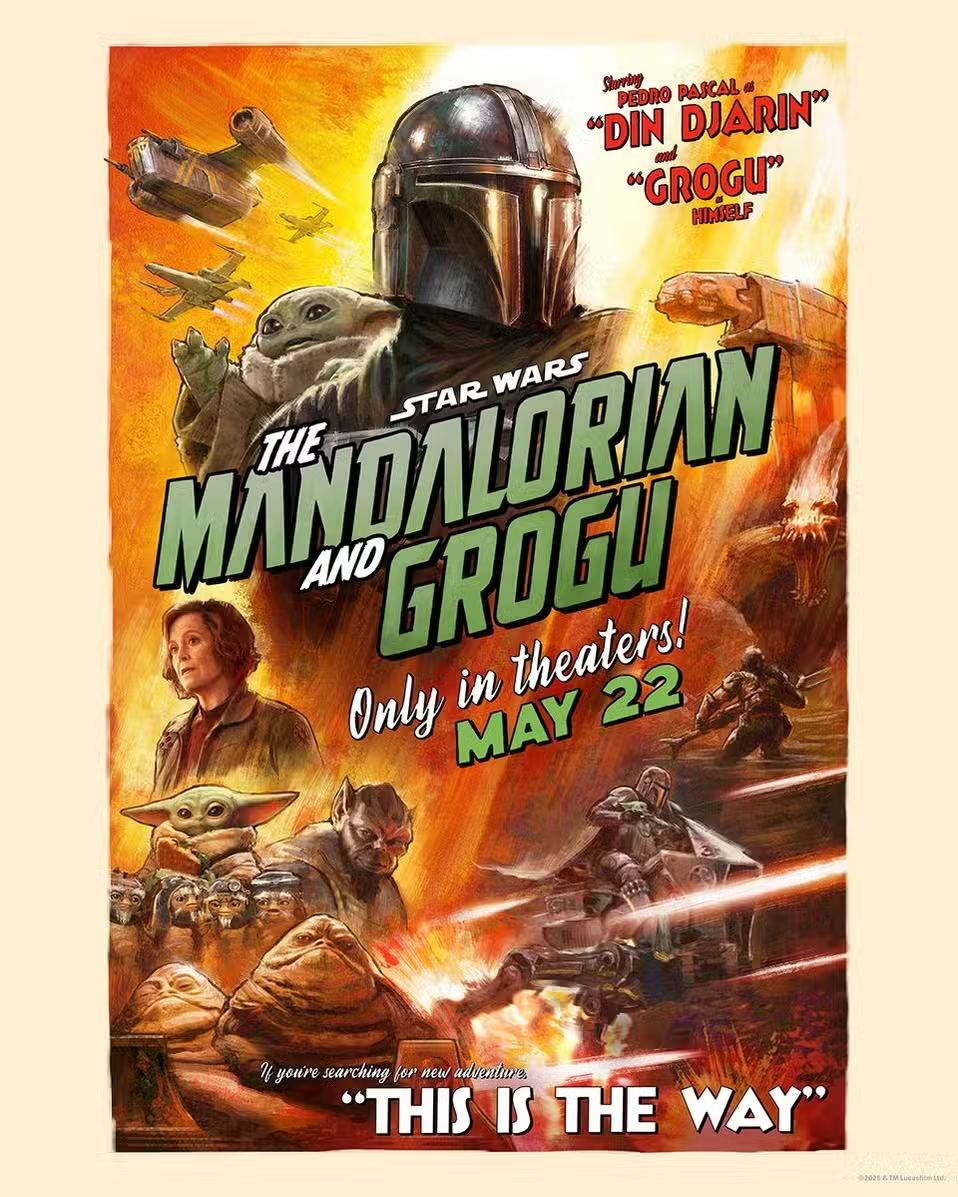

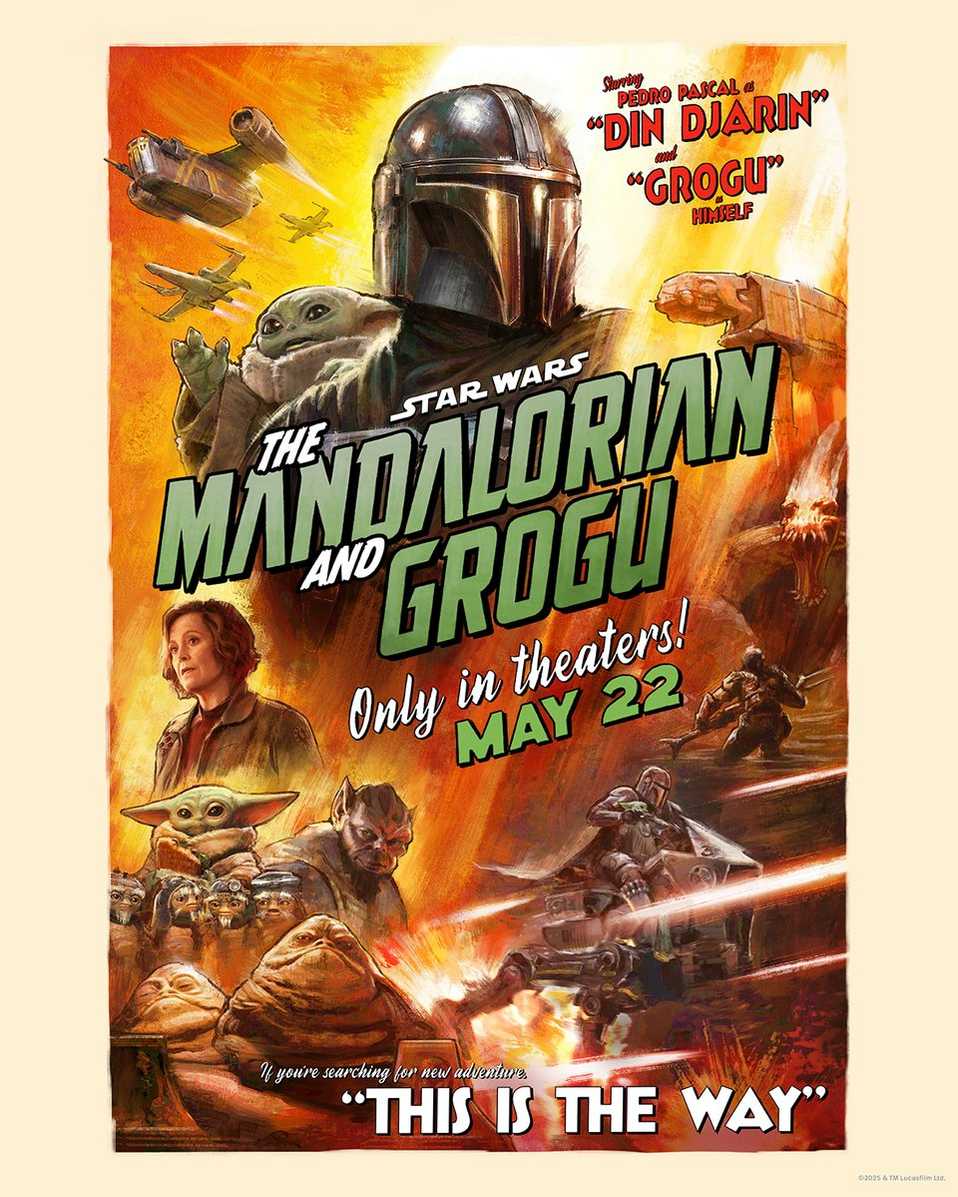

Jon Favreau Unveils the Next Chapter of ‘The Mandalorian & Grogu’ With Epic New Release

Star Wars has a long-standing history of including toys and merchandise with its films. For many, their first introduction to Boba Fett in the original trilogy came through his toy and the marketing around Star Wars: The Empire Strikes Back. So it isn’t surprising that toy-tie-ins are still part of the joy of the franchise. As part of the ramping up for the release of The Mandalorian and Grogu later this year, the team at Lucasfilm invited Collider to an event in New York to give us a sneak peek at all the new merch coming our way for fans of Star Wars!

As part of the celebration, we were privy to an exclusive fireside chat between the new Creative Director for Merchandise, Bobby Kim, and the creator of The Mandalorian, Jon Favreau, about not only the new line but the connection between Star Wars and toys as a whole. Kim encouraged Favreau to talk a lot about his own connection to the franchise, spanning back to seeing the films in theaters and playing with his action figures, to where they wanted the new merchandise for The Mandalorian and Grogu to go.

“For Star Wars, there’s always been that conversation between the two,” Favreau said about toys and the films themselves. “So it feels very organic. One leads into the other.” He also shared that one of the “thrills” of working on The Mandalorian on streaming was seeing the “Grogu/Baby Yoda phenomenon.” At the time, they wanted to keep Grogu a secret and couldn’t rush toys for him, meaning that we had to wait for little Baby Yoda plushies. Now, with this new launch, there are plenty of options for fans of Grogu.

A Wide Variety For Star Wars Fans to Love

There is literally something for everyone. If you’re hoping that you can get a new kind of Grogu toy in your life, don’t worry! There are plenty of options. The event showed us how some of the more universal Star Wars merch would look with spirit jerseys for Star Wars: Revenge of the Sith, lightsabers, a series of sunglasses, and more. But the big reveal was all for The Mandalorian and Grogu. To keep the secrets of the film, a lot of the merch was focused just on Din Djarin and Grogu in different ships and kinds of toys as well as costumes. But you will see plenty of Babu Frik included too! Check out our sneak peek above.

There is so much more coming for fans of Star Wars and the merch coming for The Mandalorian and Grogu is just the start! You can see Din and Gorgu’s next outing when it hits theaters on May 22.

- Release Date

-

May 22, 2026

- Sequel(s)

-

Dave Filoni’s Untitled Mandalorian Movie

- Franchise(s)

-

Star Wars

-

Politics5 days ago

Politics5 days agoWhy Israel is blocking foreign journalists from entering

-

Sports7 days ago

Sports7 days agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

Business5 days ago

Business5 days agoLLP registrations cross 10,000 mark for first time in Jan

-

NewsBeat4 days ago

NewsBeat4 days agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

Tech7 days ago

Tech7 days agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

Sports2 days ago

Sports2 days agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

Business5 days ago

Business5 days agoCostco introduces fresh batch of new bakery and frozen foods: report

-

Tech3 days ago

Tech3 days agoSpaceX’s mighty Starship rocket enters final testing for 12th flight

-

NewsBeat5 days ago

NewsBeat5 days agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

Video7 hours ago

Video7 hours agoThe Final Warning: XRP Is Entering The Chaos Zone

-

Sports5 days ago

Sports5 days agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Sports6 days ago

Former Viking Enters Hall of Fame

-

Politics5 days ago

Politics5 days agoThe Health Dangers Of Browning Your Food

-

Business5 days ago

Business5 days agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

Crypto World2 days ago

Crypto World2 days agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

Crypto World3 days ago

Crypto World3 days agoU.S. BTC ETFs register back-to-back inflows for first time in a month

-

Video2 days ago

Video2 days agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

Crypto World3 days ago

Crypto World3 days agoBlockchain.com wins UK registration nearly four years after abandoning FCA process

-

NewsBeat4 days ago

NewsBeat4 days agoResidents say city high street with ‘boarded up’ shops ‘could be better’

-

Sports4 days ago

Kirk Cousins Officially Enters the Vikings’ Offseason Puzzle