Crypto markets spent the past week in retreat, with more than $300 billion leaving the digital asset sector. The weekend traded flat, but there was a minor spike in activity and a subsequent price correction on Monday morning in Asia.

Moreover, several key inflation reports are due in the US this week, which could impact central bank monetary policy. This will be the final set of CPI and PPI data before the Jan. 29 Federal Reserve meeting, observed the Kobeissi Letter.

Last week, the Consumer Sentiment index reflected a rise in inflation expectations which was consistent with the price trends within the ISM Services PMI report. This may have impacted high-risk assets such as crypto and tech stocks, which corrected heavily.

Economic Events Jan. 13 to 17

Potential reacceleration in inflation led investors and analysts to voice concerns that the Fed may pause rate reductions in the first half of the year. Additionally, Fed Governor Michelle Bowman said that inflation has risen “uncomfortably above” its long-term target “while still presenting stubborn upside risks.”

December’s Producer Price Index (PPI) report is released on Tuesday, reflecting input prices for producers and manufacturers. This data measures the costs of producing consumer goods, which directly affects retail pricing and is viewed as a signal of inflationary pressures.

Another key inflation indicator, December’s Core CPI report, is due on Wednesday. The Consumer Price Index is a measure of the average change over time in the prices paid by consumers for a market basket of consumer goods and services.

“The Fed is widely expected to pause its rate-cutting cycle at its next meeting at the end of the month, but firmer-than-expected CPI data could push back market projections for further easing even later in the year,” wrote Reuters on Jan. 12.

Key Events This Week:

1. December PPI Inflation data – Tuesday

2. December CPI Inflation data – Wednesday

3. December Retail Sales data – Thursday

4. Philadelphia Fed Manufacturing Index – Thursday

5. December Housing Starts data – Friday

6. Total of 7 Fed speaker events…

— The Kobeissi Letter (@KobeissiLetter) January 12, 2025

December’s Retail Sales report is due on Thursday. It provides information on the amount of money consumers are spending on both durable and non-durable goods and is a leading indicator of the economy’s overall health.

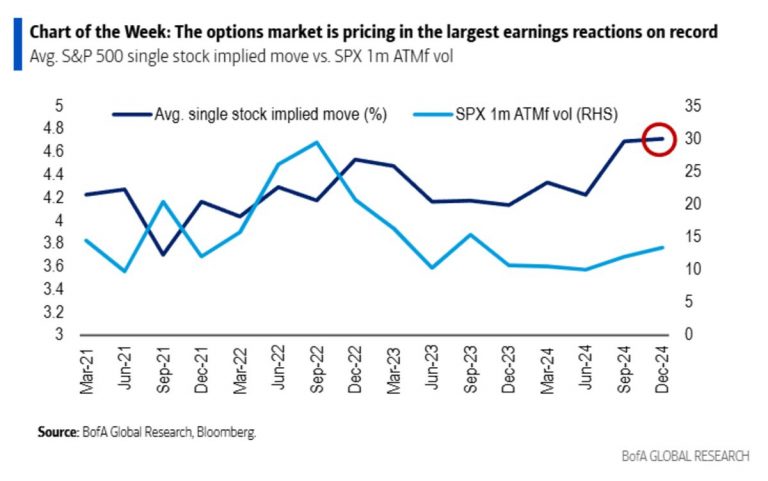

Earnings results from major banks such as JPMorgan and Goldman Sachs in the coming week kick off fourth-quarter reports for companies in the US.

Crypto Market Outlook

Total market capitalization remained flat over the weekend but dropped below $3.4 trillion at the time of writing.

Bitcoin spiked close to $96,000 during the Monday morning Asian trading session but immediately retreated back toward and below $94,000 where it has been for the past few days. The asset remains down 5% over the past week.

Ethereum mirrored the move with a spike above $3,300 only to fall back again to the $3,200 level having lost 11% over the past week.

The altcoins were predominantly in the red, with larger daily losses for Cardano (ADA), Tron (TRX), Sui (SUI), and Stellar (XLM).

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

+ There are no comments

Add yours