Labour is considering adopting a means-tested pension model similar to Australia’s as a potential solution to Britain’s retirement crisis, but critics warn this carries enormous risks.

It comes after Chancellor Rachel Reeves launched the first phase of a sweeping pensions review in November, aimed at boosting returns for savers and reducing the burden of the annual state pension bill, which is expected to reach £137.5billion in 2024-25.

Labour is exploring whether an Australian-style model could plug the spending black hole while encouraging private savings.

According to Mike Ambery of Standard Life, who knows the consultation, this would carry risks and benefits.

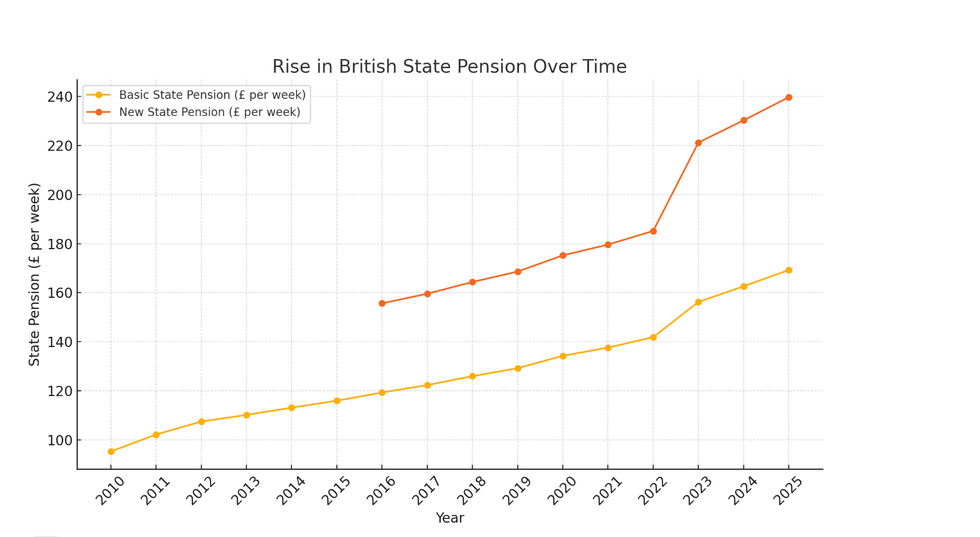

The rise in the British State Pension over time, including the projected 4.1 per cent increase in 2025

ChatGPT

To understand why, let’s compare both models.

Under current UK rules, workers aged between 22 and the state pension age earning at least £10,000 must be automatically enrolled into a workplace pension scheme. Employers contribute at least three per cent of the worker’s qualifying earnings, with employees contributing five per cent.

The full new state pension is £203.85 per week, based on 35 qualifying years of NI contributions. There’s no means test; everyone qualifying receives the same amount if they’ve made the required contributions.

Critics have consistently warned that this is not enough to live on.

In Australia, employers must contribute 11.5 per cent to workers’ pensions, nearly four times the UK’s mandatory three per cent employer contribution.

The Australian rate is set to rise further to 12 per cent in July, highlighting the growing gap between the two systems.

Unlike the UK model, the pension age in Australia is means-tested based on income and assets.

Homeowners with assets excluding their primary residence above a certain threshold see their pension reduced, and no pension is provided if assets exceed a higher threshold. Similarly, income above a certain amount leads to a reduction in pension benefits

Ambery suggests British pensioners could reap similar benefits if a similar model were rolled out here.

He said: “Around 95 per cent of Australians have a defined contribution pension and the Compulsion Act 1992 has embedded auto-enrolment.

“Crucially, it has guaranteed a high employer contribution rate and this is set to rise again in July to 12 per cent, with employees able to contribute on top of that.

“This has resulted in pot sizes two to three times larger at retirement in Australia than in the UK. We need to help Britons with a defined contribution pension build a more substantial savings pot for retirement.”

Australia’s system has also tackled the issue of tracking pension savings, with more than 85 per cent of Australians having just one pension pot that follows them between jobs.

In contrast, the UK has £31billion sitting in “lost pots” across multiple schemes. The UK’s state pension operates on a “pay-as-you-go” basis, with today’s workers funding current retirees through their taxes.

Ambery said: “I tend to think having one pot is a very good idea. The UK Treasury can facilitate this consolidation and the pensions dashboard will help, but that’s some way off, though we could solve the problem quite quickly by having individual consolidation.”

LATEST MEMBERSHIP DEVELOPMENTS

Risks reducing overall retirement income if it discourages private saving, especially for middle-income earners, one report

PA

Mixed bag

As Australia’s means-tested system represents around 10 per cent of government spending but its proportion of GDP is significantly lower than the UK’s state pension costs, it has been argued adopting a similar system could potentially reduce spending as a percentage of GDP.

Indeed, a report from the Institute for Fiscal Studies (IFS) suggests that means-testing could save significant amounts over the long term.

For instance, one analysis indicates that if means-testing were to be applied in a way similar to Australia’s system, it could save billions annually by reducing or eliminating payments to wealthier pensioners.

A separate IFS report criticises means-testing for adding complexity and administrative costs, potentially leading to inefficiencies in the system.

The report points out that while means-testing might target support, it also risks reducing overall retirement income if it discourages private saving, especially for middle-income earners.

Baroness Ros Altmann voiced this criticism back in August, tweeting: “Means testing state pension would cost far more in future than perceived short term cost savings. We undermine private saving/wealth accumulation and upend retirement for future generations.”

Ambery of Standard Life cast doubt over whether Britain can switch to the model, noting also that “the administrative process of applying is very labour-burdened, as evidenced in Australia”.

Indeed, a former DWP employee highlighted the impracticality of administering means-testing for nearly 12.7 million state pensioners, citing the complexity of tracking changes in financial situations.

+ There are no comments

Add yours