Entertainment

DNA That Does Not Belong to Nancy Guthrie Was Collected From Her Property

Authorities have found “DNA other than Nancy Guthrie’s and those in close contact to her” as the investigation into her disappearance continues.

The DNA evidence was discovered and collected at her property, the Pima County Sheriff’s Department shared in a statement with multiple media outlets on Friday, February 13.

“Investigators are working to identify who it belongs to,” the update read. “We are not disclosing where that DNA was located.”

Investigators also found several gloves, with the closest discovered approximately two miles from Nancy’s home.

The statement also clarified speculation surrounding the location of where the glove was found.

“Reports that a glove was found inside the residence or on the property are inaccurate. All collected evidence has been submitted for laboratory analysis,” the update continued.

Us Weekly has reached out to the Pima County Sheriff’s Department for comment.

Guthrie, who is the mother of the Today show’s Savannah Guthrie, was last seen alive in Tucson, Arizona, on January 30 after enjoying dinner with family members. Police later confirmed a 911 call was made on February 1 after the 84-year-old didn’t meet up with friends to watch a church service virtually.

Authorities have not identified a person of interest or suspect in Guthrie’s disappearance. They also have not officially ruled anyone out.

Nancy and Savannah Guthrie. Photo by Don Arnold/WireImage)

On Thursday, February 12, the FBI released an official description of the suspect as “a male, approximately 5’9” – 5’10” tall, with an average build. In [a newly-obtained security] video, he is wearing a black, 25-liter ‘Ozark Trail Hiker Pack’ backpack.” Federal officials confirmed they’d received 13,000 tips from the public related to Nancy’s disappearance — and were doubling their offer from $50,000 to $100,000 for any information that led to her rescue or recovery.

“Today, the FBI is increasing its reward up to $100,000 for information leading to the location of Nancy Guthrie and/or the arrest and conviction of anyone involved in her disappearance,” FBI Phoenix announced via X on Thursday. “New identifying details about the suspect in the kidnapping of Nancy Guthrie have been confirmed after a forensic analysis of the doorbell camera footage by the FBI’s Operational Technology Division.”

Following Nancy’s disappearance Savannah, 54, and her siblings, Annie Guthrie and Camron Guthrie, have pleaded for the public’s help as they desperately try to find their mom.

In an Instagram video posted on February 4, both Savannah and Annie shared a personal message to their mom.

“Mommy, if you are hearing this, you are a strong woman. You are God’s precious daughter, Nancy,” Savannah said. “We believe and know that even in this valley, He is with you. Everyone is looking for you, Mommy, everywhere. We will not rest.”

Annie added, “Nancy is our mother, we are her children. She is our beacon. She holds fast to joy and all of life’s circumstances. She chooses joy day after day despite having already passed through great trials of pain and grief. We are always going to be merely human. Just normal human people who need our mom. Mama, if you’re listening, we need you to come home. We miss you.”

Entertainment

Harvey Levin and Mark Geragos Connect Dots in Nancy Guthrie Kidnapping

Nancy Guthrie Kidnapping

Harvey and Mark Connect the Dots

Published

Nancy Guthrie‘s kidnapper has eluded authorities for 2 weeks, but the ransom note TMZ received is of intense interest to the FBI, and Harvey Levin and Mark Geragos both agree … it may be the key to cracking the case.

H&M’s latest “2 Angry Men” podcast makes it clear … the FBI is laser focused on that ransom letter, for reasons we cannot publicly discuss. They are also interested in the man who has sent TMZ 3 demand emails asking for bitcoin in return for giving up the kidnapper’s name. BTW … the man says the kidnapper is the “main individual” — meaning there’s more than one person involved.

CNN

Law enforcement’s dramatic move Friday night apparently did not yield results, but there are a number of clues, including unknown DNA found in Nancy’s house. It’s currently being analyzed.

TMZ has identified the backpack and the jacket the kidnapper was wearing … we believe it to be an Athletic Works Fusion Knit Jacket — law enforcement has not confirmed. Both items are sold at Walmart, so they may help law enforcement track down the kidnapper.

Watch the full “2 Angry Men” podcast by clicking here.

Entertainment

Bianca Censori Heads to Spa Ahead of Valentine’s Day

Bianca Censori

Squeezes In Spa Day … & Purple Tights!!!

Published

Bianca Censori will look picture-perfect for her hubby Kanye West for Valentine’s Day — ’cause she was out getting a spa touch-up the day before!

Check it out — a photog caught her headed out of a Los Angeles medspa Friday looking as radiant as ever … and showing off what her mama gave her in one of her signature curve-hugging outfits.

BACKGRID

The architectural designer dolled up in a pair of lavender tights that left little to the imagination and an off-the-shoulder chocolate brown blouse … finishing the body-contouring look with a pair of white heels.

Her tiny tights also accentuated her voluptuous behind … it’s all in the clip!

Bianca stepped out solo a few weeks back as well when she headed to a facial clinic in West Hollywood … and she opted for another skin-tight look.

It’s unclear where she and Kanye plan to celebrate V-Day … but we do know she will certainly be glowing!

Entertainment

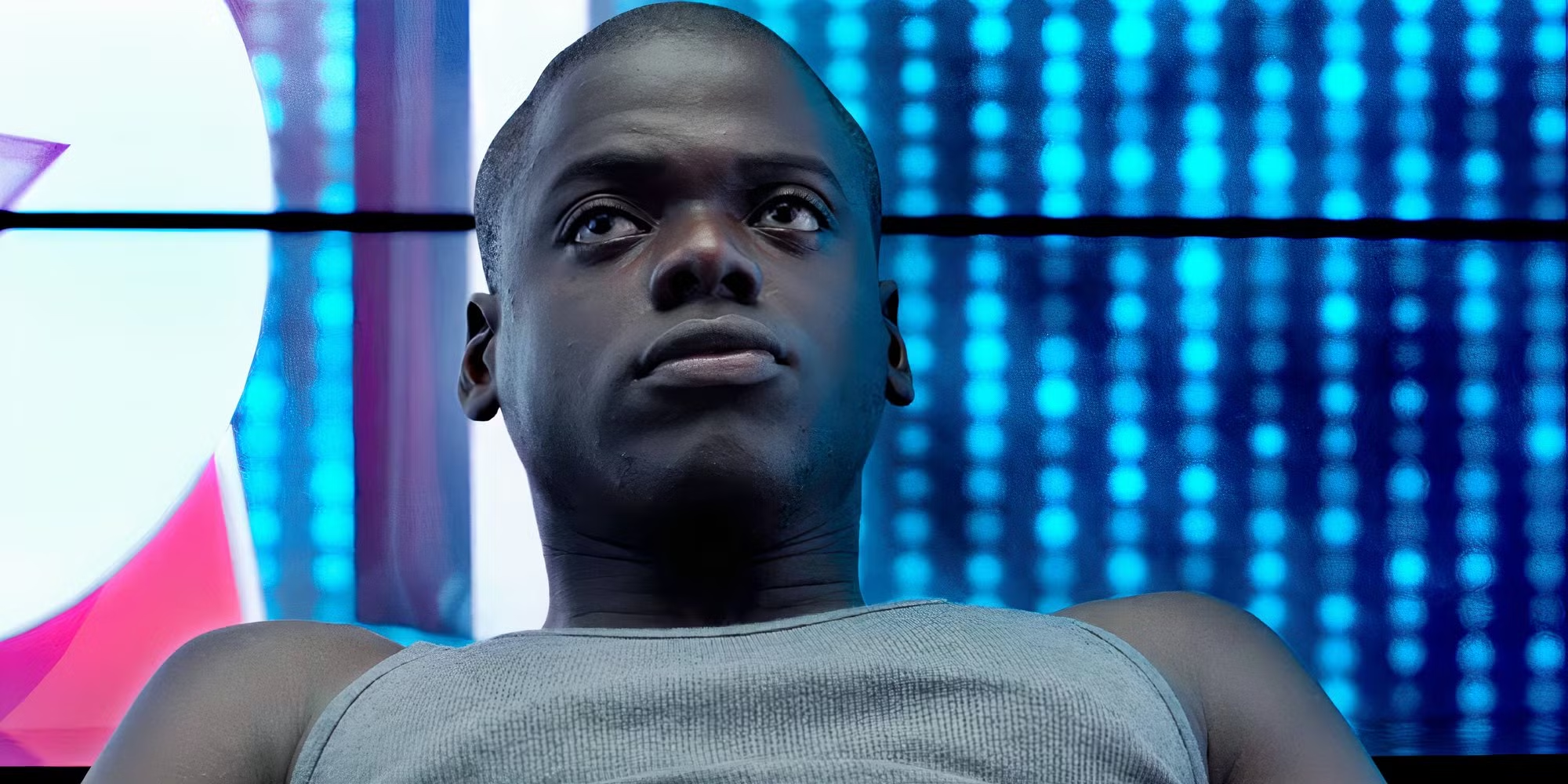

This Gripping Techno-Thriller Series Is the Perfect ‘Black Mirror’ Replacement

As far as dark techno-thrillers go, Black Mirror dominates the genre with its blatant disregard for the viewer’s comfort and its eerily prescient storytelling. But if the anthology show is a tad too dystopian, and you’d prefer something set in the world we are familiar with, then Mr. Robot should be your next watch. But unlike Black Mirror, which always comes with a shiny bit of futuristic technology, replace that with plain old hacking, the “plant a USB and watch code run across the screen” type. It has the gritty, sharp, and psychologically violent atmosphere of Black Mirror, but is rooted in a version of cybersecurity and anti-capitalism that is recognizable to a contemporary audience.

Mr. Robot follows Elliot Alderson (Rami Malek), a cybersecurity engineer who moonlights as a hacker vigilante. He is perpetually plagued by anti-capitalist diatribes, especially against the powerful E(vil) Corp, which doesn’t quite help with his social anxiety, dissociative disorder, or drug addiction. But when he meets the titular character, played by Christian Slater, who founded a community of hacker-activists called fsociety, Elliot finds a more decisive way to channel his rage against mega-corporations instead of the lone instances of vigilantism he is used to. But that means he is now on the radar of the huge conglomerate, disrupting his life of solitude and dragging him into a technological war for four seasons.

‘Mr. Robot’ Has the Prescience, Grit, and Discomfort of ‘Black Mirror’

Black Mirror has the knack for telling stories that are startlingly relevant to the modern age, despite the futuristic and almost inconceivable nature of the technology it depicts. Meanwhile, Mr. Robot achieves the same disconcerting sentiment, but on a more grounded scale. It roots itself in cybersecurity, simultaneously depicting the usefulness of hacking through grand schemes of taking down corporate overlords and the dangers of technology, forcing us to think twice about our passwords and digital footprint. Unlike the hackers we see in big-budget films, this show takes a grounded approach, often lingering on computer screens and tangible processes accompanied by explanations. Highly sophisticated firewalls aren’t toppled in mere seconds, instead that fictionalized hacking is replaced by techniques like phishing through USBs or password generator programs. Not as exciting, but terrifyingly authentic.

When Mr. Robot combines hacking with vigilantism, an even more Black Mirror-esque darkness emerges. The show veers strongly away from romanticizing the act of vigilantism, something shows like Dexter do with the instant gratification of watching a criminal finally get his comeuppance. Mr. Robot has a fiercely pragmatic approach that strips away any satisfaction. When Elliot confronts a target, he starkly lays out their crimes, whether that be accessing child pornography or running dark web marketplaces, and never really indulges in the idea of justice. Instead, we are left with the hollow feeling of knowing the crimes took place and that these figures are simply representative of others like them — there is neither respite nor catharsis.

Rami Malek Leads ‘Mr. Robot’ as a True Anti-Hero and Morally Ambiguous Hacker

Much of the show’s shifting grim tones also comes from Elliot’s characterization and Malek’s performance. Mr. Robot delivers a true anti-hero, not just a character who kills people for a good cause. Elliot is genuinely difficult to root for in the beginning, as he is socially awkward, openly finds refuge in drugs, and is utterly invasive — he hacks into the accounts of every single person he meets, good or bad. He is reminiscent of Joe Goldberg (Penn Badgley) from You in his lack of respect for privacy and the long mental monologues during conversations (though Elliot is hilariously called out for not speaking many times), but is also Joe’s antithesis. While Joe is a mix of charm and thinly-veiled misogyny, Elliot is the creepy, unblinking guy you would cross the street to avoid but his anarchistic actions actually match his beliefs.

Malek plays into the character’s awkwardness at the beginning of Mr. Robot, refusing to glamorize the vigilante at all. But as Elliot’s mental health is explored, including through scenes with a therapist, Malek deepens Elliot’s emotional texture and intensity. It’s as if we are witnessing a robot come to life, delving into the internal wiring that drives his addictions to drugs and thankless justice alike. His story unfolds evocatively, pairing effectively with the major storyline of taking down E Corp and making us more invested. Mr. Robot envelops us in darkness on all fronts, forming a thoughtful and disconcerting viewing experience that is gripping in its own right. As such, if you’ve finished up Black Mirror and need something just as uncomfortable and prescient, then this techno-thriller needs to be on your radar.

Entertainment

Cynthia Erivo addresses fans' 'strange fascination' with her and Ariana Grande, speculation they 'were lovers'

:max_bytes(150000):strip_icc():format(jpeg)/Cynthia-Erivo-and-Ariana-Grande-021326-1-755df080937c478fb36ffe489faaf7b4.jpg)

“I think people didn’t understand how it was possible for two women to be friends — close — and not lovers,” the actress said.

Entertainment

Why Did Simon Rex Leave What I Like About You After Season 1?

After joining What I Like About You with Amanda Bynes and Jennie Garth, Simon Rex was nowhere to be found after the first season of the hit WB sitcom.

What I Like About You followed the lives of two sisters living together in New York City — teenager Holly (Bynes) and her responsible older sister, Val (Garth). Rex was introduced as Val’s boyfriend, Jeff, when the show premiered in 2002.

Jeff and Val’s relationship was going well until a miscommunication on Valentine’s Day made Val think she was going to get proposed to. Instead, Jeff revealed he never wanted to get married and they subsequently called it quits. They briefly reconciled, but ultimately didn’t get back together — and Jeff was MIA when What I Like About You returned for season 2.

Rex, 51, never specifically addressed his departure from What I Like About You, but many fans think his story line just ran its course. Years later, he spoke about how his acting career suffered as he tried to navigate life in the spotlight.

“In America, we love watching someone rise — then fail. And then we love watching them come back. Americans love the cycle. It’s just more interesting,” he told news outlet Y Net in 2021 while promoting Red Rocket. “In the past, I was distracted by women and parties, always chasing pleasure. But for the first time in my life, I’m focused on creating meaningful work — and on humility. It took me a long time to become a good Jewish man but I’m finally there.”

Rex rose to fame as an MTV VJ before starring in the Scary Movie franchise and making the transition into music with his rap persona: Dirt Nasty. The actor, who was previously involved in sex work, released several albums and had other onscreen roles but he had a significant gap between projects before his critically acclaimed performance in Sean Baker‘s 2021 drama film Red Rocket.

Rex recalled not feeling in “control” at the time, adding in the 2021 interview, “I lived in Hollywood, surrounded by beautiful women and endless parties. I’d show up to auditions hungover — I wasn’t taking my work seriously.”

He continued: “As I got older, my body and mind just couldn’t keep up with that lifestyle anymore. So I told myself, ‘OK, it’s time to grow up.’ I’m lucky to be a working actor, and now all my energy is focused on my craft.”

Despite the challenges, Rex made it clear he had no regrets.

“If I had done things differently, I wouldn’t be here now, so I guess the answer is no. Of course, I’ve hurt people, and I’ve been hurt too,” he shared. “I’ve made plenty of mistakes — but I’ve learned from them. In the end, everything led me to this moment, so I’m at peace with my regrets.”

What I Like About You aired for three more seasons after Rex’s disappearance. In addition to Bynes, 39, and Garth, 53, the series starred Wesley Jonathan, Leslie Grossman, Michael McMillian, Nick Zano, Allison Munn, Dan Cortese, Edward Kerr and David de Lautour.

What I Like About You is currently streaming on Netflix.

Entertainment

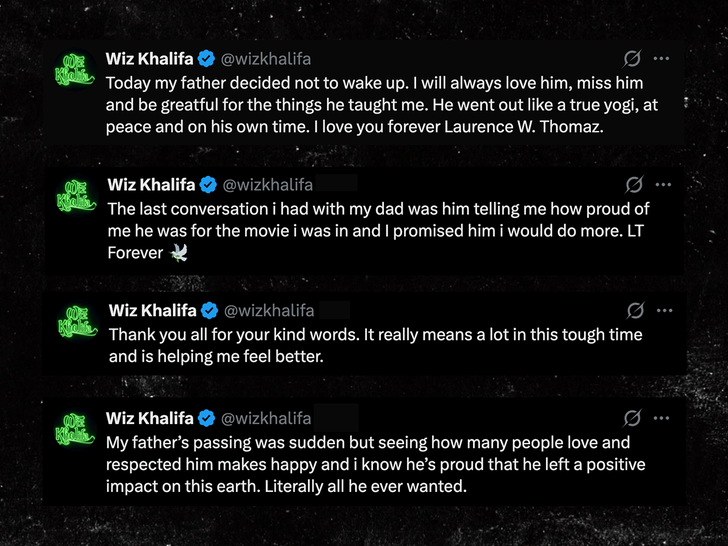

Wiz Khalifa’s Father Dead at 63

Wiz Khalifa

Dad Suddenly Dies at 63 Years Old

Published

Wiz Khalifa‘s father, Laurence W. Thomaz, has died.

The rapper shared the sad news on social media Friday, noting … “I will always love him, miss him and be [grateful] for the things he taught me.”

He did not reveal a cause of death, but said it “was sudden.” He added … “Seeing how many people love and respected him” made him happy … noting, “I know he’s proud that he left a positive impact on this earth. Literally all he ever wanted.”

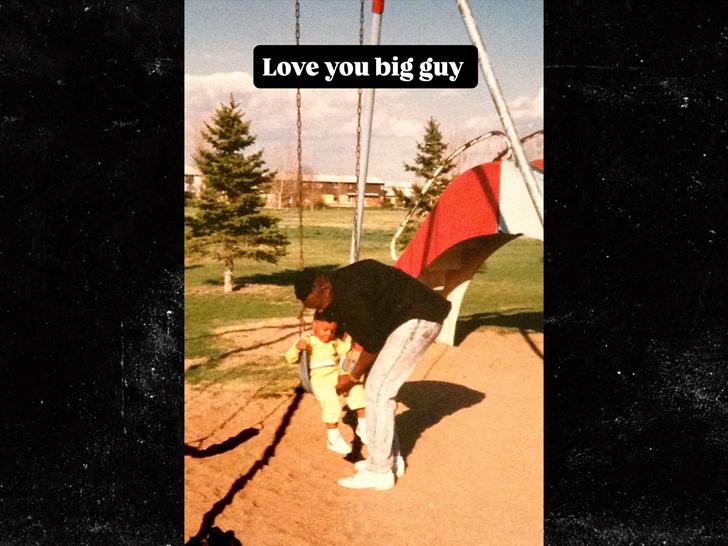

Wiz — whose real name is Cameron Jibril Thomaz — also posted a handful of throwback pics to commemorate his father, including one that shows them at the playground.

The “Young, Wild & Free” hitmaker was close to Laurence, a former military man. Wiz previously told NME his dad opened up a recording studio in his hometown of Pittsburgh, Pennsylvania, when he was a kid, which laid the foundation of his future. He recalled … “I lived in that studio. And that’s what turned me into who I am today.”

He was 63 years old.

RIP

Entertainment

Blueface Goes Viral After Flirty Moment With Celeb Wax Figures

Blueface visited a wax museum, and now he has the internet in tears over his latest antics.

Related: New Circus Addition? Internet Users Weigh In After Blueface Reacts To Pinkydoll Asking Him To Be Her Valentine (WATCH)

Blueface Visits Kylie Jenner And Zendaya Figures At Wax Museum

On Thursday, the rapper took to his social media to share clips from a visit to a wax museum, where he playfully interacted with lifelike figures of Kylie Jenner and Zendaya.

In the first video, Blueface stood behind Kylie’s wax figure and appeared to flirt with it before turning to the cameraman and jokingly telling him to “chill” because he was “with his lady.”

Moments later, the rapper shifted his attention to Zendaya’s figure, which was seated at a table. He shook the statue, sat across from it, and, jokingly, reached out to choke it, leaving viewers both shocked and amused.

The interactions quickly spread across social media, with fans cracking up over what many call Blueface’s classic behavior.

Social Media Reacts

As the clips spread, social media users wasted no time sharing their reactions over in The Shade Room Teens comment section.

Instagram user @Asia.fym wrote, “It looked so real I was like wait now Kylie wyd girl 😂”

Another Instagram user @kalontayyy wrote, “Man why tf I thought that was really her 😭😭”

While Instagram user @the0fficialmir wrote, “😂😂😂😂😂😂 aye cuh I’m happy bro home he take ova internet everytime”

Instagram user @vickienosecret wrote, “I’d call the police honestly”

Another Instagram user @kittymillianni wrote, “and that’s the closest he’ll ever get to those ladies”

While Instagram user @iamsoxxttas wrote, “Nurse he’s out again 😂”

Instagram user @shantelledominica93 wrote, “Boy bye she nor the wax don’t want u”

Another Instagram user @mstwoface wrote, “he need more jail time 😂”

While Instagram user that_person_t wrote, “why he in there playing with these folks sh** 😂😂”

Blueface Calls Out Jake Paul For A Boxing Match

Outside of his viral moments and livestream antics, Blueface has also been focused on boxing. In recent months, he has shared clips documenting his training as he prepares for upcoming fights. Most recently, the rapper went face-to-face with former NBA player Nick Young, also known as Swaggy P, as the two gear up to step into the ring.

@chrisvenegasmedia Blueface Punches Swaggy P in the Face During INTENSE Face-Off! #fyp #fypシ #boxing #blueface #bluefacebaby

During the face-off event, Blueface also talked about a possible matchup with Jake Paul.vAfter a reporter mentioned that Adam22 said he would like to see the fight, Blueface responded confidently, saying, “That’s the fight we want.” His longtime manager, Wack 100, backed him up, adding that Blueface isn’t “turning down no fight.”

@chrisvenegasmedia Blueface Calls Out Jake Paul To Fight in a Boxing Match! #fyp #fypシ #boxing #blueface #bluefacebaby

Related: NLE Choppa Stuns Fans After Seemingly Sharing Disheartening Words About Chrisean Jr. In Response To Blueface Telling Him To “Squabble Up” (VIDEOS)

What Do You Think Roomies?

Entertainment

Ego Nwodim draws gasps from“ Jimmy Kimmel Live” audience after admitting she's never seen this classic film

:max_bytes(150000):strip_icc():format(jpeg)/ego-Nwodim-jimmy-kimmel-live-021126-bc42f85ffcd641799a9210114b56e2e3.jpg)

“I’ve seen ‘Scarface,’ does that count?”

Entertainment

All the biggest changes between Emerald Fennell's Wuthering Heights and Emily Brontë’s novel

:max_bytes(150000):strip_icc():format(jpeg)/wuthering-heights-elordi-robbie-021126-a8abba7438564f838557dbbb2ffc8d69.jpg)

Fennell’s adaptation makes several key alterations to the classic novel, eliminating some characters, expanding others, and changing its ending.

Entertainment

James Van Der Beek's brother shares 'devastation' after actor's death: 'I now know why people call it heartbreak'

:max_bytes(150000):strip_icc():format(jpeg)/Jared-James-Van-Der-Beek-021426-f7375d744674443fb614babeabad490e.jpg)

“I’ve looked up to him since I was born,” the star’s sibling wrote in a candid and moving tribute. “He has never failed to be there for me whenever I needed him.”

-

Politics6 days ago

Politics6 days agoWhy Israel is blocking foreign journalists from entering

-

Business6 days ago

Business6 days agoLLP registrations cross 10,000 mark for first time in Jan

-

Sports3 days ago

Sports3 days agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

NewsBeat5 days ago

NewsBeat5 days agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

Business6 days ago

Business6 days agoCostco introduces fresh batch of new bakery and frozen foods: report

-

Tech4 days ago

Tech4 days agoSpaceX’s mighty Starship rocket enters final testing for 12th flight

-

NewsBeat6 days ago

NewsBeat6 days agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

Sports6 days ago

Sports6 days agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Video1 day ago

Video1 day agoThe Final Warning: XRP Is Entering The Chaos Zone

-

Politics6 days ago

Politics6 days agoThe Health Dangers Of Browning Your Food

-

Business6 days ago

Business6 days agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

![Heathrow has said passenger numbers were 60% lower in November than before the coronavirus pandemic and there were “high cancellations” among business travellers concerned about being trapped overseas for Christmas as Omicron spreads. The UK’s largest airport said the government’s travel restrictions had dealt a fresh blow to travel confidence and predicted it was likely to take several years for passenger numbers to return to pre-pandemic levels. This week ministers said passengers arriving in the UK would have to take a pre-departure Covid test, as well as a post-flight test, because of fears about the spread of the new variant. “[The] high level of cancellations by business travellers concerned about being trapped overseas because of pre-departure testing shows the potential harm to the economy of travel restrictions,” the airport said in an update. Heathrow said the drop in traveller confidence owing to the new travel restrictions had negated the benefit of reopening the all-important corridor to North America for business and holiday travel last month. Eleven African countries have been added to the government’s red list, requiring travellers to quarantine before reuniting with families. “By allowing Brits to isolate at home, ministers can make sure they are reunited with their loved ones this Christmas,” said John Holland-Kaye, the chief executive of Heathrow. “It would send a strong signal that restrictions on travel will be removed as soon as safely possible to give passengers the confidence to book for 2022, opening up thousands of new jobs for local people at Heathrow. Let’s reunite families for Christmas.” Heathrow said that if the government could safely signal that restrictions would be lifted soon, then employers at Heathrow would have the confidence to hire thousands of staff in anticipation of a boost in business next summer. The airport is expecting a slow start to 2022, finishing next year with about 45 million passengers – just over half of pre-pandemic levels. This week Tui, Europe’s largest package holiday operator, said it expected bookings for next summer to bounce back to 2019 levels. However, Heathrow said on Friday not to expect the aviation industry to recover for several years. “We do not expect that international travel will recover to 2019 levels until at least all travel restrictions (including testing) are removed from all the markets that we serve, at both ends of the route, and there is no risk of new restrictions, such as quarantine, being imposed,” the airport said.](https://wordupnews.com/wp-content/uploads/2026/02/shutterstock_1100012546-scaled-400x240.jpg)

![Heathrow has said passenger numbers were 60% lower in November than before the coronavirus pandemic and there were “high cancellations” among business travellers concerned about being trapped overseas for Christmas as Omicron spreads. The UK’s largest airport said the government’s travel restrictions had dealt a fresh blow to travel confidence and predicted it was likely to take several years for passenger numbers to return to pre-pandemic levels. This week ministers said passengers arriving in the UK would have to take a pre-departure Covid test, as well as a post-flight test, because of fears about the spread of the new variant. “[The] high level of cancellations by business travellers concerned about being trapped overseas because of pre-departure testing shows the potential harm to the economy of travel restrictions,” the airport said in an update. Heathrow said the drop in traveller confidence owing to the new travel restrictions had negated the benefit of reopening the all-important corridor to North America for business and holiday travel last month. Eleven African countries have been added to the government’s red list, requiring travellers to quarantine before reuniting with families. “By allowing Brits to isolate at home, ministers can make sure they are reunited with their loved ones this Christmas,” said John Holland-Kaye, the chief executive of Heathrow. “It would send a strong signal that restrictions on travel will be removed as soon as safely possible to give passengers the confidence to book for 2022, opening up thousands of new jobs for local people at Heathrow. Let’s reunite families for Christmas.” Heathrow said that if the government could safely signal that restrictions would be lifted soon, then employers at Heathrow would have the confidence to hire thousands of staff in anticipation of a boost in business next summer. The airport is expecting a slow start to 2022, finishing next year with about 45 million passengers – just over half of pre-pandemic levels. This week Tui, Europe’s largest package holiday operator, said it expected bookings for next summer to bounce back to 2019 levels. However, Heathrow said on Friday not to expect the aviation industry to recover for several years. “We do not expect that international travel will recover to 2019 levels until at least all travel restrictions (including testing) are removed from all the markets that we serve, at both ends of the route, and there is no risk of new restrictions, such as quarantine, being imposed,” the airport said.](https://wordupnews.com/wp-content/uploads/2026/02/shutterstock_1100012546-scaled-80x80.jpg) Business5 days ago

Business5 days agoWeight-loss jabs threaten Greggs’ growth, analysts warn

-

Crypto World3 days ago

Crypto World3 days agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

Crypto World4 days ago

Crypto World4 days agoBlockchain.com wins UK registration nearly four years after abandoning FCA process

-

Crypto World16 hours ago

Crypto World16 hours agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Crypto World4 days ago

Crypto World4 days agoU.S. BTC ETFs register back-to-back inflows for first time in a month

-

NewsBeat5 days ago

NewsBeat5 days agoResidents say city high street with ‘boarded up’ shops ‘could be better’

-

Video3 days ago

Video3 days agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

Sports5 days ago

Kirk Cousins Officially Enters the Vikings’ Offseason Puzzle

-

Crypto World4 days ago

Crypto World4 days agoEthereum Enters Capitulation Zone as MVRV Turns Negative: Bottom Near?