Business

Compounding, Leverage, And Discipline: The 25-Year Path From $250K To $10M

Daniel Martins is the founder of independent research firm DM Martins Research. The firm’s work is centered around building more efficient, easily replicable portfolios that are properly risk-balanced for growth with less downside risk. His work has been featured on Seeking Alpha and other platforms through 2,000+ articles, and it has been cited by the New York Times, CNN, Reuters, USA Today, and others.- – -Daniel is the founder and portfolio manager at DM Martins Capital Management LLC, a macro strategy hedge fund (leveraged risk-parity approach that uses return stacking to achieve aggressive long-term capital appreciation). He is a former equity research professional at FBR Capital Markets and Telsey Advisory in New York City and finance analyst at macro hedge fund Bridgewater Associates, where he developed most of his investment management skills earlier in his career. Daniel is also an equity research and global equities market instructor for Wall Street Prep, where he has developed content and trained hundreds of senior and junior analysts at some of the largest bulge bracket investment banks and sovereign investment funds in the world.He holds an MBA in Financial Instruments and Markets from New York University’s Stern School of Business.- – -On Seeking Alpha, DM Martins Research has partnered with EPB Macro Research and collaborated with Risk Research, Inc.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

While I do not currently hold positions in the tickers specifically mentioned in this article, I have portfolio exposure to many of them through derivatives and comparable ETFs.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Business

Carney tells Tumbler Ridge residents that Canadians ’will always be with you’ following mass shooting

Carney tells Tumbler Ridge residents that Canadians ’will always be with you’ following mass shooting

Business

Trump vs Bad Bunny: A Super Bowl feud with possible midterm consequences

Trump vs Bad Bunny: A Super Bowl feud with possible midterm consequences

Business

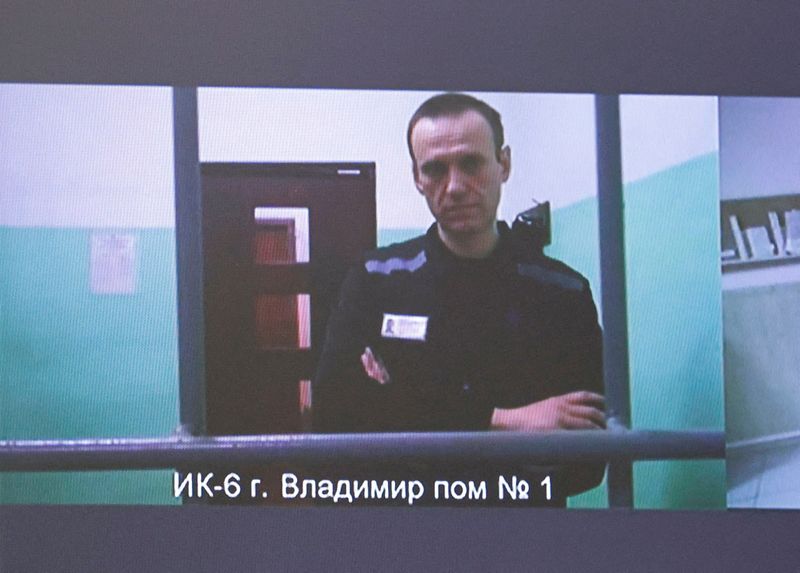

Navalny’s death was caused by dart frog poison, European allies say

Navalny’s death was caused by dart frog poison, European allies say

Business

Indian lender Manappuram gets RBI nod for Bain Capital to take joint control

Indian lender Manappuram gets RBI nod for Bain Capital to take joint control

Business

Factbox-ECB opens up euro lifeline in bid to boost global role

Factbox-ECB opens up euro lifeline in bid to boost global role

Business

ECB makes euro backstop global to bolster currency’s role

ECB makes euro backstop global to bolster currency’s role

Business

Canada wants Iran government change, increases sanctions

Canada wants Iran government change, increases sanctions

Business

Assailants kill at least 30 in northwest Nigeria villages, residents say

Assailants kill at least 30 in northwest Nigeria villages, residents say

Business

Israeli FM Saar to attend Trump’s first Board of Peace meeting on Thursday, official says

Israeli FM Saar to attend Trump’s first Board of Peace meeting on Thursday, official says

Business

‘Singles tax’ costs Americans living alone $10,470 annually in extra expenses

Altman Brothers Real Estate owner Josh Altman discusses the rising cost of California real estate on Varney & Co.

Americans who live alone are paying a five-figure “singles tax” amid rising rents around the nation, a new analysis finds.

Data from Zillow shows that the typical apartment rent is currently $1,745 and has risen 30% over the last five years, which represents a significant burden for renters who live alone and don’t have one or more roommates to split the bill with.

The premium paid by solo renters was dubbed the “singles tax” by Zillow, which found that the national average singles tax amounts to $10,470 per year.

“When you’re living alone, you’re covering the full rent on one income and that can add up fast,” said Emily Smith, Zillow rental trends expert. “Apartments often make living solo more attainable, while also offering shared spaces that help people feel connected.”

HOUSING MARKET COOLS AS PRICE GROWTH HITS SLOWEST PACE SINCE GREAT RECESSION RECOVERY

New York City had the largest “singles tax” in Zillow’s data, which amounted to $23,400 per year. (Thomas Trutschel/Photothek via Getty Images / Getty Images)

New York City tops the list of areas with the highest singles tax, as the Big Apple’s typical apartment rent of $3,900 a month amounts to a singles tax of $23,400 for the year.

San Jose ranked second, with a typical rent of $3,248 a month and a singles tax of $19,488 per year. Boston was close behind in third, with the typical rent in the city amounting to $3,014 a month and resulting in a singles tax of $18,084.

A pair of California cities rounded out the top five, with San Francisco in fourth based on a typical rent of $2,857 and a singles tax of $17,142, while Los Angeles ranked fifth with a typical monthly rent of $2,648 and a singles tax of $15,888.

HOMEBUYERS GAIN UPPER HAND IN 3 MAJOR CITIES AS INVENTORIES GROW

San Francisco ranked fourth on Zillow’s list with a “singles tax” of $17,142 per year. (Photo by Justin Sullivan/Getty Images / Getty Images)

Renters who pair up their living arrangement with a partner derive what Zillow called a “couples’ discount” from being able to split up the rental bill as well as utilities and other costs.

“For renters who choose to live with a partner or roommate, splitting everyday costs like rent, utilities and groceries can go a long way in easing the pressure of today’s higher cost of living,” Smith said.

Based on the firm’s national data, the couples’ discount amounts to a combined $20,940 in annual rental savings from splitting the bill.

RICH CALIFORNIANS FLOCK TO LAS VEGAS HOUSING MARKET AS LAWMAKERS CONSIDER WEALTH TAX

Los Angeles ranked fifth on Zillow’s list of cities with the largest “singles tax.” (iStock / iStock)

For example, given the sizable singles tax in the cities with the highest rent, couples in New York City can get a discount of $46,800 instead of the singles tax of $23,400.

The report noted the couples discount can go a long way toward helping renters save for a down payment on a home, with the national average couples discount of $20,940 being more than halfway to a 10% down payment on a typical U.S. home, per Zillow’s data.

-

Politics6 days ago

Politics6 days agoWhy Israel is blocking foreign journalists from entering

-

Business6 days ago

Business6 days agoLLP registrations cross 10,000 mark for first time in Jan

-

Sports3 days ago

Sports3 days agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

NewsBeat5 days ago

NewsBeat5 days agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

Business6 days ago

Business6 days agoCostco introduces fresh batch of new bakery and frozen foods: report

-

Tech4 days ago

Tech4 days agoSpaceX’s mighty Starship rocket enters final testing for 12th flight

-

NewsBeat6 days ago

NewsBeat6 days agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

Sports6 days ago

Sports6 days agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Video1 day ago

Video1 day agoThe Final Warning: XRP Is Entering The Chaos Zone

-

Politics6 days ago

Politics6 days agoThe Health Dangers Of Browning Your Food

-

Business6 days ago

Business6 days agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

![Heathrow has said passenger numbers were 60% lower in November than before the coronavirus pandemic and there were “high cancellations” among business travellers concerned about being trapped overseas for Christmas as Omicron spreads. The UK’s largest airport said the government’s travel restrictions had dealt a fresh blow to travel confidence and predicted it was likely to take several years for passenger numbers to return to pre-pandemic levels. This week ministers said passengers arriving in the UK would have to take a pre-departure Covid test, as well as a post-flight test, because of fears about the spread of the new variant. “[The] high level of cancellations by business travellers concerned about being trapped overseas because of pre-departure testing shows the potential harm to the economy of travel restrictions,” the airport said in an update. Heathrow said the drop in traveller confidence owing to the new travel restrictions had negated the benefit of reopening the all-important corridor to North America for business and holiday travel last month. Eleven African countries have been added to the government’s red list, requiring travellers to quarantine before reuniting with families. “By allowing Brits to isolate at home, ministers can make sure they are reunited with their loved ones this Christmas,” said John Holland-Kaye, the chief executive of Heathrow. “It would send a strong signal that restrictions on travel will be removed as soon as safely possible to give passengers the confidence to book for 2022, opening up thousands of new jobs for local people at Heathrow. Let’s reunite families for Christmas.” Heathrow said that if the government could safely signal that restrictions would be lifted soon, then employers at Heathrow would have the confidence to hire thousands of staff in anticipation of a boost in business next summer. The airport is expecting a slow start to 2022, finishing next year with about 45 million passengers – just over half of pre-pandemic levels. This week Tui, Europe’s largest package holiday operator, said it expected bookings for next summer to bounce back to 2019 levels. However, Heathrow said on Friday not to expect the aviation industry to recover for several years. “We do not expect that international travel will recover to 2019 levels until at least all travel restrictions (including testing) are removed from all the markets that we serve, at both ends of the route, and there is no risk of new restrictions, such as quarantine, being imposed,” the airport said.](https://wordupnews.com/wp-content/uploads/2026/02/shutterstock_1100012546-scaled-400x240.jpg)

![Heathrow has said passenger numbers were 60% lower in November than before the coronavirus pandemic and there were “high cancellations” among business travellers concerned about being trapped overseas for Christmas as Omicron spreads. The UK’s largest airport said the government’s travel restrictions had dealt a fresh blow to travel confidence and predicted it was likely to take several years for passenger numbers to return to pre-pandemic levels. This week ministers said passengers arriving in the UK would have to take a pre-departure Covid test, as well as a post-flight test, because of fears about the spread of the new variant. “[The] high level of cancellations by business travellers concerned about being trapped overseas because of pre-departure testing shows the potential harm to the economy of travel restrictions,” the airport said in an update. Heathrow said the drop in traveller confidence owing to the new travel restrictions had negated the benefit of reopening the all-important corridor to North America for business and holiday travel last month. Eleven African countries have been added to the government’s red list, requiring travellers to quarantine before reuniting with families. “By allowing Brits to isolate at home, ministers can make sure they are reunited with their loved ones this Christmas,” said John Holland-Kaye, the chief executive of Heathrow. “It would send a strong signal that restrictions on travel will be removed as soon as safely possible to give passengers the confidence to book for 2022, opening up thousands of new jobs for local people at Heathrow. Let’s reunite families for Christmas.” Heathrow said that if the government could safely signal that restrictions would be lifted soon, then employers at Heathrow would have the confidence to hire thousands of staff in anticipation of a boost in business next summer. The airport is expecting a slow start to 2022, finishing next year with about 45 million passengers – just over half of pre-pandemic levels. This week Tui, Europe’s largest package holiday operator, said it expected bookings for next summer to bounce back to 2019 levels. However, Heathrow said on Friday not to expect the aviation industry to recover for several years. “We do not expect that international travel will recover to 2019 levels until at least all travel restrictions (including testing) are removed from all the markets that we serve, at both ends of the route, and there is no risk of new restrictions, such as quarantine, being imposed,” the airport said.](https://wordupnews.com/wp-content/uploads/2026/02/shutterstock_1100012546-scaled-80x80.jpg) Business5 days ago

Business5 days agoWeight-loss jabs threaten Greggs’ growth, analysts warn

-

Crypto World3 days ago

Crypto World3 days agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

Crypto World4 days ago

Crypto World4 days agoBlockchain.com wins UK registration nearly four years after abandoning FCA process

-

Crypto World17 hours ago

Crypto World17 hours agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Crypto World4 days ago

Crypto World4 days agoU.S. BTC ETFs register back-to-back inflows for first time in a month

-

NewsBeat5 days ago

NewsBeat5 days agoResidents say city high street with ‘boarded up’ shops ‘could be better’

-

Video3 days ago

Video3 days agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

Sports5 days ago

Kirk Cousins Officially Enters the Vikings’ Offseason Puzzle

-

Crypto World4 days ago

Crypto World4 days agoEthereum Enters Capitulation Zone as MVRV Turns Negative: Bottom Near?