Money

Ardian and Rockfield seed pan-European student fund with €500m CBRE IM commitment

Ardian will act as investment manager for fund targeting best-in-class assets in undersupplied European markets.

The post Ardian and Rockfield seed pan-European student fund with €500m CBRE IM commitment appeared first on Property Week.

Money

Major discounter with over 850 locations to close branch in hours after just a year on high street

RETAILERS have been feeling the squeeze since the pandemic, while shoppers are cutting back on spending due to the soaring cost of living crisis.

High energy costs and a move to shopping online after the pandemic are also taking a toll, and many high street shops have struggled to keep going.

The high street has seen a whole raft of closures over the past year, and more are coming.

The number of jobs lost in British retail dropped last year, but 120,000 people still lost their employment, figures have suggested.

Figures from the Centre for Retail Research revealed that 10,494 shops closed for the last time during 2023, and 119,405 jobs were lost in the sector.

It was fewer shops than had been lost for several years, and a reduction from 151,641 jobs lost in 2022.

The centre’s director, Professor Joshua Bamfield, said the improvement is “less bad” than good.

Although there were some big-name losses from the high street, including Wilko, many large companies had already gone bust before 2022, the centre said, such as Topshop owner Arcadia, Jessops and Debenhams.

“The cost-of-living crisis, inflation and increases in interest rates have led many consumers to tighten their belts, reducing retail spend,” Prof Bamfield said.

“Retailers themselves have suffered increasing energy and occupancy costs, staff shortages and falling demand that have made rebuilding profits after extensive store closures during the pandemic exceptionally difficult.”

Alongside Wilko, which employed around 12,000 people when it collapsed, 2023’s biggest failures included Paperchase, Cath Kidston, Planet Organic and Tile Giant.

The Centre for Retail Research said most stores were closed because companies were trying to reorganise and cut costs rather than the business failing.

However, experts have warned there will likely be more failures this year as consumers keep their belts tight and borrowing costs soar for businesses.

The Body Shop and Ted Baker are the biggest names to have already collapsed into administration this year.

Money

Major Buy Now, Pay Later update for millions as huge rule change to protect shoppers will happen within months

HUGE changes to Buy Now, Pay Later rules that will protect shoppers are set to kick in within months under major new plans by the government, The Sun can reveal.

The new Labour government has confirmed that it intends to legislate to bring the Buy Now, Pay Later (BNPL) sector under the City watchdog’s rule by early 2025

This would mean the regulation would kick in in early 2026, The FCA said.

Proposals to regulate BNPL products were first touted in 2021, but have been repeatedly delayed.

We revealed earlier this year that the previous government had shelved the plans over fears that it would drive BNPL firms out of the market during a cost of living crisis.

But the lack of regulation around BNPL is bad news for shoppers as it means these firms don’t have to follow the same rules as major credit lenders and customers aren’t protected if things go wrong.

However, in an exclusive interview, economic secretary to the Treasury Tulip Siddiq told The Sun that the government has now finalised its “bespoke” plans and intends to pass the legislation “as soon as possible” in early 2025.

The plans will bring the products under FCA regulation while ensuring they also adhere to a large proportion of the Consumer Credit Act and Section 75, which give shoppers various rights.

The Treasury will run a short six-week consultation ending November 29 to iron out any final changes with stakeholders.

This would enable them to pass the legislation early in the New Year.

The City watchdog, the Financial Conduct Authority (FCA), will then have to run its own short consultation.

“The whole government is really behind this policy – the chancellor is really keen on it – because we don’t want a situation where people are trying to manage their debt and end up making it worse, which is what’s happening now,” Ms Siddiq said.

“But, we don’t want to get rid of BNPL, as there is a need in the market for it.”

What will the new rules mean for shoppers?

If a product or firm is regulated, it means that customers are covered by certain protections if they are treated unfairly or something goes wrong with their product or service.

We understand the current plans will mean the following:

Firms will have to operate in consumers’ best interests – or face FCA enforcement action

This means firms will have to be clear and transparent about any late fees, interest, or if they could affect customers’ credit ratings and how.

They should also signpost customers towards debt help in any correspondence.

“Firms will be under the supervision of the FCA who can bring enforcement action [against them] if we feel they are not treating consumers right or don’t have the consumers’ best interests at heart,” Ms Siddiq told The Sun.

Firms will have to carry out strict affordability checks

Ms Siddiq added that affordability checks will be the “number one” thing the FCA will be supervising.

Banks, for example, must review customers’ credit histories and financial situations to ensure they aren’t lending more money than they can afford.

But BNPL providers aren’t currently required to carry out such stringent checks, although some firms, like Klarna, have introduced them voluntarily.

Shoppers will be able to complain to the Financial Ombudsman Service (FOS) if they feel they’ve been treated unfairly

Consumers who deal with regulated financial firms are protected by the FOS, which settles disputes between companies and customers, if things go wrong.

But BNPL users can’t take complaints to the FOS if they have an issue.

“This supervision means there are certain rights consumers will have in terms of referring a complaint to the Financial Ombudsman Service (FOS), which you can’t do at the moment,” Ms Siddiq explained.

Firms will largely have to adhere to the Consumer Credit Act

Consumer credit in the UK is regulated by the Consumer Credit Act, which means these firms have to adhere to certain rules.

For example, firms are required to provide certain information documents and must advertise their products in a certain way.

Ms Siddiq said BNPL firms will largely have to follow these rules.

However, it is understood the Treasury has created bespoke plans to remove certain requirements around interest rates, as this doesn’t apply to BNPL firms.

It has also removed certain requirements around sending paper forms as BNPL is largely online-based.

Number of people relying on BNPL is growing

Image: Economic secretary to the Treasury Tulip Siddiq speaks to Citizens Advice workers about BNPL

By Laura Purkess, consumer features editor and consumer champion

I was invited to join City minister Tulip Siddiq in speaking to Citizens Advice staff at a branch in Southwark, London, about Buy Now Pay Later and I was blown away by how passionately the workers wanted to get this regulation over the line.

These workers hear day in, day out from people who have spiralled into debt that has followed them around for months or years after getting accepted for a BNPL product “in seconds”.

And they said some of the worst actors are sending people threatening letters with no explanation of where they can get proper debt help.

Some people are coming into branches with a pile of letters they’re too scared to open.

One staff member told me the number of people who rely on BNPL for basic living costs is clearly rising over time – but it’s those who are most vulnerable who are turning to it and ending up in an even worse situation.

“The majority of our clients are very vulnerable, English is not their first language, they’re not ‘offsite ‘au fait’ with this kind of thing, and they end up in a lot of trouble,” one worker told me.

“At the moment, if we hit a wall with a firm, we can’t direct them to anywhere else, we can’t point them to the FOS, that’s the end of the line.

“The sooner these regulations come in the better.”

Shoppers will be able to return items for a full refund if they are faulty or were mis-sold

The new plans will also bring BNPL products under Section 75 – a type of protection for shoppers which means they can return faulty items within a certain timeframe.

Currently, as BNPL products don’t have this protection applied to them, shoppers may not be able to get a refund or replacement of broken or damaged items bought this way.

Dame Clare Moriarty, chief executive of Citizens Advice, said of the plans: “We’ve long called for regulating the BNPL market and are glad to see the government making this a priority. We know the difference this can make to so many people’s lives.

“The FCA must act swiftly to set rules that protect consumers from unaffordable borrowing once the necessary legislation is in place.”

Sheldon Mills, executive director for consumers and competition at the FCA, added: “We welcome the government’s consultation on the regulation of buy now pay later products.

“We’re already preparing and will consult on the rules firms will need to follow once the law is changed. We will ensure consumers are appropriately protected while enabling firms to innovate and grow.’

What will it mean for people who rely on BNPL?

Like the previous government, Ms Siddiq is keen to ensure BNPL remains a viable payment method for people who need it.

Instead, the hope is that it will prevent people from taking on more than they can realistically afford to pay back.

“I’m not that concerned [about restricting access to BNPL] as I think what they will probably do is not borrow at such a high level,” Ms Siddiq told The Sun.

“If the firm carries out affordability checks and look at their credit ratings, they will say they can still get some form of credit, but they might also be able to come up with a repayment plan to pay it back.”

‘A real opportunity to provide protection’

Ms Siddiq has been working on BNPL regulation plans for several years and has regularly called for the rules to be implemented from the Opposition bench.

“I started looking into it a bit more and asking the government if they would do something, and they sort of paid lip service but didn’t do anything and they kept pushing it back,” she said.

So when the Labour Party won the general election in July, she decided to make it a top priority.

The plan was to confirm the plans within Labour’s first 100 days in government – a deadline they have just about missed.

Ms Siddiq was keen to get it right and has spent the past few weeks – and years – speaking with major players in the BNPL market to make sure the plans would work.

“I realised if we did win the election, this was a real opportunity to provide some protection for consumers and my own constituents,” she said.

“If you are using a BNPL product, you are probably struggling, you don’t use it on a whim, so for me it was about giving those people protection and rights.”

Sebastian Siemiatkowski, Co-founder and CEO of Klarna said: “Congratulations to Tulip Siddiq and the government on moving quickly! They have been working with the industry and consumer groups long before coming into office.

“We’re looking forward to carrying on that work to put proportionate rules in place that protect consumers while fostering growth.”

Consumer champion Martin Lewis has since posted on X, formerly Twitter: “The last Chancellor promised to regulate, then the tumbleweed rolled as he went silent, so I am delighted the new Government has quickly restarted the process.

“Too many are in trouble with multiple BNPL repayments, leading to debt-chasing and credit file damage.

“Regulation will mean firms must be overt that it’s a debt, have proper affordability rules, and will crucially let people go to the ombudsman if things go wrong.”

If you’re struggling with debt, there is plenty of free help available.

You can contact Citizens Advice’s advice line on 0800 144 8848 or speak to someone via chat on its website.

Charity Turn2Us, which helps people in financial need, can be contacted for free on 0808 802 2000 Monday to Friday between 9am and 5.30pm.

Protection is needed urgently for shoppers

By Laura Purkess, consumer features editor and consumer champion

It’s great news that the government has committed to getting regulation over the line by early next year.

It’s been years since the City watchdog, the FCA, first proposed regulating these products and a number of consultations have run since, but it’s proven trickier than it sounded to get the plans off the ground.

The sector is in desperate need of regulation to make sure the millions of households who use it have full protection if things go wrong.

The new Labour Government has long pledged that it would be much tougher on these firms than its predecessor and would get regulation through as a priority.

This announcement suggests this is not just lip service, and hopefully the Government continues to push ahead with this with the same enthusiasm over the next few months.

Money

‘Lock in a top savings rate now’ warn experts as best accounts are axed

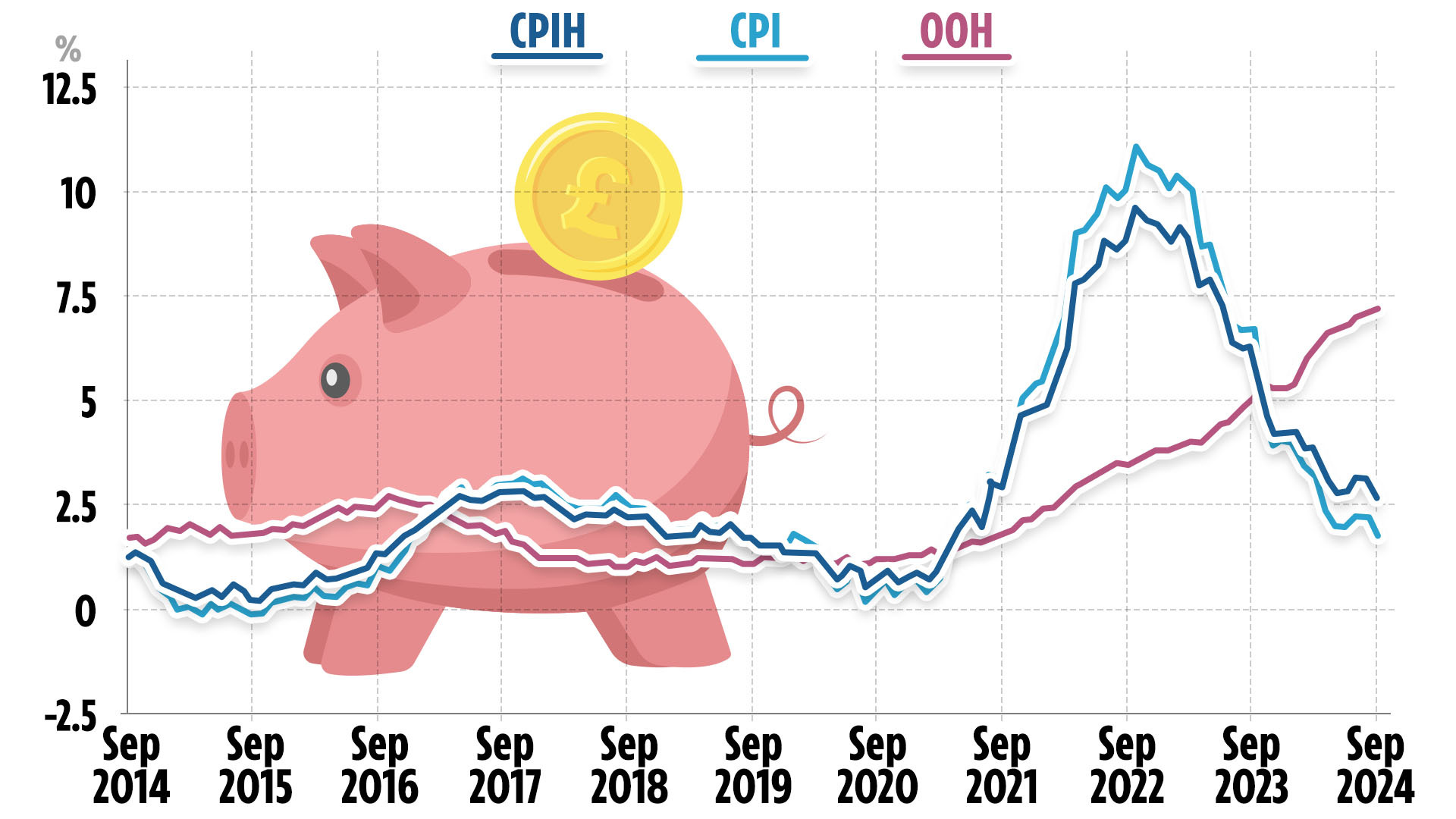

SAVERS looking for a top rate are being warned to act quickly after inflation fell by more than expected.

Savings rates have fallen since August when the Bank of England cut its base rate from 5.25% to 5%.

The rate is a key benchmark used by high street banks to set the interest rates it offers customers on borrowing and savings.

Inflation this week fell to 1.7% , the latest official figure reveal, which could prompt the central bank to slash rates again.

Rachel Springall, finance expert at MoneyFactsDaily, said savers may wish to “act quickly”.

She explained: “Those looking for guaranteed return may wish to act quickly to grab a top rate as there are expectations for interest rates to come down over the next couple of months.”

“Savers need to prepare themselves for interest rate cuts, so if fixed-rate bond or fixed Cash ISA rates plummet, savers may wish to choose a longer-term deal to secure a competitive rate for the next few years.”

A fixed-rate on savings means you have an account that locks away your money for a set period of time in exchange for a guaranteed interest rate.

It’s also known as a fixed-term bond. You may be able to choose how long your savings are locked away for, or it may be an amount of time set by your lender.

Locking in now could mean you secure e higher rate before they are cut.

These type of accounts are different to an easy-access account which lets you get hold of your cash immediately, but has a rate of interest that can change at any time.

Last month, and for the first time since January, the average interest rates for both fixed-term and easy access savings accounts declined across the board.

What’s on offer

There are only a few fixed deals currently on the market offering interest of 5%.

Two of the 5% deals are one-year fixes from the Union Bank of India.

The first offers 5% interest on a minimum deposit of £1,000 while the other offers the same on a minimum investment of £5,000.

The third is from Conister Bank which also offers 5% interest on a minimum deposit of £5,000 over one year.

There are a number of different savings accounts, but the fixed type often offers the most bang for your buck if you are looking to save money over a long period of time.

That is because if you fixed before a base rate cut your rate would stay the same.

Other examples include notice accounts which offer slightly lower rates in exchange for more flexibility when accessing your cash.

These accounts don’t lock your cash away for as long as a typical fixed bond account.

There are also regular savings accounts and easy-access accounts, which give you quick access to your money at a lower return.

Springall said: “Challenger banks and building societies continue to offer some of the top returns and have the same deposit protections in place as the more familiar high street banks, so there is little reason to overlook them in favour of a well-known brand.

“Whichever account savers decide to open, its essential they pick one that suits their needs, but if it’s an easy access account, make time to review the rate regularly.”

If you are looking to save and do not need access to your money for a few years then a two-year fix might be for you.

The best deal is from Market Harborough Building Society which offers 4.61 interest over a two year period.

However, you will have to invest a minimum of £10,000. Interest on this deal is paid yearly.

If you are looking to stow away your money for away for longer, a three-year fix could also be an option.

The more competitive option on the market for a three-year fix is by Principality Building Society.

It is offering 5% interest on a minimum of £500. With this type of account, the interest is paid on the anniversary of when you opened your account.

Four-year fixes operate just like all other fixed accounts, the only difference is you are kept away from your savings for longer.

Principality Building Society again has the best offer for four-year fixed deals.

The bank is offering 5% interest on a minimum investment of £500.

A cash ISA is a type of savings account that offers tax-free interest on your money.

This means you can earn interest on your savings in a bank or building society without paying tax.

You can save up to £20,000 each year tax-free in a cash ISA.

Virgin Money has the most competitive fixed one-year ISA.

The bank is offering 4.61% interest and the minimum amount you need to pay in a quid.

If you are looking for a two-year fixed ISA, State Bank of India is offering interest of 4.50% but the minimum you need to invest is £1,000.

If you are keen on something more long-term, UBL UK is offering customers 4.31% interest if they create a three-year fix ISA.

What is going on with interest rates?

Experts believe that September’s low rate of inflation could prompt the BoE to cut rates again.

This could single the end of attractive deals on fixed savings accounts, which have been slowly dwindling since the initial rate cut back in August.

Alice personal finance analyst at Bestinvest said that “locking in a top rate now” before the best deals disappear could be a “sensible strategy”.

Inflation, which measures how quickly the prices of things increase over time, fell below the Bank of England‘s 2% target for the first time in three years.

It’s important to note that when inflation drops it doesn’t mean that prices have stopped rising, it just means they are doing so at a slower pace.

The BoE can make changes to interest rates as a way to control inflation and keep it on target.

In recent years inflation has been far higher, creating the cost of living crisis, and the bank responded by hiking rates.

This has been bad news for borrowers especially homeowners with mortgages as interest rates on loans are far higher.

But it’s been good news for those with cash in the bank as rates on savings increased.

But as inflation falls that looks set to go into reverse with saving rates falling.

The BoE started raising its base rate in December 2021 from a historic low of 0.1% as the UK economy emerged from the coronavirus pandemic.

It reached 5.25% but the BoE cut that to 5% in August, marking the first cut since 2020.

How you can find the best savings rates

If you are trying to find the best savings rate there are websites you can use that can show you the best rates available.

Doing some research on websites such as MoneyFacts and price comparison sites including Compare the Market and Go Compare will quickly show you what’s out there.

These websites let you tailor your searches to an account type that suits you.

There are three types of savings accounts fixed, easy access, and regular savers.

A fixed-rate savings account offers some of the highest interest rates but comes at the cost of being unable to withdraw your cash within the agreed term.

This means that your money is locked in, so even if interest rates increase you are unable to move your money and switch to a better account.

Some providers give the option to withdraw but it comes with a hefty fee.

An easy-access account does what it says on the tin and usually allows unlimited cash withdrawals.

These accounts do tend to come with lower returns but are a good option if you want the freedom to move your money without being charged a penalty fee.

Lastly is a regular saver account, these accounts generate decent returns but only on the basis that you pay a set amount in each month.

Types of savings accounts

THERE are four types of savings accounts fixed, notice, easy access, and regular savers.

Separately, there are ISAs or individual savings accounts which allow individuals to save up to £20,000 a year tax-free.

But we’ve rounded up the main types of conventional savings accounts below.

FIXED-RATE

A fixed-rate savings account or fixed-rate bond offers some of the highest interest rates but comes at the cost of being unable to withdraw your cash within the agreed term.

This means that your money is locked in, so even if interest rates increase you are unable to move your money and switch to a better account.

Some providers give the option to withdraw, but it comes with a hefty fee.

NOTICE

Notice accounts offer slightly lower rates in exchange for more flexibility when accessing your cash.

These accounts don’t lock your cash away for as long as a typical fixed bond account.

You’ll need to give advance notice to your bank – up to 180 days in some cases – before you can make a withdrawal or you’ll lose the interest.

EASY-ACCESS

An easy-access account does what it says on the tin and usually allows unlimited cash withdrawals.

These accounts tend to offer lower returns, but they are a good option if you want the freedom to move your money without being charged a penalty fee.

REGULAR SAVER

These accounts pay some of the best returns as long as you pay in a set amount each month.

You’ll usually need to hold a current account with providers to access the best rates.

However, if you have a lot of money to save, these accounts often come with monthly deposit limits.

Money

‘I miss out on winter fuel payment by £2’ as state pensioners protest outside downing street over benefit axe

AMIDST a crowd of demonstrators outside Downing Street yesterday stood Robert Trewhella, a 68-year-old taxi driver from Cornwall.

Like millions of other state pensioners, Robert faces the grim reality of losing the £300 winter fuel payment this year.

The winter fuel payment was previously available to everyone over the state pension age (66).

However, cuts made by chancellor Rachel Reeves mean the payment is limited to retirees on pension credit or those receiving certain six other means-tested benefits.

It means that over 10million households will no longer qualify for the payment and a further 760,000 risk missing out if they don’t apply for pension credit before December 21.

In a powerful display of desperation, over a dozen state pensioners descended on Downing Street yesterday to protest these very cuts.

Robert was among several campaigners, backed by charities Independent Age, 38 Degrees, Silver Voices, and Organise, who delivered petitions with over half a million signatures calling for the policy to be reversed.

Robert lives alone in Penzance and receives a weekly state pension of £221, placing him just £2 above the threshold at which most people qualify for pension credit (£218.15 a week).

To make ends meet, he works a few hours each day for a small taxi company, earning approximately £300 a month.

Despite his efforts, Robert remains in a precarious financial situation.

He faces monthly expenses of £675 for private rent, £124 for council tax, and an additional £40 to £50 for gas and electricity costs.

With just under £10,000 in savings, Robert is caught in a cruel cycle of financial instability, relying on his savings to supplement his income.

He told The Sun: “I shouldn’t be working, I should be enjoying life at this point.

“But if I give it up, I will barely have enough to make ends meet, after all my savings won’t last forever.

“It’s cruel. I’m trapped in a cycle of deciding whether to work and live comfortably or suck it up and claim what little I can.”

Even if Robert were to retire, he would be eligible only for housing benefit and still not qualify for pension credit.

However, he would still not be eligible for pension credit and housing benefit claims on their own do not make you eligible for the winter fuel payment.

But, claims for housing benefit alone do not make one eligible for the Winter Fuel Payment.

When delivering the petition to Number 10 on Wednesday, Robert said: “Hopefully those in charge take notice and realise that too many older people will struggle this winter without this payment.

“It’s not right to take money away from vulnerable members of society.”

Joanna Elson CBE, chief executive of Independent Age added: “We hope the UK Government listens to the voices we’ve shared and protects the winter fuel payment for older people living on low incomes.

“It’s clear from the number of signatures that there is widespread concern about the plans.

“Tying the payment to pension credit will see far too many older people fall through the cracks.

“There are also many people in later life that just miss out on pension credit, sometimes by just a few pounds and pence.”

It comes after thousands of Sun readers flooded our Winter Fuel SOS helpline last Wednesday, looking for help to hang on to the payment.

The Sun has now launched a free tool to help you check whether you will get the winter fuel payment this year.

To be eligible for this year’s winter fuel payment, you must have an active claim for the benefits mentioned below during the “qualifying week,” which runs from 16 to 22 September.

These include Universal Credit, employment and support allowance (ESA), jobseeker’s allowance (JSA), income support, child tax credit and working tax credit and pension credit.

Most households automatically receive the winter fuel payment, including those on pension credit.

As new claims for pension credit can be backdated by up to three months, you can still apply now and qualify for this year’s winter fuel payment.

The absolute deadline to claim the benefit and qualify is December 21.

CHECK IF YOU QUALIFY

Pension credit tops up your weekly income to £218.15 if you are single or to £332.95 if you have a partner.

This is known as “guarantee credit”.

If your income is lower than this, you’re very likely to be eligible for the benefit.

However, if your income is slightly higher, you might still be eligible for pension credit if you have a disability, you care for someone, you have savings or you have housing costs.

You could get an extra £81.50 a week if you have a disability or claim any of the following:

- Attendance allowance

- The middle or highest rate from the care component of disability living allowance (DLA)

- The daily living component of personal independence payment (PIP)

- Armed forces independence payment

- The daily living component of adult disability payment (ADP) at the standard or enhanced rate.

You could get the “savings credit” part of pension credit if both of the following apply:

- You reached State Pension age before April 6, 2016

- You saved some money for retirement, for example, a personal or workplace pension

This part of pension credit is worth £17.01 for single people or £19.04 for couples.

Pension credit opens the door to other support, including housing benefits, cost of living payments, council tax reductions and the winter fuel payment.

Claims for pension credit also open doors to a number of freebies and discounts.

For example, pension credit claimants over 75 qualify for a free TV licence worth up to £169.50 a year.

Claims for the benefit also provide eligibility to £25 a week cold weather payments and the £150 warm home discount.

We have a guide on all the state pension freebies and discounts you can get.

How do I apply for pension credit?

YOU can start your application up to four months before you reach state pension age.

Applications for pension credit can be made on the government website or by ringing the pension credit claim line on 0800 99 1234.

You can get a friend or family member to ring for you, but you’ll need to be with them when they do.

You’ll need the following information about you and your partner if you have one:

- National Insurance number

- Information about any income, savings and investments you have

- Information about your income, savings and investments on the date you want to backdate your application to (usually three months ago or the date you reached state pension age)

You can also check your eligibility online by visiting www.gov.uk/pension-credit first.

If you claim after you reach pension age, you can backdate your claim for up to three months.

How much is the winter fuel payment and how is it paid?

Payments last year were worth between £300 and £600, depending on your specific circumstances.

This is because the amount included a “Pensioner Cost of Living Payment” – between £150 and £300.

This year, it will be worth £200 for eligible households or £300 for eligible households with someone aged over 80.

That means you could receive up to £300 in free cash depending on your circumstances.

Most payments are made automatically in November or December.

You’ll get a letter telling you:

- How much you’ll get

- Which bank account it will be paid into

If you do not get a letter or the money has not been paid into your account by January 29, 2025, you must contact the Winter Fuel Payment Centre on 0800 731 0160.

Are you missing out on benefits?

YOU can use a benefits calculator to help check that you are not missing out on money you are entitled to

Charity Turn2Us’ benefits calculator works out what you could get.

Entitledto’s free calculator determines whether you qualify for various benefits, tax credit and Universal Credit.

MoneySavingExpert.com and charity StepChange both have benefits tools powered by Entitledto’s data.

You can use Policy in Practice’s calculator to determine which benefits you could receive and how much cash you’ll have left over each month after paying for housing costs.

Your exact entitlement will only be clear when you make a claim, but calculators can indicate what you might be eligible for.

Money

How to Save for a House Deposit in 2 Years: A Step-by-Step Guide – Finance Monthly

Saving for a house deposit might seem daunting, but with proper planning, discipline, and the right strategies, you can reach your goal within 2 years. Whether you’re a first-time buyer or planning for your next property, following these tips will help you achieve your target faster and save for a house deposit in 2 years.

Set a Clear Savings Goal

Before you begin saving, you need to know how much you should save for a house deposit. Most buyers require between 5-20% of the property’s value for a deposit. For example, if you’re aiming to buy a £200,000 property, you’ll need a deposit between £10,000 and £40,000. Breaking this down into monthly targets will help you understand how much you need to save to reach your deposit goal in two years. It’s worth knowing that the average property price for the UK in October 2024 is £293,000, although there is significant regional variation. You’d need a deposit between £14,650 and £58,600 based on the average house price above.

Create a Detailed Budget

One of the best ways to save efficiently is by creating a budget that tracks your income and expenses. Budgeting Apps like Monzo, YNAB, or Emma can help you see exactly where your money goes and identify areas where you can cut back. A well-structured budget will ensure that you stay on track toward your savings target. Budgeting for a house deposit is essential, as it allows you to prioritize savings over unnecessary spending.

Open a Dedicated Savings Account

To maximize your savings, consider opening a high-interest savings account or a Lifetime ISA (LISA) if you’re a first-time buyer. A LISA offers a 25% government bonus (up to £1,000 annually), which can significantly boost your deposit savings. You can put in up to £4,000 each year until you’re 50. You must make your first payment into your ISA before you’re 40; otherwise, you’ll miss out.

Keeping your savings in a dedicated account will reduce the temptation to dip into it for other expenses. Obviously, there are conditions attached to a LISA, such as it must be used to buy your first house, and the £4000 does count towards your annual ISA allowance of £20000.

Cut Unnecessary Expenses

Cutting down on unnecessary expenses is crucial to hit your savings goal. Consider reducing discretionary spending on things like dining out, entertainment, gym memberships or subscriptions you rarely use, and never go to a supermarket without a shopping list. If you have Netflix, Prime, Apple TV and Disney +, do you need them all? Redirect the money saved into your house deposit savings fund. Even small sacrifices like cutting back on daily Starbucks can accumulate over time; ditching a fancy coffee a day can save approximately £1600 per year!

Boost Your Income

If cutting expenses alone doesn’t get you where you need to be, consider ways to boost your income. Picking up a side hustle like freelance work, tutoring, or driving for Uber can help you save faster. Alternatively, asking for a raise at your current job or exploring a new job opportunity can significantly accelerate your progress toward your deposit goal.

Explore Government Schemes

First-time buyers can benefit from government support, for example, in England, the First Homes Scheme, which, if you’re a first-time buyer, you may be able to buy a home for 30% to 50% less than its market value. Obviously, there are conditions such as the home must be your only or main residence, and you do need a mortgage offer for at least half the price of the home – tap into the bank of Mum and Dad, perhaps? Although you can no longer apply for a Help to Buy Equity Loan for properties in England, you can still apply for a similar scheme in Wales. This scheme offers equity Mortgages to buyers of new-build homes.

Automate Your Savings

Setting up automatic transfers to your savings account is a great way to stay consistent. Automating your savings allows you to transfer a set amount of money every month without thinking about it. This ensures that your deposit grows steadily, and you are more likely to stay on track with your savings goals. Many digital banking apps, such as Revolut and Monzo, also offer the facility to put your spare change from purchases directly into a savings account. This is a great way of building up a pot of cash without even thinking about it.

Avoid Debt and Build Credit

While you’re saving for a deposit, it’s important to avoid taking on new debt that could affect your mortgage application. Focus on building your credit score by paying off existing debts and making sure all bills are paid on time. A strong credit score will help you secure better mortgage rates when you’re ready to buy. Another thing to consider is that mortgage lenders will carry out affordability checks when you apply for a mortgage, so if you are spending £500 a month on a shiny new car, they will consider that when deciding how much you can afford to pay each month.

Track Progress and Stay Motivated – Avoid temptation

Saving for a house deposit can feel like a long journey, but by regularly tracking your progress, you’ll stay motivated. Break your total savings goal into smaller milestones, and celebrate when you achieve them – frugally! Keeping your eye on the bigger goal of homeownership can help you stay focused throughout the process. While you may not want to live like monks and never go out, you may want to think about giving your high-spending friends a bit of a wide birth if they are constantly eating out – the peer pressure could prove too much and before you know it you’ve spent £100 on a meal. According to the ONS ( Office for National Statistics), the average household spends around £1278 per year eating out – not including alcohol.

Bonus Tip: Stay Updated with Property Market Trends

As you save, keep an eye on UK property market trends and mortgage interest rates. Also, sites like Zoopla provide a lot of information on market trends. Being aware of market shifts and interest rate changes will help you make informed decisions when the time comes to buy.

Money

Industry gives final thoughts on FCA’s value for money framework proposals

Pensions providers and industry experts are having their final say on the FCA’s value for money framework proposals ahead of the consultation closing today (17 October).

In August, the FCA laid out plans to provide millions of pensions savers with better value for money.

Under the proposals, defined contribution (DC) pension schemes will be required to publicly disclose how they are doing across the three key metrics.

These are investment performance, quality of service and cost.

Each will be assessed against a red, amber and green ‘traffic light system’ to determine which – if any – need attention.

Poorly performing schemes will be required to provide an action plan of how they will improve or if they don’t, “protect” savers by transferring them to better schemes.

Where schemes are assessed as not delivering value for money, they will be closed to new business until they improve.

The regulator added that this should reduce the number of savers with workplace personal pensions that are not delivering value.

This, it added, will be done through greater scrutiny and competition on long-term value rather than predominantly cost.

If the proposals go ahead, it will be a mandatory requirement for regulated firms to provide an annual report at the end of each calendar year.

The new value for money framework has been produced in partnership with the FCA, The Pensions Regulator (TPR) and the Department for Work and Pensions (DWP).

The FCA is proposing data metrics be disclosed in retirement age cohorts for the three stages of a pension savings journeys: growth, de-risking and at retirement.

The regulator is also proposing to require disclosure of past investment performance at three levels.

The framework is designed to work in conjunction with the Consumer Duty, which states firms have an obligation to deliver fair value from pension products they offer.

The Association of British Insurers’ director of long-term savings, health and protection, Yvonne Braun, said: “The value for money framework could transform the workplace pensions market by driving a more holistic assessment of pension schemes for their overall value proposition and improving the comparability of schemes. We fully support both aims as they should benefit savers.

“It will be crucial to further finesse the metrics to guard against duplicating the Consumer Duty, and to ensure the proposed red-amber-green ratings and their implications do not trigger market disruption.

“It is also very important that the framework is applied to the trust and contract-based market consistently and at the same time.”

FCA unveils plan to give pension savers better value for money

CEO at NOW: Pensions, Patrick Luthi, said he “welcomed the FCA’s efforts to shift focus from purely cost and charges towards a more holistic view of value”.

However, he added that there are “key concerns we believe must be addressed by the FCA to ensure the intended outcomes are realised”.

“Firstly, we are concerned that a one-size-fits-all approach may not fully account for the market’s diversity, without considering the specific needs of different market segments.

“Furthermore, we believe there needs to be a greater focus on risk-based regulation.

“In practice, this should include widening the scope of the framework to include both workplace and non-workplace pensions to reflect the varying risks and protections in these systems.

“We believe that process and metrics used in the consultation need more refinement. For example, the exclusion of forward-looking investment performance metrics could stifle innovation and deter investment in private markets.”

Director and head of DC at LawDeb, Elizabeth Hartree, said: “The UK DC pensions landscape is in reasonably good shape, and we believe it allows for the provision of good outcomes for members.

“Regulatory initiatives that improve those outcomes should be welcomed, but must consider both the intended and unintended consequences.

“The value for money framework – as it stands – has the potential to risk driving provider behaviours that, in our opinion, are not in the best interests of savers.

Aegon pensions director, Steven Cameron, said: “Aegon is supportive of a single value for money framework across all defined contribution workplace schemes – contract and trust-based – to enable transparency and comparability.

“While the aims of the FCA proposals are sound, as always, the devil is in the detail, and there’s a lot of detail and prescription here.

“Our three key concerns relate to the sheer volume of data, the proposed 3-level RAG rating and its commercial implications, and the need for careful implementation with a trial period.

“We have suggested limiting past investment performance to three, five and 10 years, as one year is too short and 15 years looks like ancient history for a current value assessment.

“We also recommend focusing on the last year’s charges, rather than historic administration charges that have little relevance to current value for money.”

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoHyperelastic gel is one of the stretchiest materials known to science

-

Technology4 weeks ago

Technology4 weeks agoWould-be reality TV contestants ‘not looking real’

-

Science & Environment4 weeks ago

Science & Environment4 weeks ago‘Running of the bulls’ festival crowds move like charged particles

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoHow to unsnarl a tangle of threads, according to physics

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoMaxwell’s demon charges quantum batteries inside of a quantum computer

-

Technology3 weeks ago

Technology3 weeks agoIs sharing your smartphone PIN part of a healthy relationship?

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoLiquid crystals could improve quantum communication devices

-

Womens Workouts3 weeks ago

Womens Workouts3 weeks ago3 Day Full Body Women’s Dumbbell Only Workout

-

Science & Environment3 weeks ago

Science & Environment3 weeks agoX-rays reveal half-billion-year-old insect ancestor

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoQuantum ‘supersolid’ matter stirred using magnets

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoSunlight-trapping device can generate temperatures over 1000°C

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoWhy this is a golden age for life to thrive across the universe

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoQuantum forces used to automatically assemble tiny device

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoNerve fibres in the brain could generate quantum entanglement

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoITER: Is the world’s biggest fusion experiment dead after new delay to 2035?

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoA slight curve helps rocks make the biggest splash

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoHow to wrap your mind around the real multiverse

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoLaser helps turn an electron into a coil of mass and charge

-

News1 month ago

the pick of new debut fiction

-

News4 weeks ago

News4 weeks agoOur millionaire neighbour blocks us from using public footpath & screams at us in street.. it’s like living in a WARZONE – WordupNews

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoTime travel sci-fi novel is a rip-roaringly good thought experiment

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoNuclear fusion experiment overcomes two key operating hurdles

-

Technology3 weeks ago

Technology3 weeks agoWhy Machines Learn: A clever primer makes sense of what makes AI possible

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoPhysicists are grappling with their own reproducibility crisis

-

News1 month ago

News1 month ago▶️ Hamas in the West Bank: Rising Support and Deadly Attacks You Might Not Know About

-

News4 weeks ago

News4 weeks ago▶️ Media Bias: How They Spin Attack on Hezbollah and Ignore the Reality

-

News4 weeks ago

News4 weeks agoYou’re a Hypocrite, And So Am I

-

Business3 weeks ago

Eurosceptic Andrej Babiš eyes return to power in Czech Republic

-

Sport4 weeks ago

Sport4 weeks agoJoshua vs Dubois: Chris Eubank Jr says ‘AJ’ could beat Tyson Fury and any other heavyweight in the world

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoA new kind of experiment at the Large Hadron Collider could unravel quantum reality

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoCaroline Ellison aims to duck prison sentence for role in FTX collapse

-

Technology3 weeks ago

Technology3 weeks agoMicrophone made of atom-thick graphene could be used in smartphones

-

Business2 weeks ago

Business2 weeks agoWhen to tip and when not to tip

-

Sport2 weeks ago

Sport2 weeks agoCoco Gauff stages superb comeback to reach China Open final

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoPhysicists have worked out how to melt any material

-

News1 month ago

News1 month agoNew investigation ordered into ‘doorstep murder’ of Alistair Wilson

-

News4 weeks ago

The Project Censored Newsletter – May 2024

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoRethinking space and time could let us do away with dark matter

-

Technology3 weeks ago

Technology3 weeks agoQuantum computers may work better when they ignore causality

-

Sport3 weeks ago

Sport3 weeks agoWatch UFC star deliver ‘one of the most brutal knockouts ever’ that left opponent laid spark out on the canvas

-

Technology3 weeks ago

Technology3 weeks agoUniversity examiners fail to spot ChatGPT answers in real-world test

-

Sport2 weeks ago

Sport2 weeks agoWales fall to second loss of WXV against Italy

-

Technology2 weeks ago

Technology2 weeks agoUkraine is using AI to manage the removal of Russian landmines

-

Business2 weeks ago

DoJ accuses Donald Trump of ‘private criminal effort’ to overturn 2020 election

-

Technology2 weeks ago

Technology2 weeks agoThis AI video generator can melt, crush, blow up, or turn anything into cake

-

Health & fitness4 weeks ago

Health & fitness4 weeks agoThe secret to a six pack – and how to keep your washboard abs in 2022

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoA tale of two mysteries: ghostly neutrinos and the proton decay puzzle

-

Technology3 weeks ago

Technology3 weeks agoRobo-tuna reveals how foldable fins help the speedy fish manoeuvre

-

Business3 weeks ago

Should London’s tax exiles head for Spain, Italy . . . or Wales?

-

MMA3 weeks ago

MMA3 weeks agoConor McGregor challenges ‘woeful’ Belal Muhammad, tells Ilia Topuria it’s ‘on sight’

-

Football3 weeks ago

Football3 weeks agoFootball Focus: Martin Keown on Liverpool’s Alisson Becker

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoFuture of fusion: How the UK’s JET reactor paved the way for ITER

-

Technology3 weeks ago

Technology3 weeks ago‘From a toaster to a server’: UK startup promises 5x ‘speed up without changing a line of code’ as it plans to take on Nvidia, AMD in the generative AI battlefield

-

News4 weeks ago

News4 weeks agoIsrael strikes Lebanese targets as Hizbollah chief warns of ‘red lines’ crossed

-

Technology4 weeks ago

Technology4 weeks agoThe ‘superfood’ taking over fields in northern India

-

Technology3 weeks ago

Technology3 weeks agoGet ready for Meta Connect

-

Health & fitness3 weeks ago

Health & fitness3 weeks agoThe 7 lifestyle habits you can stop now for a slimmer face by next week

-

Business2 weeks ago

Bank of England warns of ‘future stress’ from hedge fund bets against US Treasuries

-

Technology2 weeks ago

Technology2 weeks agoAmazon’s Ring just doubled the price of its alarm monitoring service for grandfathered customers

-

News2 weeks ago

News2 weeks agoHeartbreaking end to search as body of influencer, 27, found after yacht party shipwreck on ‘Devil’s Throat’ coastline

-

Politics3 weeks ago

Robert Jenrick vows to cut aid to countries that do not take back refused asylum seekers | Robert Jenrick

-

Business2 weeks ago

Ukraine faces its darkest hour

-

TV2 weeks ago

TV2 weeks agoPhillip Schofield accidentally sets his camp on FIRE after using emergency radio to Channel 5 crew

-

News2 weeks ago

News2 weeks agoHull KR 10-8 Warrington Wolves – Robins reach first Super League Grand Final

-

Entertainment2 weeks ago

Entertainment2 weeks agoChristopher Ciccone, artist and Madonna’s younger brother, dies at 63

-

Sport4 weeks ago

Sport4 weeks agoUFC Edmonton fight card revealed, including Brandon Moreno vs. Amir Albazi headliner

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoBeing in two places at once could make a quantum battery charge faster

-

News1 month ago

News1 month agoHow FedEx CEO Raj Subramaniam Is Adapting to a Post-Pandemic Economy

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoUK spurns European invitation to join ITER nuclear fusion project

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoWhy we need to invoke philosophy to judge bizarre concepts in science

-

CryptoCurrency4 weeks ago

CryptoCurrency4 weeks agoCardano founder to meet Argentina president Javier Milei

-

Politics4 weeks ago

‘Appalling’ rows over Sue Gray must stop, senior ministers say | Sue Gray

-

Politics4 weeks ago

UK consumer confidence falls sharply amid fears of ‘painful’ budget | Economics

-

TV4 weeks ago

TV4 weeks agoCNN TÜRK – 🔴 Canlı Yayın ᴴᴰ – Canlı TV izle

-

News4 weeks ago

News4 weeks agoWhy Is Everyone Excited About These Smart Insoles?

-

Womens Workouts3 weeks ago

Womens Workouts3 weeks ago3 Day Full Body Toning Workout for Women

-

CryptoCurrency4 weeks ago

CryptoCurrency4 weeks agoDZ Bank partners with Boerse Stuttgart for crypto trading

-

Business4 weeks ago

Thames Water seeks extension on debt terms to avoid renationalisation

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoMeet the world's first female male model | 7.30

-

News4 weeks ago

News4 weeks agoFour dead & 18 injured in horror mass shooting with victims ‘caught in crossfire’ as cops hunt multiple gunmen

-

Servers computers3 weeks ago

Servers computers3 weeks agoWhat are the benefits of Blade servers compared to rack servers?

-

Sport2 weeks ago

Sport2 weeks agoWorld’s sexiest referee Claudia Romani shows off incredible figure in animal print bikini on South Beach

-

Sport2 weeks ago

Sport2 weeks agoLauren Keen-Hawkins: Injured amateur jockey continues progress from serious head injury

-

Business2 weeks ago

Business2 weeks agoChancellor Rachel Reeves says she needs to raise £20bn. How might she do it?

-

MMA2 weeks ago

MMA2 weeks agoDana White’s Contender Series 74 recap, analysis, winner grades

-

MMA2 weeks ago

MMA2 weeks agoPereira vs. Rountree prediction: Champ chases legend status

-

Technology2 weeks ago

Technology2 weeks agoTexas is suing TikTok for allegedly violating its new child privacy law

-

News2 weeks ago

News2 weeks agoMassive blasts in Beirut after renewed Israeli air strikes

-

Football2 weeks ago

Football2 weeks agoRangers & Celtic ready for first SWPL derby showdown

-

Business2 weeks ago

Can liberals be trusted with liberalism?

-

News2 weeks ago

News2 weeks ago▶ Hamas Spent $1B on Tunnels Instead of Investing in a Future for Gaza’s People

-

News2 weeks ago

News2 weeks agoNavigating the News Void: Opportunities for Revitalization

-

Entertainment2 weeks ago

Entertainment2 weeks ago“Golden owl” treasure hunt launched decades ago may finally have been solved

-

Politics4 weeks ago

Politics4 weeks agoTrump says he will meet with Indian Prime Minister Narendra Modi next week

-

CryptoCurrency4 weeks ago

CryptoCurrency4 weeks agoEthereum is a 'contrarian bet' into 2025, says Bitwise exec

-

Health & fitness4 weeks ago

Health & fitness4 weeks agoThe maps that could hold the secret to curing cancer

-

Business1 month ago

JPMorgan in talks to take over Apple credit card from Goldman Sachs

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoQuantum time travel: The experiment to ‘send a particle into the past’

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoTiny magnet could help measure gravity on the quantum scale

-

Science & Environment4 weeks ago

Science & Environment4 weeks agoMost accurate clock ever can tick for 40 billion years without error

You must be logged in to post a comment Login