Business

Canada wants Iran government change, increases sanctions

Business

Howmet Aerospace: I Was Wrong, But The Stock Remains Expensive

Dhierin-Perkash Bechai is an aerospace, defense and airline analyst.

Dhierin runs the investing group The Aerospace Forum, whose goal is to discover investment opportunities in the aerospace, defense and airline industry. With a background in aerospace engineering, he provides analysis of a complex industry with significant growth prospects, and offers context to developments as they occur, describing how they might affect investment theses. His investing ideas are driven by data informed analysis. The investing group also provides direct access to data analytics monitors.

Learn more.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Business

The Kraft Heinz Company (KHC) Q4 2025 Earnings Call Prepared Remarks Transcript

Anne-Marie Megela

VP & Global Head of Investor Relations

Hello. This is Anne-Marie Megela, Head of Global Investor Relations at The Kraft Heinz Company. I’d like to welcome you to our fourth quarter and full year 2025 business update. During the following remarks, we will make forward-looking statements regarding our expectations for the future, including related to our business plans and expectations, strategy, efforts and investments and related timing and expected impacts. These statements are based on how we see things today, and actual results may differ materially due to risks and uncertainties. Please see the cautionary statements and risk factors contained in today’s earnings release, which accompany these remarks as well as our most recent 10-K, 10-Q and 8-K filings for more information regarding these risks and uncertainties.

Additionally, we will refer to non-GAAP financial measures, which exclude certain items from our financial results reported in accordance with GAAP. Please refer to today’s earnings release and the non-GAAP information that accompany these remarks, which are available on our website at ir.kraftheinzcompany.com under News & Events for a discussion of our non-GAAP financial measures and reconciliations to the comparable GAAP financial measures. Today, our Chief Executive Officer, Steve Cahillane, will provide an update on our overall strategy and business performance. Andre Maciel, our Chief Global Financial Officer, will then provide a financial review of the fourth quarter results, and we will conclude by discussing our 2026 outlook. We have also scheduled a separate live question-and-answer session with analysts. You can access our question-and-answer session at ir.kraftheinzcompany.com. A replay will also be available following the event through the same website.

Business

5 Steps to Build a Pre-IPO Portfolio Using IPO Genie’s AI Platform

5 Steps to Build a Pre-IPO Portfolio Using IPO Genie’s AI Platform

Business

Roku's Razor And Blade Model Drives Long-Term Profitable Growth Prospects

Roku's Razor And Blade Model Drives Long-Term Profitable Growth Prospects

Business

Carney tells Tumbler Ridge residents that Canadians ’will always be with you’ following mass shooting

Carney tells Tumbler Ridge residents that Canadians ’will always be with you’ following mass shooting

Business

Trump vs Bad Bunny: A Super Bowl feud with possible midterm consequences

Trump vs Bad Bunny: A Super Bowl feud with possible midterm consequences

Business

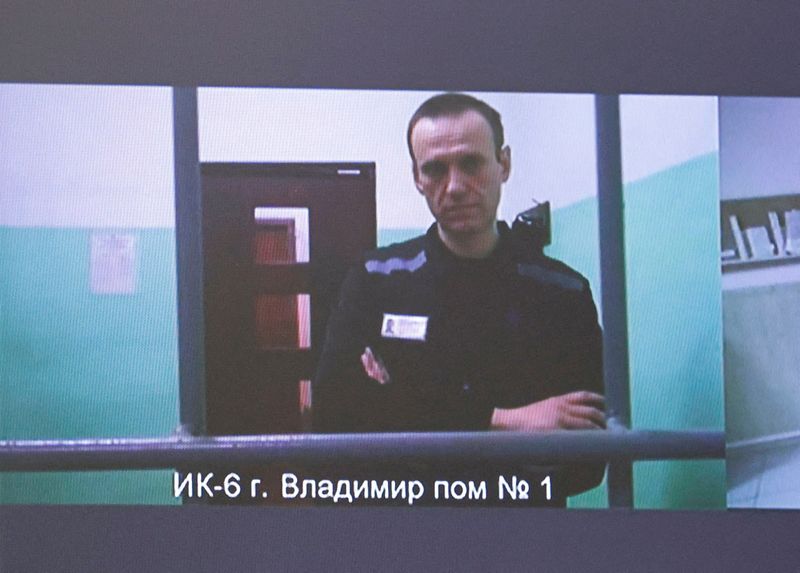

Navalny’s death was caused by dart frog poison, European allies say

Navalny’s death was caused by dart frog poison, European allies say

Business

Indian lender Manappuram gets RBI nod for Bain Capital to take joint control

Indian lender Manappuram gets RBI nod for Bain Capital to take joint control

Business

Factbox-ECB opens up euro lifeline in bid to boost global role

Factbox-ECB opens up euro lifeline in bid to boost global role

Business

ECB makes euro backstop global to bolster currency’s role

ECB makes euro backstop global to bolster currency’s role

-

Politics6 days ago

Politics6 days agoWhy Israel is blocking foreign journalists from entering

-

Business6 days ago

Business6 days agoLLP registrations cross 10,000 mark for first time in Jan

-

Sports3 days ago

Sports3 days agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

NewsBeat5 days ago

NewsBeat5 days agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

Business6 days ago

Business6 days agoCostco introduces fresh batch of new bakery and frozen foods: report

-

Tech4 days ago

Tech4 days agoSpaceX’s mighty Starship rocket enters final testing for 12th flight

-

NewsBeat6 days ago

NewsBeat6 days agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

Sports6 days ago

Sports6 days agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Video1 day ago

Video1 day agoThe Final Warning: XRP Is Entering The Chaos Zone

-

Politics6 days ago

Politics6 days agoThe Health Dangers Of Browning Your Food

-

Business6 days ago

Business6 days agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

![Heathrow has said passenger numbers were 60% lower in November than before the coronavirus pandemic and there were “high cancellations” among business travellers concerned about being trapped overseas for Christmas as Omicron spreads. The UK’s largest airport said the government’s travel restrictions had dealt a fresh blow to travel confidence and predicted it was likely to take several years for passenger numbers to return to pre-pandemic levels. This week ministers said passengers arriving in the UK would have to take a pre-departure Covid test, as well as a post-flight test, because of fears about the spread of the new variant. “[The] high level of cancellations by business travellers concerned about being trapped overseas because of pre-departure testing shows the potential harm to the economy of travel restrictions,” the airport said in an update. Heathrow said the drop in traveller confidence owing to the new travel restrictions had negated the benefit of reopening the all-important corridor to North America for business and holiday travel last month. Eleven African countries have been added to the government’s red list, requiring travellers to quarantine before reuniting with families. “By allowing Brits to isolate at home, ministers can make sure they are reunited with their loved ones this Christmas,” said John Holland-Kaye, the chief executive of Heathrow. “It would send a strong signal that restrictions on travel will be removed as soon as safely possible to give passengers the confidence to book for 2022, opening up thousands of new jobs for local people at Heathrow. Let’s reunite families for Christmas.” Heathrow said that if the government could safely signal that restrictions would be lifted soon, then employers at Heathrow would have the confidence to hire thousands of staff in anticipation of a boost in business next summer. The airport is expecting a slow start to 2022, finishing next year with about 45 million passengers – just over half of pre-pandemic levels. This week Tui, Europe’s largest package holiday operator, said it expected bookings for next summer to bounce back to 2019 levels. However, Heathrow said on Friday not to expect the aviation industry to recover for several years. “We do not expect that international travel will recover to 2019 levels until at least all travel restrictions (including testing) are removed from all the markets that we serve, at both ends of the route, and there is no risk of new restrictions, such as quarantine, being imposed,” the airport said.](https://wordupnews.com/wp-content/uploads/2026/02/shutterstock_1100012546-scaled-400x240.jpg)

![Heathrow has said passenger numbers were 60% lower in November than before the coronavirus pandemic and there were “high cancellations” among business travellers concerned about being trapped overseas for Christmas as Omicron spreads. The UK’s largest airport said the government’s travel restrictions had dealt a fresh blow to travel confidence and predicted it was likely to take several years for passenger numbers to return to pre-pandemic levels. This week ministers said passengers arriving in the UK would have to take a pre-departure Covid test, as well as a post-flight test, because of fears about the spread of the new variant. “[The] high level of cancellations by business travellers concerned about being trapped overseas because of pre-departure testing shows the potential harm to the economy of travel restrictions,” the airport said in an update. Heathrow said the drop in traveller confidence owing to the new travel restrictions had negated the benefit of reopening the all-important corridor to North America for business and holiday travel last month. Eleven African countries have been added to the government’s red list, requiring travellers to quarantine before reuniting with families. “By allowing Brits to isolate at home, ministers can make sure they are reunited with their loved ones this Christmas,” said John Holland-Kaye, the chief executive of Heathrow. “It would send a strong signal that restrictions on travel will be removed as soon as safely possible to give passengers the confidence to book for 2022, opening up thousands of new jobs for local people at Heathrow. Let’s reunite families for Christmas.” Heathrow said that if the government could safely signal that restrictions would be lifted soon, then employers at Heathrow would have the confidence to hire thousands of staff in anticipation of a boost in business next summer. The airport is expecting a slow start to 2022, finishing next year with about 45 million passengers – just over half of pre-pandemic levels. This week Tui, Europe’s largest package holiday operator, said it expected bookings for next summer to bounce back to 2019 levels. However, Heathrow said on Friday not to expect the aviation industry to recover for several years. “We do not expect that international travel will recover to 2019 levels until at least all travel restrictions (including testing) are removed from all the markets that we serve, at both ends of the route, and there is no risk of new restrictions, such as quarantine, being imposed,” the airport said.](https://wordupnews.com/wp-content/uploads/2026/02/shutterstock_1100012546-scaled-80x80.jpg) Business5 days ago

Business5 days agoWeight-loss jabs threaten Greggs’ growth, analysts warn

-

Crypto World3 days ago

Crypto World3 days agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

Crypto World4 days ago

Crypto World4 days agoBlockchain.com wins UK registration nearly four years after abandoning FCA process

-

Crypto World18 hours ago

Crypto World18 hours agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

NewsBeat5 days ago

NewsBeat5 days agoResidents say city high street with ‘boarded up’ shops ‘could be better’

-

Crypto World5 days ago

Crypto World5 days agoU.S. BTC ETFs register back-to-back inflows for first time in a month

-

Video3 days ago

Video3 days agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

Sports5 days ago

Kirk Cousins Officially Enters the Vikings’ Offseason Puzzle

-

Crypto World5 days ago

Crypto World5 days agoEthereum Enters Capitulation Zone as MVRV Turns Negative: Bottom Near?