Tech

Gear News of the Week: Samsung Sets a Date for Galaxy Unpacked, and Fitbit’s AI Coach Comes to iOS

Samsung will unveil its next flagship smartphone lineup on February 25 at its Galaxy Unpacked event in San Francisco. The company sent out invites earlier this week. The event will begin at 10 am Pacific (1 pm Eastern), and it’ll be livestreamed here.

Rumors abound that suggest the Galaxy S26 series—which will include the Galaxy S26, Galaxy S26+, and Galaxy S26 Ultra—won’t have any major changes from their predecessors. They’ll likely be powered by the latest Qualcomm Snapdragon 8 Elite Gen 5, with some minor charging speed improvements and minor upgrades to the camera hardware.

Courtesy of Samsung

Artificial intelligence features will likely sit at the forefront, likely with a few new Gemini tricks. However, one big new feature is a privacy screen built into the smartphone itself. It’ll let you selectively block parts of the display from people around you. Unfortunately, even with only minor upgrades, there may be a price increase for these phones stemming from the RAM shortage. As usual, Samsung is letting you reserve a Galaxy S26 device right now. You’ll get a $30 credit to use when preorders open up, and a chance to win a $5,000 gift card at Samsung.com.

Don’t expect to see a Galaxy S26 Edge. Samsung’s super-slim Edge phone from 2025 wasn’t a hit, and leaks suggest a successor has been canceled. Still, the Edge debuted in May 2025, so we could still see a follow-up around then. All we know is that it likely won’t make a showing at this Unpacked event. Samsung usually announces other products outside of smartphones, and this year, that may be a new pair of Galaxy Buds wireless earbuds.

We’ll be on the ground bringing the news to you live.

Fitbit’s Personal Health Coach Arrives on iOS

Photograph: Julian Chokkattu

Months after Fitbit’s Personal Health Coach launched in public preview for Android users, the Gemini-powered health service is now finally available to iOS users. To try it out, you must have an active paid or trial Fitbit Premium subscription and a phone that runs iOS 16.4 or higher. (You can check out the full list of requirements here.) Personal Health Coach is also expanding to English speakers in other countries, including the United Kingdom, Canada, Australia, New Zealand, and Singapore.

As I mentioned in my preview of the service, I would be wary of divulging too much personal health information to a large corporation, even one that promises not to use it for advertising. I also found that it’s easy to start consulting with the Coach for advice on every part of your day, which your IRL family and friends will find weird and annoying. However, it is the easiest, most helpful, and most accommodating of the AI coach services that I’ve tried so far, and $10/month for Fitbit Premium is cheaper than a real running coach. As always, your mileage (literally) may vary. —Adrienne So

iOS 26.3 Makes It Easy to Switch to Android

Photograph: Simon Hill

Apple released iOS 26.3 this week for the iPhone, and the hot new feature might surprise you. The company is making it easier to switch to Android phones, thanks to a collaboration with Google, which also recently added a similar feature for switching from Android to iPhone.

Tech

CBS Staffers Jump Ship Ahead Of More Layoffs From Another Pointless Media Merger

from the inevitable-outcomes dept

U.S. media mergers always follow the same trajectory. Pre-merger, executives promise all manner of amazing synergies and deal benefits. Post-merger, not only do those benefits generally never arrive, the debt from the acquisition spree usually results in significant layoffs, lower quality product, and higher rates for consumers. The Time Warner Discovery disaster was the poster child for this phenomenon.

After paying Trump his $16 million bribe, CBS and Skydance (Trump’s friends in the Ellison family) recently finalized their $8 billion merger. It didn’t take long for the company to announce that the only way it could pay for the debt of the pointless deal is by firing a whole bunch of people in “painful” fashion.

Despite a lot of promises last summer by Paramount executives that the layoffs would come in one fell swoop, CBS News boss Bari Weiss has implemented staggered cuts as she converts what was left of CBS into yet another safe space for right wing autocrats and their dwindling cult.

Apparently “a lot of people” at CBS News are taking Weiss up on a January town hall promise of buyouts for those insufficiently deferential to Larry Ellison’s ambitions:

“They include at least six producers out of the show’s total of roughly 20, according to another source, who added: “Seems like people are jumping ship.”

“It’s a lot of people,” a CBS insider said.”

In her head, I really do think Weiss believes she’s reshaping CBS News into a better news organization. In reality, Weiss was specifically hired by billionaire Trump ally Larry Ellison to convert CBS into yet another autocrat-friendly safe space for the perpetually aggrieved.

Weiss’ problem to date has been that she’s not just bad at management, judgment, and journalism, she’s bad at ratings-grabbing agitprop — the real reason she was hired by billionaires in the first place.

Weiss’ inaugural “town hall” with opportunistic right wing grifter Erika Kirk was a ratings dud, her new nightly news broadcast has been an error-prone hot mess, and her murder of a 60 Minutes story about Trump concentration camps — and the network’s decision to air a story lying about the ICE murder of Nicole Good — spurred a revolt among the CBS journalists who hadn’t quit yet.

Weiss’ weird ego trip is playing out alongside the old traditional failures of mindless media consolidation, the last refuge of executives who are all out of original ideas, but desperately want to goose quarterly earnings, generate temporary tax cuts, and get “savvy dealmaker” stamped on their LinkedIn profile.

The thing is, merger related promises both before and after the deal are always meaningless. The layoffs are driven by debt from acquisitions, and the new CBS has been making plenty of those, including a new $7.7 billion deal to acquire the exclusive rights to MMA fights, a costly campaign to steal Warner Brothers, and that $150 million deal to acquire Bari Weiss’ lazy contrarian propaganda blog.

Larry Ellison clearly wants to hoover up what’s left of corporate media (including CBS, CNN, HBO) — and fuse it with his co-ownership of TikTok to create a sort of Hungary-esque autocratic state media. The only thing saving us from this outcome to date is the fact that absolutely nobody in this weird assortment of nepobabies and brunchlords appears to have absolutely any idea what they’re doing.

Filed Under: bari weiss, cbs news, consolidation, journalism, larry ellison, layoffs, media, mergers

Companies: cbs, paramount, skydance

Tech

Your Friends Could Be Sharing Your Phone Number with ChatGPT

“ChatGPT is getting more social,” reports PC Magazine, “with a new feature that allows you to sync your contacts to see if any of your friends are using the chatbot or any other OpenAI product…”

It’s “completely optional,” [OpenAI] says. However, even if you don’t opt in, anyone with your number who syncs their contacts are giving OpenAI your digits. “OpenAI may process your phone number if someone you know has your phone number saved in their device’s address book and chooses to upload their contacts,” the company says…

But why would you follow someone on ChatGPT? It lines up with reports, dating back to April, that OpenAI is building a social network. We haven’t seen much since then, save for the Sora generative video app, which exists outside of ChatGPT and is more of a novelty. Contact sharing might be the first step toward a much bigger evolution for the world’s most popular chatbot.

ChatGPT also supports group chats that let up to 20 people discuss and research something using the chatbot. Contact syncing could make it easier to invite people to these chats…

[OpenAI] claims it will not store the full data that might appear in your contact list, such as names or email addresses — just phone numbers. However, the company does store the phone numbers in its servers in a coded (or hashed) format. You can also revoke access in your device’s settings.

09

Tech

Luxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

Very few consumer A/V brands reach a century in operation. Luxman has already passed that mark, and the D-100 SACD/CD Player and L-100 Integrated Amplifier are not presented as anniversary products, but as current production models that define the company’s direction going forward.

With these components, Luxman is positioning itself clearly within the high-end segment. Rather than competing on volume or feature density like Denon or Yamaha, Luxman continues to operate in a smaller category alongside manufacturers such as McIntosh, Pass Labs, and Mark Levinson. The emphasis is on long term ownership, conservative engineering, and product lifespans measured in years rather than release cycles.

Integrated amplifiers have been part of Luxman’s core lineup since the 1960s, and the L-100 CENTENNIAL Integrated Amplifier makes that continuity explicit. The recent wave of new products is not driven by short update cycles or marketing pressure, but by development timelines extended during the pandemic.

Luxman has always felt aspirational in the best possible way. The gear is built to an exceptionally high standard, it sounds better than 98 percent of what is out there, and it manages to do so without requiring the sale of a child or a second mortgage. This is not part of the new wave of affordable high end audio and no one is pretending otherwise. The D-100 and L-100 are eye watering in terms of price, but they would land on any serious endgame short list without hesitation. Luxman lasts. It has soul. And yes, it still has VU meters that look unapologetically sexy because great engineering should never be afraid to look the part.

L-100 Integrated Amplifier Defines Luxman’s Vision for Its Second Century

The Luxman L-100 Integrated Amplifier sits at the center of the company’s 100 Centennial Series and makes its priorities clear immediately. Rated at 20 watts per channel into 8 ohms and 40 watts into 4 ohms, the numbers are modest on paper and entirely deliberate in execution. This is a pure Class A integrated amplifier, not Class A/B and certainly not Class D. Every watt is delivered in continuous Class A operation, with the output devices conducting at all times. That choice favors linearity and tonal density over headline power, and it comes with the usual side effect. Yes, the amplifier runs warm. That is the cost of admission. JCP&L will be thrilled. Your accountant? Not so much.

The output stage uses a triple parallel bipolar push pull configuration supported by a substantial power supply built around a custom EI core transformer and eight large filter capacitors totaling 80,000 microfarads. This foundation provides the current stability required for Class A operation and helps explain the L-100’s damping factor of 300, which is unusually high for a low power Class A design. Luxman has focused on maintaining control and composure rather than chasing wattage for its own sake.

At the circuit level, the L-100 employs version 1.1 of Luxman’s LIFES architecture, an evolution of the company’s long running Only Distortion Negative Feedback concept first introduced in 1999. Instead of applying global feedback indiscriminately, LIFES concentrates on detecting and correcting distortion components only.

By using multiple field effect transistors in parallel at the input of the error detection circuit, Luxman aims to reduce distortion and improve linearity while preserving the tonal weight and harmonic structure the brand is known for. The result is extremely low measured distortion without the flattened dynamics often associated with heavy feedback designs.

Volume control is handled by the LECUA1000 attenuator, an 88 step electronically controlled system integrated directly into the amplifier circuitry. Shortened signal paths and discrete buffer stages derived from Luxman’s flagship preamplifiers are used to minimize degradation and maintain drive capability.

Connectivity is comprehensive and practical, with balanced and unbalanced line inputs, a high quality MM/MC phono stage, pre out and main in connections, dual speaker terminals for bi-wiring, and both 6.3 mm and 4.4 mm headphone outputs. The balanced headphone output uses independent grounds for left and right channels to improve separation and imaging.

Measured performance is consistent with Luxman’s design goals. Total harmonic distortion is specified at 0.005 percent or less at 1 kHz into 8 ohms, rising modestly to 0.015 percent across the full audio band. Frequency response extends from 20 Hz to 100 kHz on line inputs, while signal to noise ratios reach 98 dB for line level sources. Power consumption is substantial at 260 watts under operation, which again comes with the territory when running true Class A.

Physically, the L-100 weighs 25.4kg (56 lbs) and looks exactly like what it is. A serious integrated amplifier built to last. The illuminated VU meters, brushed aluminum front panel, and restrained proportions are unmistakably Luxman, but the execution is modern rather than nostalgic. Meter illumination and the central LED volume display can be switched off if desired, though few owners are likely to do so.

The L-100 is not chasing trends, efficiency charts, or lifestyle friendly form factors. It is a deliberately uncompromising Class A integrated amplifier that prioritizes operating purity, long term ownership, and musical density over convenience. It will get warm. It will not be cheap. And it sounds like Luxman doing exactly what Luxman has always done best. If that does not move the needle for you, this was never your amplifier anyway.

D-100 SACD CD Player Reminds the Streaming Crowd Why Discs Still Matter

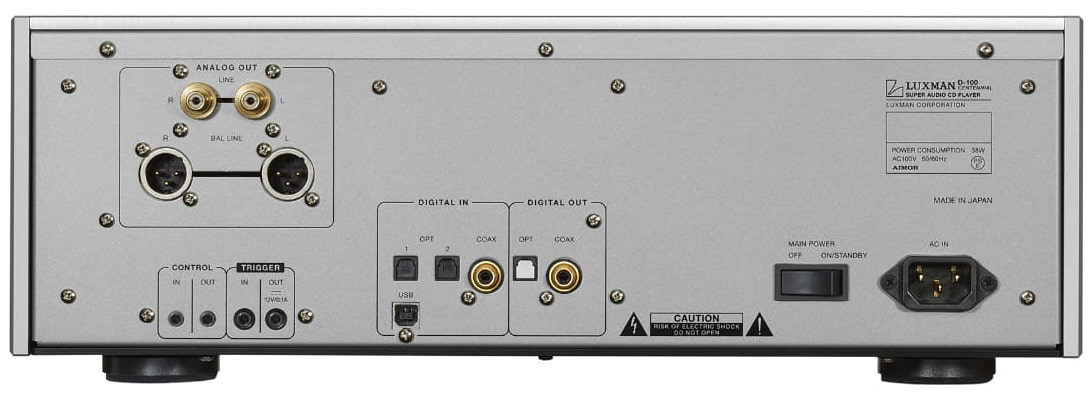

The Luxman D-100 SACD/CD Player serves as the digital counterpoint to the L-100 integrated amplifier and replaces the long-running D-10X. This is not a light refresh or a cosmetic update. Luxman has rebuilt its disc playback platform from the ground up, making it clear that optical media remains a core part of its second century rather than a legacy side project.

At the heart of the redesign is Luxman’s proprietary LxDTM-i disc transport, short for Disc Transport Mechanism improved. The mechanism is fully integrated into the main chassis and reinforced with thick aluminum side frames, a steel top plate, and an aluminum base to improve rigidity and suppress vibration. Mechanical stability remains a defining Luxman priority and the D-100 doubles down on that philosophy with cast-iron isolation feet.

Digital conversion is handled by ROHM BD34302EKV DACs in a true dual-mono configuration. File playback support is extensive, with PCM up to 768 kHz at 32-bit and DSD up to 22.5 MHz via USB, alongside native SACD and CD playback. Luxman has also focused heavily on clocking and noise management, employing a large quartz oscillator and ultra-low phase-noise circuitry to stabilize timing across both disc and file-based playback paths. Assuming it follows the same functional model as the D-10X, the D-100 can also operate as an external DAC for a high-end streamer.

The analog output stage mirrors the amplifier’s approach, using the latest LIFES 1.1 circuit in a fully balanced configuration feeding both RCA and XLR outputs. A large monochrome OLED display replaces the fluorescent panel used on earlier Luxman players, modernizing usability without turning the front panel into a glowing tablet. Luxman has not yet confirmed whether coaxial or optical digital outputs will be included as they were on the outgoing model, and the company has remained quiet on several secondary specifications.

Physically, the D-100 is very similar in size and mass to the D-10X, but weighs 3kg (6.6 lbs) more at nearly 50 lbs. The D-100 measures 440mm (17.3″) wide by 154mm (6.1″) high by 420mm (16.5″) deep.

The D-100 exists because Luxman believes physical media still deserves reference-level hardware. It is unapologetically heavy, mechanically serious, and engineered for listeners who still care about discs and are willing to pay for the privilege. Streaming may be convenient. Luxman is clearly arguing that convenience is not the same thing as satisfaction.

The Bottom Line

Luxman’s D-100 and L-100 are not casual upgrades, they are statement pieces built for listeners who still care about engineering, longevity, and physical media. The L-100 is a pure Class A integrated that prioritizes operating purity over bragging rights, pairing Luxman’s LIFES 1.1 feedback architecture with the LECUA1000 88 step attenuator, a serious power supply, and full featured connectivity including balanced inputs and MM MC phono.

The D-100 is its matching digital counterweight, a ground up disc platform with the LxDTM-i transport, dual mono ROHM conversion, fully balanced analog output using LIFES 1.1, and the kind of mechanical overbuild that makes most modern disc players feel like toys.

Who is this for. The buyer who wants an endgame two box front end, values build quality and service life, and still spins discs while using a streamer as a transport when it suits the mood. Not for bargain hunters, not for minimalists, and definitely not for anyone who thinks a phone and a soundbar counts as a system.

Price & Availability

The products will begin shipping in North America in late May or June 2026, with their first public showing expected at AXPONA in April.

North American retail pricing is set at $11,995 for the L-100 and $18,995 for the D-100. Nothing about this pairing suggests affordable. It suggests buy it once, keep it for 20 years, and stop shopping.

For more information: luxman.com

Related Reading:

Tech

Samsung readies LPCAMM2 LPDDR5X modules with up to 96GB and 9600 MT/s

The LPCAMM2 design is part of an ongoing effort to replace soldered LPDDR in mobile and ultra-thin systems with memory that is both upgradeable and space-efficient. It builds on first-generation LPCAMM2 modules, which typically shipped with LPDDR5 memory. The new LPDDR5X variant continues that evolution, delivering higher efficiency and faster…

Read Entire Article

Source link

Tech

Samsung’s making a big mistake if it skips this feature in the Galaxy S26 range

I’m not asking Samsung to reinvent the smartphone every year. If we’re being honest, it feels like the era of genuinely “new” phones is behind us – aside from occasional outliers like the Clicks Communicator and Samsung Galaxy Z TriFold – and that’s fine.

What I do want, however, is for Samsung to stop treating genuinely useful, quality-of-life upgrades like optional extras.

And if the latest Galaxy S26 chatter is on the money, Samsung is about to make a very avoidable mistake by launching yet another flagship lineup without built-in magnets for proper Qi2 wireless charging.

Yes, faster wireless charging is nice, but magnetic wireless charging is the bit that actually changes how you use your phone day-to-day. It’s something I’ve experienced not only on the iPhone side of things but also with this year’s Google Pixel 10 range, and it made using the phones so much easier.

Leaks suggest a very familiar smartphone collection

The big S26 leak doing the rounds reads like the most Samsung thing imaginable: a spreadsheet of small, sensible upgrades that won’t exactly cause much excitement.

If it’s accurate, we’re looking at the expected Galaxy S26, S26 Plus and S26 Ultra trio, with no S25 Edge successor in sight. The chipset split is said to return, with UK and EU users getting the Exynos 2600 while US users get the Snapdragon 8 Elite Gen 5, paired with 12GB of RAM across the board.

The regular Galaxy S26 is getting a slightly larger 6.3-inch screen, while the 6.7-inch S26 Plus and 6.9-inch S26 Ultra remain unchanged. That slightly larger screen means the S26 can pack a slightly larger 4300mAh cell, but the S26 Plus and Ultra’s cells remain the same as those of the S25 equivalents.

There are a few minor camera improvements, but expect the same trio of 50MP main, 10MP telephoto and 12MP ultrawide sensors on the S26 and S26 Plus. The Ultra is said to get an improved f/1.4 aperture on its main lens, along with tweaked zoom and ultrawide lenses, but the resolutions similarly stay the same across the board.

Now, don’t get me wrong; none of that is explicitly bad. It’s just very familiar, for what feels like the millionth year in a row. And when a range feels this iterative, the smaller usability wins matter even more – which brings us nicely to charging.

Full Qi2 was rumoured, but it’s not looking good

For a while, it sounded like the Galaxy S26 range might finally go all-in on the “proper” version of Qi2 – you know, the one that works like you’d expect, with magnets inside the phone so accessories snap nicely into place.

We’ve seen it from multiple generations of iPhone and Google’s Pixel 10 series, including the Pixel 10 Pro Fold, so it should be relatively easy for Samsung to do the same, right?

Unfortunately, the latest chatter around certification suggests otherwise. The Galaxy S26 models are indeed tipped to support the Qi 2.2.1 standard, which is a genuine step forward, but the listings make no mention of the Magnetic Power Profile marker you’d see if magnets are actually inside the phone.

And, without that, you end up right back where we are now; if you want a neat snap-on experience with chargers, mounts and accessories, you’ll need to stick the phone in a magnetic case first.

That’s not exactly the end of the world, but it is annoying. And it’s exactly the sort of annoyance that shouldn’t exist on a phone you’re paying proper flagship money for – especially when the competition on both sides of the iPhone/Android divide are beginning to offer it on similarly-priced handsets.

Magnets make accessories much easier to use

The best thing about magnets in a phone is the sheer lack of drama it brings.

Wireless charging without magnets is the kind of ‘convenience’ that somehow still needs managing. You put the phone down, you shuffle it a bit, you glance for the charging icon and you hope that your cat doesn’t nudge it off-centre when you don’t notice. With magnetic alignment, however, you drop it on and it lands where it should. Every. Single. Time.

Then there’s everything else to consider. Car mounts become something you can use one-handed without wrestling with a fiddly spring-loaded clamp, battery packs stop sliding around like a bar of soap in your pocket and wallet add-ons ensure you’ve always got your phone and cash in one place.

It’s also great for content creators, with magnetic tripod mounts that make setting up shots a doddle, and you can even get dedicated camera grips to turn your phone into something more like a classic digital camera.

Essentially, it turns accessories into things you actually want to use, rather than things you tolerate because you’ve already bought them.

Yes, a case can give you most of that – but “most of that” is doing a lot of work there. A case adds cost and bulk and forces you to shop around for the right one, which means Samsung still hasn’t really delivered on the feature.

Still getting faster Qi2 charging, but it’s not enough

Let me be clear; faster wireless charging would still be a welcome change to the Galaxy S26 collection.

If the S26 range does indeed land with Qi 2.2.1 support and boosted wireless charging rates – leaks suggest 15W on the S26 and S26 Plus, with 25W on the Ultra – that’s a change you’ll likely notice, especially if you’re coming from an older model of Galaxy S.

However, I’d argue that speed isn’t the frustration that Qi2 is meant to fix; it’s alignment.

If Samsung improves the numbers but still makes you buy a magnetic case to get the ‘it just works’ experience, it’ll feel like a feature implemented with one hand tied behind its back.

The worst part is that it’ll be easy for Samsung to market it as Qi2 charging, while a lot of people will discover the catch after they’ve bought a charger or mount and wonder why their £1000/$1000 phone doesn’t behave quite like they expected.

If the Galaxy S26 range really is shaping up to be yet another year of sensible, incremental upgrades, then Samsung needs at least one change that feels properly modern in daily use.

Built-in magnets are that change. Not flashy, not headline-grabbing, but the kind of smart, practical improvement that you’ll genuinely appreciate in day-to-day use.

Tech

‘Clueless’ -inspired app Alta partners with brand Public School to start integrating styling tools into websites

Much has changed for Jenny Wang, the founder who’s bringing “Clueless” fashion tech to life.

Last year, her company, Alta, raised $11 million in a round led by Menlo Ventures to let users create digital closets and try on their clothes with their own virtual avatars. It’s a tech once seen only in movies, most notably in “Clueless,” where Cher styles and plans her outfits using computer technology. Alta is similar to that, allowing users to plan and style outfits using the latest AI innovations.

A slew of big names participated in Atla’s round last year, including models Jasmine Tookes and Karlie Kloss, Anthropic’s VC arm Anthology Fund, and Rent the Runway cofounder Jenny Fleiss.

TechCrunch caught up with Wang during New York Fashion Week to talk about how the company has expanded since that round.

For starters, the product is officially in the app store; Time and Vogue named it one of the best innovations of last year, and Wang said more than 100 million outfits have been generated on the platform since its launch in 2023. It has partnerships with Poshmark and the Council of Fashion Designers of America, with more partnerships to be announced soon.

“Alta’s own app also features thousands of brands that users can shop from,” Wang said.

Right now, the company is focused on building app and website integration experiences for brands, she said, where customers can try on a designer’s clothing using a personalized Alta Avatar. This week, the company unveiled its first integration collaboration, teaming up with Public School, a storied New York City brand.

Techcrunch event

Boston, MA

|

June 23, 2026

“Shoppers can style looks from the new collection on their own Alta avatar,” Wang said.

She met the Public School team — Dao-Yi Chow and Maxwell Osborne — through the founder of Poshmak, who is also an angel investor in both companies.

“Public School designers Dao-Yi Chow and Maxwell Osborne had been looking for an AI partner and virtual try-on avatar solution, and Dao-Yi has been an Alta app user himself,” Wang said.

Public School actually went on hiatus for a few years, with this NYFW marking its grand re-debut. When asked, the founders of the brand said they rediscovered their voices and what they wanted to say.

“We have to look at tech as a partner in the business today,” Chow told TechCrunch, adding, “It’s not 2015 anymore,” so the team wants to take advantage of the latest technological developments. “We want to be thoughtful on how we use tech and AI,” he continued, “not as a design tool but as a tool to extend our storytelling and a tool to interact with the consumer and have them experience the brand even if they can’t do so in person.”

Wang said this is one of the first instances of a designer embedding personal avatar and styling technology into its own website. Near the bottom of Public School’s product page, there is an icon that says Style by Alta. Clicking that takes the customer to Alta for them to then style their avatars and test out how Public School clothing would look on them, should they purchase.

Users on Alta’s standalone app can also access Public School through Alta’s app. Wang said the goal is for Alta to integrate more experiences like this into other brands and websites, so Alta users can try on clothes on other websites even while outside the Alta app.

“Right now, a user would have to add a potential purchase into their Alta wishlist, then style outfits and try on their avatar, versus being able to do that directly on the brand website.” (For every site but Public School, that is.) “The goal is to bring their community on a new journey to engage with and shop the brand.”

Many major fashion brands, like Zara and Balmain, have already experimented with digital avatars. Wang said what makes Alta different here, especially compared to Zara, is that Alta avatars can put on at least 8 items within seconds, whereas Zara avatars can wear only four and often take around two minutes.

Overall, demand for virtual avatars has increased. Wang considers Alta both still the “Cluless” technology that it started out with, and a digital avatar business.

“The consumer Alta app is the ‘Clueless’ closet, while the enterprise Alta experience allows shoppers to style pieces and try the outfits on their pre-existing Alta avatar,” he said. Eventually, Wang said she wants Alta to be the “personal identity layer for the future of consumer AI and shopping.”

For agentic commerce to truly work, she said, “We need a data layer that understands the shopper’s style preferences, such as their closet, past purchases, and their avatar, likeness, and body, which is Alta.”

Tech

That SSSS On Your Boarding Pass Could Mean TSA Will Swab Your Electronics

No one wants to be stuck in the airport, as long lines, delayed flights, and frustrated passengers can make even the shortest trip feel much longer. Despite security tech projects that could change airport screening, the process can be even more of a hassle if you have SSSS on your boarding pass. This code means that you could be subject to enhanced screening that may involve the swabbing of your personal belongings, including electronics.

SSSS stands for Secondary Security Screening Selection, and it’s a Department of Homeland Security (DHS) designation. It’s used to identify passengers who need additional screening by the TSA. Passengers labeled SSSS typically don’t know the reason why, and neither do the TSA agents in charge of the screening. Often, it’s due to random selection, though the TSA can choose passengers for additional screening at its discretion. The DHS could also be selecting passengers using the Secure Flight program, which identifies suspected terrorists or other suspicious individuals.

Neither the DHS nor the TSA has publicly confirmed that the SSSS designation and the accompanying electronics swab are linked to Explosive Trace Detection (ETD). However, ETD screening is being carried out in some airports. It involves swabbing a passenger’s hands or belongings at the TSA checkpoint. The swab is then analyzed by a special device that can detect even the tiniest amounts of trace residue.

Enhanced airport screening and how to avoid delays

Air travelers can be repeatedly selected for enhanced screening by the Department of Homeland Security (DHS) because their identification is similar to someone on a government watchlist. Because of this, the DHS developed the TRIP program, which generates a Redress Control Number (RCN) for affected travelers, which can be used when booking future flight reservations to avoid misidentification. However, having an RCN doesn’t mean that a passenger won’t get pulled for enhanced screening for other reasons.

In fact, anyone going through the airport can be subjected to further screening, as the TSA can pull you from the line when you’re going through a checkpoint. Even wearing baggy clothes could get you patted down, and your bags may be checked. The TSA doesn’t publicly disclose all its reasons for performing further screening, but it’s clear from what it has published online that it reserves the right to conduct such screenings whenever it feels necessary.

While it might be impossible to completely avoid such delays at the airport, TSA is expanding the precheck system to make the process smoother. You can also take some steps yourself that might help. First, empty your pockets and remove any big jewelry. Place your laptop in a bin before it goes through the scanner, make sure your devices are charged and ready to power on, and as you’re leaving the checkpoint, be sure to collect all of your items so you don’t have to backtrack later.

Tech

‘I’m tired of that narrative’: Seattle VC pushes back on tech exodus talk

Enough with the hot takes about Seattle’s tech downfall.

That’s the message from Jacob Colker, managing director at the AI2 Incubator, who published a LinkedIn post Thursday pushing back on what he described as a “breathless narrative” that Seattle is one tax bill away from decline.

Colker didn’t cite specific posts or headlines. But debate has intensified in recent months as Washington lawmakers consider tax proposals that some business leaders warn could hurt the region’s innovation economy, including a bill targeting startup exits and the so-called “millionaire’s tax.”

“The math doesn’t math,” he wrote, arguing that a few points of capital gains tax don’t outweigh the region’s deep bench of AI talent, investment dollars, space leadership, fusion startups, biotech momentum, and quality of life.

He added: “Should we be thoughtful about tax policy? Heck yeah. Should it be tied to better stewardship of spending? Darn right. But the breathless narrative that Seattle is one bill from collapse is not serious analysis.”

His post sparked plenty of reaction.

- “been reading the same slop since I moved here 20 years ago… The ecosystem keeps getting better and I’m not leaving either.” — Brian Glaister, exec at Axon

- “When I moved to Seattle in 2007, a large part of that decision was bc the state constitution guaranteed no income tax. I moved here from CA. This change in policy is also why I will leave. Taking 20% of my stock is real and it’s a reason to leave.” — Aaron Bird, CEO at Inflection.io

- “When I moved to Seattle 20+ years ago this same theme was banging around. Since then, hard to count how many multi-billion $ companies have been built and the pre-seed/early stage investment capital scene is SO much better. Bullish on Seattle.” — Robert Pease, managing partner at Cascade Seed Fund

- “love this. two things can be true at the same time!” — Kirby Winfield, founder at Ascend

The debate over the state of Seattle’s startup scene comes as some founders relocate to San Francisco amid the AI boom.

Colker helps run AI2 Incubator, one of Seattle’s most prominent early stage startup investors. The firm launched an $80 million fund in October and operates AI House, the startup hub that opened last year along Seattle’s waterfront and serves as AI2 Incubator’s headquarters along with event space and co-working offices.

“Seattle isn’t perfect,” Colker wrote in his post. “No city is. But the sky isn’t falling. And I’m proud to triple down on this region — taxes or not.”

Related reading:

- An ‘extinction-level event’ for startups: Seattle tech leaders fight new state tax proposal

- Washington proposal to tax startup exits sparks backlash from Seattle tech leaders

- Washington’s ‘millionaires tax’ targets top earners as tech leaders warn of startup fallout

- Opinion: ‘Millionaires tax’ threatens Washington’s startup economy — here’s the math to prove it

- Opinion: The ‘millionaires tax’ is not an existential threat to Washington’s startup economy

- Why these startup founders are leaving Seattle for San Francisco

Tech

Today’s NYT Connections: Sports Edition Hints, Answers for Feb. 15 #510

Looking for the most recent regular Connections answers? Click here for today’s Connections hints, as well as our daily answers and hints for The New York Times Mini Crossword, Wordle and Strands puzzles.

Today’s Connections: Sports Edition pays homage to the Winter Olympics. The purple category is tough, as always — and today it expects you to hunt out hidden words inside longer words. If you’re struggling with today’s puzzle but still want to solve it, read on for hints and the answers.

Connections: Sports Edition is published by The Athletic, the subscription-based sports journalism site owned by The Times. It doesn’t appear in the NYT Games app, but it does in The Athletic’s own app. Or you can play it free online.

Read more: NYT Connections: Sports Edition Puzzle Comes Out of Beta

Hints for today’s Connections: Sports Edition groups

Here are four hints for the groupings in today’s Connections: Sports Edition puzzle, ranked from the easiest yellow group to the tough (and sometimes bizarre) purple group.

Yellow group hint: Lillehammer is another one.

Green group hint: Great White North.

Blue group hint: Think Chloe Kim.

Purple group hint: Look for a hidden word.

Answers for today’s Connections: Sports Edition groups

Yellow group: Previous Winter Olympic hosts.

Green group: Canada men’s hockey players.

Blue group: Snowboarding terms.

Purple group: Ends in a piece of winter sports equipment.

Read more: Wordle Cheat Sheet: Here Are the Most Popular Letters Used in English Words

What are today’s Connections: Sports Edition answers?

The completed NYT Connections: Sports Edition puzzle for Feb. 15, 2026.

The yellow words in today’s Connections

The theme is previous Winter Olympic hosts. The four answers are Albertville, Chamonix, Oslo and St. Moritz.

The green words in today’s Connections

The theme is Canada men’s hockey players. The four answers are Celebrini, Crosby, Marner and McDavid.

The blue words in today’s Connections

The theme is snowboarding terms. The four answers are cork, frontside, goofy and McTwist.

The purple words in today’s Connections

The theme is ends in a piece of winter sports equipment. The four answers are cheapskate, chopstick, Lipinski and milestone.

Tech

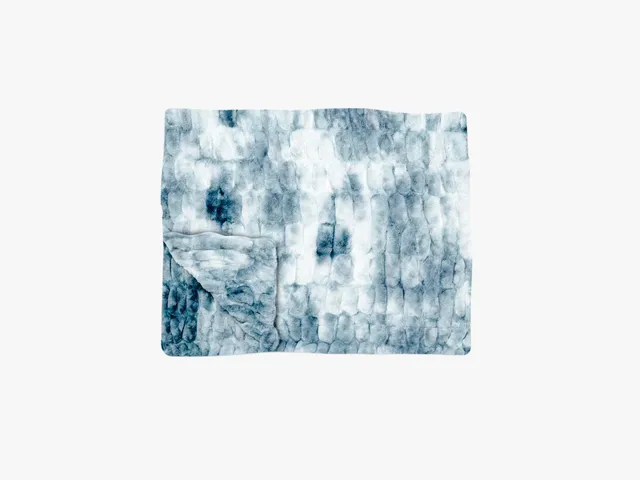

Lola Blankets Are 45 Percent Off This Presidents’ Day Weekend

If you’ve spent more than five minutes on TikTok, you’ve probably heard someone rave about Lola Blankets. They’re draped over couches in Get Ready With Me videos, folded at the foot of perfectly made beds, and name-dropped in podcast ads.

I wanted to be skeptical, but the hype is sadly real; we tested the blankets at WIRED and have included them in multiple gift guides and roundups, from the Best Weighted Blankets to the Best Housewarming Gifts to the Best Gifts for Mom.

From February 14 through February 16, Lola Blankets are 45 percent off with code WINTER45. No exclusions. This is the kind of discount that makes the math very compelling. Buy two, one for yourself and one as a present for a loved one, or a furry loved one (see below).

Lola Blankets come in two styles: the Original and the Weighted Blankets. WIRED reviewer Nena Farrell adores the Original (in Malibu Blue). It comes in an assortment of colors, patterns, and collaborations, plus five sizes: baby, medium, large, Lola XL, and travel. The double-sided fabric is an Oeko-Tex Standard 100-certified faux fur blend of 95 percent polyester and 5 percent spandex, with four-way stretch. It’s zero-shed, stain-resistant, and double-hemmed for durability. I can confirm that durability matters. Mine has survived everyday use and the affections of my cat, who has fully claimed it as her throne BTW.

-

Politics6 days ago

Politics6 days agoWhy Israel is blocking foreign journalists from entering

-

Business6 days ago

Business6 days agoLLP registrations cross 10,000 mark for first time in Jan

-

Sports3 days ago

Sports3 days agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

NewsBeat5 days ago

NewsBeat5 days agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

Business6 days ago

Business6 days agoCostco introduces fresh batch of new bakery and frozen foods: report

-

Tech4 days ago

Tech4 days agoSpaceX’s mighty Starship rocket enters final testing for 12th flight

-

NewsBeat6 days ago

NewsBeat6 days agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

Sports6 days ago

Sports6 days agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Video2 days ago

Video2 days agoThe Final Warning: XRP Is Entering The Chaos Zone

-

Politics6 days ago

Politics6 days agoThe Health Dangers Of Browning Your Food

-

Business7 days ago

Business7 days agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

![Heathrow has said passenger numbers were 60% lower in November than before the coronavirus pandemic and there were “high cancellations” among business travellers concerned about being trapped overseas for Christmas as Omicron spreads. The UK’s largest airport said the government’s travel restrictions had dealt a fresh blow to travel confidence and predicted it was likely to take several years for passenger numbers to return to pre-pandemic levels. This week ministers said passengers arriving in the UK would have to take a pre-departure Covid test, as well as a post-flight test, because of fears about the spread of the new variant. “[The] high level of cancellations by business travellers concerned about being trapped overseas because of pre-departure testing shows the potential harm to the economy of travel restrictions,” the airport said in an update. Heathrow said the drop in traveller confidence owing to the new travel restrictions had negated the benefit of reopening the all-important corridor to North America for business and holiday travel last month. Eleven African countries have been added to the government’s red list, requiring travellers to quarantine before reuniting with families. “By allowing Brits to isolate at home, ministers can make sure they are reunited with their loved ones this Christmas,” said John Holland-Kaye, the chief executive of Heathrow. “It would send a strong signal that restrictions on travel will be removed as soon as safely possible to give passengers the confidence to book for 2022, opening up thousands of new jobs for local people at Heathrow. Let’s reunite families for Christmas.” Heathrow said that if the government could safely signal that restrictions would be lifted soon, then employers at Heathrow would have the confidence to hire thousands of staff in anticipation of a boost in business next summer. The airport is expecting a slow start to 2022, finishing next year with about 45 million passengers – just over half of pre-pandemic levels. This week Tui, Europe’s largest package holiday operator, said it expected bookings for next summer to bounce back to 2019 levels. However, Heathrow said on Friday not to expect the aviation industry to recover for several years. “We do not expect that international travel will recover to 2019 levels until at least all travel restrictions (including testing) are removed from all the markets that we serve, at both ends of the route, and there is no risk of new restrictions, such as quarantine, being imposed,” the airport said.](https://wordupnews.com/wp-content/uploads/2026/02/shutterstock_1100012546-scaled-400x240.jpg)

![Heathrow has said passenger numbers were 60% lower in November than before the coronavirus pandemic and there were “high cancellations” among business travellers concerned about being trapped overseas for Christmas as Omicron spreads. The UK’s largest airport said the government’s travel restrictions had dealt a fresh blow to travel confidence and predicted it was likely to take several years for passenger numbers to return to pre-pandemic levels. This week ministers said passengers arriving in the UK would have to take a pre-departure Covid test, as well as a post-flight test, because of fears about the spread of the new variant. “[The] high level of cancellations by business travellers concerned about being trapped overseas because of pre-departure testing shows the potential harm to the economy of travel restrictions,” the airport said in an update. Heathrow said the drop in traveller confidence owing to the new travel restrictions had negated the benefit of reopening the all-important corridor to North America for business and holiday travel last month. Eleven African countries have been added to the government’s red list, requiring travellers to quarantine before reuniting with families. “By allowing Brits to isolate at home, ministers can make sure they are reunited with their loved ones this Christmas,” said John Holland-Kaye, the chief executive of Heathrow. “It would send a strong signal that restrictions on travel will be removed as soon as safely possible to give passengers the confidence to book for 2022, opening up thousands of new jobs for local people at Heathrow. Let’s reunite families for Christmas.” Heathrow said that if the government could safely signal that restrictions would be lifted soon, then employers at Heathrow would have the confidence to hire thousands of staff in anticipation of a boost in business next summer. The airport is expecting a slow start to 2022, finishing next year with about 45 million passengers – just over half of pre-pandemic levels. This week Tui, Europe’s largest package holiday operator, said it expected bookings for next summer to bounce back to 2019 levels. However, Heathrow said on Friday not to expect the aviation industry to recover for several years. “We do not expect that international travel will recover to 2019 levels until at least all travel restrictions (including testing) are removed from all the markets that we serve, at both ends of the route, and there is no risk of new restrictions, such as quarantine, being imposed,” the airport said.](https://wordupnews.com/wp-content/uploads/2026/02/shutterstock_1100012546-scaled-80x80.jpg) Business6 days ago

Business6 days agoWeight-loss jabs threaten Greggs’ growth, analysts warn

-

NewsBeat6 days ago

NewsBeat6 days agoResidents say city high street with ‘boarded up’ shops ‘could be better’

-

Crypto World3 days ago

Crypto World3 days agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

Crypto World4 days ago

Crypto World4 days agoBlockchain.com wins UK registration nearly four years after abandoning FCA process

-

Crypto World1 day ago

Crypto World1 day agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Crypto World5 days ago

Crypto World5 days agoU.S. BTC ETFs register back-to-back inflows for first time in a month

-

Video3 days ago

Video3 days agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

Sports5 days ago

Kirk Cousins Officially Enters the Vikings’ Offseason Puzzle

-

Crypto World5 days ago

Crypto World5 days agoEthereum Enters Capitulation Zone as MVRV Turns Negative: Bottom Near?

![Biggest Crypto News Happening Now!! [BlackRock + Joe Rogan + Ethereum]](https://wordupnews.com/wp-content/uploads/2026/02/1771127665_maxresdefault-80x80.jpg)