Related: Behind-the-Scenes on Team USA’s Dramatic Journey to the 2026 Winter Olympics

Advertisement

Published

TMZ.com

This actor from across the pond has starred in — and even written — some of the biggest hit films of the 21st century … but, can you guess who he is without seeing his face?

It wasn’t mission impossible to get this star to talk to us back in 2015 outside celebrity hot spot Craig’s … and, he talked all about grooming for the modern man — including whether a dude would end up in some hot fuzz for getting a “Boy-zilian”

In fact, this British star says he’s cool with absolutely anything out there fellas wanna do!

In the wake of the death of James Van Der Beek, an announcement of the tragedy has led to the blunder of another star, Dick Van Dyke, being declared dead.

The “Pose” actor, who has been battling colorectal cancer for three years, recently took his final breath, leaving behind his wife, Kimberly, and their six kids.

Radio host Ashley Roberts announced the “Texas Rangers” actor’s death on-air. However, she got the names mixed up.

Article continues below advertisement

During Thursday’s broadcast of “Breakfast Show” on iHeartRadio, Roberts opened with a costly mistake.

“I do have some sad news: Dawson’s Creek’s Dick Van Dyke has passed away,” she announced, per Entertainment Weekly, confusing Van Der Beek with the legendary Mary Poppins star.

The error was quickly corrected when the co-host Jamie Theakston cut in: “Not Dick Van Dyke. Come on, if you’re going to do a sensitive moment, if you’re going to do an obituary, you can’t just say Dick Van Dyke because…”

Roberts acknowledged the slip, while fellow presenter Amanda Holden clarified that Van Dyke is very much alive.

Theakston echoed the reassurance, adding, “Unbelievably, he’s still with us.” Roberts apologized for the error, noting she intended to say Van Der Beek.

Article continues below advertisement

Before the radio mix-up that mistakenly declared Van Dyke dead, Van Der Beek’s family had already shared the heartbreaking news on February 11 through Instagram.

As The Blast reported, the post featured a photo of the 48-year-old actor alongside a heartbreaking caption.

“Our beloved James David Van Der Beek passed peacefully this morning. He met his final days with courage, faith, and grace,” the message read.

Travis County Medical Examiner’s Office also confirmed the sad news, sharing that the death was reported to their office at 6:44 am. However, there was no cause of death cited.

Article continues below advertisement

As clarified by radio hosts after the error, Van Dyke is alive and celebrated his 100th birthday two months ago.

Per The Blast, the legendary entertainer was honored with a surprise party organized by his wife, Arlene Silver, who led a flash mob at their home, set to a medley of his songs.

Marking the milestone, Van Dyke released a book titled “100 Rules for Living to 100,” reflecting on his career and personal journey. The veteran TV icon also opened up about mortality, admitting he isn’t afraid of death, even as he acknowledges he’s nearing life’s end.

According to The Blast, Van Dyke shared that while the thought of dying crosses his mind, it doesn’t frighten him, though he would still welcome more time.

Article continues below advertisement

He explained that many fear death because they assume the dying person understands what’s happening. He confessed that he has no idea what comes after and chooses not to dwell on it.

Article continues below advertisement

Meanwhile, following Van Der Beek’s death, Hollywood has united in support of his loved ones.

A GoFundMe campaign was launched to help his family, and within 24 hours, more than 20,000 donations poured in, with fellow stars stepping up to contribute.

On the GoFundMe page, the late actor’s wife revealed that his “medical care and the prolonged battle with cancer have exhausted the family’s finances,” an honest admission that touched many to donate.

According to The Blast, “Special Ops: Lioness” star Zoe Saldaña donated $2,500 under her married name, Zoe Saldaña-Perego. “Dancing with the Stars” pro Derek Hough gave $1,000, while the Marla Maples Foundation contributed $5,000.

Additional contributions poured in from Lyn Lear, widow of Norman Lear, and YouTuber Codie Sanchez, who each pledged $5,000 in monthly support.

Article continues below advertisement

As donations continue to pour in for the grieving family, Van Der Beek’s passing has sparked questions about the financial realities faced by actors, even when tied to major franchises.

Van Der Beek played Dawson Leery in the popular WB Teen Drama for six seasons and went on to star in other successful films, such as “Varsity Blues.”

During his health battle, the actor was candid about the financial strain of the treatment, revealing he had to auction off some memorabilia from some iconic movies he played to cover the bills.

As The Blast reported, one Reddit user voiced confusion about how an actor with decades of major network roles could face money troubles, especially assuming high salaries, royalties, investments, and insurance were in place.

Zach Gilford and Liana Liberato are ringing in Valentine’s Day 2026 with plenty of PDA.

Liberato, 30, uploaded a photo seemingly kissing Gilford, 44, to her Instagram Stories on Saturday, February 14. The Stuck in Love actress dressed casually in a navy hoodie as she wrapped her arms around her boyfriend. Both of their heads were cropped out of the frame as they shared a smooch.

Liberato, who added an emoji of an envelope sealed with a heart to her post, later teased that she had another valentine beside Gilford.

“My valentine,” she captioned a follow-up Instagram Story slide of her black-and-white cat.

Us Weekly broke the news in November 2025 that Liberato and Gilford were dating after meeting on the set of Criminal Minds: Evolution.

“They started dating after they worked together,” a source told Us at the time, noting the pair’s romance was still “relatively new.”

Prior to finding love with Liberato, Gilford was married to Kiele Sanchez for 12 years. Gilford filed for divorce in April 2025, citing irreconcilable differences.Gilford and Sanchez, 48, share two kids and also work together on Criminal Minds.

“It’s actually harder,” Gilford exclusively told Us in 2024 of starring opposite his then-wife. “It’s harder because I don’t want to hold a gun to my wife’s head. … It just happened to be that the nature of these scenes were pretty gross. Honestly, all those scenes are so f***ed up. I’ll only speak for myself. Kiele can obviously speak for herself, but it felt gross [bringing those darker moments to life together].”

According to Gilford, he and Sanchez weren’t cast for Criminal Minds at the same time.

“I was on my way to work, and I said goodbye to Kiele. And she looked at her phone and said, ‘That’s weird. I just got an offer to play your wife on Criminal Minds,’” Gilford told Us. “Then, Erica [Messer, the showrunner] told me, ‘We didn’t want to put pressure on you or Kiele. We just wanted to make it very professional.’”

He continued at the time, “I think they were like, ‘Well, if Zach’s doing this then the only way we’ll get an actress of Kiele’s caliber to play this part is because she’s married to him. And it’ll be like a homie hookup.’ Once they got Kiele, they definitely leaned into it and they’re like, ‘Well, we have this actress so let’s write to her.’”

Gilford and Sanchez, who met on the set of 2010’s The Matadors, have also shared the screen on Kingdom and The Purge: Anarchy. Sanchez later wrote an episode of The Fall of the House of Usher, of which Gilford had a leading role.

“We’ve worked together several times and in very different situations,” Gilford recalled to Us in 2024. “But there’s a theme on set when you are coworkers but also a married couple. It’s kind of trying to walk that tightrope. There’s times where I want to [support her]. Like, if she’s having a discussion [with a director or a writer], I want to be like, ‘Yeah, Kiele is right!’ But that’s not my place. Kiele can talk for herself — she’s a very strong woman.”

As for Liberato, she has often kept her dating life private through the years.

:max_bytes(150000):strip_icc():format(jpeg)/Adrianne-Curry-Tyra-Banks-112224-f2d398cbbee64c79a8bf9304d4e8a2c2.jpg)

Curry told EW in a 2023 interview that the only gig she received for winning the show was a $15,000 makeup demonstration and an unsuccessful agency deal that paled in comparison to the promised prizes.

Published

TMZ.com

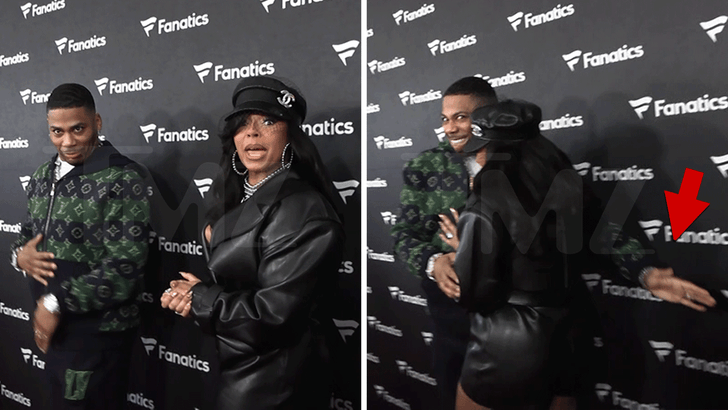

Valentine’s Day is just around the corner … and who better to give advice on how to have a romantic evening than Nelly and Ashanti!

We caught up with the music power couple on the red carpet of the Fanatics Super Bowl party Sunday in San Francisco, California. When our photog asked … “What’s the secret to a Valentine’s for you two?” even he didn’t think they’d give such a candid answer.

Nelly gave us a knowing stare … while Ashanti blurted, “The bedroom!”

The “Hot in Herre” rapper clearly agreed, giving his wife an affirming pat on the butt.

And whatever they have to say about romance, we are here for, because their love story is incredible.

Remember … they met and first started dating in 2003. After being together for about 10 years, they broke up and spent about another 10 years apart before reuniting in 2023. When they got back together, they were married by the end of the year.

So take notes people … you gotta celebrate love by making it!

Nicole Kidman sent fans into a frenzy with a stunning photo of herself just hours before Valentine’s Day.

This will mark the actress’s first Valentine’s Day celebrating solo, following her surprising split from Keith Urban last September.

The pair finalized their divorce last month, waiving both spousal and child support, while agreeing to a co-parenting plan for their two daughters.

Article continues below advertisement

Nicole Kidman treated her fans to a stunning photo on Instagram to herald Valentine’s Day as a single parent.

In the image, the “Big Little Lies” star is seated against soft white bedding, her posture relaxed and unguarded. One knee is bent and tucked partially beneath the blanket, while her hands rest loosely together near her lap.

She wore a pale pink pajama top with delicate vertical stripes, and its oversized fit draped effortlessly over her slender frame.

For the shot, Kidman styled her long blonde hair in soft, tousled waves that fell gently around her shoulders. Light streaming through the window catches in it, giving it a subtle shimmer. The same light grazed her face, which was tilted downward with her eyes closed.

Article continues below advertisement

Rounding out the striking image was a caption from Nicole Kidman that seemingly embraced her new chapter as a single woman.

She wrote, “Happy Galentine’s,” a playful twist on the Valentine’s Day phrase that was popularized in a 2010 episode of Parks and Recreation bearing the same name.

Article continues below advertisement

Fans of the Oscar winner were quick to shower her with praise after she shared her Galentine’s Day snap.

One person wrote, “Happy Galentines. This photo of you is just divine. May you give yourself the love you deserve.”

Another commented, “God was in a really good mood the day he made you,” while a third stated, “Happy Galentines, keep your chin up, darling.”

“You are Absolutely Beautiful, Nicole, and Happy Valentine’s Day,” one more person commented.

Article continues below advertisement

The post comes four months after the shocking news of her separation from singer Keith Urban emerged.

The duo were married for nearly two decades and welcomed two daughters, Sunday Rose, 17, and Faith Margaret, 15, during the course of the relationship.

At the time, rumors of infidelity swirled on the part of Urban, with fans digging deep to bring out clips of Urban’s cozy onstage antics with guitarist Maggie Baugh.

This includes a clip of him saying, “Maggie, I’ll be your guitar player,” a twist on a lyric in his 2016 song, “The Fighter.”

However, those rumors were never officially confirmed by either Kidman or Urban, and neither released a public statement to address their split directly.

Article continues below advertisement

After splitting in September, Nicole Kidman and Keith Urban finalized their divorce last month.

According to the Daily Mail, the swift resolution appeared to be tied to the pair’s reported decision to separate amicably, a sentiment further reflected in the terms of their agreement.

The duo agreed to waive all rights to both child support and spousal support and also decided to divide all shared property in a manner satisfactory to both parties. This includes household furniture and appliances, vehicles, bank accounts, investments, and personal items.

Court documents also revealed that each party will retain what they individually owned, be responsible for their own legal expenses, and split any joint court costs incurred during the divorce proceedings.

The pair will also co-parent their daughters under a parenting plan that names Kidman as the primary custodial parent. Under the agreement, the children will spend 306 days per year with the actress, while Urban will have them for the remaining 59 days, including every other weekend.

All formal “discovery, including completing interrogatories and requests,” was also waived by the former couple.

Article continues below advertisement

Since the turn of the new year, Kidman has been out and about, hinting that she is moving on just fine after her divorce.

Towards the end of January, she shared a raft of images documenting a snowbound jaunt to Antarctica with family and friends. Also, on the trip was the actress’s close sister, Antonia

A few days later, she turned heads in a quirky, feathered midi dress for her appearance at the Chanel Haute Couture spring/summer 2026 show.

That same month, she also made an appearance at The Peninsula Classes Best of the Best Awards in Paris, donning a long-sleeved, orange dress that hugged her slender frame and featured white-patterned details on the material.

through an airport terminal in Sydney on her way to an undisclosed destination. She wore head-to-toe Chanel, accessorized with dark sunglasses and a pair of sneakers.

Roomies… love is in the air, and Allison Holker is giving the internet all the feels. The ‘So You Think You Can Dance’ alum announced that she and Adam Edmunds are officially engaged after nearly two years of dating. And, the carousel of romantic photos she shared has the timeline melting. Allison’s engagement announcement comes three years after her husband Stephen “tWitch” Boss passed away in December 2022.

On Thursday, February 12, Allison Holker took to her Instagram and shared “We’re ENGAGED! It was the most romantic night of my life!” The dancer continued the post with “I am so in love with you Adam.” In the sweet snaps, Holker stunned in a red satin dress while her man Adam Edmunds rocked a crisp white button-up with a black blazer and pants.

And the proposal itself? Adam got down on one knee surrounded by a sea of red roses. The tech CEO even orchestrated a “surprise birthday party” that turned into a full-blown proposal party, complete with Clinton Kane singing their song, ‘I Guess I’m in Love.’ Holker also gushed about how Edmunds has impacted her and her kids’ lives, writing, “You helped me find me again and showed me how to love. Every morning I wake up I feel safe knowing you are My person at my side.“

This Instagram user @thetiabeestokes wrote, “Screaming with joy ❤️ so happpy for you sis!♥️😭 you deserve all the happiness and love“

And, Instagram user @agentnicolelynn shared, “Not that you need permission, but you absolutely deserve to have true love again! Congrats! ❤️”

Meanwhile, Instagram user @quinncy64 commented, “Omg congratulations🥹🥹😍😍🍾❤️🫶🏻❤️🫶🏻”

While Instagram user @lauradacity added, “The love. The smiles. The happiness. THAT DRESS. All of it. CONGRATULATIONS! 🍾🎉 ❤️”

Lastly, Instagram user @robson65 said, “Im happy you found love again.“

For those keeping track, Allison Holker began dating Adam Edmunds a little over a year after the death of her late husband, Stephen “tWitch” Boss passed away in 2022. The couple went public with their relationship at a New York Fashion Week show in September 2024. Holker has been candid about her journey since Boss’ death, including addressing criticism over her memoir and taking moments to commemorate her late husband while raising their blended family. Allison and tWitch met during the ‘So You Think You Can Dance’ wrap party in 2010. They later married in 2013 and were together until his passing in December 2022. They share three children together Maddox and Zaia Boss. Allison also has a daughter, Weslie Fowler from a previous relationship, but was later adopted by tWitch.

What Do You Think Roomies?

Team USA figure skater Ilia Malinin’s peers rallied behind him after the gold-medal hopeful finished in a disappointing eighth place during the men’s singles competition.

“I was not expecting that,” Malinin, 21, told NBC Sports on Friday, February 13, after his final 2026 Winter Olympics performance. “I felt so ready getting on that ice. Maybe I was too confident it was going to go well.”

Malinin, affectionately nicknamed the “quad god” for the sheer number of quadruple turns in his routines, was the gold-medal favorite in the 2026 Winter Olympics. After finishing the short program at the top of the leaderboard, he slid down to eighth after falling twice and making a slew of technical mistakes in his free skate.

“Finally experiencing that Olympic atmosphere, it’s crazy. It’s really different,” he told NBC after his competition. “I blew it. There’s no way that just happened.”

Ahead of the individual event, Malinin helped Team USA win gold in the team event.

Keep scrolling to see how Malinin’s fellow skaters have reacted to his surprising eighth place finish:

Tara Lipinski served as a broadcaster during Malinin’s Olympics competition.

“The grace, honesty and sportsmanship you showed in a moment of heartbreak reveals you are not only an elite athlete but a gracious human being,” Lipiniski wrote via Instagram. “I can’t wait to watch you rise.”

Johnny Weir works with Tara Lipinski as an NBC commentator during the Winter Games.

“You are one in a million @ilia_quadg0d_malinin,” Weir captioned an Instagram tribute. “You showed true sportsmanship and grace. I can’t wait to see where you’ll take us next. 🤍”

Gold medalist Nathan Chen was also confused as to why Malinin faced many missteps in the free skate.

“Something happened tonight and, truthfully, I can’t even express what it might be,” Chen told Yahoo! Sports. “I definitely can reflect back on my experience in 2018, when I went into the short program with a lot of pressure, a lot of concerns in my head [and] a lot of doubt.”

Chen further noted that Malinin appeared to “hold back” on most of his elements throughout the Olympics routine.

“By the end of it, it just was not his night,” he said. “One of the hardest parts about performing for a huge sold-out crowd is that you really can viscerally feel the reaction from the crowd. … That hurts you to your gut. Mentally, you have to figure out what went wrong and how can I regroup for the next element? Also, the energy changes in the arena and you can feel there’s tension now.”

Chen also noted that Malinin is still young and is “still hungry” to overcome his 2026 Olympics outcome.

“He has so much potential,” Chen concluded. “Tonight is a night where he’ll have to reflect and reevaluate where he was mentally and physically, and try to identify how he can come into the next Olympics and have a different outcome.”

Retired Canadian figure skater Elladj Baldé also offered his support.

“Figure Skating is one of the hardest sports mentally. The pressure is unbelievably heavy and there is no margin for error,” Baldé wrote via Instagram. “Tonight was a tough one but I am so proud of all of these skaters for the work they have put in to get here.”

Speaking to Malinin directly, he added, “You are an innovator and trailblazer of this sport and what you bring to the ice is far greater than simply your jumping ability.”

:max_bytes(150000):strip_icc():format(jpeg)/jennifer-lawrence-snl-2013428-020326-cf300464371a4931bbd0fab5e4b35b00.jpg)

The actress said she made the gig “everybody else’s problem.”

:max_bytes(150000):strip_icc():format(jpeg)/Cardi-B-performs-021326-742ff6d1ab2a44f58aba4786f4801efe.jpg)

“That was the government!” the “I Like It” rapper joked after returning to her feet.

Published

|

Updated

Spencer Pratt might have a ton of supporters backing his Los Angeles mayoral run … but, his sister Stephanie isn’t one of them — because she’s warning people not to elect him!

Stephanie took to social media Saturday to bash her bro’s political ambitions … admitting he’s done great work for the Pacific Palisades community — but he can’t be responisible for 4 million citizens.

Spencer’s only running to boost sales of his memoir “The Guy You Loved to Hate: Confessions from a Reality TV Villain,” Stephanie claims … and, she tells people to just wait and see what he does with their tax dollars if elected.

Stephanie does write she’s worried about Los Angeles — referring to Mayor Karen Bass as “ASSBASS” in one post — but adds the city doesn’t need “another unqualified and inexperienced mayor. A vote for him is a vote for stupidity.”

Spencer announced his run for mayor last month … speaking mainly about the mismanagement by the local government of the Pacific Palisades Fire which burned his house among many other structures in the area.

TMZ.com

We spoke to Spencer at a campaign event last week, and he’s confident he can defeat Mayor Bass — who he calls Karen Basura, trash in Spanish — mainly because he’s sure she’s going to end up in jail for obstruction of justice. Much of his comments seemed ripped straight from the President Trump political playbook

However, if he wants to move into the mayor’s residence, the Getty House, Spencer may need to address the discord in his own.

We’ve reached out to Spencer … so far, no word back.

Why Israel is blocking foreign journalists from entering

LLP registrations cross 10,000 mark for first time in Jan

Big Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

Mia Brookes misses out on Winter Olympics medal in snowboard big air

Costco introduces fresh batch of new bakery and frozen foods: report

SpaceX’s mighty Starship rocket enters final testing for 12th flight

Winter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

Benjamin Karl strips clothes celebrating snowboard gold medal at Olympics

The Final Warning: XRP Is Entering The Chaos Zone

Luxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

The Health Dangers Of Browning Your Food

Julius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

![Heathrow has said passenger numbers were 60% lower in November than before the coronavirus pandemic and there were “high cancellations” among business travellers concerned about being trapped overseas for Christmas as Omicron spreads. The UK’s largest airport said the government’s travel restrictions had dealt a fresh blow to travel confidence and predicted it was likely to take several years for passenger numbers to return to pre-pandemic levels. This week ministers said passengers arriving in the UK would have to take a pre-departure Covid test, as well as a post-flight test, because of fears about the spread of the new variant. “[The] high level of cancellations by business travellers concerned about being trapped overseas because of pre-departure testing shows the potential harm to the economy of travel restrictions,” the airport said in an update. Heathrow said the drop in traveller confidence owing to the new travel restrictions had negated the benefit of reopening the all-important corridor to North America for business and holiday travel last month. Eleven African countries have been added to the government’s red list, requiring travellers to quarantine before reuniting with families. “By allowing Brits to isolate at home, ministers can make sure they are reunited with their loved ones this Christmas,” said John Holland-Kaye, the chief executive of Heathrow. “It would send a strong signal that restrictions on travel will be removed as soon as safely possible to give passengers the confidence to book for 2022, opening up thousands of new jobs for local people at Heathrow. Let’s reunite families for Christmas.” Heathrow said that if the government could safely signal that restrictions would be lifted soon, then employers at Heathrow would have the confidence to hire thousands of staff in anticipation of a boost in business next summer. The airport is expecting a slow start to 2022, finishing next year with about 45 million passengers – just over half of pre-pandemic levels. This week Tui, Europe’s largest package holiday operator, said it expected bookings for next summer to bounce back to 2019 levels. However, Heathrow said on Friday not to expect the aviation industry to recover for several years. “We do not expect that international travel will recover to 2019 levels until at least all travel restrictions (including testing) are removed from all the markets that we serve, at both ends of the route, and there is no risk of new restrictions, such as quarantine, being imposed,” the airport said.](https://wordupnews.com/wp-content/uploads/2026/02/shutterstock_1100012546-scaled-400x240.jpg)

![Heathrow has said passenger numbers were 60% lower in November than before the coronavirus pandemic and there were “high cancellations” among business travellers concerned about being trapped overseas for Christmas as Omicron spreads. The UK’s largest airport said the government’s travel restrictions had dealt a fresh blow to travel confidence and predicted it was likely to take several years for passenger numbers to return to pre-pandemic levels. This week ministers said passengers arriving in the UK would have to take a pre-departure Covid test, as well as a post-flight test, because of fears about the spread of the new variant. “[The] high level of cancellations by business travellers concerned about being trapped overseas because of pre-departure testing shows the potential harm to the economy of travel restrictions,” the airport said in an update. Heathrow said the drop in traveller confidence owing to the new travel restrictions had negated the benefit of reopening the all-important corridor to North America for business and holiday travel last month. Eleven African countries have been added to the government’s red list, requiring travellers to quarantine before reuniting with families. “By allowing Brits to isolate at home, ministers can make sure they are reunited with their loved ones this Christmas,” said John Holland-Kaye, the chief executive of Heathrow. “It would send a strong signal that restrictions on travel will be removed as soon as safely possible to give passengers the confidence to book for 2022, opening up thousands of new jobs for local people at Heathrow. Let’s reunite families for Christmas.” Heathrow said that if the government could safely signal that restrictions would be lifted soon, then employers at Heathrow would have the confidence to hire thousands of staff in anticipation of a boost in business next summer. The airport is expecting a slow start to 2022, finishing next year with about 45 million passengers – just over half of pre-pandemic levels. This week Tui, Europe’s largest package holiday operator, said it expected bookings for next summer to bounce back to 2019 levels. However, Heathrow said on Friday not to expect the aviation industry to recover for several years. “We do not expect that international travel will recover to 2019 levels until at least all travel restrictions (including testing) are removed from all the markets that we serve, at both ends of the route, and there is no risk of new restrictions, such as quarantine, being imposed,” the airport said.](https://wordupnews.com/wp-content/uploads/2026/02/shutterstock_1100012546-scaled-80x80.jpg)

Weight-loss jabs threaten Greggs’ growth, analysts warn

Residents say city high street with ‘boarded up’ shops ‘could be better’

Pippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

Bhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

Blockchain.com wins UK registration nearly four years after abandoning FCA process

U.S. BTC ETFs register back-to-back inflows for first time in a month

Prepare: We Are Entering Phase 3 Of The Investing Cycle

Kirk Cousins Officially Enters the Vikings’ Offseason Puzzle