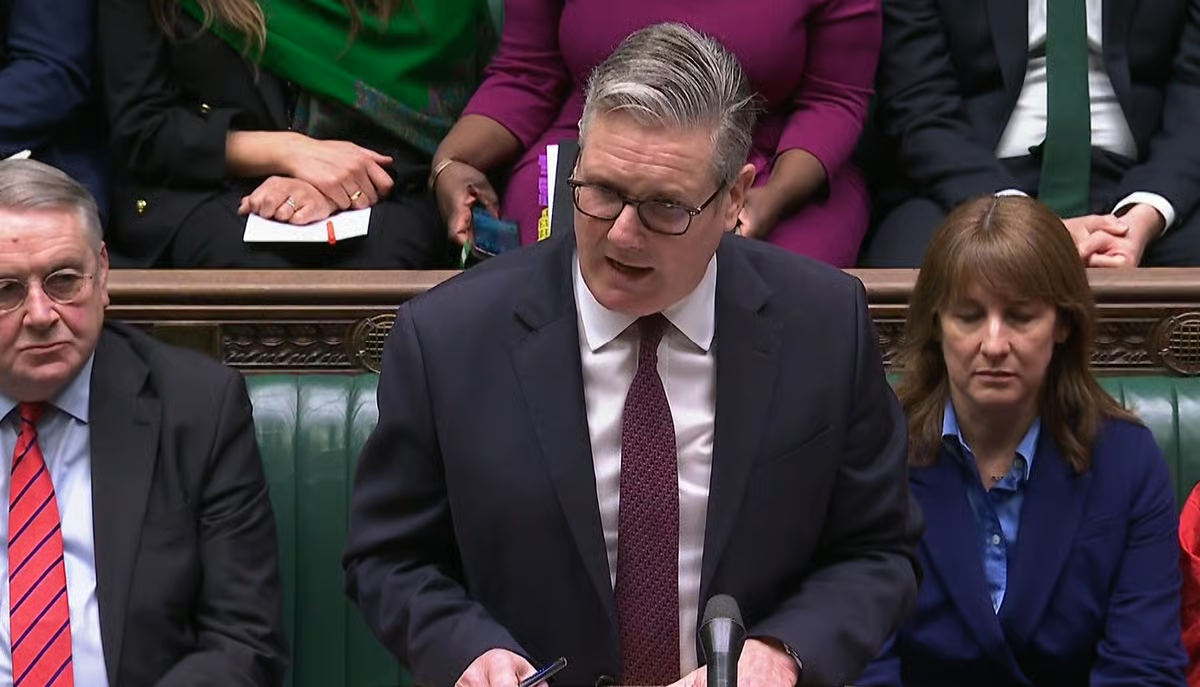

Ian Gore died nine days after the crash

The family of a ‘deeply loved’ grandfather who died after being hit by a car while pushing a broken down van off the road have paid tribute to him. Ian Gore, 62, suffered serious injuries during the crash on January 17 and died in hospital nine days later.

Police said that just before the crash on A585 A585 near Poulton-le-Fylde, Lancs, Mr Gore’s white Peugeot Partner van had broken down and was being pushed to the side of the road by him and another man who had stopped to help. Whilst it was being pushed, a blue Volkswagen Transporter taxi collided with the Partner.

The man who stopped to help, aged in his 30s, also suffered serious injuries, and has since been discharged from hospital. A woman in her 60s, the passenger of the Partner suffered minor injuries.

Try MEN Premium NOW for just £1

The driver of the Volkswagen, a man in his 70s was arrested on suspicion of causing serious injury by careless driving and has since been released under investigation.

In a tribute released today Mr Gore’s family said: “Ian Gore was a deeply loved husband, father, father-in-law, brother, uncle, and proud ‘Pops’ to his four, soon to be five, grandchildren. He loved and cherished his family above all else.

“He was a well-known and respected community man in Ormskirk, always willing to lend a hand or support those around him. Ian was also known in the Maghull area of Merseyside where along with his brother and son he had run a family business for over 30 years.

“Ian was highly regarded by industry colleagues and customers alike. His love of music and entertaining shone through his daily life and the outpouring of tributes from people he met and whose lives he touched are beautiful and heart-warming to read.

“Ian will be remembered for his kindness, generosity, cheeky smile and the positive impact he had on so many lives. The family thanks the community for their kindness, support, and respect during this incredibly difficult time.”

Police are continuing to investigate the collision. Anyone with dashcam or CCTV footage of the collision, or of the A585 near to Windy Harbour between 6pm and 6.20pm on June 17, is asked to contact police by calling 101 or emailing SCIU@lancashire.police.uk quoting log 1029 of January 17.