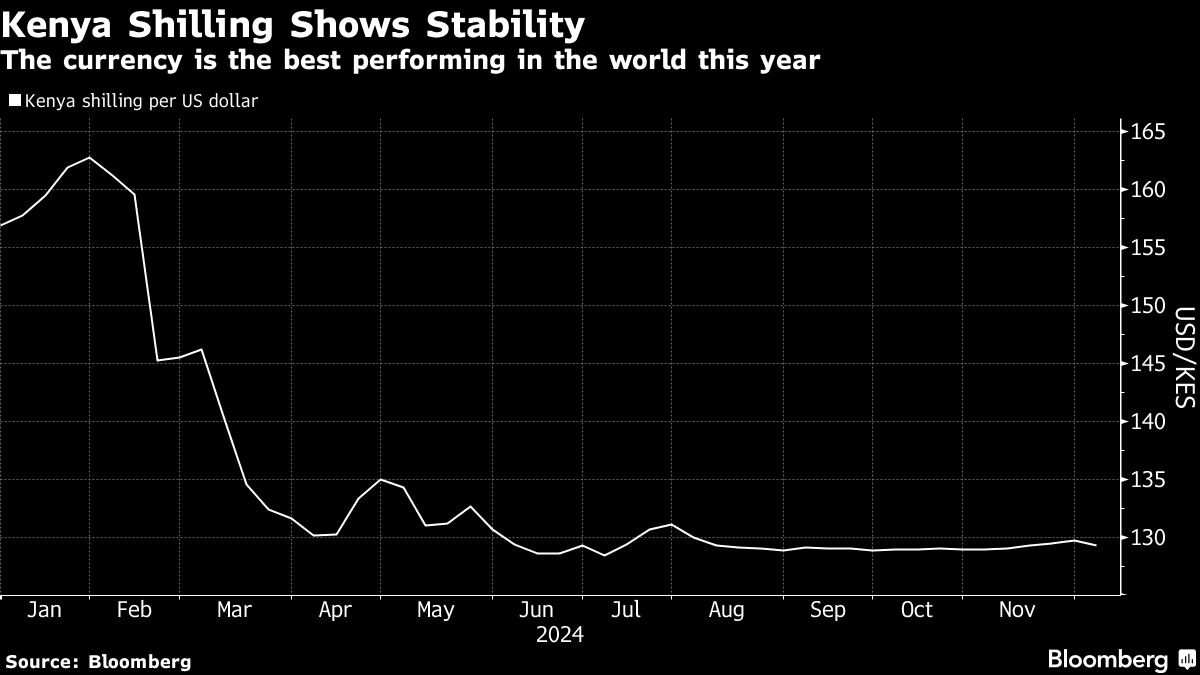

Kenya’s currency, which has weathered the surge in the dollar since Donald Trump won the US election, risks foundering unless the East African nation’s economic growth revives.

Kenyan Shilling Strength Masks Underlying Risks to Economy

Estimated read time

1 min read

You May Also Like

Bitcoin Momentum Ebbs Heading Into Last Stretch of Record Year

December 24, 2024

UK launches review of targets for sales of electric vehicles

December 24, 2024

China’s Wild Markets Send HK Derivatives to Third Record Year

December 24, 2024

More From Author

‘I won £18k in Level Up Giveaways draw but haven’t seen a penny’

December 24, 2024

TikTok’s First App Layer SonicX Will Airdrop Tokens to TikTok Users

December 24, 2024

+ There are no comments

Add yours