Crypto World

Gold Leads as Dollar Slides; Bitcoin Recasts as a Companion Asset

Bitcoin has long been pitched as a hedge against monetary erosion, but a currency backdrop with the U.S. dollar wavering near multi-year lows has nudged hedging behavior toward a broader toolkit. While Bitcoin remains part of the landscape, the current dynamic elevates gold and tokenized gold to the front lines of risk management. Market participants are embracing gold not merely as a tradable commodity but as a base layer for digital-age hedging, where tokenized versions offer on-chain access to bullion and censorship-resistant value storage. The movement signals a shift toward multi-asset strategies that blend traditional safe havens with crypto-native tools in a climate of inflation concerns and currency stress.

Key takeaways

- Tokenized gold has gained traction as a bridge between traditional assets and crypto rails, with a clear share of the market now driven by digital gold exposure.

- Tether Gold (XAUt) accounts for more than half of the tokenized gold market, with a market value exceeding $2.2 billion and 520,089 tokens in circulation as of the end of Q4, each backed by physical gold bullion.

- Gold prices topped above $5,300 per troy ounce, marking roughly a 90% gain over the past year, while the U.S. dollar index slid to multi-year lows, underscoring currency stress in macro markets.

- Bitwise launched an actively managed ETF designed to hedge currency debasement by pairing BTC with gold and other precious metals, trading on the NYSE under the ticker BPRO.

- Fidelity plans to roll out a U.S. dollar stablecoin, the Fidelity Digital Dollar (FIDD), aligning with federal standards for payments-focused digital dollars and real-time settlement.

- Laser Digital, backed by Nomura, reportedly sought a U.S. national bank trust charter, signaling a push to integrate crypto services within the U.S. regulatory banking framework.

Tickers mentioned: $BTC, $BPRO

Sentiment: Neutral

Price impact: Positive. Demand for safe-haven assets and tokenized gold supports upside potential for gold and related crypto-linked products in a currency-stressed environment.

Market context: The move toward tokenized gold, crypto-backed ETFs, and regulated digital-asset settlement rails reflects a maturing macro backdrop where liquidity, regulatory clarity, and real-time settlement influence asset allocation within the crypto ecosystem.

Why it matters

Tokenized gold represents a tangible bridge between the legacy financial system and the crypto universe. By providing on-chain access to bullion, these instruments aim to address one of the thorniest questions in the crypto space: how to offer reliable exposure to a traditional safe haven within a digital-first framework. The market has seen the gold-backed stablecoin XAUt capture a commanding share of the tokenized gold segment, illustrating investor demand for asset-backed digital instruments that can move with the speed and programmability of blockchain rails. The fact that XAUt’s circulating supply stood at 520,089 tokens and that the overall market value exceeded $2.2 billion as of late Q4 underscores both liquidity and confidence in tokenized bullion as a complement to conventional gold holdings.

Meanwhile, gold’s price ascent—surging past the $5,300 per ounce mark and representing a near-90% year-over-year increase—aligns with a broader risk-off narrative as fiat erosion concerns persist. The concurrent slide in the Bloomberg dollar index to a multi-year low reinforces the sense that investors are recalibrating portfolios toward assets with intrinsic value and cross-asset hedging capabilities. In this environment, tokenized gold and related crypto constructs are positioned not as replacements for traditional hedges but as enhancements to diversified risk management strategies. The narrative is not about abandoning Bitcoin; rather, Bitcoin is becoming a complementary piece in a safety net that blends hard assets, tokenized assets, and regulated crypto instruments.

The market’s depth is expanding beyond products that simply track crypto prices. Bitwise’s BPRO offers an actively managed route for wealth managers seeking exposure to both digital and physical assets, packaged as a currency-debasement hedge. The fund’s NYSE listing signals a convergence of conventional asset management with crypto exposure, potentially drawing in investors who previously shied away from direct crypto allocations. The ETF’s structure—combining Bitcoin with gold and mining stocks—highlights a disciplined approach to hedging currency risk while maintaining a diversified exposure that can be tailored to client risk profiles. This development illustrates how Wall Street is layering crypto into traditional portfolios through regulated vehicles rather than relying solely on pure crypto products.

The push toward formalized crypto exposure in regulated channels extends to the traditional finance giant cohort, where Fidelity is pursuing a U.S. dollar stablecoin—the Fidelity Digital Dollar (FIDD). The project is being designed to adhere to federal standards for payments-focused digital dollars and to support real-time settlement and 24/7 payments, moving beyond the speculative trading narrative that has often governed digital assets. As the GENIUS Act and other regulatory developments shape the path forward for stablecoins, Fidelity’s approach reflects a broader trend: the push to identify trusted, regulated rails that can underpin mainstream adoption of crypto-native settlement systems.

In parallel, the market is witnessing a broader regulatory push that could redefine the boundaries of crypto finance. Nomura’s Laser Digital has reportedly sought a U.S. national bank charter, potentially allowing nationwide operations under a single federal license and enabling spot trading of digital assets without custody of deposits, subject to OCC oversight. If realized, the charter would streamline operations and reduce the state-by-state frictions that have characterized many crypto-enabled services to date. The development underscores a broader shift toward federated, regulator-friendly structures as digital assets move closer to mainstream financial markets. It also aligns with other industry moves toward federal trust bank status as a mechanism to deepen integration with traditional finance while preserving the distinct benefits of crypto-native settlement and custody models.

Taken together, these threads illustrate a converging narrative: the crypto ecosystem is expanding beyond pure price exposure toward robust hedging and settlement infrastructures. Tokenized gold and regulated crypto strategies are becoming essential elements of a diversified risk framework that can adapt to shifting macro regimes. Bitcoin remains a core anchor in this evolving playbook, but its role is increasingly as a high-volatility, liquidity-providing complement to more traditional hedges and to institutional-grade crypto rails. The result is a more nuanced, multi-layered approach to navigating currency debasement risk—one that blends centuries-old safe-haven assets with the efficiency and programmability of modern crypto finance.

Crypto Biz is your weekly pulse on the business behind blockchain and crypto, delivered directly to your inbox every Thursday.

https://platform.twitter.com/widgets.js

What to watch next

- Regulatory progress on U.S. stablecoins and digital-dollar standards, including any updates to the GENIUS Act framework.

- Timeline and milestones for Fidelity’s Fidelity Digital Dollar rollout and pilot tests in settlement rails.

- Performance and flows into the Bitwise Proficio Currency Debasement ETF (EXCHANGE: BPRO) as institutional demand evolves.

- Regulatory clarity on bank charters and trust frameworks affecting crypto banking services, including OCC decisions on national charters.

- Adoption dynamics for tokenized gold products and their impact on gold price correlations with crypto assets.

Sources & verification

- XAUt token supply and market cap figures as of Q4 and the claim that XAUt accounts for more than half of the tokenized gold market.

- Gold price levels and the four-year low on the Bloomberg US dollar index referenced in relation to gold’s rally.

- Bitwise Proficio Currency Debasement ETF (BPRO) launch details and NYSE listing, including its focus on BTC, gold, and mining stocks.

- Fidelity Digital Dollar (FIDD) and the GENIUS Act alignment for stablecoins and real-time settlement infrastructure.

- Nomura-backed Laser Digital’s reported US national bank charter application with the OCC and related regulatory context.

Crypto World

Qualcomm (QCOM) Stock: What Wall Street Expects from Earnings Today?

TLDR

- Qualcomm reports December quarter earnings today with Wall Street forecasting $12.13 billion in revenue and $3.39 EPS

- The stock trades down 15% year-to-date, creating a 44% valuation discount compared to the S&P 500

- Bernstein analyst keeps Outperform rating with $200 target despite smartphone market headwinds

- Options pricing indicates approximately 6% expected move with market bias score at -1

- Critical support sits at $146-$148 while resistance holds at $150-$152

Qualcomm unveils its December quarter financial results after today’s closing bell. Analysts project revenue of $12.13 billion with adjusted earnings per share reaching $3.39.

The mobile processor and 5G chipset manufacturer has struggled in 2026. Shares have fallen 15% while the broader semiconductor sector rallied 13%.

This underperformance reflects growing concerns about smartphone demand. Rising memory prices threaten to crimp consumer device purchases throughout the year.

Yet not everyone shares this pessimistic outlook. Bernstein analyst Stacy Rasgon maintained his Outperform rating Monday.

His $200 price target suggests substantial upside from current levels. Rasgon believes the market is overlooking Qualcomm’s fundamental strengths.

“We still believe there is value to be had under the surface [with its] objectively strong product portfolio,” the analyst wrote. He acknowledged the “general distaste of smartphones” currently weighing on sentiment.

Valuation Gap Creates Opportunity

The numbers tell an interesting story. Qualcomm’s price-to-forward earnings ratio sits 44% below the S&P 500 average.

That’s a massive discount for a market leader in wireless technology. The company dominates mobile processors and 5G chipsets globally.

Wall Street expects the current quarter to deliver $11.11 billion in revenue with $2.90 EPS. These forward estimates matter just as much as December’s results.

Options traders are pricing in roughly 6% movement following the announcement. This implied volatility doesn’t favor either direction, just expects action.

Price Action Shows Shifting Dynamics

Recent trading patterns reveal something important. Selling pressure has weakened over the past several sessions.

Downside attempts keep stalling without sustained momentum. The stock has transitioned from steady decline to choppy range-bound movement.

This shift suggests sellers are losing control. But it doesn’t confirm buyers are ready to step in aggressively either.

Key support rests between $146 and $148. Holding this zone keeps the stabilization process alive.

Breaking below $146 would hand control back to sellers. That could trigger accelerated losses.

Resistance appears at $150 to $152. Failed rallies here would confirm range behavior rather than trend reversal.

The market bias score registers -1 on a scale from -10 to +10. This reflects lingering weakness alongside fading downside momentum.

Scores near zero indicate low conviction. Neither bulls nor bears have established control heading into the report.

Qualcomm continues to trade near the bottom of its post-earnings range. The corrective phase that began after last quarter’s results remains intact.

Tonight’s report will clarify whether memory price concerns are justified. Or if the market has overreacted to temporary headwinds.

The company’s product lineup remains competitive despite market skepticism. Execution and guidance will determine the stock’s next move.

Crypto World

Fed To Inject $8.3 Billion In Liquidity Today

Join Our Telegram channel to stay up to date on breaking news coverage

The Federal Reserve is planning a liquidity injection through bill purchases starting tomorrow, which will increase the money supply and often boost risk assets. The US Fed is set to add $8.3 billion in capital to support economic stability.

While short-term effects may vary, the decision to add liquidity is widely seen as super bullish in the long term, especially for risk assets like crypto and tech stocks.

Such a significant injection by the FED is also a signal that the central bank is committed to supporting financial markets amid ongoing global uncertainties. For crypto investors, this often translates into increased confidence and stronger price action over time.

Data also shows that the Fed will add $53.3 billion in liquidity by February 12 via bond reinvestments and reserve buys.

Total $55.3B liquidity added by Feb 12 via bond reinvestments & reserve buys.

QE SHOULD START SOONER NOW! pic.twitter.com/UqDRgIAttc— Money Ape (@TheMoneyApe) January 19, 2026

More liquidity can translate to calmer credit markets, lower pressure on short-term interest rates, and a supportive backdrop for both equities and bonds.

More Liquidity Good For Crypto

When the FED adds money into the system, it increases market liquidity, reduces borrowing costs, and encourages risk-taking among investors. This has historically led to higher equity and crypto prices, greater demand for scarce assets like Bitcoin, and stronger overall investor sentiment.

Crypto most thrives in high-liquidity environments, which may push the market towards a rally as capital trickles down from traditional finance.

Despite hopes of renewed momentum from shifts in the macroeconomic environment, the crypto market is currently in a sustained decline. In the last 24 hours, the crypto market has lost more than $50 million, dropping to a market capitalization of around $3.17 trillion as BTC plunged below $91,000.

This drop has resulted in massive liquidations in the market, totaling over $2 billion in the last 2 days and about $260 million in the last 24 hours, according to Coinglass data.

Related News:

Best Wallet – Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage

Crypto World

Amazon (AMZN) Stock: AWS Announces Major Cloud Partnership Before Q4 Earnings

TLDR

- AWS secures multi-year cloud and AI partnership with Prosus NV valued at hundreds of millions of dollars

- Deal consolidates Prosus cloud operations on AWS infrastructure with expected double-digit cost reductions

- Amazon reports Q4 2025 earnings Thursday with analysts forecasting $1.97 EPS and $211.44 billion revenue

- Partnership demonstrates ongoing enterprise demand for AI-enabled cloud services despite cautious spending

- Amazon stock trades at $238 with analyst price targets suggesting 25% upside potential

Amazon Web Services has locked in a substantial cloud and AI contract with Prosus NV just one day before the company releases its fourth-quarter results. The deal marks another win for AWS in the competitive enterprise cloud market.

Prosus Head of Ecosystem Igor Cardoso confirmed the three-year agreement runs into hundreds of millions of dollars. He stopped short of disclosing the precise contract value in his Bloomberg interview.

The partnership will see Prosus migrate its entire cloud and AI workload to AWS infrastructure. Multiple AWS data centers across different regions will support the consolidated operations.

Cost Efficiency Drives Enterprise Cloud Adoption

Prosus expects to slash costs by double digits through the AWS migration. The savings stem from standardizing operations on a single cloud platform rather than managing multiple vendor relationships.

This approach reflects broader enterprise trends. Companies continue investing in cloud technology when it delivers clear financial benefits and operational improvements.

For Amazon, the agreement adds meaningful contracted revenue to its AWS backlog. These long-term commitments provide stability even when quarterly spending patterns fluctuate.

The deal also validates ongoing demand for AI-integrated cloud services. Enterprises remain willing to commit substantial resources to AI infrastructure that produces measurable results.

Amazon faces Wall Street on Thursday, February 5, with its Q4 fiscal 2025 earnings report. Analysts project adjusted earnings per share will reach $1.97 compared to $1.86 in the prior-year period.

Revenue forecasts point to $211.44 billion for the quarter. That represents 12.6% growth year-over-year.

AWS Backlog Reflects Strong Customer Pipeline

Amazon’s contracted cloud revenue continues expanding according to company metrics. The growing backlog shows customers making multi-year commitments to AWS services.

These extended agreements reduce earnings volatility and improve revenue predictability. They also signal customer confidence in AWS as a strategic technology provider.

Prosus will collaborate directly with AWS technical teams to scale AI capabilities across its portfolio. The standardized infrastructure should accelerate deployment timelines while controlling expenses.

The announcement timing highlights AWS competitive strength entering the earnings release. It provides tangible proof of enterprise demand before management discusses quarterly performance.

Amazon shares have dropped 1.4% over the trailing twelve months. The stock currently sits at $238, well below analyst consensus targets.

TipRanks data shows 35 Buy ratings and one Hold rating for Amazon stock. The average analyst price target stands at $298.53, implying 25.1% upside from current trading levels.

The Prosus contract covers cloud infrastructure, AI workloads, and technical collaboration. Both companies expect the partnership to deliver enhanced efficiency through consolidated operations.

Crypto World

Intelligent Document Processing for Supply Chain Visibility & Automation

Supply chain visibility has emerged as one of the most critical priorities for enterprises operating in an increasingly complex and interconnected global economy. Organizations today manage multi-country supplier networks, volatile demand patterns, regulatory pressures, and heightened customer expectations for speed and transparency. Despite significant investments in digital platforms, many supply chain leaders still struggle with delayed insights, fragmented data, and limited operational clarity.

One of the most persistent and underestimated contributors to this challenge is document dependency. Every supply chain process, procurement, logistics, inventory management, finance, and compliance, relies heavily on documents such as purchase orders, invoices, shipping notices, bills of lading, packing lists, and regulatory certificates. These documents contain essential operational intelligence, yet much of this information remains trapped in unstructured or semi-structured formats. This is where Intelligent Document Processing Solutions are playing a transformative role. By enabling intelligent document processing for supply chain operations, organizations can eliminate visibility gaps, accelerate decision-making, and build resilient, data-driven supply chains.

The Root Causes of Visibility Gaps in Supply Chain Operations

1. Heavy Reliance on Manual Document Handling

Many supply chain processes still depend on manual document review, data entry, and validation. This approach introduces delays, errors, and inconsistencies that prevent real-time visibility. Even small discrepancies in invoices or shipping documents can cascade into payment delays, shipment holds, or compliance violations.

2. Fragmented Information Across Systems

Documents originate from multiple internal departments, suppliers, logistics partners, and regulatory authorities. Without enterprise document automation, data is often siloed across emails, shared drives, portals, and legacy systems, making it difficult to establish a single source of truth.

3. Delayed Data Availability

In many organizations, document data is entered into ERP or supply chain systems only after physical events have already occurred. This reactive data flow undermines forecasting, planning, and proactive risk mitigation.

These challenges highlight why traditional automation approaches are insufficient and why AI solutions for supply chain management are becoming essential.

Get a Custom IDP Solution for Your Supply Chain

What is Intelligent Document Processing in the Supply Chain Context?

Intelligent Document Processing Solutions use artificial intelligence technologies, including machine learning, natural language processing, and advanced optical character recognition, to automatically ingest, classify, extract, validate, and integrate data from supply chain documents. Unlike traditional OCR or rule-based systems, intelligent document processing for supply chain operations understands context rather than relying on fixed templates. It adapts to variations in document formats, learns from historical data, and continuously improves accuracy over time.

By embedding intelligence directly into document workflows, organizations can convert document-driven processes into real-time, automated data pipelines that enhance end-to-end visibility.

How Intelligent Document Processing Fixes Visibility Gaps Across the Supply Chain

Now that the visibility challenges and enabling technology are clear, it is important to understand how intelligent document processing delivers tangible improvements across supply chain operations.

1. Automating High-Volume Document Ingestion

Supply chains generate thousands, often millions of documents annually. Document automation in supply chain environments enables organizations to automatically ingest documents from emails, portals, scanners, APIs, and partner systems.

AI-driven classification models instantly identify document types and route them into the appropriate workflows. This eliminates manual sorting, reduces processing backlogs, and ensures uninterrupted data flow across the supply chain.

2. Context-Aware Data Extraction Across Supplier Ecosystems

Modern Intelligent Document Processing Solutions extract data based on semantic understanding rather than static rules. This capability is critical in global supply chains where document formats vary widely across suppliers, regions, and regulatory environments.

AI models can accurately identify invoice values, shipment dates, quantities, and compliance attributes even when layouts differ significantly. This ensures consistent, structured data capture across diverse document sources, an essential foundation for scalable supply chain automation.

3. Real-Time Integration with Enterprise Platforms

Visibility is only valuable when data is immediately actionable. Enterprise document automation integrates extracted document data directly into ERP systems, transportation management systems (TMS), warehouse management systems (WMS), and other core supply chain platforms.

This real-time integration enables:

- Accurate, up-to-date inventory visibility

- Live shipment and delivery status tracking

- Faster order and invoice reconciliation

- Immediate financial and operational reporting

As a result, decision-makers gain a unified, real-time view of supply chain performance across functions and geographies.

4. Reducing Operational, Financial, and Compliance Risk

Manual document processing remains one of the leading sources of supply chain risk. Errors in customs forms, invoices, or shipping documentation can trigger regulatory penalties, shipment delays, and reputational damage.

By embedding validation rules, confidence scoring, and anomaly detection, AI in supply chain operations identifies discrepancies early in the process. This proactive risk management approach reduces downstream disruptions, strengthens compliance posture, and improves overall operational resilience.

5. Improving Financial Transparency and Supplier Collaboration

Financial workflows are deeply interconnected with supply chain execution. Document automation in supply chain operations accelerates invoice processing, improves three-way matching accuracy, and shortens dispute resolution cycles.

These capabilities enhance cash flow visibility, reduce working capital constraints, and strengthen supplier trust, which are critical factors for maintaining stable and resilient supplier relationships in volatile markets.

The Strategic Role of AI in Supply Chain Operations

Beyond automation, AI solutions for supply chain management enable organizations to transform document data into predictive and prescriptive intelligence. Once document information is structured and standardized, it becomes a high-quality input for advanced analytics and AI models.

For example:

- Predictive analytics can identify potential shipment delays before they occur

- AI models can detect recurring compliance risks or supplier performance issues

- Automated workflows can trigger corrective actions when anomalies are detected

In this way, AI in supply chain operations shifts enterprises from reactive problem resolution to proactive and preventive supply chain management.

Industry Trends Accelerating Intelligent Document Processing Adoption

Several macro-level trends are driving the rapid adoption of Intelligent Document Processing Solutions across supply chain-intensive industries:

- Increasing Supply Chain Complexity

Global sourcing, regulatory diversity, and geopolitical uncertainty are amplifying the need for real-time visibility and automated compliance management.

- Shift Toward Autonomous Operations

Organizations are moving beyond basic automation toward intelligent, self-optimizing supply chains powered by AI-driven decision-making.

- Convergence of IDP, RPA, and Analytics

The integration of document intelligence with robotic process automation and advanced analytics enables straight-through processing across supply chain workflows.

- Demand for Scalable, Low-Code Platforms

Modern enterprise document automation solutions are designed for rapid deployment and scalability, reducing implementation complexity and dependency on IT-heavy customization.

Together, these trends position supply chain automation as a strategic capability rather than a tactical efficiency initiative.

Measurable Business Outcomes of Intelligent Document Processing

Organizations that adopt intelligent document processing for supply chain operations consistently achieve measurable outcomes, including:

- Significant reduction in document processing cycle times

- Improved accuracy of inventory, shipment, and financial data

- Lower operational and compliance risk

- Enhanced customer service and fulfillment performance

- Greater confidence in data-driven planning and execution

These outcomes directly address the visibility limitations that constrain supply chain performance and growth.

Develop AI-Driven Document Automation for Supply Chains

Why Intelligent Document Processing is a High-Value Enterprise Investment

From a strategic perspective, Intelligent Document Processing Solutions deliver value across the enterprise:

- Operations leaders gain transparency and execution control

- Finance teams achieve faster reconciliation and improved cash flow predictability

- IT teams deploy scalable, secure, AI-driven automation

- Compliance teams maintain audit-ready, traceable documentation

This cross-functional impact makes AI solutions for supply chain management one of the most compelling enterprise investments in today’s digital transformation landscape.

Building Transparent and Resilient Supply Chains

Supply chain visibility challenges are no longer caused by a lack of data, but by the inability to process document-driven information at speed and scale. Intelligent Document Processing Solutions address this challenge by transforming documents into real-time intelligence that powers connected, responsive, and resilient supply chains. By embracing enterprise document automation and AI in supply chain operations, organizations can move from fragmented workflows to unified, insight-driven supply chain management.

Antier enables enterprises to deploy advanced intelligent document processing solutions that unlock end-to-end supply chain visibility and operational intelligence. With deep expertise in AI-driven transformation, Antier helps organizations build scalable, future-ready supply chain ecosystems.

Crypto World

Flare Launches New Lending Markets with Morpho

Besides launching the first-ever modular markets for XRP, the latest development introduces modular lending to the Flare ecosystem.

The decentralized finance (DeFi) blockchain network, Flare, has unveiled first-of-its-kind modular lending markets for XRP, introducing permissionless lending for the cryptocurrency.

According to a press release shared with CryptoPotato, the deployment features a partnership with the modular lending protocol, Morpho. Additionally, Flare is also joining forces with Mystic, a platform for curating lending markets across the Ethereum Virtual Machine (EVM) ecosystem. With Morpho leading the integration of modular XRP lending markets on Flare, Mystic will serve as the front-end interface for Morpho on Flare.

Modular Lending Markets For XRP

Modular lending breaks down traditional, all-in-one crypto lending pools into isolated and customizable components. The architecture allows users to create tailored markets with specific oracle feeds and risk parameters, rather than having a single pool dictate risk for all involved assets. Such an approach enhances efficiency and security for users’ funds, given the volatile nature of the crypto market.

Besides launching the first-ever modular markets for XRP, the latest development introduces modular lending to the Flare ecosystem. The move marks a huge step forward in the network’s vision for XRP DeFi (XRPFi), which is transforming the crypto asset from a dormant one into a proactive source of yield and a composable strategy.

Flare has made it its mission to expand DeFi capabilities for XRP, as seen in yield tokenization via Spectra, spot trading through Hyperliquid, and staking via Firelight. In addition, Flare has launched its version of XRP, named FXRP, unlocking yield-generating opportunities for the digital asset.

With the addition of Morpho and Mystic to the framework, Flare has implemented an expansion that enables lending and borrowing use cases that retain XRP on its native blockchain while unlocking on-chain utility.

Expanding the XRPFi Ecosystem

Following the latest integration on Flare, FXRP can now deposit their assets into curated yield-bearing vaults, using FXRP (or other assets like Flare (FLR) and USDT0) as collateral to borrow supported assets. They can also integrate lending positions into structured strategies, gaining access to capabilities that enable capital to loop across staking, lending, and borrowing within a single ecosystem.

You may also like:

“Each market supports a single collateral and loan asset, with parameters such as loan-to-value ratios set at creation. Markets can be launched permissionlessly, while curated vaults allocate capital across selected markets based on defined risk and yield objectives,” Flare explained.

While Mystic serves as the primary access point for now, Flare intends to unveil additional interfaces, such as the Morpho main app, over time.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Michael Burry Warns Bitcoin Treasury Firms Face Existential Risk as BTC Slide Deepens

Burry says Bitcoin is behaving like a speculative trade, and not a hedge, which raises risks for companies holding massive BTC reserves.

Bitcoin’s (BTC) slide below $80,000 has intensified worries that a wider downturn in the broader crypto sector could be imminent.

Market experts believe that the recent slide in BTC’s price may not be an isolated correction, but a development that could seriously destabilize corporate balance sheets and magnify systemic risk if it continues to fall.

Major Market Casualty

Michael Burry has issued a stark warning that Bitcoin’s continued decline could erase significant value across the market, and the greatest risk is concentrated among companies that have built large corporate treasuries around the asset, which have mushroomed over the years.

In the latest Substack post following the latest crypto sell-off, “The Big Short” investor, Burry, said BTC’s drop below important technical levels opens the door to cascading stress not only within crypto markets but also across adjacent financial sectors.

He said that the world’s largest crypto asset is failing to meet a critical expectation often placed on it, that is, acting as a hedge against currency debasement. Instead, Burry said its recent behavior more closely resembles that of a speculative risk asset, particularly given its correlation with the S&P 500. He said gold and silver rallied on geopolitical uncertainty and dollar weakness, but Bitcoin did not follow those macro signals.

Burry also predicted that further downside could have severe consequences for Bitcoin treasury companies that accumulated BTC aggressively during higher price ranges. He highlighted the possibility that another 10% decline could leave major holders such as Michael Saylor’s Strategy billions of dollars underwater, and potentially cut them off from capital markets, thereby increasing bankruptcy risk.

Such outcomes, according to the investor, could amplify losses beyond individual firms and contribute to broader market fallout. Burry additionally noted that Bitcoin’s weakness has coincided with recent pressure in precious metals.

You may also like:

Galaxy Digital’s Zac Prince also questioned the long-term viability of Bitcoin treasury companies, which raise capital to hold BTC on their balance sheets while promising yield. Speaking on TheStreet Roundtable, Prince said these models rely on risky financial engineering rather than BTC’s native value. He compared them to past schemes that created tokens to generate Bitcoin and said that paying a premium for such structures does not make them sustainable.

He even explained that while some firms might pivot to revenue-generating activities, many will still struggle to justify their valuations, and added that businesses should focus on real operations first and treat BTC as a treasury strategy, not the primary driver.

Optimism Wanes

Bitcoin has been under tremendous pressure, and many analysts believe that there could be more pain ahead instead of a much-anticipated recovery.

Former Binance CEO Changpeng “CZ” Zhao also said that while he had been positive about a BTC super cycle just weeks ago, current market sentiment has made him less confident. Speaking on Binance’s social platform, he highlighted the rise of fear, uncertainty, and doubt (FUD) in the community and admitted that the emotional intensity has left him uncertain about BTC’s near-term prospects.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

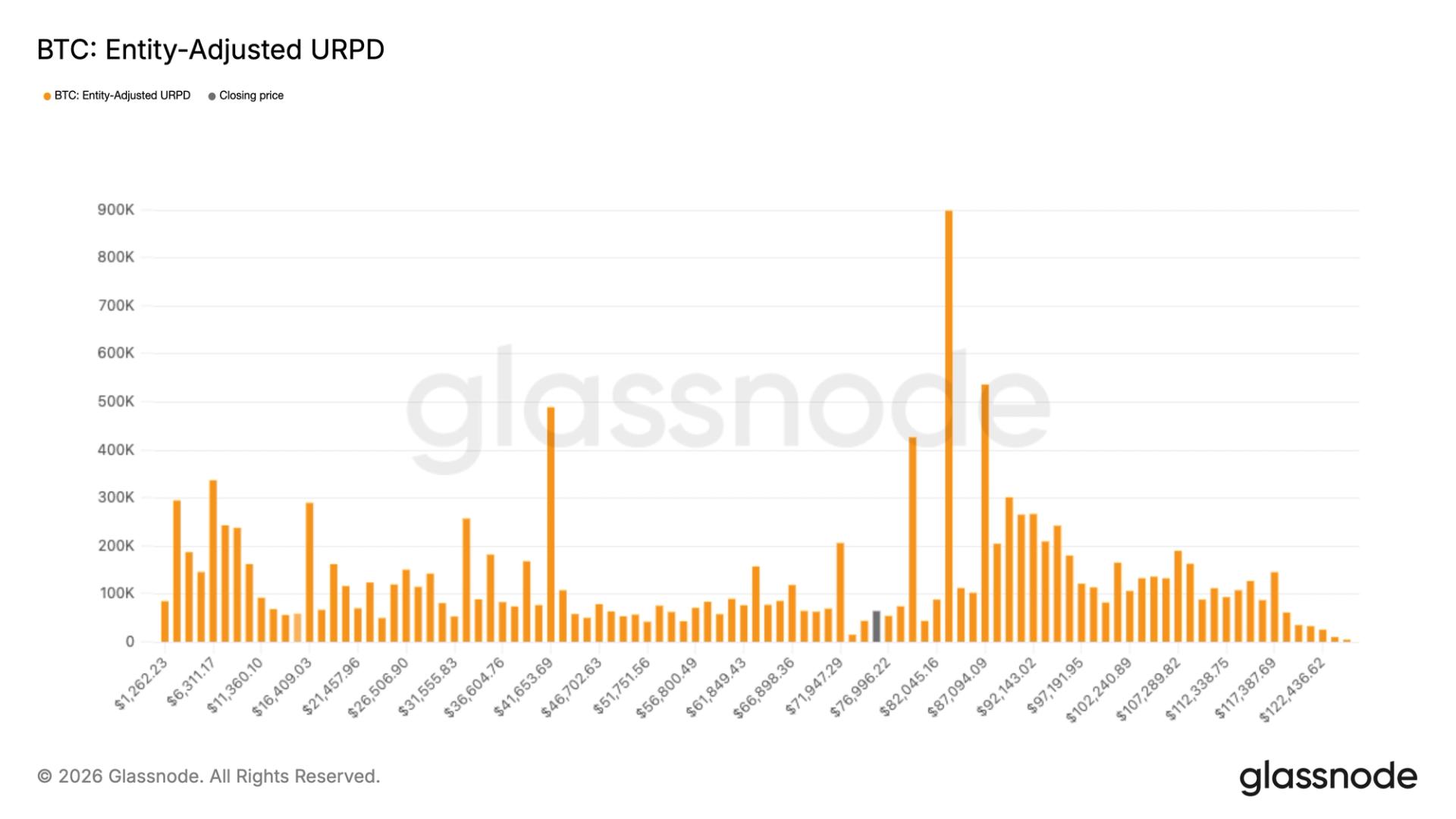

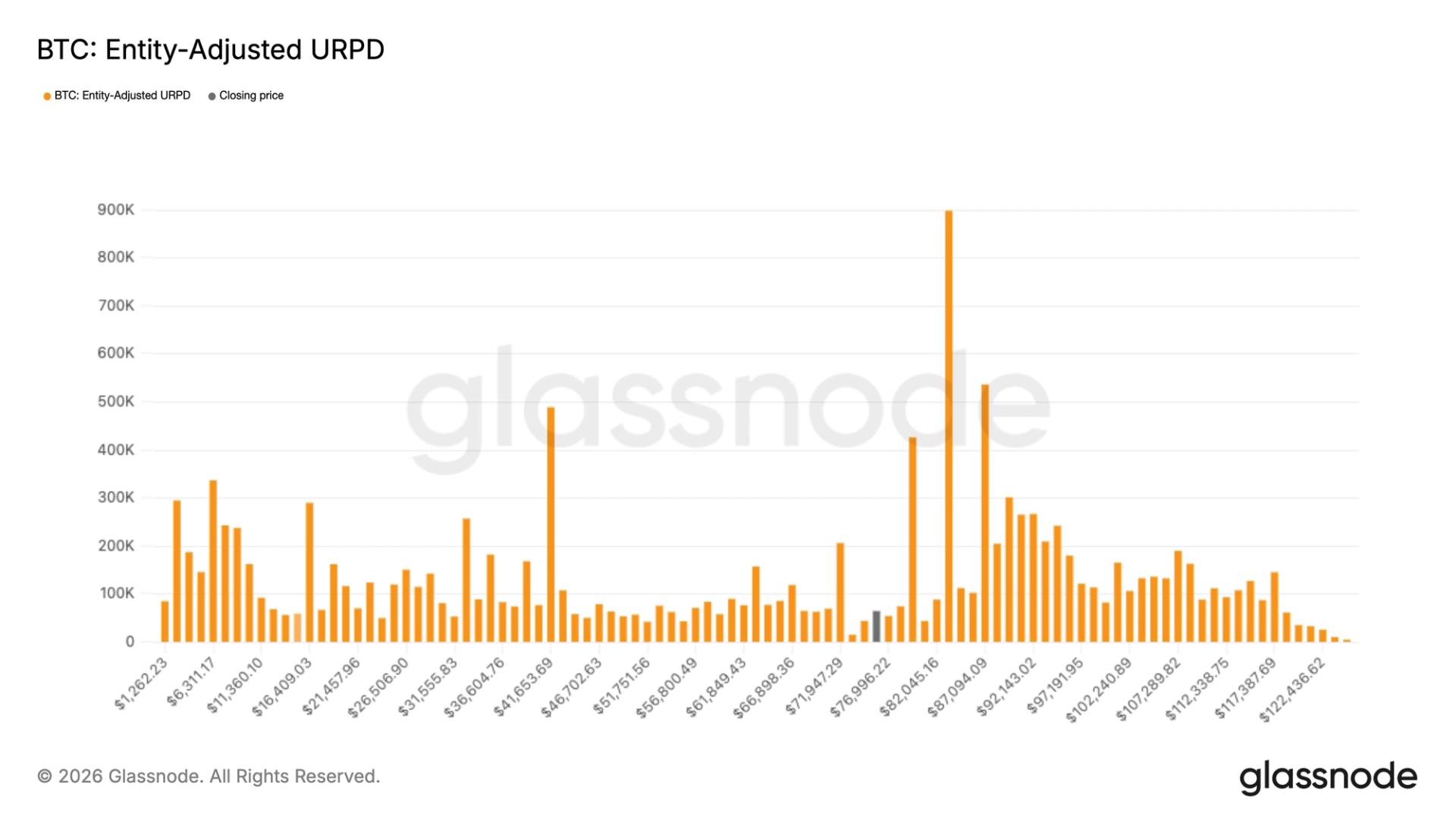

BTC’s thinnest price zone between $70,000 and $80,000

Since the weekend’s slump, the bitcoin price has been constrained between $70,000 and $79,999 for five straight days. That’s a remarkably long time for a range in which the largest cryptocurrency has spent a relatively short span of time.

In fact, bitcoin has spent about 35 days within that $10,000 bucket. Compared with other increments, it’s one of the least developed, underscoring how quickly the price has tended to move through rather than build sustained support or resistance.

The longer the price spends in a given range, the more opportunity there has been for positions to be built, which can later translate into stronger support. What this means is the price is more likely to consolidate in this range or, potentially, make another move toward the lower end near before establishing a more durable base.

During the tariff driven volatility last April, bitcoin held below $80,000 for just a few weeks before rebounding. Similarly, when it reached a then all-time high near $73,000 in March 2024, it spent only a short period at those levels before declining.

Perhaps the clearest example of how quickly bitcoin has moved through this range occurred in November 2024 following Donald Trump’s presidential election victory. The price accelerated from roughly $68,000 to $100,000 in a matter of weeks, leaving little opportunity for consolidation between $70,000 and $80,000.

It’s notable that Strategy (MSTR), the largest corporate holder of bitcoin, has only once bought bitcoin within this range. On Nov. 11, 2024, the company purchased 27,200 BTC for approximately $2 billion at an average price of $74,463.

Consider a chart that shows the prices at which bitcoin last moved within a specific price bucket. Each column represents the amount of bitcoin transferred at that price.

The data clearly shows a lack of supply between $70,000 and $80,000, suggesting that this zone remains structurally thin.

Crypto World

Major Bank Expects Solana to Outperform Bitcoin: When and How?

Standard Chartered is urging investors to look through near-term volatility in digital assets and focus on what it calls “quality” blockchain projects.

The remark comes as the recent selloff reshapes relative value across the crypto market.

Sponsored

Sponsored

Standard Chartered Backs Ethereum and Solana for Long-Term Outperformance Despite Near-Term Volatility

Geoff Kendrick, the bank’s Head of FX and Digital Assets Research, said he is actively accumulating during the downturn. According to the analyst, the pullback is a defining moment for long-term positioning.

“I am a buyer of this dip in digital assets,” Kendrick told BeInCrypto in an email. “What’s more, I think this is the start of greater differentiation in digital asset performance, whereby quality projects win.”

Within that framework, Standard Chartered continues to favor Ethereum and Solana as its top layer-1 exposures. Kendrick reiterated that view explicitly, adding:

“I have previously highlighted my view that Ethereum is one such quality project. And here I do the same for Solana. Buy quality.”

Recently, Standard Chartered said it saw Ethereum outperforming Bitcoin, citing DeFi dominance, scalability upgrades, and regulatory clarity.

The bank, however, has tempered its near-term expectations for Solana. Standard Chartered lowered its end-2026 price forecast for SOL to $250 from $310. On this, they cite the time required for the network’s next major use case to mature.

“We lower our end-2026 price forecast to USD 250, as Solana’s next dominant use case may take time,” Kendrick said.

Sponsored

Sponsored

Despite that cut, the bank raised its longer-dated projections, arguing that Solana’s structural advantages remain intact.

Solana’s Shift from Meme Coins to Micropayments Could Drive Long-Term Outperformance

According to Standard Chartered, Solana’s ultra-low-cost, high-throughput architecture positions it to eventually dominate micropayments. This, Kendrick says, is particularly true as AI-driven applications and stablecoin-based transactions gain traction.

“We raise our forecasts thereafter, as we see Solana eventually dominating the micropayments space,” Kendrick noted.

Sponsored

Sponsored

If that thesis plays out, the bank expects SOL to outperform Bitcoin between 2027 and 2030, while only gradually catching up to Ethereum as the ecosystem scales.

The report highlights a subtle but important shift underway on Solana’s decentralized exchanges. While the network has long been associated with meme coin activity, flows are increasingly rotating toward SOL-stablecoin trading pairs.

These stablecoins, Standard Chartered notes, are turning over two to three times faster than their Ethereum counterparts.

That evolution could help Solana shed its “meme coin discount,” which previously weighed on valuation and deterred TradFi participants.

Sponsored

Sponsored

Analysts Back Standard Chartered’s Quality Wins Narrative

Market commentators broadly echoed the bank’s “quality wins” narrative. Investor Mike Alfred described the drawdown as a textbook risk-off move.

“…this is a run-of-the-mill risk-off move where the lowest quality goes down the hardest, and then everything bounces… This is when real money is made,” wrote Alfred, referencing the recent market drop.

Developer and investor Mike Ippolito struck a similar tone, arguing that sentiment has swung too far in the negative direction.

“I think people are far too bearish ETH and SOL today,” he said, calling layer-1 blockchains “the Amazon or Google of our time” due to their global markets, high barriers to entry, and fee-generating potential.

Standard Chartered expects Solana to underperform Ethereum through 2026 and into 2027. But beyond that window, the bank sees a catch-up phase driven by scale, utility, and cost advantages.

In Kendrick’s view, the current volatility is less a warning sign than a sorting mechanism, one that may ultimately reward investors willing to buy quality while the market is still unsettled.

Crypto World

TRM Labs hits unicorn status in $70 million raise as crypto crime-fighting needs grow

TRM Labs, a blockchain analytics startup used by global law enforcement and financial firms, has raised $70 million in a new funding round that pushed its valuation to $1 billion.

The Series C round, Fortune reports, was led by Blockchain Capital with participation from Goldman Sachs, Citi Ventures, Bessemer, Thoma Bravo and Brevan Howard. The firm, according to data from TheTie, had raised nearly $150 million to date, having seen another $70 million fundraise back in 2023, along with other smaller fundraising rounds. That brings the total raised to $220 million.

The firm’s software helps trace cryptocurrency transactions across multiple blockchains, a service increasingly in demand as crypto crime grows more complex.

TRM counts several major government agencies, including the IRS and FBI, among its clients, as well as major banks. It was an early mover in tracking not just bitcoin but various other cryptocurrencies, a decision that set it apart from competitors. That edge has become more valuable as criminal networks diversify their use of tokens and platforms.

TRM’s global investigations team includes former federal agents, including veterans of cases that include the takedown of dark web marketplaces.

The company foresees growth in the future, given the rising sophistication of threats in the cryptocurrency space. Per Ari Redbord, TRM’s global head of policy, the company saw a 500% increase in “AI-enabled use in scams and fraud.”

TRM has also partnered with leading blockchain projects like Tron and Tether to expand its intelligence. That partnership created the T3 Financial Crime Unit task force, and has frozen more than $300 million in tainted assets.

Crypto World

An NFT Investor Allegedly Lost Punks NFTs Worth +$1M In A Hack

Join Our Telegram channel to stay up to date on breaking news coverage

Hackers and scammers are incredibly persistent, constantly evolving tactics to exploit human trust and crypto system vulnerabilities for financial gain, using sophisticated methods like phishing, AI, and automated attacks. In the latest attack, hackers have allegedly hacked the accounts of non-fungible token investor “yfimax.eth” and walked away with his eight CryptoPunks NFTs.

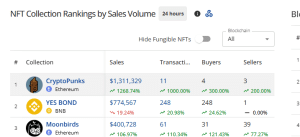

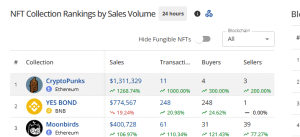

Yfimax.eth Reportedly Lost $1M In A Hack

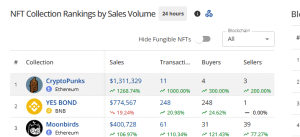

Data compiled by Cryptopunks.app shows that eight cryptopunks non-fungible token series have sold for 27.5 ETH each. CryptoPunks.app is an online tool or platform that monitors the market for the iconic CryptoPunks NFT collection, providing real-time data on floor prices, sales volume, rarity, and individual Punk details, with popular trackers found on sites like Forbes, CoinGecko, and CryptoSlam, helping users track ownership and market trends for these pioneering digital collectibles.

Bit of a tragedy just happened in the @cryptopunks world. Looks like someone just got hacked and lost all 8 of their punks.. if they were all sold at floor price of 29 ETH, that’s a total of 232 ETH (USD $742,200) loss… but quite a few of them weren’t floors so it’s more like a… pic.twitter.com/P5TwmqQAaJ

— Xeer (@Xeer) January 19, 2026

The recent sale of the eight CryptoPunks NFT collections has sparked massive speculation among traders and collectors. Some of the traders on X (formerly Twitter) have described the sale as a hack, since all Punk NFTs were sold for 27.5 ETH, which fell below the current floor price of 29 ETH. If they were all sold at the floor price of 29 ETH, that’s a total of 232 ETH (USD $742,200) loss. Nonetheless, others have opined that Yfimax.eth may have grown tired of the NFT market and decided to sell them.

Launched in 2017, CryptoPunks is a globally acknowledged non-fungible token series previously from the digital asset firm ‘Larva Labs’ but now managed by the non-profit organization, Infinite Node Foundation. The iconic NFT collection, Punks, has a fixed supply of 10,000 pixilated NFTs hosted on the Ethereum blockchain. CryptoPunks is one of the leading NFT series in the global NFT market.

Thorough Investigation Ongoing Right Now

At the time of publishing, a thorough investigation into the eight CryptoPunks NFTs sold earlier today is ongoing. In response to the recent suspicious sales, the CryptoPunks NFT collection has climbed to the top, with trading volume of +$1.3 million in the past 24 hours. The global NFT market has jumped by 28% today to $8 million, while Ethereum NFT sales have risen by 66% to $4.4 million.

Source: CryptoSlam.io

Related NFT News:

Best Wallet – Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage

-

Crypto World5 days ago

Crypto World5 days agoSmart energy pays enters the US market, targeting scalable financial infrastructure

-

Crypto World6 days ago

Software stocks enter bear market on AI disruption fear with ServiceNow plunging 10%

-

Politics5 days ago

Politics5 days agoWhy is the NHS registering babies as ‘theybies’?

-

Crypto World5 days ago

Crypto World5 days agoAdam Back says Liquid BTC is collateralized after dashboard problem

-

Video2 days ago

Video2 days agoWhen Money Enters #motivation #mindset #selfimprovement

-

Tech5 hours ago

Tech5 hours agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

NewsBeat5 days ago

NewsBeat5 days agoDonald Trump Criticises Keir Starmer Over China Discussions

-

Politics2 days ago

Politics2 days agoSky News Presenter Criticises Lord Mandelson As Greedy And Duplicitous

-

Crypto World4 days ago

Crypto World4 days agoU.S. government enters partial shutdown, here’s how it impacts bitcoin and ether

-

Fashion5 days ago

Fashion5 days agoWeekend Open Thread – Corporette.com

-

Sports4 days ago

Sports4 days agoSinner battles Australian Open heat to enter last 16, injured Osaka pulls out

-

Crypto World4 days ago

Crypto World4 days agoBitcoin Drops Below $80K, But New Buyers are Entering the Market

-

Crypto World2 days ago

Crypto World2 days agoMarket Analysis: GBP/USD Retreats From Highs As EUR/GBP Enters Holding Pattern

-

Crypto World5 days ago

Crypto World5 days agoKuCoin CEO on MiCA, Europe entering new era of compliance

-

Business5 days ago

Entergy declares quarterly dividend of $0.64 per share

-

Sports2 days ago

Sports2 days agoShannon Birchard enters Canadian curling history with sixth Scotties title

-

NewsBeat1 day ago

NewsBeat1 day agoUS-brokered Russia-Ukraine talks are resuming this week

-

NewsBeat2 days ago

NewsBeat2 days agoGAME to close all standalone stores in the UK after it enters administration

-

Crypto World14 hours ago

Crypto World14 hours agoRussia’s Largest Bitcoin Miner BitRiver Enters Bankruptcy Proceedings: Report

-

Crypto World5 days ago

Crypto World5 days agoWhy AI Agents Will Replace DeFi Dashboards