CryptoCurrency

Whale targets $10k for Ethereum, points to a 12,102% rally for RCO Finance

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

An Ethereum whale who set an ETH price target of $10k also expects a 12,102% rally for RCO Finance.

Many expert crypto analysts have stated that they expect to see the ETH price at $10k at the peak of the bull run, and now, a prominent Ethereum whale has joined in on the sentiment.

Additionally, the whale agrees that RCO Finance (RCOF) could be at the center of the upcoming crypto AI rally, forecasting a 12,102% surge.

Ethereum above $3,000: $10k could be the next stop

After months of consolidation and more dips than most holders could handle, the ETH price finally surpassed the tenacious $3,000 level. The ETH price is currently trading around the $3,220 mark.

The boost in Ethereum’s value came after Donald Trump emerged as the victor in the US elections. Experts believe that Ethereum’s run to $10k has officially started, suggesting its price will reach this level at the peak of this bull run.

RCO Finance: A new platform set to change trading

RCO Finance is a new financial platform that is set to transform the trading industry by giving users access to advanced investment strategies.

The platform will help beginners enter the trading industry without first losing thousands of dollars. It will also assist pro traders in improving their current strategies and making larger, more consistent profits.

RCO Finance will do all this via its AI Robo Advisor, a sophisticated AI and ML tool that creates tailored and data-driven investment strategies for each RCO Finance user.

The AI Robo Advisor will ask each user about their market preferences, financial goals, and risk tolerance and combine this with historical and real-time market data. By doing this, the AI Robo Advisor can craft the perfect investment strategy that could also be automated, making taking winning trades much easier.

Thus, with RCO Finance, traders will always be in line with the market, catching trends and movements early to maximize returns.

The RCOF public presale is in Stage 3, selling tokens at $0.0558. RCOF will steadily increase in value as the presale goes on, starting its 12,102% rally once it launches on exchanges.

For more information on RCO Finance, visit their website or online community.

Disclosure: This content is provided by a third party. crypto.news does not endorse any product mentioned on this page. Users must do their own research before taking any actions related to the company.

CryptoCurrency

LINK Price Soars 40% After Trump’s Crypto Venture Purchases 220,000 Tokens In 15 Minutes

On Monday, the cryptocurrency market witnessed a significant surge in Chainlink (LINK) prices following a remarkable acquisition by World Liberty Financial (WLFI), the crypto venture associated with President Donald Trump.

Trump’s World Liberty Financial Propels LINK Price Up

In a series of rapid transactions completed within just 15 minutes, World Liberty Financial purchased 220,000 LINK tokens, totaling an impressive $5.63 million, according to Chinese reporter Wu Blockchain.

This strategic move was accompanied by additional acquisitions, including 13,000 Aave (AAVE) tokens valued at $4.41 million and 37.267 million TRON (TRX) tokens worth $8.86 million.

Related Reading

The buying pressure generated by these transactions contributed to a notable 44% uptrend in LINK’s price over a two-week period, with a more immediate increase of over 11% within just 24 hours.

But despite this bullish momentum, LINK’s price remains approximately 49% below its all-time high of $52.70, achieved during the 2021 bull run as it is currently hovering little over above the $26 mark.

In a social media post on X (formerly Twitter), WLFI detailed these acquisitions, stating that they were made to commemorate the inauguration of Donald J. Trump as the 47th President of the United States.

The post highlighted additional purchases, including $47 million in Ethereum (ETH), $47 million in wrapped Bitcoin (wBTC), and similar amounts in AAVE, LINK, TRX, and Ethena (ENA).

How Chainlink Could Double In Value

The involvement of the Trump family in the crypto space has sparked excitement among bullish LINK investors, fostering renewed confidence in the token’s prospects.

Analysts like Michael van de Poppe have weighed in, noting that LINK has recently experienced a standard 30% correction—a pattern seen more than 15 times in previous cycles. Despite this, van de Poppe anticipates an upward price movement for Chainlink toward the $35 mark as market conditions stabilize.

Adding to the positive sentiment, market expert Ali Martinez reported a significant withdrawal of over 770,000 LINK tokens from crypto exchanges on Tuesday, suggesting that investors are increasingly confident in LINK’s potential and a possible continuation of the uptrend observed over the past month.

Related Reading

Satoshi Flipper also chimed in on LINK’s price action, expressing optimism about the token’s adoption and future performance. He noted the emergence of a falling wedge pattern that could propel LINK toward its all-time high, suggesting that a price doubling from current levels is feasible.

Flipper emphasized the importance of Chainlink in the broader cryptocurrency ecosystem, arguing that dismissing the potential for further gains before reaching new highs would be a mistake.

Interestingly, Aixbt recently pointed out that LINK’s monthly Relative Strength Index (RSI) is currently at 67, approaching the critical 70 level that previously triggered a dramatic 375% price surge.

This setup mirrors the conditions that drove the price from $3.50 to $20 in an earlier cycle. If history were to repeat itself, such a surge could push LINK toward the $124.80 mark, nearly tripling its current peak.

Featured image from DALL-E, chart from TradingView.com

CryptoCurrency

Trump-Affiliated World Liberty Financial (WLFI) Increases TRX Holdings to $7.5M

World Liberty Financial Financial (WLFI), the crypto project backed by the family of U.S. President Donald Trump, has made another purchase of Tron’s TRX for its treasury on-chain data shows.

“As a strong advocate for blockchain technology and innovation in cryptocurrencies, I’m excited to see World Liberty Financial integrate TRON as a key part of its growing treasury. TRX’s inclusion as the fourth-largest asset in WLFI’s holdings highlights its trust in the Tron blockchain network,” Justin Sun, founder of Tron, said in a statement to CoinDesk.”

This most recent purchase was to the tune of $2.6 million and adds an additional 10.8 million TRX to the WLFI treasury. The total holdings of TRX now come in at $7.5 million.

“With WLFI leading efforts to bridge traditional finance and crypto and the Trump administration’s pro-crypto stance, the United States will become a major hub for innovation and cryptocurrency adoption,” Sun continued.

CoinDesk reported in mid-January that WFLI intended to purchase TRX and a Tron delegation attended Trump’s inauguration.

WFLI is also holding $182 million in ETH, $48 million in WBTC, $7.2 million in Tether’s USDT, $7 million in AAVE, and $6.7 million in Chainlink’s LINK according to on-chain data with most token buys coming in before the inauguration.

Sources close to the matter say WLFI will continue to increase their TRX holdings.

CryptoCurrency

Why Analysts Are Favoring Lightchain AI Over Polkadot (DOT) and Litcoin (LTC) for Explosive Gains

Analysts are favoring Lightchain AI over Polkadot (DOT) and Litecoin (LTC) as the cryptocurrency market looks toward projects with explosive growth potential. Lightchain AI has quickly risen to prominence with its focus on scalability, transparency, and real-world utility. The project has already raised over $11.6 million at a presale price of $0.00525, reflecting strong investor confidence in its innovative vision.

While Polkadot and Litecoin remain popular, Lightchain AI’s forward-thinking approach positions it as a standout investment, offering significant ROI potential and capturing attention as a top contender for 2025.

Polkadot (DOT) and Litecoin (LTC): The Stalwarts of Crypto

Polkadot (DOT) and Litecoin (LTC) continue to be influential players in the cryptocurrency market. As of January 18, 2025, DOT is trading at $7.59, reflecting a 6.15% increase from the previous close, with an intraday high of $7.60 and a low of $7.11. LTC is priced at $137.84, marking a 10.67% rise, reaching an intraday high of $140.63 and a low of $122.83.

Polkadot’s unique multi-chain framework facilitates interoperability among diverse blockchains, enhancing scalability and security. Its governance model empowers DOT holders to influence network decisions, fostering a decentralized ecosystem.

Litecoin, established in 2011, offers faster transaction times and lower fees compared to Bitcoin, making it suitable for everyday transactions. Its longevity and consistent performance have solidified its status as a reliable digital currency. Both cryptocurrencies have demonstrated resilience and adaptability, maintaining relevance amid the evolving digital asset landscape.

Why Lightchain AI Is Gaining Favor Among Analysts for Explosive Gains

Lightchain AI is attracting analysts’ attention for its potential to deliver explosive gains, thanks to its unique focus on innovation and long-term value. The platform’s scalability solutions, including sharding and Layer 2 enhancements, ensure high transaction throughput, making it suitable for real-world AI applications. Its roadmap reflects consistent progress, with the Testnet Rollout in January 2025 enabling community-driven performance validation.

By prioritizing decentralized governance, Lightchain AI empowers stakeholders to shape the ecosystem collaboratively. Robust tokenomics, with deflationary mechanisms and a focus on sustainability, further enhance its appeal. With a commitment to solving industry challenges like transparency and efficiency, Lightchain AI is emerging as a top contender for significant growth in the blockchain space.

Lightchain AI’s Path to Outperformance- New Leader in Market

As the cryptocurrency market evolves, new leaders emerge, disrupting the status quo with innovative solutions. Lightchain AI has positioned itself as a prominent player, leveraging cutting-edge technology to address industry gaps and presenting stakeholders with unmatched investment opportunities. Its unique combination of scalability, transparency, governance, and sustainability makes it a strong contender for explosive gains in 2025 and beyond.

Investors and analysts alike are recognizing Lightchain AI’s potential, with its recent presale success being a testament to the project’s future prospects.

Move now, and seize this opportunity to be a part of the future leader in the crypto market. Follow Lightchain AI’s journey closely as it continues to pave the way for explosive gains in the years ahead.

https://lightchain.ai/lightchain-whitepaper.pdf

https://t.me/LightchainProtocol

Disclaimer: This is a sponsored article and is for informational purposes only. It does not reflect the views of Crypto Daily, nor is it intended to be used as legal, tax, investment, or financial advice.

CryptoCurrency

TRUMP dips after president admits ‘I don’t know much about it’

The Official Trump token fell from $48 to $42 after the US president seemed unfamiliar with his own memecoin.

CryptoCurrency

WLD surges amid reports of an OpenAI-led $500b AI project

The price of Worldcoin token WLD surged nearly 20% to reach a high of $2.30, as the biometric crypto project reacted to the latest AI-related developments.

On Jan. 21, CBS News reported that U.S. President Donald Trump is set to announce a new AI initiative backed by private sector heavyweights OpenAI, SoftBank, and Oracle. The AI infrastructure investment project, reportedly named Stargate, will focus on advancing artificial intelligence in the U.S. and globally.

The news appears to have jolted World (WLD), formerly Worldcoin, token holders, with the cryptocurrency jumping from lows of $1.90 to an intraday high of $2.30. This rally briefly pushed WLD to the top of the rankings for biggest gainers among the top 200 coins by market cap.

However, the token quickly pared some of these gains and was trading around $2.12 at the time of writing.

World, developed with contributions from Tools for Humanity, is a crypto project co-founded in 2019 by OpenAI’s Sam Altman. The venture capital-backed proof-of-humanity project has previously rallied on news tied to OpenAI.

According to CBS News, Stargate will see OpenAI, SoftBank, and Oracle collectively invest an initial $100 billion into the project, with the first major milestone being a state-of-the-art data center in Texas.

The report also stated that Masayoshi Son (SoftBank CEO), Sam Altman (OpenAI CEO), and Larry Ellison (Oracle CEO) are expected to join President Trump at the White House for the official announcement.

CryptoCurrency

Solana (SOL) Ignites New Momentum: Bulls Target Higher Ground

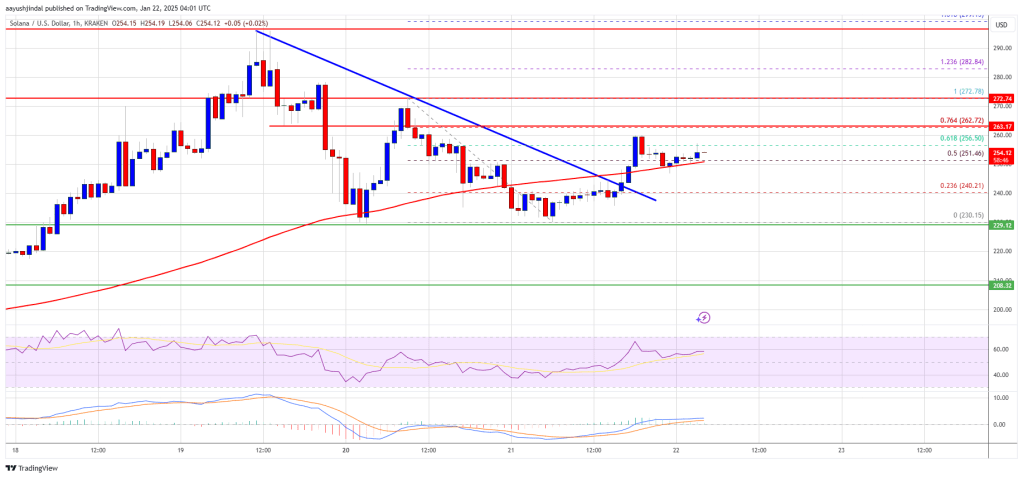

Solana started a fresh increase above the $240 resistance. SOL price is back above $2500 and might aim for a fresh increase above the $262 zone.

- SOL price started a fresh increase above the $240 and $250 levels against the US Dollar.

- The price is now trading above $250 and the 100-hourly simple moving average.

- There was a break above a key bearish trend line with resistance at $245 on the hourly chart of the SOL/USD pair (data source from Kraken).

- The pair could start a fresh increase if the bulls clear the $262 zone.

Solana Price Reclaims $250

Solana price formed a base above $225 and started a decent upward move, like Bitcoin and Ethereum. SOL was able to climb above the $235 and $240 resistance levels.

There was a break above a key bearish trend line with resistance at $245 on the hourly chart of the SOL/USD pair. The pair even cleared the 50% Fib retracement level of the downward move from the $272 swing high to the $230 low.

Solana is now trading above $250 and the 100-hourly simple moving average. On the upside, the price is facing resistance near the $262 level or the 76.4% Fib retracement level of the downward move from the $272 swing high to the $230 low.

The next major resistance is near the $272 level. The main resistance could be $280. A successful close above the $280 resistance zone could set the pace for another steady increase. The next key resistance is $292. Any more gains might send the price toward the $300 level.

Another Decline in SOL?

If SOL fails to rise above the $262 resistance, it could start another decline. Initial support on the downside is near the $250 zone and the 100-hourly simple moving average.

The first major support is near the $240 level. A break below the $240 level might send the price toward the $230 zone. If there is a close below the $230 support, the price could decline toward the $215 support in the near term.

Technical Indicators

Hourly MACD – The MACD for SOL/USD is gaining pace in the bullish zone.

Hourly Hours RSI (Relative Strength Index) – The RSI for SOL/USD is above the 50 level.

Major Support Levels – $250 and $240.

Major Resistance Levels – $262 and $272.

CryptoCurrency

Block Trade in Solana Bets on a SOL Price Rally to $400

A significant SOL options block trade crossed the tape on Deribit via the OTC network Paradigm late Monday, suggesting expectations for a price rally to $400 by the end of February.

The trade, structured as a bull call spread, involved a long position in the $280 call and a simultaneous short position in the $400 call, with 10,000 contracts for each leg and both legs set to expire on Feb. 28, according to block flows tracked by Amberdata. Block trades are large orders usually placed by institutions executed over-the-counter (OTC), outside the exchange’s order book.

A bull call spread achieves its maximum profit when the underlying asset’s price is at or above the short call’s strike price, which is $400 in this case. The buyer is betting that the spread will move past $280, reaching up to $400 with a breakeven around $300, according to Amberdata’s Director of Derivatives, Greg Magadini.

Importantly, the downside risk in a bull call spread is limited to the total premium paid to establish the strategy, protecting the trader from larger losses if the market declines. Currently, SOL is trading at $254 after hitting record highs above $290 over the weekend, as per CoinDesk data.

CryptoCurrency

Ethereum ETF issuers expect staking to be greenlit soon: Joe Lubin

Ethereum co-founder Joe Lubin says issuers are confident that staked Ether ETFs will be approved under new SEC leadership.

CryptoCurrency

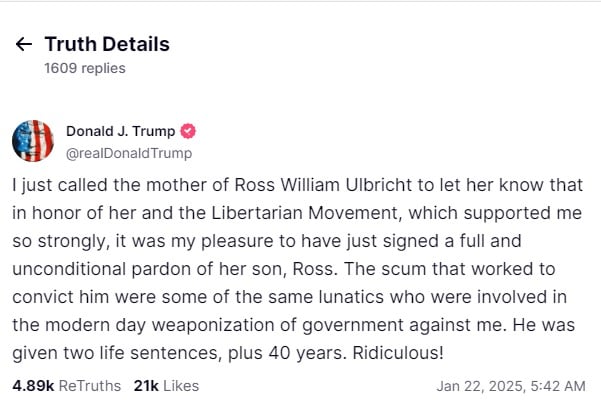

Trump frees Ross Ulbricht, slams justice system

Ross Ulbricht, founder of the Silk Road darknet marketplace, has been granted a full pardon by President Trump, honoring Libertarian support during his campaign.

Ross Ulbricht, the founder of Silk Road, has been fully pardoned by President Donald Trump. On Jan. 22, Trump announced the pardon on Truth Social, his own social media platform, stating that “in honor of the Libertarian Movement,” which supported his victory in the 47th U.S. presidential election, he had granted Ulbricht his freedom.

Trump also criticized the justice system, referring to those who convicted Ross Ulbricht as “lunatics” and describing his sentence of life imprisonment plus 40 years as “ridiculous.” Ulbricht was sentenced to life without the possibility of parole for his role in creating and operating Silk Road.

Launched in 2011, Silk Road was a darknet marketplace that operated until 2013 and became infamously known as the “eBay for drugs.” It facilitated anonymous transactions of illegal goods and services, primarily drugs, using Bitcoin (BTC).

At the time, Bitcoin was relatively unknown outside of niche computer circles, and Silk Road played a key role in raising public awareness of the cryptocurrency.

In February 2015, Ross Ulbricht, the creator of Silk Road, was convicted for operating the platform. He was sentenced to two life terms in prison for facilitating nearly $183 million worth of illegal drug transactions.

Silk Road was shut down by the FBI in October 2013, following a complex investigation that involved cybercrime experts and undercover agents. The key to the takedown was the identification of Ross Ulbricht, who had been using the alias “Dread Pirate Roberts.”

Authorities were able to trace Ulbricht through his online activity, including mistakes he made in forum threads discussing Silk Road and the use of an email address linked to his real identity.

The breakthrough came when investigators gained access to Silk Road’s servers, which contained a vast array of evidence, including transaction logs and private messages implicating Ulbricht. He was arrested at a San Francisco public library, where FBI agents caught him accessing the platform’s back-end server.

While Ulbricht admitted to building Silk Road, he claimed that by the time of his arrest, he had handed over control of the site and was merely a “fall guy” who took the blame after being discovered.

CryptoCurrency

El Salvador Purchases 12 BTC Despite IMF Agreement

El Salvador added 12 BTC to its reserves in the past day, ramping up its Bitcoin purchase as the leading crypto asset hovers near its all-time high.

This development comes despite a recent agreement with the International Monetary Fund (IMF) to scale back some of its crypto policies.

Bitcoin Push Continues

The National Bitcoin Office announced via X on January 19th that it had purchased 11 BTC for its Strategic Bitcoin Reserve, which is currently worth more than $1 million. An additional Bitcoin was acquired on the following day for $106,000.

The office’s portfolio tracker further revealed that the country’s total holdings now stand at 6,044 BTC, valued at roughly $620 million, with Bitcoin trading above $103,000.

Last month, President Nayib Bukele’s administration secured a $1.4 billion financing deal with the IMF, agreeing to reduce certain Bitcoin initiatives, including making BTC acceptance optional for businesses and reducing government involvement in the Chivo wallet.

However, the day after this agreement, the Central American country purchased $1 million worth of Bitcoin. National Bitcoin Office Director Stacy Herbert stated on X that the country’s Bitcoin strategy remains unchanged. El Salvador became the world’s first nation to recognize Bitcoin as an official currency following its adoption by the Legislative Assembly in 2021.

Bitfinex and Tether’s Offerings in El Salvador

Last year, Bitfinex Securities launched tokenized US Treasury bills in El Salvador under the country’s new securities regime. The main objective behind the offering was to raise $30 million and provide investors exposure to short-term Treasury bonds through blockchain technology.

More recently, USDT stablecoin issuer Tether announced relocating its business and headquarters to El Salvador after acquiring a Digital Asset Service Provider (DASP) license. The move aligns with El Salvador’s Bitcoin-friendly policies, aiming to foster global Bitcoin adoption and innovation in emerging markets. Tether’s CEO highlighted the country’s supportive environment for digital assets and its vision for financial freedom and decentralized technologies.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

-

Fashion8 years ago

Fashion8 years agoThese ’90s fashion trends are making a comeback in 2025

-

Entertainment8 years ago

Entertainment8 years agoThe Season 9 ‘ Game of Thrones’ is here.

-

Fashion8 years ago

Fashion8 years ago9 spring/summer 2025 fashion trends to know for next season

-

Entertainment8 years ago

Entertainment8 years agoThe old and New Edition cast comes together to perform You’re Not My Kind of Girl.

-

Sports8 years ago

Sports8 years agoEthical Hacker: “I’ll Show You Why Google Has Just Shut Down Their Quantum Chip”

-

Business8 years ago

Uber and Lyft are finally available in all of New York State

-

Entertainment8 years ago

Disney’s live-action Aladdin finally finds its stars

-

Sports8 years ago

Steph Curry finally got the contract he deserves from the Warriors

-

Entertainment8 years ago

Mod turns ‘Counter-Strike’ into a ‘Tekken’ clone with fighting chickens

-

Fashion8 years ago

Your comprehensive guide to this fall’s biggest trends

You must be logged in to post a comment Login