News Beat

Roy Keane warns Arsenal star after England duo ‘click’ under Thomas Tuchel | Football

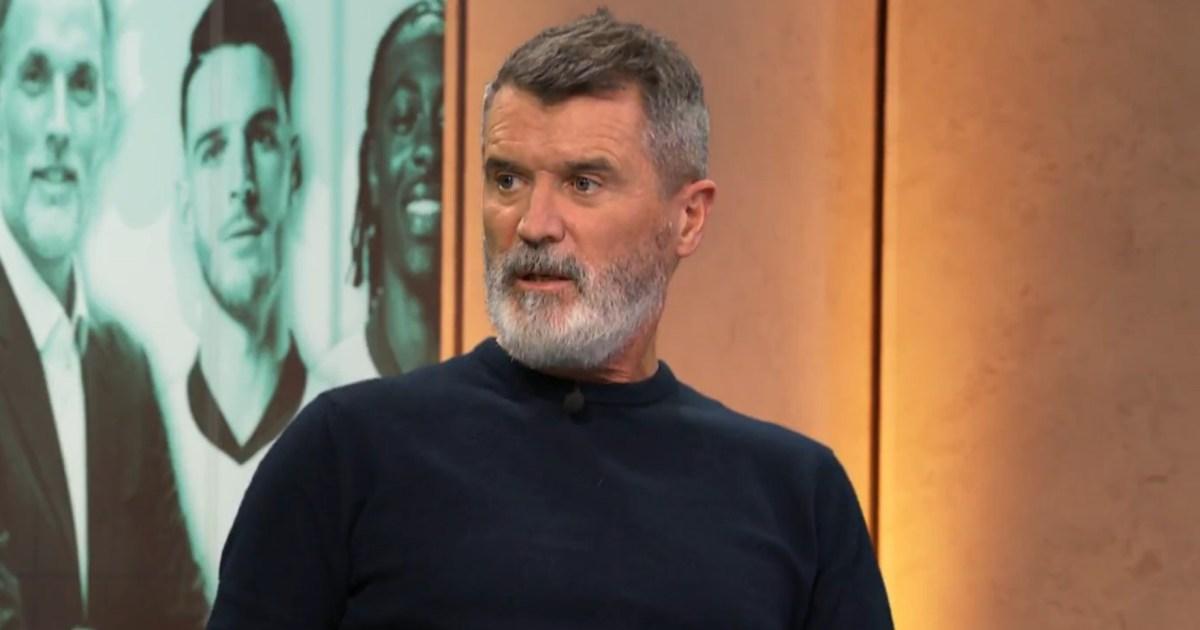

Roy Keane has fired a warning to Myles Lewis-Skelly over his lack of playing time for Arsenal after two England stars ‘clicked’ on Thursday.

Lewis-Skelly was not called up for November’s games against Serbia and Albania after losing his spot in the Arsenal XI to Riccardo Calafiori.

The 19-year-old is keen to establish himself as England’s first-choice left-back ahead of the World Cup in the USA, Canada and Mexico next year.

Lewis-Skelly faces a battle with Nico O’Reilly for a place in England’s starting line-up and the Manchester City star shined in the 2-0 win over Serbia, with Marcus Rashford playing ahead of him down the left.

‘It’s a strong looking [England] team [for the World Cup],’ Keane told ITV on Sunday.

Your ultimate guide to the football season

Metro’s football newsletter: In The Mixer. Exclusive analysis, FPL tips and transfer talk sent straight to your inbox every Friday – sign up, it’s an open goal.

‘There’s probably a few positions up for grabs. I still think [it should be] Rashford and O’Reilly, but people can build up relationships.

‘We saw that the other night and that can happen over the next few months.

‘Lewis-Skelly, I still think he is a good player [for England] if he can get back into the first-team at Arsenal. Really good options.

‘[O’Reilly] is playing for a brilliant team at Man City under a brilliant coach so he’s got into very good habits.

‘Sometimes players just click together. There’s nice chemistry between them (O’Reilly and Rashford). There’s a nice energy.’

Lewis-Skelly has played only 87 minutes of Premier League football and has not started a top-flight game for the Gunners so far this season.

With the teenager keen to make England’s World Cup squad, a number of unnamed Premier League clubs are ‘monitoring’ Lewis-Skelly’s situation ahead of the January transfer window.

Jamie O’Hara feels Lewis-Skelly would be a guaranteed starter for 18 of the 20 Premier League clubs.

England boss Thomas Tuchel, meanwhile, said this month: ‘Myles was a very good team-mate and played for us in the last camp in the World Cup qualifier in Riga, so was Ruben Loftus-Cheek, so was Morgan Gibbs-White.

‘But I said last time there is a component to it and that is about competition and performance and the door is always open for guys who perform on a high level regularly.

‘Myles, Ruben and Morgan got out-performed by [Nico] O’Reilly, Alex Scott and Jude Bellingham in their positions.

‘Myles simply needs more starts, more minutes.

‘Now came a time when O’Reilly had so many starts in that position, so he is slightly ahead for this camp.’

MORE: Thomas Tuchel warned England are not ‘at the same level’ as four teams ahead of World Cup

MORE: England set incredible World Cup record after 2-0 win against Albania

MORE: Thierry Henry aims dig at Tottenham and makes north London derby claim