Entertainment

William Shatner Warned Everyone Of The Dangers Of AI In The 60s

By Jonathan Klotz

| Published

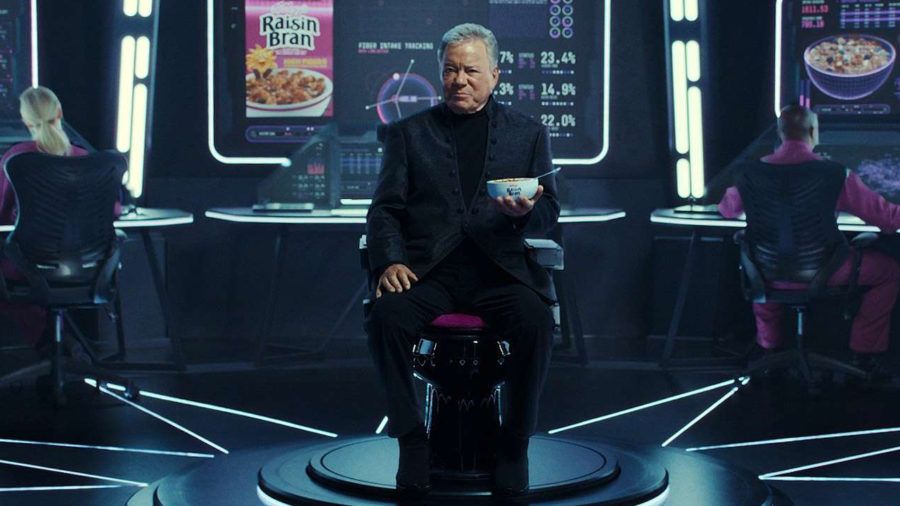

Science fiction has been warning us about the dangers of seemingly helpful technological innovations for over a hundred years. Even before computers were found in every home and in our pockets, overreliance on technology has been a common theme, including in the legendary anthology series, The Twilight Zone.

“Nick of Time” was released on November 18, 1960, and while it’s about a man’s dependence on a cheap fortune-telling novelty toy, it still works. 66 years later, in the era of ChatGPT and AI language models that are all too willing to provide advice.

William Shatner’s Choice Paralysis

“Nick of Time” stars William Shatner as Don Carter and Patricia Breslin (future wife of Baltimore Ravens owner Art Modell) as Pat Carter, newlyweds stuck in a small town in the middle of Ohio, when they come across a cheap fortune-telling novelty machine in the booth of a roadside diner. Don plays with the machine by asking it if he’ll get a promotion when he gets the affirmative response, “It has been decided in your favor.” One call to New York later, Don realizes he got the promotion, and his fascination with the tabletop trinket quickly becomes an obsession.

Don continues asking questions to the devil-topped fortune-teller and receives inane generic responses, from “that makes a good deal of sense,” to “the answer to that is obvious,” and of course, “try again.” Paralyzed by indecision without the guidance from the fortune-teller, Don remains trapped in the booth, waiting for an answer to the question, “Where should we live?” Unlike most episodes of The Twilight Zone, Pat breaks her husband free from his obsession, and they leave town, but the ending shows another couple, trapped, unable to leave until the fortune-telling machine says they can.

The unsubtle message of “Nick of Time” is the importance of human connection over a machine. The Twilight Zone has stood the test of time because of the universal morals at the heart of its twisted stories. 50 years later, Her told a similar story of a man becoming infatuated with a machine, and Ex Machina added a new wrinkleby giving the machine a human form. The AI in both movies is far, far more advanced than a penny fortune-teller, but the end result, obsession, decision paralysis, a loss of human connection, it’s all the same.

The Twilight Zone Is A Timeless Classic For A Reason

William Shatner went on to star in another, better-remembered episode of The Twilight Zone, “Nightmare at 20,000 Feet,” and a little show you may have heard of called Star Trek. His overacting has been parodied for decades, but as both of his appearances in Rod Serling’s masterpiece show, when asked to play a man slowly losing his mind, there’s no one better.

The Twilight Zone is still one of the greatest shows of all time, and episodes like “Nick of Time” prove why no amount of reboots and revivals can match the simple effectiveness of the original. In 1960, no one imagined that we’d eventually have an app on our phones that acts exactly like the devil-head fortune-teller from the episode, but it doesn’t matter. The early horror sci-fi series could have been talking about television, computers, or telephones, and its point would still land: don’t let technology rule your life. Though today, a character would come right out and say, “go touch grass.”

Entertainment

Simone Biles’ Husband Jonathan Owens Spoils Her on Bottega Shopping Spree

Simone Biles is getting the full princess treatment from her husband, Jonathan Owens, in honor of Valentine’s Day 2026.

“Always spoiling me,” Biles, 28, wrote via Instagram on Sunday, February 15, sharing a selfie with Owens, 30, at the Bottega Veneta boutique in Italy.

Biles and Owens traveled to Milan to cheer on Team USA in the 2026 Winter Olympics, finding time to make a pit stop at the Bottega Veneta store.

“I never knew Bottega did this, might be a special Milan thing?!” Biles captioned a follow-up slide of a white handbag accessorized with a “SBO” gold monogram on the exterior. “But how f***in cute?”

Biles did not immediately reveal what she and Owens picked up at the designer shop.

“The shopping in Milan is elite,” Owens succinctly wrote via his Instagram Stories on Sunday. “[I’m a] long way from St. Louis, man.”

After growing up in Missouri, Owens met Biles in 2020 on the celebrity dating app Raya.

“It was one of the few times in her life where everything was just shut off and she couldn’t do anything,” he told Texas Monthly in 2021 of connecting with the gymnast amid the coronavirus pandemic. “We used it to get to know each other — really get to know each other. It created our bond and made it stronger. Now, I’m so thankful.”

Owens, however, wasn’t clued into Biles’ career as the most decorated American gymnast of all time.

“I didn’t know who she was,” he told the outlet. “I just hadn’t heard of her, and when I told her that, that’s one of the things she liked.”

Owens has since become Biles’ No. 1 cheerleader, even dutifully attending the 2024 Summer Olympics when she made her long-awaited return to competition following her mental health-related withdrawal from the 2020 Tokyo Games.

“It is not much motivation you need to do, just because you don’t want to put extra, added pressure on anyone,” he exclusively told Us Weekly in July 2024 of supporting Biles. “I just tell her, ‘Go do your thing, baby.’”

Biles, who married Owens in 2023, also returns the favor by attending his NFL games. (Owens is a safety for the Chicago Bears after previously playing for the Green Bay Packers and the Houston Texans.)

“You get a different type of focus whenever you just have this one person that you’re focusing on,” Owens told Us in 2024. “I ain’t saying there’s something wrong with being single, but for me, knowing myself, I’ve played a lot better since [meeting Simone]. I’ve just been focused and locked in, and you come home, talk about my day and play with the dogs, you know what I mean? That’s just kind of like our thing.”

Biles seldom misses a Bears game either — and always while decked out in custom merch.

“Something you guys might not know about my husband, Jonathan, is he is actually an undrafted, D2 product. This is his eighth year in the league,” Biles said in an October 2025 TikTok video. “He’s broken down barriers, statistics and undrafted means a guy wasn’t drafted to a team, but they are free to sign with any team as an undrafted free agent. Another Bears win, well-deserved! Proud wife. Four in a row — that’s my man.”

Owens and the Bears made it to the playoffs this year, getting eliminated just shy of the conference championships.

Entertainment

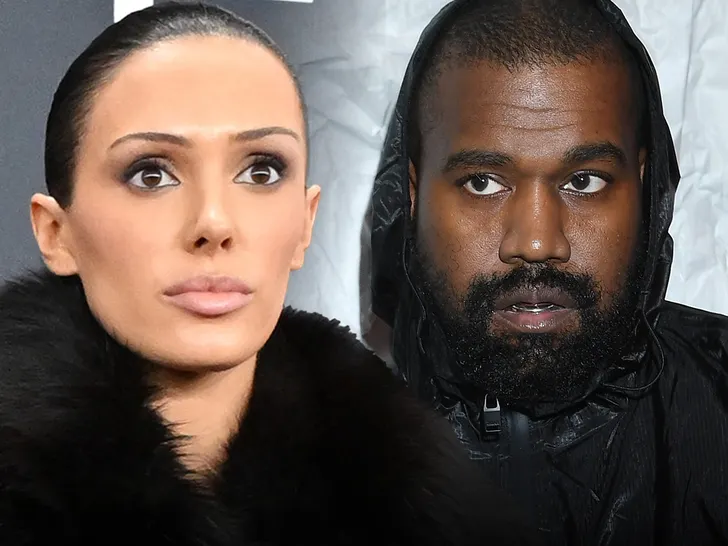

Bianca Censori Called to Testify as Witness in Kanye West’s Legal Battle

Bianca Censori

Called To Testify In Kanye’s Legal Battle

Published

Bianca Censori could be taking the witness stand soon … at least if a former Kanye West employee gets his way.

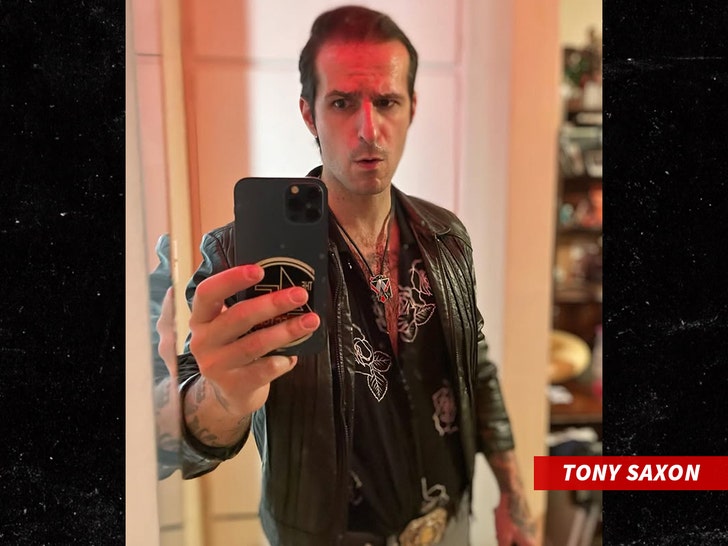

According to new court documents, obtained by TMZ, Tony Saxon — the ex-project manager suing Kanye over the chaotic Malibu mansion remodel — says he’s calling Bianca to testify in the upcoming trial, currently set for February 21.

It’s unclear what specific testimony he believes she can provide, but she’s now potentially being lined up as a witness in the case.

As we previously reported … Saxon sued Kanye, claiming he was hired in September 2021 as project manager, caretaker and 24/7 security for Kanye’s Malibu property. In the lawsuit, Saxon alleges he worked brutal 16 hour days and was forced to sleep on the floor using a coat as makeshift bedding while overseeing the remodel.

Saxon claims things spiraled in November 2021 when Kanye allegedly demanded he remove all the home’s windows and electricity. According to the suit, Saxon raised safety concerns, warning the moves posed “extreme danger,” especially after Kanye allegedly insisted on bringing large generators inside something Saxon feared could spark a fire hazard.

He also claims Kanye threatened him, saying he’d be considered “an enemy” if he didn’t comply, and told him, “If you don’t do what I say, you’re not going to work for me.” Saxon says he refused and was fired on the spot.

Tony’s suing for unpaid wages and labor code violations and potentially dragging Bianca into the courtroom drama.

Kanye has denied all allegations. In a November 2023 filing, his attorney argued that even if Saxon suffered damages — which Kanye does not admit — they were caused by other parties, not Kanye, and any liability should be reduced accordingly. Kanye also claimed Saxon performed work without his knowledge and asked the court to toss the lawsuit entirely.

Stay tuned …

Entertainment

Apple TV’s Record-Breaking Mind-Bender Just Beat ‘Ted Lasso’ at Its Own Game

For years, Apple TV+ has been associated with very specific success stories. For instance, its biggest cultural hits have largely been feel-good, accessible shows that invited broad audiences in, and it shaped expectations around what kind of series could truly thrive on the platform.

That is why a recent shift in Apple TV+’s internal rankings is actually more significant than it might look at first glance. One of the service’s most slow-burning originals, a series that is built on ambiguity, dread, and corporate paranoia, is now occupying space that was traditionally dominated by a much lighter and more crowd-pleasing Ted Lasso.

That series is Severance, created by Dan Erickson and executive-produced and directed by Ben Stiller. Severance has never been designed for passive viewing. Its premise follows employees who undergo a procedure that separates their work memories from their personal lives completely. Over time, that approach helped the show build a dedicated following, but it also positioned it as an unlikely candidate to challenge Apple TV+’s most recognizable hit, Ted Lasso, which currently sits at the #5 spot. And yet, as of February 12, 2026, Severance is sitting at #4 on Apple TV+’s Top 10 chart in the United States.

Apple’s Bold Move Paves the Way for ‘Severance’ Season 3

Severance has spent much of its existence in a delicate position, with long gaps between seasons, rising production costs, and behind-the-scenes complications. All this has made its future feel deliberately opaque, even as audience interest continued to grow. That uncertainty has lingered in the background for years, especially after the show’s ambitious second season raised questions about how sustainable its scale really was.

Behind the scenes, however, Apple appears to have been thinking several steps ahead. The show’s cultural footprint, critical standing, and unusually deep fan engagement have all played a role in shifting how Apple views its place on the platform. That shift has now become concrete, since Apple has officially acquired the full intellectual property rights to Severance. This has brought the series entirely in-house under Apple Studios. The move not only clears the path for Season 3 but might also unlock a fourth season, with the door open for future expansions beyond the main storyline.

Severance Seasons 1 and 2 are available to watch on Apple TV. The show has also been renewed for Season 3, whereas Season 4 is currently in talks. Stay tuned to Collider for more updates.

- Release Date

-

February 17, 2022

- Network

-

Apple TV

- Showrunner

-

Dan Erickson, Mark Friedman

- Writers

-

Anna Ouyang Moench, Wei-Ning Yu

Entertainment

Jack Black and Paul Rudd’s $133 Million Blockbuster Is Dominating Streaming

On Christmas Day, Jack Black and Paul Rudd starred in Anaconda, a modern reboot of the 1997 film of the same name. But unlike its predecessor, this one leaned more toward comedy than horror. Since its release, Anaconda received mixed reviews from fans and critics but was still a box-office success. Two months later, the film continues to find its audience.

Anaconda follows Doug McCallister (Black) and Ronald “Griff” Griffen Jr. (Rudd), childhood friends who team up to film a reboot of Anaconda, only to be attacked by a giant anaconda snake. The movie is filled with meta-humor, poking fun at Sony Pictures, and features an Ice Cube cameo, who previously starred in the 1997 film. Since its release, Anaconda has received a fair critics’ score of 48% and an audience score of 75% on Rotten Tomatoes and has generated over $133 million worldwide. Recently, Anaconda has been doing well on the VOD charts.

While Anaconda has yet to announce its streaming home, the movie is available to rent on Prime Video. Currently, it ranks #6 on Amazon’s Top Movies chart, between Dracula and One Battle After Another. Collider’s Aidan Kelley gave Anaconda a 5/10 in his review, praising Rudd and Black’s performances and some of its comedy, but noting the “big lack of giant snakes for a giant snake movie” and criticizing the pacing in the final act.

What To Watch if You Like 2025’s ‘Anaconda’

If 2025’s Anaconda reboot entertained you, and you want to watch something in a similar vein, but without having to sit through the 1997 action-horror, there are a handful of titles that could scratch that itch. First that comes to mind is the modern Jumanji movies, where Black plays Professor Sheldon “Shelly” Oberon, one of the playable characters. He appears in both the 2017 and 2019 films, and it’s reported that he’s set to return in the upcoming fourth film, which is scheduled for release in December 2026.

If you like the modern meta-comedy that Anaconda provided, then The Naked Gun is another good recommendation. This 2025 action comedy stars Liam Neeson, and it’s the fourth installment of the Naked Gun films. The movie brings back slapstick comedy from the ’80s, is filled with familiar genre tropes and jokes that resonate with a modern audience, and features some meta-humor.

Anaconda is available to rent on Prime Video. Follow Collider to keep up to date with the latest updates.

- Release Date

-

December 24, 2025

- Runtime

-

100 minutes

- Director

-

Tom Gormican

- Writers

-

Kevin Etten, Tom Gormican

- Producers

-

Andrew Form, Brad Fuller, Kevin Etten, Tom Gormican, Alex Ginno, Erin Vitali

Entertainment

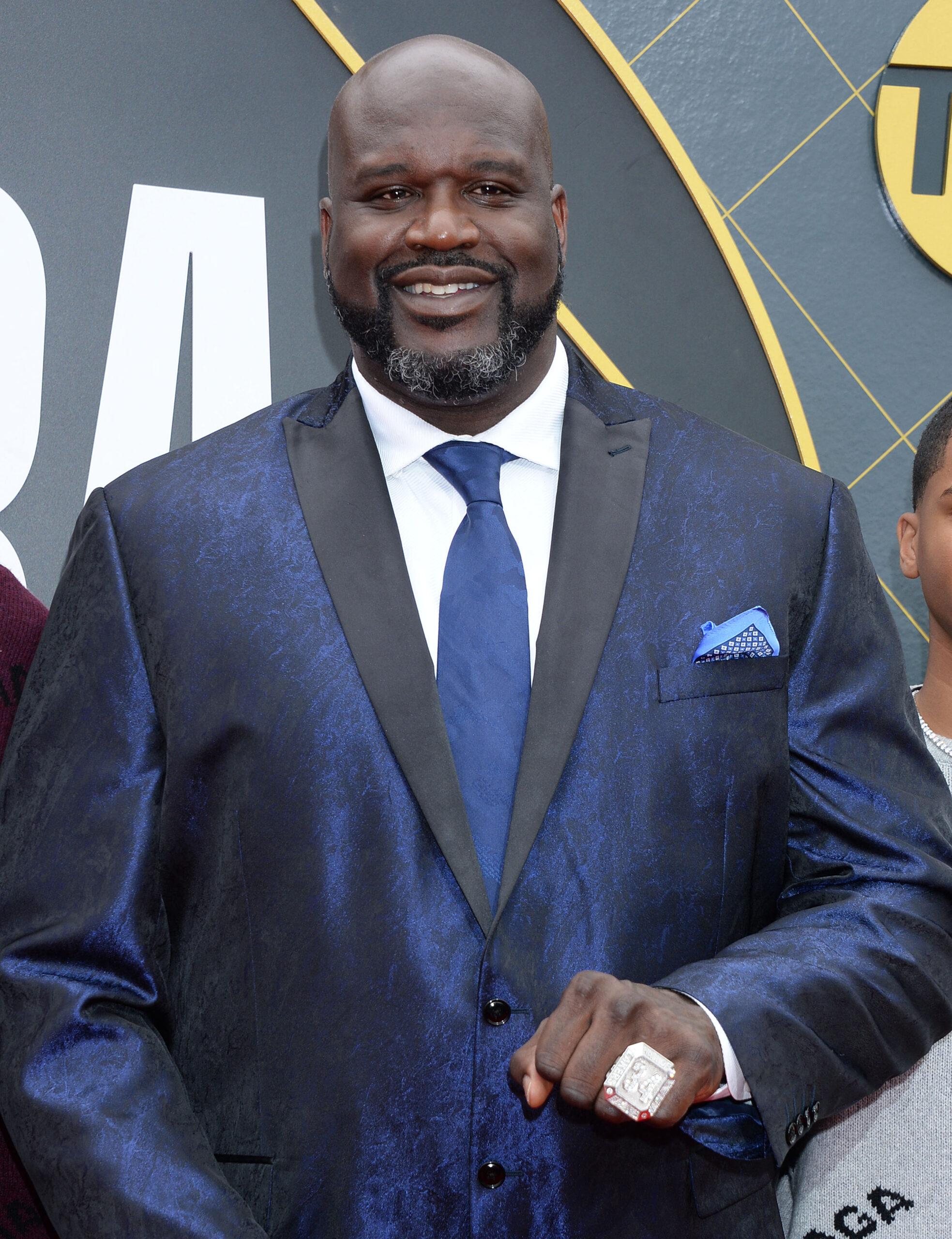

Shaquille O’Neal Shares Reason His Kids Once Stopped Talking To Him

Shaquille O’Neal recently discussed his once-strained relationship with his children.

During an episode of rapper TI‘s “expediTIously” podcast, the former Los Angeles Lakers star was candid about how his divorce from his ex-wife, Shaunie Henderson, affected his bond with his kids.

Prior to this, Shaquille O’Neal slammed online blogs for reportedly spreading “clickbait” rumors about his alleged relationship with a married woman.

Article continues below advertisement

Shaquille O’Neal Shares What He’s ‘Learned’ After Marriage And Touches On His Relationship With Kids

During his conversation with TI, Shaq reflected on the lessons he’s learned since his previous marriage.

“I learned that I know better than to be out here bullsh-tting,” the NBA champion said. “Sometimes you just get caught up. But we know better.”

Shaq was married to Henderson from 2002 to 2009 before officially splitting in 2011. Elsewhere in the episode, he acknowledged that his divorce impacted his children, though he noted they are thriving today.

“In all of that, I’m just happy and blessed that they’ve forgiven me. Because me and my babies didn’t talk for a while,” he said. “I understood that, but now we’re starting to get closer. I’m teaching my boys to be better than me. Papa was a Rolling Stone. You don’t need to be like me.”

Article continues below advertisement

Shareef O’Neal Talks About His Previous Relationship With His Father

Shaq’s comments about his children follow those of his son, Shareef O’Neal, who discussed his father during an appearance on the “Heir Time” podcast.

“The first few years it was pretty hard,” Shareef said about his parents’ divorce. “We were all too young to kind of understand what’s going on. Mom and dad aren’t going to be together. It wasn’t like a ‘choose a side’ thing.”

Shareef added that his parents didn’t seem to make things easier for them as kids when they were going through their marital woes.

“My mom [was] like, ‘If you guys wanna go with your dad, go ahead.’ My dad’s like, ‘If y’all wanna go with your mom, go ahead,’” he continued.

Things, however, eventually smoothed over, with Shareef giving props to both of his parents for how well they work together for their kids’ sake.

Article continues below advertisement

“They never come around and it’s a problem. My mom is remarried now. She can bring her husband around and dad [can] dap him up and have a conversation. So, I respect them both for never putting the stress on us,” Shareef said.

Article continues below advertisement

The NBA Star’s Ex-Wife Wrote About Their Marriage In Her Memoir

Henderson previously detailed her marriage to Shaq during her tenure on the VH1 reality series “Basketball Wives.” She shared even more in the pages of her memoir, “Undefeated: Changing the Rules and Winning on My Own Terms,” according to PEOPLE.

One section of the book that captured many readers’ attention was Henderson’s line: “Looking back, I don’t know that I was ever really in love with the man.” Shaq replied a day later with a message that read: “I understand… I wouldn’t have been in love with me either. Wishing you all the best. All love, Shaq. Trust me I get it.”

Henderson later said the viral line was taken out of context, and that she can’t change how people feel about what she’s written. “… it’s my book, my truth, and it’s my legacy.”

Article continues below advertisement

Shaquille O’Neal Calls Out The ‘Clickbait’ Rumors About Him

According to The Blast, Shaq recently responded to the claims that he was having an inappropriate relationship with his friend’s wife. During the interview, Shaq dismissed the claims as “clickbait” and affirmed that he would never cross a boundary with those in his inner circle.

“Listen, everybody wants their page to be famous, I understand it. You have to understand, you don’t go to people’s wives. That’s something you just don’t do,” he said, adding, “I’m 53, so I’m done with all that.”

Shaq’s $180,000 Problem…

Prior to these events, Shaq dealt with even more drama when his $180,000 custom Range Rover SUV was stolen.

The Blast reported that Shaq’s luxury vehicle was supposed to be transported to Louisiana, but it never arrived, prompting questions from law enforcement.

Authorities initially said hackers may have been responsible for the heist, noting they could’ve hacked the custom detailer’s system and used the information to send the NBA star’s car elsewhere.

CBS News shared in December 2025 that a man had been arrested in connection with the missing vehicle in New York.

The stolen Range Rover has not been recovered, according to authorities. In fact, they believe it may be somewhere in the Middle East.

Entertainment

Barack Obama Comes Up With Loose Ball While Courtside at NBA All-Star Game

Barack Obama

That’s What I Do!!!

Snags Loose Ball at NBA All-Star Game

Published

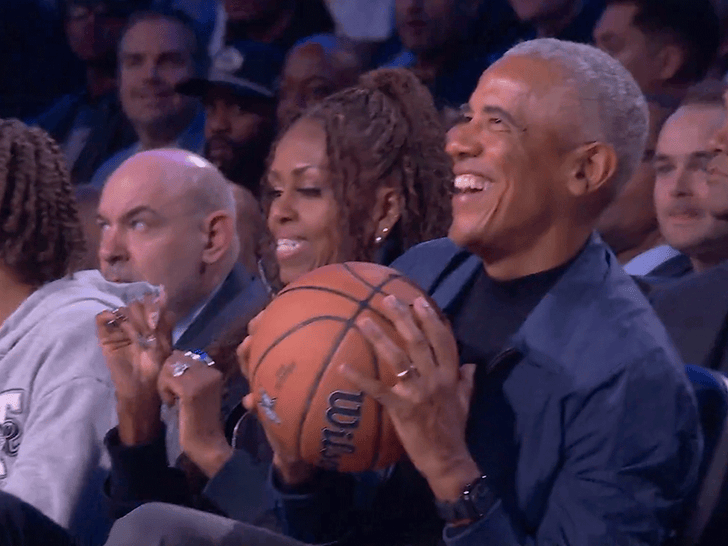

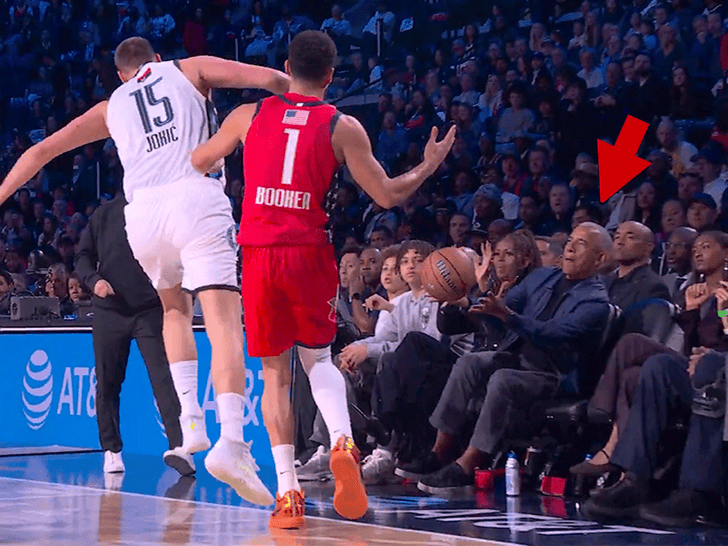

Former President Barack Obama came up clutch at the NBA All-star game Sunday … he snagged a loose ball that came barreling straight for him on the sidelines!

Watch the video … Barack is just hanging out with his wife, former First Lady Michelle Obama, courtside when the rock comes out of nowhere, almost hitting them … but Barack’s no stranger to the basketball court.

President Barack Obama comes up with the loose ball courtside!

— The Spectator Key (@spectatorinde) February 15, 2026

@spectatorinde

He showed he’s still got those quick hands, smoothly catching the ball and tossing it back in play. Check it out … he sits right back down and crosses his legs like nothing ever happened while continuing his conversation with Michelle.

Talk about calm under pressure!

It’s good to see the 44th President of the United States enjoying himself, because he’s been dealing with some B.S. lately.

Just days ago, he was responding to a video that depicted him and his wife as apes, which was later shared by President Donald Trump.

During an interview with Brian Tyler Cohen, Barack referred to both the social media posts and the administration’s public behaviors as a “clown show” … and he lamented the loss of “decorum” and “propriety” as it relates to the highest office in the land.

President Trump passed the blame onto an unnamed White House staffer … and, he said he wouldn’t apologize for the gaffe.

Entertainment

DNA On Black Glove Matches Suspect At Nancy Guthrie’s Home

Nancy Guthrie still remains missing as the investigation into her disappearance enters its third week. The latest development in the search to bring her home involves a crucial element of DNA.

Authorities have confirmed that the DNA found on the black glove recovered close to Guthrie’s home is a match for the gloves worn by the suspect captured on the surveillance footage at her front door.

Article continues below advertisement

Positive DNA Match For Gloves Worn By Nancy Guthrie Suspect And Those Found Close To Her Home

Per TMZ, a spokesperson for the FBI confirmed to the outlet that a black glove, that was previously recovered from the area close to Nancy’s home, contains a positive DNA match to the gloves worn by the man seen on the surveillance footage in front of the 84-year-old’s home the morning of her disappearance.

The FBI shared that a total of 16 gloves were recovered from the area surrounding her home, however the majority of those were gloves worn by volunteer searchers who disposed of them outside during their search efforts.

“The one with the DNA profile recovered is different and appears to match the gloves of the subject in the surveillance video,” the FBI said via statement, according to TMZ.

Article continues below advertisement

The DNA results were received on Saturday, February 14, and within the next 24 hours they will undergo quality control inspection before being entered in the FBI’s national DNA database.

Article continues below advertisement

Sheriff In The Case Offers Disheartening Update About The Search For Nancy Guthrie

On Friday, February 13, Sheriff Chris Nanos, from the Pima County Sheriff’s Department, said via the New York Times that the search for Guthrie, could take much longer than her loved ones hope for.

“Maybe it’s an hour from now,” Nanos said. “Maybe it’s weeks or months or years from now. But we won’t quit. We’re going to find Nancy. We’re going to find this guy.”

His comments come days after authorities have detained and released multiple people for questioning in the case without resulting in any concrete evidence to link them to Guthrie’s disappearance.

Article continues below advertisement

Reports Of Tension Between Savannah Guthrie And Local Authorities Have Circulated

Per reports, while speaking to Fox News, Sheriff Nanos revealed that he recently reached out to Savannah regarding the investigation, but she allegedly told him that “she has her own people and didn’t need him.”

The Pima County Sheriff’s Department has been investigating Guthrie’s disappearance from the beginning but have also faced criticism for allegedly bungling the search and recovery efforts.

Article continues below advertisement

“Actually, the FBI just wanted to send the one or two they found by the crime scene, closest to it – mile, mile and a half… I said ‘No, why do that? Let’s just send them all to where all the DNA exists, all the profiles and the markers exist.’ They agreed, makes sense,” Nanos said, per KVOA.

Authorities Previously Announced Investigation Of Additional Suspect

On February 12, a new video was revealed of a man recorded 5 miles from Guthrie’s wearing similar clothing and items as the man caught via Nest video at Guthrie’s home when she disappeared, according to TMZ.

The FBI and the Pima County Sheriff’s Department are now closely examining the new footage, and the man in the images is on their radar.

As of now, it’s unclear if the person in the new footage is the same person seen in the person video or if there are multiple people.

Authorities said they noticed that the man in the recent footage, which was captured via Ring camera, is carrying what appears to be a similar backpack as the first potential suspect, and both sets of footage were recorded around the time Guthrie disappeared.

Article continues below advertisement

Per the outlet, the backpack in question has been confirmed to be an Ozark Trail Hiker sold by Walmart.

Former FBI Agent Raises Theory That Nancy Guthrie Surveillance Footage Could Be ‘Staged’

During a recent episode of her Katie Couric Media Substack Live, former “Today” show anchor Katie Couric interviewed two retired FBI agents regarding Guthrie’s case, according to Parade.

One of the agents, Kristy Kottis, said she believes the surveillance footage “seemed and felt like a staged video,” largely due to the suspect’s behavior.

Kottis pointed specifically to the individual’s heavily layered clothing, the brief moment when they looked directly toward the camera, and the way the gun was placed in front of the suspect’s waist, which made its presence conspicuously obvious.

“It was an individual, we don’t know whether it’s a male or female, showing us what they want us to see,” she said.

Entertainment

2 Years Before ‘The Wire,’ Its Creator Made a Gritty 6-Part HBO Crime Miniseries That Aged Perfectly

The Wire is not only one of the best shows to ever air on television, but it’s also one of the most important pieces of pop culture in American history. Overlooked upon release, the Baltimore-set HBO crime drama by David Simon explores police procedure, the drug trade, politics, education, and journalism with the vigor of a riveting novel and the precision of a tell-all documentary.

What happens in The Wire, a series framed around the systemic failure and neglect of our most trusted institutions, represents America in the 21st century, where we’ve seemingly lost our way. Before aspiring to such lofty heights, Simon, a former Baltimore Sun crime reporter, cemented his journalistic voice for an HBO miniseries that aired two years before The Wire‘s premiere. Based on a book by Simon and Ed Burns, The Corner, which features various cast members and hallmarks of its spiritual successor, is every Wire obsessive’s next watch.

‘The Corner’ Laid the Groundwork for ‘The Wire’

From the outset, Simon aspired to forever alter the fabric of the television medium, which was then dominated by sensationalized police procedurals and lurid cop thrillers. His journalistic instincts first pushed the boundaries of network dramas on Homicide, also based on a book by Simon. He took things to an even grittier and unflinching scale with The Corner, a six-episode miniseries about the life of an impoverished family amid the rampant drug trade in West Baltimore that became the prototype for The Wire.

Airing on HBO in 2000, The Corner follows Gary McCullough (the recently deceased T.K. Carter), his ex-wife Fran Boyd (Khandi Alexander), and their son DeAndre (Sean Nelson), whose lives have crumbled after his parents succumb to drug addiction. The street-wise and assured DeAndre must hold his own against the perils of the slums of Baltimore, as his quest for education and familial stability is compromised by the alluring pathway to dealing drugs — a quicker way to earn some much-needed cash for the family. Fans of The Wire will take delight in seeing familiar faces in the cast, including Clarke Peters, Lance Reddick, Corey Parker Robinson, Robert F. Chew, and Delaney Williams. Every episode is directed by prolific character actor Charles S. Dutton.

David Simon Revolutionized Gritty Television With HBO’s ‘The Corner’

As expected, The Corner, which won an Emmy for Outstanding Miniseries, raises the bar for grittiness, making The Wire look like a glossy Hollywood soundstage musical. Something with this much grain and visual grime making it to a mainstream platform on HBO spoke to the channel’s artistic fearlessness and curiosity. Sentimentality is nowhere to be found in the series, with Simon and Burns crafting this unforgiving world with the sobering authenticity it deserves. Showrunners tend to find some unseemly fetishization with neighborhoods hindered by poverty and crime, but the duo’s background in journalism and law enforcement allows Baltimore to appear mundane and a reflection of decades’ worth of government neglect. Simon and Burns exhibit restraint on their own end, as they limit their scope to the troubles of DeAndre and his run-ins with the drug trade, which makes this weighty treatise on the decay of urban America into an intimately constructed character drama.

With The Wire, David Simon, thanks to contributions from Hollywood directors like Ernest Dickerson and crime novelists like Richard Price, sharpened his abilities as a dramatist and narrative storyteller, attributes that eased the show into the good graces of casual TV audiences. The Corner is less engaging on an emotional level for the audience, as everything on screen is more or less a reflection of a pre-existing world. Thanks to Dutton’s narration and interviews with the subjects, the series never lets you gloss over the text’s nonfictional roots. In the shadow of the “hood” crime thrillers of the ’90s, drug-running and activity in the projects were lurid cinematic devices, but Simon urges the audience that this downtrodden lifestyle could happen to anyone, including Gary, who once lived an upstanding, healthy middle-class life.

Things that would’ve been marginalized or cheapened in other shows are treated with austerity in The Corner, particularly the characterization of DeAndre, a teenager who carries the burden of his entire family. Dabbling in illicit crime circles is a punishing, necessary evil for DeAndre, and not a proud demonstration of his independence and toughness. Sean Nelson’s performance retroactively works as a composite of some of The Wire‘s most conflicted characters, from the street’s Robin Hood, Omar Little (Michael K. Williams), to the matured corner veteran, Bodie (J.D. Williams). DeAndre is emblematic of the modern-day Greek tragedy that is the average urban neighborhood in America. He is forced to engage with the American Dream as a survival tactic.

Entertainment

Travis Hunter Flexes Love For Leanna Lenee With Portrait Tattoo

Y’all! Travis Hunter is making the most of his first NFL off-season — and he’s doing it somewhere sunny with his family in tow. Between the stunning beach views, some serious ink flexing, and sweet moments with his wife Leanna Lenee and their baby boy, it’s clear there’s more to this trip than just a vacation. Now, fans are already zooming in on what they’re seeing, and trust us, the details have left them shook!

RELATED: Too Cute! Travis Hunter & Leanna Lenee Melt Hearts With Adorable Beachside Flicks Of Their Baby Boy (PHOTOS)

Hunter’s Love Is Literally On His Chest

Travis Hunter isn’t holding back when it comes to showing love — literally. The NFL rookie had fans doing a double take when photos surfaced of his frest chest tattoo featuring his wife Leanna’s smiling face on one side and their baby boy on the other. The viral moment came after Leanna shared a carousel of beach photos on Instagram on Valentine’s Day, captioning them simply, “Exactly.” Clearly, Hunter’s showing that his family isn’t just close to his heart — they’re on his chest too. Click here to see the spicy pic.

The Comment Section Is Still Going Off

Fans ran straight to TSR’s Instagram comment section as soon as the pics dropped, and you already know the timeline was buzzing. Some joked that they hope to find someone who goes hard for them like Travis does for Leanna. While others gushed over how much they actually love the couple. Of course, a few couldn’t resist chiming in with the classic, “If they like it, I love it.”

This Instagram user @blognae.__ commented, “He love that woman ❤️ PERIOD“

Then Instagram user @dantelee__ said, “I really don’t be seeing nothing wrong with what he doing.. dude living life 🙂↕️ blessing to him and his family“

And, Instagram user @obavita added, “If he like it I love it!👏🏾”

However, Instagram user @sherlines__ shared, “Ngl i love them idgaf. Through all the backlash they stood tall beside each other“

While, Instagram user @lazadiaaaaaa wrote, “Damn He would’ve loved me“

Lastly, Instagram user @therealkay_kg1 said, “I wish somebody was this delusional over me 😩”

The Hunter Crew Stays Living Their Best Life

Leanna Lenee and Travis Hunter often share some of the cutest family moments. The couple’s baby boy may only be a few months old, but he’s already living his best life, as seen in recent Instagram photos of the trio enjoying the beach together. One shot even shows his tiny footprints in the sand, while Leanna’s sweet caption, “When 2 became 3…🤍,” perfectly sums up the family vibes.

RELATED: Cuteness Overload! Travis Hunter & Leanna Lenee Give Glimpse Of Their Baby Boy In Adorable Family Flick (PHOTO)

What Do You Think Roomies?

Entertainment

Florida Man Charged After Fatal CashApp Dispute

Roommates… sometimes family drama goes way too far — and this latest situation out of Florida is a heartbreaking reminder of that. What reportedly started as a tense disagreement inside a shared home quickly spiraled into something no one could take back. Now, 21-year-old Jawan McBride is at the center of a tragedy that has left one family shattered.

RELATED: Anna Kepner’s Stepbrother Reportedly Arrested & Charged As Her Mother Speaks Out (VIDEOS)

Family Feud Over Funds Turns Fatal

According to Miami-Dade County court records, Jawan McBride has been charged with first-degree murder following the death of his brother. Authorities say the incident happened on January 21 at their home on Northwest Fifth Court, just north of Miami. Additionally, reports state that the brothers were arguing over money from a joint CashApp account. Also, the victim allegedly believed McBride had taken funds that belonged to him and confronted him about it.

Authorities Detail Moments Before Tragedy

Police say the disagreement escalated inside the home after the victim demanded money he felt was owed to him and allegedly threatened to take McBride’s paycheck as repayment. Investigators claim there were prior messages that suggested tensions had been building before the confrontation took place.

Authorities allege that during the dispute, McBride armed himself and a physical altercation followed in the living room area. Emergency responders transported the brother to a nearby hospital, where he was later pronounced dead. Additionally, the medical examiner ruled the death a homicide caused by sharp force injuries.

McBride Denied Bond, Remains In Custody

Officials say McBride admitted to the stabbing during questioning. An autopsy discovered the victim suffered a perforated lung, stomach, diaphragm, and small intestine, and his lower left rib was chipped, according to McClatchy News. McBride allegedly admitted that the stabbing stemmed from the feud over money.

He was denied bond and remains detained in the Turner Guilford Knight Correctional Center. The victim’s name has not yet been publicly released. Furthermore, the tragic situation has sparked conversations online about money disputes between family members and how quickly conflicts can escalate.

RELATED: Prayers Up! Pennsylvania Olive Garden Cook Reportedly Dies After Dunking Head In Deep Fryer

What Do You Think Roomies?

-

Sports4 days ago

Sports4 days agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

NewsBeat6 days ago

NewsBeat6 days agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

Tech5 days ago

Tech5 days agoSpaceX’s mighty Starship rocket enters final testing for 12th flight

-

Sports7 days ago

Sports7 days agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Tech23 hours ago

Tech23 hours agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Video3 days ago

Video3 days agoThe Final Warning: XRP Is Entering The Chaos Zone

-

![Heathrow has said passenger numbers were 60% lower in November than before the coronavirus pandemic and there were “high cancellations” among business travellers concerned about being trapped overseas for Christmas as Omicron spreads. The UK’s largest airport said the government’s travel restrictions had dealt a fresh blow to travel confidence and predicted it was likely to take several years for passenger numbers to return to pre-pandemic levels. This week ministers said passengers arriving in the UK would have to take a pre-departure Covid test, as well as a post-flight test, because of fears about the spread of the new variant. “[The] high level of cancellations by business travellers concerned about being trapped overseas because of pre-departure testing shows the potential harm to the economy of travel restrictions,” the airport said in an update. Heathrow said the drop in traveller confidence owing to the new travel restrictions had negated the benefit of reopening the all-important corridor to North America for business and holiday travel last month. Eleven African countries have been added to the government’s red list, requiring travellers to quarantine before reuniting with families. “By allowing Brits to isolate at home, ministers can make sure they are reunited with their loved ones this Christmas,” said John Holland-Kaye, the chief executive of Heathrow. “It would send a strong signal that restrictions on travel will be removed as soon as safely possible to give passengers the confidence to book for 2022, opening up thousands of new jobs for local people at Heathrow. Let’s reunite families for Christmas.” Heathrow said that if the government could safely signal that restrictions would be lifted soon, then employers at Heathrow would have the confidence to hire thousands of staff in anticipation of a boost in business next summer. The airport is expecting a slow start to 2022, finishing next year with about 45 million passengers – just over half of pre-pandemic levels. This week Tui, Europe’s largest package holiday operator, said it expected bookings for next summer to bounce back to 2019 levels. However, Heathrow said on Friday not to expect the aviation industry to recover for several years. “We do not expect that international travel will recover to 2019 levels until at least all travel restrictions (including testing) are removed from all the markets that we serve, at both ends of the route, and there is no risk of new restrictions, such as quarantine, being imposed,” the airport said.](https://wordupnews.com/wp-content/uploads/2026/02/shutterstock_1100012546-scaled-400x240.jpg)

![Heathrow has said passenger numbers were 60% lower in November than before the coronavirus pandemic and there were “high cancellations” among business travellers concerned about being trapped overseas for Christmas as Omicron spreads. The UK’s largest airport said the government’s travel restrictions had dealt a fresh blow to travel confidence and predicted it was likely to take several years for passenger numbers to return to pre-pandemic levels. This week ministers said passengers arriving in the UK would have to take a pre-departure Covid test, as well as a post-flight test, because of fears about the spread of the new variant. “[The] high level of cancellations by business travellers concerned about being trapped overseas because of pre-departure testing shows the potential harm to the economy of travel restrictions,” the airport said in an update. Heathrow said the drop in traveller confidence owing to the new travel restrictions had negated the benefit of reopening the all-important corridor to North America for business and holiday travel last month. Eleven African countries have been added to the government’s red list, requiring travellers to quarantine before reuniting with families. “By allowing Brits to isolate at home, ministers can make sure they are reunited with their loved ones this Christmas,” said John Holland-Kaye, the chief executive of Heathrow. “It would send a strong signal that restrictions on travel will be removed as soon as safely possible to give passengers the confidence to book for 2022, opening up thousands of new jobs for local people at Heathrow. Let’s reunite families for Christmas.” Heathrow said that if the government could safely signal that restrictions would be lifted soon, then employers at Heathrow would have the confidence to hire thousands of staff in anticipation of a boost in business next summer. The airport is expecting a slow start to 2022, finishing next year with about 45 million passengers – just over half of pre-pandemic levels. This week Tui, Europe’s largest package holiday operator, said it expected bookings for next summer to bounce back to 2019 levels. However, Heathrow said on Friday not to expect the aviation industry to recover for several years. “We do not expect that international travel will recover to 2019 levels until at least all travel restrictions (including testing) are removed from all the markets that we serve, at both ends of the route, and there is no risk of new restrictions, such as quarantine, being imposed,” the airport said.](https://wordupnews.com/wp-content/uploads/2026/02/shutterstock_1100012546-scaled-80x80.jpg) Business7 days ago

Business7 days agoWeight-loss jabs threaten Greggs’ growth, analysts warn

-

NewsBeat7 days ago

NewsBeat7 days agoResidents say city high street with ‘boarded up’ shops ‘could be better’

-

Crypto World6 days ago

Crypto World6 days agoU.S. BTC ETFs register back-to-back inflows for first time in a month

-

Crypto World4 days ago

Crypto World4 days agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

Crypto World2 days ago

Crypto World2 days agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Video4 days ago

Video4 days agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

Crypto World5 days ago

Crypto World5 days agoBlockchain.com wins UK registration nearly four years after abandoning FCA process

-

Sports6 days ago

Kirk Cousins Officially Enters the Vikings’ Offseason Puzzle

-

Crypto World6 days ago

Crypto World6 days agoEthereum Enters Capitulation Zone as MVRV Turns Negative: Bottom Near?

-

NewsBeat8 hours ago

NewsBeat8 hours agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Crypto World5 days ago

Crypto World5 days agoCrypto Speculation Era Ending As Institutions Enter Market

-

Business4 days ago

Business4 days agoBarbeques Galore Enters Voluntary Administration

-

Crypto World3 days ago

Crypto World3 days agoEthereum Price Struggles Below $2,000 Despite Entering Buy Zone

-

Politics5 days ago

Politics5 days agoWhy was a dog-humping paedo treated like a saint?