CryptoCurrency

Bitcoin Falls Under $86K as Whales Offload $2.78B in Crypto

Bitcoin Faces Downward Pressure Amid Whales’ Net Selling and Short-Term Losses

Bitcoin has experienced a notable decline, dropping below $86,000 as the market exhibits contrasting activity between retail traders and large institutional holders. While smaller investors continue to buy the dips, major whales are actively reducing their positions, exerting downward pressure on the cryptocurrency’s price.

Key Takeaways

- Retail and mid-sized wallets accumulated approximately $474 million in buying volume, while large holders sold $2.78 billion during the same period.

- Short-term Bitcoin holders are frequently selling at a loss, signaling potential capitulation, but a confirmed reversal remains elusive.

- The technical structure indicates increased downside risk, with a possible retest of quarterly lows at $80,600.

- Order flow data reveals a significant divergence: smaller traders bid into the downtrend, whereas whales pose the primary selling force.

Tickers mentioned: None

Sentiment: Bearish

Price impact: Negative. The liquidation of large positions combined with technical breakdowns suggests continued downward momentum.

Whales Drive Market Pressure

Analysis from Hyblock Capital highlights a stark contrast in behavior across different trader segments. Retail wallets holding less than $10,000 have amassed a net volume delta of $169 million, consistently buying into the decline. Similarly, mid-sized traders ($1,000–$100,000) have accumulated a net spot position of $305 million, attempting to anticipate a recovery.

In contrast, whales, holding between $100,000 and $10 million, remain the dominant force on the sell side, with a cumulative volume delta of -$2.78 billion. This disparity indicates that retail and mid-sized traders are unable to absorb the large-scale distribution by institutional holders, perpetuating the liquidity imbalance.

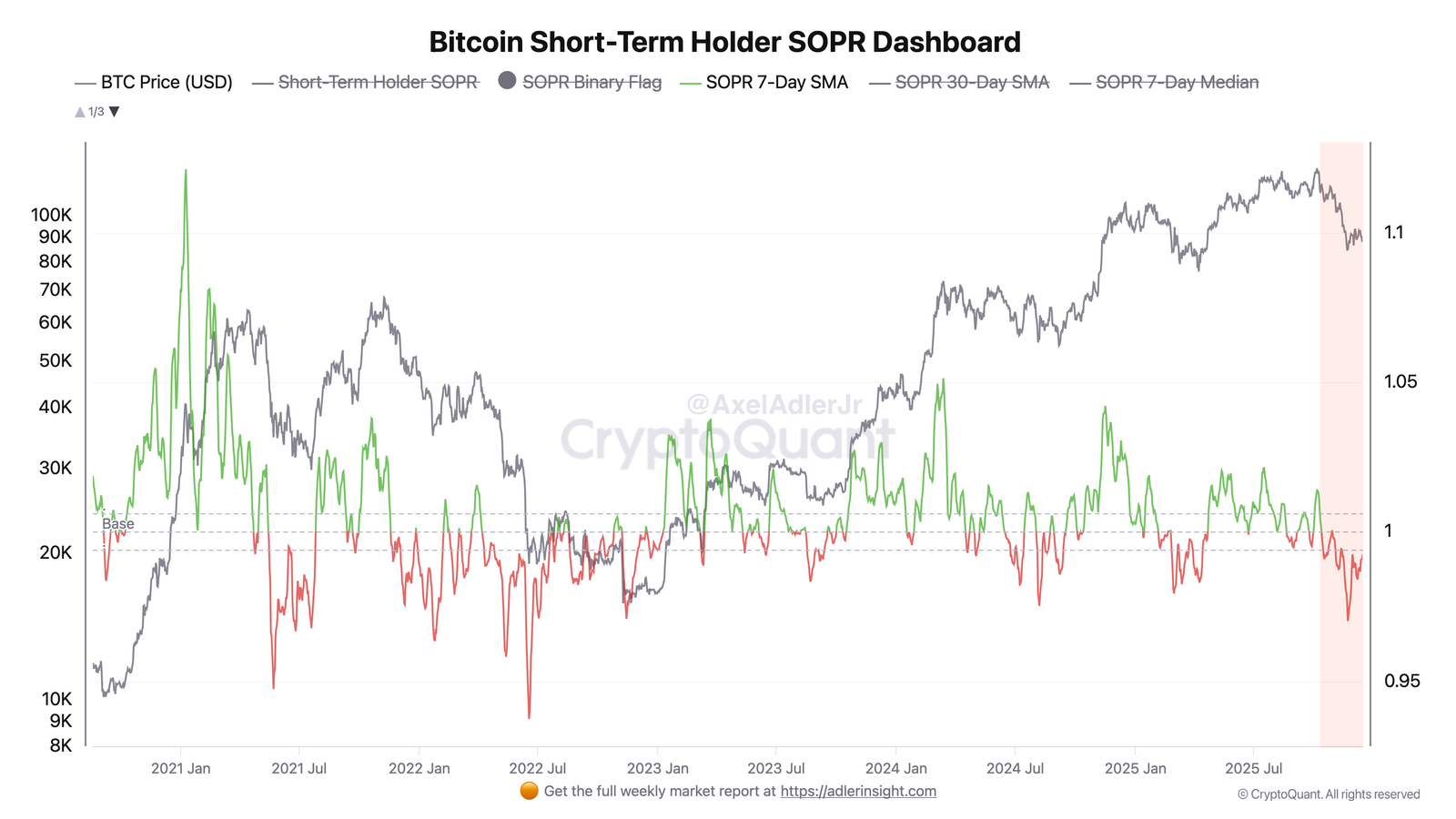

On-chain metrics further underscore bearish sentiment. Axel Adler Jr points out that the short-term holder spent output profit ratio (SOPR), measured over the past week, has dipped below 1—hovering around 0.99—indicating that coins held less than 155 days are being sold at a loss, hinting at local capitulation phases. However, Adler emphasizes that such stress signals alone do not confirm a trend reversal; sustained recovery typically requires the SOPR to recover and remain above 1.

Technical Outlook and Potential Support Zones

From a technical perspective, Bitcoin’s recent breakdown of its rising wedge pattern and violation of the monthly VWAP signals increased downside risks. The price has now fallen below $87,600, with key support levels around the previous swing low of $83,800. If sell pressure persists, the market could target the quarterly lows at $80,600, risking further decline.

Both order flow analysis and on-chain signals suggest traders remain cautious, awaiting confirmation of a bottom before expecting a sustained rally. Veteran traders warn that the recent parabola breakdown increases the likelihood of an aggressive correction, potentially up to 80% from recent highs.

For market participants, patience remains essential as the current data indicates that a definitive bottom has yet to form, requiring further declines or consolidation before a credible recovery can be established.