Video

Solve this Mystery, Win a Lamborghini

Video

How to Build a Strong Financial Foundation

How to Build a Strong Financial Foundation

How to build a strong financial foundation starts with disciplined money habits and smart planning. This video explains financial foundation principles, practical budgeting strategies, and essential financial insights to help viewers improve stability, reduce uncertainty, and develop long-term financial confidence.

Time Code

0:00 Intro

0:10 Myanmar News

1:00 Myanmar News

2:30 News

3:00 News

4:00 Myanmar News

Facebook တွင်လည်းကြည့်ရှုနိုင်ပါသည်။ Like and Share လုပ်ပေးဖို့မမေ့နဲ့နော်

https://www.facebook.com/profile.php?id=100064732721170

Youtube Channel ကို Subscribe and Share လုပ်ပေးခြင်းဖြင့်ကူညီပါ

https://www.youtube.com/@mytv8362

Youtube Play List

https://www.youtube.com/@mytv8362/playlists

#FinancialFoundation #MoneyManagement #SmartBudgeting #FinancialEducation #SmartFinance

source

Video

BTC & ETH Price Update | Market Movement Explained Today

BTC & ETH Price Update | Market Movement Explained Today

👉Premium on Telegram :

https://t.me/profitfirstpremium

👉Register on Telegram :

https://t.me/Profitfirstofficial

Bitcoin has finally broken out of its confirmation level! 🚀 In this video, we’ll analyze this breakout, decode the low trading volume, and predict the next major price move for BTC. Is this the start of a new bullish trend or just a fakeout? Watch as we cover the technical charts, key resistance levels, and what the whales are doing right now.

We’ll also cover ETH price movement and how the overall crypto market is reacting to this BTC breakout. Don’t miss this deep analysis if you’re trading or investing in crypto in 2025!

Disclaimer –

All of our videos are strictly personal opinions. Please make sure to do your own research. Never take one personal’s opinion for financial guidance. There are multiple strategies and not all strategies fit all people. Our videos ARE NOT financial advice.

Also don’t forget to Subscribe to the Channel

Copyright Disclaimer :-

Under section 107 of the Copyright Act 1976 On YouTube allowance is made for “fair use” for purposes such as criticism, comment news reporting, teaching, scholarship and research. Fair use is a use Permitted by copyright statute that might otherwise be infringing. Non-profit, educational and personal use tips the balance in favor of fair use.

Thank You 🙏

source

Video

6 Financial Rules for Greater Happiness with Dave Ramsey

I’ve hinted at this before, but in my new book, The Meaning of Your Life (https://www.arthurbrooks.com/books/the-meaning-of-your-life), I explore where meaning actually comes from—one place, for example, is by serving others with our time and treasure. However, you certainly won’t find it in the worldly idols we so often chase. This all brings us to today’s topic—money.

Most people assume that having more money will make them happier. The research suggests something more subtle. What matters is not how much money you have, but how you use it.

In this episode of Office Hours, I am joined by Dave Ramsey, one of the most influential voices in personal finance, whose work has helped millions of people change their relationship with money. Dave shares his own journey from early financial success to bankruptcy and back, and how his faith shapes his thinking about debt, discipline, and financial peace.

*Where to find Dave Ramsey:*

• X: https://x.com/daveramsey

• LinkedIn: https://www.linkedin.com/in/ramsey-dave

• Instagram: https://www.instagram.com/daveramsey

• Facebook: https://www.facebook.com/daveramsey

• Website: https://www.ramseysolutions.com

*Where to find Arthur Brooks:*

• Website: https://arthurbrooks.com/

• Newsletter: https://www.arthurbrooks.com/newsletter

• X: https://x.com/arthurbrooks

• Instagram: https://www.instagram.com/arthurcbrooks/

• Facebook: https://www.facebook.com/ArthurBrooks/

• YouTube: https://www.youtube.com/channel/UCGuyFRjJQFGCKzfHTBvWM6A

• LinkedIn: https://www.linkedin.com/in/arthur-c-brooks/

• Email: officehours@arthurbrooks.com

*Timestamps:*

(00:00) Intro

(05:14) Dave’s early experiences with entrepreneurship and money

(07:30) How Dave’s early career success gave way to financial collapse

(10:54) Why borrowing money tends to undermine happiness

(13:34) Dave’s path back to prosperity

(16:43) What financial peace means

(18:07) How serving others contributes to long-term happiness

(19:45) How hope supports lasting change

(21:20) Why intentionality matters most

(23:37) Why things won’t bring you happiness

(27:12) How the credit system’s lack of guardrails sets people up to fail

(29:02) Why credit card debt is especially damaging to well-being

(30:00) Why people make poor financial decisions

(32:25) Why car debt is usually a poor investment

(35:16) How to get an education without taking on excessive debt

(38:40) Why mortgage debt doesn’t lower happiness when kept in check

(41:25) A framework for thinking about debt and savings

(42:21) Why generosity is linked to greater prosperity

(48:14) Q&A: How to stop being so stressed about money

(50:14) Q&A: How to make a savings plan for college

(52:58) Dave’s six big principles for money and happiness

*Referenced:*

• The Meaning of Your Life: Finding Purpose in an Age of Emptiness: https://www.amazon.com/Meaning-Your-Life-Finding-Emptiness/dp/0593545427

• The Happiness Scale: https://learn.arthurbrooks.com/the-happiness-scale

• Good credit, bad credit: The differential role of the sources of debt in life satisfaction: https://onlinelibrary.wiley.com/doi/full/10.1111/joca.12388

• Financial Peace: https://www.amazon.com/Financial-Peace-Dave-Ramsey/dp/0963571206

• What Is the Law of Diminishing Marginal Utility?: https://www.investopedia.com/terms/l/lawofdiminishingutility.asp

• Why You’re Better Off Not Borrowing: https://www.theatlantic.com/ideas/archive/2024/02/debt-borrowing-happiness/677303

• How your bank balance buys happiness: The importance of “cash on hand” to life satisfaction: https://psycnet.apa.org/record/2016-17475-001

• …References continued at: https://www.arthurbrooks.com/office-hours

Production and marketing by https://penname.co/

source

Video

Crypto Just Broke… Here’s What I’m Doing With XRP

The crypto market just experienced one of its sharpest drawdowns in recent history, with XRP down roughly 30% in a single week alongside major losses across Bitcoin and Ethereum, as pressure, leveraged liquidations, and U.S. regulatory uncertainty collided at once.

In this video, I break down why XRP and the broader crypto market are under pressure, how Federal Reserve expectations, institutional outflows, and forced liquidations are impacting liquidity, and what’s happening in Washington as lawmakers struggle to finalize U.S. crypto market structure and stablecoin legislation that could determine how digital assets operate going forward.

Timestamps

00:00 Crypto market breakdown and XRP selloff

00:48 Federal Reserve expectations and rate pressure

01:25 Liquidations and leverage unwind explained

02:00 Institutional outflows and liquidity stress

02:55 U.S. crypto regulation update from Washington

04:15 Banks vs crypto platforms and stablecoin yield

05:50 Market structure bill and the Clarity Act

07:10 Coinbase controversy and political pressure

09:55 Stablecoins, banks, and deposit flight concerns

12:05 White House stance and legislative roadblocks

If you follow XRP, Bitcoin, Ethereum, CoinBase, institutional crypto adoption, regulated digital assets, global payments and settlement infrastructure, this breakdown provides important context for how these systems are evolving right now.

💜 Thanks for supporting the channel! Like, share, and comment if this helped clarify what’s really happening.

🔵 Uphold | Trade, Spend & Earn XRP

➖ U.S. Debit Card: https://uphold.sjv.io/559kj9

➖ Uphold Website: https://uphold.sjv.io/dOmGMq

➖ XRP Rewards: 4% Elite Card / 2% Virtual Card

🟢 Hardware Wallets I Use for XRP

➖ D’CENT Biometric (1x) | 18% Off ($159→$129)

Biometric Wallet – Affiliates

➖ D’CENT Biometric (2x) | 31% Off ($318→$219)

Biometric Wallet 2X Package – Affiliates

➖ Ledger | Official Store

https://www.ledger.com/crypto-sensei

🔗Contact & Collaborations

▸ Business: cryptosensei@cryptonairz.com

▸ Collabs: BD Manager | @Jaalyn_T (Telegram)

▸ Collab Form: https://forms.gle/E6fskio5BBvd4zVn9

▸ Social Links: https://linktr.ee/Crypt0Sensei

(Partnerships & Brand Deals Only | No Agencies)

⚪FREE XRP Newsletter | https://joincryptonairz.com/Newsletter

🔴Full Legal & Regulatory Disclaimer

https://docs.google.com/document/d/1T_wTsSkXDZqdgKDUOKfIEKF-a7ur2kX8gw-e3aAq_Q4/edit?usp=sharing

#XRP #CryptoRegulation #MarketStructure #Stablecoins #InstitutionalCrypto #DigitalAssets

source

Video

BREAKING XRP DISCLOSED NEWS!!! (BANKS Hold MIllions of XRP!)

💲👇💲

💰WIN 3,000 XRP this month on BTCC, up to $10,000 Bonus!!

👉https://bit.ly/btcc-ramos

💰My Inner Circle on DISCORD, know my trades and TOP community!!

👉https://bit.ly/patreon-ramos

💰Newcomer Bonus of $10,000 on Bitunix!!

👉https://bit.ly/bitunix-ramos

💰Crypto IRA Sign Up Now for $100 funding bonus on iTrustCapital!!

👉https://bit.ly/itrust-ramos

💰YouTube Membership for Livestream Perks!!

👉https://bit.ly/youtube-ramos-member

Socials:

💎Ramos Official Site and Free TRADE Group!!

👉https://bit.ly/ramos-official

💎Tiktok

👉https://bit.ly/tiktok-ramos

💎X

👉https://bit.ly/x-ramos

💎Instagram

👉https://bit.ly/insta-ramos

💎Facebook

👉https://bit.ly/face-ramos

💎LinkedIn

👉https://bit.ly/linkedin-ramos

💎Email (BUSINESS ONLY)

👉ramos.team589@gmail.com

💎Telegram (BUSINESS ONLY)

👉https://bit.ly/tele-ramos

BREAKING XRP DISCLOSED NEWS!!! (BANKS Hold MIllions of XRP!)

#xrp #crypto #bitcoin

✅$1 CRO Party Telegram: https://t.me/ramoscro

✅TRADING Academy: https://epiqtradingfloor.com/?aff=5d65fe20

⛔️Disclaimer⛔️

This video is for educational purposes only. Please do your own research before making any decisions with your money. I will not be held liable for any losses or gains you may experience. I am not your financial or investment advisor. This is completely educational content and should be taken as such – the views expressed in the content are opinions. Nothing on this channel should be taken as a recommendation to buy a particular crypto asset. The information shared on this channel is not indicative of future results. Analyses are not absolute and are prone to change in accordance with present and future market events. Please do all of your own research before you buy any cryptocurrency or any financial product.

Some of the links and other products that appear on this video are from companies which Oscar Ramos will earn an affiliate commission or referral bonus. Oscar is part of an affiliate network and receives compensation for sending traffic to partner sites. The video is accurate as of the posting date but may not be accurate in the future.

I WILL NEVER CONTACT YOU IN ANYWAY (ON ANY PLATFORM). IF YOU GET CONTACTED BY ANYONE CLAIMING TO BE ME, IT IS NOT ME. FOR EXAMPLE, COMMENTS SHOWING WHATSAPP NUMBERS ARE NOT ME. ADDITIONALLY, PEOPLE HAVE THE ABILITY TO CALL YOU USING AI TECHNOLOGY SO IT SOUNDS LIKE ME. THIS AGAIN IS NOT ME. NEVER WILL I CONTACT YOU IN ANY WAY. DO NOT RESPOND OR INTERACT WITH ANYONE ON ANY PLATFORM CLAIMING TO BE ME OR WORKING ON MY BEHALF – THEY ARE SCAMMERS.

ripple xrp news,xrp news today crypto news,xrp ripple, ripple xrp,xrp news,xrp,xrp news today now,xrp community, ripple, ripple news, ripple lawsuit,xrp lawsuit update, bitcoin price prediction,xrp price prediction, ripple xrp news today, Ripple, Ripple vs SEC,xrp case, ripple case,xrp price

source

Video

New activity in Bitcoin account connected to Nancy Guthrie ransom: TMZ

“There is activity in that bitcoin account” tied to a ransom note related to Nancy Guthrie’s disappearance, TMZ’s Harvey Levin tells “CUOMO.” The ransom note was sent to TMZ and two Tucson TV stations earlier in the week.

MORE: https://www.newsnationnow.com/cuomo-show/activity-nancy-guthries-ransom-bitcoin/

source

Video

this is not financial advice always do your own research #JJK #Investing

Video

Expiry Hero Zero Trade Nifty SENSEX | Live Trading | Banknifty Analysis | 16-Feb | #livetrading

Free Option Chain Analysis Course | Open IND money Trading Account

https://indstocks.onelink.me/N8Ao/gtzm7vkx

Flash Trading by INDmoney https://indstocks.onelink.me/N8Ao/gtzm7vkx

Live Trading Nifty Options | first trade today 16-Feb | Nifty Bank | Nifty 50 | Finnifty | Bankex | Sensex | Trader Hitesh Nanwani

Free Option Chain Analysis Course | Open IND money Trading Account

https://indstocks.onelink.me/N8Ao/gtzm7vkx

https://join.suncrypto.in/2332115/refer

suncrypto referral code 2332115

Free Crypto Trading Course | Contact – 8619476606

Open Delta Trading Account https://www.delta.exchange/?code=DAJVDO

Join free telegram channel for Indian Market Updates

https://telegram.me/Hiteshnanwanilive

Join crypto telegram

https://telegram.me/trader_hiteshnanwani

Free Crypto Trading Course | Contact – 8619476606

Open Delta Trading Account https://www.delta.exchange/?code=DAJVDO

Download our learning App (Android)

https://play.google.com/store/apps/details?id=co.jack.bafwq

Instagram Business

https://www.instagram.com/trader_hiteshnanwani/?igsh=aGRsbDU5M3Z5dmNi#

Disclaimer:

📢 SEBI Registration: Hitesh Nanwani is registered with SEBI as a Research Analyst under registration number INH000022288.

📢 “Investment in securities market are subject to market risks. Read all the related documents carefully before investing.”

📢 “Registration by SEBI and certification from NISM do not guarantee the performance of the intermediary or assure returns for investors.”

📢 “The securities mentioned are for illustration only and are not recommendations.”

📢 Past performance does not indicate future results. Investments may lead to partial or permanent loss of capital or portfolio value during unfavourable conditions.

📢 Posts, visuals, or opinions shared on social media platforms do not constitute buy, sell, or hold recommendations in any securities or financial instruments. It is for educational purposes or personal opinion. Viewers, readers are strongly advised to consult their SEBI-registered financial adviser or investment professional before acting on any opinions or information shared online.

📢 No Loss Claims: There is no legal avenue or entitlement for claiming compensation or reimbursement for losses incurred based on our research recommendations, and all investment decisions are the sole responsibility of the investor, and the investor must act based on their risk appetite.

📢 We explicitly disclaim any assurances or guarantees of returns or any unethical activities. Any claims made on our behalf promising assured profits or returns or unethical activities must be reported immediately to our Compliance Officer through email at hiteshnanwani.connect@gmail.com and If you engage with such unauthorized persons, including our employees or associates, or accept return guarantees or others without officially informing the company, the company will not be liable for any resulting losses or liabilities.

📢 F&O Risks: High risk involved; suitable only for investors with appropriate risk appetite.

📢 The research analyst declares no conflict of interest and no other professional businesses adversely affecting the independence of research activities.

📢 For detailed terms & Conditions, risk disclosures, Investor Charter, Grievances, MITC, and Others, please visit: www.hiteshnanwani.com , and please read everything to avoid any future conflict of interest.

Topic-

options trading live,

live options trading,

trading options live,

intraday live trading,

banknifty live trade,

live intraday trading today,

live intraday trading,

option trading,

trading live,

live day trading,

live trade,

trading techstreet,

live,

banknifty live intraday trading,

nifty prediction,

nifty prediction for tomorrow,

mayank live trading,

mayank singh live trading,

today market analysis,

market prediction for tomorrow,

banknifty options for tomorrow,

bank nifty tomorrow prediction,

wealth secret live,

wealth secret,

tomorrow share market prediction,

bank nifty,

intraday trading,

shambhar takke,

sagar naik, live nifty option,

live daily help trading,

live bankniifty option trading,

day trading live,

live stock trading,

market prediction live,

live trap trading,

live trading profit,

the trade room,

crypto live trading,

trader room live,

nifty live,

banknifty live,

trade room,

mayank trader,

banknifty,

finnifty,

finnifty expiry day strategy,

trading,

live daytrading,

option trading live,

intraday trading live,

trade ideas live,

day trading live stream,

nse live trading,

option chain analysis for intraday,

today live trade,

Live trading karol,

Live trading with karol,

trading femme live,

trading femme live dipika,

zee business live,

live trading nifty,

live trading nifty options,

options trading live,

source

Video

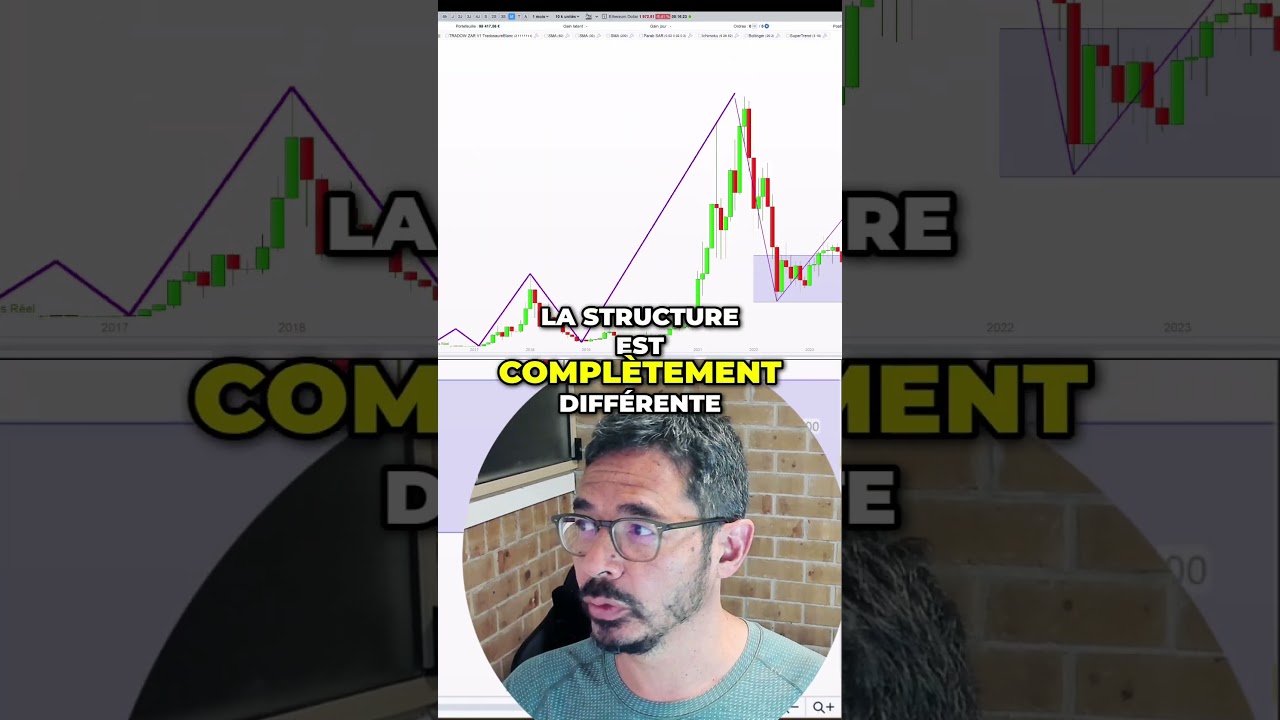

ETHEREUM arrive sur un point critique! #ethereum #eth #cryptos

ETHEREUM arrive sur un point critique.

Daily baissier.

Monthly haussier.

La décision approche.

Analyse complète en vidéo.

-

Sports4 days ago

Sports4 days agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

NewsBeat6 days ago

NewsBeat6 days agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

Tech5 days ago

Tech5 days agoSpaceX’s mighty Starship rocket enters final testing for 12th flight

-

![Heathrow has said passenger numbers were 60% lower in November than before the coronavirus pandemic and there were “high cancellations” among business travellers concerned about being trapped overseas for Christmas as Omicron spreads. The UK’s largest airport said the government’s travel restrictions had dealt a fresh blow to travel confidence and predicted it was likely to take several years for passenger numbers to return to pre-pandemic levels. This week ministers said passengers arriving in the UK would have to take a pre-departure Covid test, as well as a post-flight test, because of fears about the spread of the new variant. “[The] high level of cancellations by business travellers concerned about being trapped overseas because of pre-departure testing shows the potential harm to the economy of travel restrictions,” the airport said in an update. Heathrow said the drop in traveller confidence owing to the new travel restrictions had negated the benefit of reopening the all-important corridor to North America for business and holiday travel last month. Eleven African countries have been added to the government’s red list, requiring travellers to quarantine before reuniting with families. “By allowing Brits to isolate at home, ministers can make sure they are reunited with their loved ones this Christmas,” said John Holland-Kaye, the chief executive of Heathrow. “It would send a strong signal that restrictions on travel will be removed as soon as safely possible to give passengers the confidence to book for 2022, opening up thousands of new jobs for local people at Heathrow. Let’s reunite families for Christmas.” Heathrow said that if the government could safely signal that restrictions would be lifted soon, then employers at Heathrow would have the confidence to hire thousands of staff in anticipation of a boost in business next summer. The airport is expecting a slow start to 2022, finishing next year with about 45 million passengers – just over half of pre-pandemic levels. This week Tui, Europe’s largest package holiday operator, said it expected bookings for next summer to bounce back to 2019 levels. However, Heathrow said on Friday not to expect the aviation industry to recover for several years. “We do not expect that international travel will recover to 2019 levels until at least all travel restrictions (including testing) are removed from all the markets that we serve, at both ends of the route, and there is no risk of new restrictions, such as quarantine, being imposed,” the airport said.](https://wordupnews.com/wp-content/uploads/2026/02/shutterstock_1100012546-scaled-400x240.jpg)

![Heathrow has said passenger numbers were 60% lower in November than before the coronavirus pandemic and there were “high cancellations” among business travellers concerned about being trapped overseas for Christmas as Omicron spreads. The UK’s largest airport said the government’s travel restrictions had dealt a fresh blow to travel confidence and predicted it was likely to take several years for passenger numbers to return to pre-pandemic levels. This week ministers said passengers arriving in the UK would have to take a pre-departure Covid test, as well as a post-flight test, because of fears about the spread of the new variant. “[The] high level of cancellations by business travellers concerned about being trapped overseas because of pre-departure testing shows the potential harm to the economy of travel restrictions,” the airport said in an update. Heathrow said the drop in traveller confidence owing to the new travel restrictions had negated the benefit of reopening the all-important corridor to North America for business and holiday travel last month. Eleven African countries have been added to the government’s red list, requiring travellers to quarantine before reuniting with families. “By allowing Brits to isolate at home, ministers can make sure they are reunited with their loved ones this Christmas,” said John Holland-Kaye, the chief executive of Heathrow. “It would send a strong signal that restrictions on travel will be removed as soon as safely possible to give passengers the confidence to book for 2022, opening up thousands of new jobs for local people at Heathrow. Let’s reunite families for Christmas.” Heathrow said that if the government could safely signal that restrictions would be lifted soon, then employers at Heathrow would have the confidence to hire thousands of staff in anticipation of a boost in business next summer. The airport is expecting a slow start to 2022, finishing next year with about 45 million passengers – just over half of pre-pandemic levels. This week Tui, Europe’s largest package holiday operator, said it expected bookings for next summer to bounce back to 2019 levels. However, Heathrow said on Friday not to expect the aviation industry to recover for several years. “We do not expect that international travel will recover to 2019 levels until at least all travel restrictions (including testing) are removed from all the markets that we serve, at both ends of the route, and there is no risk of new restrictions, such as quarantine, being imposed,” the airport said.](https://wordupnews.com/wp-content/uploads/2026/02/shutterstock_1100012546-scaled-80x80.jpg) Business7 days ago

Business7 days agoWeight-loss jabs threaten Greggs’ growth, analysts warn

-

Tech1 day ago

Tech1 day agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Video3 days ago

Video3 days agoThe Final Warning: XRP Is Entering The Chaos Zone

-

Crypto World6 days ago

Crypto World6 days agoU.S. BTC ETFs register back-to-back inflows for first time in a month

-

NewsBeat7 days ago

NewsBeat7 days agoResidents say city high street with ‘boarded up’ shops ‘could be better’

-

Crypto World4 days ago

Crypto World4 days agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

Crypto World2 days ago

Crypto World2 days agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Crypto World6 days ago

Crypto World6 days agoBlockchain.com wins UK registration nearly four years after abandoning FCA process

-

Video4 days ago

Video4 days agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

Sports6 days ago

Kirk Cousins Officially Enters the Vikings’ Offseason Puzzle

-

Crypto World6 days ago

Crypto World6 days agoEthereum Enters Capitulation Zone as MVRV Turns Negative: Bottom Near?

-

NewsBeat15 hours ago

NewsBeat15 hours agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Crypto World5 days ago

Crypto World5 days agoCrypto Speculation Era Ending As Institutions Enter Market

-

Business4 days ago

Business4 days agoBarbeques Galore Enters Voluntary Administration

-

Crypto World4 days ago

Crypto World4 days agoEthereum Price Struggles Below $2,000 Despite Entering Buy Zone

-

Politics5 days ago

Politics5 days agoWhy was a dog-humping paedo treated like a saint?

-

NewsBeat17 hours ago

NewsBeat17 hours agoMan dies after entering floodwater during police pursuit