Looking for those projects that can take your investment to the moon? With Cardano not showing much promise in recent times, investors are now looking for the best altcoins to hold in 2025, which isn’t ADA. Experts have shortlisted three tokens that might be better than ADA in 2025. These projects include NEAR Protocol (NEAR), Polkadot (DOT), and Remittix (RTX). This article will explain why each project might be better long-term to hold than Cardano.

Polkadot (DOT)

Polkadot (DOT) is a blockchain that links different networks together. Its focus on interoperability helps developers create new projects across multiple chains. Recently, Polkadot (DOT) made headlines when Koni Stack teamed up with Mythical Games to launch Football Rivals, boosting user engagement. Another big move is vDOT, a liquid staking token that lets people borrow extra DOT. Within 15 hours of listing vDOT on a public money market, the project reached $2.2 million in Total Locked Value. This shows that Polkadot might just be one of the best long-term projects to hold. While it has dropped 23.37% over the last 30 days, experts say it may recover. With the consistent innovations in the DeFi, it is easy to see why they rate it as one of the best altcoins to hold in 2025.

Near Protocol (NEAR)

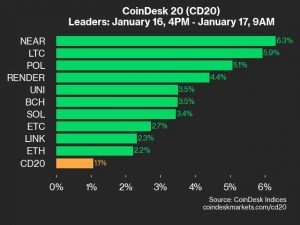

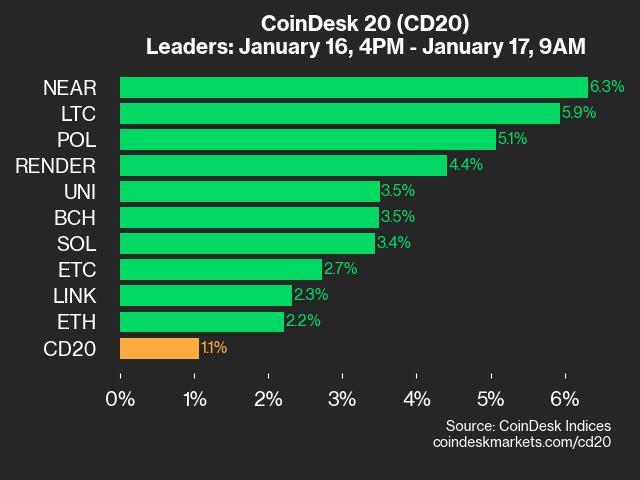

Near Protocol (NEAR) Near Protocol (NEAR) made headlines by becoming the first non-EVM chain to work fully with MetaMask. This makes Near Protocol much simpler for people who already use Ethereum tools. The NEAR Snap feature allows account creation and transaction signing right from MetaMask, which shows how serious Near Protocol is about Web3 growth. While the coin is now at $5, it had a +25.41% jump in the last month. Though it dropped 4.97% this week, some see Near Protocol (NEAR) as one of the best altcoins to hold in 2025. Its focus on easy user experience could draw more developers, leading to bigger projects on Near Protocol.

Remittix (RTX)

Remittix (RTX) is attracting huge interest for its real-world payment solutions. Unlike Polkadot (DOT) or Near Protocol (NEAR), Remittix (RTX) is all about making international money transfers cheaper and faster. Its PayFi model bridges crypto with traditional banking, letting people convert over 40 cryptocurrencies into fiat and deposit funds into bank accounts within 24 hours. Demand for Remittix (RTX) keeps growing—its price just rose to $0.0207, proving investor excitement. Gurus like how Remittix tackles everyday issues rather than just tech problems. They call Remittix (RTX) the best pick among these three, giving it a strong chance to outpace Cardano. For those wanting real utility, Remittix might truly be the best altcoins to hold in 2025.

Conclusion

Crypto experts think Polkadot (DOT), Near Protocol (NEAR), and Remittix (RTX) have more upside than Cardano (ADA). Polkadot offers cross-chain power, Near Protocol leads with user-friendly tools, and Remittix fixes real payment problems. Recent Remittix (RTX) growth shows it might have the best shot at strong returns. These three coins could bring solid gains if you’re looking for something beyond Cardano. Still, always research carefully since crypto markets can change fast. Remember that the key is picking projects with true value—like Remittix (RTX)—that can grow even in tough markets.

Join the Remittix revolution today:

Disclaimer: This is a sponsored article and is for informational purposes only. It does not reflect the views of Crypto Daily, nor is it intended to be used as legal, tax, investment, or financial advice.

+ There are no comments

Add yours