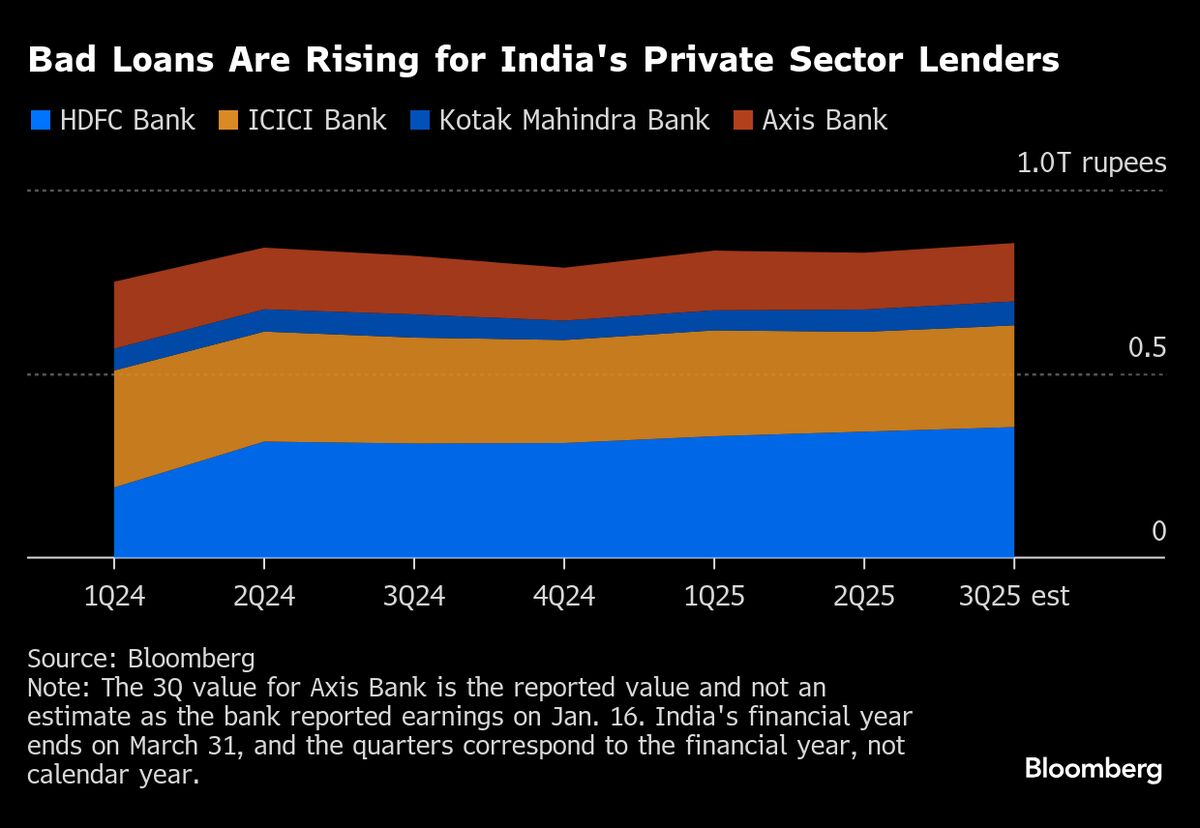

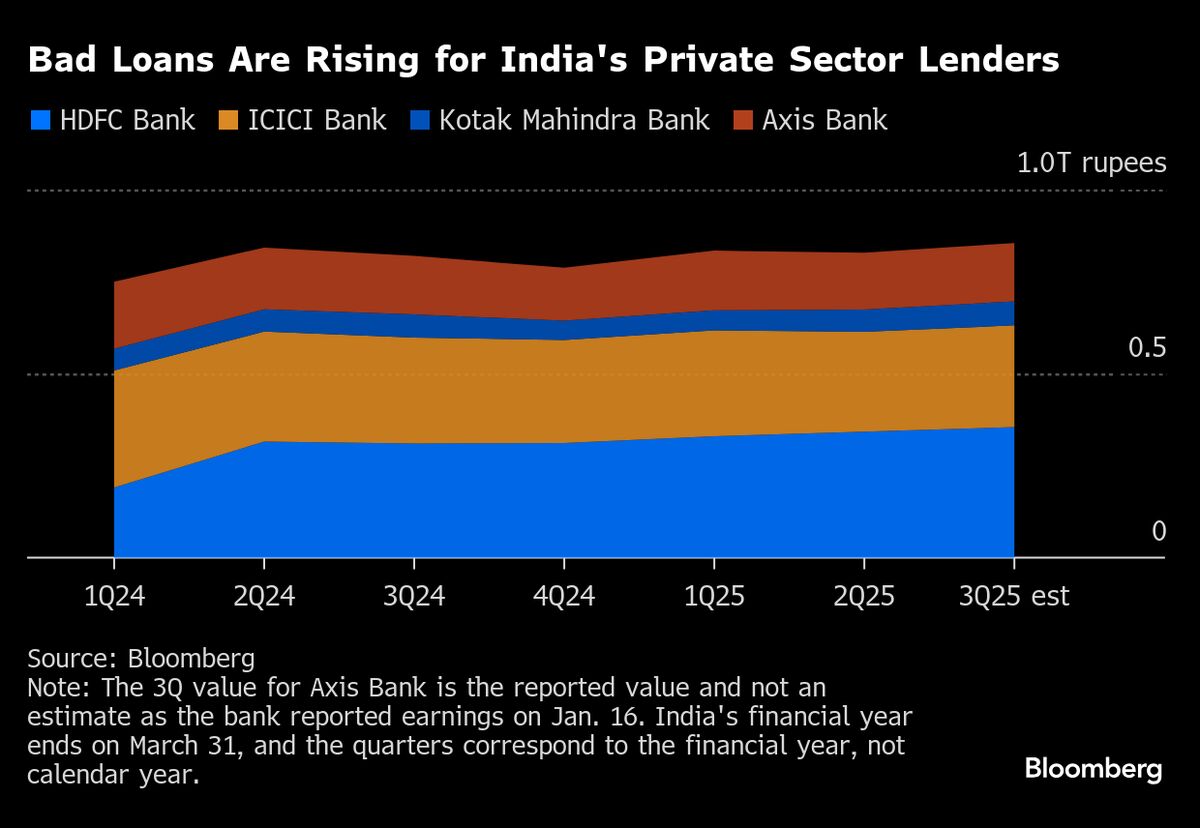

Falling wages and high inflation in India will have dented earnings at HDFC Bank Ltd., Kotak Mahindra Bank Ltd. and Hindustan Unilever Ltd. as the lenders brace for an asset quality deterioration and consumer firms grapple with penny-pinching customers.

HDFC Bank, Hindustan Unilever Squeezed as Indian Middle Class Struggles

Estimated read time

1 min read

+ There are no comments

Add yours