CryptoCurrency

NEAR Protocol Falls 4.1%, Leading Index Lower

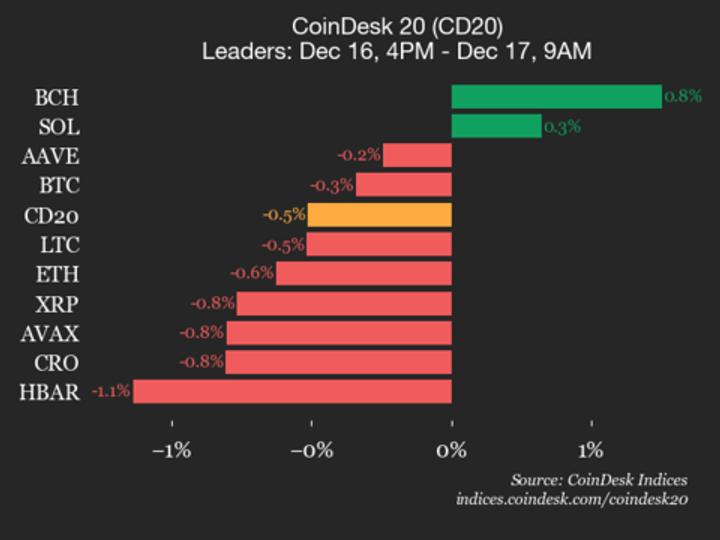

CoinDesk Indices presents its daily market update, highlighting the performance of leaders and laggards in the CoinDesk 20 Index.

The CoinDesk 20 is currently trading at 2726.78, down 0.5% (-14.03) since 4 p.m. ET on Tuesday.

Two of the 20 assets are trading higher.

Leaders: BCH (+0.8%) and SOL (+0.3%).

Laggards: NEAR (-4.1%) and SUI (-2.4%).

The CoinDesk 20 is a broad-based index traded on multiple platforms in several regions globally.