Business

Treasury announces Trump accounts with $1,000 for American children

Counselor to the Treasury Secretary Joe Lavorgna discusses President Trumps Trump accounts for children, tackling affordability and more on Making Money.

Treasury Secretary Scott Bessent on Wednesday announced new details about the creation of so-called Trump accounts that were created under the One Big Beautiful Bill Act and launched a website for the initiative.

Bessent spoke at the Treasury Department and said that with the rollout of the investment accounts, “An entire generation of Americans is about to learn in the most life-changing way possible how even small contributions can become generational wealth, and it’s all thanks to President Trump.”

Trump accounts will be provided to every American child born between January 1, 2025, and December 31, 2028, and seeded with $1,000 invested in an index fund. The accounts are in the child’s name and their parents are the custodian until the age of 18. While no contributions are necessary, up to $5,000 can be deposited into the accounts per year.

“Trump accounts are the president’s gift to the American people. They represent perhaps the most groundbreaking policy innovation of modern times,” Bessent said. “They are shaped by a very simple vision: every American a shareholder. When every American owns a share of the most powerful economy on earth, every American will benefit from our nation’s growth.”

‘TRUMP ACCOUNTS,’ EXPLAINED: WHO QUALIFIES, HOW THEY WORK AND WHEN YOU CAN CLAIM

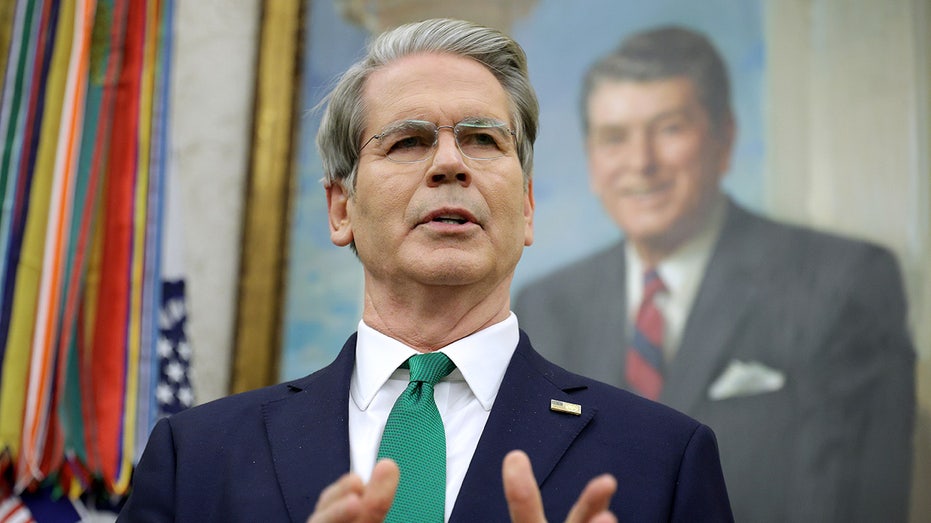

Treasury Secretary Scott Bessent revealed more details about Trump accounts as the administration launched a website. (Alex Wong/Getty Images / Getty Images)

“Every American will capture a portion of the productivity gains brought about by AI, robotics, and other world-changing technologies,” he added. “And every American will be invested in the free market system and most importantly, its continued success.”

Trump accounts will officially launch on July 4, 2026. Parents can enroll their children by making an election when they file their tax returns.

“To claim this investment, most families need merely to check a box on Form 4547, the most aptly named tax document of all time,” Bessent said in reference to Trump serving as the 45th and 47th U.S. president.

WEALTHY AMERICANS ‘RINGING OUR PHONES OFF THE HOOK’ TO HELP WITH TRUMP ACCOUNTS, HASSETT SAYS

Trump accounts were included in the One Big Beautiful Bill Act, which the president signed into law on July 4, 2025. (Tom Brenner For The Washington Post via Getty Images / Getty Images)

Once the program goes live, a financial institution will receive the funds for a given child’s account and activate it. From then on, up to $5,000 can be contributed to the account per year, though no additional deposits are necessary.

“The compound growth from Treasury’s initial seed funding alone stands to make young Americans wealthy. The S&P has grown at a rate of 10.5% each year, on average, since the 1950s. Assuming that growth rate continues, a single $1,000 deposit into a Trump account at birth will grow to over $600,000 by the age of retirement,” Bessent said.

Parents may also create Trump accounts for any child under the age of 18, not just those born between 2025 and 2028.

MICHAEL AND SUSAN DELL DONATE $6.25B TO FUND ‘TRUMP ACCOUNTS’

Michael and Susan Dell donated over $6 billion to help fund Trump accounts for children under the age of 10. (Andrew Caballero-Reynolds/ AFP/Getty Images / Getty Images)

Bessent noted that Susan and Michael Dell contributed $6.25 billion to help fund Trump accounts for 25 million children under the age of 10.

“To put this number in perspective, the Dell’s made the single-largest private commitment to U.S. children in our nation’s history. Their donation provides an additional $250 in funding to Trump accounts for children across the country,” he said.

The treasury secretary said that the Dell’s donation spurred a race among philanthropists to provide seed money for Trump accounts and that investor Ray Dalio joined the new “50 State Challenge” in that effort.

“We are inviting every philanthropist in every state across the country to partner with us in building generational wealth for America’s children through Trump accounts. Ray is representing Connecticut in the 50 State Challenge. Today, he will announce a generous contribution to boost funding for Trump accounts for kids across Connecticut,” Bessent said.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

“Ray has made the first move, but we welcome other donors and foundations in Connecticut and across the country to join him in the 50 state challenge,” he added.

More information about Trump accounts can be found at trumpaccounts.gov.