This article is an on-site version of our FirstFT newsletter. Subscribers can sign up to our Asia, Europe/Africa or Americas edition to receive the newsletter every weekday. Explore all of our newsletters here

Today’s agenda: EY fires staff for “cheating”; Mubadala Capital’s private equity push; Chinese share buybacks soar; Navalny’s memoir; and the use and abuse of Orwell

Good morning. We start with the latest updates on the US presidential race, with a Financial Times analysis showing Kamala Harris raised $971mn in the past three months, more than the Trump campaign’s entire haul of $894mn since the start of January 2023.

Who’s donating? The vice-president has received contributions from more than three times the number of individual donors as Donald Trump since she entered the race in July. The Republican former president has been more reliant on billionaires giving through so-called super political action committees, which unlike political candidates can raise unlimited amounts from individuals. Nearly half of Trump’s money has come from super Pacs, and four billionaire donors combined — Timothy Mellon, Miriam Adelson, Elon Musk and Richard Uihlein — have given $395mn to four pro-Trump super Pacs.

Why it matters: A recent poll shows Trump has all but erased the slender lead Harris had built up in crucial swing states. The poll found that about a quarter of registered voters described themselves as “uncommitted” to either candidate. With just two weeks to go until the November 5 vote, both candidates are criss-crossing the country and splashing out on expensive advertising in the battleground states that could decide the outcome.

We have more on the money race here, and further analysis below:

-

Harris’s economic team: The Democratic candidate is expected to bring in her own people if she wins. We explore her potential choices for Treasury secretary and key policy advisers.

-

Global impact: Strongman leaders around the world would welcome a victory for the Republican former president, writes Gideon Rachman.

Sign up for our US Election Countdown newsletter for the latest updates on the final stretch of the White House race. And here’s what else I’m keeping tabs on today:

-

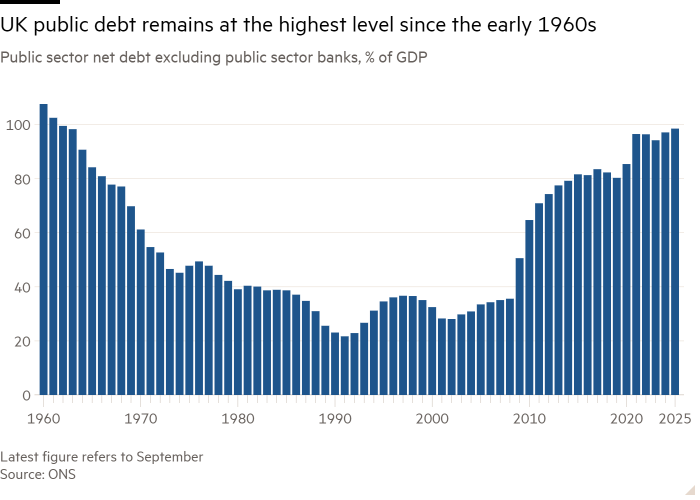

Economic data: The IMF publishes its latest world economic outlook and its global financial stability report. The UK has data on public sector finances, and the US has labour figures, both for September.

-

Brics summit: Leaders of the group gather in Kazan, Russia. Narendra Modi and Xi Jinping are set to attend after India yesterday said a deal was reached with China on patrols at their disputed border.

-

Companies: Chanel is expected to announce a deal with the Oxford-Cambridge annual boat race. General Motors, Kimberly-Clark, Lockheed Martin, Moody’s, Philip Morris International are among those reporting results. Full list in our Week Ahead newsletter.

Five more top stories

1. Exclusive: EY has fired dozens of US staff for what it called cheating on professional training courses. The dismissals took place last week after an investigation found that some employees had attended more than one online training class at a time during the “EY Ignite Learning Week” in May. Several of the fired employees told the FT they did not believe they were violating EY policy.

2. Exclusive: An arm of Abu Dhabi’s sovereign wealth fund is preparing a push into private equity markets, spotting what it believes is an opportunity to take over large holdings as buyout groups race to sell assets and return cash to investors. Mubadala Capital has raised $3.1bn for its latest private equity fund, surpassing a $2bn target. Antoine Gara has more details.

3. Iran’s currency and stocks have declined and most foreign airlines have suspended flights in anticipation of an Israeli retaliatory attack on the Islamic republic. While regime loyalists insist that Tehran is not afraid of a potential war with Israel, many fear that the country’s sanctions-hit economy can ill-afford another cycle of escalation.

4. Share buybacks on mainland China’s biggest exchanges have soared to a record high of Rmb235bn ($33bn) so far this year, more than double last year’s total and far surpassing the previous record of Rmb133bn in 2022. The rush comes amid policymakers’ attempts to revive a flagging stock market.

-

Beijing’s U-turn: After resisting calls for fiscal stimulus for years, today’s Big Read explores why Xi Jinping changed his mind — and whether it will be enough.

5. PureGym plans to make the US its second-biggest market, with more than 300 sites by 2030, as it pursues a $105mn deal to buy dozens of outlets from collapsed chain Blink Fitness. The UK’s largest gym operator has offered to buy “a substantial portion” of Blink’s estate after it was put into Chapter 11 by owner gym group Equinox in August. Read the full story.

News in-depth

Launching a “national conversation” about the future of England’s NHS yesterday, health secretary Wes Streeting admitted it was in the midst of “the worst crisis in its history”. As health leaders press for a substantial funding injection in the UK’s Budget on October 30, the latest data underlines the scale of the strains on the taxpayer-funded system.

Think you can run the UK economy? Step into the chancellor’s shoes and play the FT’s new Budget game.

We’re also reading . . .

-

Moldova’s EU bid: Here’s how Russia won over the former Soviet country’s south to deliver an unexpected upset for President Maia Sandu’s referendum to join the bloc.

-

Immersive fashion: Vogue’s next event will go beyond the runway to become a theatrical light show. Is immersive entertainment more than a passing fad?

-

Alexei Navalny: Patriot, the memoir of Vladimir Putin’s murdered opponent, is a worthy testament to his courage, defiance and humour, writes FT Moscow bureau chief Max Seddon.

-

Victims of success: While challenging, the prevalence of today’s mental and physical conditions may actually be a good sign for the human race, writes Stephen Bush.

Graphic of the day

Long regarded as more science fiction than reality, low-cost, high-energy laser weapons are getting renewed attention from the defence sector, as militaries around the world look to the cutting-edge technology as one of the ways to counter cheap new missile threats such as drones.

Take a break from the news

For years, journalists, critics and columnists have vied for George Orwell’s posthumous approval, writes Irish novelist Naoise Dolan for the FT Magazine. How did one of Britain’s greatest writers become the single answer to so many questions, in so many different subjects, for so many people?

Additional contributions from Gordon Smith and Benjamin Wilhelm

You must be logged in to post a comment Login