Fashion

Tuesday’s Workwear Report: Louisa Wool-Cashmere Tipped Cardigan

This post may contain affiliate links and Corporette® may earn commissions for purchases made through links in this post. As an Amazon Associate, I earn from qualifying purchases.

Our daily workwear reports suggest one piece of work-appropriate attire in a range of prices.

I have a million cardigans in my closet, but nothing quite like this one from Reiss. I really like the contrast piping, especially on the pockets. I could see this being a big part of my wardrobe for the next 2-3 months, paired with a midi skirt for the office or denim and tee for the weekend.

If you don’t wear a lot of navy, it also comes in gray with a light brown detailing.

The sweater is $248 at Reiss and comes in sizes XS-XL.

Sales of note for 2/13:

Fashion

Debenhams Footwear for Women – Up to 25% Off & More!

Refresh your shoe rack with the definitive Debenhams Footwear for Women – Up to 25% Off event this February. Whether you’re hunting for the perfect “it-girl” chunky loafer or need the refined comfort of a wide-fit court shoe, our 2026 collection is currently seeing major price drops. From the viral Vanessa Platform to bridal-ready diamante straps, these styles are designed to take you from the boardroom to the dancefloor without skipping a beat. Don’t wait – stock is moving fast on our most popular sizes!

Vanessa Faux Leather Platform Ankle Strap High Block Heel Court Shoes – Shop Now

Wide Fit Exmoor Faux Suede Comfort Medium Block Heel Court Shoes – Shop Now

Wide Fit Leoni Chunky Loafers – Shop Now

Wide Fit Lara Penny Loafers – Shop Now

Jenna Faux Suede Mesh Detail Lace Up Trainers – Shop Now

Wide Fit Leigh Fringe Loafers – Shop Now

Wide Fit Bridal Deyla Satin Diamante Asymmetric Strap High Block Heel Court Shoes – Shop Now

Wide Fit Petunia Faux Leather Tassel Loafers – Shop Now

For any questions/feedback regarding the above mentioned products/brands,

please do contact us anytime by clicking here

Fashion

ERDEM Autumn Winter 2026 Show

This isn’t just another runway; it’s a milestone. As we hit February 2026, ERDEM marks its 20th anniversary two decades of redefining romanticism, narrative-driven design, and the “unforgettable Erdem woman.” To honor this legacy, Erdem Moralıoğlu is inviting the world to witness his Autumn Winter 2026 collection, a show that promises to be a “dialogue between past and present.” Whether you’ve followed the house since its 2006 debut or recently fell for its signature florals, this is the fashion event of the season.

For any questions/feedback regarding the above mentioned products/brands,

please do contact us anytime by clicking here

Fashion

The Art of the Pour – Waterford Whiskey Glass Sets 2026

Elevate your spirits with the legendary brilliance of Waterford. Whether you prefer a peaty single malt neat or a classic Old Fashioned on the rocks, the 2026 collection offers a vessel for every nuance of the whiskey experience. As 2026 settles in, Waterford Whiskey Glass Sets continue to set the standard for bold, brilliant luxury, with select archival designs now entering the “final opportunity” vault. From the modern, linear cuts of the Circon to the heritage-steeped Olann, each set of two is a masterclass in hand-cut crystal, designed to sit perfectly in the hand while enhancing the bouquet of your favorite pour.

Circon Tumbler, 250ml, Set of 2 – Shop Now

Rounded Tumbler, 180ml, Set of 2 – Shop Now

Double Old Fashioned, 340ml, Set of 2 – Shop Now

Olann Double Old Fashioned, 340ml, Set of 2 – Shop Now

Mastercraft Irish Lace Double Old Fashioned, 340ml, Set of 2 – Shop Now

Tumbler, 340ml, Set of 2 – Shop Now

For any questions/feedback regarding the above mentioned products/brands,

please do contact us anytime by clicking here

Fashion

FRASERS Mid Season Style Edit 2026

This is the perfect moment to refresh your essentials or finally try the style that’s been calling your name. As of February 2026, the FRASERS mid season style edit is live, offering a bridge between winter warmth and spring’s new arrivals. With massive price drops on heritage brands like Barbour and prep-favorites like Polo Ralph Lauren, you can curate a high-end wardrobe for a fraction of the original investment.

New fashion essentials

Out with the old. In with the new. This is the perfect moment to refresh your essentials or finally try the style that’s been calling your name.

For any questions/feedback regarding the above mentioned products/brands,

please do contact us anytime by clicking here

Fashion

How to Dress Like Beth Dutton

Being one of the most fearless and bold female leads within the western TV genre, Beth Dutton is a prime example of fierce, loyal, and loving women who would rather take matters into her own hands than be a damsel. She’s admired by every Yellowstone fan due to her strong and empowering femininity and stylishness in fashion, which ideally reflect her unapologetic attitude.

From timeless leather jackets to self-expressive blouses, Beth’s fashion balances both ruggedness and contemporary flair within her bold fashion dresses, making her one of the most influential standout icons within modern Western fashion, inspiring women to recreate their appearance in Beth Dutton’s signature looks in real life.

Why Fans Love Beth Dutton’s Style

Portrayed by the gorgeous actress Kelly Reilly, Bethany Dutton is more than just an empowering female. She’s a character who balances tradition and modernity of the 21st century in her manner and personality. She chooses to be independent but also has deep respect, love, and loyalty for her patriarchal father and husband, supporting them in their endeavors, inspiring fans on how to be a strong and beloved woman.

Regardless, throughout the series, Beth Dutton’s Outfits showcase her mood, energy, and style. Her wardrobe choices not only reflect countryside fashion and cowgirl silhouette but also often carry a sharp intent to provoke her enemies. Especially her coats, which represent her elegance as well as her fearlessness. Likewise, here are some of the signature coats she wore throughout the series.

Statement Coats That Define Beth Dutton’s Look

To begin with, Beth Dutton’s wardrobe is built around powerful, eye-catching coats. These coats are not only stylish but also practical for warmth and comfort, showcasing both charm and confidence in every step.

The Blue Coat Look

Inspired by season three, episode six, where the character wore a warm and luxurious poncho-style blue coat in sharp blue tones. The item featured colorful prints of Aztec patterns in lovely blue shades. This outerwear is made from soft wool fabric and soft inner viscose, delivering a sleek finish and cozy fit, perfect for city style and winter nights. The coat features an open hem, a laid-back design with a hooded collar, an elaborated fang-like button closure on the front, and waist pockets, offering functional and versatility for urban street fashion.

The Floral Coat Look

Showcasing her feminine charm with a bold edge, the Beth Dutton Floral Coat is a luxurious outerwear that offers a high-end yet simple style. Made from a soft blend of wool fabric, with an inner soft viscose, while the exterior features pockets, open hem cuffs, button closure and a printed pattern of floral tapestry in black shades, reflecting the high-end fashion combined with function.

The Cheetah Print Coat Look

Admired for her fearlessness in season two. The Beth Dutton Cheetah Print Coat is another piece of luxury that represents style and a courageous look. Made from soft faux furs, combined with soft cotton-polyester blend linings, for warmth and comfort. The item is ideal for seasonal style and winter weather. The coat features an elaborated stand-up collar and a buttoned front closure, while the laid-back designed offers versatility for pairing with minimal layers. Similarly, the cheetah pattern makes a statement by reflecting empowerment.

Dresses, Boots, and Accessories That Complete the Look

Whether with a coat or any other inspired strong outerwear, if you’re planning on following Beth’s fashion. Then go with figure-hugging tops, combined with rugged pants, soft trousers, and skirts. For essential footwear, go with western or cowboy boots for function and a chic appearance. Wear minimal jewelry and choose confident makeup choices leaning more towards blushes, transforming simplicity with impactful and bold clothing.

How to Pull Off the Beth Dutton Look in Real Life

Similarly, to pull off real Beth’s style in real life, consider choosing one bold piece like a coat or jacket and keep the rest simple to create a bold and impacting look. Focus on fabric’s textures like leather, wool, or denim for a natural finish. Stick with neutral colors for versatility and ruggedness. Lastly, remember the key lies in the confidence to make your appearance stand out.

Where to Find Beth Dutton-Inspired Pieces

Invest in quality by choosing the best by shopping for Beth Dutton coats and jackets from The Western Outfitters, where you’ll find high-quality western and Yellowstone pieces in perfect trims and craftsmanship down to the last detail, offering style and functionality for an effortless, practical clothing experience.

Conclusion

With all said and done, Beth’s style is the epitome of female confidence, strength, and individuality. Her appearance showcases stylishness and also shares a purpose often to provoke her enemies, while keeping her demeanor simple yet impactful. Nonetheless, her style is a prime example of female empowerment, whether you want to copy her own exact looks or take inspiration to recreate your very own original style. At the end of the day, what matters most is the confidence that Beth perfectly represented, and if you’re someone who wants to be like her, then be sure to explore our site to find bold coats and inspiring western outerwear to express your individuality just like hers, starting today.

Fashion

Reformation’s Spring Dresses Are Ready for Their Moment

Fashion

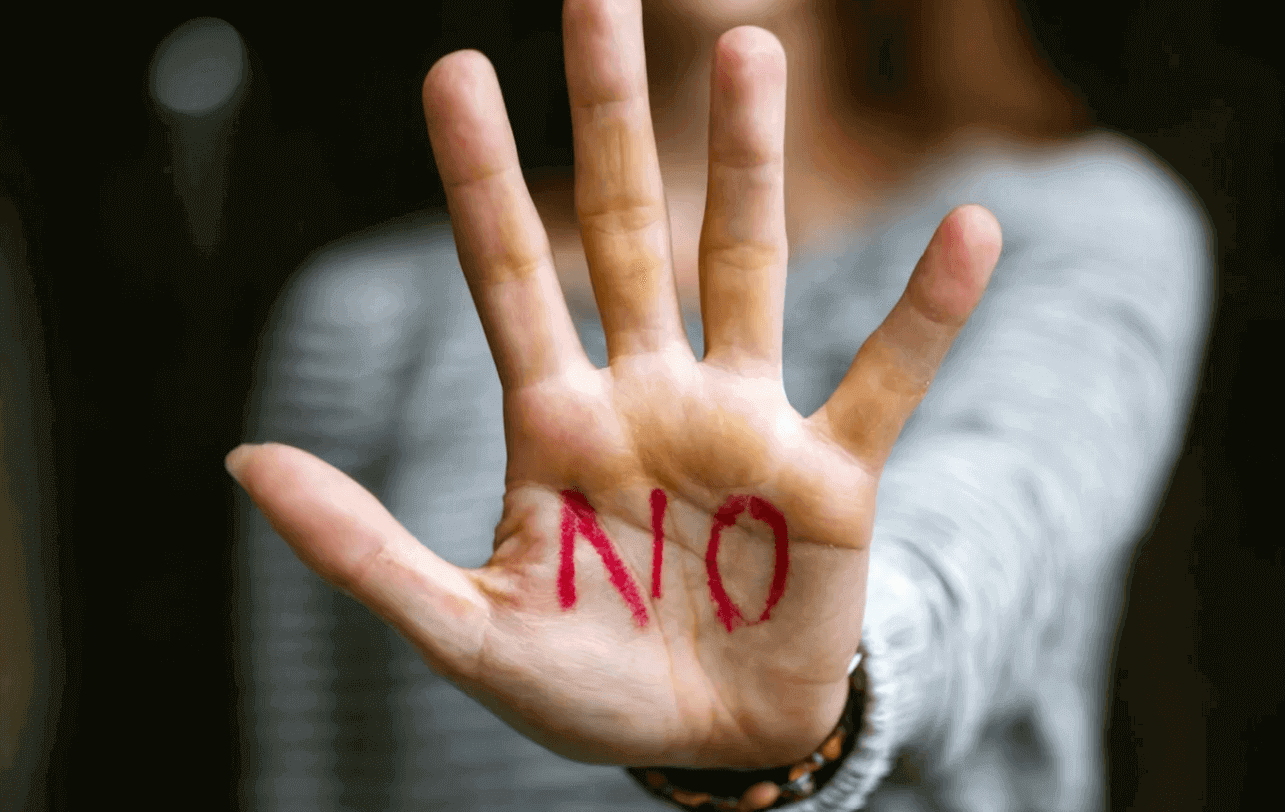

The Power of Saying No In The Influencer World: Protecting Your Energy in a World That Expects More

To provide the best experiences, we use technologies like cookies to store and/or access device information. Consenting to these technologies will allow us to process data such as browsing behavior or unique IDs on this site. Not consenting or withdrawing consent, may adversely affect certain features and functions.

The technical storage or access is strictly necessary for the legitimate purpose of enabling the use of a specific service explicitly requested by the subscriber or user, or for the sole purpose of carrying out the transmission of a communication over an electronic communications network.

The technical storage or access is necessary for the legitimate purpose of storing preferences that are not requested by the subscriber or user.

The technical storage or access that is used exclusively for statistical purposes.

The technical storage or access that is used exclusively for anonymous statistical purposes. Without a subpoena, voluntary compliance on the part of your Internet Service Provider, or additional records from a third party, information stored or retrieved for this purpose alone cannot usually be used to identify you.

The technical storage or access is required to create user profiles to send advertising, or to track the user on a website or across several websites for similar marketing purposes.

Fashion

Loane Normand Looks Chic in Chanel for ELLE Germany

Fashion

How to Take Outfit Photos Like a Pro

Fashion

Boots Eau de Parfum Fragrance Sale 2026

Upgrade your signature scent this February with the Boots eau de parfum fragrance sale 2026. Whether you’re looking to treat yourself or find the perfect late Valentine’s gift, Boots has slashed prices on the world’s most coveted luxury brands. From the dark, seductive notes of Tom Ford to the ethereal garden blends of Guerlain, our 2026 sale features discounts of up to 50% off designer favorites. Don’t wait—these premium bottles are moving fast, and once they’re gone, they’re gone!

TOM FORD Black Orchid Eau de Parfum Spray 50ml – Shop Now

TOM FORD Ombré Leather Eau de Parfum 100ml – Shop Now

GUERLAIN Aqua Allegoria Forte Florabloom Eau De Parfum 75ml – Shop Now

Maison Margiela Replica Jazz Club Eau De Toilette 100ml – Shop Now

GUERLAIN Absolus Allegoria Florabloom Eau De Parfum 125ml – Shop Now

Dolce&Gabbana The One for Men Eau de Toilette 100ml – Shop Now

Tom Ford Cafe Rose Eau de Parfum 100ml – Shop Now

Hermès Terre D’Hermès Eau Intense Vetiver Eau de Parfum 50ml – Shop Now

For any questions/feedback regarding the above mentioned products/brands,

please do contact us anytime by clicking here

-

Sports6 days ago

Sports6 days agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

Tech6 days ago

Tech6 days agoSpaceX’s mighty Starship rocket enters final testing for 12th flight

-

Video23 hours ago

Video23 hours agoBitcoin: We’re Entering The Most Dangerous Phase

-

Tech3 days ago

Tech3 days agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Video4 days ago

Video4 days agoThe Final Warning: XRP Is Entering The Chaos Zone

-

Tech12 hours ago

Tech12 hours agoThe Music Industry Enters Its Less-Is-More Era

-

Crypto World7 days ago

Crypto World7 days agoBlockchain.com wins UK registration nearly four years after abandoning FCA process

-

Video6 hours ago

Video6 hours agoFinancial Statement Analysis | Complete Chapter Revision in 10 Minutes | Class 12 Board exam 2026

-

Crypto World6 days ago

Crypto World6 days agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

Crypto World4 days ago

Crypto World4 days agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Video5 days ago

Video5 days agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

Crypto World6 hours ago

Crypto World6 hours agoCan XRP Price Successfully Register a 33% Breakout Past $2?

-

NewsBeat2 days ago

NewsBeat2 days agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Sports12 hours ago

Sports12 hours agoGB's semi-final hopes hang by thread after loss to Switzerland

-

Business5 days ago

Business5 days agoBarbeques Galore Enters Voluntary Administration

-

Crypto World6 days ago

Crypto World6 days agoCrypto Speculation Era Ending As Institutions Enter Market

-

Crypto World5 days ago

Crypto World5 days agoEthereum Price Struggles Below $2,000 Despite Entering Buy Zone

-

Politics7 days ago

Politics7 days agoWhy was a dog-humping paedo treated like a saint?

-

NewsBeat2 days ago

NewsBeat2 days agoMan dies after entering floodwater during police pursuit

-

NewsBeat3 days ago

NewsBeat3 days agoUK construction company enters administration, records show