Entertainment

10 Greatest Spy Thrillers of the Last 100 Years, Ranked

Spy movies and thrillers are two genres that get along remarkably well, and as such, several of the greatest spy films of all time are thrillers, and vice versa. These are stories that naturally lend themselves to suspense, excitement, tension-filled action sequences, and mysterious narratives full of intrigue. No wonder so many masterful ones have come out throughout the last century.

Going through Hollywood’s Golden Age with classics like Notorious all the way to Daniel Craig‘s Bond days with films like Skyfall, the best spy thrillers of the last 100 years are a testament to the heights the genre can reach when in the hands of a capable filmmaker. As thought-provoking as they are adrenaline-pumping, these great films are among the best in the history of this exhilarating genre.

10

‘The Spy Who Came In from the Cold’ (1965)

With John le Carré arguably having been the quintessential master of the art of the spy novel, it’s no surprise that so many films based on his work have been made over the years. The question of what the best one of the bunch is, however, isn’t really a question at all. That title would have to go to the British spy thriller The Spy Who Came In from the Cold, one of the best spy movies of all time.

It’s old-school spy filmmaking at its best, one of the greatest and most realistic films ever made about the Cold War. Many people over the years have lovingly referred to this as the perfect anti-Bond movie, and especially seeing as le Carré actually devised the original book as his antidote to those 007 stories that he so intensely disliked, it’s hard to argue against them. There’s no glamor or fancy fictional gadgets here: It’s a gritty, cold look at contemporary Cold War espionage entirely committed to sincerity.

9

‘Skyfall’ (2012)

They may not be the best choice for those who prefer spy movies at their most realistic, but who doesn’t love watching a good James Bond film every now and then? Daniel Craig‘s run as the legendary MI6 agent wasn’t without bumps along the road, but it also had some of the highest points in the character’s entire filmography. Case in point: Skyfall.

It’s nothing short of one of the best spy movies of the 21st century, perfectly balancing action, suspense, emotionally compelling character work, and the same kind of intelligent deconstruction of the Bond mythos that characterized Craig’s whole tenure. With Javier Bardem at his most terrifying and Craig having made the role of 007 entirely his own, there’s no way of watching Skyfall without enjoying its many sprawling set pieces and engaging character moments.

8

‘The Hunt for Red October’ (1990)

Tom Clancy is perhaps best known as the writer who created the iconic Jack Ryan, so it’s no coincidence that his debut novel, The Hunt for Red October, was also the character’s debut. Both creator and creation came into the public eye together, and six years later, the first-ever film adaptation of a Jack Ryan story came out. Directed by Die Hard and Predator‘s John McTiernan, the thriller of the same name is one of the best spy movies of the ’90s.

Starring top-form Alec Baldwin and Sean Connery, the film is a faultless submarine thriller that proves spy movies are very much capable of breathing underwater. Immensely tense and perfectly acted, it’s a true ticking time bomb of a film that feels like it never lets up. The Hunt for Red October is edge-of-your-seat suspense at its most entertaining, and it was a hell of a way of bringing Jack Ryan to the big screen for the first time.

7

‘The Day of the Jackal’ (1973)

The best classic spy thrillers were many times based on iconic novels, and the British-French co-production The Day of the Jackal (based on Frederick Forsyth‘s book of the same name) is no exception. What could possibly go wrong with a spy film when you have an airtight screenplay, direction full of personality, and an incredibly exciting structure? As it turns out, very little.

The Day of the Jackal is about as close as the genre can possibly come to perfection, delivering an intricately constructed story where it feels like every detail—no matter how small—was meticulously put in place and polished up. That attention to detail, however, never robs the movie of its feeling of unpredictability. It’s mysterious and suspenseful like every great spy flick should be, and throughout its whole 2-and-a-half-hour runtime, it never ceases to be exciting.

6

‘The Manchurian Candidate’ (1962)

Based on the 1959 Richard Condon novel of the same name, The Manchurian Candidate is one of the best thriller movies of the ’60s. Bolstered by a flawless cast featuring the likes of Frank Sinatra and Angela Lansbury, it’s an inventive and intrigue-filled masterpiece the likes of which could only have been made at the tail end of Hollywood’s Golden Age.

Blending thriller and satirical elements in perfect measure, the film feels as timely today as it did back in 1962. But aside from being ahead of its time, The Manchurian Candidate is also irresistibly entertaining, full of colorful and memorable characters shot in perfect black and white. Though it was a commentary on McCarthyism, its themes and story have aged like fine wine and still feel entirely relevant in today’s divided political climate.

5

‘Notorious’ (1946)

Although best known as the Master of Suspense, Alfred Hitchcock also made some great romance movie masterpieces in his career, and Notorious is one of his best. Starring Cary Grant and Ingrid Bergman in one of the most explosive actor-actress duos of Hollywood’s Golden Age, it’s a spy noir that many critics throughout history have recognized as Hitchcock’s first attempt at a serious romance.

Notorious is sublime thanks to Hitchcock’s thrilling direction and its expertly woven-together technical elements.

Aside from its historic importance and its two exceptional stars, Notorious is sublime thanks to Hitchcock’s thrilling direction and its expertly woven-together technical elements. It may not be its director’s absolute best, but it’s definitely up there, with a terrific sense of suspense and a hypnotic atmosphere as its foundations, plus a healthy dose of unexpected but much-welcome eroticism.

4

‘Casino Royale’ (2006)

It was the one that started it all for Daniel Craig’s legendary run as the ultra-iconic James Bond. Casino Royale wasn’t just the perfect introduction for this brazenly modern version of 007, but it’s arguably also the best Bond film to date. From the gadgets to the romance to the martinis, it’s a complete twist and reinvention of the Bond formula for the new millennium.

Craig is magnificently elegant and imposing in the role, and Eva Green works wonders as one of the best Bond girls in the franchise (certainly one of the most consequential). Top that with a stellar villain in Mads Mikelsen‘s Le Chiffre and a story revolving around the price to pay for a life of secrecy, and you have an all-time great spy movie. Casino Royale is clever, exciting, entertaining, often unexpectedly amusing, and packed with winks and details that fans of the character are bound to love.

3

‘The Lives of Others’ (2006)

The winner of the 2007 Academy Award for Best International Feature Film, the German masterpiece The Lives of Others is one of the best spy thrillers of all time, period. It was the first notable drama film about the fall of the Berlin Wall and the end of the German Democratic Republic, and two decades later, it’s still one of the best surveillance thrillers ever made.

Some have argued that the film grants its main character a bit too much sympathy, but Stasi Captain Gerd Wiesler (played by a top-notch Ulrich Mühe) is the perfect pair of eyes through which to see this enthralling story. It makes for some really effective intrigue and gut-wrenching emotion, and though fans of more action-heavy spy thrillers may prefer to look elsewhere, The Lives of Others is a must-see for those who love to see when the genre leads more toward the “spy” side of things.

2

‘North by Northwest’ (1959)

If there’s any filmmaker who deserves to be mentioned twice when talking about excellent thrillers, no matter the subgenre, it’s Alfred Hitchcock. The director’s North by Northwest is widely regarded as one of the greatest films ever made, and for good reason. It’s certainly one of the most incredibly spy movies ever, largely boosted by Cary Grant’s unforgettable lead performance.

North by Northwest is the gold standard for mistaken-identity thrillers, a practically perfect film that’s every bit as exciting as it is amusing. Gripping, breezily-paced, and full of iconic shots, it’s an entirely unique spy film that’s impossible to look away from. Hitchcock sprinkles dark humor in all the right places, making the movie one of the most genuinely enjoyable outings in his whole filmography.

1

‘Mission: Impossible – Fallout’ (2018)

The Mission: Impossible franchise has long been famous for being one of the most consistent action movie franchises of all time, but even the best movie series have a pinnacle, and this one’s is Mission: Impossible — Fallout. It’s the sixth entry in the saga, one of the best action thrillers of the last 10 years.

From the helicopter chase during the third act to the iconic bathroom fight scene, one can find several of the best and most entertaining action sequences of the 21st century here. The stunts are as death-defying as ever, Tom Cruise and the rest of the ensemble do a phenomenal job, and the villains are easily among the series’ best. There’s virtually nothing about this perfectly-paced, emotionally engaging, absolutely nail-biting spy thriller that doesn’t work, and that makes it reasonable to call it the best that the genre has ever seen.

Entertainment

Sheriff explains how Nancy Guthrie's relatives were cleared as suspects in missing person case

:max_bytes(150000):strip_icc():format(jpeg)/Pima-County-Sheriff-Chris-Nanos-nancy-guthrie-021726-b9de9e5ad17547c7b52df7d3a494fe65.jpg)

“I’m not going to sit in silence when others are attacking the innocent,” said Pima County Sheriff Chris Nanos.

Entertainment

Days of our Lives: Is Liam Deliberately Setting Jeremy Up to Take the Fall?

Days of Our Lives exposes Jeremy Horton (Michael Roark) is planning to leave Salem soon, but something is going to mess up his exit plans. It may be another stalker incident, and now I wonder if Liam Selejko (Hank Northrop) is to blame and is doing a sketchy sort of frame job on him.

I want to dive into what’s behind Jeremy not being allowed to leave Salem when he really wants to and whether Liam is to blame because he’s a criminal for hire. We have a lot of ground to cover.

Liam Selejko’s Criminal Gigs and the Link to Stephanie Johnson’s Stalker on Days of Our Lives

Small-time thug Liam is picking up random criminal gigs. I don’t know if there’s an app like Crooks R Us or TaskRabbit for felons, but not only did the guy that Abe Carver (James Reynolds) is mentoring take money from Peter Blake (Dan Gauthier) to help Vivian Alamain (Louise Sorel) henchman Klaus move those supplies into the crypt, but the question is: could Liam also be taking pay and working for Stephanie Johnson‘s (Abigail Klein) stalker?

Liam obviously does whatever it takes, including criminal activity, to put food on the table for his young son, Gage Selejko (Jack Ferrero). We know that Liam was involved with Vivian’s goon, Klaus, because he described him to the cops. Liam only gave up that info because the cops traced Peter’s money back to him and he wanted to stay out of jail.

We all know that Owen Kent (Wes Ramsey) is the stalker who’s planning to take Stephanie. That was confirmed back in the winter promo. But there also seems to be some signs that Owen may have a co-conspirator or at least somebody doing dirty work for him.

The Mystery of the Black Hoodie in Horton Square on DOOL

Now, one option is that it is indeed Jeremy, but I feel like it’s not because of the frame job. We still haven’t seen for sure who was in that black hoodie taking video of Stephanie and Alex Kiriakis (Robert Scott Wilson) in Horton Square. That could have been work done for hire by Liam.

It would make sense to hire somebody to take photos of Stephanie and Alex who wouldn’t be noticed. Liam is somebody that people are used to seeing around Salem, unlike Owen, who has been missing since an escape from a prison transport two decades ago on Days of our Lives. People would notice Owen, but they are used to seeing Liam.

We still don’t know much about Liam other than he’s been in and out of jail for various crimes. Many years ago, when he was in high school, he bullied Theo Carver (Cameron Johnson). Liam’s unusual last name, Selejko, ties him to some sketchy people from Salem’s distant past. Some of them were criminals as well.

Abe Carver’s Mentorship and Liam Selejko’s Desperate Motives on Days

Theo was upset when his dad, Abe, said that he would be mentoring Liam for that literacy program as part of his court-ordered rehabilitation. Liam told Abe he’s trying to turn his life around. But at the same time, Liam is a single dad who has to put food on the table to keep his kid in medicine, food, and school supplies.

He’ll take an easy buck where it is, and his only skills seem to be criminal ones. Liam tried to steal Cat Greene’s (AnnaLynne McCord) purse last year, and then he took money from Klaus via Peter. He then claimed to the cops that he had no idea there were going to be kidnapping victims in the crypt.

Liam claims he thought he was basically doing some kind of prepper thing. EJ DiMera (Dan Feuerriegel) is furious because Vivian masterminded their kidnappings and she seems to be getting away with it because Gwen Rizczech (Emily O’Brien) is trying to frame Dimitri von Leuschner DiMera (Peter Porte). If EJ can’t punish Vivian, he may target Liam. EJ wants people involved in this to pay for trying to kill the DiMeras.

Potential Dangers for Liam Selejko from the DiMera Family and Beyond

Peter is dead and Vivian is out of his reach right now, but Liam is right there in Salem. Meanwhile, Liam may have another person that’s ready to take him down. Yvonne and Klaus are in Alamainia this week talking about tying up loose ends to keep Madame Vivian safe for her role in the DiMera kidnappings.

They may be figuring out what needs to be done, and those two may decide that Liam needs to go so he cannot keep talking to the cops. In the interim, we may find out that Liam’s been working with Owen.

Do you remember the time that Abe couldn’t be there for his tutoring session with Liam? I think it was when Theo was either kidnapped or in the hospital. Abe asked Jeremy to fill in for him. Jeremy showed up for Liam’s mentoring session and brought along his laptop for Liam to use to work on a resume.

Days of Our Lives: Did Liam Selejko Plant Evidence on Jeremy Horton’s Laptop?

Jeremy’s kindness might have been repaid with treachery. Liam was on Jeremy’s computer, so he could have planted evidence on the laptop to make Jeremy the scapegoat. This would ensure people won’t know that Liam is the true culprit.

Jeremy was in the dark about why they thought he owned the website dedicated to stalking Stephanie. Liam could have had the credit card info from Owen and taken that opportunity to use Jeremy’s computer. Liam may have been tasked with just buying the URL on someone’s laptop.

Maybe he got lucky with Jeremy, or maybe he was specifically targeting him. Up until now, Jada Hunter (Elia Cantu), Steve Johnson (Stephen Nichols), Kayla Brady (Mary Beth Evans), Stephanie, and her new husband, Alex, have all been 100% certain Jeremy’s the stalker.

Jeremy Horton Claims Innocence Despite His Toxic Past on DOOL

Jeremy insists he’s not guilty and thinks someone is setting him up, but only Julie Williams (Susan Seaforth Hayes) actually believes him. It is possible Liam is taking money from Owen to lay this groundwork so that Owen can fly under the radar. If Liam is helping set up Jeremy, I’m sure Liam knows he’s doing a bad thing.

Now, Julie believes in Jeremy, but her track record on judgment isn’t perfect. She believed the best of Doug Williams III (Peyton Meyer), and that turned out badly. Julie also stuck up for Nick Fallon (Blake Berris), who was just very bad.

Jeremy claims even though he and Stephanie had a toxic relationship, he has changed. Jeremy went and got his teaching degree and seems well-respected at the elementary school. Other than the suspicions of Jada Hunter, Stephanie, Alex, and Steve, there’s no solid proof against Jeremy.

Is Stephanie Johnson’s Ego Clouding Her Judgment on Days?

They’re judging him on his past from many years ago when he and Stephanie had a troubled relationship. Jeremy is to blame for what he did back then, but that was a long time ago. When he first came back to Salem, he appealed to Stephanie to apologize.

From the get-go, she just assumed Jeremy was up to no good and was stalking her again. I kind of think there’s some ego around that for her to think that Jeremy is still obsessed with her after all this time.

Stephanie even thinks Jeremy hacked the Salem dating app to get a date with her bestie Jada. That seems like a big reach. Now that Stephanie and Alex are newly married, the stalker has that bug in the photo frame. He’s probably listening to them celebrating being husband and wife and honeymooning.

Owen Kent’s Plan to Kidnap Stephanie Escalates

It’s creepy, but Owen is a stalker after all, and he is another one who had a fixation on Stephanie. Her marrying Alex may force Owen to escalate the schedule of what he’s going to do. We know he’s going to kidnap Stephanie.

Owen may have been planning to snatch her before they elope, but then they snuck off and tied the knot. We could see Stephanie snatched very soon. When she’s taken, Alex assaults Jeremy, blaming him.

We know Stephanie is taken from the hospital. Then in the park, Steve grabs a guy in a dark hoodie, expecting to have grabbed Jeremy the kidnapper. But it’s Owen Kent—a blast from the past nobody was expecting.

The Final Twist and Jeremy Horton’s Delayed Exit from Salem on Days of Our Lives

In the end, we may find out Liam was helping Owen set up Jeremy. Michael Roark’s last air date as Jeremy is not until the end of April, so he can go ahead and pack his bags, but he is not leaving Salem just yet. I expect another stalkerish event points back to Jeremy, having the SPD demanding that he stay in Salem and doesn’t leave.

Entertainment

Karrueche Tran Shares Look At Deion Sanders V-Day Date (Video)

Karrueche Tran shared a glimpse of her and Deion Sanders‘ Valentine’s Day date, and internet users can’t stop crackin’ up at one thing.

RELATED: Awww! Footage Shows Karrueche Tran & Deion Sanders Shopping For Their Holiday Festivities (WATCH)

Karrueche Tran Shares Glimpse Of Her & Deion Sanders’ Valentine’s Day Date With

Last week, Deion Sanders sat down for an episode of ‘We Got Time Today’ alongside his co-host Rocsi Diaz. During their conversation, Diaz asked Sanders about his Valentine’s Day plans, and he referred to Karrueche Tran, whom he had on FaceTime. In a clip shared to the show’s Instagram, Tran explained that she and Sanders had a “cute little weekend planned.” This, per Tran, consisted of a jazz night, dinner, and a spa day.

Peep the clip below.

Then, over the weekend, Tran took to her Instagram Story to show that she and Sanders were at the spa, preparing to get facials. However, she was in disbelief at Sanders being “fully clothed under his robe.”

Internet Users Can’t Stop Crackin’ Up At One Thing

Social media users couldn’t stop crackin’ up at the footage of Deion Sanders fully clothed at the spa. Furthermore, they left their reactions in TSR’s comment section.

Instagram user @_boww5 wrote, “‘i ain’t getting naked for somebody i don’t know’ LMAO iktr”

While Instagram user @partee_nextdoor added, “😂😂😂😂😂 Older men are effortlessly hilarious af”

Instagram user @coco__naoko wrote, “You know what I need to leave these young whipper snappers alone and get me one of these 👴🏽🤣😂💀”

While Instagram user @famouskillake added, “WHEN I SAY I NEED OLDER AND HANDSOME THIS EXACTLYYYYYY WHAT I WANT 😍😂🔥 … THAT MAN IS HANDSOMEEEEEE 😩”

Instagram user @bossymissi wrote, “I love them together so much 😅🥰”

While Instagram user @coopcancook added, “And I mean FULLY clothed 😂”

Instagram user @emisecrest wrote, “Said like a real OG! I love this for her, he is going to make sure she is good, and she is giving him life!!!”

While Instagram user @brookedabrand added, “😂 old men don’t be with none of that 😍”

Instagram user @6lue.6lasian wrote, “Yall ain’t about to catch Unc lackin 😂”

More On Karrueche Tran & Deion Sanders’ Valentine’s Day Date

In addition to showing their time at the spa, the couple also gave fans a look at their follow-up plans. On Monday, February 16, a video was uploaded to Sanders’ YouTube channel, which showed him and Tran on a train after their facial.

Around the 25-minute mark of the video, things got sentimental when Sanders opened up about cutting down on work and deciding to live more and “enjoy life.” Tran credited herself with helping Sanders make the adjustment, and ultimately, the pair ended up reflecting on her making the choice to stay by his side through his recent bladder cancer scare.

RELATED: Relax, Coach! Deion Sanders Drops Spicy Reaction To Karrueche Tran’s Recent Photos

What Do You Think Roomies?

Entertainment

Jelly Roll And Bunnie XO Reveal Twin Baby Plan

In her new memoir “Stripped Down: Unfiltered and Unapologetic,” the podcast host revealed that after years of challenges, she and Roll have secured a surrogate and are hoping to welcome twins.

The couple’s IVF journey has been emotional, complicated, and very public. Now, they are stepping into a new chapter with hope and a clear plan to grow their family.

Article continues below advertisement

Jelly Roll And Bunnie XO Find A Surrogate After Years Of Waiting

In her memoir, Bunnie XO explained that she and Jelly Roll finally feel ready to expand their family. After a decade together filled with growth and healing, she said they began seriously discussing the future.

“Now that we’re finally stable financially and somewhat emotionally after all the healing we’ve done over this decade together, we’re talking about the future — including growing our family,” she wrote per TMZ.

That conversation led to a major step forward. Bunnie XO revealed, “J and I have a surrogate, the sweetest woman ever, and soon I’ll be starting my IVF stims.”

IVF stims refer to ovarian stimulation, where medication is used to help the ovaries produce more follicles. This increases the chances of retrieving healthy eggs.

The couple is hoping the process will result in twins.

Article continues below advertisement

Roll is already a father to Bailee, 17, and Noah, 9, from previous relationships. Still, this journey represents something new and meaningful for him and Bunnie XO, who he married in August 2016.

Article continues below advertisement

Jelly Roll and Bunnie XO’s Fertility Journey Began On A Halloween Date

Bunnie XO revealed that she and Jelly Roll first started their fertility journey on Oct. 31, 2019. Looking back, she found humor in the timing.

“I can’t help but giggle because a Halloween date is so fitting for us. I call us ‘the Addams family’ of country music,” she said.

However, the process quickly became difficult. Early testing showed that her fallopian tubes were blocked.

She explained, “I would need surgery,” adding that it still wouldn’t guarantee she’d be able to carry a baby.

Around the same time, the couple faced a rough patch in their relationship and decided to pause treatment.

Bunnie XO later admitted she was nervous to ask Roll if he wanted to try again. His answer gave her reassurance. “I would love to have a baby with you,” he told her.

Article continues below advertisement

That moment helped them move forward again, determined not to give up.

Article continues below advertisement

Jelly Roll And Bunnie XO Face Criticism About Having Kids After 40

While excited, Bunnie XO admitted she feels both hopeful and nervous.

“I’ve waited this long to have kids with someone I knew would be a great father — and to be able to make sure they have the best life,” she shared.

She is aware that some people question their decision because of their age. “Some people frown upon our decision to bring babies into this world at our age,” Bunnie admitted, adding that she didn’t care.

She made it clear they are focused on love and stability.

“We’re going to raise these babies in love and give them everything we were never given,” she continued. “I can’t wait to see a piece of me and him running around outside of our bodies.”

Jelly Roll And Bunnie XO Share The Emotional Reality Of IVF

Bunnie XO has been open about how hard the process has been.

On her podcast in March, she admitted, “[I’m] going through all of the emotions, the rollercoaster, the worry, just so that I can have a little piece of my husband and me.” She described wanting “Just a little piece wrapped in skin to add to the other two beautiful children that we have together.”

At first, the couple planned to keep their fertility journey private. However, they later decided to speak openly.

In 2024, Jelly Roll and Bunnie XO wrote on Instagram, “[We] decided our IVF journey needed to be shared because we’ve always been so open. And w/all odds stacked against us, it’s already been hard & we have only just begun.”

Bunnie XO also expressed confidence in modern medicine and their surrogate’s support.

Article continues below advertisement

“With how much IVF has advanced over the years,” she wrote, “and with the help of the most unselfish woman willing to carry twins for us, we’ll be able to make our baby dreams come true.”

Jelly Roll Admits He And Bunnie XO Have Baby Fever

On the Wednesday, January 28 episode of Netflix’s “Star Search,” Jelly Roll revealed that both he and Bunnie XO were experiencing serious “baby fever.”

As The Blast reported, after watching eight-year-old aerialist Kaylen Fairchild perform, Jelly Roll told her, “First of all, you are just the cutest little nugget I’ve ever seen in my life. Me and my wife have baby fever, and you just tripled that tonight,” making it clear that he and his wife were emotionally ready and excited about the idea of having a child of their own.

Shortly after, PEOPLE reported that the 46-year-old shared a clip of her getting all emotional as she reviewed a call related to her IVF journey.

Article continues below advertisement

She described it as a huge win for them, writing that they finally got the call they waited five months for. She then praised God for wiping away her tears and shreds of hopelessness.

Entertainment

Kendall Jenner’s Ex Devin Booker ‘Didn’t Watch’ Bad Bunny Halftime Show

Devin Booker made it very clear that he didn’t watch Kendall Jenner‘s ex Bad Bunny‘s Super Bowl halftime show.

Booker, 29, who previously dated Jenner, was asked about Bad Bunny’s performance after the NBA All-Star Game on Sunday, February 15. The Phoenix Suns player went on to correct a reporter who asked “for the fans of Puerto Rico” how it “felt to be a part of” Bad Bunny’s milestone.

“I’m Mexican,” Booker noted. “I didn’t watch, to be completely honest.”

Super Bowl LX went down in history as Bad Bunny, 31, performed 11 songs — only in Spanish — during the Super Bowl on February 8. During the halftime show, Bad Bunny focused on celebrating Puerto Rican culture, which sparked backlash among some conservatives.

Bad Bunny did receive support from his ex Jenner, 30, who was spotted cheering him on from the stands. Before her romance with Bad Bunny, Jenner dated Booker off and on from 2020 to 2022. Following their 2022 split, the pair reconciled several other times before officially calling it quits last year.

“They have been off and on for years now and have called it quits recently,” an insider told Us in June 2025. “It always comes down to them both being busy, navigating schedules and just not being on the same page. They have communication issues.”

Bad Bunny JOSH EDELSON / AFP

Jenner started dating Bad Bunny in 2023 during one of her breaks from Booker. They broke up later that year but briefly got back together before parting ways in 2024.

Amid Jenner’s off and on romance with Bad Bunny, the musician appeared to take aim at Booker in his 2023 track “Coco Chanel.” He rapped that the “sun in Puerto Rico is hotter than in Phoenix” and “she knows it.”

In a now-deleted Instagram comment, Booker responded, “He worried about another MAN again.”

While Bad Bunny caught shade from Booker about his Super Bowl performance, he received praise from a multitude of celebrities — including Marc Anthony.

“It was a proud moment all the way around. Here’s a gentleman who is not only a great friend of mine, but I’ve known him since before he even started in music,” Anthony, 57, told The Hollywood Reporter earlier this month. “Bad Bunny is proud of his culture, proud of everything that we as Puerto Ricans offer as a people.”

Lady Gaga, meanwhile, thanked Bad Bunny for including her in his special moment. (Pedro Pascal, Cardi B, Jessica Alba, Karol G, Young Miko and Cardi B were some of the other celebrities who made cameos during Bad Bunny’s performance.)

“Thank you Benito for including me in this powerful, important, and meaningful performance,” Gaga, 39, wrote via Instagram. “I am so humbled to be a part of this moment.”

The singer continued: “It’s all the more special because it was with you and your beautiful heart and music. ❤️❤️❤️❤️❤️❤️ All my love to Benito, Ricky [Martin] and the whole cast.”

Entertainment

Stephen Colbert Slams CBS for Banning His James Talarico Interview

Stephen Colbert publicly called out his bosses at CBS for banning an upcoming interview from airing on his late-night show.

During the Monday, February 16, episode of The Late Show With Stephen Colbert, the host, 61, called out CBS and FCC Chairman Brendan Carr for not allowing him to speak with Texas State Representative James Talarico, a Democrat, as originally planned.

“You know who is not one of my guests tonight? That’s Texas State Representative James Talarico,” he said after introducing Jennifer Garner’s upcoming appearance on the show. “[James] was supposed to be here, but we were told in no uncertain terms by our network’s lawyers, who called us directly, that we could not have him on the broadcast.”

The comedian chose to address the issue live on his show, adding, “Then, I was told, in some uncertain terms, that not only could I not have him on, I could not mention me not having him on. And because my network clearly does not want us to talk about this … let’s talk about this.”

After speaking with his bosses, Colbert was told that the interview was scrapped due to new guidance from Carr. It was suggested that Colbert follow the “equal time” rule, which requires broadcasters to provide equal time to each political candidate running for office.

Colbert, meanwhile, pointed out that there have been exceptions for news and talk-show interviews with politicians.

“Well, FCC you,” Colbert fired back. “Let’s call this what it is: Donald Trump‘s administration wants to silence anyone who says anything bad about Trump on TV because all Trump does is watch TV. He’s like a toddler with too much screen time.”

Colbert went on to claim that he and fellow late-night host Jimmy Kimmel were the most affected after Kimmel’s show was temporarily suspended from ABC after his comments following the death of conservative activist Charlie Kirk.

“I decided to take Brendan Carr’s advice,” Colbert said about his decision to still interview Talarico and post it on the Late Show YouTube channel. “The network says I can’t give you a URL or a QR code, but I promise you, if you go to our YouTube page, you [will] find it.”

CBS previously announced that The Late Show would end in May. CBS executives previously released a statement addressing their decision, claiming it was not “related in any way to the show’s performance, content or other matters happening at Paramount” but was instead due to finances.

Colbert broke his silence about the shocking cancellation at the time.

“Before we start the show I want to let you know something that I found out just last night. Next year will be our last season,” he announced during a taping in July 2025 as the audience booed. “I share your feelings. It’s not just the end of our show, but it’s the end of The Late Show on CBS. I’m not being replaced. This is all just going away.”

He continued: “I do want to say that the folks at CBS have been great partners. … And I’m grateful to the audience, you, who have joined us every night, in here, out there and all around the world.”

Entertainment

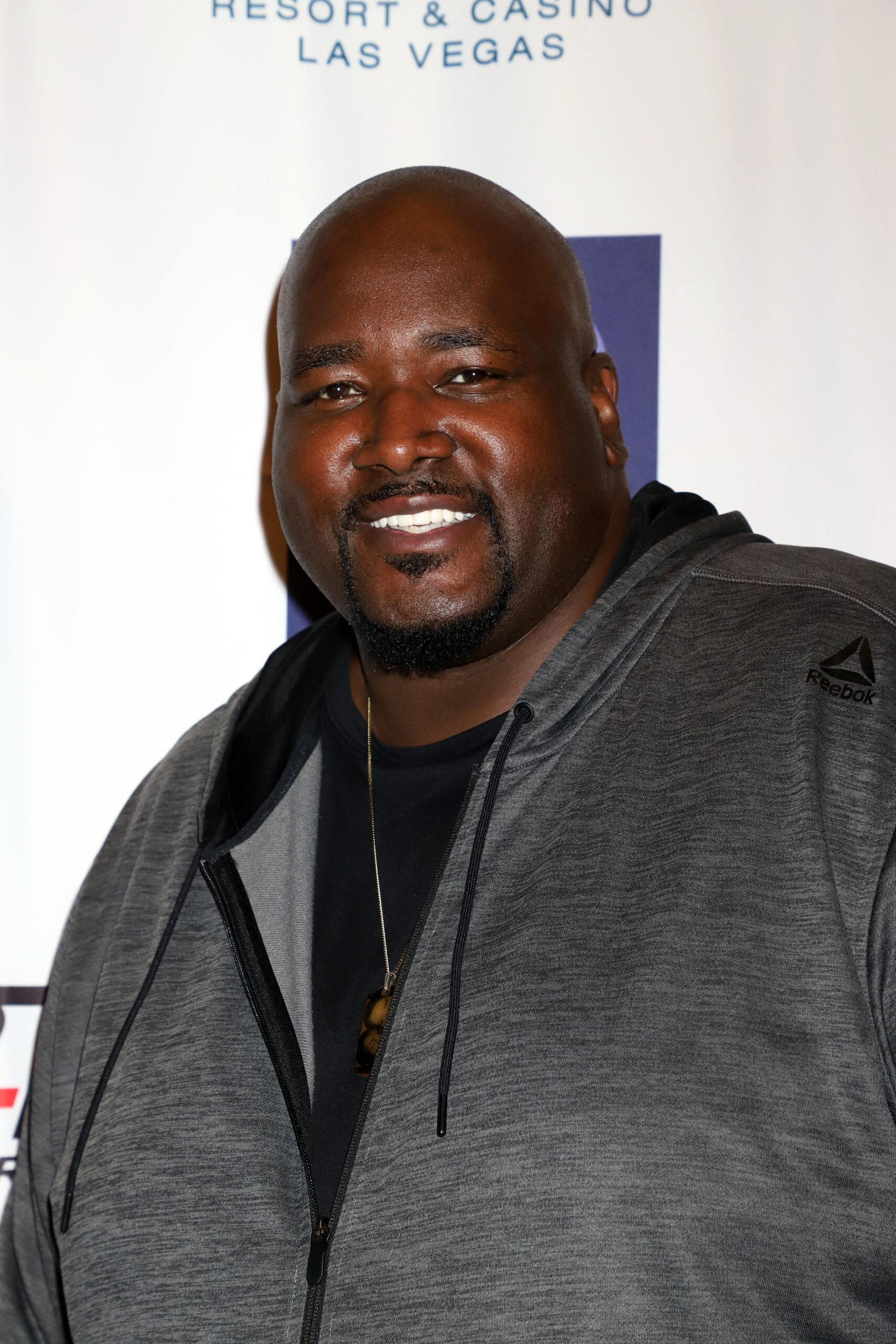

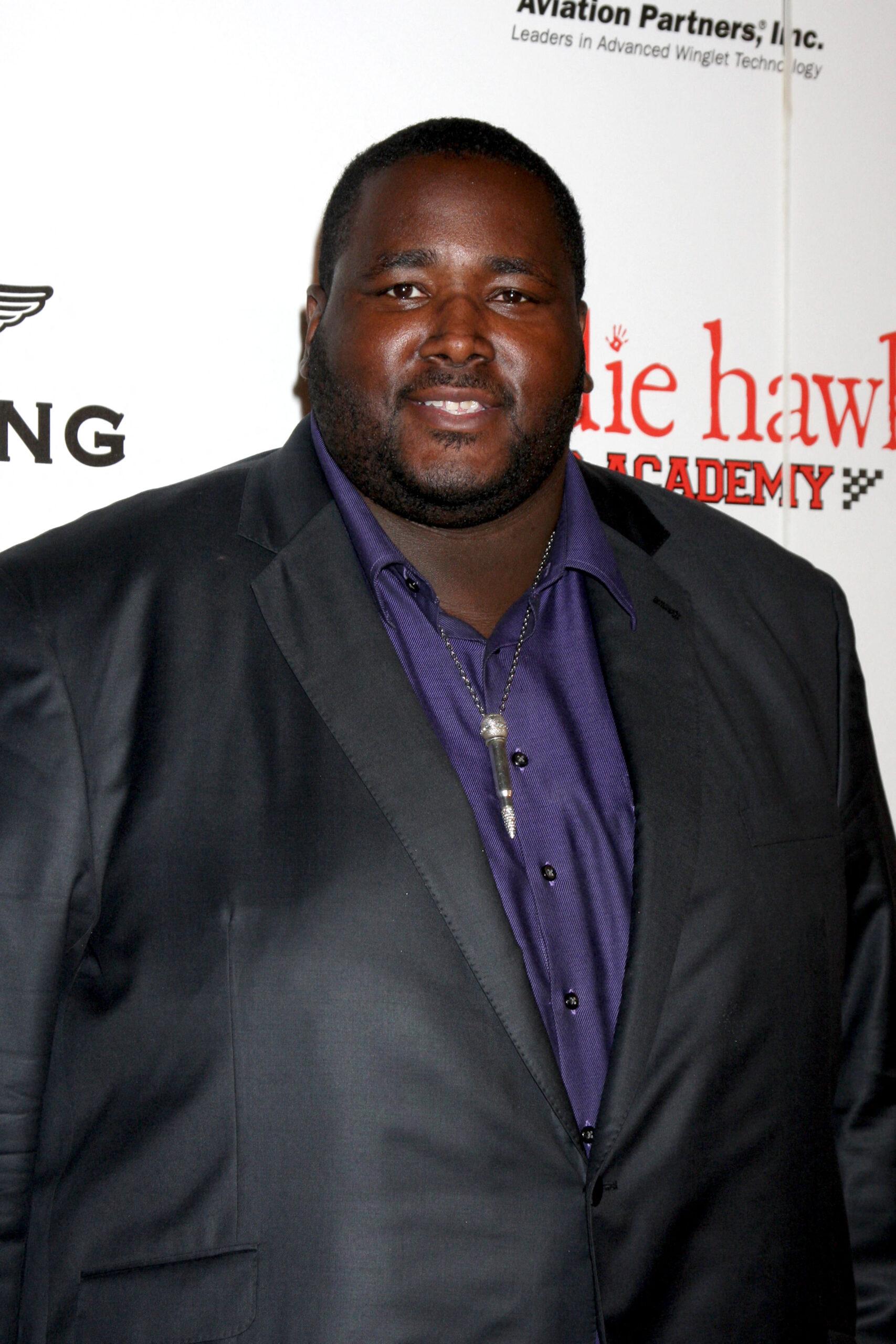

‘Blind Side’ Star Quinton Aaron Learns ‘Wife’ Is Married To Another Man

Quinton Aaron is awake and in stable condition after suffering a severe spinal stroke that left him battling for dear life.

However, reports suggest he’s disappointed that his “wife,” Margarita Aaron, is actually married to another man and has told family members he doesn’t want to see her.

Margarita, who claims to be “spiritually married” to Quinton, played a major role in his health journey as she made some health decisions on his behalf and was the one who called for help when he suffered a neck infection earlier this year.

Article continues below advertisement

Quinton Aaron Is Awake But Saddened That His ‘Wife’ Is Married To Another Man

“The Blind Side” star Quinton Aaron has come out of his health crisis and is on the way to full recovery.

Family members of the 41-year-old actor told TMZ in a statement this week that Quinton is now awake and fully alert following a life-threatening spinal stroke.

In fact, he’s understood to be very active and has been engaging in physical activities like writing and solving puzzles, with reports suggesting he’s starting to regain sensation in his legs.

Quinton has his family’s full support and is understood to be receiving approved visitors. However, his “wife” Margarita is not welcome as the news outlet reports he has warned severely that he does “NOT want to see Margaret at all.”

Article continues below advertisement

Margarita Aaron Claimed To Be ‘Spiritually Married’ To The Actor

All through Quinton’s hospitalization, a woman named Margarita was by his side, identifying herself as his “wife” to medical staff and the public.

She even told TMZ that she and Quinton “got spiritually married,” but the actor’s family raised an alarm that their purported marriage was never legal.

The situation raised eyebrows when they revealed that Margarita is actually married to another man, with her own daughter and niece confirming the claims.

Quinton’s brother Jarred was particularly worried that she was misrepresenting herself as his legal sister-in-law and was helping to make “crucial and life-saving medical decisions” for his brother.

Article continues below advertisement

As a result, Jarred shared that he “genuinely feared” for his brother’s life at the time, but Margarita fought back, saying she “does NOT have power of attorney, and has never made medical decisions on Quinton’s behalf.”

Article continues below advertisement

Margarita And Quinton’s Brother Have Been At Each Other’s Necks

The situation somewhat turned into a back-and-forth between Jarred and Margarita, as they exchanged words publicly.

Margarita defended her position as Quinton’s “spiritual” wife, adamantly insisting that they’re married.

She even took a dig at Jarred, saying, “If he’s saying I’m such a bad person, why does he live with me and Quinton?”

However, Jarred claimed that at the time they all lived under the same roof, he didn’t know that they were not legally married.

“I have all this crucial information that Quinton doesn’t know about, and now it feels like I’ve gotten it too late,” Jarred noted.

Article continues below advertisement

The Actor Was Left ‘Disappointed’ After Finding Out About His Wife’s Alleged Double Life

According to the news outlet, Quinton’s family has filled him in on everything that has been going on, which left the actor “disappointed.”

However, he still feels supported by his family and has said he’ll explain “in full detail” everything he went through as he focuses on his full recovery.

Meanwhile, his family offered an apology for not nipping the confusing situation in the bud sooner than now.

Quinton Aaron Had To Change His Lifestyle

Quinton, who has battled other health conditions in the past, including congestive heart failure, diabetes, and an incident that saw him cough blood, told Fox News Digital in October that a previous medical scare prompted him to change his lifestyle.

“I had this come-to-Jesus kind of moment a few years back,” he remembered. “I was at this waterfront in Mandeville, Louisiana. This is like during COVID, 2021ish. And I used to always go there and sit and just meditate, listen to the water and stuff.”

Article continues below advertisement

He added, “There’s one day I’m sitting there on the wall, and I’m just listening to the water vibe, and then I wake up underwater. So I literally passed out, fell off the wall, and it was like a 12-foot drop, but the water was only three feet deep. I didn’t know that at the time. Well, thank God it was three feet deep, because I can’t swim.”

The actor recalled hearing a voice encouraging him to “stand up,” but the water started “pushing” him into the rocks.

He managed to climb out of the water and was rushed to the hospital, after which doctors conducted tests and discovered he had an infection in one of his big toes that had spread to his bone.

“I was in the hospital for a few weeks getting IV antibiotics,” Quinton said. “I almost lost my toe, but thankfully I didn’t. They just cut a piece of it off, and it had to heal.”

Entertainment

Tyler Reddick’s Rep Shuts Down Question On Viral Moment With Michael Jordan, Son

NASCAR’s Tyler Reddick

Mum On Viral Moment W/ MJ, Son

… Handler Shuts Down Question

Published

TMZSports.com

Tyler Reddick had no interest in revisiting the viral Victory Lane moment involving his son and Michael Jordan — with a member of his team shutting down the question before it ever got off the ground.

With the controversy still swirling on social media, TMZ Sports asked the NASCAR star directly on Tuesday about the interaction involving his 6-year-old son, Beau, and MJ following the Daytona 500 victory … but his camp immediately deflected.

“We’re not going to talk about that,” Reddick’s rep interjected when pressed on the controversy.

Full stop.

The now-viral clip from the chaotic post-race celebration shows Jordan — who co-owns Reddick’s team, 23XI Racing — appearing to playfully grab or tap the child during the chaotic celebration.

Interesting celebration choice by Michael Jordan after winning the Daytona 500.

— Breaking911 (@Breaking911) February 16, 2026

@Breaking911

Social media lit up with debate over the interaction … with some users calling it awkward, with others defending it as harmless amid the confetti-filled frenzy.

Jordan hasn’t publicly commented on the matter, either.

Reddick — who won the regular-season Cup title in 2024 and then went winless in 2025 — burst through a last-lap wreck Sunday to shake a 38-race winless streak and celebrate his first Daytona 500 victory.

For now, he appears focused on racing — not rehashing a viral clip.

Entertainment

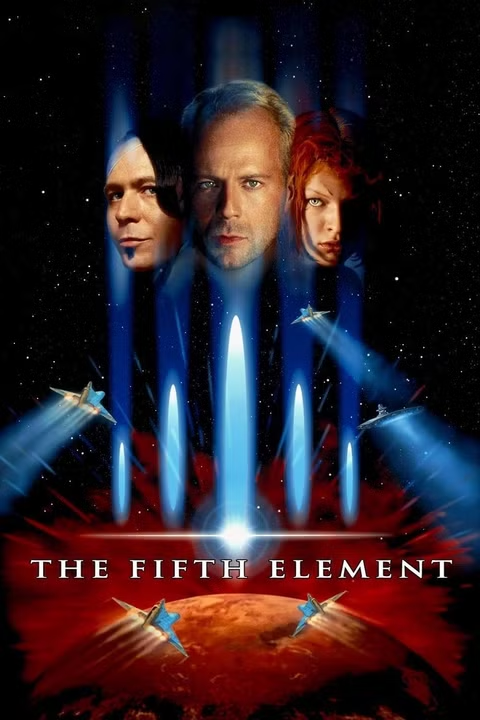

Gary Oldman’s $263M Sci-Fi Cult Classic Is Heading Back to Theaters for the 4th Time

Almost three decades after it first crash-landed into theaters, The Fifth Element is heading back to the big screen — for the fourth time. The sci-fi spectacle starring Gary Oldman, Bruce Willis, and Milla Jovovich will return to theaters on July 26 and 27, 2026, as part of Fathom Entertainment’s Big Screen Classics series.

When the film originally hit theaters in 1997, it split critics. Domestically, it pulled in $63 million, but internationally it soared to $200 million, bringing its worldwide total to $263 million. Over time, what was once considered loud, bizarre, and borderline chaotic has fully evolved into a bona fide cult classic.

It already celebrated a 20th anniversary re-release in 2017 and returned again in 2024. Now, in 2026, fans will get another shot to see Luc Besson’s neon-drenched space opera the way it was meant to be seen: huge. The cast also includes Ian Holm as Father Vito Cornelius, Chris Tucker as Ruby Rhod, Luke Perry, Brion James, and Lee Evans.

The re-release comes via Fathom Entertainment’s annual Big Screen Classics lineup, which this year includes titles like Citizen Kane, Ocean’s Eleven, The Silence of the Lambs, Gone with the Wind, It’s a Wonderful Life, The Birdcage, Ben-Hur, A Beautiful Mind, The Maltese Falcon, and Willy Wonka and the Chocolate Factory, among others. Each screening will feature an introduction from legendary film critic Leonard Maltin.

In a statement, Fathom CEO Ray Nutt explained that these re-releases are “an important theatrical programming category,” which has been “embraced by filmgoers of all ages.” The 2026 selections include “some of the greatest masterpieces of all time,” and Fathom is “thrilled” to bring back Maltin for his fourth time as host of the Big Screen Classic series.

“Classic and popular re-releases are an important theatrical programming category, and the curated movies Fathom Entertainment brings to the big screen continue to be embraced by filmgoers of all ages. The 2026 Fathom’s Big Screen Classics slate is filled with anniversary celebrations from some of the greatest cinematic masterpieces of all time and showcases a wide breadth of iconic hits and award-winning films. Fathom is also thrilled with the return of Leonard Maltin, casting a spotlight with exclusive introductions for these cinematic treasures.”

Is There a ‘Fifth Element’ Sequel?

Not at the moment, but there is a seed of an idea in the works. Jovovich previously teased that Besson is toying with the idea of an animated spin-off:

“I think Luc is making some sort of spin-off of a bunch of his biggest characters, and Leeloo might be one of them. An animated, cartoon version. I think back in those days, people weren’t thinking about sequels; it was just about making the best movie you could possibly make. For me, Leeloo was one of the most important characters of my young life at that point. It’s what really introduced me to what being a real actor was about.”

The Fifth Element will be re-released in theaters on July 26 and 27, 2026.

- Release Date

-

May 9, 1997

- Runtime

-

126 minutes

- Director

-

Luc Besson

- Writers

-

Luc Besson, Robert Mark Kamen

- Producers

-

Patrice Ledoux

Entertainment

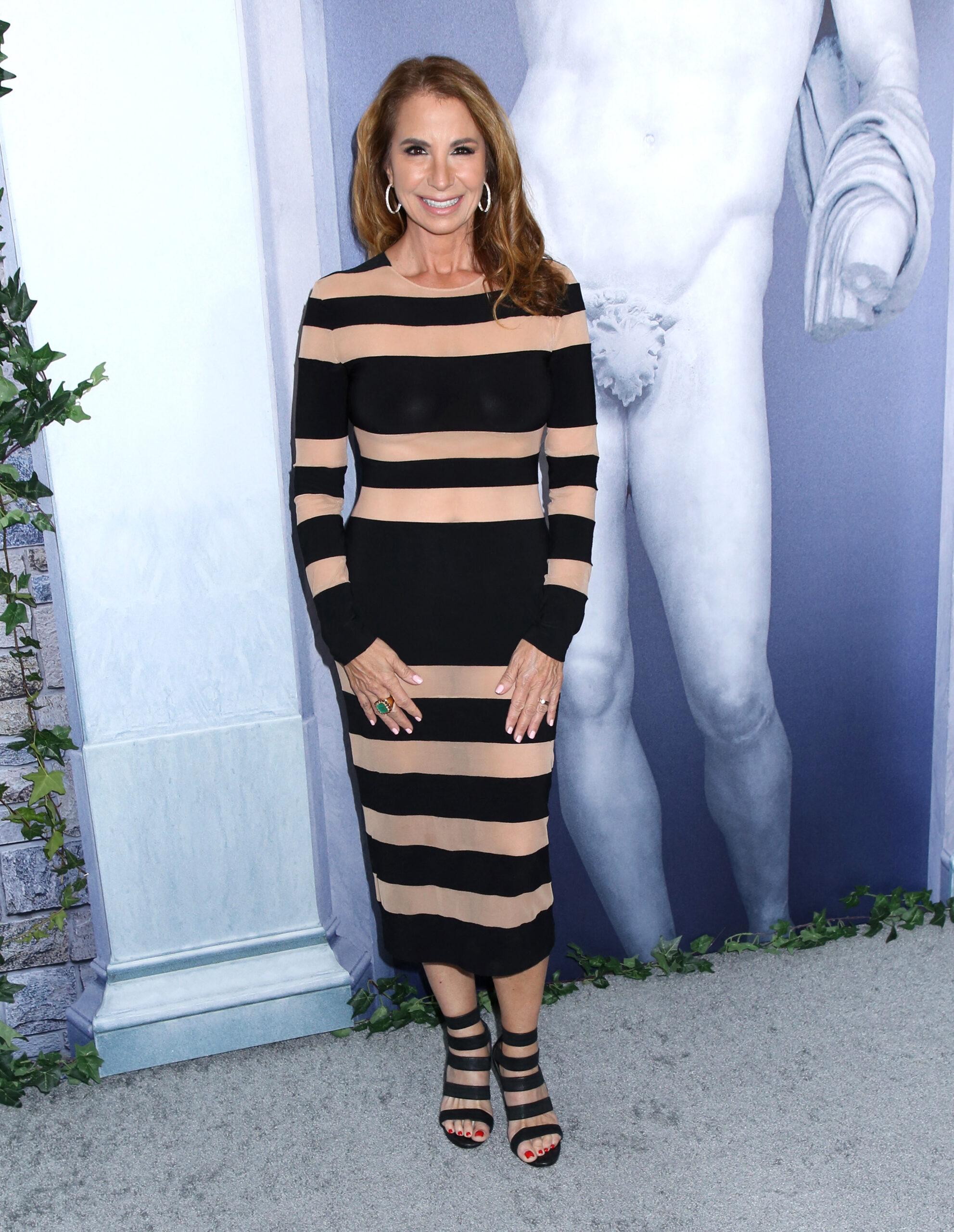

Dorinda Medley Confirms ‘The Golden Life’ Casting

Dorinda Medley is officially headed back to familiar territory. The former “Real Housewives of New York City” star has confirmed she will be joining her former castmates on the upcoming reality series “The Golden Life” following the abrupt firing of Jill Zarin.

Ongoing rumors have swirled that Medley would join the cast after Zarin was fired due to her racist comments regarding Bad Bunny’s Super Bowl halftime show performance.

Article continues below advertisement

Dorinda Medley Officially Joins Cast Of ‘The Golden Life’ After Jill Zarin’s Firing

Just as many fans suspected, Dorinda Medley is now a confirmed cast member on E! ‘s upcoming reality series, “The Golden Life.” She shared the news on Tuesday, February 17, via statement, according to PEOPLE.

“Well, the rumors are true! I will be joining the women on ‘The Golden Life’ in Palm Beach,” Medley said. “After decades of friendship and navigating life’s ups and downs together, it will be nice to reconnect with my ‘sisters.’ I am so excited to celebrate and share the next chapter of our lives!”

Medley will join previously announced cast members: LuAnn de Lesseps, Sonia Morgan, Kelly Bensimon, and Ramona Singer.

Article continues below advertisement

Jill Zarin Was Fired From ‘The Golden Life’ After Posting A Video About The Bad Bunny Super Bowl Performance

Two days after Zarin’s racist remarks went viral online and sparked widespread outrage, Blink49 Studios, the production company behind “The Golden Life,” issued a statement announcing her firing.

“In light of recent public comments made by Jill Zarin, Blink49 Studios has decided not to move forward with her involvement in ‘The Golden Life.’ We remain committed to delivering the series in line with our company standards and values,” the company said on February 10, per Variety.

Article continues below advertisement

Zarin Sparked Immense And Immediate Backlash Due To Her Comments

After Bad Bunny’s Super Bowl halftime show performance, Zarin took to Instagram to post a since-deleted video where she heavily criticized his performance via comments that were racist in nature.

“It’s 250 years that we’re celebrating right now in the United States, and I just don’t think it was appropriate to have it in Spanish,” she said at the start of the video.

“I don’t speak Spanish, I would have liked to have known the words he was saying,” Zarin continued. “To me, it looked like a political statement because there were literally no white people in the entire thing.”

Article continues below advertisement

“I’m not taking a side one way or the other, I just do,” the reality TV star added. “I think it was an ICE thing. I just think that the NFL sold out, and it’s very sad because this was 75 years, and you know, shame. Shame.”

Article continues below advertisement

She Defended Herself After She Was Fired From The Show

Speaking exclusively with In Touch after the news of her firing spread, Zarin blamed E!, saying the network “didn’t even give me a chance” to rectify the situation. “I took it down right away. People make mistakes. I’m human.”

According to Radar Online, Zarin is reportedly not handling her firing well. “She’s angry she got fired,” a source told the outlet. “She doesn’t understand how she could get fired.”

The source also shared that Zarin has “no remorse” for the video.

“She’s blaming the response to her comments instead of reflecting and taking accountability for them,” the source said. “She’s not looking within and realizing she did something wrong.”

Dorinda Medley Is A Cast Member On ‘Traitors’ Season 4

After being the first person eliminated on season 3 of the hit Peacock reality competition series, Medley expressed her excitement at being given a second chance to return in the show’s fourth season.

“I think going back for Season 4, and the cast is so great, and we had so much fun,” she said, per Yahoo! Entertainment. “I just felt so honored. Like, I really feel like it was a special honor to be back twice, right? When I got the call, I literally cried. Because I, too, felt robbed.”

“To be able to go back and sort of have this experience again was really incredible,” the reality star added.

“It’s such a bonding experience. You’re just stuck in this castle this whole time, and there’s not really a lot of outside noise going on. You can’t help but build a bond with them,” she said.

-

Sports6 days ago

Sports6 days agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

Tech7 days ago

Tech7 days agoSpaceX’s mighty Starship rocket enters final testing for 12th flight

-

Video1 day ago

Video1 day agoBitcoin: We’re Entering The Most Dangerous Phase

-

Tech3 days ago

Tech3 days agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Video4 days ago

Video4 days agoThe Final Warning: XRP Is Entering The Chaos Zone

-

Tech17 hours ago

Tech17 hours agoThe Music Industry Enters Its Less-Is-More Era

-

Video12 hours ago

Video12 hours agoFinancial Statement Analysis | Complete Chapter Revision in 10 Minutes | Class 12 Board exam 2026

-

Crypto World6 days ago

Crypto World6 days agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

Crypto World4 days ago

Crypto World4 days agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Video6 days ago

Video6 days agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

Crypto World11 hours ago

Crypto World11 hours agoCan XRP Price Successfully Register a 33% Breakout Past $2?

-

Sports18 hours ago

Sports18 hours agoGB's semi-final hopes hang by thread after loss to Switzerland

-

NewsBeat2 days ago

NewsBeat2 days agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Business5 days ago

Business5 days agoBarbeques Galore Enters Voluntary Administration

-

Crypto World7 days ago

Crypto World7 days agoCrypto Speculation Era Ending As Institutions Enter Market

-

Crypto World5 days ago

Crypto World5 days agoEthereum Price Struggles Below $2,000 Despite Entering Buy Zone

-

NewsBeat2 days ago

NewsBeat2 days agoMan dies after entering floodwater during police pursuit

-

NewsBeat3 days ago

NewsBeat3 days agoUK construction company enters administration, records show

-

Crypto World4 days ago

Crypto World4 days agoKalshi enters $9B sports insurance market with new brokerage deal

-

Crypto World4 days ago

Crypto World4 days agoBlackRock Enters DeFi Via UniSwap, Bitcoin Stages Modest Recovery