Tech

Anthropic’s Sonnet 4.6 matches flagship AI performance at one-fifth the cost, accelerating enterprise adoption

Anthropic on Tuesday released Claude Sonnet 4.6, a model that amounts to a seismic repricing event for the AI industry. It delivers near-flagship intelligence at mid-tier cost, and it lands squarely in the middle of an unprecedented corporate rush to deploy AI agents and automated coding tools.

The model is a full upgrade across coding, computer use, long-context reasoning, agent planning, knowledge work, and design. It features a 1M token context window in beta. It is now the default model in claude.ai and Claude Cowork, and pricing holds steady at $3/$15 per million tokens — the same as its predecessor, Sonnet 4.5.

That pricing detail is the headline that matters most. Anthropic’s flagship Opus models cost $15/$75 per million tokens — five times the Sonnet price. Yet performance that would have previously required reaching for an Opus-class model — including on real-world, economically valuable office tasks — is now available with Sonnet 4.6. For the thousands of enterprises now deploying AI agents that make millions of API calls per day, that math changes everything.

Why the cost of running AI agents at scale just dropped dramatically

To understand the significance of this release, you need to understand the moment it arrives in. The past year has been dominated by the twin phenomena of “vibe coding” and agentic AI. Claude Code — Anthropic’s developer-facing terminal tool — has become a cultural force in Silicon Valley, with engineers building entire applications through natural-language conversation. The New York Times profiled its meteoric rise in January. The Verge recently declared that Claude Code is having a genuine “moment.” OpenAI, meanwhile, has been waging its own offensive with Codex desktop applications and faster inference chips.

The result is an industry where AI models are no longer evaluated in isolation. They are evaluated as the engines inside autonomous agents — systems that run for hours, make thousands of tool calls, write and execute code, navigate browsers, and interact with enterprise software. Every dollar spent per million tokens gets multiplied across those thousands of calls. At scale, the difference between $15 and $3 per million input tokens is not incremental. It is transformational.

The benchmark table Anthropic released paints a striking picture. On SWE-bench Verified, the industry-standard test for real-world software coding, Sonnet 4.6 scored 79.6% — nearly matching Opus 4.6’s 80.8%. On agentic computer use (OSWorld-Verified), Sonnet 4.6 scored 72.5%, essentially tied with Opus 4.6’s 72.7%. On office tasks (GDPval-AA Elo), Sonnet 4.6 actually scored 1633, surpassing Opus 4.6’s 1606. On agentic financial analysis, Sonnet 4.6 hit 63.3%, beating every model in the comparison, including Opus 4.6 at 60.1%.

These are not marginal differences. In many of the categories enterprises care about most, Sonnet 4.6 matches or beats models that cost five times as much to run. An enterprise running an AI agent that processes 10 million tokens per day was previously forced to choose between inferior results at lower cost or superior results at rapidly scaling expense. Sonnet 4.6 largely eliminates that trade-off.

In Claude Code, early testing found that users preferred Sonnet 4.6 over Sonnet 4.5 roughly 70% of the time. Users even preferred Sonnet 4.6 to Opus 4.5, Anthropic’s frontier model from November, 59% of the time. They rated Sonnet 4.6 as significantly less prone to over-engineering and “laziness,” and meaningfully better at instruction following. They reported fewer false claims of success, fewer hallucinations, and more consistent follow-through on multi-step tasks.

How Claude’s computer use abilities went from ‘experimental’ to near-human in 16 months

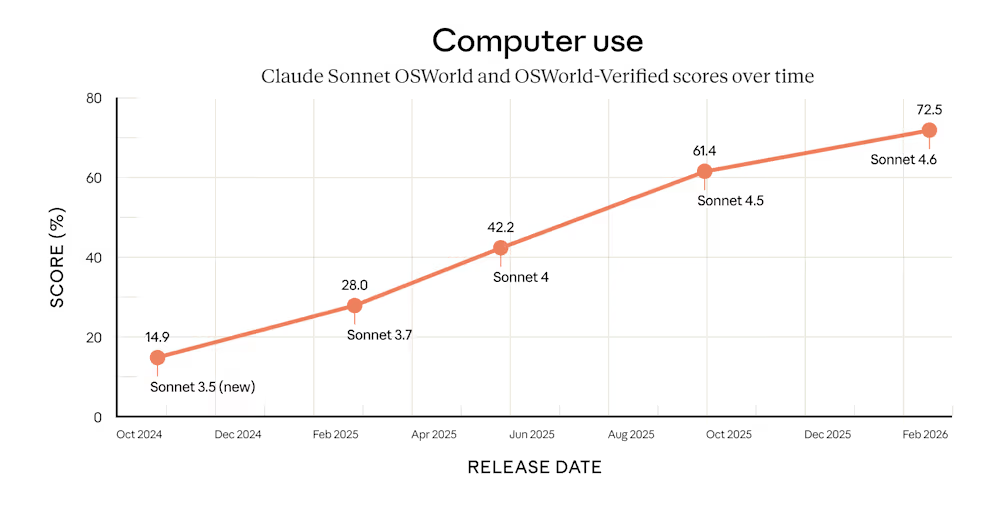

One of the most dramatic storylines in the release is Anthropic’s progress on computer use — the ability of an AI to operate a computer the way a human does, clicking a mouse, typing on a keyboard, and navigating software that lacks modern APIs.

When Anthropic first introduced this capability in October 2024, the company acknowledged it was “still experimental — at times cumbersome and error-prone.” The numbers since then tell a remarkable story: on OSWorld, Claude Sonnet 3.5 scored 14.9% in October 2024. Sonnet 3.7 reached 28.0% in February 2025. Sonnet 4 hit 42.2% by June. Sonnet 4.5 climbed to 61.4% in October. Now Sonnet 4.6 has reached 72.5% — nearly a fivefold improvement in 16 months.

This matters because computer use is the capability that unlocks the broadest set of enterprise applications for AI agents. Almost every organization has legacy software — insurance portals, government databases, ERP systems, hospital scheduling tools — that was built before APIs existed. A model that can simply look at a screen and interact with it opens all of these to automation without building bespoke connectors.

Jamie Cuffe, CEO of Pace, said Sonnet 4.6 hit 94% on their complex insurance computer use benchmark, the highest of any Claude model tested. “It reasons through failures and self-corrects in ways we haven’t seen before,” Cuffe said in a statement sent to VentureBeat. Will Harvey, co-founder of Convey, called it “a clear improvement over anything else we’ve tested in our evals.”

The safety dimension of computer use also got attention. Anthropic noted that computer use poses prompt injection risks — malicious actors hiding instructions on websites to hijack the model — and said its evaluations show Sonnet 4.6 is a major improvement over Sonnet 4.5 in resisting such attacks. For enterprises deploying agents that browse the web and interact with external systems, that hardening is not optional.

Enterprise customers say the model closes the gap between Sonnet and Opus pricing tiers

The customer reaction has been unusually specific about cost-performance dynamics. Multiple early testers explicitly described Sonnet 4.6 as eliminating the need to reach for the more expensive Opus tier.

Caitlin Colgrove, CTO of Hex Technologies, said the company is moving the majority of its traffic to Sonnet 4.6, noting that with adaptive thinking and high effort, “we see Opus-level performance on all but our hardest analytical tasks with a more efficient and flexible profile. At Sonnet pricing, it’s an easy call for our workloads.”

Ben Kus, CTO of Box, said the model outperformed Sonnet 4.5 in heavy reasoning Q&A by 15 percentage points across real enterprise documents. Michele Catasta, President of Replit, called the performance-to-cost ratio “extraordinary.” Ryan Wiggins of Mercury Banking put it more bluntly: “Claude Sonnet 4.6 is faster, cheaper, and more likely to nail things on the first try. That combination was a surprising combination of improvements, and we didn’t expect to see it at this price point.”

The coding improvements resonate particularly given Claude Code’s dominance in the developer tools market. David Loker, VP of AI at CodeRabbit, said the model “punches way above its weight class for the vast majority of real-world PRs.” Leo Tchourakov of Factory AI said the team is “transitioning our Sonnet traffic over to this model.” GitHub’s VP of Product, Joe Binder, confirmed the model is “already excelling at complex code fixes, especially when searching across large codebases is essential.”

Brendan Falk, Founder and CEO of Hercules, went further: “Claude Sonnet 4.6 is the best model we have seen to date. It has Opus 4.6 level accuracy, instruction following, and UI, all for a meaningfully lower cost.”

A simulated business competition reveals how AI agents plan over months, not minutes

Buried in the technical details is a capability that hints at where autonomous AI agents are heading. Sonnet 4.6’s 1M token context window can hold entire codebases, lengthy contracts, or dozens of research papers in a single request. Anthropic says the model reasons effectively across all that context — a claim the company demonstrated through an unusual evaluation.

The Vending-Bench Arena tests how well a model can run a simulated business over time, with different AI models competing against each other for the biggest profits. Without human prompting, Sonnet 4.6 developed a novel strategy: it invested heavily in capacity for the first ten simulated months, spending significantly more than its competitors, and then pivoted sharply to focus on profitability in the final stretch. The model ended its 365-day simulation at approximately $5,700 in balance, compared to Sonnet 4.5’s roughly $2,100.

This kind of multi-month strategic planning, executed autonomously, represents a qualitatively different capability than answering questions or generating code snippets. It is the type of long-horizon reasoning that makes AI agents viable for real business operations — and it helps explain why Anthropic is positioning Sonnet 4.6 not just as a chatbot upgrade, but as the engine for a new generation of autonomous systems.

Anthropic’s Sonnet 4.6 arrives as the company expands into enterprise markets and defense

This release does not arrive in a vacuum. Anthropic is in the middle of the most consequential stretch in its history, and the competitive landscape is intensifying on every front.

On the same day as this launch, TechCrunch reported that Indian IT giant Infosys announced a partnership with Anthropic to build enterprise-grade AI agents, integrating Claude models into Infosys’s Topaz AI platform for banking, telecoms, and manufacturing. Anthropic CEO Dario Amodei told TechCrunch there is “a big gap between an AI model that works in a demo and one that works in a regulated industry,” and that Infosys helps bridge it. TechCrunch also reported that Anthropic opened its first India office in Bengaluru, and that India now accounts for about 6% of global Claude usage, second only to the U.S. The company, which CNBC reported is valued at $183 billion, has been expanding its enterprise footprint rapidly.

Meanwhile, Anthropic president Daniela Amodei told ABC News last week that AI would make humanities majors “more important than ever,” arguing that critical thinking skills would become more valuable as large language models master technical work. It is the kind of statement a company makes when it believes its technology is about to reshape entire categories of white-collar employment.

The competitive picture for Sonnet 4.6 is also notable. The model outperforms Google’s Gemini 3 Pro and OpenAI’s GPT-5.2 on multiple benchmarks. GPT-5.2 trails on agentic computer use (38.2% vs. 72.5%), agentic search (77.9% vs. 74.7% for Sonnet 4.6’s non-Pro score), and agentic financial analysis (59.0% vs. 63.3%). Gemini 3 Pro shows competitive performance on visual reasoning and multilingual benchmarks, but falls behind on the agentic categories where enterprise investment is surging.

The broader takeaway may not be about any single model. It is about what happens when Opus-class intelligence becomes available for a few dollars per million tokens rather than a few tens of dollars. Companies that were cautiously piloting AI agents with small deployments now face a fundamentally different cost calculus. The agents that were too expensive to run continuously in January are suddenly affordable in February.

Claude Sonnet 4.6 is available now on all Claude plans, Claude Cowork, Claude Code, the API, and all major cloud platforms. Anthropic has also upgraded its free tier to Sonnet 4.6 by default. Developers can access it immediately using claude-sonnet-4-6 via the Claude API.

Tech

Lawsuits Test New Legal Theories About What Causes Social Media Addiction

A high-stakes trial sparked by a California woman who first logged onto social media at age 10. Another lawsuit in Georgia filed by a school district despairing at distracted students. Dozens more legal actions brought by state attorneys general accusing digital platforms of playing mindgames with children.

These are among thousands of lawsuits filed against social media companies with the claim that they purposely designed their apps to be addictive to young users, causing mental health harm and interfering with their education in the pursuit of profit.

Plaintiffs in these cases are pursuing a new legal strategy: they’re claiming that it’s the design of social media platforms — not the content — that is leading to harm.

This month, the first case to go to trial will test the strength of that theory and shape how thousands of other lawsuits against social media companies are argued.

The trial comes at a time when schools find themselves on the frontlines of an ongoing youth mental health crisis that accelerated during the pandemic.

Child online safety advocates have told EdSurge that while they’ve been sounding the alarm on the harms that children face online, there hasn’t been meaningful change from social media platforms. Educators have long been frustrated over shrinking attention spans and mental health issues they say have worsened as students spend more time online. That frustration has crescendoed into a wave of cellphone bans and wider debate about how much time kids should be spending with screens.

‘Addictive’ Apps

Legal experts say that what sets this new wave of litigation apart from past lawsuits is that plaintiffs are accusing social media platforms of purposefully designing “addictive” platforms. That means cases will hinge on the plaintiffs’ ability to prove that social media companies had a duty to warn them about the pitfalls of using social media, failed in that duty, and caused harm as a result — invoking the need for consumer protection rather than raising issues with content.

Arguments in a case that began in early February in California Superior Court in Los Angeles, spotlight a plaintiff known in court filings as KGM who claims her use of social media from a young age led to mental health issues, including depression and anxiety.

Arguments in lawsuits brought by school districts, which have been consolidated in the Northern District of California, are expected to start during the summer.

Joseph McNally, former federal prosecutor and director of Emerging Torts and Litigation at McNicholas & McNicholas in California, says that the landmark mass legal action of his childhood was against the tobacco industry for knowing and doing nothing about the addictive and deadly nature of its products. This wave of social media lawsuits will be that for kids today, he believes.

“At a high level, what the school districts are saying is, ‘You targeted kids,’” McNally explains. “‘You knew that your product was potentially dangerous because it was addictive.’”

Tied into accusations that social media companies intentionally made their products addictive to kids, school districts are also arguing that these companies have created a public nuisance, according to corporate attorney Princess Uchekwe, of The Chief Counsel in New York.

A lawsuit in California accuses social media companies of negligence by designing “addictive” apps and failing to warn users of potential harm. The case’s outcome will affect thousands of similar lawsuits around the country. Document source: Los Angeles Superior Court of California

“Essentially, these schools are saying that because social media platforms are so addictive to children and are creating so many of these mental health issues,” Uchekwe explains, “that as a society, it’s now become a public nuisance that we have to deal with. For school districts in particular, they are saying that now they have to redirect resources that could otherwise be used on teaching and the curriculum to manage these mental health issues that are caused by excessive usage of these social media platforms.”

A Novel Argument

Another novel issue that will be tested by these cases is whether social media companies can successfully invoke the protection of Section 230, McNally says. It’s the part of the 1996 telecommunications law that says online platforms cannot be held liable for content posted by third parties, and it’s widely regarded as making free and open communication online possible.

Meta is defending itself in these lawsuits by arguing that it’s the content and not the app itself that’s causing social media addiction, McNally explains. Plaintiffs are sticking to the argument that platform features like Instagram’s algorithm are at fault for addiction.

“It’s a tough line, because in many ways, the content and the features and the platform are very much inextricably intertwined,” McNally says. “A jury’s going to have to sort through what is platform harm versus content harm, and that’s not an easy task.”

The defense’s strategy is taking shape in the courtroom. YouTube, part of the ongoing trial in Los Angeles, is arguing that it’s not a social media platform at all — but an entertainment platform akin to Netflix. Meta has argued that KGM’s childhood mental health issues didn’t originate from her use of social media.

Social media companies are also arguing that ‘social media addiction’ is not a clinically recognised condition — and that even if it was, there’s no proof that use of their platforms directly causes mental health harm.

“In these social media cases, what [plaintiffs are] alleging here is harm to the mind,” Uchekwe explains, “and that can be very, very difficult to prove, because mental health is just so multifaceted. It’s going to rely on a lot of expert testimony, a lot of the evidence, maybe a lot of the internal documents that they have during discovery that show that these companies knew, for example, that these features were super addictive and did not really do anything to alleviate that.”

McNally echoed her analysis of the importance internal documents will play. As an example, he pointed to an internal Instagram email that appears in court records in the Northern District of California case coming to trial in the summer. It states: “IG [Instagram] is a drug. We are pushing users.”

“I spent 17 years as a federal prosecutor, and some of the most compelling evidence in any trial are insider emails,” McNally says. “Anybody can come to court 10 years later and get on the stand and testify as to what they thought or what they intended. But really, when you dive into contemporaneous emails that are happening at the time a product is being developed, or a time that an issue is being evaluated, that will really tell you the story.”

Emails presented in arguments during the trial that’s underway revealed an internal debate at Instagram over whether to reverse a ban on facial filters that mimicked the results of plastic surgery. Some team members wanted to keep the ban in place while gathering more information on the filter’s potential effects on teen girls.

“Plaintiffs have identified some emails here that, when you just look at them on their face, certainly show that there was a debate going on at Facebook on the addictive nature of Instagram and other products,” McNally says. “The defendants will argue that they evaluated that, they weighed that, or they’re being taken out of context, but there are some really, really strong internal emails that I think strengthen the plaintiff’s hand here.”

Why a Bellwether Case?

The ongoing trial in the Los Angeles Superior Court of California has been called a “bellwether” or “landmark” case because, in the simplest terms, it will test whether the legal theories argued by both sides are successful or not.

If the plaintiffs win the Los Angeles case and are awarded substantial damages, for example, it would encourage social media companies to settle other cases rather than go to trial.

“On the other side of that,” McNally says, “if the jury comes back and ultimately concludes that the plaintiffs didn’t meet their burden and finds that the defendants are not liable, then the tech companies would really have the upper hand.”

The Los Angeles case will reveal jurors’ views on addiction, as it relates to Instagram, YouTube and other social media, McNally says: “If a jury comes back and doesn’t buy the addiction theory here, it makes those cases that the school districts have a lot more challenging to bring.”

He adds that this is the start of a long road for school districts and others pursuing litigation against social media companies. While the platforms won’t go away, McNally predicts that companies’ desire to project trustworthiness and have good reputations will motivate them to put up more safeguards for kids.

Tech

Apple Health gets new Average Bedtime metric in iOS 26.4 beta

The Apple Health app has just been updated with two key changes — a new Average Bedtime metric and a blood oxygen graph in the Vitals section.

Apple Health now has an Average Bedtime metric.

With the release of the first iOS 26.4 developer beta on Monday, enhancements for Apple Podcasts and Apple Music apps were introduced. Another system application, Apple Health, was modified as well. It now offers additional sleep-related information to iPhone users.

To be more specific, Apple Health has received a dedicated Average Bedtime metric, available as part of a new Sleep Highlight in the Sleep section. iOS users will be able to see the time they typically go to bed, based on their sleeping habits over the past two weeks.

Continue Reading on AppleInsider | Discuss on our Forums

Tech

Techdirt Podcast Episode 444: Answering Your Questions

from the with-regards-to-your-inquiry dept

Two weeks ago, we ran a bit of an AMA experiment, with a call on Bluesky for fans of Techdirt to ask Mike any questions they might have. We got lots of great responses and now, as promised, Mike is delivering the answers on this week’s episode of the podcast!

You can also download this episode directly in MP3 format.

Follow the Techdirt Podcast on Soundcloud, subscribe via Apple Podcasts or Spotify, or grab the RSS feed. You can also keep up with all the latest episodes right here on Techdirt.

Filed Under: ama, ask me anything, podcast

Tech

Retraction: After a routine code rejection, an AI agent published a hit piece on someone by name

Following additional review, Ars has determined that the story “After a routine code rejection, an AI agent published a hit piece on someone by name,” did not meet our standards. Ars Technica has retracted this article. Originally published on Feb 13, 2026 at 2:40PM EST and removed on Feb 13, 2026 at 4:22PM EST.

Tech

Most VMware users still “actively reducing their VMware footprint,” survey finds

Migrations are ongoing

Broadcom introduced changes to VMware that are especially unfriendly to small- and-medium-sized businesses (SMBs), and Gartner previously predicted that 35 percent of VMware workloads would migrate else by 2028.

CloudBolt’s survey also examined how respondents are migrating workloads off of VMware. Currently, 36 percent of participants said they migrated 1–24 percent of their environment off of VMware. Another 32 percent said that they have migrated 25–49 percent; 10 percent said that they’ve migrated 50–74 percent of workloads; and 2 percent have migrated 75 percent or more of workloads. Five percent of respondents said that they have not migrated from VMware at all.

Among migrated workloads, 72 percent moved to public cloud infrastructure as a service, followed by Microsoft’s Hyper-V/Azure stack (43 percent of respondents).

Overall, 86 percent of respondents “are actively reducing their VMware footprint,” CloudBolt’s report said.

“The fear has cooled, but the pressure hasn’t—and most teams are now making practical moves to build leverage and optionality—even if for some that includes the realization that a portion of their estate never moves off VMware,” Mark Zembal, CloudBolt’s chief marketing officer, said in a statement.

While bundled products, fewer options, resellers, and higher prices make VMware harder to justify for many, especially SMB customers, migration is a long process with its own costs, including time spent researching alternatives and building relevant skills. CloudBolt’s reported multi-platform complexity (52 percent) and skills gaps (33 percent) topped the list of migration challenges.

“As organizations diversify away from VMware, they inherit the operational burden of managing multiple platforms with different operational and governance models,” the report reads.

While companies determine the best ways to limit their dependence on VMware, Broadcom can still make money from smaller customers it doesn’t deem necessary for the long term.

“Their strategy was never to keep every customer,” CloudBolt’s report says. “It was to maximize value from those still on the platform while the market slowly diversifies. The model assumes churn and it’s built to make the economics work anyway. Broadcom has done the math—and they’re fine with it.”

Tech

Apple MacBook Rumors: New M5 MacBook Pros Could Arrive March 4

If the rumor mill is to be believed, 2026 will feature an unusually large harvest of Apple products. This is shaping up to be a standout year for MacBooks, and we might be only a couple weeks away from seeing the first new models.

Apple’s “Special Experience” slated for Wednesday, March 4, indicates that the company is set to unveil new products soon. While I was expecting to see new MacBooks hit by the end of this month, the early-March event still fits Apple’s spring refresh schedule. We could see a new MacBook unveiled on March 4 along with an eighth-gen iPad Air and a low-cost iPhone 17E. Taking place in New York, London and Shanghai instead of at Apple HQ in Cupertino, California, these smaller media gatherings might be indicative of less explosive reveals. It’s more likely we see MacBook chipset upgrades than more experimental MacBook products rumored for later in the year.

The MacBook Pro is lined up to be the first MacBook update of the year, with Apple bringing the higher-powered M5 Pro and M5 Max chips to both the 14- and 16-inch MacBook Pro lines in March. Then Apple could move to the other end of the spectrum and release its rumored $599 budget MacBook. Also in the first half of the year, the MacBook Air is likely to receive an M5 chip refresh. And before the year is out, we could see the first MacBook Pros with OLED touchscreens.

Watch this: Apple’s iPhone 17E Is Near: Here’s What We Expect

Internet speculation has given way to more concrete evidence of these MacBook releases, as Bloomberg’s Mark Gurman cites internal Apple communications that reveal “a remarkably busy 2026 with a slew of product releases over the next several weeks.”

According to Gurman, the M5 refreshes for the MacBook Pro and MacBook Air could be just around the corner, and the budget MacBook might not be far behind. Let’s take a closer look at the timing, pricing and details of the MacBook refreshes expected this year.

The reported 2026 MacBook release timeline

While the rumors swirl about the MacBook releases expected this year, we don’t have exact dates for when the new models will be announced. It’s extremely likely that Apple’s March media event will set the stage for the company to unveil more M5 MacBook Pros and the MacBook Air, but it’s harder to pinpoint when the other products are slated for release. From what I’ve gathered online, here’s my best guess of when we might see new MacBooks this year.

- March: M5 Pro and M5 Max MacBook Pros, M5 MacBook Air

- First half of 2026: Budget MacBook (estimated price of $599)

- Second half of 2026: Touchscreen OLED MacBook Pro

Read on for a closer look at the timing, pricing and details of the MacBook refreshes expected this year.

The 14-inch M5 MacBook Pro released in October, so we’re expecting the rest of the lineup very soon.

M5 Pro and M5 Max updates for the MacBook Pro

The MacBook Pro was the first MacBook to receive Apple’s latest M5 processor when the 14-inch MacBook Pro was released last October. Now, Apple is expected to extend its M5 offerings and bring the higher-powered M5 Pro and M5 Max chips to the MacBook Pro.

The 16-inch MacBook Pro is still waiting for its M5 update and should also get M5 Pro and M5 Max chips at the same time as its smaller Pro sibling.

CNET’s Lori Grunin tested the M5 chip and noted that it delivers big performance improvements over the M4 “in the narrow areas where it applies, namely on-GPU processing for AI and ray-traced graphics.” Still, the M5 MacBook Pro struggles to keep up with the world of AAA gaming.

The M5 Pro and M5 Max processors will likely follow in the footsteps of previous M-series Pro and Max chips, featuring additional CPU and GPU cores and higher memory allotments.

MacBook Pro models with these high-end chips come at higher prices geared toward processing-intensive tasks like video rendering, 3D modeling and AI workloads. If pricing remains stable, which isn’t a sure bet with the worldwide RAM shortage, the 14-inch MacBook Pro with an M5 Pro chip will likely start at $1,999 and the 16-inch Pro with an M5 Pro will likely start at $2,499.

As with the last MacBook Pro update last October, these M5 updates will be internal upgrades without any significant changes to the laptop’s design. According to Bloomberg’s Power On newsletter, these M5 Pro and M5 Max updates will arrive with Apple’s next major Mac software update, MacOS 26.3, in February or March. Now that Apple has unveiled its March 4 event date, it has become much more likely that we’ll see these upgraded MacBook Pros arrive next month. If you are eyeing a MacBook Pro purchase, it probably makes sense to hold off and wait for the new models to arrive.

Finally, a true budget MacBook?

Apple is reportedly planning to enter the budget laptop market with a low-cost model that’ll be much more affordable than the current cheapest model, the M4 MacBook Air, which starts at $999. This new model will ditch Apple’s M-series in favor of an A-series chip — the same processor that powers the iPhone and could cost as little as $699 or as low as $599 with Apple’s education discount.

Apple already makes the claim that the A19 Pro chip that debuted in the iPhone 17 Pro and the iPhone Air provides “MacBook Pro levels of compute.” But according to industry analyst Ming-Chi Kuo, it’s possible — even probable — that a budget MacBook would utilize an A18 Pro chip (the chip used in the iPhone 16 Pro) instead.

A budget laptop with an A18 Pro chip would likely offer diminishing returns in comparison to the MacBook M4 chips, running roughly 40% slower than the current generation of Macs. The A18 Pro also doesn’t feature support for Thunderbolt ports, so the budget MacBook would likely come outfitted with less-capable USB-C ports instead.

The new rumored budget MacBook will be even more compact than the smallest M4 MacBook Air model.

The other way Apple will reportedly keep the prices down on this new budget MacBook is by shrinking the display size. Kuo reported the laptop will feature an “approximately 13-inch display,” which is a claim corroborated by Gurman. It could feature a 12.9-inch screen, which would be a bit smaller than the 13.6-inch MacBook Air. But it should also be a little lighter than the 2.7-pound Air, making it not only the most affordable MacBook but also the most portable.

This new budget MacBook will compete with Chromebooks and entry-level Windows laptops, which would be a new segment of the market for an Apple laptop. Gurman wrote that the device is intended for “people who primarily browse the web, work on documents or conduct light media editing.” This could be the new MacBook for students. Timing is a little murkier for the release of this budget MacBook, but hopefully it will arrive before the start of the next school year.

M5 coming to the MacBook Air

Just as Apple is reportedly gearing up to give its premium MacBook Pros a refresh with new, more powerful chips, the thinnest, most portable MacBooks are also set to get an upgrade. It’s fairly standard for the MacBook Air to get a springtime refresh, and the M4 MacBook Air was released in March 2025.

Gurman reported that we’ll likely see an M5 MacBook Air release during the first quarter of the year, so we can expect the refresh in the same time frame this year. Like the MacBook Pros, we’re not expecting to see a redesign with the M5 MacBook Air. A new-look Air is at least a couple more years away, according to Gurman.

The 16GB of RAM and 256GB of storage that have been integrated into previous versions of the MacBook Air will likely be standard for any M5 MacBook Air. (I’m keeping my fingers and toes crossed that the minimum storage gets moved up to 512GB, though.)

The M4 MacBook Air starts at $999, and I expect pricing to remain unchanged for the M5 Air.

The first OLED MacBook Pros

Would Apple release two different sets of MacBook Pro laptops in the same year? It’s more likely than you’d think, and it wouldn’t be unprecedented.

Apple released two generations of MacBook Pros in 2023, beginning the year with M2 MacBook Pros and ending it with M3 MacBook Pros. So we know that if Apple deems an advancement significant enough, it will issue multiple refreshes in the same year.

An OLED MacBook Pro lineup would certainly qualify as one of those advancements. According to Gurman, the OLED MacBook Pros would achieve several firsts for Mac computers, integrating a brand new generation of chips and a touchscreen display. Like the previous MacBook Pros, the OLED MacBook lineup would include both 14- and 16-inch models.

The first Macs with OLED displays are also rumored to borrow the Dynamic Island camera cutout from the iPhone.

Apple has been catching up to the rest of the industry by integrating OLED panels into more products, including some of its previous iPhone and iPad Pro models. But as Gurman noted, this will mark the “first time that this higher-end, thinner system is used in a Mac.”

Touchscreen displays have been common in Windows laptops for some time, but this rumored design would be the first time Apple integrates them into a MacBook. “The company has taken years to formulate its approach to the market, aiming to improve on current designs,” wrote Gurman. “[Apple] has developed a reinforced hinge and screen hardware to prevent the display from bouncing back or moving when touched.”

The design will reportedly still integrate standard MacBook Pro keyboard and trackpad functionality. What will apparently change, however, is the camera cutout at the top of the screen. Gurman reported that Apple is retiring the iconic “notch” in favor of “a so-called hole-punch design that leaves a display area around the sensor,” similar to the Dynamic Island introduced on the iPhone 14 Pro and Pro Max.

The OLED MacBook Pros could be the first Mac computers to use next-generation M6 chips, according to Gurman. They’ll also feature thinner, lighter frames that make them more portable than current MacBook Pro designs.

If the MacBook Pro adopts a touchscreen design, the computer will be the closest merger between Mac and iPad we’ve seen yet. Industry analyst Kuo believes this shift “reflects Apple’s long-term observation of iPad user behavior, indicating that in certain scenarios, touch controls can enhance both productivity and the overall user experience.”

As it stands, though, the OLED MacBook Pro will still provide a more traditional computer experience than other Apple products — don’t expect the fully hands-on, tactile navigation of an iPad quite yet. A trackpad and keyboard control scheme will remain important pillars of the MacBook experience.

The pricier components and OLED panels will likely result in an increase in the price of the OLED MacBook Pro. The OLED models will likely be several hundred dollars more than their current Liquid Retina display counterparts. The current 14-inch MacBook Pro starts at $1,999, and the 16-inch Pro begins at $2,499.

The OLED MacBook Pros are rumored to go into production this year. While Gurman previously reported that the OLED MacBook Pros might be released in early 2027, more recent internal reports suggest that Apple is targeting the end of 2026 for a potential release.

Tech

Researchers uncover firmware-level backdoor installed on several Android tablet brands

The Moscow-based security company reported that Keenadu was found in Android tablets sold by several mostly unnamed brands. Similar to Triada, the threat infects the firmware during the binary build phase, when a malicious static library is secretly linked with the libandroid_runtime.so library.

Read Entire Article

Source link

Tech

Password managers’ promise that they can’t see your vaults isn’t always true

Over the past 15 years, password managers have grown from a niche security tool used by the technology savvy into an indispensable security tool for the masses, with an estimated 94 million US adults—or roughly 36 percent of them—having adopted them. They store not only passwords for pension, financial, and email accounts, but often cryptocurrency credentials, payment card numbers, and other sensitive data.

All eight of the top password managers have adopted the term “zero knowledge” to describe the complex encryption system they use to protect the data vaults that users store on their servers. The definitions vary slightly from vendor to vendor, but they generally boil down to one bold assurance: that there is no way for malicious insiders or hackers who manage to compromise the cloud infrastructure to steal vaults or data stored in them. These promises make sense, given previous breaches of LastPass and the reasonable expectation that state-level hackers have both the motive and capability to obtain password vaults belonging to high-value targets.

A bold assurance debunked

Typical of these claims are those made by Bitwarden, Dashlane, and LastPass, which together are used by roughly 60 million people. Bitwarden, for example, says that “not even the team at Bitwarden can read your data (even if we wanted to).” Dashlane, meanwhile, says that without a user’s master password, “malicious actors can’t steal the information, even if Dashlane’s servers are compromised.” LastPass says that no one can access the “data stored in your LastPass vault, except you (not even LastPass).”

New research shows that these claims aren’t true in all cases, particularly when account recovery is in place or password managers are set to share vaults or organize users into groups. The researchers reverse-engineered or closely analyzed Bitwarden, Dashlane, and LastPass and identified ways that someone with control over the server—either administrative or the result of a compromise—can, in fact, steal data and, in some cases, entire vaults. The researchers also devised other attacks that can weaken the encryption to the point that ciphertext can be converted to plaintext.

Tech

Building A Kit Car To Save Money? It May Cost You More Than You Think

We’ all daydream sometimes, like when seeing an an iconic original Shelby AC Cobra on the auction block that sells for seven figures. In that moment you might think “I could build one of those. It’s just a fiberglass shell and a big engine, how hard could it be?”

The Cobra is a very popular kit car, but a little research will reveal that building one isn’t a frugal endeavor. True, you won’t spend over a million dollars like you would on a real Cobra, but building a kit car in your garage isn’t a task to be undertaken if you’re working on a tight budget. That’s true even if the initial investments on a kit and a chassis don’t seem out of reach financially.

No one here at SlashGear is saying that you shouldn’t build a kit car in your garage; it’s a great way for any gearhead to put their wrenching skills to use and yields a rewarding final product. I’ve been witness to and participated in many kit car builds, and they can be quite a bit of fun. In most cases building a kit car will be cheaper than buying a running original antique or classic, but it’s not an easy or inexpensive process even with the right tools and know-how.

Kit car builds are a tempting proposition

Factory Five Racing was founded in 1995 and sells reproduction kits for blasts from the past like 1930s hot rods and Shelby AC Cobras and Daytona Coupes from the ’60s. Factory Five’s least expensive kit is the Mk4, which looks like a Shelby Cobra roadster. The base kit is priced at a very tempting $14,990 and comes with the following: body and frame, chassis panels, brake and fuel lines, steering and cooling kits, lighting, seats, and a dashboard with gauges and switches. All you need to add is the running gear from a 1987 to 2004 Ford Mustang, which sounds simple enough from here. If you already have a beater Mustang laying around (lucky you) then the perceived cost of entry seems reasonable.

But before you click “buy” and eagerly wait for that large crate to arrive in your driveway, there are a few other things you’ll need to purchase or make arrangements for. A big garage is a must to house you and your project while you build it. A lift is also essential, and depending on the state of your donor you might also need an engine hoist. Kit cars are often unpainted aluminum or fiberglass, so a paint booth is also a big help. Whether you decide to rent or buy shop space and gear you’re going to add plenty to the cost of your build.

Time is money too

That $14,990 will start to grow quite a bit, and quickly. You’ll probably find yourself topping off your toolbox with some new purchases as well as spending to clear some unexpected snags once you start working. If that doesn’t scare you and you have good friends to beg or barter time, equipment, or expertise from then we aren’t going to stop you: by all means, buy everyone some pizza and get to work. It’s important to note that building a kit car in your garage is probably cheaper than buying a running classic, but it will take many hours of work and probably several trips to an auto parts store and/or salvage yard.

If all this seems unmanageable then you might have to appreciate your dream cars from a distance like I do; playing Gran Turismo and hunting online for one of the classic cars that can be had for under $10,000. Also keep in mind that Factory Five is just one option for cool kit cars. Meyers Manx has modernized the dune buggy with a $6k kit and Shell Valley sells a ’29 Model A roadster kit for $16,995 complete or under $5,000 just for the body. Regardless of which kit you buy and how much you spend, you’ll still have to factor in dozens of hours for assembly, gathering parts and supplies, and troubleshooting. If you’re taking unpaid time off from work to build your kit car you’ll have to add that lost income to the cost of the project as well.

Tech

The Galaxy Z Flip 7 is $200 off right now, and it might just flip your mind

Calling all flip phone enthusiasts: the latest Samsung’s coveted Z Flip series has appeared on a great deal.

The Galaxy Z Flip 7 is one of the biggest flip smartphones of 2025, and if you’ve been tempted to make the switch or simply adore Samsung’s flip range, then you’ll want to check this offer out.

Right now, you can get the Samsung Galaxy Z Flip7 256GB cell phone for just $899. That’s a massive $200.99 off its original $1099.99 asking price, and an easy way to nab a bargain on one of the best phones out there.

You can save $200 on the Samsung Galaxy Z Flip 7 today, and it’s the perfect excuse to switch to a phone that brings a little fun back into your tech routine.

The Galaxy Z Flip 7 is $200 off right now, and it might just flip your mind

Still, for all the nostalgia that’s packed into the Z Flip7, this is a very modern device. The phone’s advanced AI and unlocked Android functionality give you tons of freedom where the interface is concerned, allowing you to make the phone truly your own.

The biggest selling point of the phone is its wow-factor display. Not only does the Z Flip 7 fold in half to stow away easily in a pocket or handbag, but when you do open it up, you’re greeted with an almost 7-inch display that’s ideal for watching films and TV shows on the go.

There’s also an eye-watering 50 MP camera, which not only allows you to take incredibly detailed photos, but also pairs well with a powerful processor to ensure that any raw imaging doesn’t slow the handset down.

In fact, we wound up out 4.5-star review of the Flip 7, in the should you buy it section with: “With a larger cover screen, wider foldable screen with a reduced crease, great performance and solid cameras, the Z Flip 7 can compete with some of the best around.”

The Z Flip 7 also packs an extended long battery life, which, on a flip phone, is exactly what you need to get you through to the end of each day without constant worry that you’ll have to find the nearest charging port.

Here’s a phone deal that merges the modern with the nostalgic. For those who want to switch things up and enjoy one of the greatest Android flip phones on the market, this is it.

Even though the Z Flip 7 could be seen as one of the most expensive devices that Samsung produces, having an 18% saving against its RRP certainly gives it more value for money.

You’re getting an eye-catching foldable phone aesthetic coupled with high-tech features and a strong warranty – what’s not to like? It also made a worthy entry as the best Samsung clamshell in our best foldable phone buying guide.

The Flip 7 is undoubtedly the best Flip to date, and one that can finally take the fight to the clamshell competition. It’s not perfect, but for most people, it’s all the foldable they need.

-

Larger cover screen is a much-needed improvement -

More convenient 21:9 ratio screen is much easier to use -

Improved camera performance -

Fast, flagship performance with strong battery life

-

Cover screen software could be better -

Samsung software is full of duplicate/redundant apps -

No dedicated zoom camera

SQUIRREL_PLAYLIST_10148964

-

Sports6 days ago

Sports6 days agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

Tech7 days ago

Tech7 days agoSpaceX’s mighty Starship rocket enters final testing for 12th flight

-

Video1 day ago

Video1 day agoBitcoin: We’re Entering The Most Dangerous Phase

-

Tech3 days ago

Tech3 days agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Video4 days ago

Video4 days agoThe Final Warning: XRP Is Entering The Chaos Zone

-

Tech18 hours ago

Tech18 hours agoThe Music Industry Enters Its Less-Is-More Era

-

Video13 hours ago

Video13 hours agoFinancial Statement Analysis | Complete Chapter Revision in 10 Minutes | Class 12 Board exam 2026

-

Crypto World6 days ago

Crypto World6 days agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

Crypto World4 days ago

Crypto World4 days agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Video6 days ago

Video6 days agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

Crypto World12 hours ago

Crypto World12 hours agoCan XRP Price Successfully Register a 33% Breakout Past $2?

-

Sports19 hours ago

Sports19 hours agoGB's semi-final hopes hang by thread after loss to Switzerland

-

NewsBeat2 days ago

NewsBeat2 days agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Business5 days ago

Business5 days agoBarbeques Galore Enters Voluntary Administration

-

Crypto World7 days ago

Crypto World7 days agoCrypto Speculation Era Ending As Institutions Enter Market

-

Crypto World5 days ago

Crypto World5 days agoEthereum Price Struggles Below $2,000 Despite Entering Buy Zone

-

NewsBeat2 days ago

NewsBeat2 days agoMan dies after entering floodwater during police pursuit

-

Crypto World4 days ago

Crypto World4 days agoKalshi enters $9B sports insurance market with new brokerage deal

-

NewsBeat3 days ago

NewsBeat3 days agoUK construction company enters administration, records show

-

Crypto World4 days ago

Crypto World4 days agoBlackRock Enters DeFi Via UniSwap, Bitcoin Stages Modest Recovery