Crypto World

Elemental Royalty Corporation Offers Dividends in Tether Gold

Elemental Royalty Corporation becomes the first publicly listed gold company to offer dividends in Tether Gold (XAU₮)

Elemental Royalty Corporation plans to offer dividends in Tether Gold (XAU₮), making it the first publicly listed gold company to embrace this financial model. According to the company, this move showcases the potential of tokenized assets in modern finance by integrating traditional gold with digital financial infrastructure.

Tether Gold (XAU₮) is a digital asset representing ownership of one troy ounce of gold on a London Good Delivery bar. It is available as an ERC-20 token on Ethereum and a TRC20 token on TRON, bridging the gap between conventional gold value and digital finance.

“Gold has always been one of the most trusted stores of value in the world, yet integrating it directly into modern financial distribution models has been difficult,” said Paolo Ardoino, CEO of Tether. “Using XAU₮ for shareholder dividends changes that dynamic completely. This marks a major step forward for the gold industry and shows how tokenized assets can unlock new financial models that were previously out of reach.”

Elemental Royalty Corporation specializes in acquiring royalties from gold mining companies, providing investors with exposure to gold without the direct risks associated with mining. This new dividend initiative is expected to offer investors more direct exposure to gold, rather than cash equivalents.

This article was generated with the assistance of AI workflows.

Crypto World

Bridge receives conditional OCC approval for national trust bank charter

Bridge, a stablecoin platform acquired by Stripe in 2024, has received conditional approval from the Office of the Comptroller of the Currency to become a federally chartered national trust bank, the company announced.

Summary

- Stablecoins are digital currencies designed to maintain stable value, typically backed by reserve holdings such as U.S. dollars.

- Bridge stated that the federal charter would create “the regulatory backbone” companies need to deploy stablecoins securely and at scale.

- Ripple, Circle, BitGo, Fidelity Digital Assets, and Paxos reportedly received conditional approvals in December.

The national trust bank charter would enable Bridge to store digital assets for customers, issue stablecoins, and monitor reserve funds backing those digital currencies, according to the company. Stablecoins are digital currencies designed to maintain stable value, typically backed by reserve holdings such as U.S. dollars.

Bridge stated that the federal charter would create “the regulatory backbone” companies need to deploy stablecoins securely and at scale. The charter would allow the platform to serve financial institutions, fintech companies, cryptocurrency firms, and enterprises seeking digital payment options.

Bridge joins several major cryptocurrency companies seeking federal charters from the OCC. Ripple, Circle, BitGo, Fidelity Digital Assets, and Paxos reportedly received conditional approvals in December, according to industry reports. Anchorage Digital Bank remains the only company to have completed the process and secured a national trust bank charter, which it obtained in 2021.

The conditional approval positions Bridge to operate under the Guiding and Establishing National Innovation for U.S. Stablecoins Act, known as the GENIUS Act. The legislation, signed in 2024, establishes a legal framework for stablecoin issuance and oversight in the United States. The law includes provisions for increased transparency, strengthened reserve requirements, and federal regulatory oversight of firms involved in stablecoin issuance and custody.

The OCC’s recent conditional approvals indicate federal regulators are increasingly willing to integrate cryptocurrency companies into the regulated financial system. However, the approvals remain conditional as regulators proceed cautiously amid concerns about potential risks cryptocurrency companies could pose to the financial system.

For Stripe, Bridge’s approval could strengthen the payment processor’s position in digital payments. Stablecoins are emerging as alternatives to traditional cross-border payment systems, offering faster transaction speeds and lower costs, according to industry analysts.

Crypto World

BitMine Stacks 45,759 ETH Amid Crypto Mini-Winter as Tom Lee Eyes Market Bottom

TLDR:

- BitMine acquired 45,759 ETH in one week, bringing total holdings to 4,371,497 ETH worth $8.7 billion.

- Tom Lee compares current crypto sentiment to 2018 and 2022 lows, calling the pullback a buying opportunity.

- BitMine’s staked ETH of 3.04 million tokens generates $176M annually at a 7-day yield of 2.89%.

- MAVAN, BitMine’s proprietary staking validator network, is set to launch in early 2026 with three partners.

Tom Lee’s Bitmine Immersion Technologies (NYSE AMERICAN: BMNR) purchased 45,759 ETH in a single week, pushing total holdings to 4,371,497 tokens.

The move comes as Lee publicly identifies what he calls bottom-like sentiment across crypto markets. Combined with cash and other investments, Bitmine’s total holdings now stand at $9.6 billion, reinforcing its position as the world’s largest Ethereum treasury.

Lee Calls Market Sentiment a Buy Signal

Tom Lee drew a direct comparison between today’s crypto market and the lows of 2018 and 2022. He described current investor mood as carrying the same weight as previous cycle bottoms. Unlike past downturns, however, no major institutional failures have triggered the current weakness.

Lee pointed to a specific turning point, stating that “crypto has remained weak since the ‘price shock’ and massive deleveraging seen on October 10th.”

He noted that 2025 and 2026 have not produced the large-scale debacles seen in prior cycles, such as the FTX collapse or Three Arrows Capital in 2022. The current softness, in his view, is a sentiment-driven correction rather than a structural breakdown.

At Consensus Hong Kong, Lee outlined three long-term growth drivers for Ethereum, covering Wall Street tokenization, AI agent payment infrastructure, and creator-focused Layer 2 standards.

He argued that “Ethereum is well positioned to garner significant share, given its neutrality and 100% uptime and reliability.” These themes dominated panel discussions throughout the conference, reinforcing his conviction.

On the company’s buying strategy, Lee was direct: “We cannot control the price of Ethereum, and the company is acquiring ETH regardless of price trend, as the long-term outlook for Ethereum remains outstanding.”

He added that Bitmine continues to “buy ETH even as crypto moves through this ‘mini-winter,’” framing the pullback as an accumulation window rather than a warning sign.

Staking Machine Running as MAVAN Nears Launch

Beyond accumulation, Bitmine is generating meaningful revenue from its existing ETH stack. Total staked ETH now stands at 3,040,483 tokens, valued at roughly $6.1 billion at current prices. Annualized staking revenues have climbed to $176 million, based on a 7-day yield of 2.89%.

Lee noted that “at scale, when Bitmine’s ETH is fully staked by MAVAN and its staking partners, the ETH staking rewards is $252 million annually.”

The company is currently working with three staking providers as it prepares to deploy MAVAN, its proprietary Made in America Validator Network. The solution is expected to launch in early 2026 as a best-in-class staking infrastructure platform.

Bitmine’s total holdings also include 193 Bitcoin, $670 million in cash, a $200 million stake in Beast Industries, and a $17 million position in Eightco Holdings.

The company ranks 158th among all US-listed stocks by average daily dollar volume, trading approximately $0.9 billion per day. Institutional backers include ARK’s Cathie Wood, Founders Fund, Pantera, Galaxy Digital, and Kraken.

Crypto World

Bitwise, GraniteShares Join Race for Prediction Market-Style ETFs

Bitwise and GraniteShares have moved to put political-event outcomes inside the ETF framework, filing with the U.S. Securities and Exchange Commission to launch six PredictionShares funds on NYSE Arca. The prospectuses describe a lineup built around binary event contracts that settle to $1 if the specified outcome occurs and $0 otherwise. The target scope spans three election cycles: the 2028 presidential contest, the 2026 Senate race, and the 2026 House race. Each fund would invest at least 80% of its net assets in binary-event derivatives traded on exchanges regulated by the Commodity Futures Trading Commission, with the expectation that the market’s implied probabilities drive share prices day to day. The filings emphasize that if the Democratic candidate were to win the 2028 presidential election, the fund would aim to deliver capital appreciation for investors.

The risk, as spelled out in the prospectus, is equally stark: should the Democratic candidate not win the 2028 presidential race, the fund would likely lose substantially all of its value. In effect, the product translates political prognostication into an ETF vehicle, allowing investors to buy and sell exposure to a binary outcome through regulated venues. The envisioned mechanism—contracts that settle at $1 for a successful outcome and $0 otherwise—creates a differentiated price signal that fluctuates with polls, news developments, and evolving sentiment around the election landscape.

The two filings come as Bitwise publicly circulated its six-ETF lineup under the PredictionShares label, while GraniteShares independently submitted a parallel set of six funds with the same structural logic. The broader narrative this week reflects a growing appetite among ETF sponsors to explore the application of prediction-market dynamics within traditional investment products, a theme that has drawn commentary from market observers about the normalization of politically oriented risk assets in mainstream markets.

Market observers have noted that these funds represent a novel fusion of prediction markets and exchange-traded funds. The arrangement would allow investors to select a fund aligned with a specific political outcome, rather than taking a broad bet on a party or policy. Price discovery for each fund would be driven by the market’s probability assessment for the referenced outcome, with share prices moving within a $0–$1 band in response to new information and evolving forecasts. This construct differentiates itself from conventional political bets by anchoring the exposure in an ETF structure and publicly traded shares on a major U.S. exchange.

The move has drawn attention from critics and observers alike. James Seyffart, a Bloomberg ETF analyst, commented that “the financialization and ETF-ization of everything continues,” underscoring how investors and issuers are increasingly packaging complex, event-driven risk into standardized, regulated vehicles. The fact that two separate issuers are pursuing similar six-fund lineups suggests a broader push to test how far prediction-market concepts can be integrated into mainstream financial products. Notably, Roundhill Investments had signaled a nearby path with a comparable six-fund filing focused on the same election outcomes, a reminder that the sector of prediction-market ETFs is far from a one-off experiment.

Market context

Market context: These filings arrive amid growing investor curiosity about how political outcomes can be monetized through regulated products, even as the broader market debates the valuation of event-driven exposures and the regulatory boundaries surrounding binary bets. The rollout aligns with a trend of experimentation within the ETF space, where sponsors seek to diversify risk-bearing strategies beyond traditional equity or fixed income exposures.

Why it matters

For investors, the proposed PredictionShares funds would represent a distinct way to express views on political outcomes, leveraging a market-driven pricing mechanism rather than a single directional bet. Because each fund targets a specific outcome, the price of a share would, in theory, reflect the market’s current odds for that outcome and adjust as polls and news flow shift. The structure’s 80% allocation to binary-event contracts on CFTC-regulated venues provides a path to enforce a standardized, regulated approach to what has historically been a hybrid of prediction markets and speculative trading.

From a market-structure perspective, the filings illustrate how ETF designers are exploring increasingly binary, outcome-based products as part of a broader push to repackage risk. The prospectuses stress that a successful outcome would deliver capital appreciation, while the opposite outcome could wipe out most of the value, highlighting both the potential upside and the material downside risk inherent in this genre of investing. The conversation around these products has intensified since similar proposals emerged earlier in the year from other issuers, signaling a test case for whether regulatory clearances, liquidity, and investor demand can align to support a new class of event-driven ETFs.

Industry observers also point to the regulatory and compliance considerations that such funds would entail, given their reliance on binary settlement mechanics and politically anchored exposure. The SEC and the CFTC would likely scrutinize the contract types, counterparty risk, liquidity, and the potential for market manipulation in a space where polling data and headlines can meaningfully swing valuations in real time. The debate is not merely academic: if these funds reach the market, they could influence how hedge-like exposures tied to political events are priced and traded, potentially widening the spectrum of publicly accessible tools for managing political-risk bets.

What to watch next

- SEC action on Bitwise’s and GraniteShares’ prospectuses for the six PredictionShares ETFs, including potential comments or conditions from regulators.

- Whether NYSE Arca lists the funds and the pace of any initial trading, including liquidity expectations and settlement logistics for binary-event contracts.

- Further filings from other issuers, such as Roundhill, and the degree to which multiple teams compete in offering prediction-market ETFs.

- Regulatory guidance or policy developments regarding binary event contracts and their use inside ETFs, which could influence product design and investor protection measures.

Sources & verification

- Bitwise PredictionShares prospectus filed with the SEC: https://www.sec.gov/Archives/edgar/data/1928561/000121390026017412/ea0277256-01_485apos.htm

- GraniteShares six-fund prospectus filing with the SEC: https://www.sec.gov/Archives/edgar/data/1689873/000149315226007125/form485apos.htm

- Roundhill Investments’ similar event-contracts/prediction-market ETF filing referenced in coverage: https://cointelegraph.com/news/roundhill-investments-event-contracts-prediction-markets-etf-united-states-election

- Related discussion of prediction markets’ role in open-source intelligence and market design: https://cointelegraph.com/opinion/prediction-markets-new-spycraft

Prediction markets move to the ETF stage: six funds, one framework

The filings reveal a structured approach to capturing political-outcome probabilities within six distinct funds, with each fund keyed to a specific outcome across three election cycles. The first pair targets the presidential result in 2028, designating a Democrat or a Republican as the winner; two more funds focus on which party captures control of the Senate in 2026, and the final two on House control. The investment thesis centers on deploying at least 80% of net assets into binary-event derivatives that settle at $1 if the referenced outcome materializes and $0 if it does not. While the concept offers a clear path to capital appreciation should the expected outcome occur, the prospectus makes the flip side explicit: if the anticipated outcome fails to materialize, the portfolio could experience a sharp decline in value, potentially approaching zero for the affected fund.

In practice, investors would see the daily price of each fund move between $0 and $1 as market participants adjust their views in response to polling data, election dynamics, and news flow. This pricing dynamic mirrors the very essence of prediction markets while placing it inside a regulated, exchange-traded wrapper. The framing also allows for diversified exposure: instead of a single bet on a party or a policy, an investor could select a fund aligned with a particular outcome, effectively creating a basket of binary-event bets under a single ticker and governance structure. The filings underscore that such products are not simply novelty investments; they are designed to be traded on regulated venues with defined settlement mechanics and disclosures about risk levels.

Industry voices have framed this development as part of a broader narrative about how traditional finance intersects with prediction-market concepts. The comment from James Seyffart about the ongoing “financialization and ETF-ization” of new risk assets encapsulates a sentiment that regulators and market participants are recalibrating the boundary between political risk and tradable financial instruments. The Roundhill filing referenced alongside Bitwise and GraniteShares signals that multiple teams are testing the appetite for six-fund lineups that cover presidential, Senate, and House outcomes, pointing to a possible wave of similar products if the regulatory path remains navigable and investor demand proves durable.

Crypto World

Gemini executive depart amid cost-cutting push

Cryptocurrency exchange Gemini disclosed plans for a leadership restructuring that will see three senior executives depart as the company narrows its geographic focus and implements cost reductions, according to a regulatory filing released Tuesday.

Summary

- Gemini operates in more than 60 countries, but demand in certain regions proved insufficient to support continued growth.

- The firm plans to execute separation agreements with three executives that may allow them to remain temporarily to assist with transitions.

- The board appointed Chief Accounting Officer Danijela Stojanovic as interim CFO.

Chief Operating Officer Marshall Beard, Chief Financial Officer Dan Chen, and Chief Legal Officer Tyler Meade will leave their positions effective Feb. 17, the company stated in a Form 8-K filing. Gemini plans to execute separation agreements with each executive that may allow them to remain temporarily to assist with transitions, during which they would receive base salary and benefits without additional bonuses or incentive compensation.

Beard also resigned from Gemini’s board of directors on the same date. The filing indicated his departure was not related to disagreements over operations, policies, or practices.

Gemini announced a round of layoffs earlier this month.

The company will not fill the chief operating officer position. Co-founder Cameron Winklevoss will assume many of Beard’s responsibilities, including revenue-related duties, according to the filing. The board appointed Chief Accounting Officer Danijela Stojanovic as interim CFO, while Kate Freedman, currently associate general counsel and corporate secretary, will serve as interim general counsel.

ETF analyst James Seyffart characterized the changes as a “big shakeup” in a post on social media platform X following the filing’s publication.

The leadership changes accompany broader operational restructuring announced earlier this month. Gemini Space Station Inc. will cease operations in the United Kingdom, the European Union, and Australia, the company stated. Gemini also announced workforce reductions of approximately 25% to decrease costs and concentrate on core priorities.

Company management indicated that expansion into multiple countries created operational complexity and elevated expenses. While Gemini operates in more than 60 countries, demand in certain regions proved insufficient to support continued growth, executives stated. Future operations will focus primarily on the U.S, which management identified as the company’s strongest market.

Unaudited financial results for the previous year reflected mixed performance. Monthly transacting users increased approximately 17% year-over-year to roughly 600,000, according to company data. Net revenue is projected between $165 million and $175 million, compared with $141 million in 2024.

Operating costs, however, outpaced revenue growth significantly. The company estimated operating expenses may reach $530 million, with adjusted EBITDA losses of approximately $260 million. Total net losses for the year could approach $600 million, according to the projections.

Market participants responded negatively to the disclosed losses, according to reports.

Crypto World

Wall Street Bets on Prediction Markets With New ETF Wave

Institutional investors are entering prediction markets, following a strategy seen earlier in the crypto space.

Asset managers are filing for prediction-market tied exchange-traded funds as the space continues to gain traction.

Sponsored

Sponsored

Institutional Capital Moves Into Prediction Markets as ETF Race Begins

On February 17, 2026, Bitwise Asset Management submitted a post-effective amendment to register six ETFs under a new brand called “PredictionShares.” The proposed funds, tied to event contracts on the outcome of US elections, would be listed and primarily traded on NYSE Arca.

“PredictionShares will serve as a new Bitwise platform focused on providing exposure to prediction markets. Bitwise’s CIO Matt Hougan says prediction markets are accelerating in both scale and importance, making client exposure an opportunity the firm couldn’t pass up,” Crypto In America host Eleanor Terrett wrote.

The six proposed funds are:

- PredictionShares Democratic President Wins 2028 Election

- PredictionShares Republican President Wins 2028 Election

- PredictionShares Democrats Win Senate 2026 Election

- PredictionShares Republicans Win Senate 2026 Election

- PredictionShares Democrats Win House 2026 Election

- PredictionShares Republicans Win House 2026 Election

Each ETF seeks capital appreciation tied to a specific US election outcome. It follows an 80% investment policy under which it will invest at least 80% of its net assets, plus any borrowings for investment purposes, in derivative instruments whose value is linked to that defined political event.

The funds gain exposure primarily through swap agreements that reference CFTC-regulated event contracts listed on designated contract markets, although they may also invest directly in those event contracts. The event contracts follow a binary payout structure, typically settling at $1 if the specified outcome occurs and at $0 if it does not.

“This makes an investment in the Fund highly risky. An investment in the Fund is not appropriate for investors who do not wish to invest in a highly risky investment product or who do not fully understand the Fund’s investment strategy. Such investors are urged not to purchase Fund Shares,” the filing reads.

Sponsored

Sponsored

Moreover, GraniteShares, an independent ETF issuer, also filed a Form 485APOS on February 17 for six similar funds. These two filings followed shortly after Roundhill made the same move.

Bloomberg Intelligence Senior Research Analyst James Seyffart indicated that more filings are likely to continue.

“The financialization and ETF-ization of everything continues,” he added.

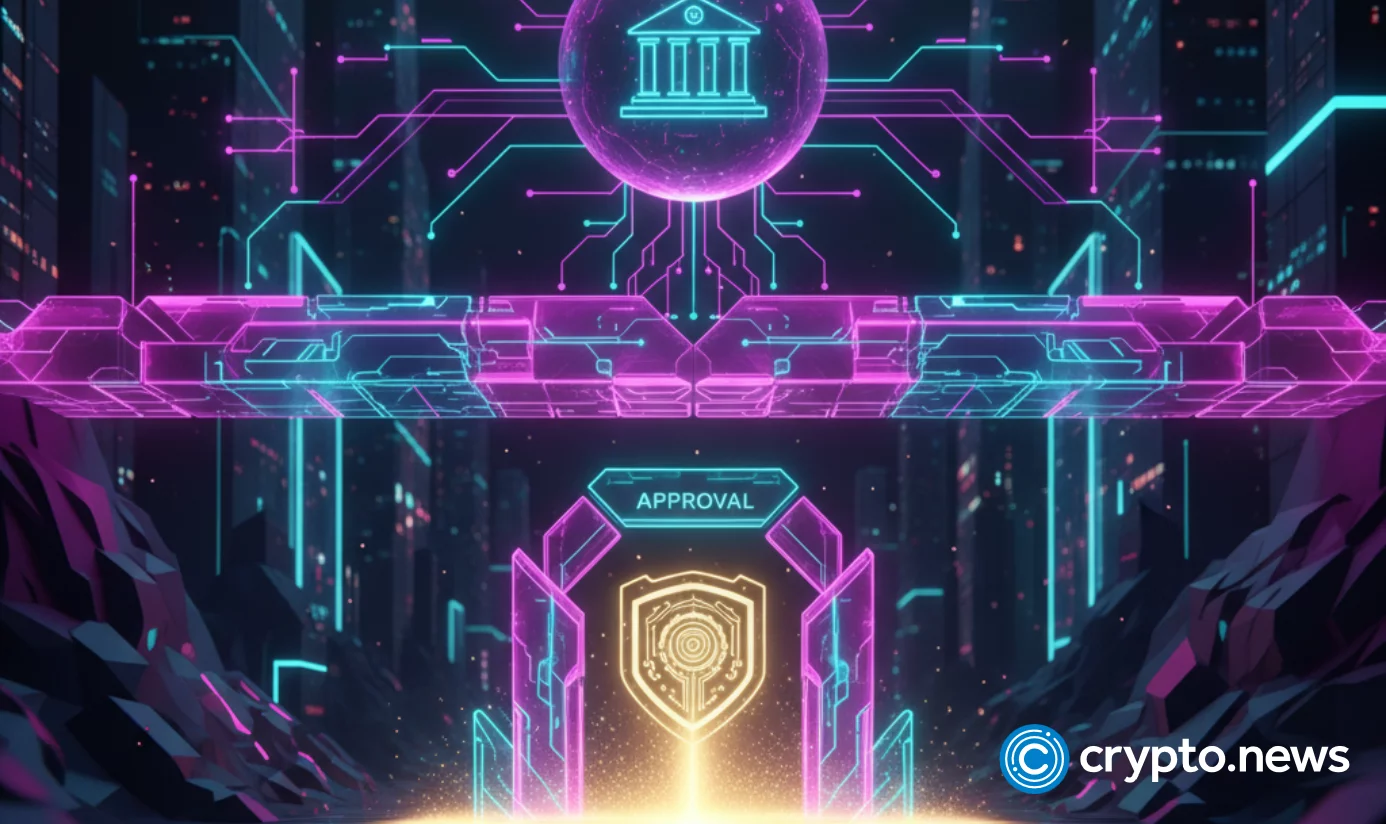

The ETF filings arrive as the prediction market sector posts record-breaking growth. The move mirrors the surge of ETF applications tied to digital assets, when asset managers rushed to capitalize on renewed momentum in the sector following the election of a pro-crypto administration.

While demand for Bitcoin and Ethereum ETFs appears to have slowed, evidenced by significant outflows from the spot products, institutions may be looking to broaden their exposure to the growing prediction market space.

Data from Dune Analytics highlights the sector’s momentum. Monthly trading volume climbed to $15.4 billion in January, setting a new all-time high.

Transaction count also reached a record, surpassing 122 million, while monthly users rose to 830,520. Taken together, these suggest sustained growth across the prediction market sector, alongside increasing product development and institutional interest.

Crypto World

Dragonfly Raises $650M for New Fund to Back DeFi, Prediction Markets and Stablecoins

Dragonfly Capital has announced the closing of its $650 million Fund IV, focusing on stablecoins, decentralized finance, and prediction markets.

Dragonfly Capital, a crypto venture capital firm, has closed its Fund IV at $650 million, to focus on DeFi, stablecoins and prediction markets, despite stagnant prices and a mildly down market.

Haseeb Qureshi, managing partner at Dragonfly Capital, announced in an X post today, Feb. 17, that Fund IV is the firm’s “biggest bet yet that the crypto revolution is still early in its exponential.” Qureshi added:

“If you look at our recent bets — Polymarket, Ethena, Rain, Mesh — the growth speaks for itself. Agentic payments, on-chain privacy, the tokenization of everything — crypto’s surface area is about to explode, and we want to be backing the founders at the center of it.”

Dragonfly Capital’s approach during market downturns is not new. The firm has raised capital during previous challenging periods, such as the 2018 ICO winter and prior to the Luna collapse, Qureshi added.

The firm’s first fund in 2018 closed at roughly $100 million during the ICO downturn, followed by a $225 million Fund II in 2021, and a $650 million Fund III in 2022 — overshooting an initial $500 million target — just before the market’s prolonged downturn.

This article was generated with the assistance of AI workflows.

Crypto World

BlackRock, Coinbase to keep 18% of ETH ETF staking revenue

BlackRock and Coinbase plan to take an 18% share of staking rewards from BlackRock’s proposed Ethereum staking exchange-traded fund, according to an updated regulatory filing.

Summary

- BlackRock and Coinbase will take 18% of ETH ETF staking rewards.

- Between 70% and 95% of the fund’s Ethereum would be staked, with Coinbase serving as custodian and execution agent.

- Supporters see institutional yield access as positive, while critics warn about fees and centralization risks.

The firms disclosed the fee structure in an amended S-1 filing with the U.S. Securities and Exchange Commission on Feb. 17. According to the filing, investors will receive 82% of gross staking rewards, with the fund sponsor and its execution partner receiving 18%.

A sponsor fee that ranges from 0.12% to 0.25% of the investment value will be paid by shareholders each year in addition to the staking fee.

How the staking model will work

Under the proposed structure, most of the fund’s Ethereum (ETH) holdings will be used for staking. The filing says between 70% and 95% of assets may be staked under normal conditions, with the rest kept available for liquidity and redemptions.

Coinbase will act as the prime execution agent and custodian through its institutional services unit. The company may also pass part of its share to third-party validators and infrastructure providers involved in the staking process.

BlackRock has already seeded the trust with $100,000, equal to 4,000 shares priced at $25 each. The firm is also building its Ethereum position ahead of a potential launch.

Based on early 2026 network data, Ethereum staking yields have averaged close to 3% annually. After the 18% cut and other fees, the effective return for investors is expected to be lower, depending on market conditions and network participation.

Market reaction and centralization concerns

The fund is a yield-generating variant of BlackRock’s current Ethereum spot ETF, which has garnered significant institutional interest since its inception. After the success of its Bitcoin (BTC) and Ethereum products, the company has established itself as a significant player in digital asset ETFs over the last two years.

Nasdaq has already applied to list the staked, indicating growing support for regulated crypto yield products in traditional markets.

Some analysts say the structure could appeal to investors seeking exposure to blockchain rewards without managing wallets or validators. Others have questioned whether an 18% share of staking income is too high, especially as competition in the ETF space increases.

Concerns have also been raised about the concentration of influence. In the same week as BlackRock’s filing, Vitalik Buterin warned that growing Wall Street involvement in Ethereum could increase centralization risks over time.

Supporters argue that institutional products help bring liquidity and legitimacy to the market. Critics say they may shift too much control toward large financial firms.

Crypto World

Ether Bulls Eye $2.5K as Staking ETF Debuts; RWA Market Cap Grows

Ether has not reclaimed the $2,500 level since late January, and traders are awaiting catalysts to spark a fresh run. The latest signals from institutions point to a shift in appetite: some of the industry’s biggest players are reallocating from BTC-centric exposure toward Ethereum-focused ETFs. Harvard’s endowment disclosed an $87 million stake in BlackRock’s iShares Ethereum Trust during Q4 2025, while trimming holdings in the iShares Bitcoin Trust. Separately, the market for real-world assets tokenized on Ethereum surpassed $20 billion in aggregate value, reflecting a growing blend of traditional finance with blockchain rails. With the bear market bottom noted around $1,744 on February 6, analysts are watching for decisive momentum that could sustain a rebound.

Key takeaways

- Institutional sentiment is shifting toward Ether as elite funds reallocate capital from Bitcoin to Ether ETFs.

- BlackRock’s Staked Ethereum ETF features a 0.25% expense ratio and an 18% retention of staking rewards as service fees to intermediaries, balancing incentives in the staking flow.

- Real-world asset tokenization on Ethereum has surpassed $20 billion in aggregate value, with broad participation from BlackRock, JPMorgan Chase, Fidelity and Franklin Templeton.

- Harvard’s SEC filings show an $87 million addition to BlackRock’s iShares Ethereum Trust during Q4 2025, alongside a reduction in its iShares Bitcoin Trust.

- Dragonfly Capital’s $650 million funding round signals sustained appetite for tokenized stocks and private credit offerings on-chain, reinforcing the momentum toward RWAs and custody infrastructure.

Tickers mentioned: (omitted as per guidance to avoid introducing tickers not clearly provided in the source)

Sentiment: Neutral

Price impact: Positive. The combination of renewed institutional interest and expanding RWA activity on Ethereum could support a constructive price bias for ETH over the medium term.

Trading idea (Not Financial Advice): Hold. The emerging mix of ETF activity and RWA infrastructure suggests potential for a delay-driven rebound, pending clearer price confirmations.

Market context: The ETH narrative sits at the intersection of regulated access to staking, continued ETF experimentation, and a broadening roster of on-chain real-world asset use cases. While spot flows have been modest in the near term, the participation of major asset managers in ETH-focused vehicles points to growing demand for regulated exposure and secure custody solutions within the crypto ecosystem. The sector remains sensitive to overall risk appetite, macro cues, and regulatory developments that could influence institutional allocations to crypto assets.

Why it matters

The trajectory for Ether as a mainstream financial instrument hinges on the alignment between traditional finance’s risk controls and the evolving capabilities of on-chain infrastructure. The ongoing expansion of RWAs on Ethereum demonstrates that large-scale capital is looking beyond pure speculative bets toward assets that can be tokenized, securitized, and traded within regulated frameworks. A 0.25% expense ratio on a Staked Ethereum ETF, paired with an 18% retention of staking rewards as fees, signals an industry attempt to balance competitive pricing with sustainable staking incentives. The underlying staking ecosystem—where custodians like Coinbase play a key role in facilitating services—highlights a path for institutions to access ETH staking without shouldering daily operational risk directly.

Moreover, the $20+ billion RWA market on Ethereum reflects a concerted effort to bring real assets onto the blockchain, blending gold, Treasuries and bonds with programmable settlement and liquidity access. The involvement of BlackRock, JPMorgan Chase, Fidelity and Franklin Templeton underscores how the line between traditional custody and digital asset infrastructure is blurring. In parallel, venture funding from players like Dragonfly Capital reinforces confidence in the long-run viability of tokenized stocks and private credit offerings, suggesting a maturation phase for the sector that could underpin sustained demand for ETH as a settlement and collateral layer.

Price catalysts remain tied to the broader risk environment. While a near-term move to $2,500 is discussed in market chatter, the path will likely depend on regulatory clarity, ETF inflows, and the pace at which RWAs scale from pilot projects to widely adopted products. The bear market bottom observed in early February may prove to be a reference point if new catalysts emerge, but investors will want to see consistent demand signals, improved liquidity, and clear governance for staking yield structures before committing meaningful capital.

What to watch next

- Regulatory milestones for ETH-focused ETFs and any SEC updates on product approvals or adjustments.

- Upcoming quarterly ETF flow data to gauge whether institutional inflows into Ether-based products accelerate.

- New RWAs issuances and partnerships on Ethereum, including any large-scale tokenizations of traditional assets.

- Price action around the $2,000–$2,500 zone and whether macro risk sentiment supports a durable breakout for ETH.

Sources & verification

- Harvard’s 2025 Q4 Form 13F filings showing an $87 million stake in BlackRock’s iShares Ethereum Trust and adjustments to its iShares Bitcoin Trust.

- MarketBeat data detailing changes in notable iShares Ethereum Trust holdings.

- DefiLlama data on the RWAs aggregate on Ethereum exceeding $20 billion in value.

- Dragonfly Capital’s $650 million fundraise focused on tokenized RWAs and related on-chain infrastructure.

Institutional bets build as ETH ETFs mature and RWAs expand

Ether (CRYPTO: ETH) has begun to demonstrate a degree of resilience that could be the prelude to a broader regime shift in active institutional exposure. The most meaningful signal to date is the combination of major asset managers embracing Ethereum-based products and the rapid expansion of real-world asset tokenization that sits atop the Ethereum chain. The Harvard disclosures, which show an $87 million addition to BlackRock’s iShares Ethereum Trust in Q4 2025, and a concurrent trimming of iShares Bitcoin Trust holdings, exemplify a nuanced preference for ETH-driven exposure over BTC-focused routes. This bifurcation in appetite suggests institutions are seeking regulated, scalable access to staking and on-chain liquidity, rather than relying solely on the volatility of the broader crypto market.

BlackRock’s Staked Ethereum ETF adds another dimension to the narrative. With a 0.25% expense ratio and an 18% retention of staking rewards as service fees, the vehicle aims to strike a pragmatic balance between cost efficiency and the revenue necessary to compensate the intermediaries that enable staking. The arrangement underscores a broader trend in the industry: in order to scale, staking products must align the incentives of custodians, exchanges, and fund managers with the long-term interests of investors seeking yield-bearing crypto exposure. Coinbase’s involvement as a staking service intermediary is cited as a notable practical factor in ensuring smooth on-ramp and on-chain execution for such portfolios.

Beyond the ETF mechanics, the size and scope of RWAs on Ethereum point to a maturation of the ecosystem. The aggregate RWAs on Ethereum now surpass $20 billion, a milestone that includes tokenized gold and a growing slice of US Treasuries, bonds, and money market funds. The involvement of major financial institutions—BlackRock, JPMorgan Chase, Fidelity, and Franklin Templeton—signals a coordinated push to bring more traditional assets under a tokenized, on-chain framework. When measured alongside other blockchain ecosystems, Ethereum’s RWAs stand out as a bridge between regulated finance and decentralized technologies, reinforcing the case for ETH as a robust platform for both settlement and collateral.

The venture funding environment is also shifting in this space. Dragonfly Capital’s recent $650 million round, aimed at real-world assets and tokenized financial instruments, illustrates persistent appetite from crypto-focused investors to back asset-backed models that operate in concert with established market infrastructure. In practice, this means more pilot programs, more credible custodial arrangements, and more sophisticated deals that link asset origination with tokenized issuance and on-chain trading. The result could be a multi-year trajectory in which RWAs contribute to sustained demand for ETH, even as the broader crypto market experiences sideways or choppy price action.

From a price perspective, the catalysts discussed—ETF inflows, deeper RWA adoption, and regulatory clarity—could provide the conditions for a rebound toward the $2,500 level noted in market discussions. The bear cycle that bottomed near $1,744 on February 6 has left a price floor that investors are watching closely, with the possibility of a renewed risk-on environment driving ETH higher as institutional confidence grows. While no single event guarantees a sustained rally, the confluence of regulated access, staking economics, and tangible on-chain assets tied to ETH strengthens the case for a constructive, though cautious, upside path in the medium term. The landscape suggests that the next phase of ETH’s price narrative will be driven less by frothy retail speculation and more by disciplined, asset-backed finance and regulated market access. Harvard’s stake in BlackRock’s ETH Trust and the evolving real-world asset framework remain central reference points as this story develops. For additional context on RWAs’ market dynamics, see Tokenized RWAs climb despite market rout, and for coverage of Dragonfly Capital’s funding round, visit Dragonfly’s $650M fund. The price-angle discussion around a potential move to $2,500 is also explored in ETH chart patterns and rally scenarios as noted in market analysis. Investors should monitor price action, ETF flow data, and regulatory developments to gauge how these structural shifts translate into tangible market movements.

Crypto World

Grayscale Says XRP Is Second Most Talked-About Asset After Bitcoin

The positive sentiment reflects strong and meaningful activity from the XRP community, despite the bears dominating the broader market.

The crypto market may be in a bear season now, but some assets are in the spotlight, thanks to their strong communities. One such cryptocurrency is XRP, the native asset of the XRP Ledger (XRPL), otherwise known as the Ripple Network.

Recent data from the asset management giant Grayscale ranked XRP as the second-most-discussed asset in the platform’s community, after bitcoin (BTC). This reflects strong and meaningful activity from the XRP community.

The Second Most Talked-About Asset

According to a voiceover from Grayscale’s Head of Product and Research, Rayhaneh Sharif-Askary, during the Ripple Community Day, XRP has a broad, vibrant community with “diehard fans.”

Grayscale advisors have reported that their clients are constantly asking about XRP. The asset is even considered the second-most discussed asset, behind BTC in some cases. Sharif-Askary revealed that a huge part of the excitement surrounding XRP is from persistent demand for products linked to the asset. Investors see the XRPL as a “battle-tested blockchain that has a real opportunity to capture market share” and are looking to tap into the ecosystem.

Additionally, the Grayscale product and research head believes the narrative and price sentiment surrounding XRP will change. The asset’s growth may have been delayed so far by lagging product-market fit and regulatory challenges. However, positive sentiment from the community is likely to change the narrative for the asset.

Bullish Predictions For XRP

Sharif-Askary’s remarks about positive community sentiment are echoed by weekly inflows into crypto investment products. CryptoPotato reported that most crypto funds just recorded a fourth consecutive week of outflows, but only products tied to assets like XRP saw positive flows.

Bitcoin and Ethereum have continued to lag in sentiment, with their investment products losing $133 million and $85 million, respectively, last week. XRP, on the other hand, attracted over $33.4 million, with relatively steady demand.

You may also like:

Interestingly, analysts are making bullish price calls for XRP. Last weekend, XRP emerged as one of the top gainers in the market, rallying over 16%, amid predictions that the Ripple asset may have begun to decouple from other larger-cap cryptocurrencies. At the time of writing, data from CoinMarketCap showed XRP trading around $1.45, with a slight decline over the last 24 hours. Regardless of the downturn, market experts foresee a bullish breakout in the asset’s price trajectory over the coming weeks.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Bitwise files for prediction market-backed ETFs

Bitwise Asset Management has filed with regulators to launch a new line of exchange-traded funds tied to political prediction markets, marking its latest push into alternative investment products.

Summary

- Bitwise has filed with regulators to launch a new line of ETFs focused on U.S. election outcomes.

- The proposed funds would give investors regulated access to political prediction contracts through traditional brokerage accounts.

- Approval is still pending, and regulators continue to review how these products fit within existing securities rules.

The filing was disclosed by Bloomberg ETF analyst James Seyffart, who shared details on social media. According to the preliminary prospectus dated Feb. 17, the proposed funds would operate under the “PredictionShares” brand and remain subject to regulatory approval.

The document states that the offering is incomplete and that the securities cannot be sold until the registration statement becomes effective.

Election-focused contracts at the core

The filings outline several proposed ETFs linked to U.S. political outcomes. These include separate funds tracking whether Democrats or Republicans win the 2028 presidential election, as well as products tied to control of the House and Senate in the 2026 mid-term elections.

Rather than investing in companies connected to prediction markets, the funds are designed to hold event-based contracts sourced from regulated trading venues. These contracts pay out based on specific real-world outcomes, such as election results.

Bitwise said PredictionShares will serve as a dedicated platform for clients seeking regulated exposure to prediction markets through traditional brokerage accounts. No launch date has been set, and approval from the U.S. Securities and Exchange Commission has not yet been granted.

Seyffart noted that similar filings have appeared in recent months and said more are likely to follow as interest in the sector grows.

Growing competition and market interest

Bitwise’s chief investment officer, Matt Hougan, said prediction markets are expanding in both size and relevance, making them difficult for asset managers to ignore. He added that client demand played a key role in the decision to pursue the products.

Other firms have also moved into the space. Roundhill Investments previously filed for similar election-based ETFs, while GraniteShares has submitted competing proposals. None has yet received regulatory clearance.

With platforms like Polymarket reporting heavy trading volume during significant political events, prediction markets have drawn increased attention in recent election cycles. Supporters say these markets often reflect public opinion more quickly than traditional polls.

Critics, like Vitalik Buterin, warn that they are extremely risky and can behave like speculative bets. Industry analysts caution that funds associated with particular outcomes could lose most of their value if forecasts prove to be wrong.

Additionally, regulators are examining how these products align with current derivatives and securities regulations.

-

Sports6 days ago

Sports6 days agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

Video2 days ago

Video2 days agoBitcoin: We’re Entering The Most Dangerous Phase

-

Tech3 days ago

Tech3 days agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Video5 days ago

Video5 days agoThe Final Warning: XRP Is Entering The Chaos Zone

-

Tech1 day ago

Tech1 day agoThe Music Industry Enters Its Less-Is-More Era

-

Business6 hours ago

Business6 hours agoInfosys Limited (INFY) Discusses Tech Transitions and the Unique Aspects of the AI Era Transcript

-

Video21 hours ago

Video21 hours agoFinancial Statement Analysis | Complete Chapter Revision in 10 Minutes | Class 12 Board exam 2026

-

Crypto World4 days ago

Crypto World4 days agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Crypto World20 hours ago

Crypto World20 hours agoCan XRP Price Successfully Register a 33% Breakout Past $2?

-

Crypto World6 days ago

Crypto World6 days agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

Video6 days ago

Video6 days agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

Sports1 day ago

Sports1 day agoGB's semi-final hopes hang by thread after loss to Switzerland

-

NewsBeat3 days ago

NewsBeat3 days agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Business6 days ago

Business6 days agoBarbeques Galore Enters Voluntary Administration

-

Crypto World7 days ago

Crypto World7 days agoCrypto Speculation Era Ending As Institutions Enter Market

-

Crypto World5 days ago

Crypto World5 days agoEthereum Price Struggles Below $2,000 Despite Entering Buy Zone

-

NewsBeat3 days ago

NewsBeat3 days agoMan dies after entering floodwater during police pursuit

-

Crypto World5 days ago

Crypto World5 days agoKalshi enters $9B sports insurance market with new brokerage deal

-

NewsBeat4 days ago

NewsBeat4 days agoUK construction company enters administration, records show

-

Crypto World4 days ago

Crypto World4 days agoBlackRock Enters DeFi Via UniSwap, Bitcoin Stages Modest Recovery

![I AM SHAKING!!!! [insane Bitcoin Signal]](https://wordupnews.com/wp-content/uploads/2026/02/1771392411_maxresdefault-80x80.jpg)