CryptoCurrency

Did Arthur Hayes Sell $1.5M In Ethereum After $20K Prediction?

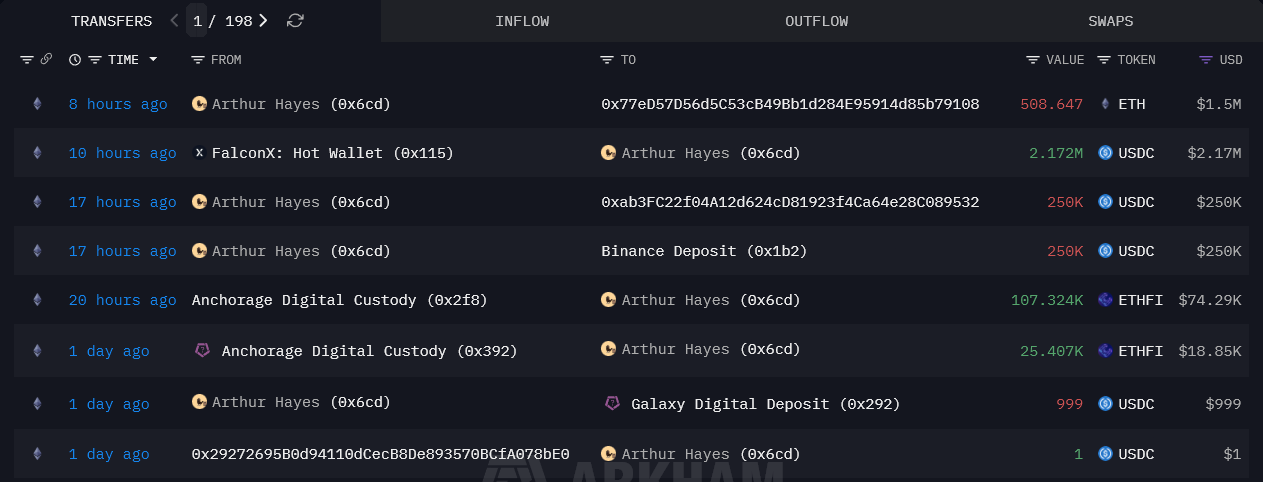

Arthur Hayes has moved 508.647 ETH, worth roughly $1.5 million, to Galaxy Digital, sparking fresh speculation that the crypto veteran may be trimming exposure.

The move is surprising because recently Hayes delivered one of his strongest bullish theses on Ethereum.

Sponsored

Sponsored

Arthur Hayes Ethereum Sell Speculation

On-chain data shows the transfer originated from a wallet linked to Hayes and landed at a Galaxy Digital deposit address.

Transfers to institutional desks do not always signal an immediate sale. But such movements are commonly associated with liquidity provisioning or over-the-counter execution.

The transaction comes as Ethereum trades just below the psychologically important $3,000 level, following a volatile December marked by ETF outflows and derivatives repositioning.

Despite the move, Hayes still controls more than 4,500 ETH.

So, any selling would represent portfolio management rather than a full exit.

The timing is notable. Only days earlier, Hayes laid out a detailed case for Ethereum’s institutional future, arguing that large financial players have finally accepted the limits of private blockchains.

“You can’t have a private blockchain. You must have a public blockchain for security and real usage.”

Sponsored

Sponsored

Hayes framed stablecoins as the catalyst that makes Ethereum legible to traditional finance. He predicted that banks would increasingly build Web3 infrastructure on Ethereum rather than bespoke ledgers.

“You’re going to see large banks start doing crypto and Web3 using a public blockchain. I think the public blockchain will be Ethereum.”

He acknowledged that privacy remains a sticking point for institutional adoption but argued that the issue will be addressed at the application or Layer-2 level, with Ethereum continuing to anchor security.

“They might build an L2 that has some sort of privacy features… but the substrate, the security layer, is still Ethereum.”

However, market conditions remain mixed. Ethereum has struggled to regain sustained momentum above $3,000 as spot ETH ETFs recorded notable outflows in mid-December, while implied volatility in derivatives markets has compressed. This reflects caution rather than panic.

At the protocol level, activity continues to migrate toward rollups, keeping transaction costs low but limiting fee capture on Ethereum’s base layer.

Hayes also struck a pragmatic tone on valuation expectations, offering a long-term target rather than a near-term prediction.

“If ETH gets to $20,000, that’s about 50 Ethereum to make a million… by the end of the cycle, by the next presidential election.”

For now, Hayes’ on-chain activity suggests tactical positioning, not a reversal of conviction. His thesis remains intact: Ethereum wins if stablecoins and institutional on-chain finance scale.

The market, however, may still be waiting for that narrative to fully materialize.